Fillable Printable Application Form to Claim A Refund or Transfer Credit

Fillable Printable Application Form to Claim A Refund or Transfer Credit

Application Form to Claim A Refund or Transfer Credit

FORM REF-583

APPLICATION TO CLAIM A REFUND

OR TRANSFER CREDIT BASED ON OVERPAYMENT

OF REAL ESTATE TAXES, WATER CHARGES,

SEWER RENTS, OR IMPROVEMENT ASSESSMENTS

PLEASE READ THIS BEFORE COMPLETING THIS APPLICATION:

USE THIS FORM

to apply for a refund or to transfer a valid credit

ONLY in one of the following circumstances:

❑ If you believe that you have overpaid real estate taxes, water charges, sewer

rents, or improvement assessments;

❑ If you paid the correct amount of a tax or charge and another party also paid

the same tax or charge;

❑ If you mistakenly paid a tax or charge on a property in which you have

no interest; or

❑ If you paid a tax or charge that was later cancelled.

DO NOT USE THIS FORM to apply for a refund or to transfer a credit that

has resulted from a reduction in the assessed valuation of a property.

For that type of refund or credit transfer, you must use FORM REF-400.

NYC Department of Ffinance

Refunds and Adjustments Unit

25 Elm Place, 4th Floor

Brooklyn, NY

11201

www.nyc.gov/finance

FINANCE

NEW

●

YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

REF-583 rev. 08/03

FINANCE

NEW

●

YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

CITY OF NEW YORK

●

DEPARTMENT OF FINANCE

●

25 ELM PLACE

●

4TH FLOOR

●

BROOKLYN

●

NY 11201

Dear Taxpayer or Taxpayer’s Representative,

This packet was designed to help you obtain a refund or transfer of a real estate tax

credit for yourself or your client.

Please be sure to submit all the required information and all required documenta-

tion, signatures, and notarizations, so we can process your claim as quickly as pos-

sible.

You may use this application to request any ONE of the following options:

1. A refund, by check;

2. A transfer of the refund money to liquidate one or more charges on the same

property;

3. A transfer of the refund money to liquidate one or more charges on another

property in which you (or your client) have/has an interest; OR

4. A partial refund, by check, and the balance transferred as in #2 and #3 above.

PLEASE READ THE INSTRUCTIONS CAREFULLY as you complete this applica-

tion. If you have questions, please call Customer Assistance at 718-935-9500.

B.

