Fillable Printable Income and Assets Sample Form

Fillable Printable Income and Assets Sample Form

Income and Assets Sample Form

SA369.1409

Income and Assets

1 of 17

This form asks you to provide information about your income and assets.

This information is used to calculate your Centrelink payment.

Purpose of this form

Filling in this form

• Please use black or blue pen.

• Print in BLOCK LETTERS.

• Mark boxes like this

with a or .

• Where you see a box like this

Go to 5

skip to the question number shown. You do not

need to answer the questions in between.

Returning your form

Check that you have answered all the questions you need to answer, and that you

(and your partner) have signed and dated this form.

You can return this form and any supporting documents:

• online – submit your documents online. For more information about how to access an

Online Account or how to lodge documents online, go to

www.

humanservices.gov.au/submitdocumentsonline

• by post

• in person – if you are unable to submit this form and any supporting documents online

or by post, you can provide them in person to one of our Service Centres.

For more information

Go to our websitewww.humanservices.gov.au/dsp orwww.humanservices.gov.au/carerpayment

or

www.humanservices.gov.au/agepension or call us on 132 717 for Disability, Sickness and

Carers or 132 300 for Seniors or visit one of our Service Centres.

If you need a translation of any documents for our business, we can arrange this for you

free of charge.

To speak to us in languages other than English, call 131 202.

Note: Call charges apply – calls from mobile phones may be charged at a higher rate.

If you have a hearing or speech impairment you can contact the TTY service on

Freecall™ 1800 810 586. A TTY phone is required to use this service.

Online Services

You can access your Centrelink, Medicare and Child Support Online Services through myGov.

myGov is a fast, simple way to access a range of government services online with one

username, one password, all from one secure location. To create a myGov account, go to www.

my.gov.au

You must tell us about your partner’s income and assets.

You can complete this form for both you and your partner.

OR

You may choose to complete an

Income and Assets

form (SA369) separately.

