Fillable Printable Certificate of Non-Foreign Status

Fillable Printable Certificate of Non-Foreign Status

Certificate of Non-Foreign Status

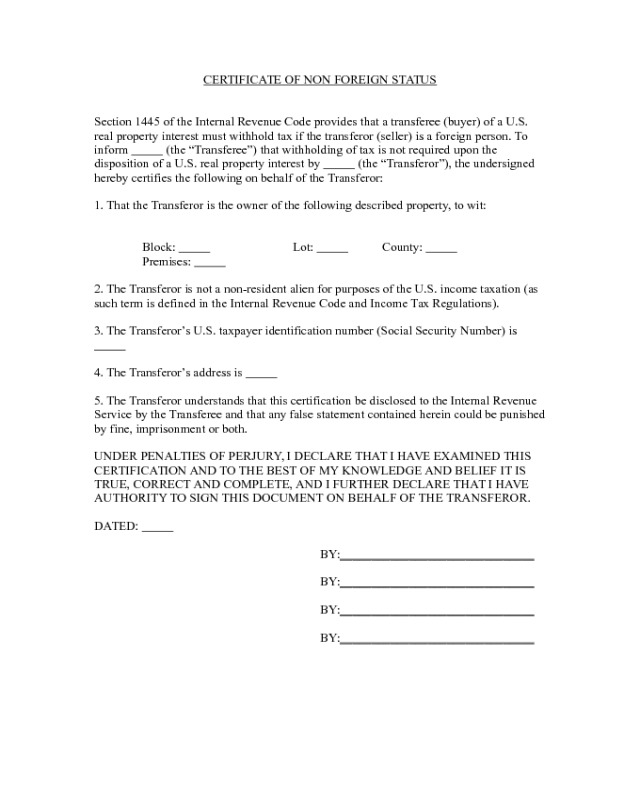

CERTIFICATE OF NON FOREIGN STATUS

Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S.

real property interest must withhold tax if the transferor (seller) is a foreign person. To

inform (the “Transferee”) that withholding of tax is not required upon the

disposition of a U.S. real property interest by (the “Transferor”), the undersigned

hereby certifies the following on behalf of the Transferor:

1. That the Transferor is the owner of the following described property, to wit:

Block: Lot: County:

Premises:

2. The Transferor is not a non-resident alien for purposes of the U.S. income taxation (as

such term is defined in the Internal Revenue Code and Income Tax Regulations).

3. The Transferor’s U.S. taxpayer identification number (Social Security Number) is

4. The Transferor’s address is

5. The Transferor understands that this certification be disclosed to the Internal Revenue

Service by the Transferee and that any false statement contained herein could be punished

by fine, imprisonment or both.

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS

CERTIFICATION AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS

TRUE, CORRECT AND COMPLETE, AND I FURTHER DECLARE THAT I HAVE

AUTHORITY TO SIGN THIS DOCUMENT ON BEHALF OF THE TRANSFEROR.

DATED:

BY:_______________________________

BY:_______________________________

BY:_______________________________

BY:_______________________________