- Notification of Change of Ownership - Western Australia

- Vehicle Transfer/Tax Form - British Columbia

- Application to Transfer or Retain a Vehicle Registration Number - UK

- Vehicle Registration Transfer Application - Queensland State

- Vehicle Registration/Title Application - New York

- Power of Attorney to Transfer Motor Vehicle - Mississippi

Fillable Printable Application to Transfer or Retain a Vehicle Registration Number - UK

Fillable Printable Application to Transfer or Retain a Vehicle Registration Number - UK

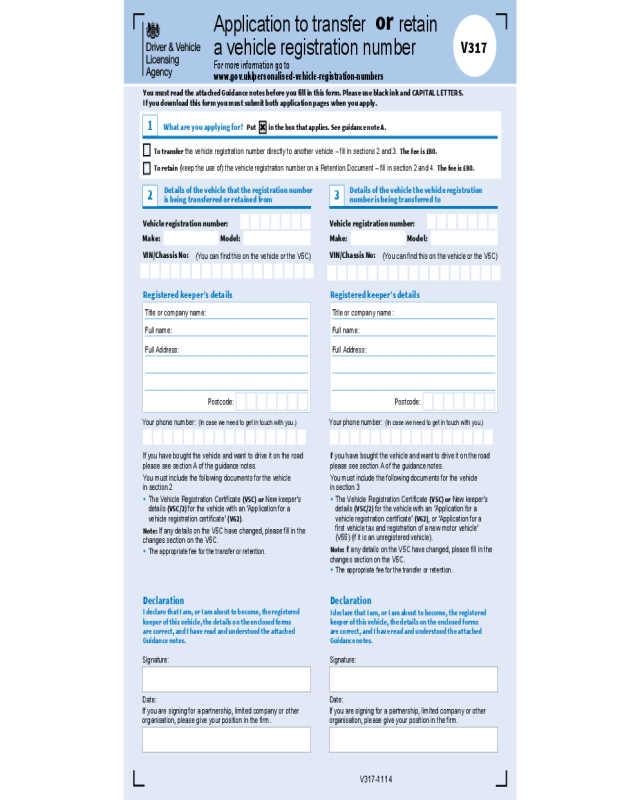

Application to Transfer or Retain a Vehicle Registration Number - UK

Application to transfer

or

retain

a vehicle registration number

V317

You must read the attached Guidance notes before you fill in this form. Please use black ink and CAPITAL LETTERS.

If you download this form you must submit both application pages when you apply.

For more information go to

www.gov.uk/personalised-vehicle-registration-numbers

V317-1114

Details of the vehicle that the registration number

is being transferred or retained from

2

Vehicle registration number:

Your phone number:

(In case we need to get in touch with you.)

3

Address:

Make: Model:

Registered keeper’s details

Title or company name:

Full name:

Full Address:

Postcode:

Details of the vehicle the vehicle registration

number is being transferred to

Vehicle registration number:

VIN/Chassis No:

(You can find this on the vehicle or the V5C)

Your phone number:

(In case we need to get in touch with you.)

Make: Model:

✖

✖

To transfer the vehicle registration number directly to another vehicle – fill in sections 2 and 3. The fee is £80.

To retain (keep the use of) the vehicle registration number on a Retention Document – fill in section 2 and 4. The fee is £80.

What are you applying for?

Put

✖

in the box that applies. See guidance note A.

1

VIN/Chassis No:

(You can find this on the vehicle or the V5C)

Registered keeper’s details

Title or company name:

Full name:

Full Address:

Postcode:

If you have bought the vehicle and want to drive it on the road

please see section A of the guidance notes.

You must include the following documents for the vehicle

in section 2

• The Vehicle Registration Certificate (V5C) or New keeper’s

details (V5C/2) for the vehicle with an ‘Application for a

vehicle registration certificate’ (V62).

Note: If any details on the V5C have changed, please fill in the

changes section on the V5C.

•

The appropriate fee for the transfer or retention.

Declaration

I declare that I am, or I am about to become, the registered

keeper of this vehicle, the details on the enclosed forms

are correct, and I have read and understood the attached

Guidance notes.

Date:

If you are signing for a partnership, limited company or other

organisation, please give your position in the firm.

Signature:

If you have bought the vehicle and want to drive it on the road

please see section A of the guidance notes.

You must include the following documents for the vehicle

in section 3

• The Vehicle Registration Certificate (V5C) or New keeper’s

details (V5C/2) for the vehicle with an ‘Application for a

vehicle registration certificate’ (V62), or ‘Application for a

first vehicle tax and registration of a new motor vehicle’

(V55) (if it is an unregistered vehicle).

