- Labor Certified Transcript of Payroll - Illinois

- Certified Weekly Payroll Report - New Jersey

- Certified Transcript of Payroll - Illinois

- Public Works Payroll Reporting Form - California

- Certified Payroll Report - Washington Department of Labor and Industries

- Weekly Payroll Certification for Public Works Projects - Pennsylvania

Fillable Printable Weekly Payroll Certification for Public Works Projects

Fillable Printable Weekly Payroll Certification for Public Works Projects

Weekly Payroll Certification for Public Works Projects

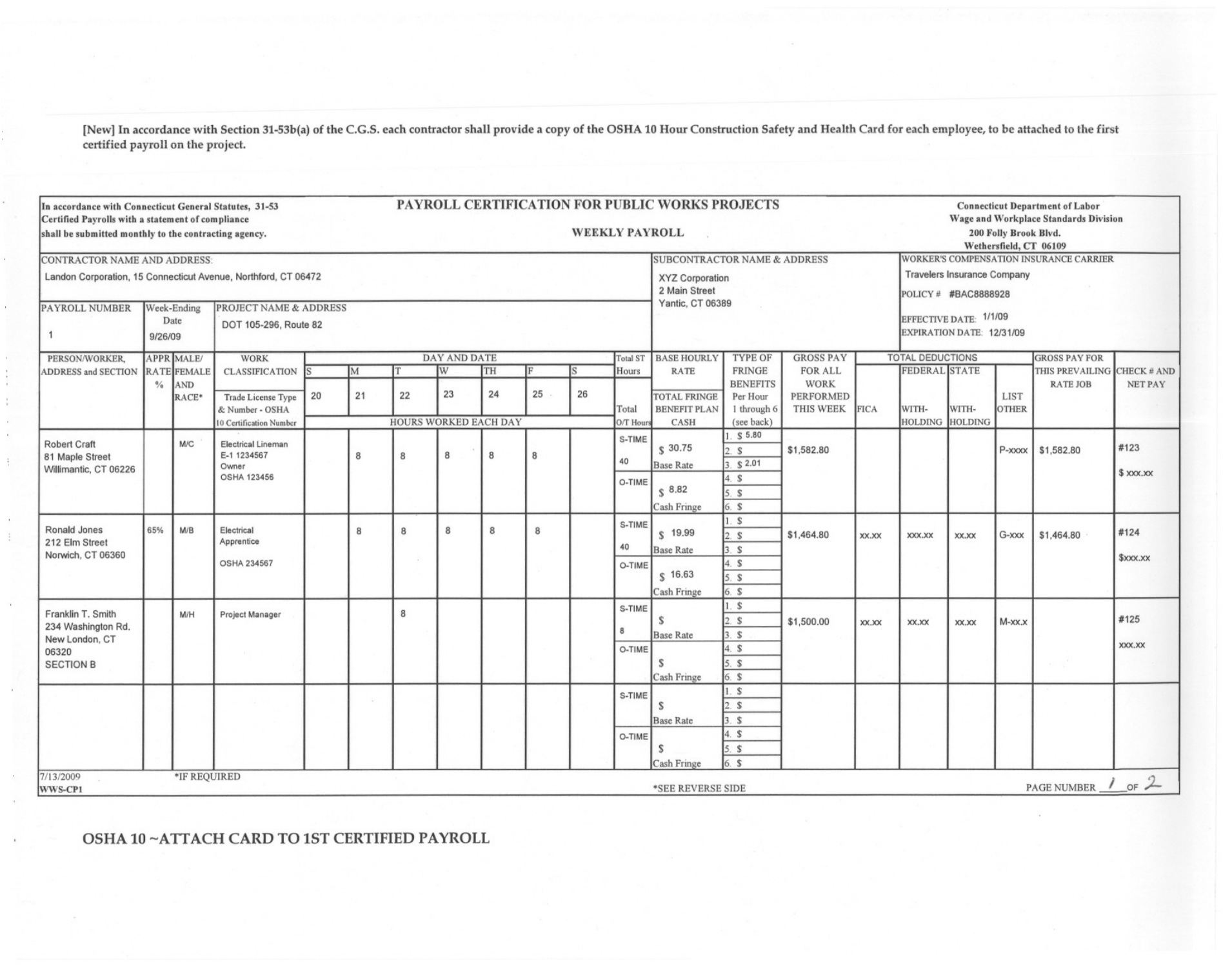

[New] In accordance with Section 31-53b(a) of the CG.S. each contractor shall provide a copy of the OSHA 10 Hour Construction Safety and Health Card for each employee, to be attached to the first

certificd payroll on the project.

In accordance with Connecticut General Statutes, 31-53

PAYROLL CERTIFICATION FOR PUBLIC WORKS PROJECTS

Connecticut Department of Labor

Certified Payrolls with a statement of compliance

Wage and Workplace Standards Division

shall be submitted monthl}' to the contracting agency.

