Fillable Printable Blank Shareholders' Agreement Template

Fillable Printable Blank Shareholders' Agreement Template

Blank Shareholders' Agreement Template

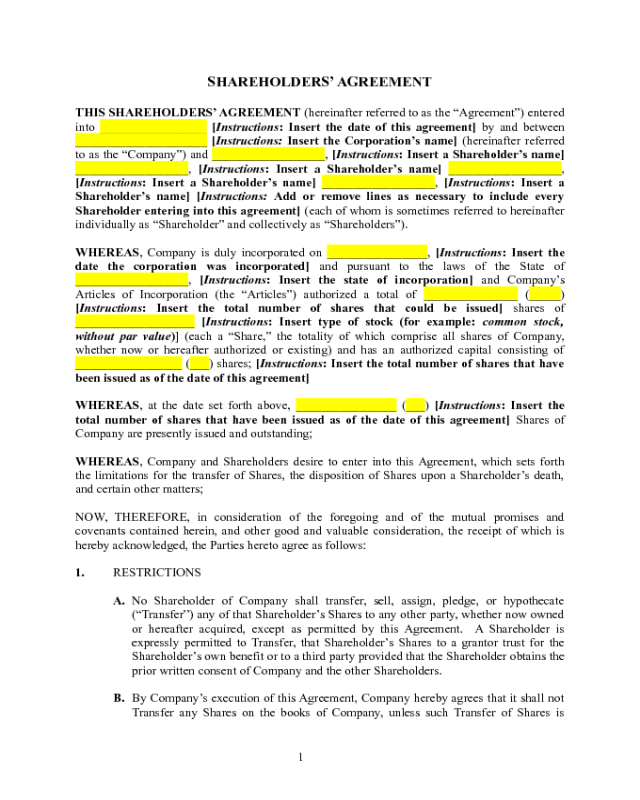

SHAREHOLDERS’ AGREEMENT

THIS SHAREHOLDERS’ AGREEMENT (hereinafter referred to as the “Agreement”) entered

into _________________ [Instructions: Insert the date of this agreement] by and between

_____________________ [Instructions: Insert the Corporation’s name] (hereinafter referred

to as the “Company”) and __________________, [Instructions: Insert a Shareholder’s name]

__________________, [Instructions: Insert a Shareholder’s name] __________________,

[Instructions: Insert a Shareholder’s name] __________________, [Instructions: Insert a

Shareholder’s name] [Instructions: Add or remove lines as necessary to include every

Shareholder entering into this agreement] (each of whom is sometimes referred to hereinafter

individually as “Shareholder” and collectively as “Shareholders”).

WHEREAS, Company is duly incorporated on ________________, [Instructions: Insert the

date the corporation was incorporated] and pursuant to the laws of the State of

__________________, [Instructions: Insert the state of incorporation] and Company’s

Articles of Incorporation (the “Articles”) authorized a total of _______________ (_____)

[Instructions: Insert the total number of shares that could be issued] shares of

___________________ [Instructions: Insert type of stock (for example: common stock,

without par value)] (each a “Share,” the totality of which comprise all shares of Company,

whether now or hereafter authorized or existing) and has an authorized capital consisting of

_________________ (___) shares; [Instructions: Insert the total number of shares that have

been issued as of the date of this agreement]

WHEREAS, at the date set forth above, ________________ (___) [Instructions: Insert the

total number of shares that have been issued as of the date of this agreement] Shares of

Company are presently issued and outstanding;

WHEREAS, Company and Shareholders desire to enter into this Agreement, which sets forth

the limitations for the transfer of Shares, the disposition of Shares upon a Shareholder’s death,

and certain other matters;

NOW, THEREFORE, in consideration of the foregoing and of the mutual promises and

covenants contained herein, and other good and valuable consideration, the receipt of which is

hereby acknowledged, the Parties hereto agree as follows:

1. RESTRICTIONS

A. No Shareholder of Company shall transfer, sell, assign, pledge, or hypothecate

(“Transfer”) any of that Shareholder’s Shares to any other party, whether now owned

or hereafter acquired, except as permitted by this Agreement. A Shareholder is

expressly permitted to Transfer, that Shareholder’s Shares to a grantor trust for the

Shareholder’s own benefit or to a third party provided that the Shareholder obtains the

prior written consent of Company and the other Shareholders.

B. By Company’s execution of this Agreement, Company hereby agrees that it shall not

Transfer any Shares on the books of Company, unless such Transfer of Shares is

1

permitted by the terms of this Agreement and shall not issue any Shares of Company

except in accordance with this Agreement.

2. RIGHT OF FIRST REFUSAL

A. Any Shareholder who desires to Transfer any of that Shareholder’s Shares (the

“Transferring Shareholder”) shall give notice of such proposed Transfer (the

“Notice”) to Company and to the other Shareholders and shall set out in the Notice

the number and class of Shares that the Transferring Shareholder desires to Transfer

(the “Offered Shares”) and the terms upon which and the price at which the

Transferring Shareholder desires to Transfer the Offered Shares (the “Purchase

Price”).

B. Upon Notice, the other Shareholders shall have the right to purchase all, but not less

than all, of the Offered Shares for the Purchase Price. The other Shareholders shall be

entitled to purchase the Offered Shares pro rata based upon the number of Shares

beneficially owned by the Shareholder or in such other proportion as the Shareholders

may agree in writing.

C. Within _____________ (___) [Instructions: Insert the number of days the 1st

purchase period will last] business days of having been given Notice (the “1

st

Purchase Period”), each Shareholder who desires to purchase all of the Offered

Shares that that Shareholder is entitled to purchase shall give notice to the

Transferring Shareholder, Company, and the other Shareholders. If any Shareholder

does not give such Notice, the Offered Shares that that Shareholder had been entitled

to purchase (the “Rejected Shares”) may instead be purchased by Shareholders who

did give such Notice, pro rata based upon the number of Shares beneficially owned

by such Shareholders as between themselves or in such other proportion as such

Shareholders may agree in writing, and, within _____________ (___) [Instructions:

Insert the number of days the 2nd purchase period will last] business days of the

expiry of the 1

st

Purchase Period (the “2

nd

Purchase Period”). Each Shareholder who

desires to purchase all of the Rejected Shares that that Shareholder is entitled to

purchase in accordance with the provisions of this Paragraph shall provide additional

notice to the Transferring Shareholder, Company, and the other Shareholders. If any

Shareholder entitled to give additional notice does not do so, the Rejected Shares that

the Shareholder had been entitled to purchase may instead be purchased by the

Shareholders who did give such notice, and so on, until the Shareholders are willing

to purchase all of the Offered Shares or until they are not willing to purchase any

more. If the Shareholders are willing to purchase all, but not less than all, of the

Offered Shares, the transaction of purchase and sale shall be completed in accordance

with the terms set out in the Notice.

D. If the Shareholders do not give Notice that they are willing to purchase all of the

Offered Shares, in accordance with the provisions of Paragraph 2(C) above, the rights

of the Shareholders to purchase the Offered Shares shall forthwith cease and the

Transferring Shareholder may Transfer the Offered Shares to any person within

2

_____________ (___) [Instructions: Insert the number of months that the

Transferring Shareholder will be allowed to sell to outsiders if no existing

Shareholder purchases the shares] months after the expiry of the 1

st

Purchase

Period, the 2

nd

Purchase Period, or any other applicable purchase period, as the case

may be, as specified in Paragraph 2(C), for a price not less than the Purchase Price

and on terms no more favorable to such person than those set forth in the Notice,

provided that the person to whom the Transferring Shareholder’s Shares are to be

transferred agrees prior to such Transfer to be bound by this Agreement and to

become a party hereto in place of the Transferring Shareholder with respect to the

Offered Shares. If the Offered Shares are not transferred within such period on such

terms, the right of first refusal of the Shareholders pursuant to this Paragraph 2 shall

again take effect.

3. DEATH OR INCAPACITY OF SHAREHOLDER

A. In the event that any Shareholder dies, or is determined, by a court of law, to be

mentally incompetent (the “Incapacitated Shareholder”) and has a committee or other

legal representative appointed to administer the Incapacitated Shareholder’s affairs

(the “Incapacitated Shareholder’s Representative”), Company may, at Company’s

option, redeem or purchase for cancellation within _____________ (___)

[Instructions: Insert the number of days that Company has to purchase shares

after the date of Shareholder death or incompetence] days of the date of death or

such determination, all of the Shares of any class registered in the name of the

Incapacitated Shareholder at fair market value at such date, provided that Company

provides the Incapacitated Shareholder’s Representative with at least _____________

(___) [Instructions: Insert the number of days notice the Company has to provide

to the Incapacitated Shareholder’s Representative if they want to purchase the

shares] days written notice.

B. The Board of Directors shall determine, at its sole discretion, whether and upon what

terms to purchase contracts of life insurance insuring the lives of the Shareholders, or

one or more of them, for the purpose of providing funds for the purchase of their

Shares in accordance with Paragraph 3(A). If Company exercises its option to

purchase the Shares of an Incapacitated Shareholder, any proceeds so obtained by

Company from such life insurance contracts upon the death of such Shareholder shall

be used by Company to purchase, in whole or in part, as such proceeds may be

available, the Shares owned by such Incapacitated Shareholder and any balance of

such proceeds shall be retained for the sole benefit of Company.

C. In the event that there are no life insurance proceeds payable to Company upon the

death of an Incapacitated Shareholder, Company may, at its sole option, elect to

assign to the remaining Shareholders, Company’s option to purchase the Shares

registered in the name of the Incapacitated Shareholder upon the same terms and

conditions as specified in Paragraph 3(A) above. If one or more of the remaining

Shareholders wish to exercise the option to purchase Shares assigned to the remaining

3

Shareholders, such Shares shall be purchased by such Shareholders in the proportions

that they, in their sole discretion, determine.

4. BANKRUPTCY OR OTHER INVOLUNTARY TRANSFER

A. In the event of the bankruptcy of any Shareholder or the Transfer, voluntary or

involuntary, by any Shareholder of any of his or her Shares to any creditor in total or

partial satisfaction of any debt, obligation, judgment, or other liability (any trustee or

receiver of such Shareholder’s assets or any such creditor referred to herein as the

“Involuntary Transferee;” the bankrupt Shareholder or the Shareholder whose interest

passes to the Involuntary Transferee referred to herein as the “Bankrupt

Shareholder”), Company shall have the option to purchase all but not less than all of

the Shares of the Bankrupt Shareholder by giving written notice of its election to

purchase same within _____________ (___) [Instructions: Insert the number of

days notice the Company must provide to purchase the shares of a Bankrupt

Shareholder] days after such bankruptcy has been adjudicated or such Transfer shall

have occurred at a price equal to ___________ percent (____%) [Instructions: Insert

the percentage of the fair market value that will be paid for such shares] of the

fair market value of such Shares.

B. The purchase price for the Shares of the Bankrupt Shareholder shall be paid to the

Involuntary Transferee within _____________ (___) [Instructions: Insert the

number of days after the notice that the Involuntary Transferee will be paid]

days after the delivery of Notice pursuant to Paragraph 4(A) above by Company.

Upon receipt of such consideration, the Involuntary Transferee shall execute and

deliver whatever instruments of conveyance, assignment, and release that shall be

necessary or desirable to carry out such Transfer, and, if he or she fails or refuses to

do so, the Secretary or any other duly appointed officer of Company is irrevocably

constituted and appointed the attorney-in-fact of the Bankrupt Shareholder to effect

such execution.

C. Company may, at its sole option, elect to assign to the remaining Shareholders the

option to purchase the Shares from the Involuntary Transferee upon the same terms

and conditions as specified in Paragraphs 4(A) and 4(B) above. If one or more of the

remaining Shareholders wishes to exercise the option to purchase assigned to the

remaining Shareholders, such Shares shall be purchased by such Shareholders in the

proportion that they shall, in their sole discretion, determine.

5. GENERAL PROVISIONS REGARDING TRANSFER

Notwithstanding anything to the contrary contained herein, in the event a Transferring

Shareholder desires to Transfer that Transferring Shareholder’s Shares:

A. Transferring Shareholder shall deliver to the purchaser certificates representing the

Shares to be transferred, duly endorsed in blank for Transfer, along with original

executed copies of all documents as required to affect the Transfer including, without

4

limitation, succession duty releases, letters probate, and declarations of transmission.

Transferring Shareholder shall also deliver to Company a certified check representing

payment in full of all amounts owed by Transferring Shareholder to Company, if any;

B. The purchaser shall deliver to Transferring Shareholder the purchase price and

Company shall deliver to Transferring Shareholder a certified check representing

payment in full for all amounts owing by Company to the Transferring Shareholder, if

any.

C. In the Transfer, Transferring Shareholder shall warrant to the purchaser that:

i. Transferring Shareholder has good, marketable title to the Shares to be sold,

free and clear from any option or refusal right, voting trust, pledge,

hypothecation, mortgage, lien, charge, encumbrance, security interest, or other

right or interest of any other person other than by or pursuant to this

Agreement; and

ii. Transferring Shareholder has full power and authority to complete, and is

otherwise fully entitled to complete, the Transfer;

D. In the event that the Shares to be transferred represent all of the Shares then held by

Transferring Shareholder:

i. Company shall use its best efforts to deliver a release of Transferring

Shareholder from any guarantees and covenants which the Shareholder has

given on behalf of Company and shall indemnify the Transferring Shareholder

with respect to any claims for which such a release cannot be obtained;

ii. Transferring Shareholder shall deliver a release from any and all claims which

the Transferring Shareholder may have against Company or the remaining

Shareholders.

E. In the event a Transferring Shareholder fails to comply with the provisions of

Paragraph 5() above, and all conditions of such Paragraph have been met by the

purchaser and the remaining Shareholders, Transferring Shareholder hereby

irrevocably appoints the Secretary or any other authorized officer of Company as

Transferring Shareholder’s attorney-in-fact to effect the Transfer of the Shares to be

sold on the books of Company.

6. MANDATORY SALE

In the event that the Shareholders receive a bona fide, arms length, third-party offer to purchase

all of the issued and outstanding Shares upon the same terms and conditions and the holders of at

least ___________ percent (____%) [Instructions: Insert the minimum percentage of shares

that must be approve for a mandatory sale] of the then-issued and outstanding Shares desire

to accept, all of the Shareholders shall be required to Transfer their Shares and take all such

5

actions and execute all such further agreements or instruments as may be reasonably necessary or

desirable in order to complete said Transfer.

7. VALUATION

A. For the purposes of any Transfer, contemplated herein and expressed to occur at fair

market value, the parties to such Transfer shall, at the date of the Transfer, make their

joint determination of the fair market value of the Shares which are the subject of the

Transfer on the basis of the most current financial information with respect to

Company, the contracts entered into by Company, the markets and marketability of

Company as a whole, and any other factors relevant to such valuation, all in

accordance with generally accepted accounting principles, which principles shall be

consistently applied. In the event that the parties to said Transfer are able to make

such a joint determination, then such value shall be binding upon them for the

purposes of that Transfer. Said determination of fair market value shall have no

bearing on any other transfers or upon any other parties hereto.

B. In the event that the parties to a Transfer are unable to make a joint determination of

the fair market value of the Shares subject to the Transfer, within the time provided in

paragraph 7(A) above, the parties to the Transfer shall mutually agree upon an

independent business valuator (the “Valuator”). The Valuator shall determine the fair

market value of all of the issued and outstanding Shares in the capital of Company as

of the last day of the month in which the event giving rise to the Transfer occurs. If

the parties to the Transfer cannot mutually agree upon a Valuator within

_____________ (___) [Instructions: Insert the number of days the parties have to

agree on a valuator] days, then the Valuator shall be chosen by a court of competent

jurisdiction upon the application of either of the parties to the Transfer. The

determination of the fair market value of all of the issued and outstanding Shares in

the capital of Company made by the Valuator shall, for the purposes of this

Agreement, be binding and effective upon the parties to the Transfer. Said

determination of fair market value shall have no binding on any other Transfer or

upon any other parties hereto. In arriving at such valuation, the Valuator shall take

into account and apply generally accepted accounting and valuation principles. The

Valuator shall value Company as a going concern but shall not apply any discount or

premium for a minority or majority interest, as the case may be, and shall not include

as an asset of Company, the proceeds of any insurance policies payable on the death

of a Shareholder. Additionally, if the event in question is the death of a Shareholder,

the Valuator shall not have regard to the occurrence of the death of the deceased or

the imminent possibility thereof. The valuation arrived at by the Valuator, made as an

expert and not as umpire or arbitrator, shall be final and binding and no appeal shall

lie therefrom.

8. INDEPENDENT LEGAL ADVICE

Each of the Shareholders hereby acknowledges that, prior to executing this Agreement, they have

been advised to and have had the opportunity to obtain independent legal advice and that, upon

6

consideration and of their own free will and volition, they have determined that they do not

require independent legal advice. The Shareholders understand fully the nature and

consequences of executing this Agreement and that none of the other parties hereto, or any of

their employees, agents or officers, have used any compulsion or made any threat or exercised

any undue influence to induce them to execute this Agreement.

9. MISCELLANEOUS

A. This Agreement constitutes the entire agreement between the parties with respect to

the specific subject matter hereof and supersedes all prior agreements or

understandings of any kind with respect to same.

B. Any notice or other communication made for the purposes of this Agreement shall be

given or made in writing and shall be served personally, by courier, or prepaid

registered mail, return receipt requested:

i. In the case of Company, to: ________________________________;

[Instructions: Insert the Company’s address]

ii. In the case of any Shareholder, to the last known address of that Shareholder

as recorded in the records of Company;

iii. Or to such other address as any of the parties shall have last notified in the

manner provided herein.

C. This Agreement may be executed in any number of counterparts, each of which when

so executed shall be deemed to be an original and such counterparts together shall

constitute one agreement deemed to be dated as of the date hereof.

D. To the extent necessary to implement the provisions of this Agreement, the power of

the Board of Directors of Company to manage or supervise the management of the

business and affairs of Company is hereby restricted.

E. Subject to the provisions herein, this Agreement may not be assigned, in whole or in

part, without the prior approval of all parties hereto. Subject thereto, this Agreement

shall inure to the benefit of and shall be binding upon the parties hereto and their

respective successors, heirs, executors, administrators, other personal and legal

representatives (including trustees and receivers in bankruptcy), and permitted

assigns.

F. The term of this Agreement shall commence on the date first set forth above and

continue in full force and effect until there is only one holder of Shares of record or

until terminated by agreement of the holders of all of the then-issued and outstanding

Shares. This Agreement may only be amended by the agreement of the holders of at

least __________ percent (____%) [Instructions: Insert the percentage of shares

7

that must approve an amendment to this agreement] of the then-issued and

outstanding Shares.

G. It is intended that each provision of this Agreement shall be viewed as separate and

divisible, and in the event that any provision herein shall be held invalid or

unenforceable, the remaining provisions shall continue to be in full force and effect.

H. The parties shall sign such further and other documents, cause such meetings to be

held, resolutions passed and by-laws enacted, exercise their vote and influence, do

and perform and cause to be done and performed such further and other acts and

things as may be necessary or desirable in order to give full force and effect to this

Agreement and every part hereof.

I. Time shall be of the essence of this Agreement and of every part hereof and no

extension or variation of this Agreement shall operate as a waiver of this provision.

J. This Agreement shall be governed in accordance with the laws of the State of

________________, [Instructions: Insert the state’s laws that will govern this

agreement] applicable to agreements to be wholly performed therein.

K. If legal action is instituted to enforce any of the provisions of this Agreement, the

prevailing party therein shall be entitled to recover his reasonable costs and attorneys’

fees.

L. Each Shareholder acknowledges receiving and reading a copy of this Agreement prior

to its execution and acknowledges that the Shareholder has had an opportunity to seek

independent legal advice prior to its execution. Each Shareholder acknowledges that

the Shareholder understands fully the nature and effect of this Agreement and that he

or she has executed this Agreement of the Shareholder’s own free will and volition

and under no compulsion to act.

[THE REMAINDER OF THIS PAGE HAS BEEN LEFT INTENTIONALLY BLANK –

SIGNATURE PAGE TO FOLLOW]

8

IN WITNESS THEREOF, the parties have duly executed this Agreement as of the day and year

first written above.

COMPANY:

________________________________

By: _____________________________ [Instructions: Insert the signatory’s name]

Title: ____________________________ [Instructions: Insert the signatory’s job title]

SHAREHOLDERS:

________________________________

By: ___________________________ [Instruction: Insert the signatory’s name]

Title: Shareholder

________________________________

By: ___________________________ [Instruction: Insert the signatory’s name]

Title: Shareholder

________________________________

By: ___________________________ [Instruction: Insert the signatory’s name]

Title: Shareholder

________________________________

By: ___________________________ [Instruction: Insert the signatory’s name]

Title: Shareholder

9