Note: If any details on the V5C have changed, please fill in the

changes section on the V5C.

• The appropriate fee for the transfer or retention.

Declaration

I declare that I am, or I am about to become, the registered

keeper of this vehicle, the details on the enclosed forms

are correct, and I have read and understood the attached

Guidance notes.

Date:

If you are signing for a partnership, limited company or other

organisation, please give your position in the firm.

Signature:

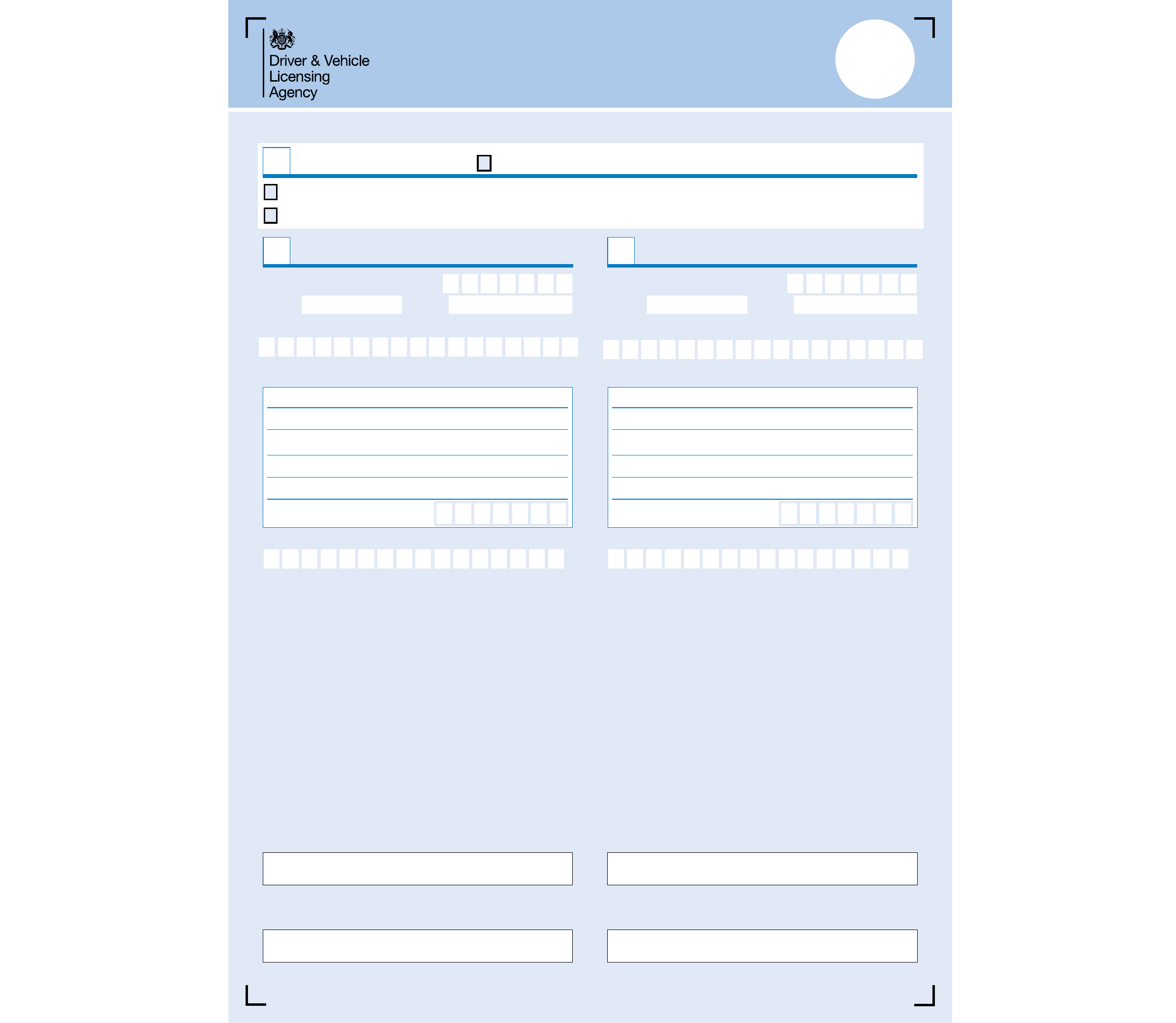

Dealer/Agent details

5

If a dealer is acting on your behalf and you want the paperwork

returned to them, please fill in this section with their details.

