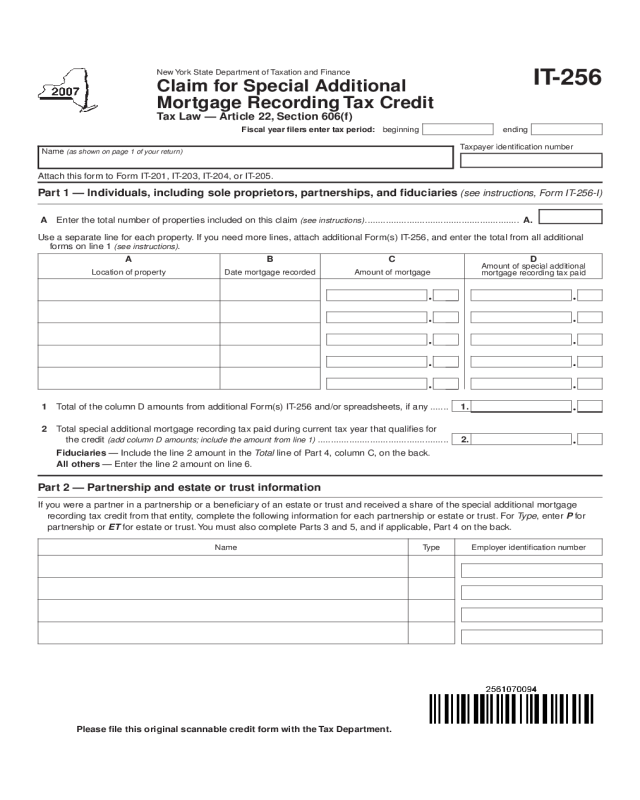

Fillable Printable IT-256 Claim for Special Additional Mortgage Recording Tax Credit (2007)

Fillable Printable IT-256 Claim for Special Additional Mortgage Recording Tax Credit (2007)

IT-256 Claim for Special Additional Mortgage Recording Tax Credit (2007)

New York State Department of Taxation and Finance

Claim for Special Additional

Mortgage Recording Tax Credit

Tax Law — Article 22, Section 606(f)

IT-256

Use a separate line for each property. If you need more lines, attach additional Form(s) IT‑256, and enter the total from all additional

forms on line 1

(see instructions).

A

Location of property

D

Amount of special additional

mortgage recording tax paid

B

Date mortgage recorded

C

Amount of mortgage

1 Total of the column D amounts from additional Form(s) IT‑256 and/or spreadsheets, if any ....... 1.

2 Total special additional mortgage recording tax paid during current tax year that qualifies for

the credit

(add column D amounts; include the amount from line 1) .................................................. 2.

Part 2 — Partnership and estate or trust information

If you were a partner in a partnership or a beneficiary of an estate or trust and received a share of the special additional mortgage

recording tax credit from that entity, complete the following information for each partnership or estate or trust. For Type, enter P for

partnership or ET for estate or trust. You must also complete Parts 3 and 5, and if applicable, Part 4 on the back.

Name

Fiduciaries — Include the line 2 amount in the Total line of Part 4, column C, on the back.

All others — Enter the line 2 amount on line 6.

Please file this original scannable credit form with the Tax Department.

Taxpayer identification number

Fiscal year filers enter tax period: beginning ending

Name

(as shown on page 1 of your return)

Attach this form to Form IT‑201, IT‑203, IT‑204, or IT‑205.

Type Employer identification number

A Enter the total number of properties included on this claim (see instructions) ........................................................... A.

Part 1 — Individuals, including sole proprietors, partnerships, and fiduciaries

(see instructions, Form IT-256-I)

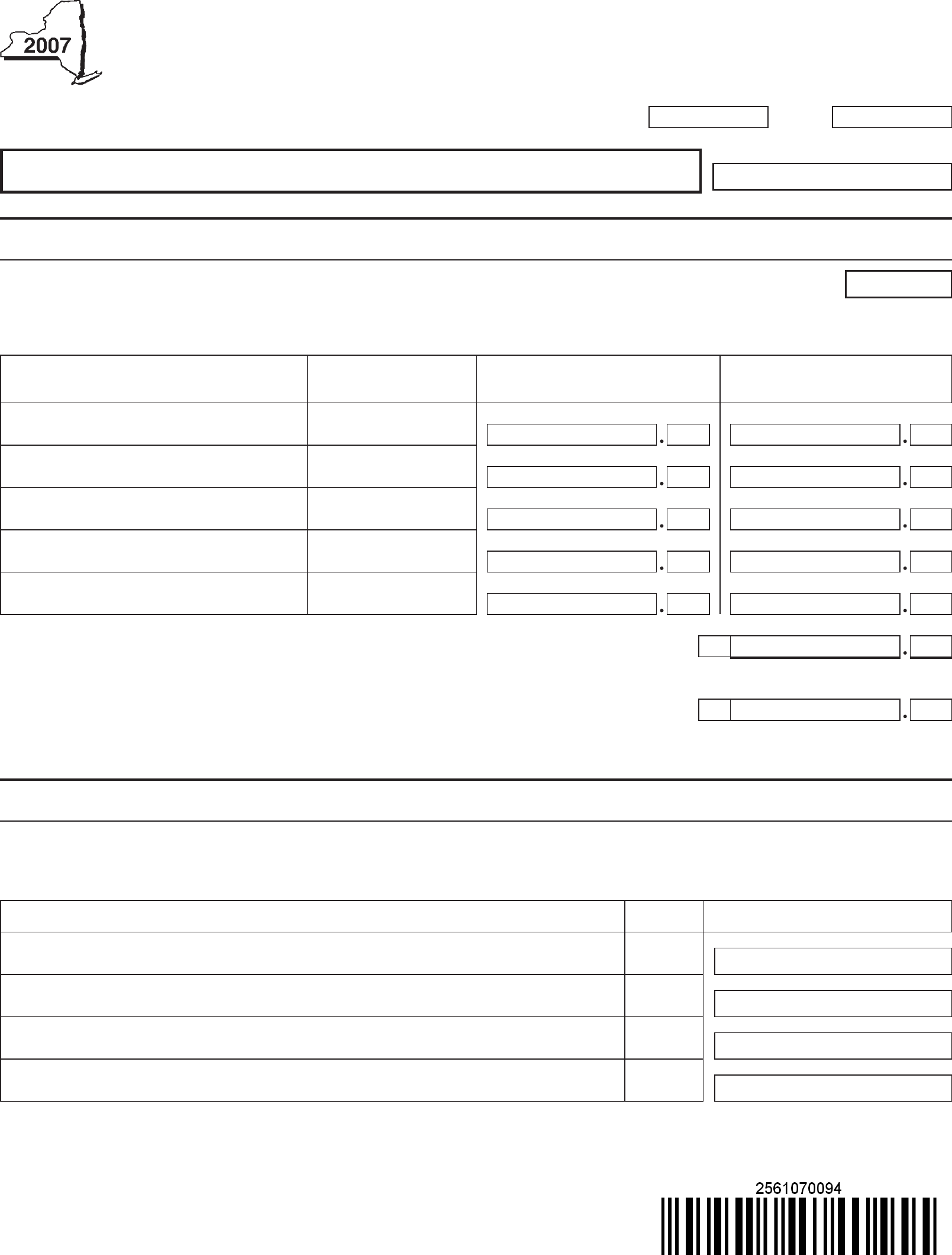

IT-256 (2007) (back)

Part 4 — Beneficiary’s and fiduciary’s share of credit

Individuals (including sole

proprietors) and partnerships

6

Enter the amount from P

art 1, line 2 ....................................

6.

Partners and beneficiaries 7

Enter the amount from P

art 3, line 5 ....................................

7.

Fiduciaries

8 Enter the amount from Par

t 4, Fiduciary line, column C ......

8.

9 Credit f

or the current tax year (add lines 6, 7, and 8) ..............

9.

10 Enter an

y unused special additional mortgage recording

tax credit from preceding per

iod(s)

(see instructions) .........

10.

11 T

otal credit available for the current tax year

(see instructions) .................................................................

11.

A

Beneficiary’s name (same as on

Form IT-205, Schedule C)

B

Identifying number

C

Share of special additional

mortgage recording tax

Part 5 — Computation of special additional mortgage recording tax credit available for the current tax year

Total (fiduciaries, enter the amount from Part 1, line 2, plus the

amount from Part 3, line 5)

Fiduciary

Partner

3 Enter your share of the credit from your partnership

(see instructions) ................................................................

3.

Beneficiary

4 Enter your share of the credit from the fiduciary’s

Form IT‑256, Part 4, column C ......................................... 4.

5 T

otal (add lines 3 and 4) ........................................................

5.

Fiduciaries (that are also partners or beneficiaries of other entities) — Include the line 5 amount in the Total line of Part 4, column C.

All others — Enter the line 5 amount on Par

t 5, line 7.

Part 3 — Partner’s or beneficiary’s share of credit

Part 6 — Application of credit and computation of carryover

12 Total credit (see instructions) ........................................................................................................... 12.

13 Amount that you applied against your 2007 tax

(see instructions) ................................................. 13.

14 Amount of credit available for carryover to 2008

(subtract line 13 from line 12) ............................... 14.

Please file this original scannable credit form with the Tax Department.