Fillable Printable 2015 Auditor Report - NSW Fair Trading

Fillable Printable 2015 Auditor Report - NSW Fair Trading

2015 Auditor Report - NSW Fair Trading

2015 AUDITOR’S REPORT,

for AUDIT OF TRUST ACCOUNTS

Property, Stock and Business Agent s Act 2002- secti on 111

This AUDITO R’S REPORT is only r equir ed to be lodged w ith Fair Trading if it is qualified by the audit or

AUDITORS’ DECLARATION

Dated:

this day of 20

A

uditor’s Full Name :

[print in full]

A

uditor’s Firm:

[if app li cabl e]

*Co

mpany Auditor’s

Regi st rat ion Number:

[if app li cabl e]

Auditor’s Postal Address:

1. Neither I or my firm are disqu ali f ied from undertaking this aud it pursuant to sectio n 115 o f

the Act.

2. Pursuant to section 111, I h ave completed this report i n resp ect of the foll ow in g Licensee

En

tity (ie sole trader, or corporation or partnership) that held trust mon eys and carried on

business, or held trust moneys and was inactive, during the period:

L

icen see Ent ity

Name(s):

L

icen see Ent ity No(s) of

the abo ve:

For audit year to Due by 30/ 09/2015

3. Th e Tru st Records referred to in this repo rt rel ate to Trust Accounts, as listed under

S

chedule 1, conducted under the Licensee En tit y Name(s) as n amed above, being i

n

rel ation to trust m oney s received or hel d duri ng the above audit period

Auditor ’s Dec lar ation cont inued page 2

Phone No.

1/07/2014

30/06/2015

1

Auditor ’s Dec lar ation cont inued from page 1

4. I wa

s provided with the Trust Records of the Licensee Entity for whom this report is

prep ared, on: _________/______ _____/20_ _______

5. In carrying out the audit, I have made t est examinations o f the tran sact io ns recorded in

the Trust Accounts in accordance with gen erally accepted auditing standards and

practice.

6. In accordance with item 8 Notes, thi s AUDIT OR’S REPORT has ident ified breach es that

ar e in c ont r a v e ntio n of t he le g is la t i on

.

YES NO If Yes, those breaches are list ed on Schedule 2

7. In my opinion, subject to the qualifications as reported on Schedule 3, for the period

covered by the report, h aving regard to the legislation appli cabl e at th e time that the

mo

ney was held in the T rust Accou nts, based on appropri at e examin at io ns and sampling

techniques:-

a. t

he books o f accoun t required to be kept under Secti on s 103 and 104 of the P rop ert y,

Sto ck and Business Agen t s Act 2002 have been kept in accordance with the Act and

its associat ed Regulation,

b. du rin g the p erio d of reconciled balance(s) of the trust accoun t ( s) were su f ficient to

meet all trust credit ors of the licen see entity as disclosed by the books of accounts

and records.

completed report,

Signature of Reporting Auditor:

2

8. NOTES:

a) Important information for the Licensee Entity

Amendment s un der the Propert y, Stock and Business Agen t s Amend ment Act

2012 now affects your audit oblig at io n as a licensee under the Property, Stock and

Business Agen t s Act 2002T

requirem ent falls under s ec tion 111 of P a rt 8 Division 2 of the Act, as follows;

“(1) A person who is a licens ee, a former licensee or the personal representativ e of

a licensee mus t, within 3 months after the end of the audit period applicable t o the

person:

(a) caus e the rec or ds and doc um ents relating t o any trust m oney held dur ing that

period by t he per s on in ac c or danc e with this Act t o be audited by a person qualif ied

to act as an auditor for t he pur pos es of this Divis ion, and

(b) if the auditor’s r epor t on t he audit is a qualified report, lodge t he report with the

Director – General..

(1A) A n auditor’s r epor t is a qualified report if it sets out any dis c ov er y by the

auditor that any br eac h of this Act or the regulations has been c om m itt ed, that t her e

is any disc r epanc y r elating to the t r ust ac c ount t o whic h the audit r elates or that the

records or doc um ents concerned are not kept in such a manner as to enable them to

be properly audited.