Name and Address:

Postcode:

Full daytime phone number:

Official use only

ITT 126

ITT 127

Donor/Retained vehicle details

VRN

CD

Vehicle Make

Payment Type

Who paid: Donor

Recipient

Other

EPOS Receipt No.

T/C

Period

CC/CO

2

Value

Vehicle tax expiry

Vehicle tax details 1

M M Y Y

Vehicle tax details 2

M M Y Y

Associated docs: V10 n V85 n

Replacement vehicle registration number or V53

C/D

Is this replacement vehicle

registration number transferable? Yes

n

No

n

Is this vehicle registration number

being retained? Yes

n

No

n

Receiving vehicle details

VRN

CD

Vehicle Make/Model

T/C

Period

CC/CO

2

Value

Associated docs: V10 n

V85 n V55 n

Actioning section code n

Output marker n Action code n

Indicator(s): Void n

Retained n Inhibit n SOM n

Date received at DVLA

Date processed at DVLA

ITT 126

ITT 127

Retention

Transfer

Details for the Retention Document

4

Grantee’s details

(see note A, section 4)

Grantee’s phone number:

(In case we need to get in touch with you.)

Title or company name:

Full name:

Full Address:

Postcode:

Nominee’s details

(see note A, section 4)

If you are retaining the vehicle registration number and are

becoming the Grantee you may want to assign it (put it on) to

a vehicle registered in someone else’s name. This person is

known as the Nominee. Give the Nominee’s details below.

Title: Mr Mrs Miss Ms

First name:

Surname:

Company name:

Other

(for example, Dr)

Grantee’s signature:

Date:

11/14

IMPORTANT – Please read this section and guidance note A,

Section 4 before filling in.

If you are retaining the vehicle registration number, as the

registered keeper do you want to become the Grantee

(the Grantee is the one who has the right to the vehicle

registration number)?

Yes No

If you do not want to become the Grantee, for example you are

giving the vehicle registration number as a gift, give the details

of who should be the Grantee in the box below. This means

that as the registered keeper, you will give up the right to

the vehicle registration number.

✖ ✖

nn nn nnnn

D D M M Y Y Y Y

Vehicle tax expiry

Vehicle tax details 1

M M Y Y

Vehicle tax details 2

M M Y Y

• The Grantee is the person who has the right to the

vehicle registration number.

• The Grantee has the right to assign the vehicle

registration number to a vehicle registered in someone

else’s name. This person is known as a Nominee.

• If a Nominee has been given on this application the

Grantee (this can either be the registered keeper or

the new Grantee) must sign section 4. The Grantee

can choose to add a Nominee when assigning the

registration number to another vehicle.

• Only the Grantee can assign the vehicle registration

number to their vehicle or to the Nominee’s vehicle.

• The Nominee will have no right to the vehicle

registration number until it is assigned to their vehicle.

• If there is a Nominee they must be the registered

keeper of the vehicle the vehicle registration number

is going to be assigned to.

• The retention certificate will be valid for 10 years. It can

be renewed upon expiry (free of charge).

You must send both application pages and the

appropriate documents to DVLA Personalised

Registrations, Swansea SA99 1DS.

All documents must be originals, not photocopies or

faxed copies. For vehicles registered with a Northern

Ireland address, downloaded copies of a certificate of

insurance or cover note are acceptable.

To transfer or retain a vehicle registration number the

following must apply:

• The vehicle must exist and be registered at DVLA.

• You must be or are becoming the registered

keeper of the vehicle in section 2.

• The vehicle must be available for inspection.

• You must not sell or get rid of the vehicle until you

receive a replacement V5C. If you do sell or get rid

of the vehicle before you get a replacement V5C,

the new keeper is entitled to keep the vehicle

registration number if they want to.

• The vehicle in section 2 and section 3 should

be taxed. If the vehicle is not taxed you can still

apply without renewing the tax if you have made

a Statutory Off Road Notification (SORN). There

must be no break between the date the tax run

out and the start of the SORN.

• We will not accept an application for a vehicle

that has been declared off road (SORN) for more

than 5 years.

• The vehicle must be a testable type, subject to

MOT/GVT (road worthiness test).

• You cannot display a vehicle registration number

that will make your vehicle appear younger.

Under the Retention of Registration Marks Regulations

(as amended) at any time we may withdraw your right

to the vehicle registration number.