If you choose this option, tick this box

If you need more copies of this form, go to our website

www.humanservices.gov.au/forms

If you have a partner

SA369.1409

2 of 17

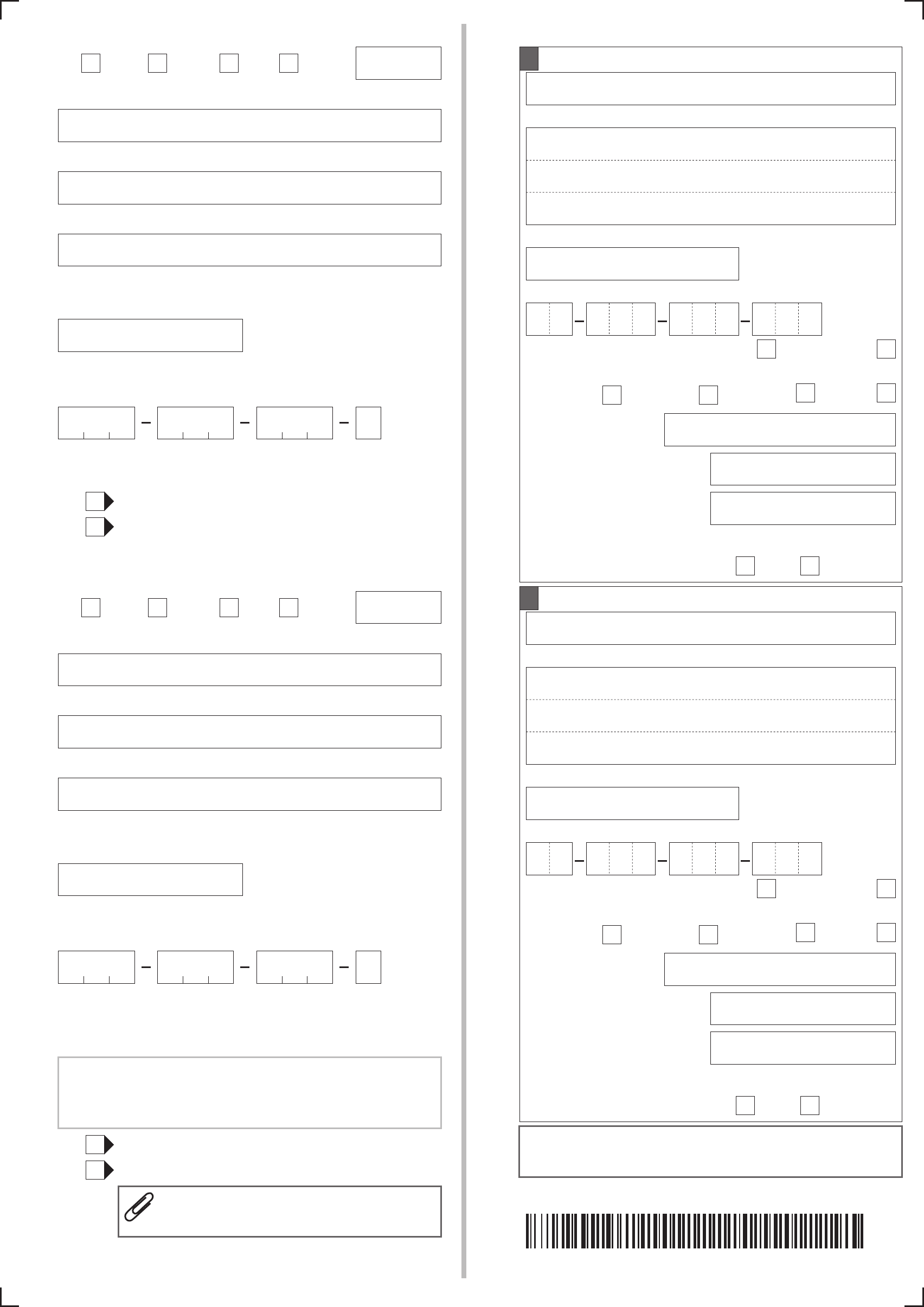

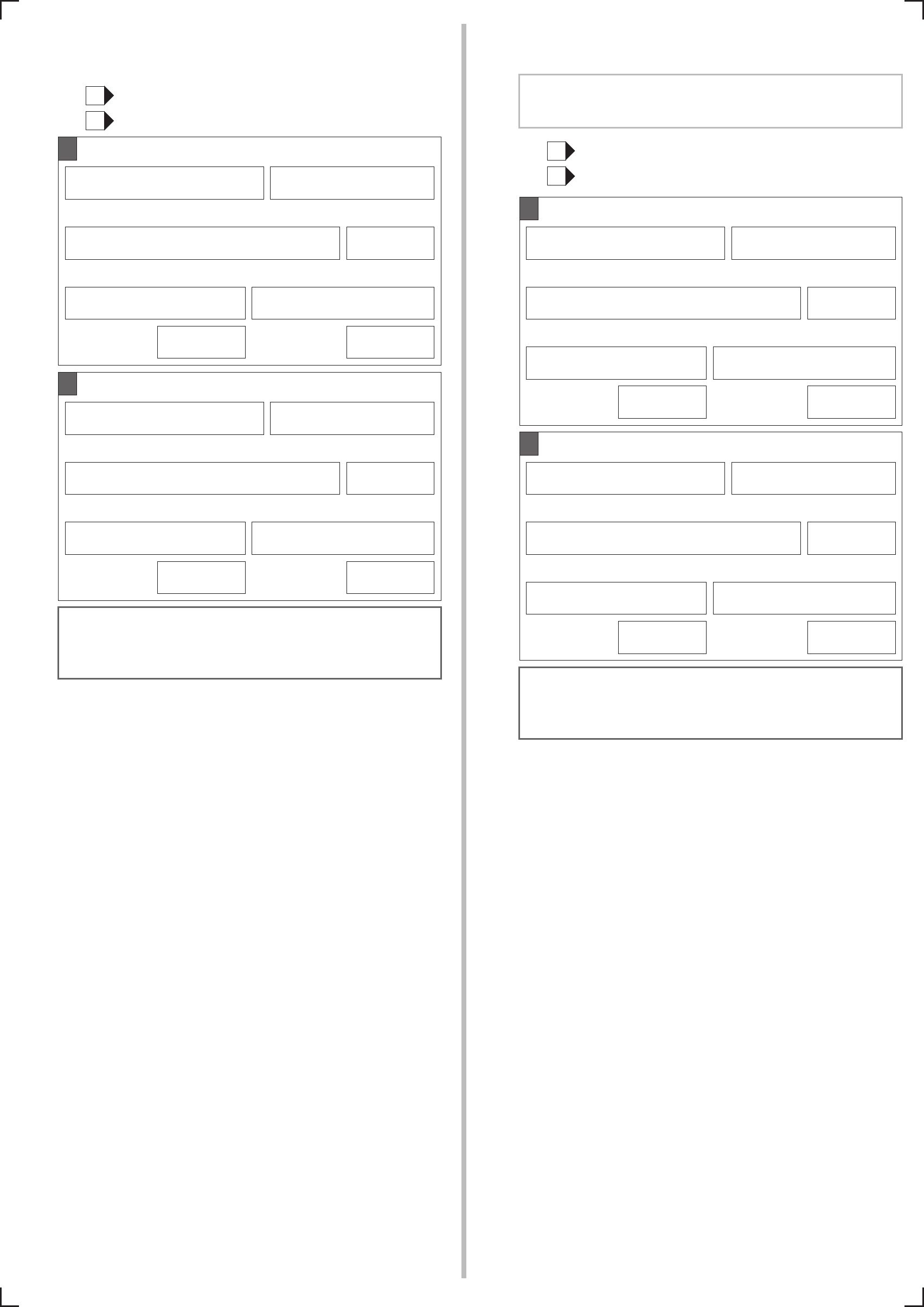

Your date of birth

/ /

2

Your name

Other

Family name

1

First given name

Second given name

MsMissMrsMr

Your Centrelink Reference Number (if known)

3

Do you have a partner?

4

Go to next question

Go to 8

No

Yes

Your partner’s date of birth

/ /

6

Your partner’s name

Other

Family name

5

First given name

Second given name

MsMissMrsMr

Your partner’s Centrelink Reference Number (if known)

7

Do you (and/or your partner) CURRENTLY receive any

income from work other than self-employment?

8

Give details in the next column

Go to 10

No

Yes

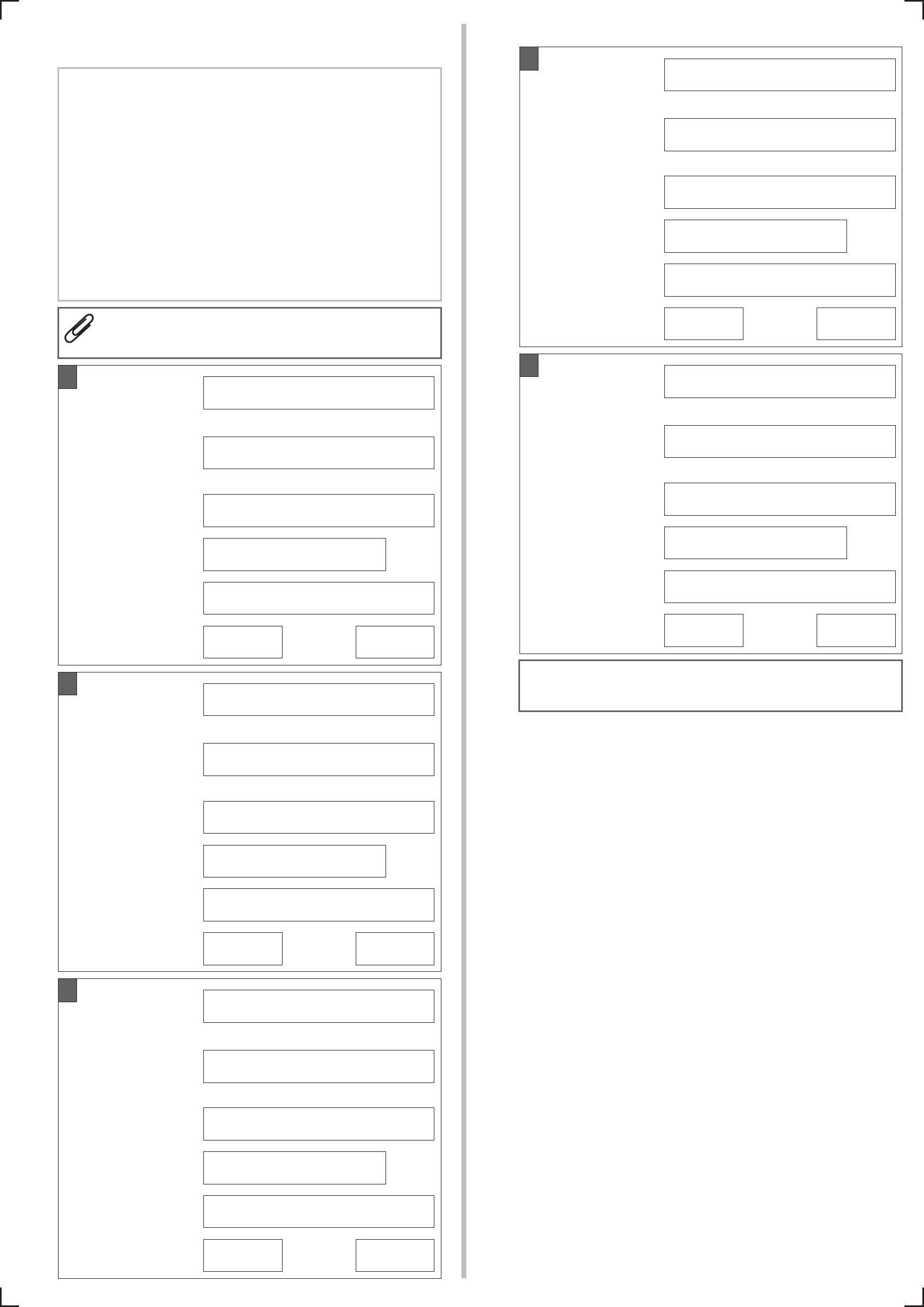

If you (and/or your partner) currently get income from

more than 2 jobs, attach a separate sheet with details.

Attach the 2 most recent payslips from

each employer.

GROSS income from employment includes amounts

voluntarily salary sacrificed into superannuation and the

value of employer provided fringe benefits.

Address

Postcode

Phone number

( )

Employer’s name

1

Is this your usual wage?

Personnel, service or

clock-card number

Hours worked per fortnight

GROSS amount earned per

fortnight (before tax and

other deductions)

per fortnight$

Who works for this employer: You Your partner

Australian Business Number (ABN)

Is this work:

CasualSeasonalPart-timeFull-time

per fortnight

No Yes

Continued

Address

Postcode

Phone number

( )

Employer’s name

2

Is this your usual wage?

Personnel, service or

clock-card number

Hours worked per fortnight

GROSS amount earned per

fortnight (before tax and

other deductions)

per fortnight$

Who works for this employer: You Your partner

Australian Business Number (ABN)

Is this work:

