Fillable Printable Domicile Declaration - Connecticut

Fillable Printable Domicile Declaration - Connecticut

Domicile Declaration - Connecticut

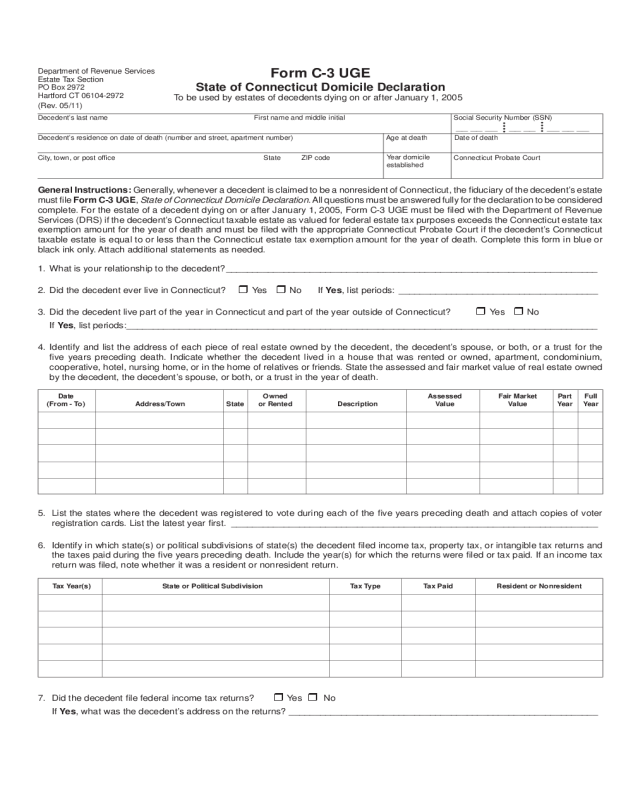

Form C-3 UGE

State of Connecticut Domicile Declaration

Department of Revenue Services

Estate Tax Section

PO Box 2972

Hartford CT 06104-2972

(Rev. 05/11)

Decedent’s last name First name and middle initial Social Security Number (SSN)

__ __ __ __ __ __ __ __

Decedent’s residence on date of death (number and street, apartment number) Age at death Date of death

City, town, or post offi ce State ZIP code Connecticut Probate Court

•

•

•

•

•

•

•

•

General Instructions: Generally , whenever a decedent is claimed to be a nonresident of Connecticut, the fi duciary of the decedent’s estate

must fi le Form C-3 UGE, State of Connecticut Domicile Declaration. All questions must be answered fully for the declaration to be considered

complete. For the estate of a decedent dying on or after January 1, 2005, Form C-3 UGE must be fi led with the Department of Revenue

Services (DRS) if the decedent’s Connecticut taxable estate as valued for federal estate tax purposes exceeds the Connecticut estate tax

exemption amount for the year of death and must be fi led with the appropriate Connecticut Probate Court if the decedent’s Connecticut

taxable estate is equal to or less than the Connecticut estate tax exemption amount for the year of death. Complete this form in blue or

black ink only. Attach additional statements as needed.

1. What is your relationship to the decedent? _______________________________________________________________________

2. Did the decedent ever live in Connecticut? Yes No If Yes, list periods: ______________________________________

3. Did the decedent live part of the year in Connecticut and part of the year outside of Connecticut? Yes No

If Yes, list periods: __________________________________________________________________________________________

4. Identify and list the address of each piece of real estate owned by the decedent, the decedent’s spouse, or both, or a trust for the

fi ve years preceding death. Indicate whether the decedent lived in a house that was rented or owned, apartment, condominium,

cooperative, hotel, nursing home, or in the home of relatives or friends. State the assessed and fair market value of real estate owned

by the decedent, the decedent’s spouse, or both, or a trust in the year of death.

5. List the states where the decedent was registered to vote during each of the fi ve years preceding death and attach copies of voter

registration cards. List the latest year fi rst. ______________________________________________________________________

6. Identify in which state(s) or political subdivisions of state(s) the decedent fi led income tax, property tax, or intangible tax returns and

the taxes paid during the fi ve years preceding death. Include the year(s) for which the returns were fi led or tax paid. If an income tax

return was fi led, note whether it was a resident or nonresident return.