WEEKLY PAYROLL

200 Foil)' Brook 81vd.

Wethersfield, CT 06109CONTRACTOR NAME AND ADDRESS:

SUBCONTRACTOR NAME

& ADDRESSWORKER'S COMPENSATION INSURANCE CARRIER

landon Corporation. 15 Connecticut Avenue, Northford, CT 06472

XYZ Corporation

Travelers Insurance Company

2 Main Street

POLICY # #BAC8888928

PA YROLL NUMBER

Week-Ending

PROJECT NAME

& ADDRESS

Yantic, CT 06389

Date

DOT 105-296, Route 82

EFFECTIVE DATE: 1/1/09

1

9/26/09

EXPIRATION DATE: 12/31/09

PERSON/WORKER,

APPRMALE!

WORK DAY AND DATE

Tolal ST

BASE 1I0URL Y

TYPE OFGROSS PAYTOTAL DEDUCTIONSGROSS PAY FOR

ADDRESS and SECTION

RATEFEMALE

CLASSIFICATION

SM

T

WTIIFSHoursRATEFRINGEFOR ALL

FEDERAL

STATE THIS PREVAILING

CHECK # AND

%

AND

BENEFITS

WORK RATE JOB

NET PAY

RACE'

Trade License Type

20

21

2223

2425

26

TOTAL FRINGE

Per HourPERFORMED LIST

& Number - OSHA

Total

BENEFIT PLAN

I through 6

THIS WEEKFICA

WITH-WITH-

OTHER

10 Certification

Number

HOURS WORKED EACH DAY

Off Hou

CASH

(see back)

HOLDING

HOLDING

Robert Craft

S-TIME

I.

$ 5.80

M/C

Electrical Lineman

$ 30.75

#123

81 Maple Street

E-1 1234567

8

8

88

8

2

$

$1,582.80 P-xxxx

$1,582.80

Owner

40

Base Rate

3

$ 2.01

Willimantic, CT 06226 OSHA 123456

4. $

$ xxx.xx

O-TIME

$ 8.82

5.

$

Cash Fringe

6.

$

S-TIME

I. $

Ronald Jones

65%

MISElectrical

8

8

88

8

$ 19.99

2.

$

$1,464.80

G-xxx

#124

xx.xx

xxx.xx

xx.xx

$1,464.80

212 Elm Street

Apprentice

40

Norwich, CT 06360

Base Rate

3.

$

$xxx.xx

OSHA 234567

O-TIME

4.

$

$

16.63

5. $

Cash Fringe

6.

$

Franklin T. Smith

S-TIME

I.

$

MIH

Project Manager

8

$

#125

234 Washington Rd.

2. $

$1,500.00

xx.xx

xx.xx

xx.xx

M-xx.x

8

New london. CT

Base Rate

3.

$

06320

0- TIME

4. $

xxx.XX

SECTION B

$

5. $

Cash Fringe

6.

$

S-TIME

1. $

$

2. $

Base Rate

3.

$

O-TIME

4.

