Fillable Printable Withholding Tax Percentage Formula, 150-206-677

Fillable Printable Withholding Tax Percentage Formula, 150-206-677

Withholding Tax Percentage Formula, 150-206-677

150-206-677 (Rev. 07-15) 1

Withholding Tax

Percentage Formula

To figure Oregon withholding amounts, you may

use the formulas shown below. If you use your own

formula, it must be approved by the Oregon Depart-

ment of Revenue before use.

To use the formulas for each payroll period, you

must figure a ‘base wage’ (BASE) amount. The base

wage is the employee’s wage minus the federal tax

withheld minus standard deduction. The federal

tax deduction can’t be more than $6,450 per year in

2015. That’s because Oregon personal income tax

law limits the amount of federal income tax that is

subtracted from federal adjusted gross income (AGI).

For payroll periods of less than a year, figure the

annual withholding then divide by the number of

pay periods.

Once you figure the base wage, use the base wage in

the formulas below to compute your Oregon with-

holding (WH).

Example 1: A single employee has an annual wage

of $15,000 and claims one allowance. If the federal

withholding for this employee is $1,440, and stan-

dard deduction is $2,145, then the base is $11,415 =

($15,000 – $1,440 – $2,415). The amount of annual

Oregon withholding from the table below would be

$986.

WH = $715 + [(BASE – $8,400) x 0.09] – (194 x Allowances)

WH = $715 + [($11,415 – $8,400) x 0.09] – 194 x 0 = $986

You can figure Oregon withholding for this employee

as follows:

1. Wage ............................................................ $15,000

2. Less federal withholding.......................... – $1, 44 0

3. Less standard deduction .......................... – $ 2,14 5

4. BASE ............................................................ $11,415

5. Amount of BASE over $7,950 .................... $3,015

6. Tax on first $8,400 of BASE....................... $715

7. Tax on excess (0.09 × $3,015) ..................... $271

8. Total tax from rates (lines 6 + 7) .............. $986

9. Less personal exemption credit ($194 × 0) – $0

10. Net tax to be withheld .............................. $986

Example 2: To figure withholding based on the same

information listed in example 1:

• For monthly, take the annual “net tax to be with-

held” ($986) & divide by 12 = $82.

• For twice a month, take the $986 and divide by 24

= $41.

• For every two weeks, take the $986 and divide by

26 = $38.

• For weekly, take the $986 and divide by 52 = $19.

• For daily, take the $986 and divide by 260 = $4.

Example 3: A single employee earns $132,000 a year

and claims four allowances on her federal W-4.

Because the employee makes more than $125,000

annually, the employee’s subtraction for federal

withholding is limited. For example, if the employ-

ee’s federal tax withheld is $9,368 for the year, they

may only subtract $3,850 of that amount. Because

the single taxpayers adjusted gross income is over

$100,000, the personal exemption credits of four are

not allowed.

Example 4: A married employee earns $175,000 a year

and claims four allowances on his federal W-4 but

he requests his employer to withhold at the higher

single rate even though he is married. Because his

annual income is higher than $145,000 which is the

final step in the phase-out for the single withholding

rates, his employer would not give any subtraction

for federal tax withheld. His employer would also

not allow any allowances in the formula because his

income is over $100,000 for a single individual.

Have questions? Need help?

General tax information .......... www.oregon.gov/dor

Salem ....................................................(503) 378-4988

Toll-free from an Oregon prefix ... 1 (800) 356-4222

Asistencia en español:

En Salem o fuera de Oregon .............(503) 378-4988

Gratis de prefijo de Oregon ........... 1 (800) 356-4222

TTY (hearing or speech impaired; machine only):

Salem area or outside Oregon ...........(503) 945-8617

Toll-free from an Oregon prefix ....1 (800) 886-7204

Americans with Disabilities Act (ADA): Call one of the help

numbers above for information in alternative formats.

March 2015 www.oregon.gov/dor

150-206-677 (Rev. 07-15) 2

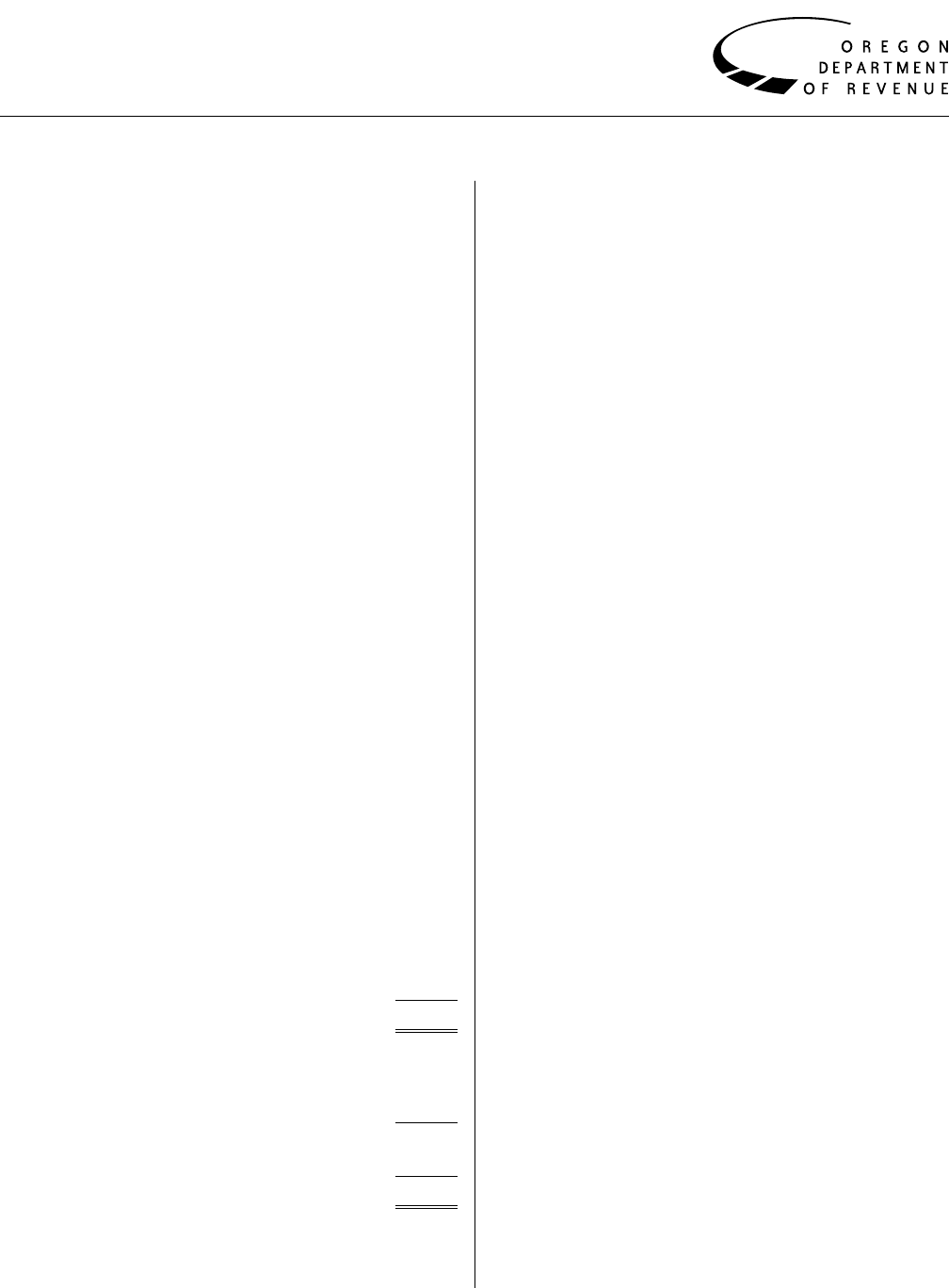

Use the formula that matches your payroll period

Annual wages up to $50,000

Annual formula: BASE = wages – federal tax withheld (not to exceed $6,450) – standard deduction ($2,145[S] / $4,295[M])

Single with less than 3 allowances (A) Single with 3 or more allowances (A) or Married

If BASE is: If BASE is:

Over But not over Over But not over

0 > 3,350 WH = 194 + [BASE × 0.05] – (194 × allow.) 0 > 6,700 WH = 194 + [BASE × 0.05] – (194 × allow.)

3,450 > 8,400 WH = 362 + [(BASE – 3,450) × 0.07] – (194 × allow.) 6,700 > 16,800 WH = 529 + [(BASE – 6,700) × 0.07] – (194 × allow.)

8,400 > 50,000 WH = 715 + [(BASE – 8,400) × 0.09] – (194 × allow.) 16,800 > 50,000 WH = 1,236 + [(BASE – 16,800) × 0.09] – (194 × allow.)

Annual wages of $50,000 or higher

Annual formula: BASE = wages – federal tax withheld (not to exceed phase out) – standard deduction ($2,145[S] / $4,295[M])

Single with less than 3 allowances (A) Single with 3 or more allowances (A) or Married

If BASE is: If BASE is:

Over But not over Over But not over

41,405 > 125,000 WH = 521 + [(BASE – 8,400) × 0.09] – (194 × allow.) 39,255 > 250,000 WH = 1,042 + [(BASE – 16,800) × 0.09] – (194 × allow.)

125,000 WH = 11,015 + [(BASE – 125,000) × 0.099] – (194 × allow.) 250,000 WH = 22,030 + [(BASE – 250,000) × 0.099] – (194 × allow.)

Phase out amounts

Single

Annual

wages ≥ $50,000 and < $125,000 = $6,450

wages ≥ $125,000 and < $130,000 = $5,150

wages ≥ $130,000 and < $135,000 = $3,850

wages ≥ $135,000 and < $140,000 = $2,550

wages ≥ $140,000 and < $145,000 = $1,250

wages ≥ $145,000 = $0

Married

Annual

wages ≥ $50,000 and < $250,000 = $6,450

wages ≥ $250,000 and < $260,000 = $5,150

wages ≥ $260,000 and < $270,000 = $3,850

wages ≥ $270,000 and < $280,000 = $2,550

wages ≥ $280,000 and < $290,000 = $1,250

wages ≥ $290,000 = $0