Fillable Printable Application for Credit or Refund of Sales or Use Tax - New York

Fillable Printable Application for Credit or Refund of Sales or Use Tax - New York

Application for Credit or Refund of Sales or Use Tax - New York

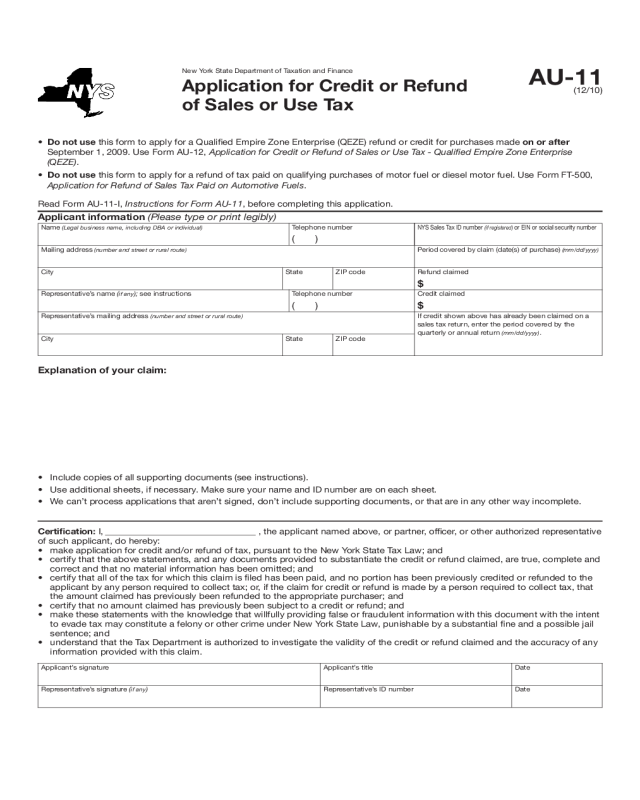

AU-11

(12/10)

New York State Department of Taxation and Finance

Application for Credit or Refund

of Sales or Use Tax

• Do not use this form to apply for a Qualied Empire Zone Enterprise (QEZE) refund or credit for purchases made on or after

September 1, 2009. Use Form AU-12, Application for Credit or Refund of Sales or Use Tax - Qualified Empire Zone Enterprise

(QEZE).

• Do not use this form to apply for a refund of tax paid on qualifying purchases of motor fuel or diesel motor fuel. Use Form FT-500,

Application for Refund of Sales Tax Paid on Automotive Fuels.

Read Form AU-11-I, Instructions for Form AU-11, before completing this application.

Applicant information (Please type or print legibly)

Name (Legal business name, including DBA or individual) Telephone number

NYS Sales Tax ID number (if registered) or EIN or social security number

( )

Mailing address (number and street or rural route)

Period covered by claim (date(s) of purchase) (mm/dd/yyyy)

City State ZIP code Refund claimed

$

Representative’s name (if any); see instructions Telephone number Credit claimed

( )

$

Representative’s mailing address (number and street or rural route) If credit shown above has already been claimed on a

sales tax return, enter the period covered by the

quarterly or annual return

(mm/dd/yyyy).

City State ZIP code

Explanation of your claim:

Applicant’s signature Applicant’s title Date

Representative’s signature (

if any) Representative’s ID number Date

Certification: I, , the applicant named above, or partner, ofcer, or other authorized representative

of such applicant, do hereby:

• makeapplicationforcreditand/orrefundoftax,pursuanttotheNewYorkStateTaxLaw;and

• certifythattheabovestatements,andanydocumentsprovidedtosubstantiatethecreditorrefundclaimed,aretrue,completeand

correctandthatnomaterialinformationhasbeenomitted;and

• certifythatallofthetaxforwhichthisclaimisledhasbeenpaid,andnoportionhasbeenpreviouslycreditedorrefundedtothe

applicantbyanypersonrequiredtocollecttax;or,iftheclaimforcreditorrefundismadebyapersonrequiredtocollecttax,that

theamountclaimedhaspreviouslybeenrefundedtotheappropriatepurchaser;and

• certifythatnoamountclaimedhaspreviouslybeensubjecttoacreditorrefund;and

• makethesestatementswiththeknowledgethatwillfullyprovidingfalseorfraudulentinformationwiththisdocumentwiththeintent

toevadetaxmayconstituteafelonyorothercrimeunderNewYorkStateLaw,punishablebyasubstantialneandapossiblejail

sentence;and

• understandthattheTaxDepartmentisauthorizedtoinvestigatethevalidityofthecreditorrefundclaimedandtheaccuracyofany

information provided with this claim.

• Includecopiesofallsupportingdocuments(seeinstructions).

• Useadditionalsheets,ifnecessary.MakesureyournameandIDnumberareoneachsheet.

• Wecan’tprocessapplicationsthataren’tsigned,don’tincludesupportingdocuments,orthatareinanyotherwayincomplete.