Fillable Printable Sample Shareholder Agreement

Fillable Printable Sample Shareholder Agreement

Sample Shareholder Agreement

1

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

Shareholders’ Agreement of [Company name] company.

1 Partners to the Agreement

[Company Name] [Company Type], a Company in planned to be registered in [Country, City]

(hereinafter referred also as the Company) for [Summary of what company does] (hereinafter

referred also as Company services),

Partners:

a [Partner Name], [address], [Personal or Business ID if any] (hereinafter referred also as

[initials])

b [Partner Name], [address], [Personal or Business ID if any] (hereinafter referred also as

[initials])

c [Partner Name], [address], [Personal or Business ID if any] (hereinafter referred also as

[initials])

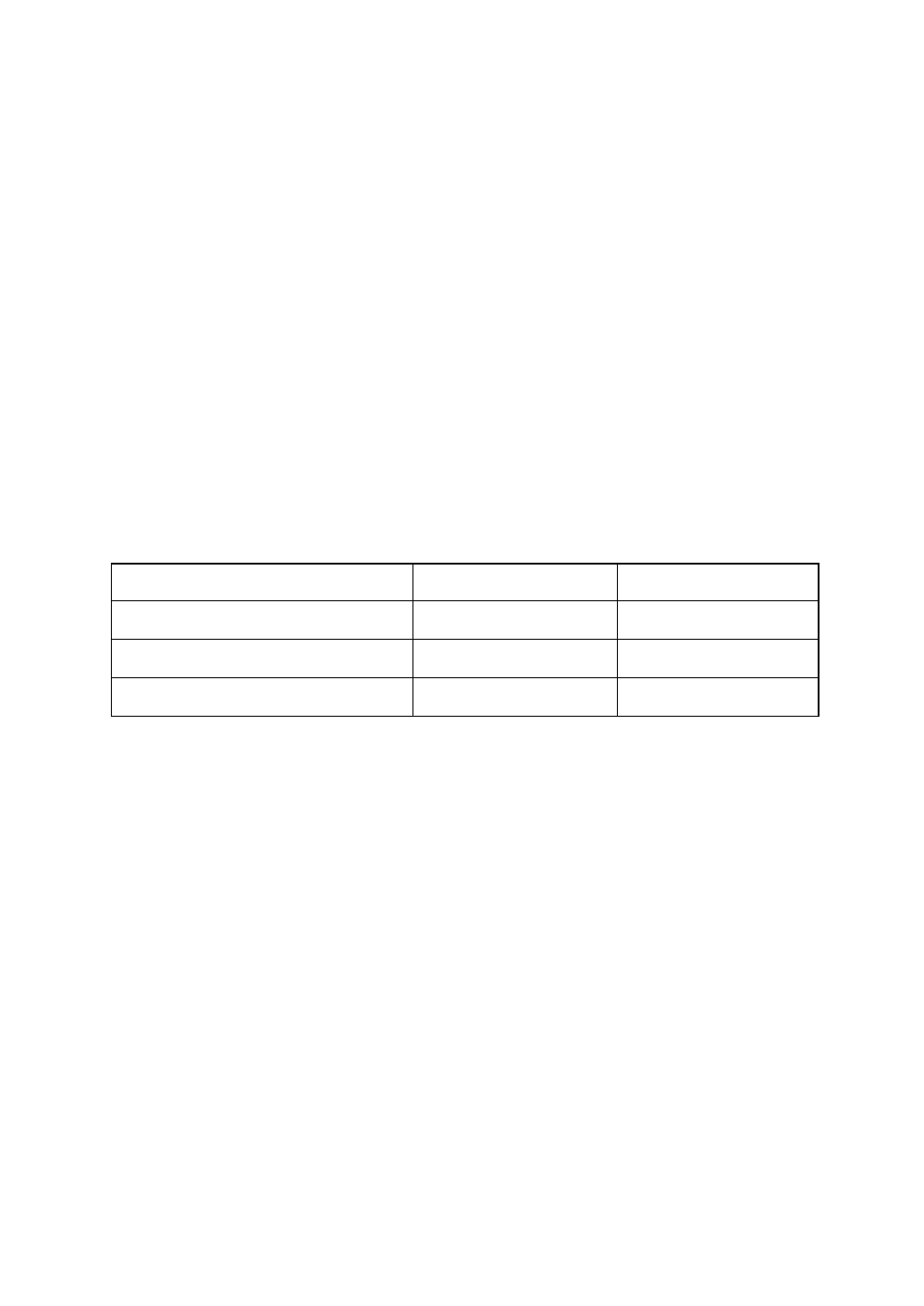

2 Ownership of the shares

The ownership of the shares (total [Number of shares]) is presented in the table below.

Shareholder

Number of shares

%

[Partner Name]

[Partner Name]

[Partner Name]

3 Background & Rational and the Spirit of this Agreement

This Shareholders’ Agreement defines the co-operation principles between the Partners, and

related measures and responsibilities.

The Partners have recognized a growing market opportunity to provide company services to

[customer types] [In what markets]. The Partners have agreed upon pursuing this opportunity

by their engagement with The Company.

The goal of the Partners is to develop The Company rapidly into [What type of Company is being

target; size, scale, etc.]. The initial business outline is presented in the [Annex 1 ie. company

presentation/business plan], and related revenue allocation structure is presented in Exhibit D.

The Company develops the plan continuously based on the market feedback and opportunities.

The purpose of this Agreement is to protect the interests of the Partners. It is not meant to

punish a Partner who unintentionally breaches this Agreement and discontinues his or her

misconduct after notification from other Partners.

2

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

In this spirit, the Partners agree not to sell The Company’s shares to outsiders when share

disposal restriction provisions of this Shareholders’ Agreement (hereinafter referred also as

Agreement) restrict the selling of the shares.

4 General Commitments

The Partners agree to the following:

We, as the Partners to this Agreement, agree to conduct our tasks in the field of The Company’s

business operations in the interests of the Company. All immaterial and other property rights

created during or directly related to The Company business development process will become

property of The Company unless agreed otherwise in written by all Partners.

Tasks and/or roles of the Partners :

[Partner] [Role/Title]

Main tasks & responsibilities:

● manage the business

● etc

Related incentive plan presented in Exhibit C

[Partner] [Role/Title]

Main tasks & responsibilities:

● manage the business

● etc

Related incentive plan presented in Exhibit C

[Partner] [Role/Title]

Main tasks & responsibilities:

● manage the business

● etc

Related incentive plan presented in Exhibit C

5 Proceedings

By default, each Partner can freely vote in a shareholders' meeting. However, the Partners agree

on two exceptions to the above:

Firstly, if more than 2/3 of the shares owned by the Partners are supporting certain voting

behavior, then all Partners will vote in agreement with the 2/3 majority of Partners. The

3

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

purpose is to ascertain that the Partners will be unified, acting as a single group, even in the

situations when there would be other shareholders in the Company than the Partners alone.

Secondly, certain decisions will require support by Partners holding at least 90% of all Partner

shares; otherwise all Partners agree to vote against these decisions. The decisions are the

following:

● Increasing and decreasing the share capital,

● Issuing new shares,

● Issuing convertible loans or options that can be transferred to shares,

● Selling all or a major part of the business of the company,

● Authorizing the Board to make decisions listed above.

To implement the proceedings describe above, the Partners agree to efficiently work together at

the shareholders’ meetings and before them. Any Partner may call the partners to meet in two

week’s notice, either in person if possible, or over internet/telephone, and otherwise following

the protocols used for inviting a shareholders’ meeting. The Partners will do their best effort to

find meeting times – several meetings if necessary – to work out their common voting strategy.

The Partners agree to participate in all shareholders’ meetings, either in person or by proxy

instructed to follow the proceedings describe above.

6 Competition Restriction Clause

The Partners who have an active role in The Company undertake not to compete in any way,

directly or indirectly, with the business of The Company. Here, the following definitions are

used:

● Active role in The Company is defined as being either employed by The Company, or

acting as a Board director, advisor, or consultant for the company.

● The business of The Company is defined based on the strategy, business plans, customer

relations and pipeline, product roadmaps, and IPR’s of The Company at any given time.

If a Partner ceases to have an active role in The Company, then the Partner agrees not to

compete in any way with the business of The Company as defined at that moment, during the

following [number of months ie. 12].

In addition to the above, all Partners (not just those having an active role in The Company)

agree not to compete in any way with the business of The Company during the first [number of

months ie. 6] after signing this Shareholders Agreement of the company.

If The Company decides to change its strategy, business plan or business focus, this change and

new business plan must be communicated to each Partner. If a competitive situation follows

from the change by The Company, this is not considered as a breach of this Competition

Restriction Clause.

If one or several Partners materially breach this Competition Restriction Clause, and do not

correct the breach within [number of days ie. 30] after being notified about the breach by The

Company or other Partners having at least 2/3 of the remaining Partner shares, with shares of

the Partner(s) breaching the Clause excluded, then following sanction will be applicable:

4

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

The Partner(s) breaching the Competition Restriction Clause agree to sell their shares at a price

that is 10% of their fair market price (as defined in Clause 9 below), pro rata of the other

Partners’ ownerships. In addition, each Partner breaching the Clause agrees to pay [EUR ie

30,000 Euros] to The Company.

This breach shall be documented by the Board and it shall be proven to be harmful (e.g. The

Company has lost business or competitive advantage) for The Company.

The Partners shall be deemed to have provided written consent in terms of this Chapter 6 to

each Partner current ownership of and role/appointment in other companies/businesses and

other activities as set forth in Exhibition B and each of the Partner shall not be in breach of this

Chapter 6 in relation to any such ownership, role, appointment or activity.

7 Buy Back Option in normal Partner Exit Situation and Share Disposal Restrictions

The Partners undertake not to transfer their shares to third parties before [number of months

ie. 36] of signing the shareholders Agreement for the first time, unless otherwise agreed in

writing by the Partners holding at least 90% of the shares of the Company. Each Partner shall

inform the other Partners about any intent to transfer the Partner’s shares, and about the

information to be given to third parties in connection with such intent to transfer shares.

The Partners to this Agreement have the right to buy shares back for a period of [number of

months ie. 12] from resignation of a Partner, if the buyback has not materialized earlier.

8 Exit

In connection with the Liquidation Event, any Net Consideration shall be distributed pro-rata

between the shareholders.

9 Abnormal Exit Situations

In the event that the Partner leaves the Company as a Bad Leaver, a defined percent as defined

in Exhibit A of his shares shall be subject to mandatory transfer to the Company at their nominal

value.

A bad leaver is any shareholder that discontinues to be employed by the Company, in a

consultant-relation with the Company, a board member before the Milestones as described in

the Exhibit A has been achieved for any of the following reasons:

(a) does not contribute the agreed minimum time and/or effort to The Company an on-

going bases, as agreed by partners, and continues to not contribute after notification

from other Partners.

(b) material breach of this Agreement;

(c) gross misconduct or any serious or persistent breach of any obligation to the Company

or any associated Company of the Company;

(d) conviction of a criminal offence (for which a custodial sentence is imposed) by a court of

competent jurisdiction; or

5

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

A Bad Leaver is determined by 3/4 of the Partners agreeing, backed with proper

documentation.

10 Rules Governing Share Disposal

If any of the Partners, (the “Selling Partner”), negotiates with a third party/Partners (“the

Buying Parties”) on the transfer of its shares, the Selling Partner undertakes to promptly notify

the other Partners in writing (“Tag-Along Notice”) about such intent. Other Partners shall have

the right, but not the obligation, to require the Selling Partner to cause that, either all, or

proportionately the same amount of their shares, as the Selling Partner intends to transfer are

purchased by that Buying Party/Partners (“Tag-Along Right”) at the same consideration and

otherwise on the same terms and conditions obtained by the Selling Party. In such share

transfer, the Selling Partner shall make best efforts to find a third Partner to whom all of the

shares could be transferred at market price. The other Partners respectively must inform the

Selling Partner within [number of days ie. 30] from the receipt of the Tag-Along Notice whether

they wish to use their respective Tag-Along Rights.

In the event that a group of owners holding majority of Company shares (“Majority Holders”)

have found a candidate (“Third Partner Offeror”) who wishes bona fide to purchase all of the

shares of the Company, the Majority Holders shall have the right but not the obligation, to

require that the other Partners to this Agreement transfer their shares to the Third Partner

Offeror (“Drag-Along Right”) at the same consideration and otherwise on the same terms and

conditions obtained by the Majority Holders. The Drag Along-Right shall be exercised by a

notice submitted to the other Partners at least [number of days ie. 30] before the consummation

of the transfer of shares from the Partners to the Third Partner Offeror.

A transfer of shares from a Partner to a third party must always happen simultaneously with the

third party becoming also a partner in this Shareholders agreement, and the selling Partner is

responsible to see that this happens.

11 Market Value Determination

If the shares are to be valued based on provisions of this Agreement, and if the Partners

concerned cannot agree on what the market value for the shares will be, the market value shall

be determined on the basis of an arms-length third Partner purchase offer for the shares. In the

absence of such offer, a respectable financial advisor or investment bank appointed by the

Board of Directors shall determine the market value.

12 Disclaimers and Order of Interpretation

The Agreement here is understood by all the Partners to contain all relevant questions currently

concerning the governance of the Company.

This Agreement supersedes – only for the above-mentioned issues handled within this

Agreement– any arrangements, understandings, promises or Agreements made or existing

between the Partners hereto, prior to, or simultaneously with the Agreement and constitutes

the entire understanding between the Partners hereto.

6

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

If this Agreement, related Agreements and documents or the Articles of Association are

inconsistent with each other, the documents shall be interpreted in the following order:

1. this Agreement;

2. other Agreements or documents signed between the Partners

3. the Articles of Association of the Company.

If the Partners decide to modify this Agreement it has to be done in writing and signed by and

on behalf of all Parties. In that Agreement there must be a clause mentioning that this is a

modification to the existing shareholders Agreement or the modification must be otherwise

evident by the circumstances.

13 Other Shareholder Agreements

The Partners understand and are aware that some of the Partners have existing shareholder

agreements or competition restriction clauses in other companies. These agreements restrict

competition. The Partners agree to make their best effort to avoid conflicts with these other

shareholder agreements and competition restrictions. The Partners agree that if any Partner

encounters liabilities from these agreements or restrictions, the Company will cover those

liabilities, including but not limited to compensation payments and legal costs. The Board shall

make the final decision, to what extent the Company covers the costs.

14 Insight and confidentiality

The Partners shall hold in confidence and shall not disclose to any third Partner without prior

written consent of all the Partners the material contents of this Agreement unless disclosure is

required by law, regulation, stock exchange rules or order of a court of competent jurisdiction.

The Partner under an obligation to make a disclosure as defined hereinabove shall use its best

efforts to notify other Partners before making the disclosure.

The Partners shall not at any time hereafter disclose or communicate to any person (other than,

where relevant, to their officers, employees or professional advisors, whose position makes it

necessary to know the same) any confidential information concerning the business, accounts,

financial or contractual arrangements or other dealings, transactions or affairs of the Company

or any of its subsidiaries which may be within or which may come to its knowledge save for;

a) such information that at the time of disclosure is public knowledge,

b) when disclosure is required by law, regulation, stock exchange rules, or order of a court

of a competent jurisdiction.

Any Partner wishing to disclose confidential information to a prospective transferee of shares

and to their representatives and advisers shall first obtain an appropriate commitment as to

confidentiality before making the disclosure.

15 Communication among Partners to the Agreement

7

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

Any communication between the Partners concerning this Agreement will be in writing and will

be delivered in person or by e-mail in such a way that the recipient confirms having received the

information, or sent by registered mail and fully prepaid in an envelope properly addressed to

the address given by the Partner to the Company or to other Partners. Any such notice will be in

the English language and will be considered to have been given at the time when actually

delivered and confirmed by all Partners or in any other event between [number of days ie. 14]

after it was mailed in the manner herein before provided.

16 Costs

Each of the Partners hereto will bear his/her or its own legal, accountancy and other costs,

charges and expenses connected with the negotiation, preparation and implementation of this

Agreement and any other Agreement incidental to or referred to in this Agreement.

17 Assign Ability

This Agreement cannot be assigned by any one of the Partners without the prior written

consent of the other Parties.

18 Disputes and Governing Law

This Agreement will be governed by and constructed in accordance with the laws of [Country].

Any disputes arising out of this agreement shall be resolved in the [District Court or other] of

[City, Country].

19 Term

This Agreement becomes effective upon the signature by all Partners and shall be binding on

each Partner as long as that Partner is the owner of the Shares or other Equity Securities. This

Agreement shall, however, be terminated upon the consummation of a Trade Sale or an IPO.

Notwithstanding the aforesaid, Sections 7 - 10 (Competition Restriction Clause, Buy Back Option

in normal Partner Exit Situation and Share Disposal Restrictions, Abnormal Exit Situations, and

Rules Governing Share Disposal) and Sections 18 (Disputes And Governing Law) will be binding,

to the extent applicable, upon the Party even if the Party has ceased to be a Party to this

Agreement.

20 Ancillary Provisions and Signature

Except as otherwise provided herein, no addition, amendment to or modification of this

Agreement will be effective, unless it is made in writing and signed by and on behalf of all

Parties.

There will be no waiver of any term, provision or condition of this Agreement unless such

waiver is evidenced in writing and signed by the waiving Parties.

8

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

No omission or delay on the part of any Partner hereto in exercising any right, power or

privilege hereunder will operate as a waiver thereof, nor will any single or Partial exercise of

any such right, power or privilege preclude any other. The rights and remedies herein provided

are cumulative with and not exclusive of any rights or remedies provided by law.

In the event that any of these terms, conditions or provisions will be determined invalid,

unlawful or unenforceable to any extent, such term, condition or provision will be severed from

the remaining terms, conditions and provisions which will continue to be valid to the fullest

extent permitted by law.

This Agreement in has been executed in [number of copies] identical originals, and reviewed

completely by the Parties, signed after approval and all pages in appendixes inclusive initialed

by the Parties. The Company has received one and each Partner has received one original

bearing the following legally binding signatures.

This Agreement contains the entire agreement and understanding of the parties hereto relating

to the subject matter hereof, and merges and supersedes all prior and contemporaneous

discussions, agreements and understandings of every nature between the parties hereto.

This Agreement may be executed in one or more counterparts, and by the different parties

hereto in separate counterparts, each of which when executed shall be deemed to be an original

but all of which taken together shall constitute one and the same agreement. Delivery of an

executed counterpart of a signature page to this Agreement by telecopier shall be effective as

delivery of a manually executed counterpart of this Agreement.

_____________________________ ______________________________ ________________________________

[Partner & title/role] [Partner & title/role] [Partner & title/role]

9

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

Exhibit A

Before the Milestone 1 all (100%) of the shares shall be subject to mandatory transfer. After

that the percents of the mandatory transfer, when each milestone is achieved, are the following:

1 Milestone 1 definition, ninety (90) percent of the shares shall be subject to mandatory

transfer:

● [time and/or development stage of company]

2 Milestone 2 definition, seventy (70) percent of the shares shall be subject to mandatory

transfer:

● [time and/or development stage of company]

3 Milestone 3 definition, fifty (50) percent of the shares shall be subject to mandatory

transfer:

● [time and/or development stage of company]

4 Milestone 4 definition, zero (25) percent of the shares shall be subject to mandatory

transfer:

● [time and/or development stage of company]

10

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

Exhibit B

Current Roles [if any]:

[Partner name]

● [any role in other company/entity where having commitments]

● etc.

[Partner name]

● [any role in other company/entity where having commitments]

● etc.

[Partner name]

● [any role in other company/entity where having commitments]

● etc.

11

Shareholders’ Agreement of [Company Name]

[Company name]

[Document ID]

[company URL]

Exhibit C

Additional incentives [Per partner if any]

1 [number of shares] shares (or stock options representing equal amount of shares)

from the allocated company incentive options pool after reaching the below

targets:

● [Additional target per person/role]

● [Additional target per person/role]

● [Additional target per person/role]

● etc.

2 [Additional external compensations if any]*

● [Additional target per person/role]

● [Additional target per person/role]

● etc.

*a separate agreement will be executed to cover [type of] incentives.

Targets will be re-evaluated periodically and new targets with new incentives set as needed.