(3) An Auditor’s r epor t under this section m ust be k ept for a least 3 years:

(a) by the licensee at t he lic ens ee’s r egis tered offic e (while the lic ens ee r em ains

a licensee), or

(b) if the licens ee c eas es to be a licensee, by the former licensee in his or her

possession, custody or contr ol unles s the former licensee aut hor is es s om e other

person t o hav e pos s es s ion, custody or contr ol of t he r eport,or

(c) by any other per s on who obtains poss es s ion, cus tody or contr ol of t he report

whether as a result of being the pers onal r epr es entativ e of a licensee or by tr ans fer

of t he bus ines s of t he lic ens ee or otherwise.

i) The list of persons who ar e qualified to audit trust accounts is ex panded.to inc lude audit

companies and m em ber s of certain professional ac c ounting bodies who hold a Public

Certificat e or Certificat e of Public Practice. You should ensure the auditor you engage

holds a curr ent registrat ion – you can check this at t he following Aus tralian Sec ur ities &

Investm ents Comm is s ion webs ite page, http://www.search.asic.gov.au/pro.html

.

b) Important information for the Engaged Auditor

i) Under section 115 of the Act, a person can undert ak e this audit only in t he follow ing

circumstances;

115 Qualifications of auditors

(1) A person is qualified to act as an audit or for the purpos es of this Division if the

person:

(a1) is an authorised audit company w ithin t he m eaning of the Cor por ations Act, or

(a2) is a m em ber of a profes s ional ac c ounting body within the meaning of the

Aust r alian s ec ur ities and Investment s Commiss ion A c t 2001 of the Com m onwealth

and holds a Public P r ac tice Certific ate or Cert ificate of Public practic e is s ued by the

body, or

(b) is a person who has been nominated by the person whos e records and

document s ar e to be audited and who has been approved by the Director-General

by order in wr iting.

(2) Such a person is not qualified to act as an auditor for the purposes of t his

Division if the person:

(a) is or has at any t im e within 2 year s before the last day of the period in respec t of

whic h the audit is to be made, been an em ploy ee or partner of the person whose

records or doc um ents are to be audited, or

(b) is a licensee, or a s har eholder in a c or por ation that is a licensee and t hat has not

more than tw enty shareholders.

3

ii) Und er section 116, the person engaged to undertake the audit has the following

duty;

(1) If an auditor in the course of making an audit for the purposes of this

Divi sio n discovers that an y breach of this Act or the regul ations has been

commi t t ed, that there is any discrepancy rel at ing to the trust mon ey to which

the aud it relates or th at th e record s or documen t s con cerned are not kept in

such a manner as to enable them to be properly audited, the auditor must:

(a) fully set out the facts so discovered by the auditor in the report made by

the auditor for the purposes of the audit, and

(b) forward a copy of the report to the Di rect or-General within 14 days after

providing the report to the licensee.

Maximum penalty: 50 penalty units

iii) This auditor’s r epor t provided by y ou pursuant to the provision of sec tion 111 would be

an engagem

ent t o ex am ine the accounting recor ds and internal c ontrols and pr oc edur es

of t he Lic ens ee E ntity during t he audit period, in relation to tr ust money and ot her

matters designated by P ar t 7 Trust Money of the Act, and report those matt er s in ter ms

of t he gener ally ac c epted auditing s tandards and pr ac tice.

iv) This r epor t would be an examination, in term s of, but does not hav e to be limited to, the

f

ollowing pr ov is ions of the legis lation;