7. Did the decedent fi le federal income tax returns? Yes No

If Yes, what was the decedent’s address on the returns? ___________________________________________________________

Date Owned Assessed Fair Market Part Full

(From - To) Address/Town State or Rented Description Value Value Year Year

Tax Year(s) State or Political Subdivision Tax Type Tax Paid Resident or Nonresident

Year domicile

established

To be used by estates of decedents dying on or after January 1, 2005

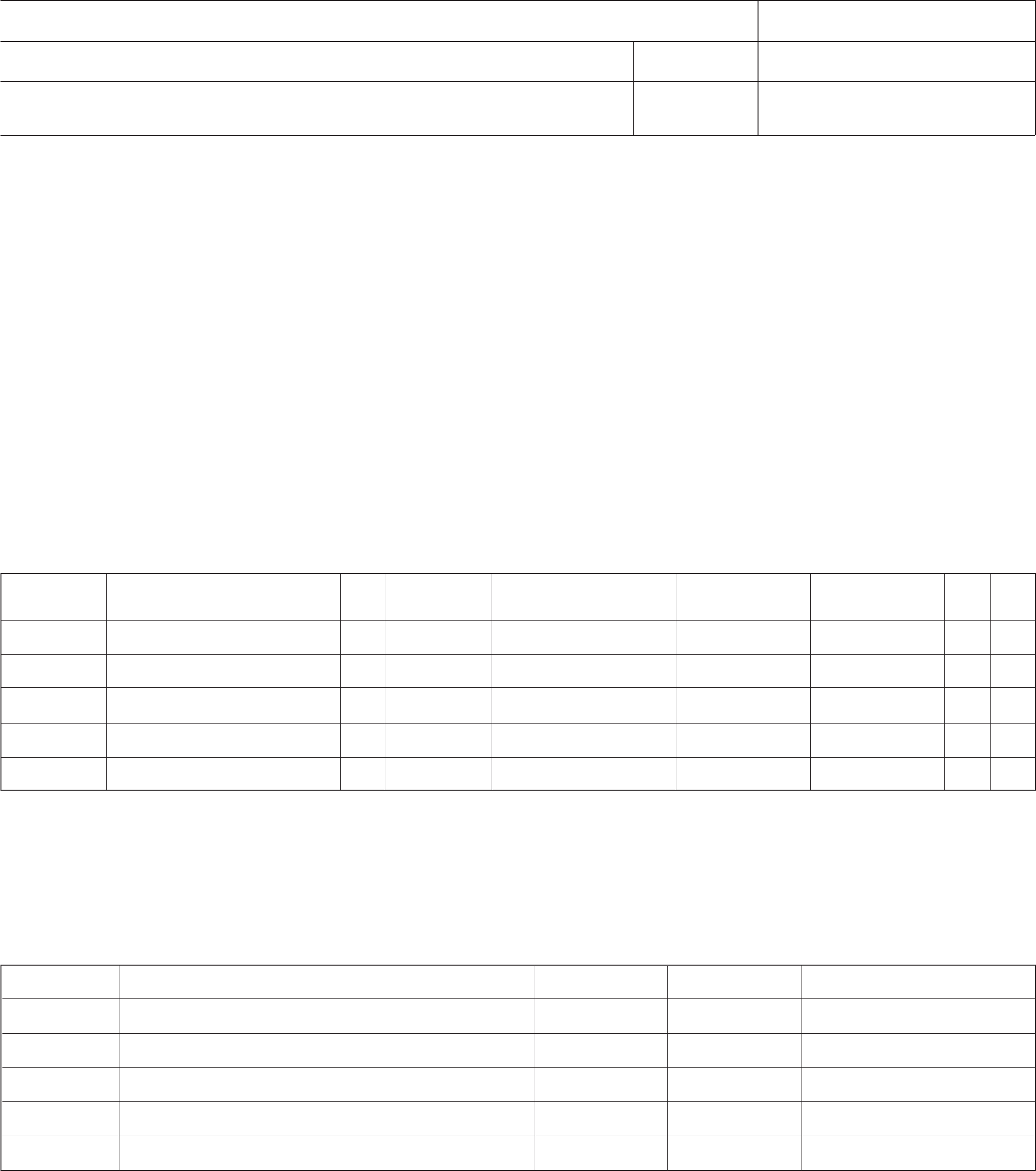

8. Was the decedent employed or engaged in a business or profession in the fi ve years preceding death? Yes No

If Yes, list the employment or business activities engaged in by the decedent during the fi ve years preceding the date of death.

