Fillable Printable Principal Residence Exemption (PRE) Affidavit - Michigan Department of Treasury

Fillable Printable Principal Residence Exemption (PRE) Affidavit - Michigan Department of Treasury

Principal Residence Exemption (PRE) Affidavit - Michigan Department of Treasury

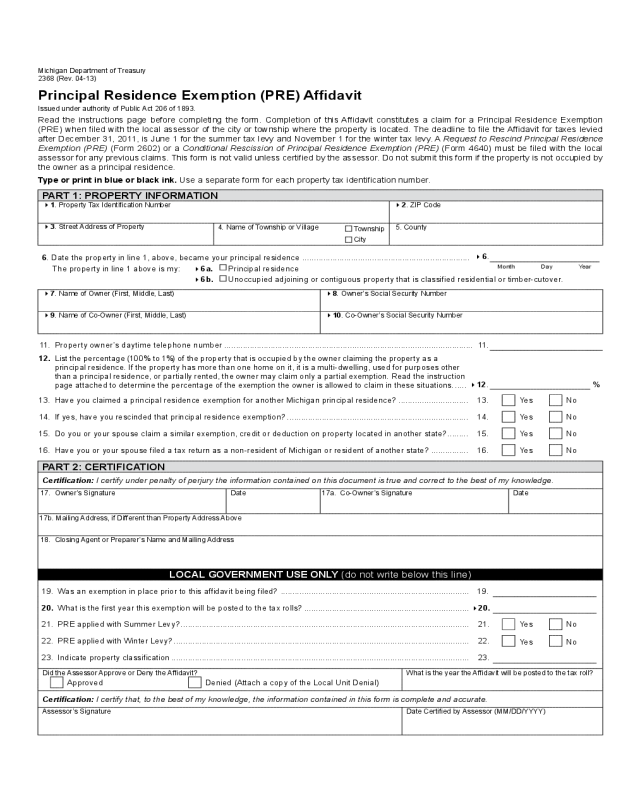

Michigan Department of Treasury

2368 (Rev. 04-13)

Principal Residence Exemption (PRE) Afdavit

Issued under authority of Public Act 206 of 1893.

Read the instructions page before completing the form. Completion of this Afdavit constitutes a claim for a Principal Residence Exemption

(PRE) when led with the local assessor of the city or township where the property is located. The deadline to le the Afdavit for taxes levied

after December 31, 2011, is June 1 for the summer tax levy and November 1 for the winter tax levy. A Request to Rescind Principal Residence

Exemption (PRE) (Form 2602) or a Conditional Rescission of Principal Residence Exemption (PRE) (Form 4640) must be led with the local

assessor for any previous claims. This form is not valid unless certied by the assessor. Do not submit this form if the property is not occupied by

the owner as a principal residence.

Type or print in blue or black ink. Use a separate form for each property tax identication number.

PART 1: PROPERTY INFORMATION

41. Property Tax Identication Number 42. ZIP Code

43. Street Address of Property

4. Name of Township or Village

Township

5. County

City

6. Date the property in line 1, above, became your principal residence ........................................................................

46

.

The property in line 1 above is my: 46a. Principal residence

Month Day Year

46b. Unoccupied adjoining or contiguous property that is classied residential or timber-cutover.

4

7. Name of Owner (First, Middle, Last) 48. Owner’s Social Security Number

49. Name of Co-Owner (First, Middle, Last) 410. Co-Owner’s Social Security Number

11. Property owner’s daytime telephone number ........................................................................................................... 11.

12.

List the percentage (100% to 1%) of the property that is occupied by the owner claiming the property as a

principal residence. If the property has more than one home on it, it is a multi-dwelling, used for purposes other

than a principal residence, or partially rented, the owner may claim only a partial exemption. Read the instruction

page attached to determine the percentage of the exemption the owner is allowed to claim in these situations. .....

412. %

13. Have you claimed a principal residence exemption for another Michigan principal residence? .............................. 13. Yes No

14. If yes, have you rescinded that principal residence exemption? .............................................................................. 14. Yes No

15. Do you or your spouse claim a similar exemption, credit or deduction on property located in another state? ......... 15. Yes No

16. Have you or your spouse led a tax return as a non-resident of Michigan or resident of another state? ................ 16. Yes No

PART 2: CERTIFICATION

Certication: I certify under penalty of perjury the information contained on this document is true and correct to the best of my knowledge.