• Part 8 Records, Div is ion 1, sections 103 and 104 of the Act

• Part 7 Trust Money, Divis ion 1, sect ion 85, Divis ion 2, sections 86 and 88 to 89

and Division 4, s ec tions 96 and 97 of the Act

Requir

ed document s and lis t of deposit-tak ing ins titutions c an be ac ces s ed v ia

http://www.fairtrading.nsw.gov.au/Property_agents_and_managers/Agency_responsi

bilities/Trust_accounts.html

• Part 4 Trust Money and P art 5 Recor ds, of t he Regulation

• The com m is s ion and expenses that m ay be charged, and rebates or disc ounts

and the disbursements [in accordance with sect ion 86 (1) ( b) of t he Act] that

may be ef fected, are pres c r ibed under P ar t 4 Agency Agreements Div is

ion 1

s

ections 54, 55 (1) – (3) and 57of the Act and inc or por ating Par t 2 Conduct of

agency busines s , clauses 12 and c laus e 13 [in particular, for comm is s

ion and

sums or costs Schedule 7 clauses 8 & 9 ] [ and for dis bursements, Schedule 12

m

anagement of residential & rur al land c laus e 1 ( d) – (g) and (k), Sc

hedule 13

leas

ing only of r es idential and rural land, Schedule 14 m anagem ent of str ata or

community t itle land] of the Regulation

• The prov is ions of Part 3 General conduct of licensees and regist er ed per s ons

Division 2 sec tion 32 (4) r equir em ents 1, 2 and 6 would be applicable f or trust

record-keeping purposes

S

ee these r equir em ents at this site;

http://www.fairtrading.nsw.gov.au/pdfs/Property_agents_and_managers/psbas32gui

deline.pdf .

v) T he legis lation can be acc es s ed under “ B r ows e’ at

http://www.legislation.nsw.gov.au/

.

9. REQUIRED TRUST BANK RECONCILIATION(S) AND LIST OF T RUST TRIAL BALANCE(S)

FO R THE AUDIT YEAR 1 JULY 2014 TO 30 JUNE 2015

Wh ere t here are audit qu alificat io ns of a fi nancial nature, t he audi tor must attach a copy of

the trust bank reconciliation statements and the trial balance (incorporating the list of

ledger accounts of the principals that moneys are held for), for the relevant accounti

ng

p

eriod/s, and for the final end of audit year accounting period, in respect of the affected

Trust Account/s.

4

10. General information

Information about the Property Stock and Business Agents Act 2002 can be found on the NSW

Fair Trading home page at http://www.fairtrading.nsw.gov.au. by accessing the sites under

Property Agents & Managers.

Trust audit guidelines to assist with the completion of this audit can be accessed on the same

NSW Fair Trading website, http://www.fairtrading.nsw.gov.au, go to Property Agents &

Managers, Agency responsibilities, Trust accounts and then Trust account audit requirements

for audit information and form.

