Fillable Printable Claim for New York City School Tax Credit - New York

Fillable Printable Claim for New York City School Tax Credit - New York

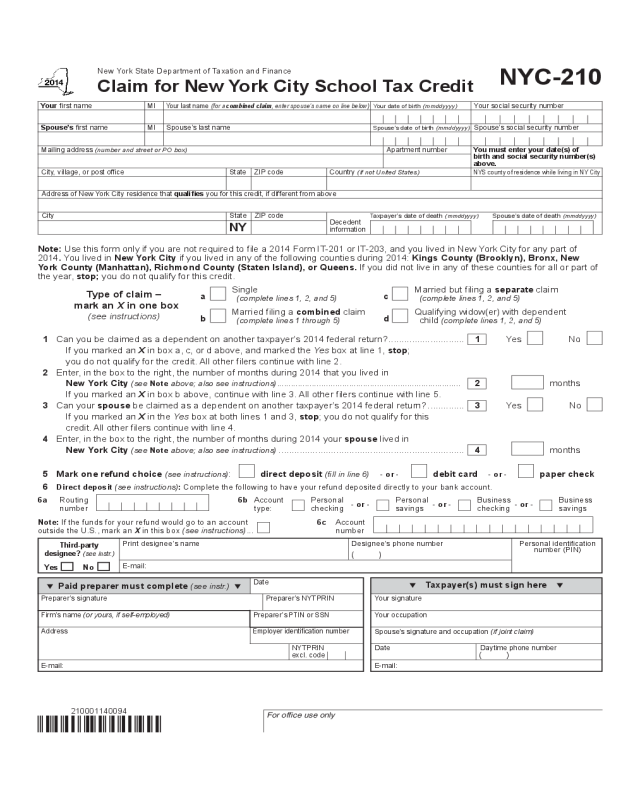

Claim for New York City School Tax Credit - New York

210001140094

Your signature

Your occupation

Spouse’s signature and occupation (if joint claim)

Date Daytime phone number

E-mail:

New York State Department of Taxation and Finance

Claim for New York City School Tax Credit

Type of claim –

mark an X in one box

(see instructions)

NYC-210

1 Can you be claimed as a dependent on another taxpayer’s 2014 federal return? ............................. 1 Yes No

If you marked an X in box a, c, or d above, and marked the Yes box at line 1, stop;

youdonotqualifyforthecredit.Allotherlerscontinuewithline2.

2 Enter, in the box to the right, the number of months during 2014 that you lived in

New York City

(see Note above; also see instructions) ............................................................................... 2 months

If you marked an Xinboxbabove,continuewithline3.Allotherlerscontinuewithline5.

3 Can your spouse be claimed as a dependent on another taxpayer’s 2014 federal return? .............. 3 Yes No

If you marked an X in the Yes box at both lines 1 and 3, stop; you do not qualify for this

credit.Allotherlerscontinuewithline4.

4 Enter, in the box to the right, the number of months during 2014 your spouse lived in

New York City

(see Note above; also see instructions) ....................................................................... 4 months

Marriedbutlingaseparate claim

c

(complete lines 1, 2, and 5)

Qualifying widow(er) with dependent

d

child (complete lines 1, 2, and 5)

Note: Usethisformonlyifyouarenotrequiredtolea2014FormIT-201orIT-203, and you lived in New York City for any part of

2014. You lived in New York City if you lived in any of the following counties during 2014: Kings County (Brooklyn), Bronx, New

York County (Manhattan), Richmond County (Staten Island), or Queens. If you did not live in any of these counties for all or part of

the year, stop; you do not qualify for this credit.

Single

a

(complete lines 1, 2, and 5)

Marriedlingacombined claim

b

(complete lines 1 through 5)

You must enter your date(s) of

birth and social security number(s)

above.

5 Mark one refund choice (see instructions): direct deposit (ll in line 6) - or - debit card - or - paper check

Printdesignee’sname Designee’sphonenumber Personalidentication

( )

number (PIN)

E-mail:

Third-party

designee?

(see instr.)

Yes No

Address of New York City residence that qualies you for this credit, if different from above

City State ZIP code

NY

Your rstname MI

Your last name (for a combined claim, enter spouse’s name on line below)

Your date of birth (mmddyyyy) Your social security number

Spouse’srstname MI Spouse’s last name

Spouse’s date of birth (mmddyyyy) Spouse’s social security number

Mailing address

(number and street or PO box) Apartment number

City,village,orpostofce State ZIPcode Country

(if not United States)

NYS county of residence while living in NY City

6 Direct deposit (see instructions): Complete the following to have your refund deposited directly to your bank account.

6a Routing 6b

Account

Personal Personal Business Business

number type: checking

- or -

savings

- or -

checking

- or -

savings

Note: If the funds for your refund would go to an account 6c

Account

outside the U.S., mark an X in this box (see instructions) ... number

Taxpayer(s) must sign here

( )

Paid preparer must complete (see instr.)

Date

Preparer’s signature Preparer’s NYTPRIN

Firm’s name (or yours, if self-employed) Preparer’s

PTIN or SSN

Address

Employeridenticationnumber

NYTPRIN

excl. code

E-mail:

Taxpayer’s date of death (mmddyyyy) Spouse’s date of death (mmddyyyy)

Decedent

information

For office use only

210002140094

Need help?

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure

thatourlobbies,ofces,meetingrooms,andother

facilities are accessible to persons with disabilities. If

you have questions about special accommodations

for persons with disabilities, call the information

center.

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): If you

haveaccesstoaTTY,contactusat(518)485-5082.

If you do not own a TTY, check with independent

livingcentersorcommunityactionprogramstond

out where machines are available for public use.

Telephone assistance

Automatedincometaxrefundstatus: (518)457-5149

Personal Income Tax Information Center:

(518)457-5181

Toorderformsandpublications: (518)457-5431

Visit our Web site at www.tax.ny.gov

• getinformationandmanageyourtaxesonline

• checkfornewonlineservicesandfeatures

When and where to le Form NYC-210

FileyourclaimassoonasyoucanafterJanuary1,2015.

Mail your claim to:

NYS TAX PROCESSING

PO BOX 22017

ALBANY NY 12201-2017

Private delivery services

If you choose, you may use a private delivery service, instead of

the U.S. Postal Service, to mail in your form and tax payment.

However, if, at a later date, you need to establish the date you

ledorpaidyourtax,youcannotusethedaterecordedbya

private delivery service unless you used a delivery service that

has been designated by the U.S. Secretary of the Treasury

or the Commissioner of Taxation and Finance. (Currently

designateddeliveryservicesarelistedinPublication55,

Designated Private Delivery Services. See Need help? for

information on obtaining forms and publications.) If you have

used a designated private delivery service and need to establish

thedateyouledyourform,contactthatprivatedeliveryservice

for instructions on how to obtain written proof of the date

your form was given to the delivery service for delivery. See

Publication55forwheretosendtheformscoveredbythese

instructions.

Privacy notication

New York State Law requires all government agencies that

maintainasystemofrecordstoprovidenoticationofthelegal

authority for any request, the principal purpose(s) for which the

information is to be collected, and where it will be maintained.

To view this information, visit our Web site, or, if you do not

haveInternetaccess,callandrequestPublication54,Privacy

Notication. See Need help? for the Web address and telephone

number.

NYC-210 (2014) (back)