Fillable Printable Credit Application for Individuals Who Become Residents of Canada

Fillable Printable Credit Application for Individuals Who Become Residents of Canada

Credit Application for Individuals Who Become Residents of Canada

GST/HST Credit Application

for Individuals Who Become Residents of Canada

Is this form for you?

Use this form to apply for the goods and services tax/harmonized

sales tax (GST/HST) credit for the year that you became a resident

of Canada.

What is the GST/HST credit?

The GST/HST credit is a non-taxable quarterly payment that helps

individuals and families with low and modest incomes offset all or

part of the GST/HST that they pay.

Are you eligible for the credit?

You are eligible for this credit if, you are a resident of Canada for

income tax purposes in the month before and at the beginning of

the month in which we make a payment, and at least one of the

following applies:

•

you are 19 years of age or older;

•

you have (or had) a spouse or common-law partner; or

•

you are (or were) a parent and live (or lived) with your child.

If you are turning 19 years of age before April in the year after you

became a resident of Canada, you can apply for the credit now.

Generally, you have to be 19 years of age or older to get the

GST/HST credit, but you can be younger than 19 years of age

to apply.

Are you a resident of Canada?

We consider you to be a resident of Canada when you establish

sufficient residential ties in Canada. Residential ties include:

•

a home in Canada;

•

a spouse or common-law partner or dependants in Canada;

•

personal property in Canada, such as a car or furniture; and

•

economic and social ties in Canada.

Other ties that may be relevant include a Canadian driver's licence,

Canadian bank accounts or credit cards, and health insurance with

a Canadian province or territory.

If you got a letter from us about your residency status, include a copy

of it with this application.

If you are not sure if you are a resident of Canada, complete

Form NR74, Determination of Residency Status (Entering Canada),

and include it with this application. We will give you our opinion about

your residency status.

Do you have a spouse or common-law partner?

You can get the GST/HST credit for your spouse or common-law

partner. Generally, he or she has to be a resident of Canada for

income tax purposes in the month before and at the beginning of

the month in which we make a payment. Complete the section

"Information about your spouse or common-law partner" on the

first page of the application form.

If you have a spouse or common-law partner, only one of you can

get the GST/HST credit for both of you. No matter which one of

you applies, the amount will be the same.

Definitions

Common-law partner – this applies to a person who is not your

spouse (defined below), with whom you are living in a conjugal

relationship, and to whom at least one of the following situations

applies. He or she:

a) has been living with you in a conjugal relationship, and this

current relationship has lasted at least 12 continuous months;

Note

In this definition, 12 continuous months includes any

period you were separated for less than 90 days

because of a breakdown in the relationship.

b) is the parent of your child by birth or adoption; or

c) has custody and control of your child (or had custody and

control immediately before the child turned 19 years of age)

and your child is wholly dependent on that person for support.

Separated – you are separated when you start living separate

and apart from your spouse or common-law partner because of a

breakdown in the relationship for a period of at least 90 days and

you have not reconciled.

Once you have been separated for 90 days (because of a

breakdown in the relationship), the effective day of your separated

status is the date you started living separate and apart.

Spouse – this applies only to a person to whom you are legally

married.

Do you have children under 19 years of age?

You can get the credit for each of your children if all of the following

apply at the beginning of the month in which we make a payment.

The child:

•

is your child, or is dependent on you or your spouse or

common-law partner for support;

•

is under 19 years of age;

•

has never had a spouse or common-law partner;

•

has never been a parent of a child he or she lived with; and

•

lives with you.

To register your child for the GST/HST credit, go

to www.cra.gc.ca/myaccount or send a completed Form RC66,

Canada Child Benefits Application.

If you share custody of a child, go to www.cra.gc.ca/gsthstcredit

and select the "Shared custody" link, call 1-800-959-1953, or see

Booklet T4114, Canada Child Benefits, for more information.

Note

Your child should apply for his or her own GST/HST credit by

completing Form RC151 if he or she is under 19 years of age and:

•

has (or had) a spouse or common-law partner; or

•

is (or was) a parent and lives (or lived) with his or her child.

RC151 E (15)

How do we calculate your credit?

We base your GST/HST credit on your and your spouse's or

common-law partner's income from all sources, both inside and

outside Canada (if he or she is a resident of Canada), and on

the number of children you have registered.

If you became a resident of Canada:

•

before April, you must complete Steps 1, 2, and 3 in Part D

of the form; or

•

after April, you must complete Steps 1 and 2 in Part D of

the form.