CasualSeasonalPart-timeFull-time

per fortnight

No Yes

CLK0SA369 1409

SA369.1409

3 of 17

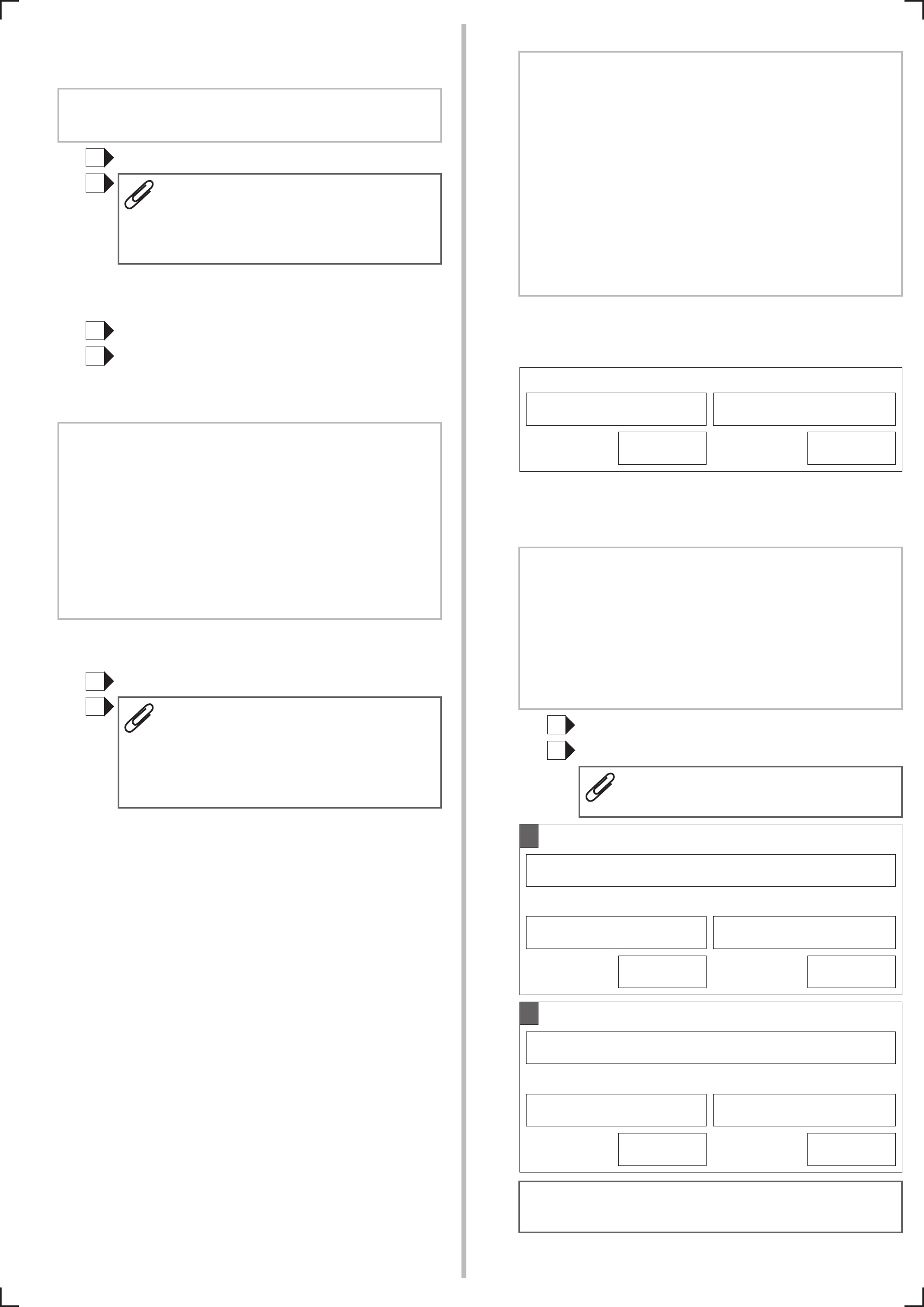

Do you (and/or your partner) get any fringe benefits

provided by an employer (e.g. use of a car as part of a

salary package, rent/mortgage paid)?

9

Go to next question

No

Yes

Attach details that indicate the type of

fringe benefit and its value, and whether

or not the amount provided is ‘grossed up’

or not ‘grossed up’.

Fringe benefits – means a benefit received as part of

earned income but not as a wage or salary.

Are you (and/or your partner) claiming Age Pension?

10

Go to next question

No

Yes

Go to 12

Please read this before answering the following question.

11

Seasonal work is work that is available for part or parts

of the year at approximately the same time each year.

Contract work is any intermittent work that is performed

under a contract for a specific function and/or period

including sub-contract work.

Intermittent work is work that is available from time to

time, can reasonably be predicted to end or not be

available for a period, is less than a year in duration and

does not accrue leave entitlements.

In the last 6 months, have you (and/or your partner) done

any seasonal, contract or intermittent work?

Go to next question

No

Yes

You will need to complete and attach a

Seasonal, Contract and Intermittent

Work Details

form (SU496). If you do not

have this form,

go to our website

www.humanservices.gov.au/forms or call us.

Please read this before answering the following question.

12

The

current market value

of an item is what you

would get if you sold it. It is not the replacement or

insured value.

Include:

• all furniture (including soft furnishings such as

curtains), antiques and works of art

• electrical appliances such as televisions and fridges

• jewellery for personal use and hobby collections

(e.g. stamps, coins).

Do NOT include:

• fixtures such as stoves and built-in items.

What is your estimate of the current market value of your

(and/or your partner’s) household contents and personal

effects?

Current market value

Your share

Partner’s

share

$

Amount owed

$

%%

Do you (and/or your partner) have a life insurance policy

that can be cashed in?

13

Include:

• policies with a surrender value (e.g. whole of life, paid

up and endowment policies).

Do NOT include:

• friendly society bonds or life insurance bonds

• details of home, contents, car, mortgage or similar

policies.

Give details below

Go to next question

No

Yes

Attach the policy document and the latest

statement for each policy.

Name of insurance company

1

Policy number Surrender value

$

Your share

Partner’s

share

%%

Name of insurance company

2

Policy number Surrender value

$

Your share

Partner’s

share

%%

If you (and/or your partner) have more than

2 insurance policies, attach a separate sheet with details.

