Fillable Printable Foreign Account or Asset Statement

Fillable Printable Foreign Account or Asset Statement

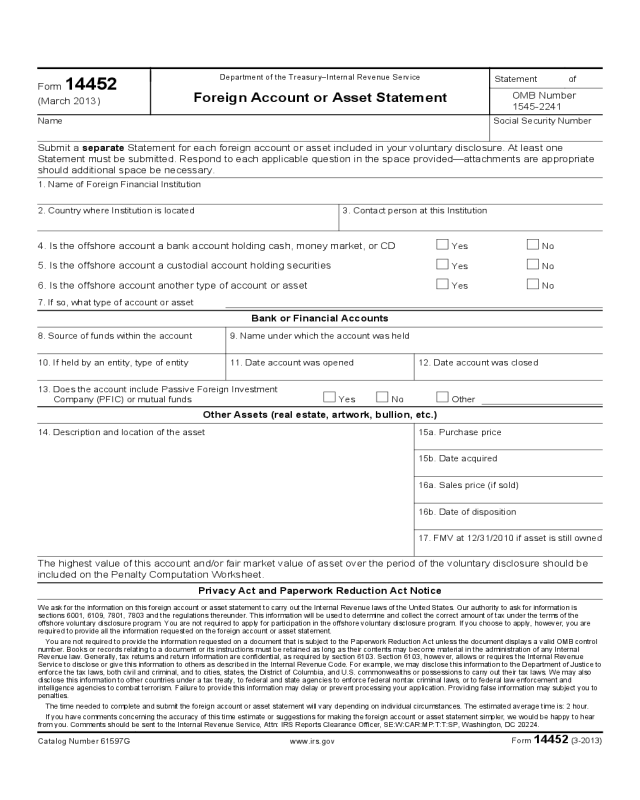

Foreign Account or Asset Statement

Form 14452

(March 2013)

Department of the Treasury–Internal Revenue Service

Foreign Account or Asset Statement

OMB Number

1545-2241

Statement of

Name Social Security Number

Submit a separate Statement for each foreign account or asset included in your voluntary disclosure. At least one

Statement must be submitted. Respond to each applicable question in the space provided—attachments are appropriate

should additional space be necessary.

1. Name of Foreign Financial Institution

2. Country where Institution is located 3. Contact person at this Institution

4. Is the offshore account a bank account holding cash, money market, or CD

Yes No

5. Is the offshore account a custodial account holding securities

Yes No

6. Is the offshore account another type of account or asset

Yes No

7. If so, what type of account or asset

Bank or Financial Accounts

8. Source of funds within the account 9. Name under which the account was held

11. Date account was opened10. If held by an entity, type of entity 12. Date account was closed

13. Does the account include Passive Foreign Investment

Company (PFIC) or mutual funds

Yes No Other

Other Assets (real estate, artwork, bullion, etc.)

14. Description and location of the asset 15a. Purchase price

15b. Date acquired

16a. Sales price (if sold)

16b. Date of disposition

17. FMV at 12/31/2010 if asset is still owned

The highest value of this account and/or fair market value of asset over the period of the voluntary disclosure should be

included on the Penalty Computation Worksheet.

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this foreign account or asset statement to carry out the Internal Revenue laws of the United States. Our authority to ask for information is

sections 6001, 6109, 7801, 7803 and the regulations thereunder. This information will be used to determine and collect the correct amount of tax under the terms of the

offshore voluntary disclosure program. You are not required to apply for participation in the offshore voluntary disclosure program. If you choose to apply, however, you are

required to provide all the information requested on the foreign account or asset statement.

You are not required to provide the information requested on a document that is subject to the Paperwork Reduction Act unless the document displays a valid OMB control

number. Books or records relating to a document or its instructions must be retained as long as their contents may become material in the administration of any Internal

Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. Section 6103, however, allows or requires the Internal Revenue

Service to disclose or give this information to others as described in the Internal Revenue Code. For example, we may disclose this information to the Department of Justice to

enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also

disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and

intelligence agencies to combat terrorism. Failure to provide this information may delay or prevent processing your application. Providing false information may subject you to

penalties.

The time needed to complete and submit the foreign account or asset statement will vary depending on individual circumstances. The estimated average time is: 2 hour.

If you have comments concerning the accuracy of this time estimate or suggestions for making the foreign account or asset statement simpler, we would be happy to hear

from you. Comments should be sent to the Internal Revenue Service, Attn: IRS Reports Clearance Officer, SE:W:CAR:MP:T:T:SP, Washington, DC 20224.

Catalog Number 61597G www.irs.gov

Form 14452 (3-2013)