Fillable Printable Form 8938 - Statement of Foreign Financial Assets (2014)

Fillable Printable Form 8938 - Statement of Foreign Financial Assets (2014)

Form 8938 - Statement of Foreign Financial Assets (2014)

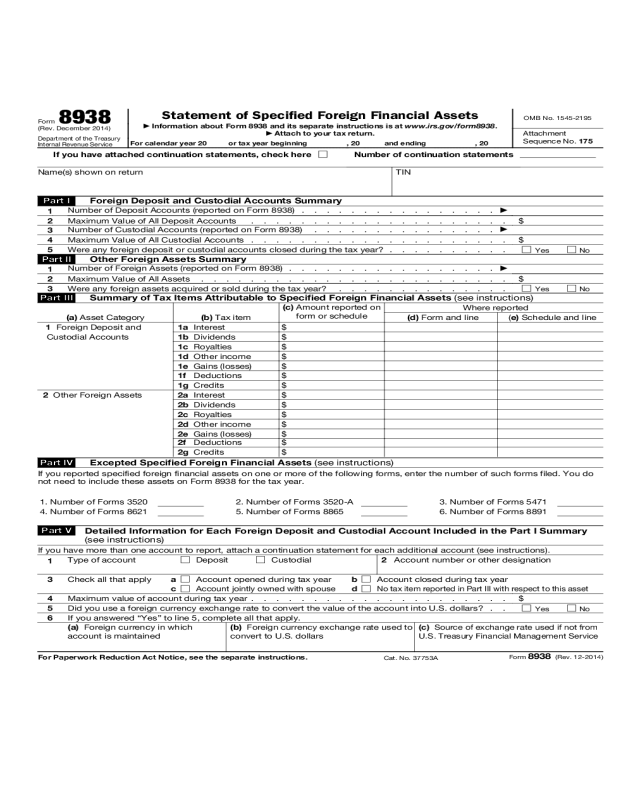

Form 8938

(Rev. December 2014)

Department of the Treasury

Internal Revenue Service

Statement of Specified Foreign Financial Assets

▶

Information about Form 8938 and its separate instructions is at www.irs.gov/form8938.

▶

Attach to your tax return.

OMB No. 1545-2195

Attachment

Sequence No. 175

For calendar year 20

or tax year beginning

, 20and ending, 20

If you have attached continuation statements, check hereNumber of continuation statements

Name(s) shown on returnTIN

Part IForeign Deposit and Custodial Accounts Summary

1

Number of Deposit Accounts (reported on Form 8938) ................

▶

2

Maximum Value of All Deposit Accounts ..................... $

3

Number of Custodial Accounts (reported on Form 8938) ...............

▶

4Maximum Value of All Custodial Accounts ..................... $

5Were any foreign deposit or custodial accounts closed during the tax year? ..........

YesNo

Part IIOther Foreign Assets Summary

1

Number of Foreign Assets (reported on Form 8938) .................

▶

2Maximum Value of All Assets ......................... $

3Were any foreign assets acquired or sold during the tax year? ..............

YesNo

Part IIISummary of Tax Items Attributable to Specified Foreign Financial Assets (see instructions)

(a) Asset Category(b) Tax item

(c) Amount reported on

form or schedule

Where reported

(d) Form and line(e) Schedule and line

1 Foreign Deposit and

1a Interest$

Custodial Accounts1b Dividends$

1c Royalties$

1d Other income$

1e Gains (losses)$

1f Deductions$

1g Credits$

2 Other Foreign Assets2a Interest$

2b Dividends$

2c Royalties$

2d Other income$

2e Gains (losses)$

2f Deductions$

2g Credits$

Part IVExcepted Specified Foreign Financial Assets (see instructions)

If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. You do

not need to include these assets on Form 8938 for the tax year.

1. Number of Forms 35202. Number of Forms 3520-A3. Number of Forms 5471

4. Number of Forms 86215. Number of Forms 88656. Number of Forms 8891

Part V

Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part I Summary

(see instructions)

If you have more than one account to report, attach a continuation statement for each additional account (see instructions).

1

Type of account

DepositCustodial

2 Account number or other designation

3Check all that applya

Account opened during tax yearbAccount closed during tax year

c

Account jointly owned with spouse

d

No tax item reported in Part III with respect to this asset

4Maximum value of account during tax year ..................... $

5Did you use a foreign currency exchange rate to convert the value of the account into U.S. dollars? ..

YesNo

6If you answered “Yes” to line 5, complete all that apply.