SA369.1409

4 of 17

Year

Do you (and/or your partner) own, partly own or have a

financial interest in any motor vehicles, motor cycles or

trailers?

14

Give details below

Go to next question

No

Yes

Type of asset

(e.g. car)

1

Make (e.g. Ford)

Your share

Partner’s

share

%%

Current market value Amount owed

$$

Model

(e.g. Focus)

Do you (and/or your partner) own, partly own or have a

financial interest in any boats or caravans/motor homes?

15

Give details below

Go to next question

No

Yes

If you (and/or your partner) have more than 2 motor

vehicles, motor cycles or trailers, attach a separate sheet

with details.

If you (and/or your partner) have more than 2 boats,

caravans or motor homes, attach a separate sheet

with details.

Year

Type of asset

(e.g. car)

2

Make (e.g. Holden)

Your share

Partner’s

share

%%

Current market value Amount owed

$$

Model

(e.g. Astra)

Year

Type of asset

(e.g. boat)

1

Make (e.g. Quintrex)

Your share

Partner’s

share

%%

Current market value Amount owed

$$

Model

(e.g. Coastrunner)

Year

Type of asset

(e.g. caravan)

2

Make (e.g. Jayco)

Your share

Partner’s

share

%%

Current market value Amount owed

$$

Model

(e.g. Heritage)

Do NOT include a boat or caravan that is your

principal home.

SA369.1409

5 of 17

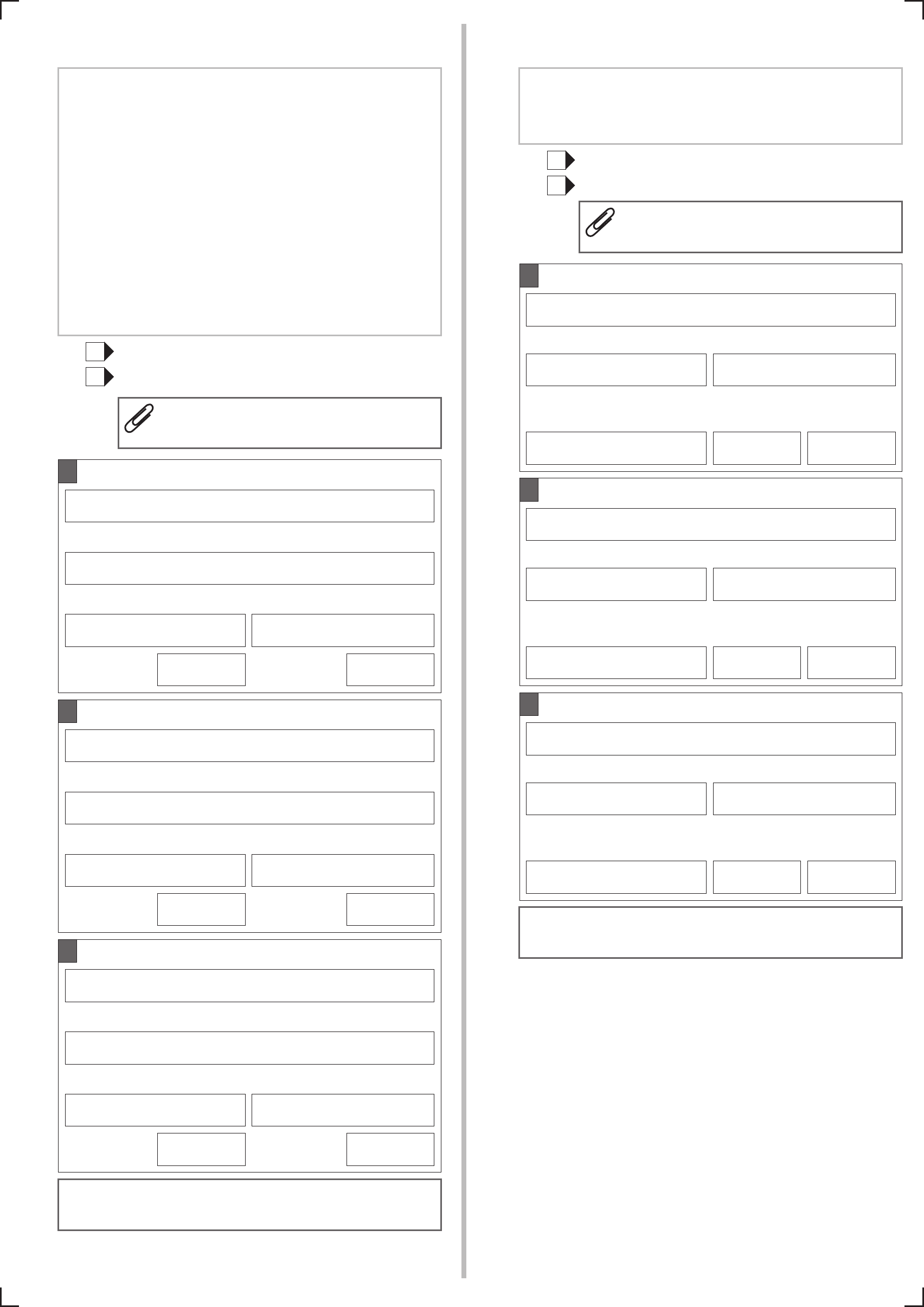

Give details below of all accounts held by you (and/or your

partner) in banks, building societies or credit unions.

16

Name of bank,

building society or

credit union

Include savings accounts, cheque accounts, term

deposits, joint accounts, accounts you hold in trust or

under any other name, or money held in church or

charitable development funds.

Accounts and term deposits outside Australia should be

included, with the current balance in the type of currency

in which it is invested. We will convert this into Australian

dollars.

Do NOT include shares, managed investments or an

account used exclusively for funding from the National

Disability Insurance Scheme.

Attach proof of all account balances (e.g. ATM slip,

statements, passbooks). Copies can be provided.

1

Your share

Partner’s

share

%%

Account number

(this may not be

your card number)

Type of account

Balance of account

Currency if not AUD

$

Continued

If you (and/or your partner) have more than 5 accounts,

attach a separate sheet with details.

Name of bank,

building society or

credit union

2

Your share

Partner’s

share

%%

Account number

(this may not be

your card number)

Type of account

Balance of account

Currency if not AUD

$

Name of bank,

building society or

credit union

3

Your share

Partner’s

share

%%

Account number

(this may not be

your card number)

Type of account

Balance of account

Currency if not AUD

$

Name of bank,

building society or

credit union

4

Your share

Partner’s

share

%%

Account number

(this may not be

your card number)

Type of account

Balance of account

Currency if not AUD

$

Name of bank,

building society or

credit union

5

Your share

Partner’s

share

%%

Account number

(this may not be

your card number)

Type of account

Balance of account

Currency if not AUD

$

SA369.1409

6 of 17

Do you (and/or your partner) have any bonds or

debentures?

17

Bonds refer to government and semi-government bonds.

Include:

• investments in and/or outside Australia

Bonds or debentures outside Australia should be

included, with the current balance in the type of currency

in which it is invested. We will convert this into Australian

dollars.

Do NOT include:

• friendly society bonds, funeral bonds or life insurance

bonds

• accommodation bonds for residing in an aged care

facility.

Give details below

Go to next question

No

Yes

Attach a document which gives details for

each bond or debenture.

Name of company

1

Current amount invested Currency if not AUD

Your share

Partner’s

share

%%

Type of investment

$

Name of company

2

Current amount invested Currency if not AUD

Your share

Partner’s

share

%%

Type of investment

$

Name of company

3

Current amount invested Currency if not AUD

Your share

Partner’s

share

%%

Type of investment

$

If you (and/or your partner) have more than 3 bonds or

debentures, attach a separate sheet with details.

Do you (and/or your partner) have money on loan to another

person or organisation?

18

Include all loans, whether they are made to family

members, other people or organisations or trusts.

Do NOT include loans to get accommodation in a hostel.

Give details below

Go to next question

No

Yes

Attach a document which gives details for

each loan (if available).

Who did you lend the money to?

1

Current balance of loan

Amount lent

$

Lent by you

Lent by your

partner

%%

Date lent

$

/ /

Who did you lend the money to?

2

Current balance of loan

Amount lent

$

Date lent

$

/ /

Who did you lend the money to?

3

Current balance of loan

Amount lent

$

Date lent

$

/ /

If you (and/or your partner) have more than 3 loans,

attach a separate sheet with details.

Lent by you

Lent by your

partner

%%

Lent by you

Lent by your

partner

%%

SA369.1409

7 of 17

Do you (and/or your partner) own any shares, options,

rights, convertible notes or other securities LISTED on an

Australian Stock Exchange (e.g. ASX, NSX, APX or Chi-X) or

a stock exchange outside Australia?

19

Include shares traded in exempt stock markets.

Do NOT include managed investments.

Give details below

Go to next question

No

Yes

Attach the latest statement for each share

holding.

Name of company

1

Country if not Australia

ASX code (if known)

Your share

Partner’s

share

%%

Number of shares

or other securities

Name of company

2

Country if not Australia

ASX code (if known)

Your share

Partner’s

share

%%

Number of shares

or other securities

Name of company

3

Country if not Australia

ASX code (if known)

Your share

Partner’s

share

%%

Number of shares

or other securities

If you (and/or your partner) have more than 3 share

holdings, attach a separate sheet with details.

Do you (and/or your partner) own any shares, options or

rights in PUBLIC companies, NOT listed on a stock

exchange?

20

Do NOT include managed investments.

Give details below

Go to next question

No

Yes

Attach the latest statement detailing

your share holding for each company

(if available).

Name of company

1

Current market value

Type of shares

Your share

Partner’s

share

%%

Number of shares

$

Name of company

2

Current market value

Type of shares

Your share

Partner’s

share

%%

Number of shares

$

Name of company

3

Current market value

Type of shares

Your share

Partner’s

share

%%

Number of shares

$

Name of company

4

Current market value

Type of shares

Your share

Partner’s

share

%%

Number of shares

$

If you (and/or your partner) have more than 4 share

holdings, attach a separate sheet with details.

Margin loan balance

$

Margin loan balance

$

Margin loan balance

$

SA369.1409

8 of 17

Do you (and/or your partner) have any managed

investments in and/or outside Australia?

21

Include:

• investment trusts

• personal investment plans

• life insurance bonds

• friendly society bonds.

Do NOT include:

• conventional life insurance policies

• funeral bonds, superannuation or rollover investments.

APIR code – is commonly used by fund managers to

identify individual financial products.

Give details below

Go to next question

No

Yes

Attach a document which gives details

(e.g. certificate with number of units or

account balance) for each investment.

Name of company

1

Name of product

(e.g. investment trust)

Type of product/option

(e.g. balanced, growth)

APIR code (if known)Number of units

Current market value Currency if not AUD

$

Your share

Partner’s

share

%%

Name of company

2

Name of product

(e.g. investment trust)

Type of product/option

(e.g. balanced, growth)

APIR code (if known)Number of units

Current market value Currency if not AUD

$

Your share

Partner’s

share

%%

If you (and/or your partner) have more than 2 managed

investments, attach a separate sheet with details.

22

Do you (and/or your partner) have any funeral bonds/

funeral investments, including a pre-paid funeral?

23

Have you (and/or your partner) a contract to have funeral

services provided for which an agreed sum has already

been paid to the provider or used to buy funeral bonds

assigned to the provider?

If you (and/or your partner) have more than 2 funeral

bonds/funeral investments, attach a separate sheet with

details.

Give details below

Go to 24

No

Yes

Name of company

1

Current value

as per latest statement

Name of product

Your share

Partner’s

share

%%$

APIR code

Purchase price incl.

instalments but not interest

Name of company

2

Current value

as per latest statement

Name of product

Your share

Partner’s

share

%%$

APIR code

Purchase price incl.

instalments but not interest

Go to next question

No

Yes

Attach a copy of each contract.

$

$

SA369.1409

9 of 17

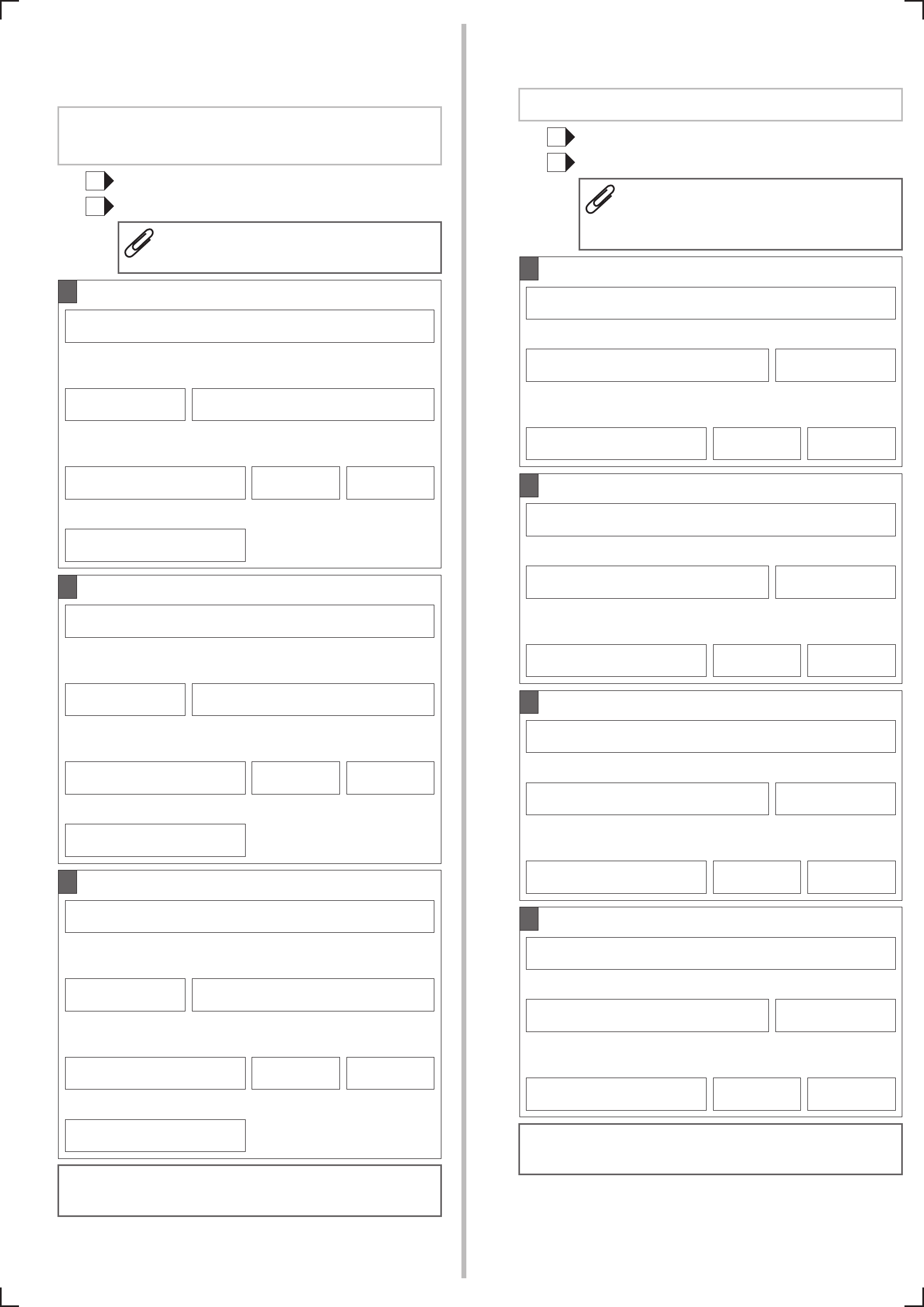

Please read this before answering the following question.

24

YOU should answer this question ONLY if you are over

age pension age or claiming Age Pension.