5

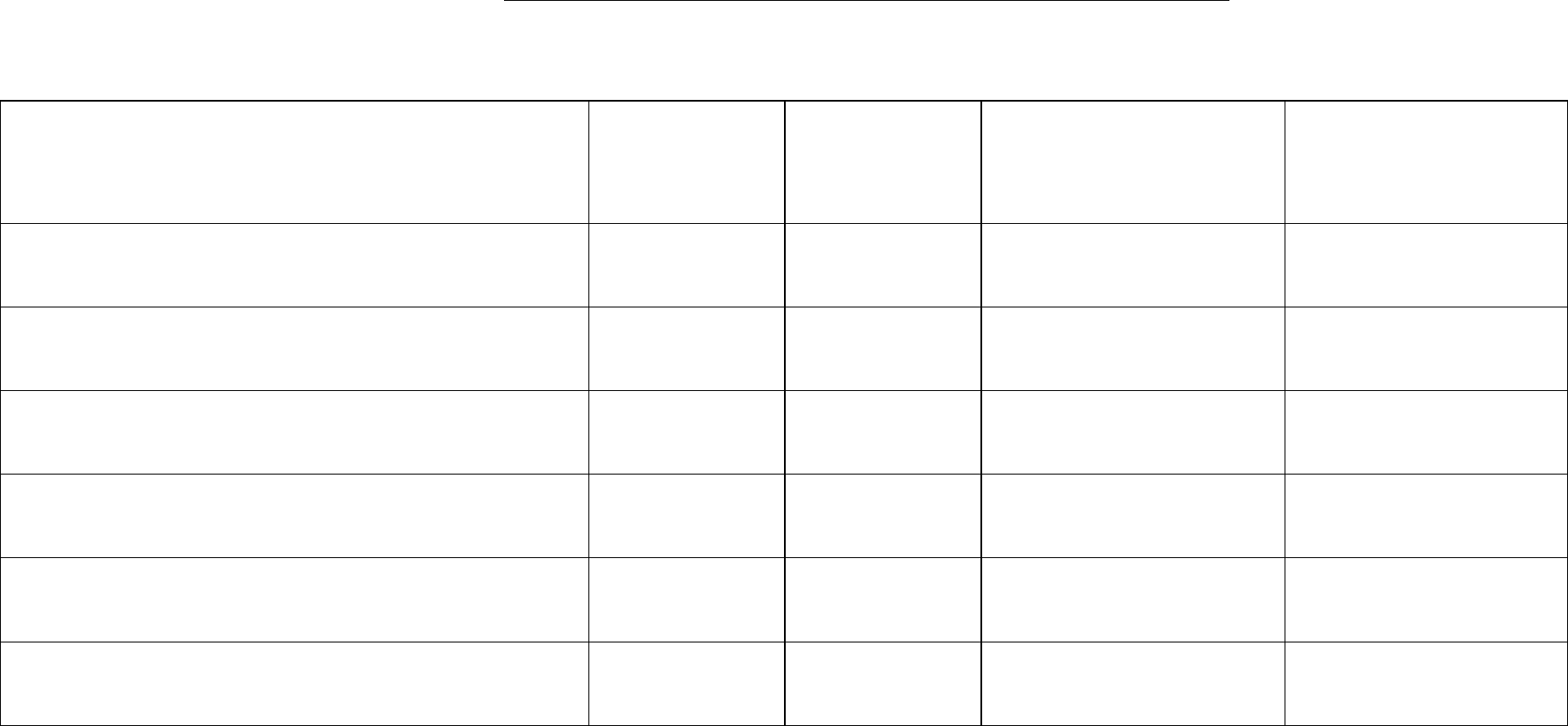

S

CHEDUL E 1

For Lic ens ee E ntit y

DE

TAILS OF TRUST ACCOUN TS HELD

For A UDIT YEAR 01/07/2014 TO 30/06/2015

Name o

f Trust Accoun t

Name of

Financial

Institution

BS

B No.

Acco

unt No.

Closing balance [or if

closed during this period,

dat e clo sed]