17. Owner’s Signature Date 17a. Co-Owner’s Signature Date

17b. Mailing Address, if Different than Property Address Above

18. Closing Agent or Preparer’s Name and Mailing Address

LOCAL GOVERNMENT USE ONLY (do not write below this line)

19. Was an exemption in place prior to this afdavit being led? ................................................................................. 19.

20. What is the rst year this exemption will be posted to the tax rolls? .......................................................................

420.

21. PRE applied with Summer Levy? ............................................................................................................................ 21. Yes No

22. PRE applied with Winter Levy? ............................................................................................................................... 22.

Yes No

23. Indicate property classication ................................................................................................................................ 23.

Did the Assessor Approve or Deny the Afdavit? What is the year the Afdavit will be posted to the tax roll?

Approved Denied (Attach a copy of the Local Unit Denial)

Certication: I certify that, to the best of my knowledge, the information contained in this form is complete and accurate.

Assessor’s Signature Date Certied by Assessor (MM/DD/YYYY)

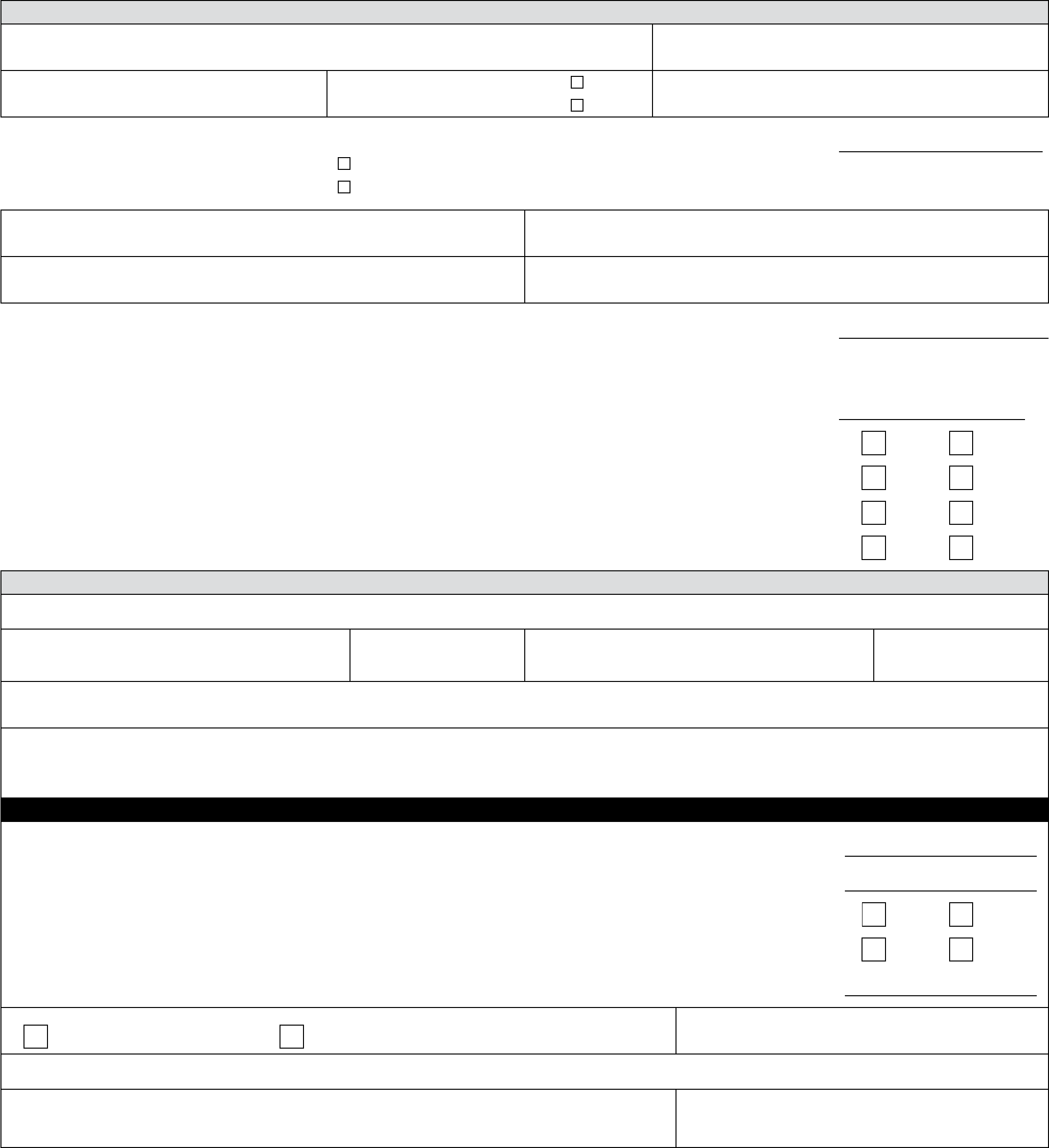

If you own and occupy your principal residence, it may be exempt from a portion of your local school operating taxes. To claim an

exemption, complete this Afdavit and le it with your township or city by June 1 or November 1 of the year of the claim. Failure to

complete an Afdavit (including the refusal to provide a social security number) may be a cause to deny the claim for an exemption.