$

$

5. $

Cash Frinl.!e

6

$

7/13/2009

'IF REQUIRED

I

OF ;:L

WWS-CPI

'SEE REVERSE SIDE

PAGE NUMBER

OSHA 10 -ATIACH CARD TO 1ST CERTIFIED PAYROLL

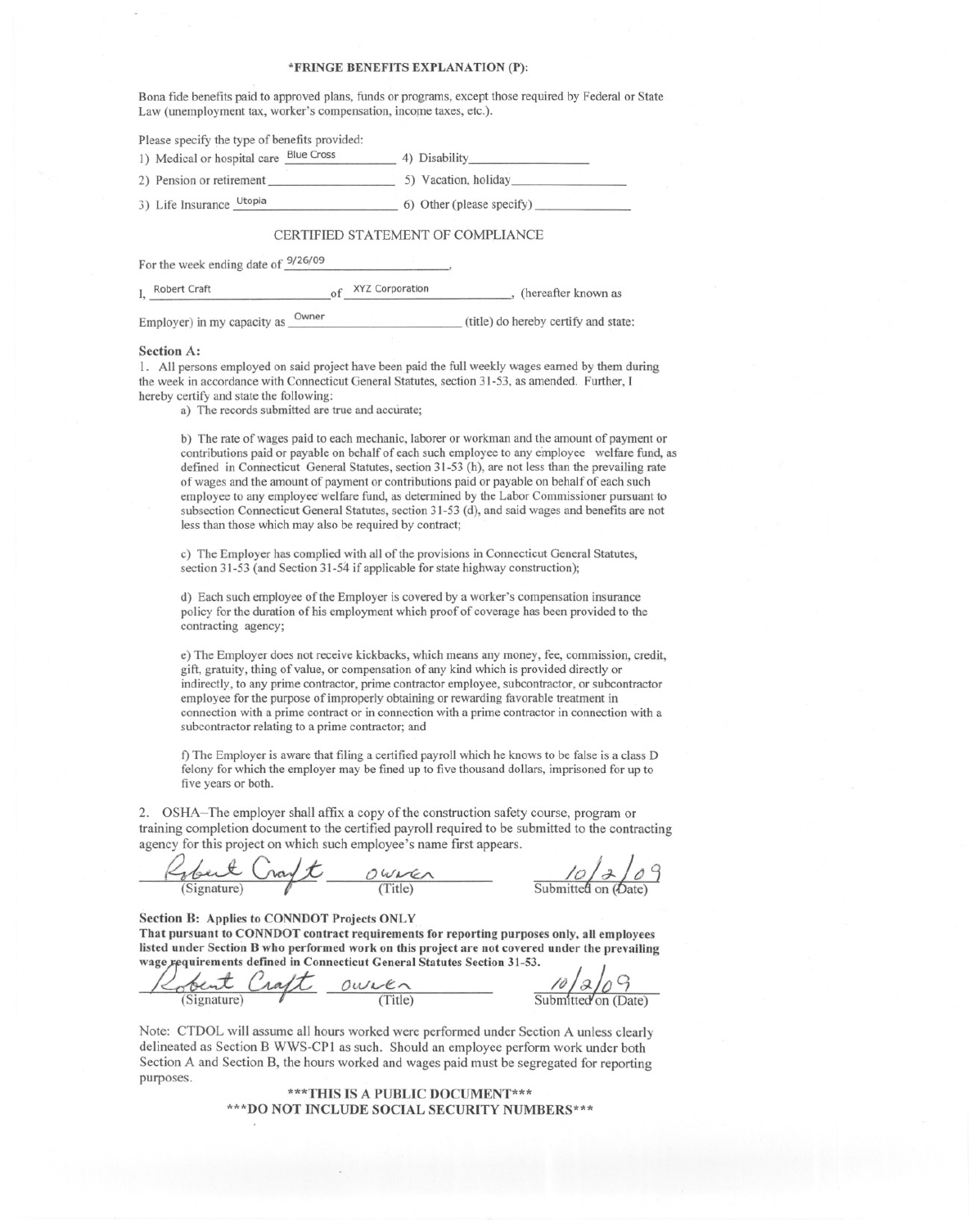

*FRINGE BENEFITS EXPLANATION (P):

Bona fide benefits paid to approved plans, funds or programs, except those required by Federal or State

Law (unemployment tax, worker's compensation, income taxes, etc.).

Please specify the type of benefits provided:

1) Medical or hospital care

Blue Cross 4) Disability _

2) Pension or retirement 5) Vacation, holiday _

3) Life Insurance

Utopia 6) Other (please specify) _

CERTIFIED STATEMENT OF COMPLIANCE

For the week ending date of 9/26/09

-----------'

I, Robert Craft

of XYZ Corporation

, (hereafter known as

Employer) in my capacity as

Owner (title) do hereby certify and state:

Section A:

I. All persons employed on said project have been paid the full weekly wages earned by them during

the week in accordance with Connecticut General Statutes, section 31-53, as amended. Further, I

hereby certify and state the following:

a) The records submitted are true and accurate;

b) The rate of wages paid to each mechanic, laborer or workman and the amount of payment or

contributions paid or payable on behalf of each such employee to any e'mployee welfare fund, as

defined in Connecticut General Statutes, section 31-53 (h), are not less than the prevailing rate

of wages and the amount of payment or contributions paid or payable on behalf of each such

employee to any employee'welfare fund, as determined by the Labor Commissioner pursuant to

subsection Connecticut General Statutes, section 31-53 (d), and said wages and benefits are not

less than those which may also be required by contract;

c) The Employer has complied with all of the provisions in Connecticut General Statutes,

section 31-53 (and Section 31-54 if applicable for state highway construction);

d) Each such employee of the Employer is covered by a worker's compensation insurance

policy for the duration of his employment which proof of coverage has been provided to the

contracting agency;

e) The Employer does not receive kickbacks, which means any money, fee, commission, credit,

gift, gratuity, thing of value, or compensation of any kind which is provided directly or

indirectly, to any prime contractor, prime contractor employee, subcontractor, or subcontractor

employee for the purpose of improperly obtaining or rewarding favorable treatment in

connection with a prime contract or in connection with a prime contractor in connection with a

subcontractor relating to a prime contractor; and

f) The Employer is aware that filing a certified payroll which he knows to be false is a class D

felony for which the employer may be fined up to five thousand dollars, imprisoned for up to

five years or both.

2. OSHA-The employer shall affix a copy of the construction safety course, program or

training completion document to the certified payroll required to be submitted to the contracting

agency for this project on which such employee's name first appears.

~~~

(Signature) ,

ow~

(Title)

/o/~-)t/ Cj

Submitte6 on (.Date)

Section B: Applies to CONNDOT Projects ONLY

That pursuant to CONNDOT contract requirements for reporting purposes only, all employees

listed under Section B who performed work on this project are not covered under the prevailing

wageRquirements defined in Connecticut General Statutes Section 31-53.

ou/I.../e;"-

(Title)

Note: CTDOL will assume all hours worked were performed under Section A unless clearly

delineated as Section B WWS-CP I as such. Should an employee perform work under both

Section A and Section B, the hours worked and wages paid must be segregated for reporting

purposes.

***THIS IS A PUBLIC DOCUMENT***

***DO NOT INCLUDE SOCIAL SECURITY NUMBERS***