9. Did the decedent execute a will, codicil, trust indenture, deed, mortgage, lease, or any other document in the fi ve years preceding death?

Yes No If Yes, give the dates and facts and attach copies of all documents. _______________________________

10. Was the decedent a party to any legal proceedings in the State of Connecticut during the fi ve years preceding death?

Yes No If Yes, explain fully and submit copies of the court documents fi led by or for the decedent. ______________

_______________________________________________________________________________________________________

11. Did the decedent hold membership in any religious organizations, clubs, or societies in Connecticut in the fi ve years preceding death?

Yes No If Yes, detail the facts. ___________________________________________________________________

12. Did the decedent hold membership in any religious organizations, clubs, or societies outside Connecticut in the fi ve years preceding

death?

Yes No If Yes, detail the facts. ___________________________________________________________________

13. Did the decedent lease a safe deposit box located in Connecticut at the time of death? Yes No

If Yes, has it been inventoried? Yes NoIf Yes, attach copy of inventory.

Name and address of bank where box is located: ________________________________________________________________

_______________________________________________________________________________________________________

14. Did the decedent have a license in Connecticut or elsewhere to operate a business, profession, motor vehicle, airplane, or

boat at any time within fi ve years preceding death? Yes NoIf Yes, list below and attach copies of the license(s).

15. Was an automobile registered in the decedent’s name in Connecticut or elsewhere at any time within fi ve years preceding death?

Yes No If Yes, where and when (that is, the dates of registrations)? ______________________________________

16. Was the decedent hospitalized in Connecticut at any time within fi ve years preceding death? Yes No

If Yes, furnish name and address of the hospital(s) and the dates of hospitalization(s). ___________________________________

17. Did the decedent undergo medical treatment or examination in Connecticut at any time within the fi ve years preceding death?

Yes No If Yes, furnish name and address of the doctor or hospital and the dates of treatment(s) or examination(s).

_______________________________________________________________________________________________________

18. Provide the place of the decedent’s death and burial. Attach copies of the decedent’s death certifi cate and obituaries in the newspapers

in Connecticut and elsewhere. _______________________________________________________________________________

License Number Type of License Date of Issuance Name and Location of Issuing Offi ce

In Connecticut Outside Connecticut

Period of Time

(From - To) Nature of Employment or Business Activities Nature of Employment or Business Activities

Period of Time

(From - To)