YOUR PARTNER should answer this question ONLY if

they are over age pension age or claiming Age Pension.

Owned by:

From 1 July 2017, the qualifying age for Age Pension will

increase from 65 years to 65 years and 6 months. The

qualifying age will then rise by 6 months every 2 years,

reaching 67 years by 1 July 2023. See table below.

Do you (or your partner) have any money invested in

superannuation where the fund is still in accumulation

phase and not paying a pension?

Include:

• superannuation funds such as retail, industry,

corporate or employer and public sector

• retirement savings accounts

• Self Managed Superannuation Funds (SMSF) and

Small APRA Funds (SAF) if the funds are complying.

Give details below

Go to next question

No

Yes

Attach the latest statements for retirement

savings accounts and superannuation

funds. If you have a SMSF or SAF, attach

the financial statement including income

tax return and member statement.

Name of institution/fund manager

1

Name of fund

Current market value

$

Date of joining/investment

/ /

You Your partner

Continued

If you (and/or your partner) have more than

3 superannuation investments, attach a separate sheet

with details.

Owned by:

Name of institution/fund manager

2

Name of fund

Current market value

$

Date of joining/investment

/ /

You Your partner

Owned by:

Name of institution/fund manager

3

Name of fund

Current market value

$

Date of joining/investment

/ /

You Your partner

1 July 1952 to

31 December 1953 65 years and 6 months

1 January 1954 to

30 June 1955 66 years

1 July 1955 to

31 December 1956 66 years and 6 months

From 1 January 1957 67 years

Qualifying age atDate of birth

SA369.1409

10 of 17

Do you (and/or your partner) have any money invested in,

or do you receive income from, any other investments not

declared elsewhere on this form?

26

Include:

• all investments from outside Australia (including

superannuation) not declared elsewhere on this form.

Do NOT include:

• income from real estate in or outside Australia, private

trusts, private companies or business

• social security payments

• an account used exclusively for funding from the

National Disability Insurance Scheme.

Give details below

Go to next question

No

Yes

Attach a document which gives details for

each investment.

Type of investment

1

Currency if not AUD

Name of organisation/company

Your share

Partner’s

share

%%

Current value

of investment

Income received

in last 12 months

Type of investment

2

Currency if not AUD

Name of organisation/company

Your share

Partner’s

share

%%

Income received

in last 12 months

If you (and/or your partner) have more than

2 investments, attach a separate sheet with details.

Current value

of investment

Give details below

Go to next question

No

Yes

You (and/or your partner) will need to

attach a

Details of income stream

product

form (SA330) or a similar

schedule, for each income stream

product. The form or similar schedule

must be completed by your product

provider or the trustee of the Self

Managed Superannuation Fund (SMSF) or

Small APRA Fund (SAF) or the SMSF

administrator.

If you do not have this form, go to our

website

www.humanservices.gov.au/forms or

call us on 132 300.

Do you (and/or your partner) receive income from any

income stream products?

If you (and/or your partner) have more than 2 income

stream products, attach a separate sheet with details.

Name of product provider/SMSF/SAF

1

Type of income stream

Product reference number

Please read this before answering the following question.

25

An income stream product is a regular series of

payments which may be made for a lifetime or a fixed

period by:

• a financial institution

• a retirement savings account

• a superannuation fund

• a Self Managed Superannuation Fund (SMSF)

• a Small APRA Fund (SAF)

.

Types of income streams include:

• account-based pension (also known as allocated

pension)

• market-linked pension (also known as term allocated

pension)

• annuities

• defined benefit pension (e.g. ComSuper pension, State

Super pension)

• superannuation pension (non-defined benefit).

Commencement date

/ /

Owned by: You Your partner

Name of product provider/SMSF/SAF

2

Type of income stream

Product reference number Commencement date

/ /

Owned by: You Your partner

SA369.1409

Do you (or your partner) receive payments from sources

other than Centrelink income support payments?

27

Give details below

Go to next question

No

Yes

Attach a letter or other document(s) that

shows the reference number and details

for each payment (other than payments

made by us).

Paid to:

Type of payment

1

Who pays it?

Reference number

(if known)

Date commenced

(if known)

/ /

You Your partner

Paid to:

Type of payment

2

Who pays it?

Reference number

(if known)

Date commenced

(if known)

/ /

You Your partner

If you (and/or your partner) receive more than

2 payments, attach a separate sheet with details.

Do you (and/or your partner) receive payments from an

authority or agency outside Australia?

28

Give details below

Go to next question

No

Yes

Attach a document from the issuing

authority or agency which gives details

including the amount in the foreign

currency (e.g. latest pension certificate)

for each payment.

Type of payment

1

Country which pays it?

Authority or agency which pays it?

Date commenced

(if known)

/ /

If you (and/or your partner) receive more than

2 payments from an authority or agency outside

Australia, attach a separate sheet with details.

Include pensions from other countries, benefits,

allowances, superannuation, compensation and war

related payments.

Note: You must include details of pensions, allowances

and other payments even if they are not taxable in the

country of payment.

Type of payment

2

Country which pays it?

Authority or agency which pays it?

Date commenced

(if known)

/ /

11 of 17

Paid to: You Your partner

Paid to: You Your partner

For example:

• a payment from Department of Veterans' Affairs (DVA),

or

• New Enterprise Incentive Scheme (NEIS) Allowance,

or

• Community Development Employment Projects (CDEP)

wages.