6

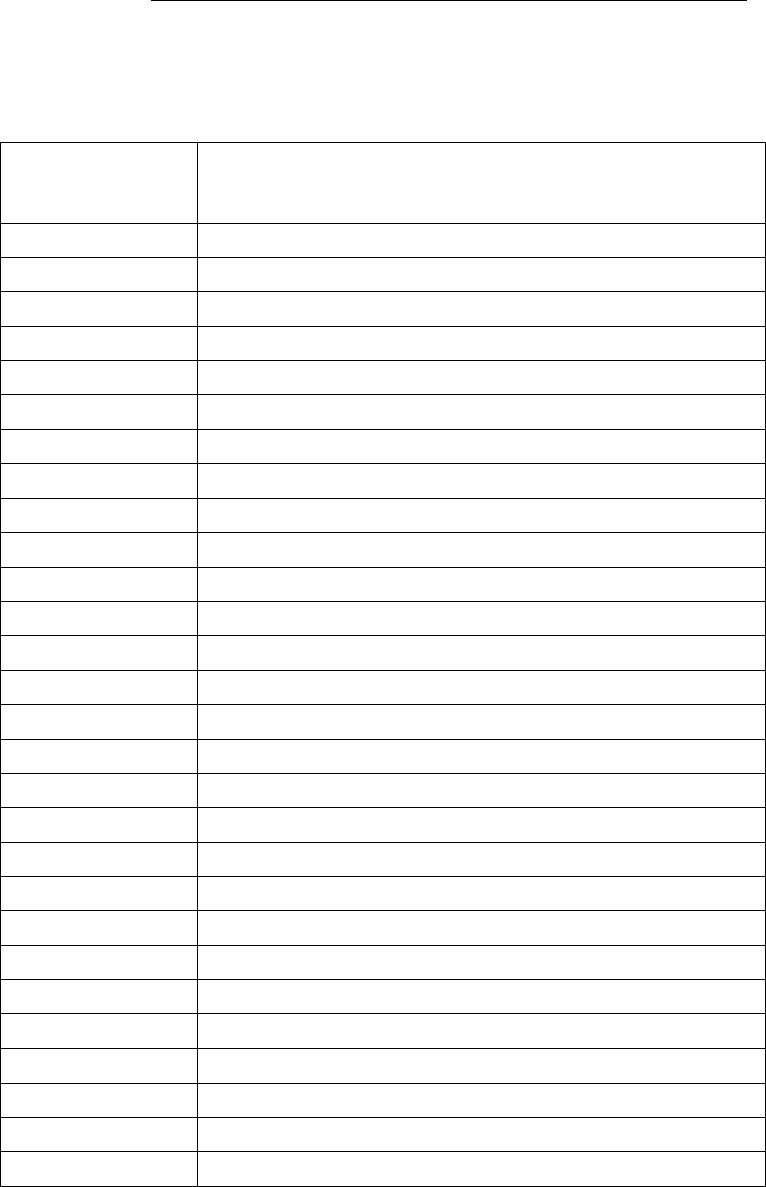

S

CHEDULE 2

For Lic ens ee E ntity

S

UMMARY OF BREACHES OF T HE ACT AND/OR REGULATION

For A UDIT YEA R 01/07/2014 TO 30/06/2015

[I

f no breac hes noted sho w result “NIL”]

