- Application to Transfer or Retain a Vehicle Registration Number - UK

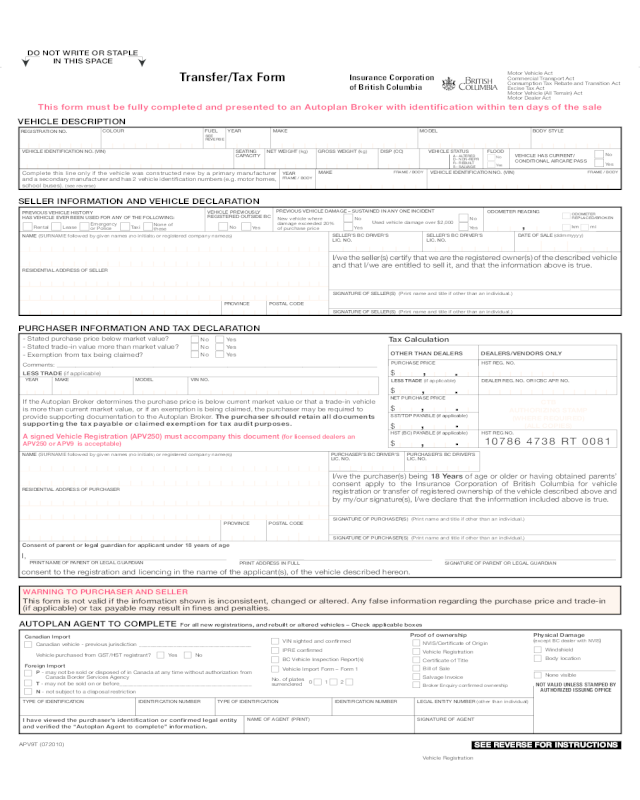

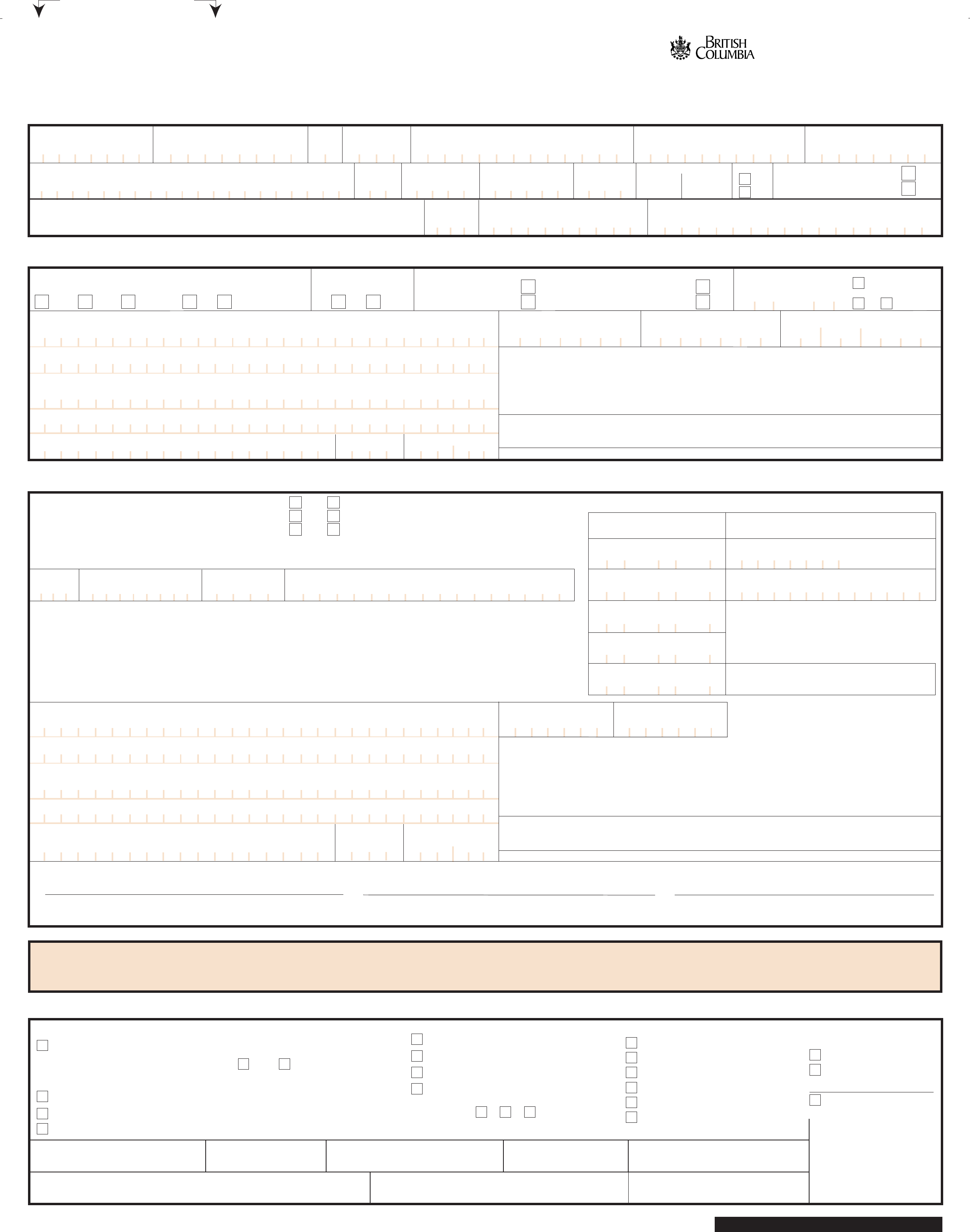

- Vehicle Transfer/Tax Form - British Columbia

- Affidavit in Support of a Claim for Exemption from Sales or Use Tax for a Motor Vehicle Transferred Within a Family

- Vehicle Registration/Title Application - New York

- Gift of a Vehicle - British Columbia

- Vehicle Registration Transfer Application - Queensland State

Fillable Printable Vehicle Transfer/Tax Form - British Columbia

Fillable Printable Vehicle Transfer/Tax Form - British Columbia

Vehicle Transfer/Tax Form - British Columbia

DO NOT WRITE OR STAPLE

IN THIS SPACE

Motor Vehicle Act

Commercial Transport Act

Consumption Tax Rebate and Transition Act

Excise Tax Act

Motor Vehicle (All Terrain) Act

Motor Dealer Act

Insurance Corporation

of British Columbia

Transfer/Tax Form

This form must be fully completed and presented to an Autoplan Broker with identification within ten days of the sale

WARNING TO PURCHASER AND SELLER

This form is not valid if the information shown is inconsistent, changed or altered. Any false information regarding the purchase price and trade-in

(if applicable) or tax payable may result in fi nes and penalties.

SEE REVERSE FOR IN STRUC TIONS

APV9T (072010)

Canadian Import

Foreign Import

Proof of ownership

Physical Damage

(

except BC dealer with NVIS)

Canadian vehicle - previous jurisdiction _______________________________________

P - may not be sold or disposed of in Canada at any time without authorization from

Canada Border Services Agency

N - not subject to a disposal restriction

T - may not be sold on or before ______________________________________________

TYPE OF IDENTIFICATION TYPE OF IDENTIFICATION

AUTOPLAN AGENT TO COMPLETE For all new registrations, and rebuilt or altered vehicles – Check applicable boxes

NVIS/Certifi cate of Origin

Vehicle Registration

Bill of Sale

Salvage Invoice

012

Broker Enquiry confi rmed ownership

BC Vehicle Inspection Report(s)

Vehicle Import Form – Form 1

IPRE confi rmed

VIN sighted and confi rmed

Windshield

Body location

None visible

Vehicle Registration

Certifi cate of Title

I have viewed the purchaser’s iden ti fi ca tion or confirmed legal entity

and verified the “Autoplan Agent to complete” information.

No. of plates

surrendered

IDENTIFICATION NUMBER IDENTIFICATION NUMBER

LEGAL ENTITY NUMBER

(other than individual)

NAME OF AGENT (PRINT) SIGNATURE OF AGENT

NOT VALID UNLESS STAMPED BY

AUTHORIZED ISSUING OFFICE

MAKE

FRAME / BODY

VEHICLE IDENTIFICATION NO. (VIN)

FRAME / BODY

VEHICLE IDENTIFICATION NO. (VIN)

NET WEIGHT

(kg)

GROSS WEIGHT

(kg)

DISP (CC)

FUEL YEAR MAKE MODEL

COLOUR

REG IS TRA TION NO.

Complete this line only if the vehicle was constructed new by a primary manufacturer

and a secondary manufacturer and has 2 vehicle identifi cation numbers (e.g. motor homes,

school buses). (see reverse)

A - ALTERED

D - NON-REPR

R - REBUILT

S - SALVAGE

VEHICLE STATUS

FLOOD

PROVINCE POSTAL CODE

RESIDENTIAL ADDRESS OF SELLER

NAME

(SURNAME followed by given names

(

no initials

)

or registered company name

(

s

)

)

Comments: _______________________________________________________________________________________________________

YEAR MAKE MODEL VIN NO.

LESS TRADE (if applicable)

SIGNATURE OF PARENT OR LEGAL GUARDIAN

I,

Consent of parent or legal guardian for applicant under 18 years of age

PRINT NAME OF PARENT OR LEGAL GUARDIAN

PRINT ADDRESS IN FULL

consent to the registration and licencing in the name of the applicant(s), of the vehicle described hereon.

If the Autoplan Broker determines the purchase price is below current market value or that a trade-in vehicle

is more than current market value, or if an exemption is being claimed, the purchaser may be required to

provide supporting documentation to the Autoplan Broker. The purchaser should retain all documents

supporting the tax payable or claimed exemption for tax audit purposes.

- Stated purchase price below market value?

- Stated trade-in value more than market value?

- Exemption from tax being claimed?

A signed Vehicle Registration (APV250) must accompany this document (for licensed dealers an

APV250 or APV9 is acceptable)

No

Yes

DATE OF SALE

(ddmmyyyy)

PREVIOUS VEHICLE HISTORY

Lease

HAS VEHICLE EVER BEEN USED FOR ANY OF THE FOLLOWING:

Rental

Emergency

or Police

None of

these

Taxi

No

Yes

No

No

No

Yes

Yes

Yes

NoNo

Yes Yes

PREVIOUS VEHICLE DAMAGE – SUSTAINED IN ANY ONE INCIDENT

No

Yes

VEHICLE HAS CURRENT/

CONDITIONAL AIRCARE PASS

Used vehicle damage over $2,000

New vehicle where

damage exceeded 20%

of purchase price

VEHICLE PREVIOUSLY

REGISTERED OUTSIDE BC

VEHICLE DESCRIPTION

SELLER INFORMATION AND VEHICLE DECLARATION

PURCHASER INFORMATION AND TAX DECLARATION

SEE

REVERSE

SEATING

CAPACITY

YEAR

FRAME / BODY

BODY STYLE

,

ODOMETER READING

ODOMETER

REPLACED/BROKEN

mikm

SELLER’S BC DRIVER'S

LIC. NO.

SELLER’S BC DRIVER'S

LIC. NO.

SIGNATURE OF SELLER(S)

(Print name and title if other than an individual.)

SIGNATURE OF SELLER(S)

(Print name and title if other than an individual.)

I/we the seller(s) certify that we are the registered owner(s) of the described vehicle

and that I/we are entitled to sell it, and that the information above is true.

PROVINCE POSTAL CODE

RESIDENTIAL ADDRESS OF PURCHASER

NAME

(SURNAME followed by given names

(

no initials

)

or registered company name

(

s

)

)

CTB

AUTHORIZING STAMP

(WHERE REQUIRED)

(ALL COPIES)

$

$

$

$

$

PURCHASE PRICE

LESS TRADE

(if applicable)

SST/TDP PAYABLE (if applicable)

HST (BC) PAYABLE (if applicable) HST REG NO.

.

.

,

,

,

,

,

.

.

.

OTHER THAN DEALERS

DEAL ERS/VENDORS ONLY

Tax Calculation

HST REG. NO.

DEALER REG. NO. OR ICBC APP. NO.

PURCHASER’S BC DRIVER'S

LIC. NO.

PURCHASER’S BC DRIVER'S

LIC. NO.

SIGNATURE OF PURCHASER(S)

(Print name and title if other than an individual.)

SIGNATURE OF PURCHASER(S)

(Print name and title if other than an individual.)

I/we the purchaser(s) being 18 Years of age or older or having obtained parents’

consent apply to the Insurance Corporation of British Columbia for vehicle

registration or transfer of registered ownership of the vehicle described above and

by my/our signature(s), I/we declare that the information included above is true.

10786 4738 RT 0081

NET PURCHASE PRICE

Vehicle purchased from GST/HST registrant?

Yes No

TAX OWING:

Vehicles Purchased prior to July 1, 2010

• Social Service Tax (SST) is owing. For vehicles purchased July 1, 2010 or later, follow the instructions below under “Vehicles purchased in BC”

and “Vehicles Purchased Outside BC,” as applicable.

Vehicles Purchased in BC

Dealer and Vendor Sales: HST will be collected by the dealer or vendor. The dealer’s or vendor’s HST registrant number is required.1.

Private Sales: Tax on Designated Property (TDP) is payable on the net purchase price.2.

Vehicles Purchased Outside BC

1. Purchased in Canada, HST Paid: no tax is owing. The dealer’s or vendor’s HST registrant number is required.

2. Purchased in Canada, GST Paid: the provincial portion of HST (HST(BC)) is owing. Proof of payment of GST is required.

3. Private Sales in Canada: Tax on Designated Property (TDP) is payable on the net purchase price.

4. Purchased Outside Canada: the provincial portion of HST (HST(BC)) is owing. Proof of payment of GST is required.

The purchaser must provide supporting documentation if claiming an exemption, and may be asked to provide documentation if the purchase price

is lower than current market value, or if the trade-in value is more than the current market value.

SUBSTITUTE VEHICLE:

An owner of a BC licensed and insured vehicle may transfer the number plates to a newly purchased BC vehicle and operate the vehicle for a

maximum period of ten days from the date the vehicle has been purchased if:

1.

the newly purchased vehicle is of the same type (eg. passenger vehicle replaced by passenger vehicle) and corresponding number plates are compatible;

2. the newly purchased vehicle is a BC registered vehicle or is a new vehicle purchased from a BC registered dealer;

3. title or interest in the original vehicle has been transferred;

4.

during the ten day period and before the agent has validated the necessary forms, the operator shall carry and produce to a Peace Offi cer upon request,

a. Purchaser’s copies of completed and signed Transfer/Tax Form (APV9T)

b. Purchaser’s Owner’s Certifi cate of Insurance and Vehicle Licence valid for the transferred original vehicle

c. Previous Owner’s Certifi cate of Registration for the new vehicle, or a signed and dated Bill of Sale if brand new vehicle purchased

from a BC Registered Dealer

5. the plates are not compatible or the title to or the interest in the original vehicle has not been transferred, the necessary forms must be completed

by an agent and new plates issued before the new vehicle can be operated on a highway and until that form is completed and new plates

issued, no insurance is in force on the new vehicle.

To have the newly purchased vehicle registered in the name of the holder of the licence, the application for transfer of registered ownership must

be presented to an agent within ten days of purchase, along with the documents mentioned in paragraph 4.

COMPLETION OF TRANSFER/TAX FORM (APV9T)

-

The purchaser is advised to check for liens and encumbrances with the Personal Property Registry, Victoria, BC before fi nalizing the sale.

-

The seller completes the ‘Seller’ section of the form including information from the Vehicle Registration, and signs the Seller’s Certifi cation.

- The purchaser completes and signs the ‘Purchaser’ section.

- The seller retains the Seller copy of the form with the ‘Seller’ and ‘Purchaser’ sections completed.

- The purchaser must present the remaining copies of the Transfer/Tax Form (APV9T) and the Vehicle Registration (APV250

only, signed by the registered owner) to an Autoplan Broker for registration within 10 days of sale.

Signatures -

where the seller or purchaser is a registered company, the signatures required are of signing offi cer(s) with offi cial title(s) with the company.

Note: Business names not registered with the Corporate Registry, Victoria, BC, may not be used.

NEW VEHICLE REGISTRATIONS - TWO VINs ON NEW VEHICLE INFORMATION STATEMENT (NVIS)

The year, make and vehicle identifi cation numbers recorded on the NVIS will be entered on the Transfer/Tax Form as follows:

School Bus - Year and Make: Always record year and make of secondary manufacturer on the fi rst line of the Transfer/Tax document.

Record the year and make of the primary manufacturer on the third line of the Transfer/Tax document, circling the word “Frame”.

VIN: Record the secondary manufacturer’s VIN on the second line of the Transfer/Tax document only if the VIN is 17 digits long, otherwise record

the primary manufacturer’s VIN. Record the alternate VIN on the third line of the Transfer/Tax document and circle “Frame” or “Body”.

Motor Home Class A: Follow Year and Make and VIN instructions as for school bus.

Motor Home Class C: Year and Make: Record year, make and VIN of primary manufacturer on the fi rst line of the Transfer/Tax doc u ment.

Record year and make of the secondary manufacturer on the third line of the Transfer/Tax document, circling the word “Body”.

VEHICLES BROUGHT INTO BRITISH COLUMBIA FROM ANOTHER JURISDICTION:

Passenger vehicles, including small pickup trucks, motorcycles and trailers used for personal/pleasure use, must be registered by the owner within

30 days of entering the province. Cars, motor homes, vans and small trucks with a net weight of 3,500 kgs or less that have been previously registered,

titled or licensed in another jurisdiction must pass a certifi ed safety inspection before they can be registered and licenced in BC.

Commercial vehicles (except for commercial trailers) used for commercial purposes must be registered immediately. Commercial trailers that are

licensed in compliance with their home jurisdiction may be operated on a BC highway.

All vehicles imported by the owner into BC must be taken to an Autoplan Broker by the owner, where the ownership, description of the vehicle,

body style, vehicle identifi cation number and odometer reading will be verifi ed. Tax is payable unless the owner qualifi es under the settlers’ effects

exemption contained in the Consumption Tax Rebate and Transition Regulations.

Present Vehicle Registration, Certifi cate of Title and plates - must be surrendered. Owner(s) of a vehicle from another country must also produce

a Vehicle Import Form - Form 1 and surrender it at the time of registration.

Code Fuel Type Code Fuel Type Code Fuel Type Code Fuel Type

A Alcohol F Diesel - Butane N Natural Gas T Diesel - Propane

B Butane G Gasoline P Propane U Gasoline - Natural Gas

D Diesel H Gasoline - Alcohol R Diesel - Natural Gas W Gasoline - Propane

E Electric L Gasoline - Electric S Propane - Natural Gas Y Hydrogen

Z Multi-Fuel

FUEL

TYPE

CODES

PRIVACY NOTICE:

The personal information on this form is collected: (a) by ICBC for the purpose of considering the application by seller and purchaser of the initial vehicle registration or transfer of

vehicle ownership and is authorized by the Motor Vehicle Act, the regulations thereunder and other related legislation; (b) by ICBC for the purpose of administering the Excise Tax Act

and the regulations thereunder, and (c) by the Ministry of Finance (“Ministry”) for the purpose of administering the Consumption Tax Rebate and Transition Act and the regulations

thereunder. Each of ICBC and the Ministry may use and disclose this information in accordance with the provisions of Part 3 of the Freedom of Information and Protection of Privacy

Act. Questions about the collection of this information can be directed to: (a) for ICBC, to the Manager, Information and Privacy, by phone 604-661-2800 or to this address: ICBC,

PO Box 5050 Station Terminal, Vancouver BC V6B 4T4; for the Ministry, to the Information and Privacy Analyst, at, Ministry of Finance, by phone in Victoria at (250) 953-3671, or

in Vancouver at (604) 660-2421, elsewhere in BC at 1-800-663-7867 and ask to be re-directed, or to this address: PO BOX 9432, Stn Prov Govt, Victoria, BC V8W 9N6.