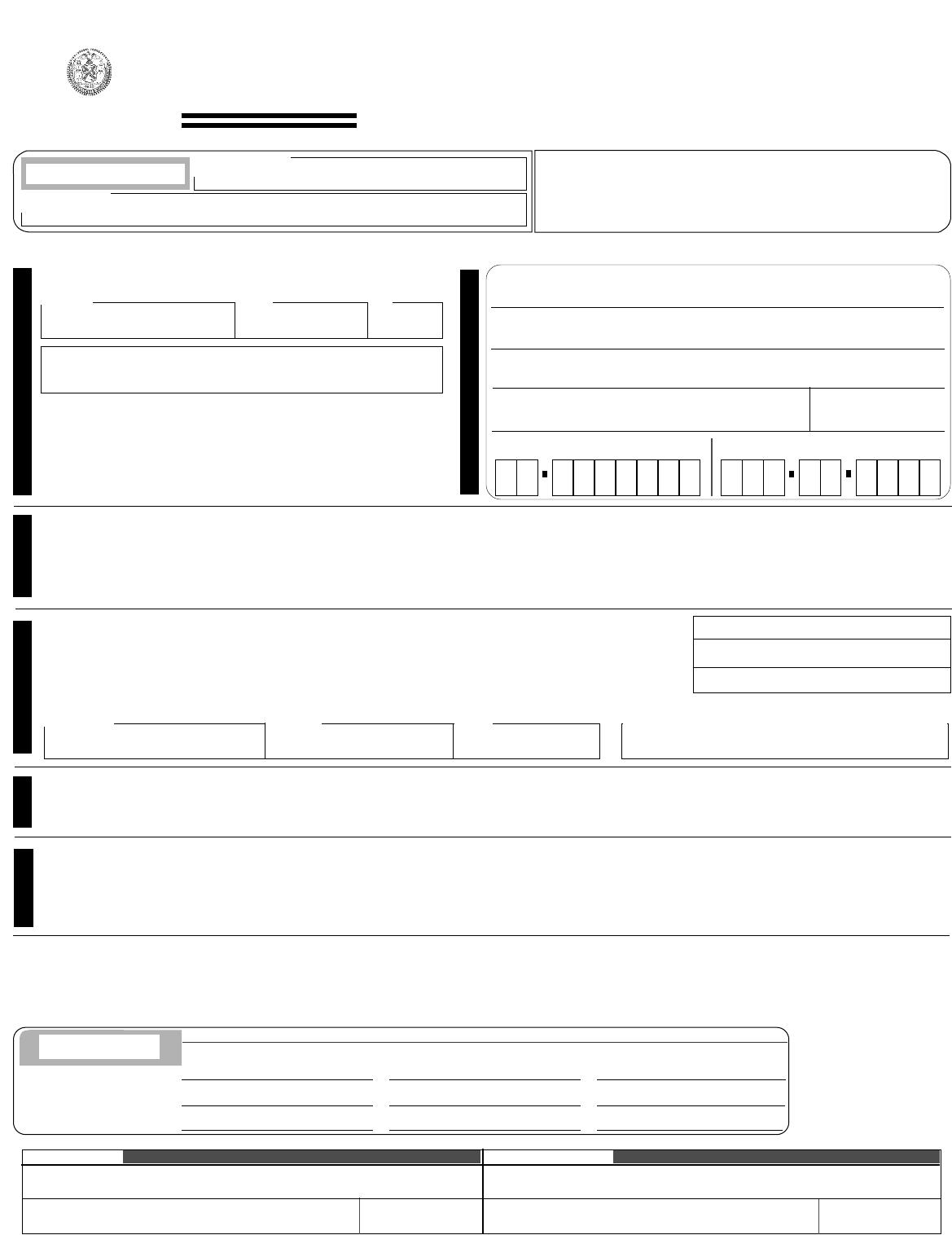

APPLICANT'S INTEREST IN THE PROPERTY LISTED ABOVE

(CHECK (✓) THE APPROPRIATE BOX)

❑

OWNER

❑

TENANT

❑

MORTGAGEE

❑

MANAGING AGENT

❑

NONE

❑

OTHER (specify) _____________________________________

NAME OF OWNER

A.

Specify the total amount of overpayment

........................................................................ $

B.

Specify the amount to be transferred............................................................................... $

C. Specify the amount to be refunded ................................................................................. $

Applicant's name

c/o Attorney or representative, if applicable

Mailing Address (number and street)

City and State Zip Code

CLAIM NUMBER ▼

DESCRIPTION ▼

APPLICANT IS REQUESTING A REFUND OR TRANSFER FOR:

(CHECK (✓) THE APPROPRIATE BOX)

❑

REAL ESTATE TAX

❑

WATER AND/OR SEWER RENT CHARGE

❑

EMERGENCY REPAIR CHARGE

❑

FIRE DEPARTMENT CHARGE

❑

DEPARTMENT OF BUILDINGS CHARGE

❑

DEPARTMENT OF HEALTH CHARGE

❑

SIDEWALK REPAIR CHARGE

❑

OTHER __________________________________

❑

OVERPAYMENT

❑

CANCELLATION OF PREVIOUSLY PAID CHARGE

❑

PAYMENT ON WRONG PROPERTY

❑

OTHER (specify): ________________________________________________________________

OWNER'S EMPLOYER IDENTIFICATION NUMBER OWNER'S SOCIAL SECURITY NUMBER

(

IF CORPORATION OR PARTNERSHIP)(IF OWNER IS INDIVIDUAL)

Total amount of overpayment ...

Total amount of transfer ...........

Total amount of refund..............

REFUND OR TRANSFER TO:

REAL ESTATE TAX WATER/SEWER RENT CHARGE IMPROVEMENT ASSESSMENT

BOROUGH

LOT

BLOCK

WERE THE PAYMENTS MADE THROUGH A MORTGAGE ESCROW ACCOUNT? .......................................................