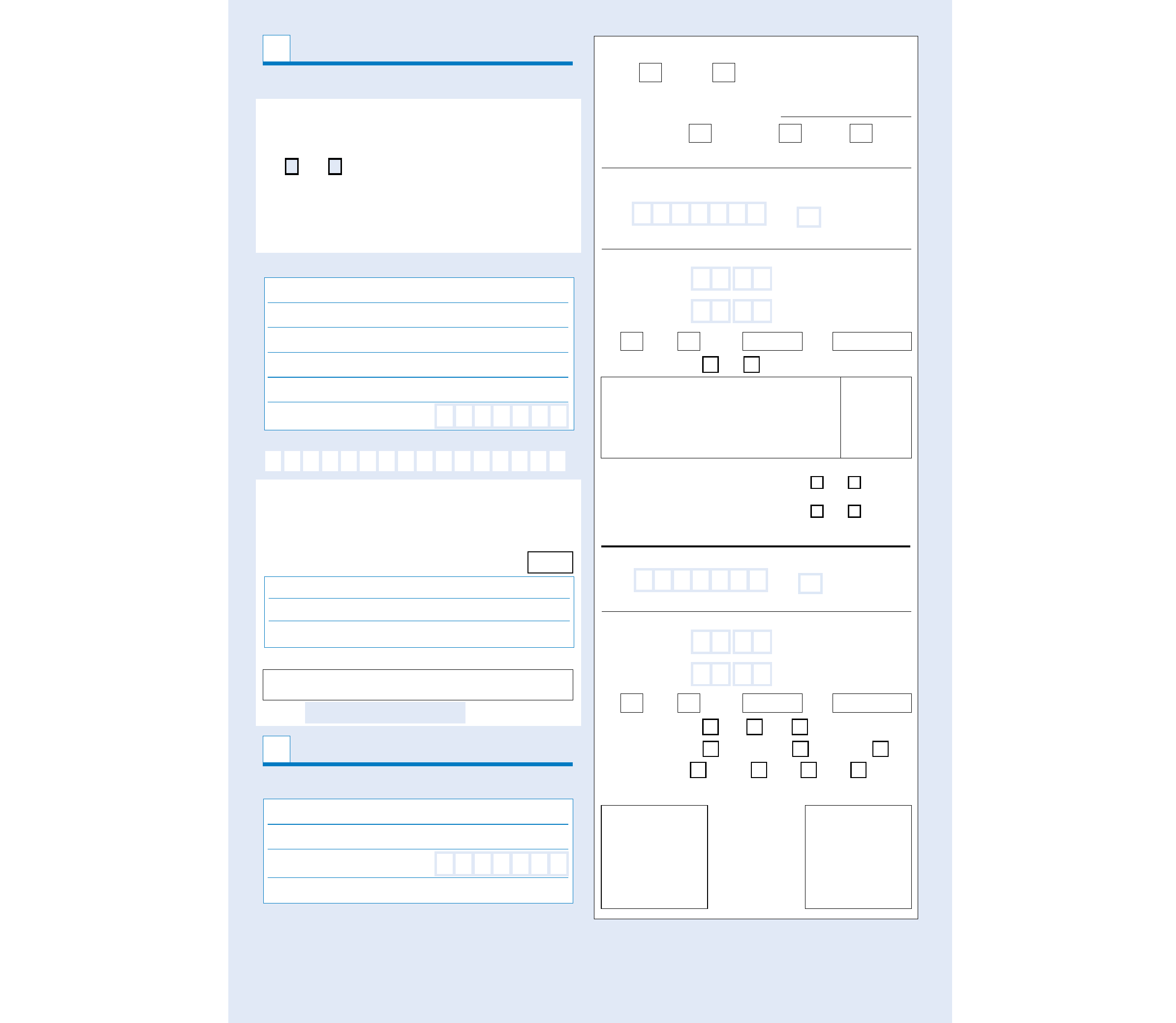

How to fill in this form

A

Guidance notes

.

Read the notes on the front and back of this page before filling in the form and keep them

safe so you can read them in the future. You should also read our leaflet ‘Registration numbers and you’ (INF46)

which you can get from www.gov.uk/personalised-vehicle-registration-numbers

Section 1 – What are you applying for?

If you choose to retain or transfer a vehicle registration

number (directly to another vehicle), please make sure

you fill in section 1 and send the correct fee.

Section 2 – Details of the vehicle that

the vehicle registration number is being

transferred or retained from

Only the registered keeper or the person about to

become the registered keeper of this vehicle can apply.

Give all the details section 2 asks for.

• If you are enclosing a New keeper’s details (V5C/2)

with an ‘Application for a Vehicle registration certificate’

(V62) you must ensure that it has not been previously

stamped by the DVLA. If your V5C/2 has been

previously stamped or you do not have one, you

will need to fill in a V62 and wait for your registration

certificate before you apply for a transfer or retention.

