Fillable Printable Withholding Income Statement Transmittal Form

Fillable Printable Withholding Income Statement Transmittal Form

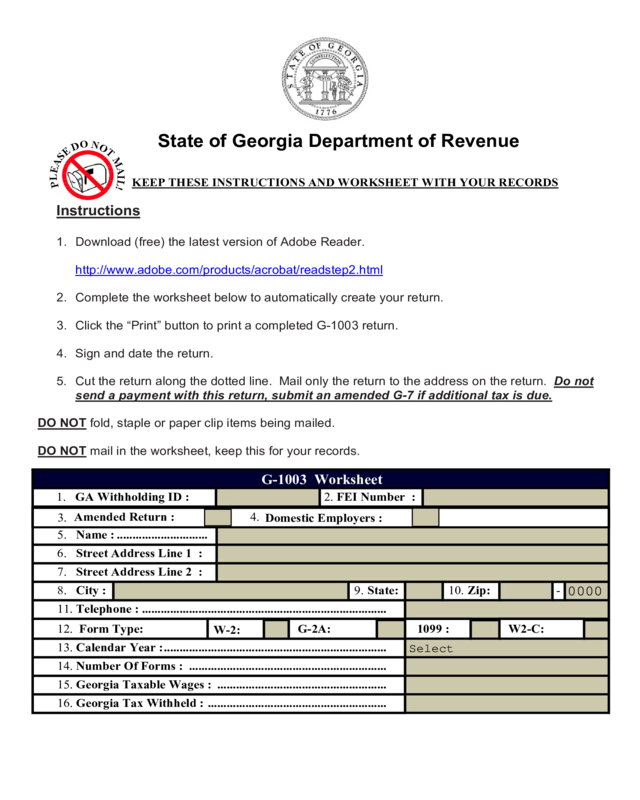

Withholding Income Statement Transmittal Form

Instructions

1. Download (free) the latest version of Adobe Reader.

http://www.adobe.com/products/acrobat/readstep2.html

2. Complete the worksheet below to automatically create your return.

4. Sign and date the return.

5. Cut the return along the dotted line. Mail only the return to the address on the return. Do not

send a payment with this return, submit an amended G-7 if additional tax is due.

DO NOT fold, staple or paper clip items being mailed.

DO NOT

mail in the worksheet, keep this for your records.

1. GA Withholding ID : 2. FEI Number :

5. Name : .............................

Street Address Line 1 :

Street Address Line 2 :

City :

State: Zip:

-

11. Telephone : ..............................................................................

13. Calendar Year :.......................................................................

Number Of Forms : ...............................................................

Georgia Taxable Wages : ......................................................

Georgia Tax Withheld : .........................................................

6.

7.

8. 9. 10.

12.

14.

15.

16.

Domestic Employers :

Amended Return :

3.

4.

State of Georgia Department of Revenue

P

L

E

A

S

E

D

O

N

O

T

M

A

I

L

!

KEEP THESE INSTRUCTIONS AND WORKSHEET WITH YOUR RECORDS

3. Click the “Print” button to print a completed G-1003 return.

G-1003 Worksheet

W-2:

Form Type: G-2A: 1099 : W2-C:

0000

Select

Print

Clear

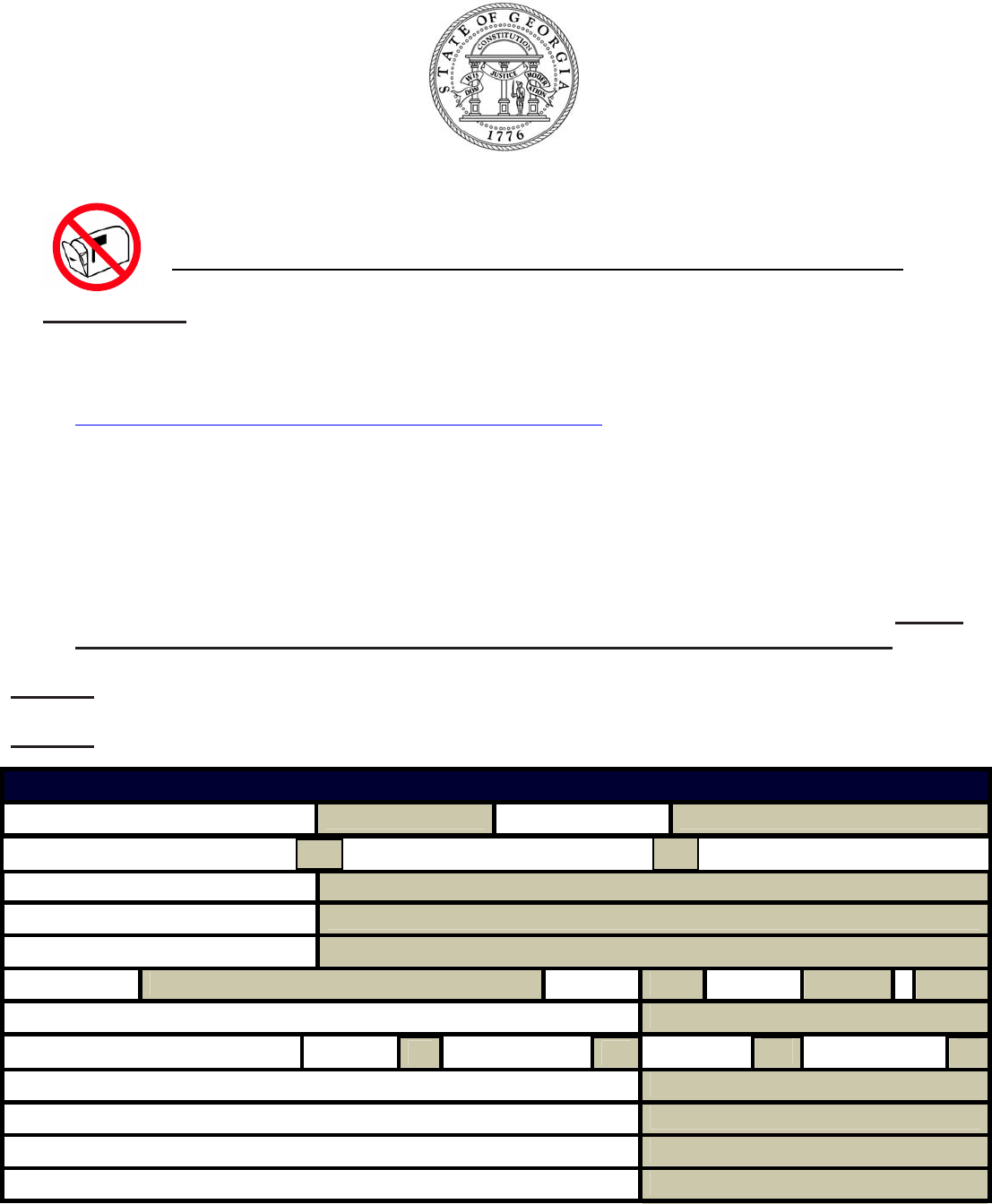

Income Statement Return

DO NOT SUBMIT PAYMENT WITH THIS FORM

GA Withholding ID FEI Number

Tax Year

Number of Forms

Georgia Taxable Wages

Signature

Telephone Date

Georgia Tax Withheld

Vendor Code

EMPLOYER NAME AND ADDRESS

Check here if correction to

Social Security Numbers only.

Form Type

W-2 G2-A 1099 W2-C

_________________

PO BOX 105685

GEORGIA DEPARTMENT OF REVENUE

PROCESSING CENTER

G-1003

ments electronically. Also employers who are federally required to file income statements electronically

Instructions for Preparing the G-1003

Income statements are due on or before February 28th of the following calendar year. If this date is a

weekend or holiday, the due date is the next business day. If a business closes during the taxable year,

income statements are due within 30 days after payment of final wages. Please note for a flow-through

Submit non-wage statements (1099s ) only if Georgia tax is withheld. Statements that do not indicate

Georgia tax withheld may be filed under the Combined Federal/State Filing Program.

The “Number of Forms,” “Form Type” “Georgia Taxable Wages” and “Georgia Tax Withheld” blocks must

Copies of the corrected W2s/1099s/G2-As must accompany all amended returns.

Submit Form G-1003 and paper copies of income statements to:

Ge

orgia Department of Revenue

PO Box 105685

Processing Center

Atlanta, GA 30348-5685

If you file and pay electronically or are filing Form G2-FL, you must file the G-1003 and related state-

must file them electronically for Georgia purposes. Reg. 560-7-8-.33. Even if the employer is not required

to file electronically, they may choose to do so. To obtain a copy of our specifications, visit our website

https://etax.dor.ga.gov or call 1-877-GADOR11 (1-877-423-6711).

entity, the G-1003 and the related G2-As for nonresident members are due by the earlier of the date

such entity’s income tax return is filed or the due date for filing such entity’s income tax return

(without

extension).

be completed

where applicable

.

(Rev. 7/13)

Title

Under penalty of perjury, I declare that this return has been examined by me and to the best of my knowledge and belief it is true,

correct and complete.

Cut on dotted line

PLEASE DO NOT mail this entire page. Please cut along dotted line and mail coupon only.

PLEASE DO NOT STAPLE OR PAPER CLIP.

Amended Return

Domestic employer

with no GA Tax Withheld

040

ATLANTA GA 30348-5685

Date Received