❑

YES

❑

NO

IF "YES", PLEASE GIVE THE NAME OF THE BANK OR MORTGAGE COMPANY AND MORTGAGE NUMBER ▼

Name: _________________________________________________________ Number: ___________________________________________________

INDICATE THE BOROUGH, BLOCK AND LOT THAT THE CREDIT (OR PORTION THEREOF) IS TO BE TRANSFERRED TO

▼

INDICATE THE CHARGE(S)/PERIOD(S)

▼

BOROUGH

▼

LOT

▼

BLOCK

▼

REASON FOR REFUND

OR TRANSFER OF CREDIT

:

(CHECK THE APPROPRIATE BOX)

ATTACH COPIES OF THE CANCELLED CHECKS AND RECEIPTED BILLS SHOWING PAYMENT OF THE TAXES OR CHARGES TO

BE REFUNDED OR TRANSFERRED. FAILURE TO SUBMIT THE REQUESTED MATERIALS WILL INVALIDATE THE APPLICATION.

IF THE APPLICANT IS NOT THE PAYER, THE PAYER MUST COMPLETE THE CONSENT FORM ON PAGE 2.

REF-583

TYPE OR PRINT ALL INFORMATION

1

2

3

4

5

6

FILE THIS FORM WITH:

NYC DEP.T OF FINANCE

25 ELM PLACE, 4TH FLOOR

BROOKLYN, NY 11201

❑

REAL ESTATE TAX ONLY

❑

REFUND ONLY

❑

IMPROVEMENT ASSESSMENTS

❑

TRANSFER ONLY

❑

WATER/SEWER RENT CHARGE ONLY

❑

TRANSFER PORTION AND REFUND BALANCE

FOR OFFICIAL USE ONLY

FOR OFFICIAL

USE ONLY

A.

INDICATE THE BOROUGH, BLOCK AND LOT ON WHICH PAYMENT WAS MADE

FINANCE

NEW

●

YORK

APPLICATION TO CLAIM A REFUND

OR TRANSFER CREDIT BASED ON OVERPAYMENT

OF REAL ESTATE TAXES, WATER CHARGES,

SEWER RENTS OR IMPROVEMENT ASSESSMENTS

EXAMINER ▼ APPROVED BY ▼

PRINT NAME: PRINT NAME:

SIGNATURE: DATE: SIGNATURE: DATE:

rev 08/03

✔

Form NYC-REF-583 Page 2

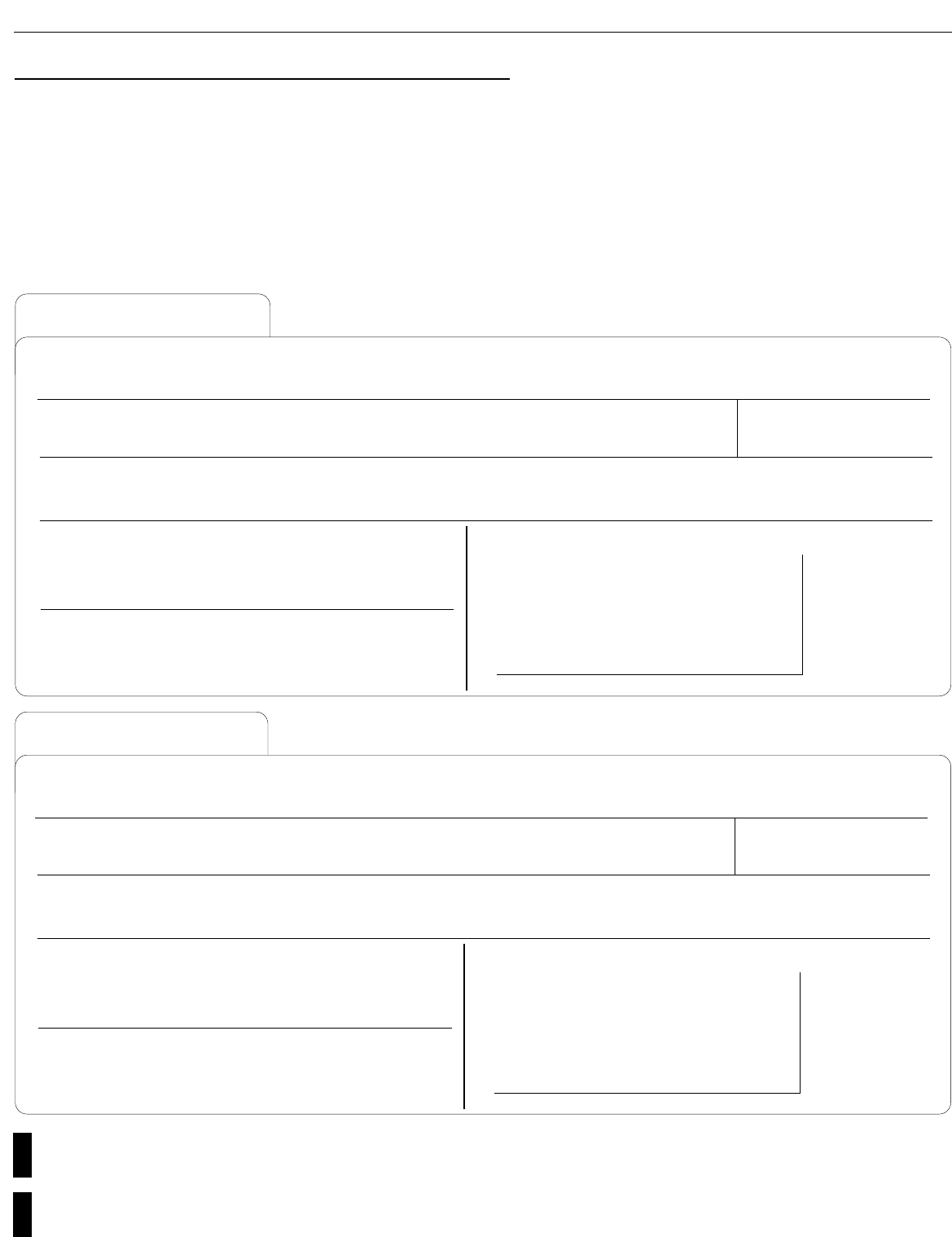

Line 1. Enter the full name of the payer, the individual or entity whose name appears on the check and who made the payment to be refunded.

If the payer is a partnership or corporation, enter the full name of the entity.

Line 2. If the payer is a partnership or corporation, enter the name and telephone number of the partner or officer signing this consent. If the

payer is represented by an attorney, trust or other entity, enter the name of the individual signing this consent and attach a Power of

Attorney, court order or other documentation of the representative's capacity.

Line 3. Sign. If the payer is not an individual, the person whose name appears on line 2 must sign this form.

Line 4. Enter the full address of the party signing this form.

Line 5. Have this form notarized and dated.

Name of payer ▼

Name of partner, corporate officer or legal representative of the payor, if applicable ▼ Telephone number ▼

I am the payer, or an officer, partner or legal representative of the payer, of a tax or charge upon which this claim is based. I have read this claim for

refund or transfer of credit and acknowledge that, to the best of my knowledge, it is true and correct. If the City of New York verifies that an overpayment

exists for this claim, I consent that the refund be paid to the applicant, and I release the City of New York from any claims arising from this refund.

Signature of payer (see instructions) ▼

Address ▼

CONSENT

1.

2.

3.

4.

AFFIDAVIT

5. Sworn to and subscribed to before me on this

______ day of _______________ 20 _______

State of ______________________________

County of _____________________________

Signature of Notary

▲ Stamp or Seal ▲

Name of payer ▼

Name of partner, corporate officer or legal representative of the payee, if applicable ▼ Telephone number ▼

I am the payer, or an officer, partner or legal representative of the payer, of a tax or charge upon which this claim is based. I have read this claim for

refund or transfer of credit and acknowledge that, to the best of my knowledge, it is true and correct. If the City of New York verifies that an overpayment

exists for this claim, I consent that the refund be paid to the applicant, and I release the City of New York from any claims arising from this refund.

Signature of payer (see instructions) ▼

Address ▼

CONSENT

1.

2.

3.

4.

AFFIDAVIT

5. Sworn to and subscribed to before me on this

______ day of _______________ 20 _______

State of ______________________________

County of _____________________________

Signature of Notary

▲ Stamp or Seal ▲

If a taxpayer is requesting a refund in which the overpayment was made by a bank or other lending

institution, then, a signed consent is required by both the taxpayer and the bank/lending institution.

If a taxpayer is requesting a refund in which the overpayment was made by a bank or other lending

institution, then, a signed consent is required by both the taxpayer and the bank/lending institution.

INSTRUCTIONS FOR C

ONSENT OF

PAYOR

NOTE: Complete the section below if you made none or only some of the payments to be refunded.