You cannot continue with your application.

• The registered keeper of this vehicle must sign and

date the declaration.

Section 3 – Details of the vehicle the vehicle

registration number is being transferred to

Give all the details section 3 asks for.

• If you are enclosing a V5C/2 you must ensure that it

has not been previously stamped by the DVLA.

• If your V5C/2 has been previously stamped or you do

not have one, you will need to fill in a V62 before you

apply for a transfer or retention.

• The registered keeper of this vehicle must sign and

date the declaration.

Taxing the vehicle in section 2 and section 3

If you have bought the vehicle and you want to drive it

on the road you must tax it immediately before you can

transfer/retain the registration number. Go online at

www.gov.uk/vehicletax or to a Post Office

®

branch that

deals with vehicle tax using the ‘New keeper’s details’

(V5C/2) section. For further information please visit

www.gov.uk/dvla/nomoretaxdisc

If you are the registered keeper and need to tax your

vehicle you also need to include with this application:

• An ‘Application for vehicle tax’ (V10) or an ‘Application

to tax a Heavy Goods Vehicle (HGV)’ (V85).

• The appropriate fee for the vehicle tax.

• Certificate of insurance or cover note for vehicles

registered with a Northern Ireland address.

Section 4 – Details for the Retention Document

Give all the details section 4 asks for.

Conditions for transferring or retaining

a vehicle registration number

C

How and where to apply

B

IMPORTANT

If you are retaining the vehicle registration number, you, as

the registered keeper, can choose to become the Grantee or

you can give up your right to the vehicle registration number

and give the details of someone else as the Grantee. Once

the retention application is finalised only the Grantee will

have the right to the vehicle registration number.

• The DVLA may want to inspect your vehicle. If so,

the DVLA will contact you.

Once your application is approved, the following will apply.

• The vehicle in section 2 will be given a replacement

vehicle registration number appropriate to its age,

unless you want to assign another appropriate

vehicle registration number at the same time.

• The vehicle in section 3 will have its current vehicle

registration number withdrawn (even if it is a

personalised registration number), unless you also

apply to transfer or retain it when you make this

application.

• We will send your new V5C and a Retention Document,

(if you are retaining the vehicle registration number),

within two weeks of receiving your application.

However, this could take up to four weeks if you

included a V62 or if we need to inspect the vehicle.

If you do not receive your documents after eight weeks,

phone DVLA Customer Enquiries on 0300 790 6802.

• If you have given someone else’s details as the

Grantee the Retention Document will be sent to them.

• You are responsible for informing your insurance

provider of your new registration number, otherwise

you may receive a continuous insurance penalty.

Conditions on taxing a vehicle

E

What happens next?

G

Insurance write-off

D

Also, we can cancel a transfer or retention application if:

•

you have not met the conditions for transferring

or retaining a vehicle registration number;

• any information you give in this form, or in any

document used to support this form, is false or

incorrect;

• there is any mistake relating to the vehicle

registration number; or

• your bank does not send us your payment.

Further information:

• You cannot transfer or retain a vehicle registration

number starting with a ‘Q’ or ‘QNI’ prefix.

• It is an offence to misrepresent a vehicle registration

number on a number plate (for example, by making

a ‘5’ look like an ‘S’). See leaflet ‘Vehicle registration

numbers and number plates’ (INF104) which you can

get from www.gov.uk/displaying-number-plates

• You can transfer a vehicle registration number to or

from a vehicle as long as both vehicles are registered

within the UK. See leaflet INF46.

This applies to the vehicle in section 2.

If your vehicle has been written off it may still be possible

to transfer or retain its vehicle registration number if:

• your insurers have not scrapped the vehicle and

have agreed, in writing, to you transferring or

retaining the vehicle registration number (include the

written agreement with your application);

• the vehicle is available for us to inspect (we will also

ask for an insurer’s engineers report); and

• you have met the conditions for transferring or

retaining the vehicle registration number.

You can pay by:

• Cheque, banker’s draft or postal order made payable

to ‘DVLA Swansea’.

You can get application forms V62 and ‘Application for

vehicle tax’ (V10) or an ‘Application to tax a Heavy Goods

Vehicle (HGV)’, (V85) from www.gov.uk/dvlaforms or

any Post Office

®

branch that deals with vehicle tax.

You can get an ‘Application for first vehicle tax and

registration of a new motor vehicle’ (V55) by phoning

0300 790 6802. If you are deaf or hard of hearing and

have a textphone, phone 0300 123 1279. (This number

will not respond to ordinary phones).

Insurance write-off

D

How to pay

E

Where to get your application forms

F