We will send you a GST/HST credit notice telling you how much

you will get and how we calculated the amount. GST/HST credit

payments are normally issued in January, April, July, and October

each year.

To get an estimate of your GST/HST credit, go

to www.cra.gc.ca/benefits-calculator.

Related provincial programs

The Canada Revenue Agency administers the following

provincial programs that are related to the GST/HST credit:

•

BC low income climate action tax credit;

•

Newfoundland and Labrador harmonized sales tax credit;

•

Newfoundland and Labrador seniors' benefit;

•

Nova Scotia affordable living tax credit;

•

Ontario sales tax credit;

•

Prince Edward Island sales tax credit; and

•

Saskatchewan low-income tax credit.

You do not need to apply to a province to get payments for these

programs. If you qualify and you have applied for the GST/HST

credit, your provincial credit payments will be combined with your

GST/HST credit payments (except for the Ontario sales tax credit

payments, which are issued separately as part of the Ontario trillium

benefit).

When should you contact us?

Go to www.cra.gc.ca/myaccount or call 1-800-959-1953 to tell us

immediately about any changes described below, as well as the date

they happened or will happen:

•

you move (if we do not have your new address, your payments

may stop, whether you get them by direct deposit or by cheque);

•

you get your payments by direct deposit and your banking

information changes;

•

the number of children in your care changes; or

Note

When a child for whom you get the credit turns 19 years of age,

you do not need to contact us. We will automatically reduce your

credit. However, the child should apply for his or her own credit.

•

your marital status changes.

Note

You can also tell us by sending a completed Form RC65,

Marital Status Change, or by sending a letter indicating

your new marital status and the date of the change.

Call 1-800-959-1953 to tell us immediately about any changes

described below, as well as the date they happened or will happen:

•

you (or your spouse or common-law partner) are no longer

a resident of Canada; or

•

the GST/HST recipient has died.

For more information

For information about the GST/HST credit, go

to www.cra.gc.ca/gsthstcredit, call 1-800-959-1953, or see

Booklet RC4210, GST/HST Credit.

To get our forms and publications, go to www.cra.gc.ca/forms or

call 1-800-959-1953.

Where do you send your form?

Send your completed form or letter and any documents to the tax

centre that serves your area. Use the chart below to get the address.

If your tax services office is

located in:

Send your correspondence

to the following address:

British Columbia, Regina, or Yukon

Surrey Tax Centre

9755 King George Boulevard

Surrey BC V3T 5E1

Alberta, London, Manitoba,

Northwest Territories, Saskatoon,

Thunder Bay, or Windsor

Winnipeg Tax Centre

PO Box 14005, Station Main

Winnipeg MB R3C 0E3

Barrie, Sudbury (the area of

Sudbury/Nickel Belt only),

Toronto Centre, Toronto East,

Toronto North, or Toronto West

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C1

Laval, Montréal, Nunavut, Ottawa,

Rouyn-Noranda, Sherbrooke,

or Sudbury (other than the

Sudbury/Nickel Belt area)

Shawinigan-Sud Tax Centre

4695 12e Avenue

Shawinigan-Sud QC G9P 5H9

Chicoutimi, Montérégie-Rive-Sud,

Outaouais, Québec, Rimouski,

or Trois-Rivières

Jonquière Tax Centre

PO Box 1900, Station LCD

Jonquière QC G7S 5J1

Kingston, New Brunswick,

Newfoundland and Labrador,

Nova Scotia, Peterborough,

or St. Catharines

St. John's Tax Centre

PO Box 12071, Station A

St. John's NL A1B 3Z1

Belleville, Hamilton,

Kitchener/Waterloo, or

Prince Edward Island

Summerside Tax Centre

102 – 275 Pope Road

Summerside PE C1N 5Z7

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca/formulaires ou en composant le 1-800-959-1954.)

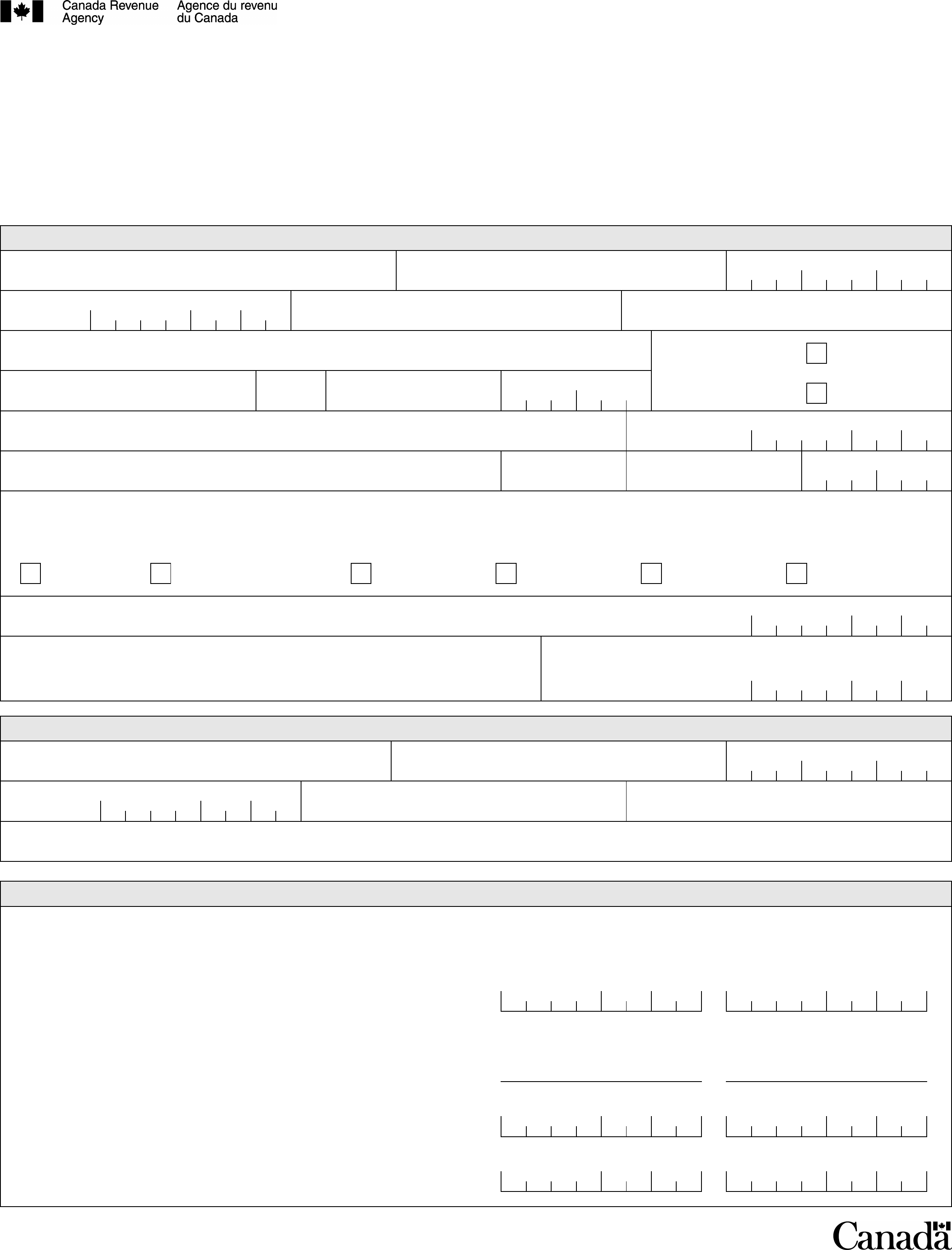

Protected B

when completed

GST/HST Credit Application

for Individuals Who Become Residents of Canada

Complete this application to apply for the GST/HST credit for the year that you became a resident of Canada. If you have a spouse

or common-law partner, only one of you can apply for the credit for both of you. Send your completed form to your tax centre. For more

information, go to www.cra.gc.ca/gsthstcredit, or see the attached information sheet or Booklet RC4210, GST/HST Credit.

Do you have a social insurance number (SIN)?

You need a SIN to apply for this credit. For more information, or to get an application for a SIN, visit the Service Canada website at

www.servicecanada.gc.ca or call 1-800-206-7218. To find the address of the Service Canada Centre nearest you, call 1-800-622-6232.

Part A – Information about the applicant

First name and initial Last name Social insurance number

Date of birth:

Year Month Day Home telephone number Work telephone number

Mailing address (Apt No – Street No Street name, PO Box, RR)

City

Province

or territory

Postal code

Your language

of correspondence:

Votre langue

de correspondance :

English

Français

Home address (if different from mailing address) (Apt No – Street No Street name, RR)

Date of address

change:

Year Month Day

City

Province or territory

Postal code

Marital status Tick Married if you have a spouse. Tick Living common-law if you have a common-law partner. We define spouse,

common-law partner, and separated on the attached information sheet.

Tick the box that applies to your marital status on the date you became a resident of Canada.

1. Married 2. Living common-law 3. Widowed 4. Divorced 5. Separated 6. Single

Enter the date this marital status began (if you ticked box 2 or 5 above, see the definitions for common-law partner and

separated on the attached information sheet to determine the date you must enter):

Year Month Day

If your marital status has changed since you became a resident of Canada, enter your

new marital status:

Date of marital status change:

Year Month Day

Part B – Information about your spouse or common-law partner

First name and initial Last name Social insurance number

Date of birth:

Year Month Day Home telephone number Work telephone number

If your spouse or common-law partner's address is different from yours, please explain:

Part C – Residency status

For more information, see "Are you a resident of Canada?" on the attached information sheet.

New residents of Canada

Enter the date you became a resident of Canada . . . . . . . . . . . . . . . . . . . . . . . . . . . .

You

Year Month Day

Your spouse or common-law

partner

Year Month Day

Returning residents of Canada

Enter the Canadian province or territory in which you resided before

you left Canada . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the date you became a non-resident of Canada . . . . . . . . . . . . . . . . . . . . . . .

Year Month Day Year Month Day

Enter the date you became a resident of Canada again . . . . . . . . . . . . . . . . . . . . . .

Year Month Day Year Month Day

RC151 E (15)

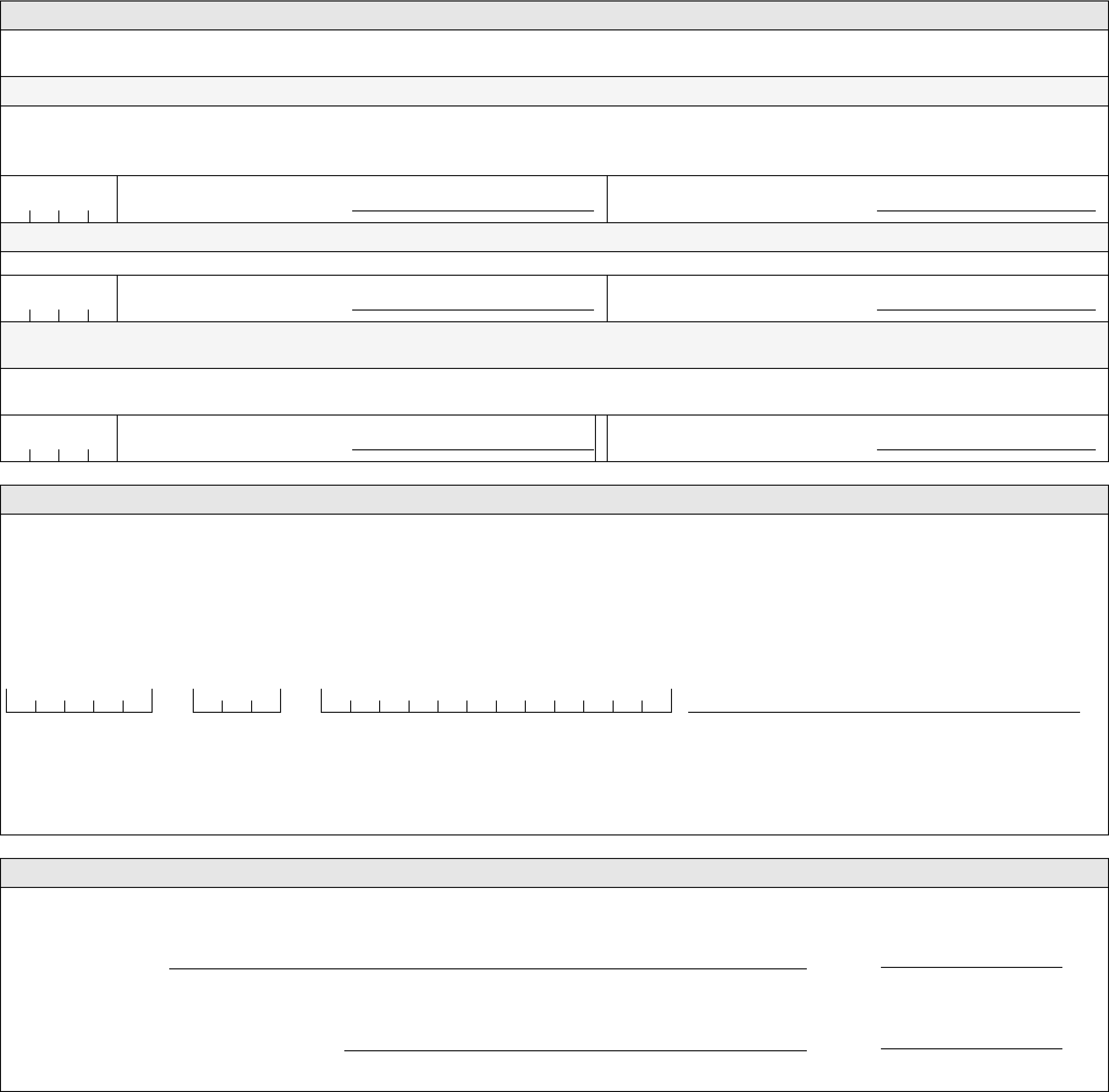

Protected B

when completed

Part D – Statement of income

Enter income from all sources, both inside and outside Canada, in Canadian dollars. Do not include income that you and your spouse or common-law

partner have reported on a Canadian tax return. Enter "0" if you had no income.

Step 1 – Year you became a resident of Canada

Enter the year you became a resident of Canada. Enter your income from January 1 of that year to the date you became a resident. If you had a spouse or

common-law partner, enter his or her income from January 1 of that year to the date he or she became a resident. Do not enter your spouse's or

common-law partner's income if he or she did not become a resident of Canada in that year.

Year

Your income (dollars only): $

Your spouse's or common-law

partner's income (dollars only):

$

Step 2 – One year before you became a resident of Canada

Enter one year before the year that you indicated in Step 1, and enter your income and that of your spouse or common-law partner for that year.

Year

Your income (dollars only): $

Your spouse's or common-law

partner's income (dollars only):

$

Step 3 – Two years before you became a resident of Canada

Complete this step only if the applicant became a resident of Canada before April of the year you entered in Step 1.

Enter the year that is two years before the year that you indicated in Step 1, and enter your income and that of your spouse or common-law partner for

that year.

Year

Your income (dollars only): $

Your spouse's or common-law

partner's income (dollars only):

$

Part E – Direct deposit

You can have your GST/HST credit payments deposited directly into your account at a financial institution in Canada. To start direct deposit, attach a blank

cheque with your banking information encoded on it and write "VOID" across the front, or complete the boxes below. To find these numbers, see your passbook,

bank statement, encoded deposit slip, or cheque, or contact your financial institution. If you choose direct deposit for your GST/HST credit, we will use the same

account to deposit all payments from the Canada Revenue Agency, including your income tax refund, Canada child tax benefit and related provincial and

territorial payments, working income tax benefit advance payments, any deemed overpayment of tax, and universal child care benefit. You can also go

to www.cra.gc.ca/myaccount to start or update your direct deposit information.

Branch No.

(5-digits)

Institution No.

(3-digits)

Account No.

(maximum 12-digits)

Name of financial institution

Your direct deposit request will stay in effect until you change the information or cancel the service. If you move, let us know your new address as soon as

possible. Otherwise, your payments may stop.

If you are changing any account into which we deposit a payment, do not close the old account before we deposit a payment into the new account. If your

financial institution tells us that you have a new account, we will deposit your payments into the new account. If we cannot deposit a payment into your account,

we will mail a cheque to you at the address we have on file. For more information, go to www.cra.gc.ca/directdeposit or call 1-800-959-1953.

Part F – Certification

I certify that the information given on this form and in all documents attached is, to the best of my knowledge, correct and complete.

Applicant's signature

It is a serious offence to make a false statement.

Date

Spouse's or common-law partner's signature

It is a serious offence to make a false statement.

Date

Personal information is collected under the Income Tax Act to administer tax, benefits, and related programs. It may also be used for any purpose related to the administration or

enforcement of the Act such as audit, compliance and the payment of debts owed to the Crown. It may be shared or verified with other federal, provincial/territorial government

institutions to the extent authorized by law. Failure to provide this information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right

to access their personal information and request correction if there are errors or omissions. Refer to Info Source at www.cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng.html, Personal Information

Banks CRA PPU 140 and CRA PPU 005.