_____________________________________ ___________________ ____________________________ _______________________

Signature of Applicant Date Title (If Corporate Officer) Phone Number

7

_____________________________________ ___________________ ____________________________ _______________________

Signature of Agent Date Title (If Corporate Officer) Phone Number

8

REQUIREMENTS FOR ALL APPLICANTS

To be eligible for a refund or transfer of credit, you must show

either of the following:

●

That you paid the taxes or charges to be refunded, OR

●

That another party paid the taxes or charges and that the party

consents that the refund be made to you.

If you paid by check, you must submit a copy of the cancelled

check showing who made the payment.

If you paid in cash, you must submit the original

receipt you

received at the time of payment. This shows the receipt number,

the borough, block and lot, the account type, the due date of the

tax that was paid, and the payment date.

If you, personally, did not pay the taxes or charges, the City can-

not give you the refund or transfer of credit unless you produce a

written, notarized consent form from the party who actually made

the payment. Page 2 of this application has been provided for

this purpose.

Finally, please note: If you wish to request a refund or transfer of

credit for more than one property, you must file a separate Form

REF-583 for each property.

SPECIFIC INSTRUCTIONS

LINE 1 - DESCRIPTION OF PROPERTY

Enter the borough, block and lot credited with the payment upon

which this claim is based.

Enter the property owner's full name. If the property owner is a

partnership or a corporation, enter the full name of the entity.

Check the box which indicates your interest in the property. If

you have no interest in the property (which would mean that your

payment was credited to the wrong property), check NONE.

LINE 2 - APPLICANT INFORMATION

Enter the applicant's full name. If the applicant is a partnership

or corporation, enter the full name of the entity.

Enter the name of the applicant's attorney or representative, if

applicable. If the attorney for this refund claim is different from

the attorney of record for the action upon which this claim is

based, a letter of authorization from the original attorney must be

submitted.

Enter the mailing address. Correspondence and refund checks

will be mailed to this address. If the applicant is represented by

an attorney and wishes these items to be mailed to that attorney,

enter the attorney's address.

If the property owner is a partnership or a corporation, enter the

owner's Employer Identification Number. If the property owner

is an individual, enter the owner's Social Security Number.

LINE 3 - TYPE OF REFUND OR TRANSFER

Check the appropriate box for the type of refund or transfer of

credit that you are requesting.

LINES 4A - 4C - AMOUNT OF OVERPAYMENT

LINE 4A

Enter the total amount of the overpayment, including both the

amount to be transferred and the amount to be refunded by check.

LINE 4B

Enter the amount of the overpayment to be refunded.

LINE 4C

Enter the amount you wish transferred and indicate the borough,

block and lot that the credit is to be transferred to. You may

request that your credit be transferred to an unpaid charge on the

same property or to an unpaid charge on another property in

which you have an interest. Specify the type of charge(s) and the

period(s). If you do not specify a particular charge to which you

would like the credit applied, we will apply it to the oldest lien on

the property you have indicated.

LINE 5 - REASON FOR REFUND OR TRANSFER

Check the appropriate box for the reason you are claiming a

refund or transfer of credit.

LINE 6 - ESCROW ACCOUNTS

Check the box which indicates if your payments were made

through an escrow account. If the answer is "YES", write the

name of the bank or mortgage company and mortgage number in

the space provided.

SIGNATURE (on page 2)

Sign and date the form. If the applicant is a corporation, an offi-

cer must sign. If the applicant is a partnership, a partner must

sign.

NOTE

If the payments upon which your claim is based were made by

check, attach photocopies of the front and back of each cancelled

check (and copies of receipted bills, if available). If payments

were made in cash, original receipted bills must be attached.

Form NYC-REF-583 Page 3

REF-583 (REVISED 08/03)

Instructions for Form REF-583

FINANCE

NEW

●

YORK

NYC DEPARTMENT OF FINANCE

REFUNDS AND ADJUSTMENTS UNIT

25 ELM PLACE, 4TH FLOOR

BROOKLYN, NY 11201

www.nyc.gov/finance

TO:

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

APPLICATION TO CLAIM A REFUND

OR TRANSFER CREDIT BASED ON

OVERPAYMENT OF REAL ESTATE

TAXES, WATER CHARGES, SEWER

RENTS OR IMPROVEMENT

ASSESSMENTS

FORM REF-583

FINANCE

NEW

●

YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE