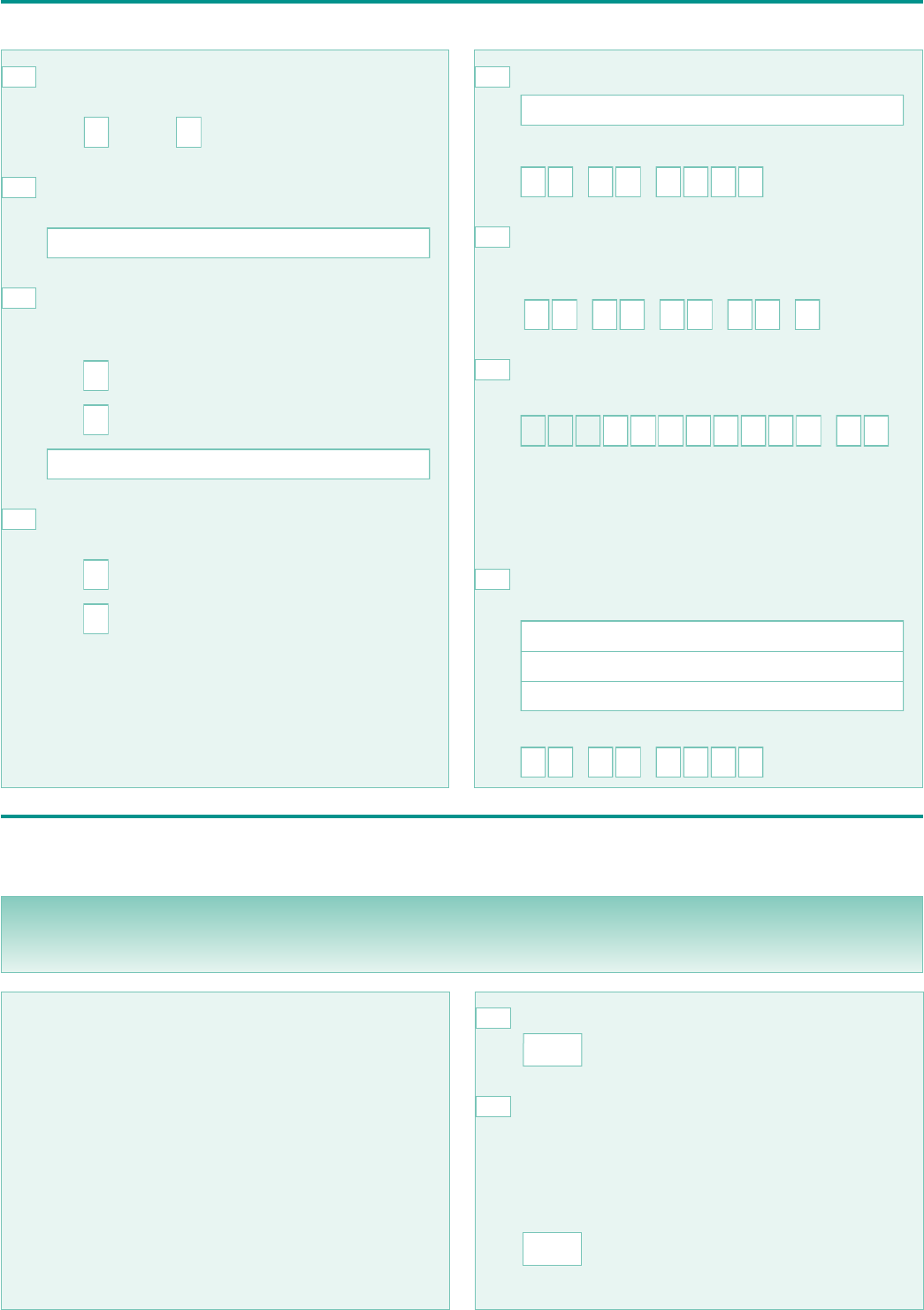

Fillable Printable Child Benefits Claim Form

Fillable Printable Child Benefits Claim Form

Child Benefits Claim Form

CH2 MM5013727 Page 1 HMRC 07/13

Child Benefit claim form

Important

Claim now

or you may lose money

Child Benefit cannot be backdated

more than three months

To help you fill in this form use Child Benefit – Getting your claim right (CH2 Notes). These notes also contain important

information that you should read. Please answer all the questions that apply to you, writing clearly in capital letters and send

u

s all the documents we ask for. If you don’t, we may need to get in touch with you which could delay your claim. If you need

more help or information, please go to www.hmrc.gov.uk/childbenefit or phone our helpline on 0300 200 3100 or textphone

on 0300 200 3103.

State Pension

Filling in this form helps to ensure that you are registered to receive National Insurance credits if you have a child under 12 and

either look after the child at home, or work but don’t earn enough to pay National Insurance contributions. These ‘credits’ can

help to protect your State Pension.

The information below only applies to you if your or your partner’s individual income is more than

£50,000 a year. If it does not apply, please go straight to page 2 and fill in this claim form.

Completing this form

also helps to protect your

State Pension

For more information go to

www.hmrc.gov.uk/chbprotectpension

Important change if you or your partner have an individual income of more

than £50,000 a year

From 7 January 2013 if either you or your partner have an individual income of more than £50,000 a year, then the partner

with the higher income will have to pay a High Income Child Benefit Charge on some, or all, of the Child Benefit you receive.

If these changes apply to you or your partner you should jointly decide whether to stop getting Child Benefit payments,

and not have to pay a tax charge, or continue getting Child Benefit payments and declare them for tax purposes.

Filling in the Child Benefit claim form also ensures that you are registered to receive National Insurance credits which can

help to protect your State Pension. It is therefore really important to fill in the form if you have a new child in your family

even if you do not wish to receive the Child Benefit payments. Part 4 of this claim form lets you tell us if you want to be paid

Child Benefit.

1. I have an income between £50,000 and £60,000. Should I still claim and be paid my Child Benefit?

The tax charge applies at a rate of 1% of the Child Benefit paid for every £100 of income over £50,000. If you or your

partner have an individual income between £50,000 and £60,000 the tax charge will be less than the total amount of

Child Benefit so you might like to keep getting Child Benefit payments and declare them for Income Tax purposes.

2. I have an income of more than £60,000. Should I still claim, even if I don’t want to be paid

Child Benefit and not pay the tax charge?

If you or your partner have an individual income of more than £60,000 the tax charge will be equal to the total amount of

Child Benefit so you might wish to stop receiving payments and not have to pay a tax charge. But it is really important to

fill in the Child Benefit form if you have a new child in your family.

Completing the Child Benefit claim form ensures you are registered to receive National Insurance credits which can help to

protect your State Pension and help your child get their National Insurance number.

For more information please read the notes with this form or go to www.hmrc.gov.uk/childbenefitcharge.htm

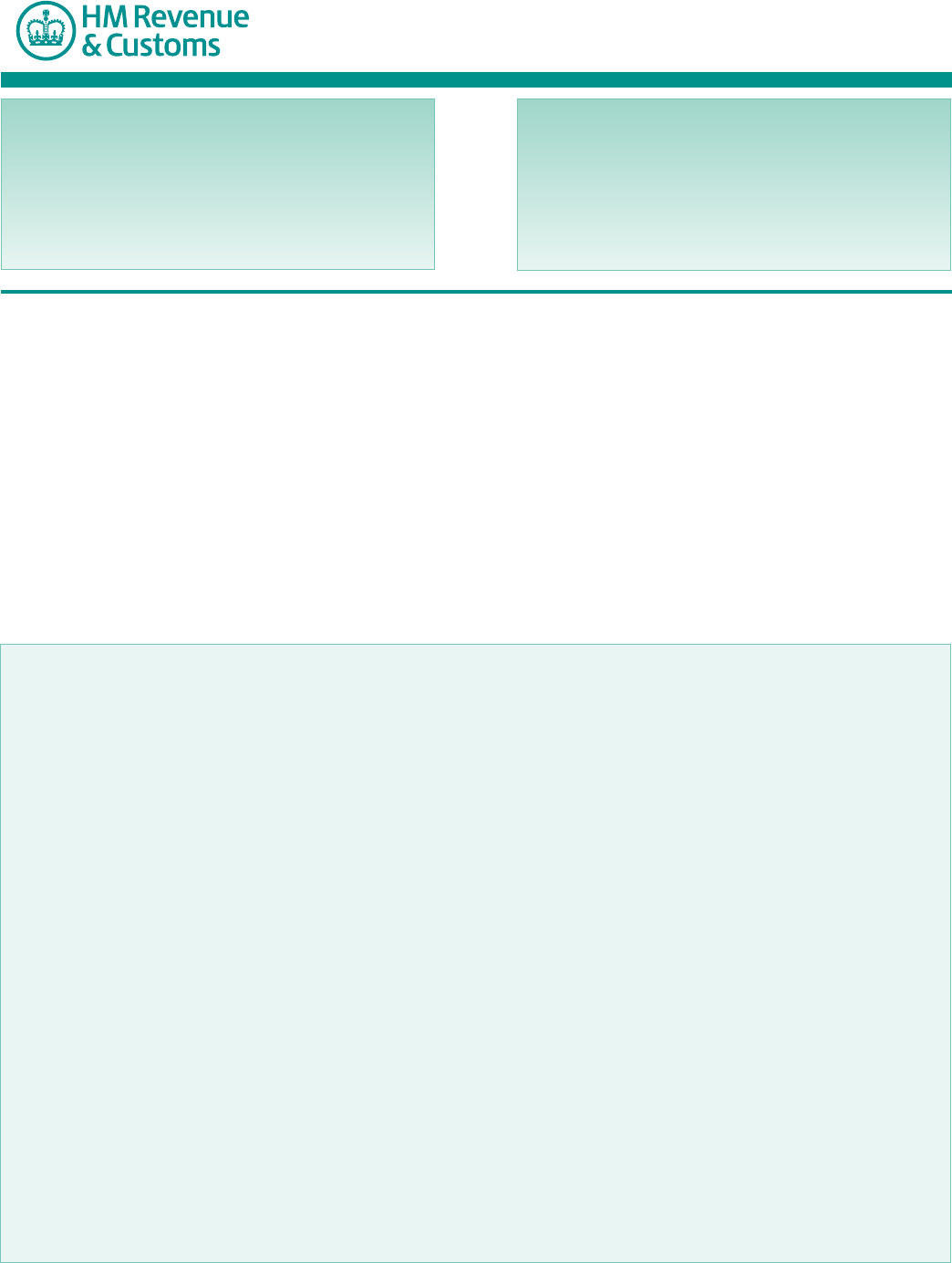

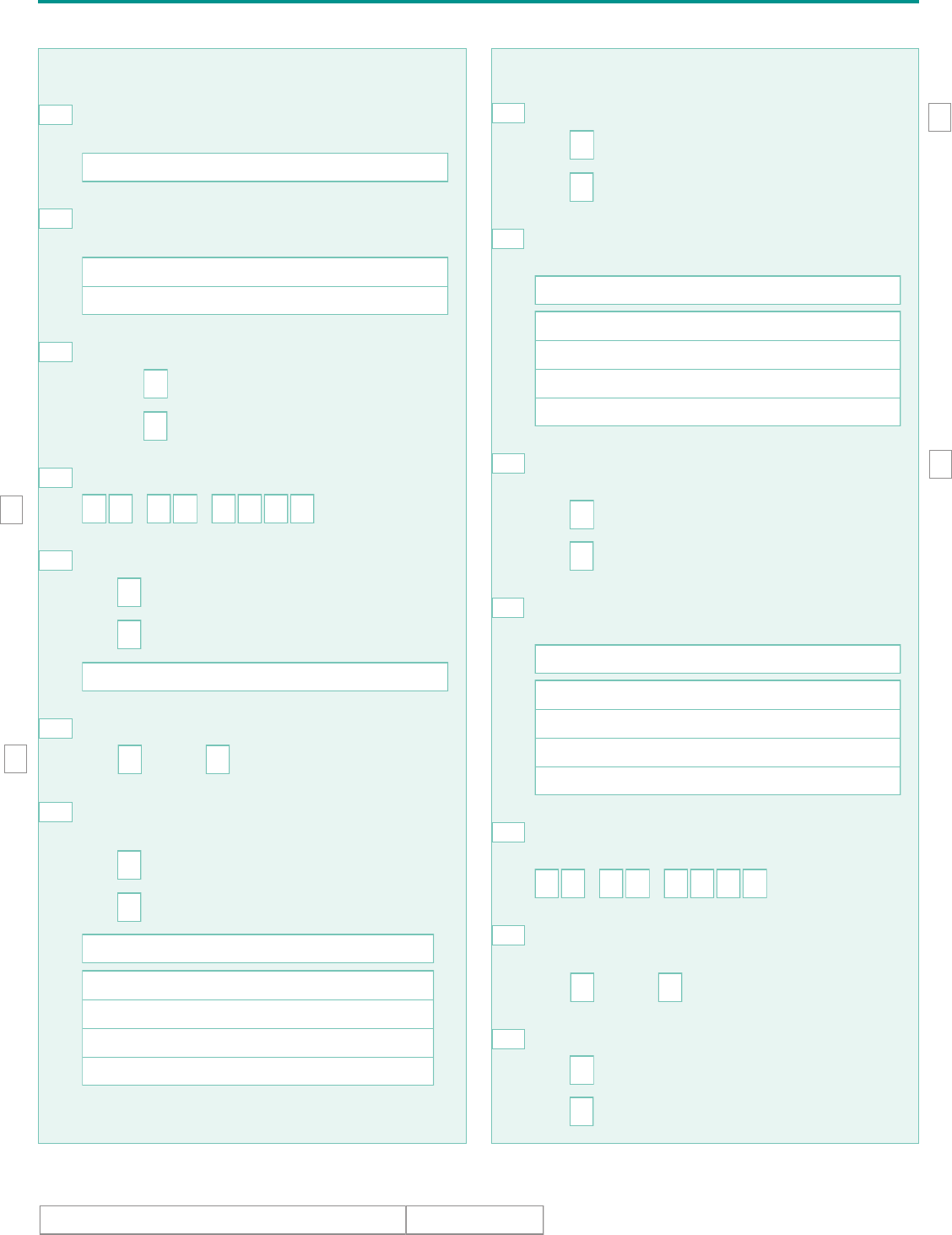

Page 2

T

itle for example Mrs, Miss, Ms, Mr, Dr

Y

our surname or family name

Your first name and any middle name(s)

Have you ever been known by any other surname

or family name? Include your maiden name

No

Yes If Yes, please write it below

Your date of birth DD MM YYYY

Your address

Have you lived at this address for more than 12 months?

No If No, please go to question 8

Yes If Yes, please go to question 9

Please tell us your last address

1

2

3

First name

Middle name(s)

4

5

6

Postcode

7

8

Postcode

Do you have a National Insurance (NI) number?

S

ee page 3 of the CH2 Notes

No

Y

es If Yes, please tell us your NI number

Example of a National Insurance number XX 99 99 99 X

Your phone number(s)

Have you claimed Child Benefit for any child(ren) before?

No If No, go to question 14

Yes If Yes, go to question 12

Tell us your Child Benefit number if you know it

Example of a Child Benefit number CHB 99999999 XX

You can find your Child Benefit number on letters

we have sent you or on your bank statements

If you don't know your Child Benefit number you should

still claim now

Are you currently entitled to Child Benefit?

No

Yes If Yes, please tell us the full name and date

of birth of the eldest child you are entitled

to or getting Child Benefit for, then go to

question 23

Child’s date of birth DD MM YYYY

11

10

Daytime number

Evening number

1

2

C H B

13

Child’s surname

Child’s first name

Child’s middle name(s)

9

1 – About you

For office

use 1

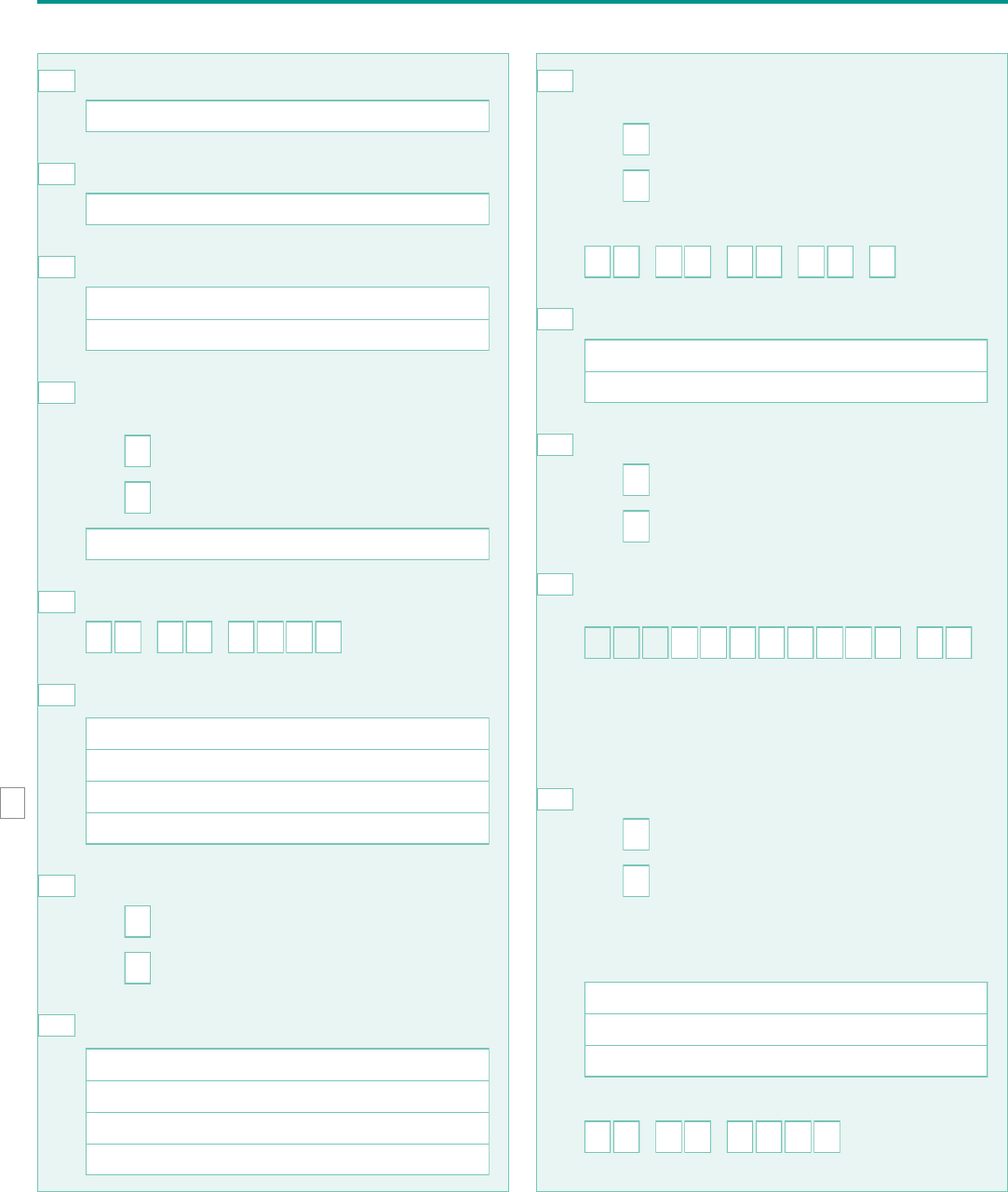

Page 3

If you have been subject to immigration control in the

last three months, tell us the date your immigration status

was granted DD MM YYYY

Please send a copy of your Home Office documents to

us with this form

Are you now, or have you at any time in the last three

months, worked in another country or received benefit

from another country?

No

Yes If Yes, please tell us the name of the country

Are you a member of HM Forces or a civil servant

working abroad?

No Yes

What is your marital or civil partnership status?

Please tick one box

Married or in a civil partnership Go to question 24

Living with a partner as if you

are married or a civil partner Go to question 24

Widowed Go to question 32

Separated Go to question 32

Divorced Go to question 32

Single Go to question 32

2

2

2

0

2

1

23

What is your nationality?

This is shown on your passport if you have one

Have you always lived in the UK?

By this we mean you have never lived outside the UK

See page 3 of the CH2 Notes

No I have lived outside the UK

Go to question 16

Yes I have always lived in the UK

Go to question 21

Do you usually live in the UK?

See page 3 of the CH2 Notes

No

Yes If Yes, go to question 18

Which country do you usually live in?

Go to question 19

Did you arrive in the UK in the last three months?

No

Yes If Yes, tell us the date you arrived

DD MM YYYY

Are you subject to immigration control now, or have you

been at any time in the last three months?

See page 3 of the CH2 Notes

No If No, go to question 21

Yes

1

4

15

17

16

18

19

1 – About you continued

For

office

use 2

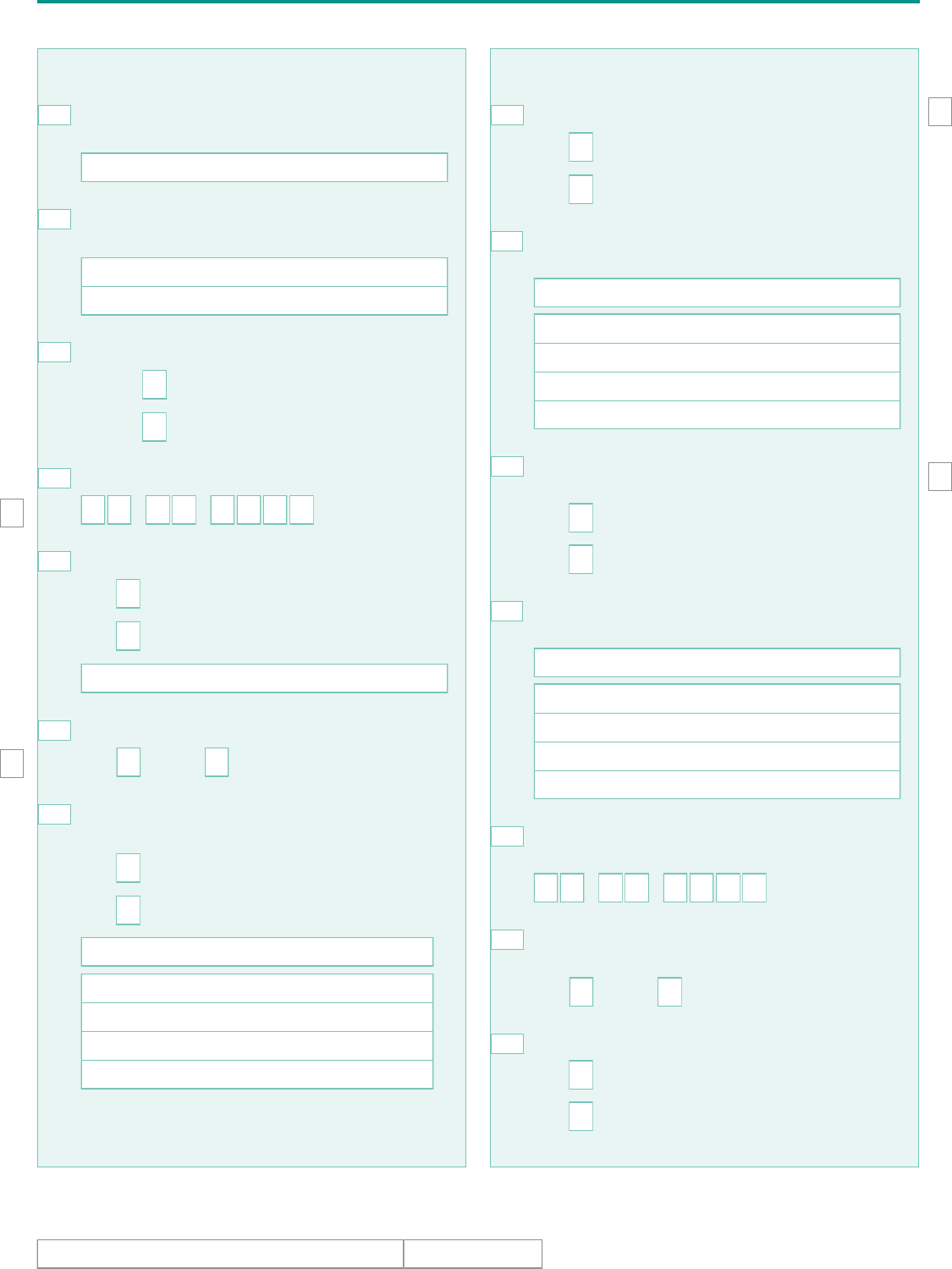

Page 4

Is your partner a member of HM Forces or a civil servant

working abroad?

No Yes

What is your partner’s nationality?

This is shown on their passport if they have one

Does your partner now, or have they at any time in the

last three months, worked in another country or received

b

enefit from another country?

No

Y

es If Yes, tell us the name of the country

Is your partner receiving Child Benefit now or are they

waiting to hear if they can get Child Benefit?

No If No, go to question 32

Yes

2

4

2

6

27

25

Your partner’s full name and date of birth

Partner’s date of birth DD MM YYYY

Your partner’s National Insurance number

See page 3 of the CH2 Notes

Example of a National Insurance number XX 99 99 99 X

Your partner’s Child Benefit number if you know it

Example of a Child Benefit number CHB 99999999 XX

Their Child Benefit number is on any letters we have

sent them

If you don't know their Child Benefit number you should

still claim now

The full name and date of birth of the eldest child your

partner is receiving Child Benefit for

Child’s date of birth DD MM YYYY

Child’s surname

Child’s first name

Child’s middle name(s)

2

9

2

8

31

C H B

3

0

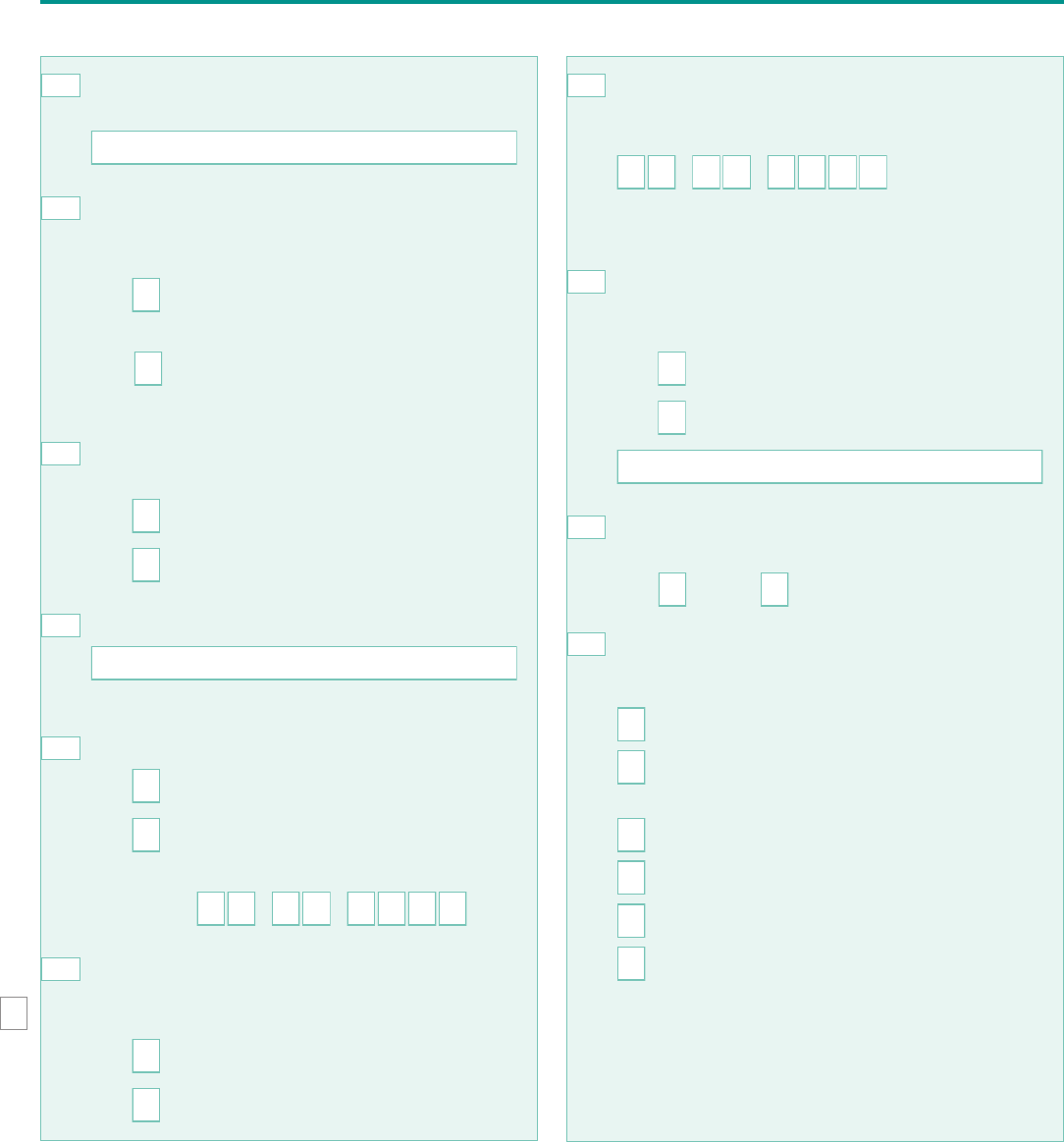

Please note

For each child in this claim we need to see their:

• birth certificate (full or short version), or

• adoption certificate.

If any child in this claim was born outside the UK we also

need to see their passport(s) or their travel documents used

to enter the UK

We do not accept photocopies of birth certificates

If you don’t send the documents we need with the claim form,

a decision on your claim will be delayed.

How many children are you claiming for on this form?

How many birth certificates are you sending

with this form?

We do not accept photocopies

of birth certificates

We don’t need to see a birth certificate for a child

that has been claimed for by you or someone else

in the past

Please now go to

question 34

32

33

2 – About your partner

3 - Children you want to claim for

You don’t need to tell us about children you already get Child Benefit for.

Important

If no-one else has claimed Child Benefit for the children named on this form, send us their birth certificate(s)

Partner’s name

Page 5

Name

3 – Children you want to claim for continued

Name

N

ame

Name

Social worker

Child 1 continued

Does this child live with you? See page 4 of the CH2 Notes

No

Yes If Yes, go to question 43

What is the name and address of the person this child

lives with?

Has this child lived with anyone else in the last 12 months?

See page 4 of the CH2 Notes

No If No, go to question 46

Yes

What is the name and address of the person this child

lived with?

What date did the child come to live with you?

DD MM YYYY

Are you adopting or planning to adopt this child through

a local authority?

No Yes

Do you want to claim for any more children now?

No If No, go to question 62

Yes If Yes, go to question 48

47

4

1

P

ostcode

4

2

Postcode

46

45

44

43

Name

C

hild 1

Child's surname or family name

As shown on the birth or adoption certificate

Child's first name and any middle name(s)

As shown on the birth or adoption certificate

Is this child male or female?

Male

Female

Child’s date of birth DD MM YYYY

Has this child ever been known by any other name?

No

Yes If Yes, please write it below

Is this child your own? See page 4 of the CH2 Notes

No Yes

Has anyone else ever claimed Child Benefit for this child?

See page 4 of the CH2 Notes

No If No, go to question 41

Yes If Yes, please tell us their name and address

Go to question 41

F

irst name

Middle name(s)

34

3

6

3

7

3

8

35

Postcode

40

39

Name

Name

Name

For

o

ffice

use 4

For

office

use 3

For

office

u

se 6

For

office

use 5

For official use only

Page 6

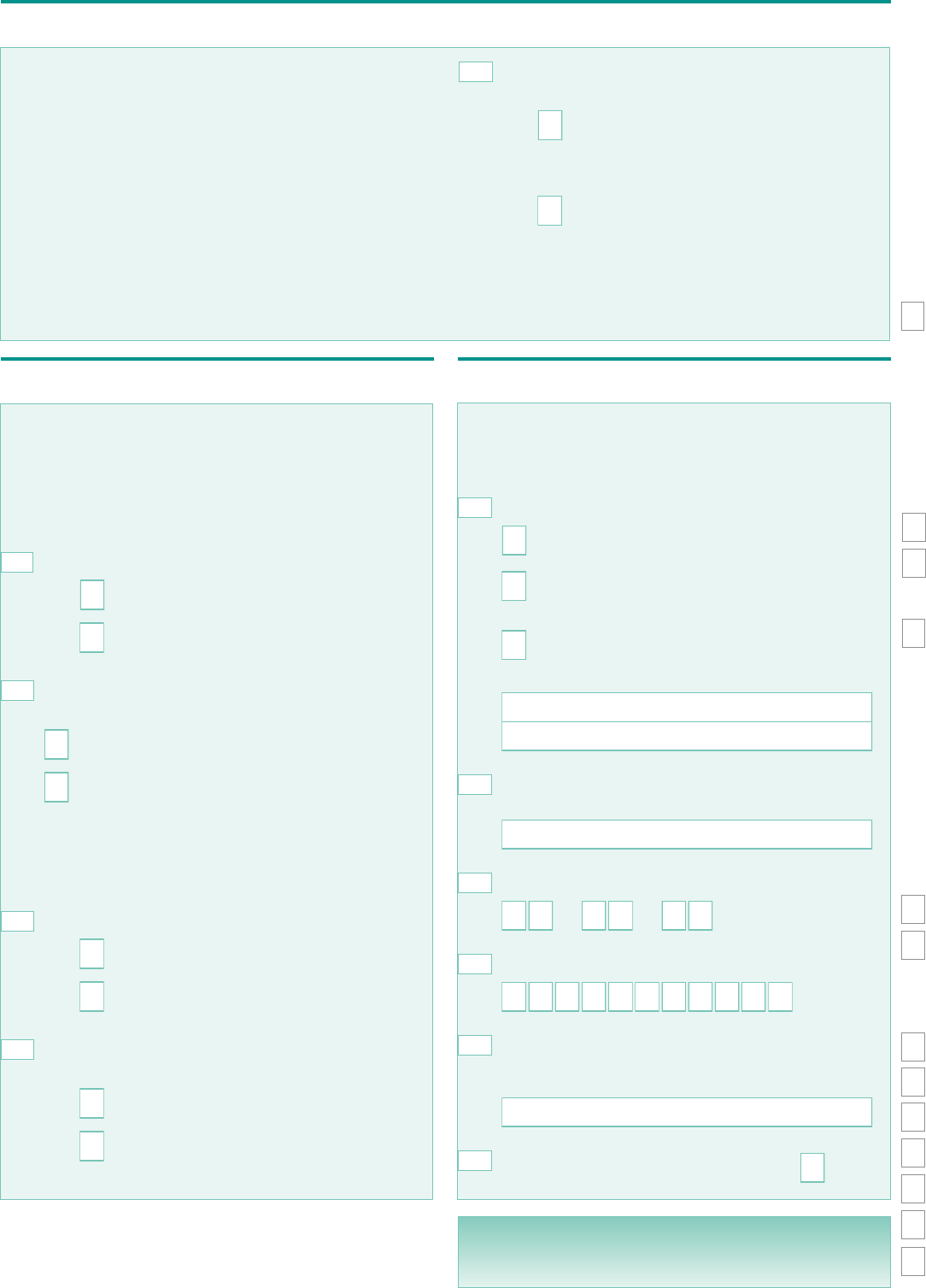

3 – Children you want to claim for continued

Child 2 c

ontinued

Does this child live with you? See page 4 of the CH2 Notes

No

Yes If Yes, go to question 57

What is the name and address of the person this child

lives with?

Has this child lived with anyone else in the last 12 months?

See page 4 of the CH2 Notes

No If No, go to question 60

Yes

What is the name and address of the person this child

lived with?

What date did the child come to live with you?

DD MM YYYY

Are you adopting or planning to adopt this child through

a local authority?

No Yes

Do you want to claim for any more children now?

No If No, go to question 62

Yes If Yes, go to page 7 of the CH2 Notes. Fill in

the additional sheet then go to question 62.

61

5

5

P

ostcode

5

6

Postcode

60

59

58

57

Name

Child 2

Child's surname or family name

As shown on the birth or adoption certificate

Child's first name and any middle name(s)

As shown on the birth or adoption certificate

Is this child male or female?

Male

Female

Child’s date of birth DD MM YYYY

Has this child ever been known by any other name?

No

Yes If Yes, please write it below

Is this child your own? See page 4 of the CH2 Notes

No Yes

Has anyone else ever claimed Child Benefit for this child?

See page 4 of the CH2 Notes

No If No, go to question 55

Yes If Yes, please tell us their name and address

Go to question 55

First name

M

iddle name(s)

50

5

1

5

2

4

9

4

8

Postcode

54

53

Name

Name

Name

For

office

use 8

For

office

use 7

For

o

ffice

use 10

For

office

use 9

For official use only

Page 7

Please note

We normally pay Child Benefit every four weeks into a

bank or building society account

Page 5 of the CH2 Notes tells you if you can be paid

every week

Do you want to be paid Child Benefit every week?

No If No, go to question 65

Yes If Yes, go to question 64

To get Child Benefit every week please tick all boxes which

apply to you or your partner

I am a single parent

I or my partner receive one or more of the following:

• Income Support

• income-based Jobseeker’s Allowance

• Pension Credit

• income-related Employment and Support Allowance.

Do you already get Child Benefit?

No If No, go to question 67

Yes

Do you want to change the bank or building society we pay

your Child Benefit into?

No If No, please go to the Declaration on page 8

Yes

64

63

65

66

Please note

Read page 5 of the CH2 Notes before filling in this section

We can’t pay into an account that is in a child’s name

Please tick the box which applies to you

The account is in my name, go to question 68

The account is in someone else’s name

Tell us the name in the box below

The account is in joint names

Tell us the names in the boxes below

Name of your bank or building society

If you have a Post Office® card account write ‘Post Office’

Your branch sort code. See page 5 of the CH2 Notes

Your account number. See page 5 of the CH2 Notes

If your account is with a building society tell us the roll

or reference number if you have one

See page 5 of the CH2 Notes

If you do not have an account that

we can pay into please put an ‘X’ in this box

Name 1

Name 2

67

68

69

— —

70

71

72

5 – How you want to be paid

For

office

use 12

For

office

use 13

For

office

use 14

For

office

use 15

4 – Higher income earners

Please note

Only fill in question 62 if either you or your partner have an

individual income of more than £50,000 a year.

If you or your partner have an individual income of:

• more than £60,000 a year - a tax charge equal to the

Child Benefit payment will apply, so you may not wish to

be paid Child Benefit

• between £50,000 and £60,000 a year - a tax charge of

less than the Child Benefit payment will apply, so you may

wish to be paid Child Benefit.

If you are not sure if either you or your partner have an

individual income of more than £50,000 see page 2 of the

CH2 Notes.

Do you want to be paid Child Benefit?

See page 5 of the CH2 Notes

No I don’t want to be paid Child Benefit, but I

want to protect my State Pension.

G

o to the Declaration on page 8

Yes I want to to be paid Child Benefit.

I understand that I or my partner may

have to pay an Income Tax charge.

G

o to question 63

62

6 – Bank details

Important

Please complete the Declaration on page 8.

For

o

ffice

use 11

Page 8

For official use only

Corres Traced CLI

Birth certificate

Normal

Passport Recorded

Other Registered

Date claim received

Document(s) returned

Declaration

Please now tick the boxes that apply to you and sign this form to claim Child Benefit.

I am sending the birth certificate(s) or other documents that you need with this form.

If you don’t send the documents we need with this claim form, a decision on your claim will be delayed.

Do not send photocopies.

I declare that the information I have given on this form is correct and complete.

If I give information which I know is not correct or complete, you may take action against me.

Signature

Help

If you need more help or information,

please go to hmrc.gov.uk or phone

our helpline.

If you have a change in your

circumstances please write to us at:

Child Benefit Office

PO Box 1

NEWCASTLE UPON TYNE

NE88 1AA

When you get in touch with us

please tell us:

• your full name

• your National Insurance number

• your Child Benefit number

(if you know it or have one), and

• a daytime phone number.

If you are in the United Kingdom:

• Helpline 0300 200 3100

• Textphone 0300 200 3103

• Ffoniwch 0300 200 1900

i dderbyn fersiynau Cymraeg o

ffurflenni a chanllawiau.

If you are overseas:

Helpline 00 44 161 210 3086

For information about other money

you may be entitled to, please read

page 6 of Child Benefit — Getting

your claim right (CH2 Notes).

Documents we need

You need to send us these documents with your claim form:

• The birth certificate or adoption certificate for each child in this claim.

Do not send photocopies of birth certificates.

If you don’t send the documents we need with the claim form, a decision on

your claim will be delayed.

• Extra pages you’ve filled in if you want to claim for more than two children.

• Any Home Office documents that we’ve asked you to send us. I

f any child in this

claim was born outside the UK we also need to see their passport(s) or their travel

documents used to enter the UK.

Make sure we have the right address to return your documents. If you move without

telling us your new address we will be unable to return your documents and we may

destroy them.

If we believe that any of the documents you send us are not genuine, we may

keep them.

What to do now

Please fill in the address label and include it in the enclosed envelope with this claim

form and any documents or pages from the list above.

If you don’t have an envelope send this form to:

Child Benefit Office (GB)

Washington

NEWCASTLE UPON TYNE

NE88 1ZD

We will normally send the document(s) back to you within four weeks. When we have

dealt with your claim we will write to tell you if you can get Child Benefit and if so

how much.

Date DD MM YYYY

F

or

office

use 16

Address label – please fill in and send this back with your completed claim form.

Please fill in your name and address above in block

capitals using a black pen and send this address label

back to us with your completed claim form.

Important – if you don’t send this address label with your claim form, it may take us longer to send

your documents back to you and to make a decision on your claim.

Make sure your postcode is shown correctly

within the boxes

Example

Postcode XX1 6AA would be shown as

Name

Address line1

Address line 2

Town/City

County

Postcode

X

X

1

6 A

A

CH3 (Address label) 7002163 HMRC 04/13

Your documents

Thank you for sending us your claim form. I have enclosed your

birth certificate(s).

other document(s).

You do not need to do anything – we will write to you again as soon as we have made a decision

about your claim.

HMRC use only – we will use this when we send your documents back to you.