- Notice of Transfer And Release of Liability - California

- Affidavit in Support of a Claim for Exemption from Sales or Use Tax for a Motor Vehicle Transferred Within a Family

- Vehicle Transfer/Tax Form - British Columbia

- Vehicle Registration/Title Application - New York

- Application to Transfer or Retain a Vehicle Registration Number - UK

- Gift of a Vehicle - British Columbia

Fillable Printable Gift of a Vehicle - British Columbia

Fillable Printable Gift of a Vehicle - British Columbia

Gift of a Vehicle - British Columbia

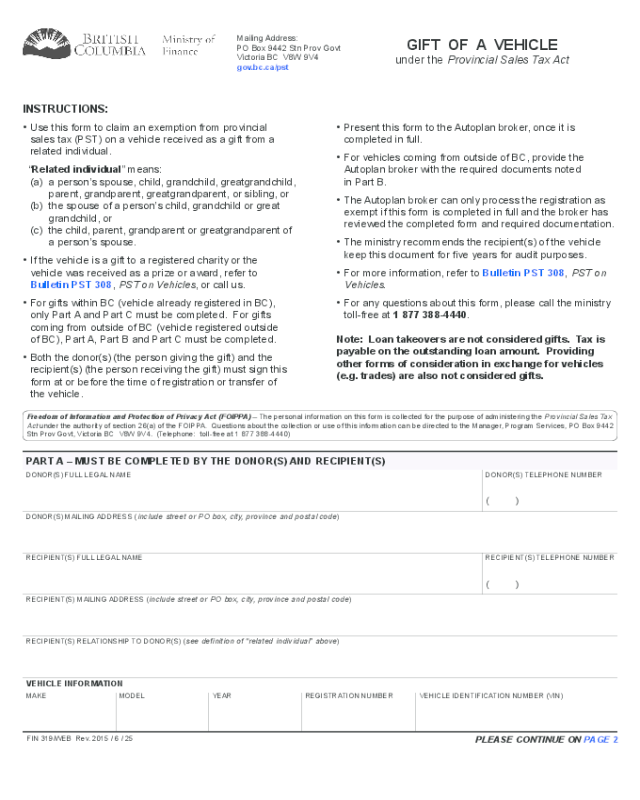

GIFT OF A vehIcle

under the Provincial Sales Tax Act

INSTRUcTIONS:

•Usethisformtoclaimanexemptionfromprovincial

salestax(PST)onavehiclereceivedasagiftfroma

relatedindividual.

“Related individual”means:

(a)aperson’sspouse,child,grandchild,greatgrandchild,

parent,grandparent,greatgrandparent,orsibling,or

(b)thespouseofaperson’schild,grandchildorgreat

grandchild,or

(c)thechild,parent,grandparentorgreatgrandparentof

aperson’sspouse.

•Ifthevehicleisagifttoaregisteredcharityorthe

vehiclewasreceivedasaprizeoraward,referto

Bulletin PST 308, PST on Vehicles,orcallus.

•ForgiftswithinBC(vehiclealreadyregisteredinBC),

onlyPartAandPartCmustbecompleted.Forgifts

comingfromoutsideofBC(vehicleregisteredoutside

ofBC),PartA,PartBandPartCmustbecompleted.

•Boththedonor(s)(thepersongivingthegift)andthe

recipient(s)(thepersonreceivingthegift)mustsignthis

formatorbeforethetimeofregistrationortransferof

thevehicle.

Freedom of Information and Protection of Privacy Act (FOIPPA) – ThepersonalinformationonthisformiscollectedforthepurposeofadministeringtheProvincial Sales Tax

Act undertheauthorityofsection26(a)oftheFOIPPA.Questionsabout thecollectionoruseofthisinformationcanbedirectedtotheManager,ProgramServices,POBox9442

StnProvGovt,VictoriaBCV8W9V4.(Telephone:toll-freeat1877388-4440)

MailingAddress:

POBox9442StnProvGovt

VictoriaBCV8W9V4

gov.bc.ca/pst

DOnOr(S)FUllleGAlnAMe

PART A – MUST Be cOMPleTed By The dONOR(S) ANd RecIPIeNT(S)

DOnOr(S)MAIlInGADDreSS(include street or PO box, city, province and postal code)

DOnOr(S)TelePhOnenUMBer

•PresentthisformtotheAutoplanbroker,onceitis

completedinfull.

•ForvehiclescomingfromoutsideofBC,providethe

Autoplanbrokerwiththerequireddocumentsnoted

inPartB.

•TheAutoplanbrokercanonlyprocesstheregistrationas

exemptifthisformiscompletedinfullandthebrokerhas

reviewedthecompletedformandrequireddocumentation.

•Theministryrecommendstherecipient(s)ofthevehicle

keepthisdocumentforveyearsforauditpurposes.

•Formoreinformation,refertoBulletin PST 308, PST on

Vehicles.

•Foranyquestionsaboutthisform,pleasecalltheministry

toll-freeat1 877 388-4440.

Note: loan takeovers are not considered gifts. Tax is

payable on the outstanding loan amount. Providing

other forms of consideration in exchange for vehicles

(e.g. trades) are also not considered gifts.

()

reCIPIenT(S)FUllleGAlnAMe

reCIPIenT(S)TelePhOnenUMBer

()

reCIPIenT(S)MAIlInGADDreSS(include street or PO box, city, province and postal code)

reCIPIenT(S)relATIOnShIPTODOnOr(S)(

see denition of “related individual” above)

reGISTrATIOnnUMBer

VehICleIDenTIFICATIOnnUMBer(VIn)YeAr

MAKe

MODel

vehIcle INFORMATION

FIn319/WeBrev.2015/6/25

PLEASE CONTINUE ON PAGE 2

FIn319/WeBrev.2015/6/25

Page2

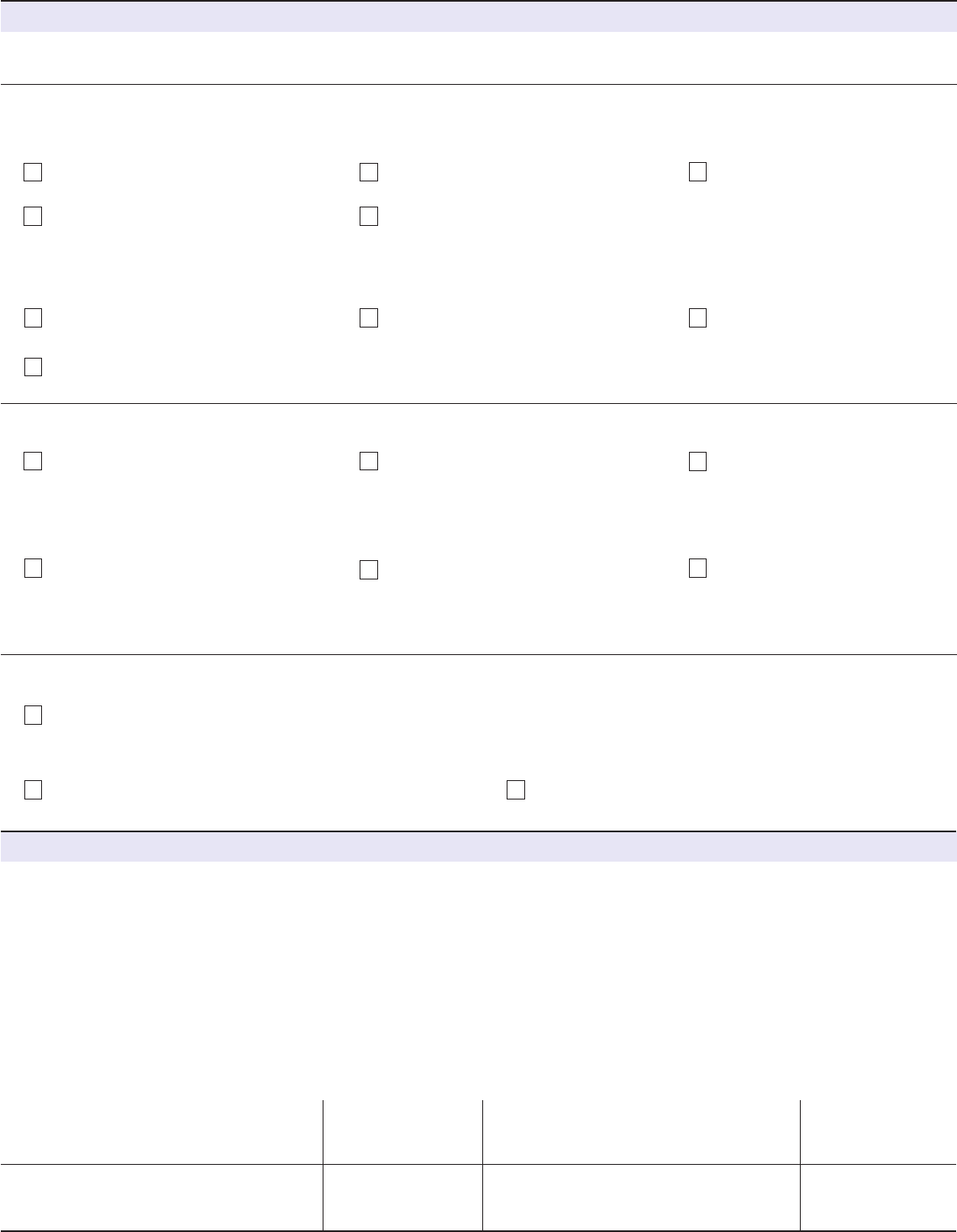

1. The dONOR PAId ONe OF The FOllOwING TAXeS: (check ( ) one)

PART B – FOR OUT-OF-PROvINce GIFTS wIThIN cANAdA ONly (PART A MUST AlSO Be cOMPleTed)

PSTafter March 31, 2013

(undertheProvincial Sales Tax Act)

PSTbefore July 1, 2010

(undertheSocial Service Tax Act)

ToqualifyforanexemptionfromPSTonanout-of-provincevehiclereceivedasagift,thedonormustbearelatedindividual

andhavepreviouslypaidaqualifyingtax,qualiedforanexemptionorreceiveditasagiftinBCbeforeApril1,2013.

TaxonDesignatedProperty(TDP)from

July 1, 2010 to March 31, 2013

(undertheConsumption Tax Rebate and

Transition Act)

7%BCportionofthehSTfrom July 1, 2010

to March 31, 2013(undertheExcise Tax Act)

Salestaxinanotherprovince

(GST is not a qualifying tax)

3. The dONOR ReceIved The vehIcle AS A GIFT IN Bc:

CopyofICBCAPV9T(Transfer/Tax Form)showingproofofgift

before April 1, 2013

notarizedstatementfromdonor.Mustincludeconrmationthatthe

donoracquiredthevehicleasagiftinBCbefore April 1, 2013.

notarizedstatementfromdonor.

Mustincludeconrmationthatdonor.

acquiredpropertyexempt,reasonfor

exemption,taxthatwouldhaveapplied

andyearofacquisitionbydonor.

2. The dONOR QUAlIFIed FOR AN eXeMPTION FROM ONe OF The FOllOwING TAXeS: (check ( ) one)

DATeSIGneD

DATeSIGneD

YYYY/MM/DD

YYYY/MM/DD

Bysigningthisform,thedonor(s)andrecipient(s)certifythatthisvehicleisagiftandnoconsideration,includingapayoutor

takeoverofaloan,hasbeenorwillbegiveninexchange.Thedonor(s)andrecipient(s)certifythatthedonor(s)didnotreceive

thevehicleasanexemptgiftfromarelatedindividualafterMarch31,2013andwithintheprevious12months,unlessthat

exemptgiftwasgiventothedonor(s)bytherecipient(s).

Thedonor(s)andrecipient(s)understandthatthistransferissubjecttoauditbytheMinistryofFinanceandeitherpartymaybe

contactedtoverifyeligibilityfortheexemption.Ifitisdeterminedthatthetransferdidnotqualifyasagiftorthattherewasan

incorrectamountoftaxpaid,theministrymayassesstherecipientforthetaxowingpluspenaltyandinterest.

IacknowledgethatifImakeafalsestatementtoavoidpayingtax,theProvincial Sales Tax Actchargesaneofupto$10,000

and/orimprisonmentupto2years,inadditiontoapenaltyof25%ofthetaxdueandanassessmentforthetaxthatshould

havebeenpaid.

PART c – ceRTIFIcATION

X

X

reCIPIenT’SSIGnATUre(if more than one recipient)

reCIPIenT’SSIGnATUre

DOnOr’SSIGnATUre

DOnOr’SSIGnATUre(

if more than one donor)

DATeSIGneD

DATeSIGneD

YYYY/MM/DD

YYYY/MM/DD

X

X

Completeoneofthefollowingthreesections:

ATTAch ONe OF The FOllOwING dOcUMeNTS AS PROOF OF TAX PAId: (check ( ) one)

CopyoforiginalBillofSalefrom

dealerorsellershowingtaxpaid

receiptshowingtaxpaidtoanotherprovince

(does not include GST)

CopyofICBCAPV9T(Transfer/Tax Form)

showingtaxpaid

notarizedstatementfromdonor.

Muststatewhichtaxwaspaid,yearof

paymentandinwhatprovince.

PSTafter March 31, 2013

(undertheProvincial Sales Tax Act)

TaxonDesignatedProperty(TDP)from

July 1, 2010 to March 31, 2013

(undertheConsumption Tax Rebate and

Transition Act)

PSTbefore July 1, 2010

(undertheSocial Service Tax Act)

ATTAch ONe OF The FOllOwING dOcUMeNTS AS PROOF OF ReceIvING AN eXeMPTION: (check ( ) one)

CopyoforiginalBillofSalefrom

dealerorsellershowingan

exemptionwasreceived

CopyofICBCAPV9T(Transfer/Tax Form)

showinganexemptionwasreceived

ThedonorreceivedthevehicleasagiftbeforeApril 1, 2013

ATTAch ONe OF The FOllOwING dOcUMeNTS AS PROOF OF ReceIvING A GIFT: (check ( ) one)

Print Form

Clear Form