Section of Act/

Clau se of Regu lation

DESCRIPT IO N AND E XTE NT OF BREACH

7

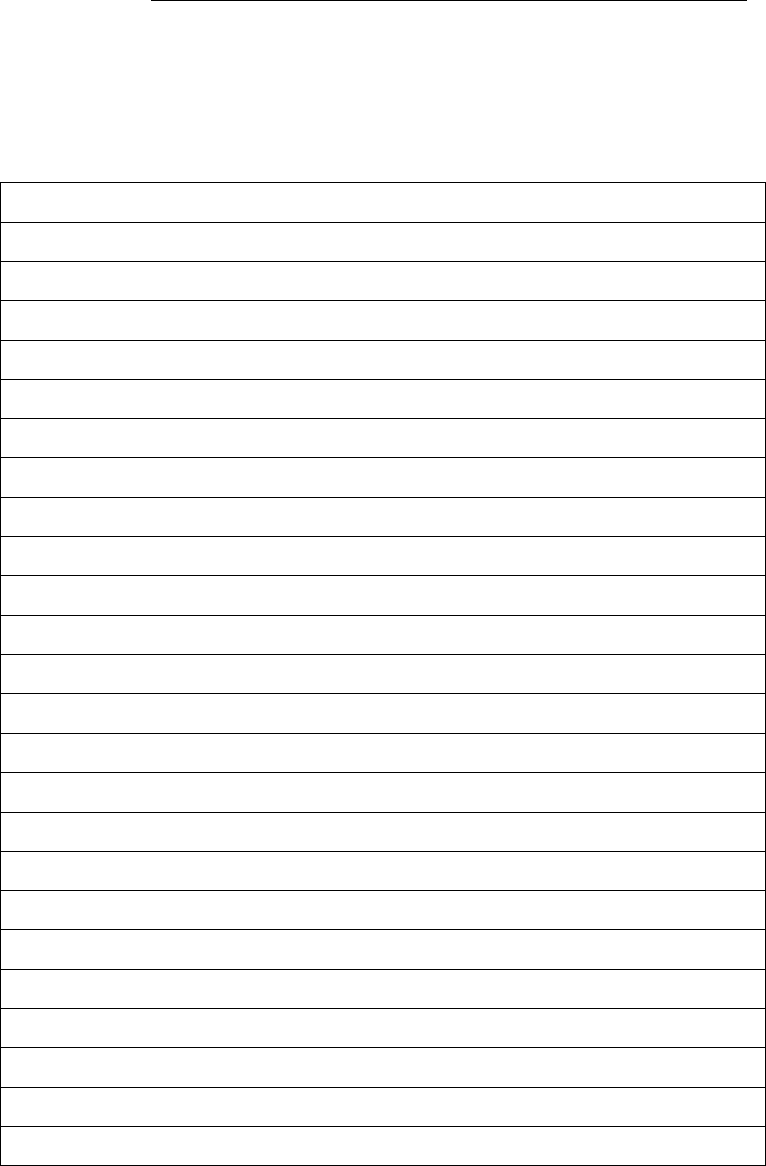

S

CHEDULE 3

For Licensee Entity

SU

MMARY REVIEW OPINION MEMORANDUM

For A UDIT YEAR 01/07/2014 TO 30/06/2015

T

his m emorandum summari ses the r eas ons f or i ssuing a qualified opinion t o the audi t repor t and

is to be c omplet ed after c onsi der ing the r esults of al l procedures followed to compl et e the Report . If

no qualifi ed opinion not ed show result “NIL”

8

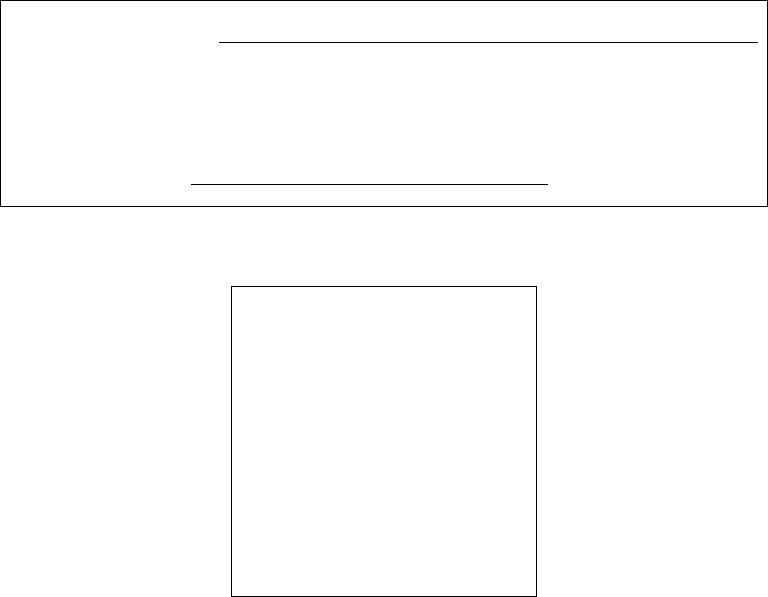

Impor

tant: Read the information that is provided in this documentation and on the NSW Fair

Trading website before making any telephone inquiries.

I, the licensee-in-charge

[pr

int ful l nam e ]

ack

nowledge that I have received this completed 2015 Auditor’s Report.

Licensee signature / /20

Return to:

Department of Finance,

Services and Innovation

c/- NSW Fair Trading

Locked Bag 5066

Parramatta NSW 2124

Inquiries:

T

el ephone: 13 32 20

Office Hours: 8:30 am – 5: 00 pm

Monday – Friday

The Licensee Entity is required to retain a full copy of this report at their registered office whether

the repo rt is qualified o r not for a period of th ree years and make it availabl e for in spectio n by

NSW Fai r Trad ing if required.

9