Fillable Printable Wh1603Formgenerator-2017Values.Xlsx

Fillable Printable Wh1603Formgenerator-2017Values.Xlsx

Wh1603Formgenerator-2017Values.Xlsx

YEARLY MONTHLY

SEMI-

MONTHLY BI-WEEKLY WEEKLY

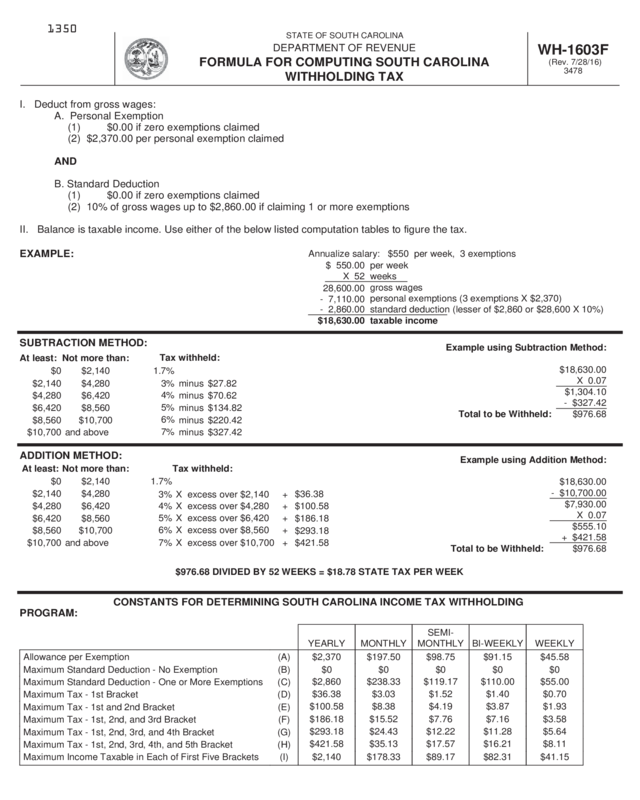

Allowance per Exemption (A) $2,370 $197.50 $98.75 $91.15 $45.58

Maximum Standard Deduction - No Exemption (B) $0 $0 $0 $0 $0

Maximum Standard Deduction - One or More Exemptions (C)

$2,860 $238.33 $119.17 $110.00 $55.00

Maximum Tax - 1st Bracket (D)

$36.38 $3.03 $1.52 $1.40 $0.70

Maximum Tax - 1st and 2nd Bracket (E)

$100.58 $8.38 $4.19 $3.87 $1.93

Maximum Tax - 1st, 2nd, and 3rd Bracket (F)

$186.18 $15.52 $7.76 $7.16 $3.58

Maximum Tax - 1st, 2nd, 3rd, and 4th Bracket (G)

$293.18 $24.43 $12.22 $11.28 $5.64

Maximum Tax - 1st, 2nd, 3rd, 4th, and 5th Bracket (H)

$421.58 $35.13 $17.57 $16.21 $8.11

Maximum Income Taxable in Each of First Five Brackets (I) $2,140 $178.33 $89.17 $82.31 $41.15

SUBTRACTION METHOD:

At least: Not more than:

Tax withheld:

$0 $2,140 1.7%

$2,140 $4,280 3% minus $27.82

$4,280 $6,420

4%

minus $70.62

$6,420 $8,560

5%

minus $134.82

$8,560 $10,700

6%

minus $220.42

$10,700 and above

7%

minus $327.42

per week

weeks

gross wages

personal exemptions (3 exemptions X $2,370)

standard deduction (lesser of $2,860 or $28,600 X 10%)

taxable income

$ 550.00

X 52

28,600.00

- 7,110.00

- 2,860.00

$18,630.00

1350

I. Deduct from gross wages:

A. Personal Exemption

(1) $0.00 if zero exemptions claimed

(2) $2,370.00 per personal exemption claimed

AND

B. Standard Deduction

(1) $0.00 if zero exemptions claimed

(2) 10% of gross wages up to $2,860.00 if claiming 1 or more exemptions

II. Balance is taxable income. Use either of the below listed computation tables to figure the tax.

WH-1603F

(Rev. 7/28/16)

3478

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

FORMULA FOR COMPUTING SOUTH CAROLINA

WITHHOLDING TAX

EXAMPLE:

Annualize salary: $550 per week, 3 exemptions

Example using Subtraction Method:

$18,630.00

X 0.07

$1,304.10

- $327.42

Total to be Withheld: $976.68

Example using Addition Method:

$18,630.00

- $10,700.00

$7,930.00

X 0.07

$555.10

+ $421.58

Total to be Withheld: $976.68

ADDITION METHOD:

At least: Not more than: Tax withheld:

$0 $2,140 1.7%

$2,140 $4,280

3% X excess over $2,140 +

$36.38

$4,280 $6,420

4% X excess over $4,280 +

$100.58

$6,420 $8,560

5% X excess over $6,420 +

$186.18

$8,560 $10,700

6% X excess over $8,560 +

$293.18

$10,700 and above

7% X excess over $10,700 + $421.58

$976.68 DIVIDED BY 52 WEEKS = $18.78 STATE TAX PER WEEK

CONSTANTS FOR DETERMINING SOUTH CAROLINA INCOME TAX WITHHOLDING

PROGRAM: