Fillable Printable Renters' Tax Credit Instructions and Application Form - Maryland

Fillable Printable Renters' Tax Credit Instructions and Application Form - Maryland

Renters' Tax Credit Instructions and Application Form - Maryland

2015

s

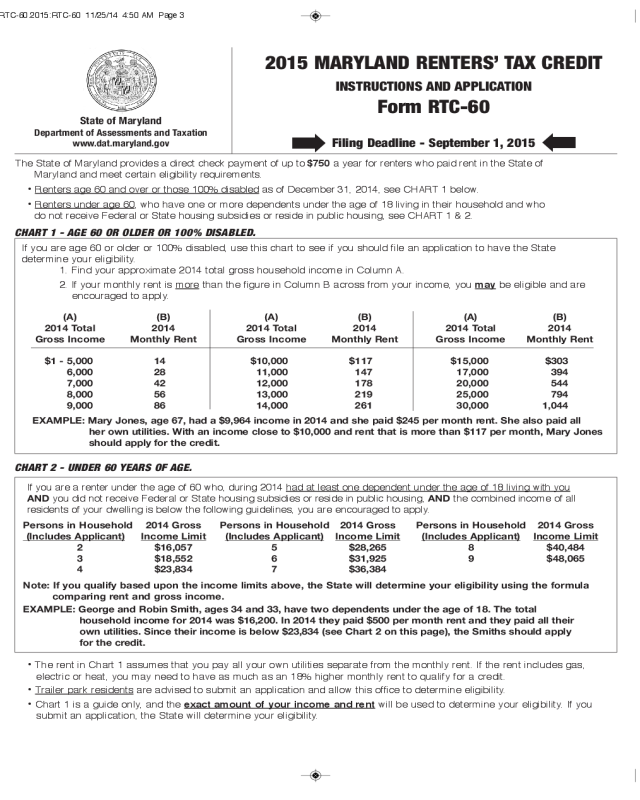

2015 MARYLAND RENTERS’ TAX CREDIT

INSTRUCTIONS AND APPLICATION

Form RTC-60

Filing Deadline - September 1, 2015

·

·

State of Maryland

D

epartment of Assessments and Taxation

www.dat.maryland.gov

The State of Maryland provides a direct check payment of up to $750 a year for renters who paid rent in the State of

Maryland and meet certain eligibility requirements.

• Renters age 60 and over or those 100% disabled as of December 31, 2014, see CHART 1 below.

• Renters under age 60, who have one or more dependents under the age of 18 living in their household and who

do not receive Federal or State housing subsidies or reside in public housing, see CHART 1 & 2.

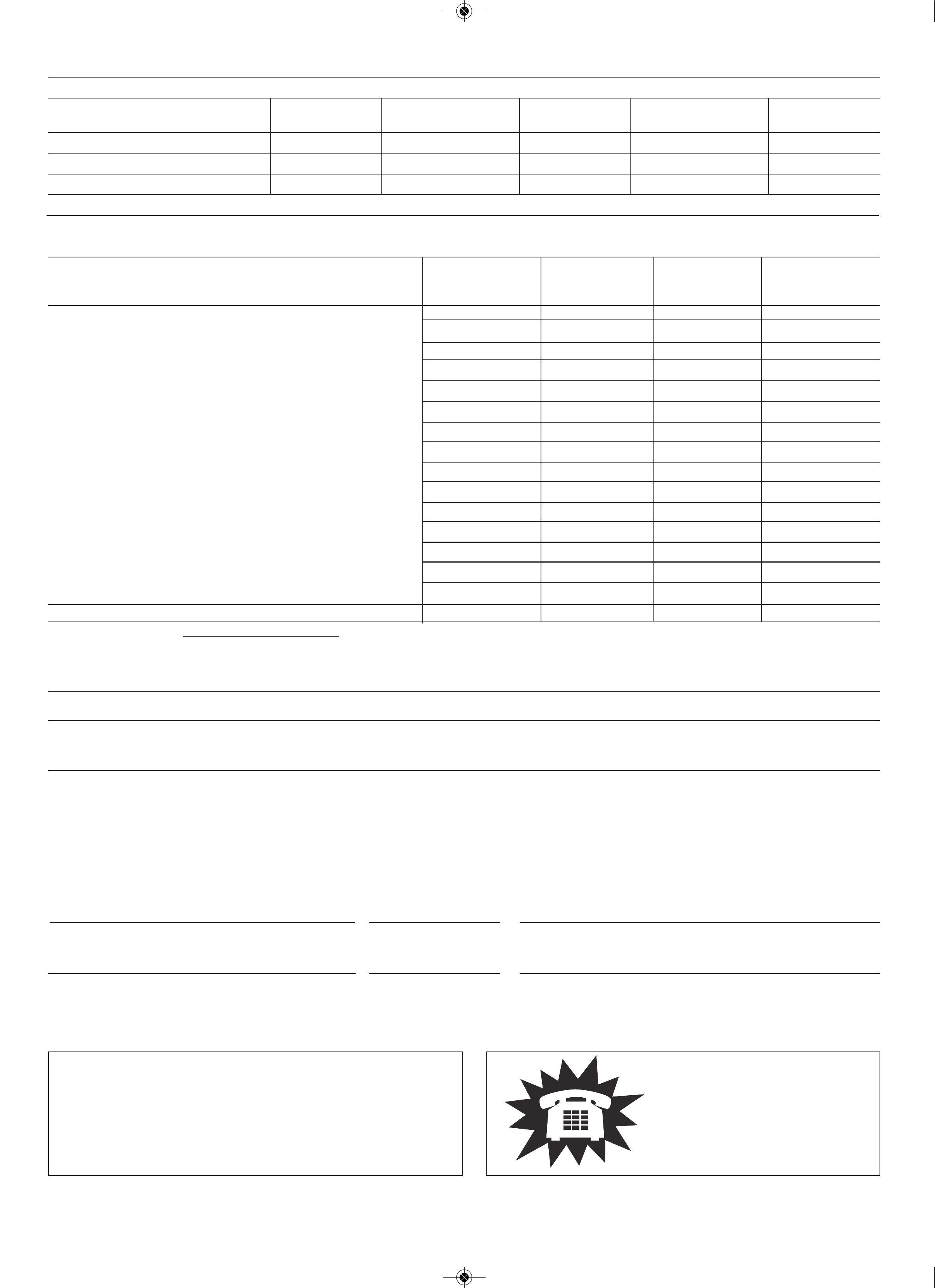

CHART 1 - AGE 60 OR OLDER OR 100% DISABLED.

If you are age 60 or older or 100% disabled, use this chart to see if you should file an application to have the State

determine your eligibility.

1. Find your approximate 2014 total gross household income in Column A.

2. If your monthly rent is more than the figure in Column B across from your income, you may be eligible and are

encouraged to apply.

(A) (B) (A) (B) (A) (B)

2014 Total 2014 2014 Total 2014 2014 Total 2014

Gross Income Monthly Rent Gross Income Monthly Rent Gross Income Monthly Rent

$1 - 5,000 14 $10,000 $117 $15,000 $303

6,000 28 11,000 147 17,000 394

7,000 42 12,000 178 20,000 544

8,000 56 13,000 219 25,000 794

9,000 86 14,000 261 30,000 1,044

EXAMPLE: Mary Jones, age 67, had a $9,964 income in 2014 and she paid $245 per month rent. She also paid all

her own utilities. With an income close to $10,000 and rent that is more than $117 per month, Mary Jones

should apply for the credit.

If you are a renter under the age of 60 who, during 2014 had at least one dependent under the age of 18 living with you

AND you did not receive Federal or State housing subsidies or reside in public housing, AND the combined income of all

residents of your dwelling is below the following guidelines, you are encouraged to apply.

CHART 2 - UNDER 60 YEARS OF AGE.

Persons in Household 2014 Gross Persons in Household 2014 Gross Persons in Household 2014 Gross

(Includes Applicant) Income Limit (Includes Applicant) Income Limit (Includes Applicant) Income Limit

2 $16,057 5 $28,265 8 $40,484

3 $18,552 6 $31,925 9 $48,065

4 $23,834 7 $36,384

Note: If you qualify based upon the income limits above, the State will determine your eligibility using the formula

comparing rent and gross income.

EXAMPLE: George and Robin Smith, ages 34 and 33, have two dependents under the age of 18. The total

household income for 2014 was $16,200. In 2014 they paid $500 per month rent and they paid all their

own utilities. Since their income is below $23,834 (see Chart 2 on this page), the Smiths should apply

for the credit.

• The rent in Chart 1 assumes that you pay all your own utilities separate from the monthly rent. If the rent includes gas,

electric or heat, you may need to have as much as an 18% higher monthly rent to qualify for a credit.

• Trailer park residents are advised to submit an application and allow this office to determine eligibility.

• Chart 1 is a guide only, and the exact amount of your income and rent will be used to determine your eligibility. If you

submit an application, the State will determine your eligibility.

RTC-60.2015:RTC-60 11/25/14 4:50 AM Page 3

P

LEASE COMPLETE OTHER SIDE OF APPLICATION FIRST

1. WHO CAN FILE?

A

GE 60 OR OVER OR 100%

DISABLED

In order to be eligible for a 2015

Renters’ Tax Credit, the applicant must

meet ONE of the following requirements.

• have reached age 60, on or before

December 31, 2014 OR

• be 100% totally and permanently

disabled as of December 31, 2014

and submit proof of disability from the

Social Security Administration, other

federal retirement system, the federal

Armed Services or the local

City/County Health Officer,

OR

• be the surviving spouse of one who

otherwise could have satisfied the

age or disability requirement.

UNDER 60 YEARS OF AGE

In order to be eligible for a credit, an

applicant must meet ALL of the

following requirements:

• had at least one dependent under the

age of 18 living with you during 2014

AND

• did not receive Federal or State

housing subsidies in 2014 AND

• your 2014 total gross income was

below the limit listed in Chart 2 on the

first page of this form.

Applicant must provide a copy of the

child’s social security card and birth

certificate.

If the applicant files a Federal return,

the eligible dependent(s) must be listed

on the Federal return in order to apply

for this credit.

2. REQUIREMENTS FOR ALL

APPLICANTS

Each of the following requirements must

be met by every applicant:

• the applicant must have a bona

fide leasehold interest in the

property and be legally responsible

for the rent;

• first time applicants, and prior year

applicants who moved in 2014

must submit a copy of their 2014

lease(s), rental agreement,

cancelled checks, money order

receipts, or other proof of rent paid.

Other applicants must submit a

copy upon request;

• the dwelling must be the principal

residence where the applicant

resided for at least six months in

Maryland in calendar year 2014,

• the dwelling may be any type of

rented residence or a mobile home

pad on which the residence rests,

but it may not include any unit

rented from a public housing

authority or from an exempt

organization;

• the applicant, spouse and/or co-

tenant must have a combined net

worth of less than $200,000 as of

December 31, 2014.

An individual applicant may later be

requested to submit additional

information to verify what was

reported on the application. This

request may include a statement of

living expenses when it appears that the

applicant has reported insufficient means

to pay the rent and other living expenses.

3. SPECIFIC INSTRUCTIONS

FOR CERTAIN LINE ITEMS

ITEM 14 - SURVIVING SPOUSE

If you are filing as the surviving

spouse of a person who would have

met the age requirement, include a

copy of his/her death certificate. If

your spouse was disabled, include a

copy of their death certificate and

proof of disability.

ITEM 19 - SOURCES OF INCOME

All nontaxable sources of income

s

uch as retirement benefits, also

must be reported here.The tax credit

is based upon “total income”,

regardless of its source or taxability.

Public assistance, government

grants, gifts in excess of $300,

expenses paid on your behalf by

others, and all monies received to

s

upport yourself must be reported.

You must report room and board,

household expenses, or the gross

income of any other nondependent

occupants. Co-tenants cannot pay

room and board.

Applicants who receive Public

Assistance must provide a copy of

the 2014 AIMS Public Assistance

letter showing dependents and

benefits received.

ITEM 20 - RENT YOU PAID

List only that amount of rent you

actually paid and do not include

subsidies paid on your behalf such

as HUD/Section 8 payments. Do not

include monthly fees for any services

such as meals, pet fees, garage

charges, late charges, security

deposits, etc. If you live in a home in a

trailer park, report only the rent you paid

for the trailer pad or lot.

ITEM 23- PERJURY OATH/SOCIAL

SECURITY RELEASE

By signing the form, the applicant,

spouse and/or co-tenant is attesting

under the penalties of perjury as to the

accuracy of the information reported

and that the legal requirements for

filing have been met. In addition, the

signature also authorizes the listed

government agencies, Credit Bureaus

and the landlord to release information

to the Department in order to verify the

income or benefits received and rental

terms reported by the applicant.

R

EAD THIS IMPORTANT INFORMATION BEFORE COMPLETING THE APPLICATION

PRIVACY AND STATE DATA SYSTEM SECURITY NOTICE

The principal purpose for which this information is sought is to determine your eligibility for a tax credit. Failure to provide this information will

result in a denial of your application. Some of the information requested would be considered a “Personal Record” as defined in State Government

Article, § 10-624 consequently, you have the statutory right to inspect your file and to file a written request to correct or amend any information you

believe to be inaccurate or incomplete. Additionally, it is unlawful for any officer or employee of the state or any political subdivision to divulge any

income particulars set forth in the application or any tax return filed except in accordance with judicial legislative order. However, this information is

available to officers of the state, county or municipality in their official capacity and to taxing officials of any other state, or the federal government,

as provided by statute.

FILING DEADLINE IS SEPTEMBER 1, 2015

If you need further information or free assistance in completing this application form, please call

410-767-4433 in the Baltimore metropolitan area or 1-800-944-7403 (toll free) for those living

elsewhere in Maryland.

RTC-60.2015:RTC-60 11/25/14 4:50 AM Page 4

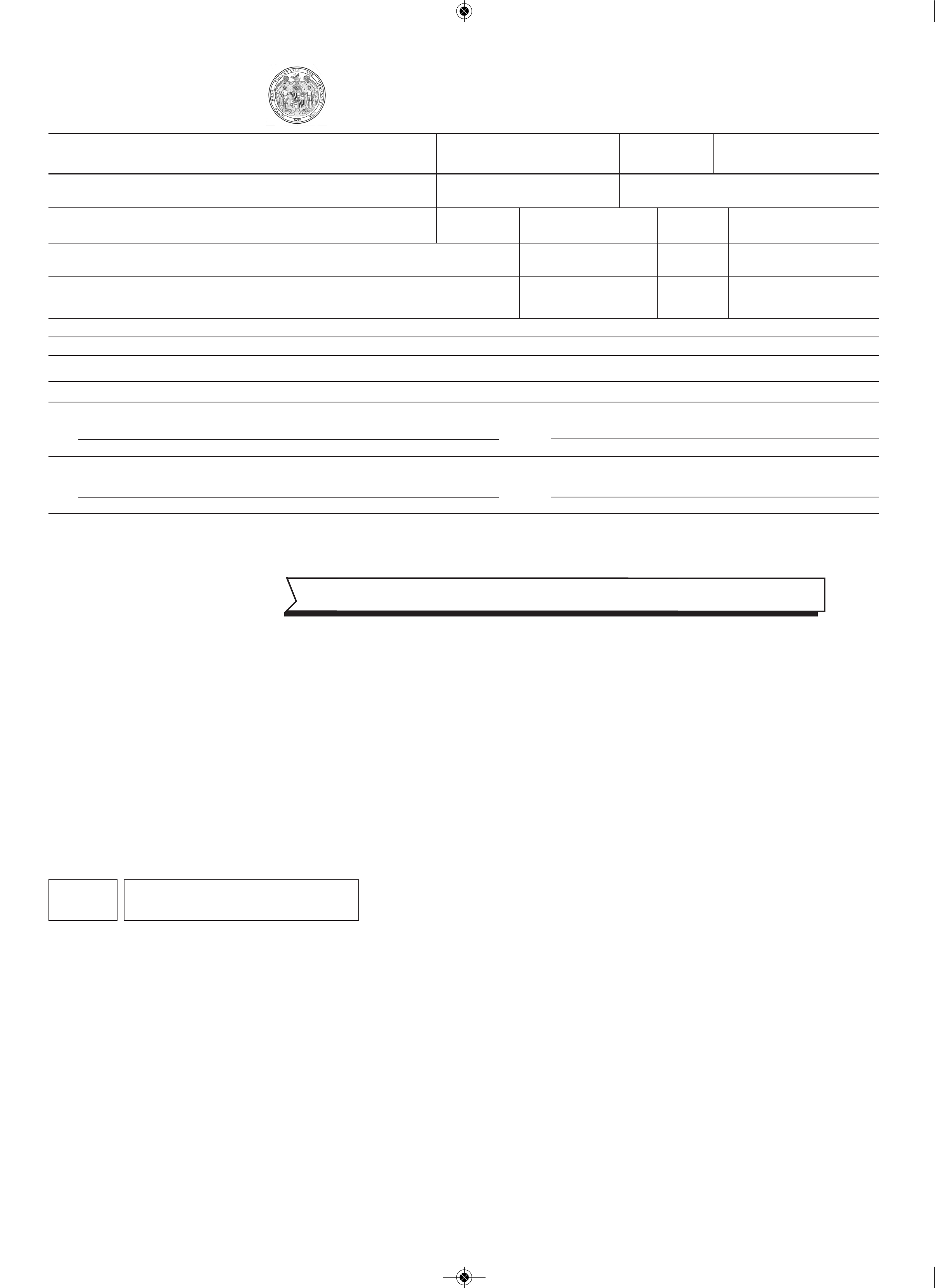

Name of Management Company or Landlord. Address of Management Company or Landlord

State of Maryland

Department of Assessments and Taxation

Renters’ Tax Credit Application

1.

n

Mr. Last Name First Name and Middle Initial 2. Your Social Security Number 3. Your Birth Date 4. Daytime Telephone No.

n

Mrs.

n

M

s. ( )

5. Enter Spouse’s or Co-tenant’s Full Name (Circle Which) 6. His/Her Social Security Number 7. His/Her Birth Date

8

. Present Address (Number and Street, Rural Route) Apartment No. City, Town, or Post Office County Zip Code

9. Address in 2014 if Different from Above City, Town, or Post Office County Zip Code

1

0. Mailing Address if Different from Present Address City, Town, or Post Office State Zip Code

2015

FORM

RTC-60

Name of Management Company or Landlord. Address of Management Company or Landlord

TURN OVER TO OTHER SIDE TO COMPLETE AND SIGN THE APPLICATION

s

DO NOT WRITE BELOW - OFFICE USE ONLY

APPL. #___________________

RTC15

11. Did you reside in public housing in 2014?

n

Yes

n

No

12. Marital Status

n

Single

n

Married (

n

Separated

n

Divorced

n

Widowed If so, date ____________________ )

13. Check one of the following which describes your rented residence:

n

Apartment Building Unit

n

Single Family House

n

Mobile Home Pad

n

Other (Specify)

14. Applicant Status:

n

Age 60 or Over

n

Totally Disabled (Submit proof)

n

Surviving Spouse

n

Under Age 60 with Dependent Child

15a. Enter the name and address of the management company or person to whom you paid rent for at least six months in 2014. List any other landlord on a separate sheet of paper.

15b. Enter the name and address of the current management company or person to whom you are now paying rent.

1

6. Do you rent from a person related to you (including In-Laws)?

n

Y

es

n

N

o

I

f yes, attach a photocopy of your lease. Relationship______________________________________________________

1

6a. Do you own any real estate in the State of Maryland or elsewhere?

n

Y

es

n

N

o

RTC-60.2015:RTC-60 11/25/14 4:50 AM Page 2

If more space is needed, attach a separate list

(

1) (2) (3) OFFICE

APPLICANT SPOUSE/ ALL USE

CO-TENANT OTHERS ONLY

W

ages, Salary, Tips, Bonuses, Commissions, Fees................................................................

Interest and Dividends (Includes both taxable and non-taxable)............................................

C

apital Gains (Includes non-taxed gains) ..............................................................................

Rental Profits (Net) or Business Profits (Net) (Circle which) ..................................................

Room & Board paid to you by a nondependent resident ......................................................

U

nemployment Insurance; Workers’ Compensation (Circle which) ........................................

Alimony; Support Money (Circle which) ................................................................................

P

ublic Assistance (Attach AIMS) or other Government Grants (Circle which)..........................

Social Security (Attach copy of 2014 Form SSA-1099) If none,enter “0” ..............................

S

.S.I. Benefits for 2014 (Attach Proof) ..................................................................................

Railroad Retirement (Attach copy of 2014 Verification or Rate letter) ....................................

Veteran’s Benefits per year ..................................................................................................

O

ther Pensions, Annuities, and IRAs per year (If a rollover, attach proof) ..............................

Gifts over $300; Expenses Paid by Others; Inheritances (Circle which) ................................

All Other Monies Received (Indicate Source) ........................................................................

N

ame Date of Birth Social Security Number Your Dependent? Relationship 2014 Income

Y

es or No

P

LEASE COMPLETE OTHER SIDE OF APPLICATION FIRST

·

1

7. List all household residents who lived with you in 2014. (If none, write NONE.) You must answer this question.

1

8. Did or will you, and/or your spouse, file a Federal Income Tax Return for 2014?

n

Y

es

n

N

o If yes, a copy of your return (and if married filing

s

eparately, a copy of your spouse’s return) with all accompanying schedules must be submitted with this application.

19.

A

MOUNTS AND SOURCES OF INCOME IN 2014

PROOF OF ALL INCOME MUST BE ATTACHED

(ATTACH COPIES - NOT ORIGINALS)

TOTAL INCOME, CALENDAR YEAR 2014

20. Enter the amount of rent you paid each month in Maryland from January 1 through December 31, 2014 Total Rent for 2014__________________

Jan. _________________ Feb. _________________ March __________________ April _________________ May _________________ June _________________

July _________________ Aug. _________________ Sept. _________________ Oct. _________________ Nov. _________________ Dec. _________________

21. Do you receive any rent subsidy?

n

No

n

Yes, from whom____________________________________________________________________________________

22. Which utilities or services were included in the monthly rent: If none, check None.

Utilities:

n

Electric (other than for heat)

n

Gas (other than for heat)

n

Heat

n

None

Services:

n

Meals

n

Pet Fee

n

Housecleaning/Medical

n

Parking Garage Fee

n

Other

n

None

23. I declare under the penalties of perjury, pursuant to Sec. 1-201 of the Maryland Tax-Property Code Ann., that this application (including any accompanying forms and

statements) has been examined by me and the information contained herein, to the best of my knowledge and belief, is true, correct and complete, that I have listed all

monies received, and that my net worth is less than $200,000. Further, I hereby authorize the Social Security Administration, Comptroller of the Treasury, Internal

Revenue Service, the Income Maintenance Administration, Unemployment Insurance, the State Department of Human Resources, and the Credit Bureaus to

release to the Department of Assessments and Taxation any and all information concerning the income or benefits received. I further authorize any landlord

listed on this application to provide information about my rental agreement and occupants of the rental unit. I understand that the Department may request

at a later date additional information to verify the amount of income reported on the form, and that independent verifications of the information reported may

be made.

·

Name of Preparer Other Than Applicant

Applicant’s Signature

Date Spouse’s or Co-tenant’s Signature

Date Telephone

Applications are processed in the order in which they are received if additional information is not required.

RETURN TO

Department of Assessments and Taxation

Renters’ Tax Credit Program

301 W. Preston Street

9th Floor, Room 900

Baltimore, Maryland 21201

Baltimore Metropolitan Area

410-767-4433

All Other Areas

1-800-944-7403

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION - FILING DEADLINE IS SEPTEMBER 1, 2015

AT8-60R

FOR INFORMATION CALL

R

EAD THIS IMPORTANT INFORMATION BEFORE COMPLETING THE APPLICATION

RTC-60.2015:RTC-60 11/25/14 4:50 AM Page 5