A valid afdavit led by June 1 allows an owner to receive an exemption on the current year summer and winter tax levy and subsequent

levies so long as it remains the owner’s principal residence. A valid afdavit led by November 1 allows an owner to receive an exemption

on the current year winter tax levy and subsequent levies so long as it remains the owner’s principal residence. Principal residence means

the dwelling that you occupy as your permanent home and any unoccupied adjoining or contiguous properties that are classied residential

or timber-cutover. Do not submit this form if the property is not occupied by the owner as his or her principal residence.

Owners are dened in MCL 211.7dd(a). Only the owner’s listed in MCL211.7dd(a) are eligible to claim the exemption. Renters can

not le this form.

Occupying means this is your principal residence, the place you intend to return to whenever you go away. It should be the address

that appears on your driver's license or voter registration card. Vacation homes and income property that you do not occupy as your

principal residence may not be claimed. You may have only one principal residence at a time, however, you can le a Conditional

Rescission of Principal Residence Exemption (PRE) (Form 4640) on unsold property that is your previous principal residence under the

following conditions: it is for sale, is not occupied, is not leased, and is not used for any business or commercial purpose.

RESCINdING YOUR ExEMPTION

Within 90 days of when you no longer own or occupy the property as a principal residence, you must complete and le a Request to

Rescind Principal Residence Exemption (PRE) (Form 2602) or le Form 4640, as noted above, with your township or city assessor.

Failure to do so may subject you to additional tax plus penalties and interest as determined under the General Property Tax Act.

INTEREST ANd PENALTY

If it is determined that you claimed property that is not your principal residence, you may be subject to the additional tax plus penalty

and interest as determined under the General Property Tax Act.

PART 1: PROPERTY INFORMATION

Submit a separate afdavit for each property tax identication number being claimed.

It is important that your property tax identication number is entered accurately. This ensures that your property is identied

properly and that your township or city can accurately adjust your property taxes. You can nd this number on your tax bill and on your

property tax assessment notice. If you cannot nd this number, call your township or city assessor.

NOTE: Do not include information for a co-owner who does not occupy the property as a principal residence.

The request for the Social Security number is authorized under Section 42 USC 405 (c) (2) (C) (i). It is used by the Department of

Treasury to verify tax exemption claims and to deter fraudulent lings. Any use of the number by closing agents or local units of

government is illegal and subject to penalty.

Line 12: If you own and occupy the entire property as a principal residence, you may claim a 100 percent exemption. If you own

and live in a multi-unit or multi-purpose property (e.g., a duplex or apartment building, or a storefront with an upstairs at), you can

only claim a partial exemption based on that portion that you use as a principal residence. Calculate your portion by dividing the oor

area of your principal residence by the oor area of the entire building. A percentage must be provided.

If the parcel of property you are claiming has more than one home on it, you must determine the percentage that you own and occupy

as your principal residence. A second residence on the same property (e.g., a mobile home or second house) is not part of your principal

residence, even if it is not rented to another person. Your local assessor can tell you the assessed value of each residence to help you

determine the percentage that is your principal residence.

If you rent part of your home to another person, you may have to prorate your exemption. If your home is a single-family dwelling

and less than 50 percent of your home is rented to others who use it as a residence, you may claim a 100 percent exemption. If 50 percent

or more is rented to others who use it as a residence or if part of the home was converted to an apartment with a separate entrance, you

must calculate the percentage that is your principal residence by dividing the oor area of your principal residence by the oor area of

the entire building.

PART 2: CERTIFICATION

Sign and date the form. Enter your mailing address if it is different from the address under Part 1.

MAILING INFORMATION

Mail your completed form to the township or city assessor where the property is located. This address may be on your most recent tax

bill or assessment notice. DO NOT send this form directly to the Department of Treasury.

If you have any questions, visit www.michigan.gov/PRE or call (517) 373-1950.

2368, Page 2

Instructions for Form 2368

Principal Residence Exemption (PRE) Afdavit