Form C-3 UGE (Rev. 05/11) Page 2 of 3

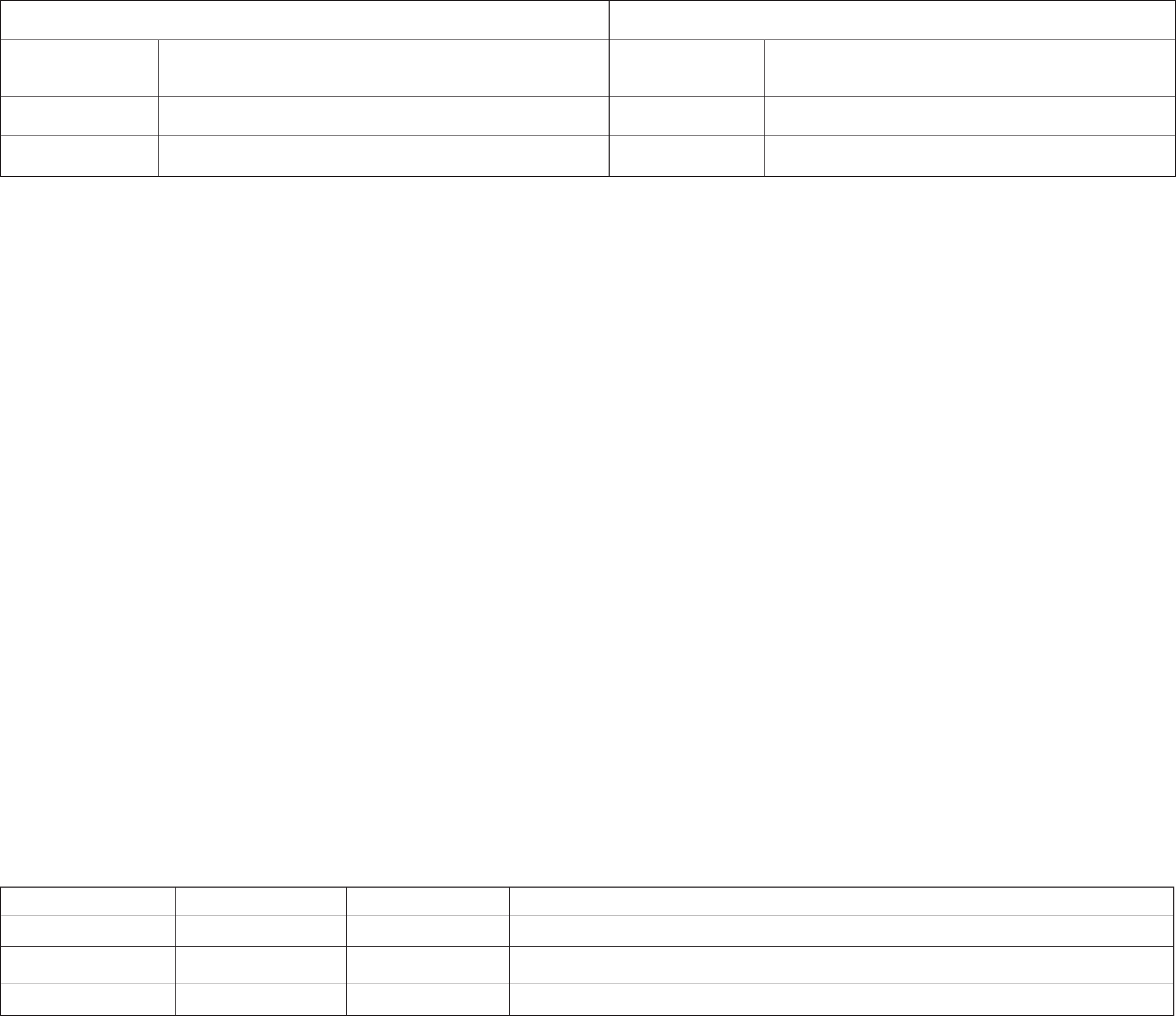

19. Name and address of the bank to which decedent’s social security payments were deposited during each of the fi ve years preceding

death. __________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

20. Did the decedent execute and fi le a Declaration of Domicile in another jurisdiction?

Yes No If Yes, attach a copy.

21. If the decedent was at one time a resident of Connecticut, what event(s) or action(s) changed the decedent’s status to nonresident?

________________________________________________________ On what date did this occur? ______________________

22. What additional information do you wish to submit in support of the contention that the decedent was not domiciled in Connecticut at

the time of death? Attach additional sheets if necessary. ___________________________________________________________

_______________________________________________________________________________________________________

23. Enter the number of days the decedent actually stayed in Connecticut and in the state where domicile is claimed for each of the fi ve

years preceding death. The estate may be asked to provide more details to support the information provided.

24. List the name, address, and relationship of all family members of the decedent with whom he or she had the closest familial relationship.

25. Estimate the total value of the gross estate, less deductions, for federal estate tax purposes. Be sure to add to that fi gure the Connecticut

taxable gifts made by the decedent during all calendar years beginning on or after January 1, 2005: $ ___________________________

26. Signature and declaration

Law fi rm name

Address City State ZIP code

Attorney or authorized representative’s name Date Telephone number

( )

Declaration for DRS: I declare under penalty of law that I have examined this document (including any accompanying schedules and statements) and, to the

best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false document to DRS is a fi ne of not more

than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which

the preparer has any knowledge.

Declaration for Probate Court: I declare under penalty of false statement under Conn. Gen. Stat. §§53a-157b that I have examined this document (including

any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. The declaration of a paid preparer

other than the fi duciary is based on all information of which the preparer has any knowledge

Determination Signed

Offi cial

Use

Only

Address City State ZIP code

Fiduciary’s signature Date of fi duciary’ s signature

Sign Here

Keep a

copy of

this return

for your

records.

Fiduciary’s name Telephone number

( )

Form C-3 UGE (Rev. 05/11) Page 3 of 3

Year Days in Connecticut Days in State Where Decedent’s Domicile Is Claimed

Name Address Relationship