(a) Foreign currency in which

account is maintained

(b) Foreign currency exchange rate used to

convert to U.S. dollars

(c) Source of exchange rate used if not from

U.S. Treasury Financial Management Service

For Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 37753A

Form

8938 (Rev. 12-2014)

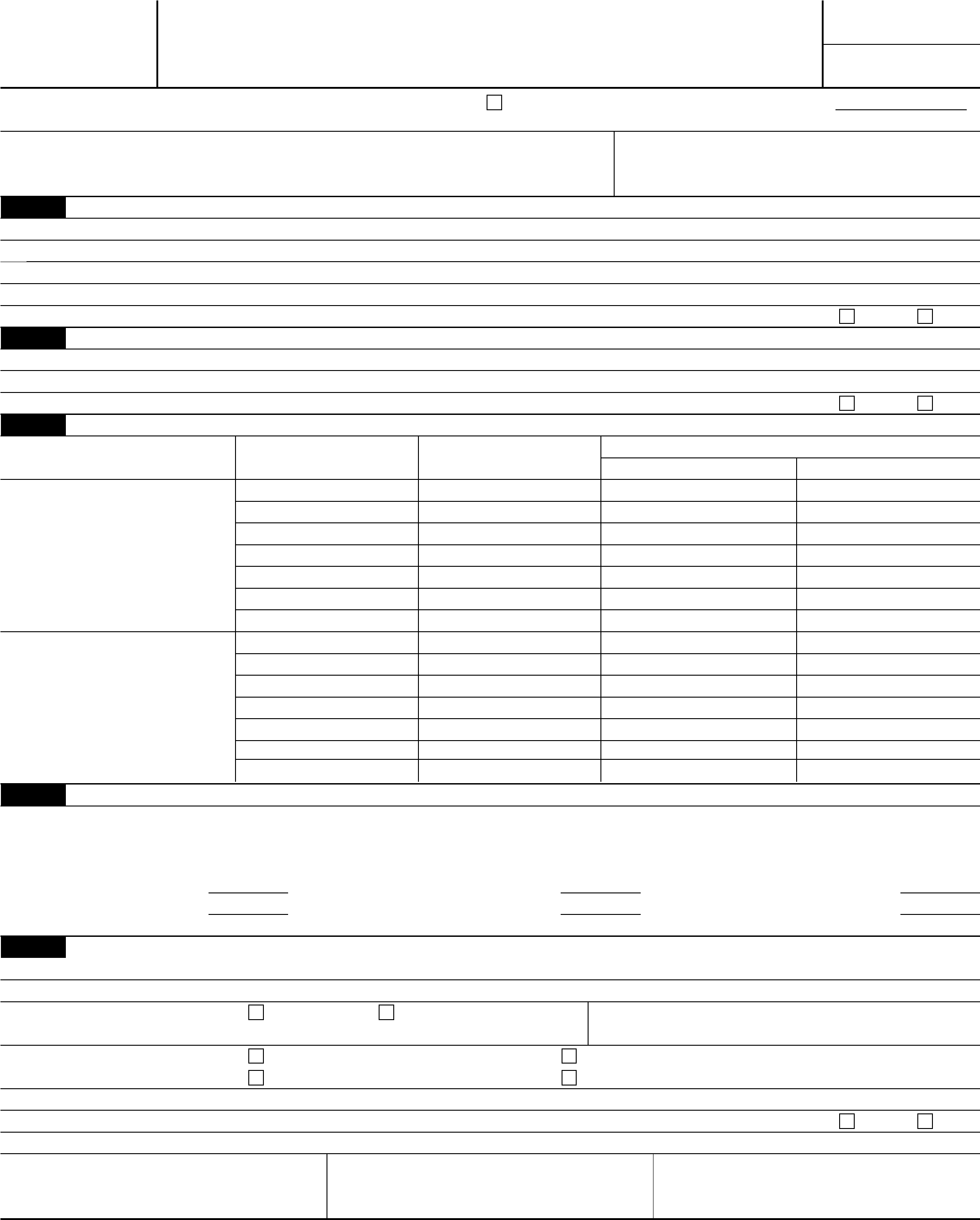

Form 8938 (Rev. 12-2014)

Page 2

Part V

Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part I Summary

(see instructions) (continued)

7a

Name of financial institution in which account is maintainedb Reserved

8

Mailing address of financial institution in which account is maintained. Number, street, and room or suite no.

9

City or town, state or province, and country (including postal code)

Part VIDetailed Information for Each "Other Foreign Asset" Included in the Part II Summary (see instructions)

Note.If you reported specified foreign financial assets on Forms 3520, 3520-A, 5471, 8621, 8865, or 8891, you do not have to include

the assets on Form 8938. You must complete Part IV. See instructions.

If you have more than one asset to report, attach a continuation statement for each additional asset (see instructions).

1

Description of asset

2 Identifying number or other designation

3Complete all that apply. See instructions for reporting of multiple acquisition or disposition dates.

a

Date asset acquired during tax year, if applicable ..................

b

Date asset disposed of during tax year, if applicable .................

c

Check if asset jointly owned with spousedCheck if no tax item reported in Part III with respect to this asset

4Maximum value of asset during tax year (check box that applies)

a

$0 - $50,000b$50,001 - $100,000c$100,001 - $150,000d$150,001 - $200,000

e

If more than $200,000, list value ........................$

5Did you use a foreign currency exchange rate to convert the value of the asset into U.S. dollars? ...

YesNo

6If you answered “Yes” to line 5, complete all that apply.

(a) Foreign currency in which asset

is denominated

(b) Foreign currency exchange rate used to

convert to U.S. dollars

(c) Source of exchange rate used if not from

U.S. Treasury Financial Management Service

7

If asset reported on line 1 is stock of a foreign entity or an interest in a foreign entity, enter the following information for the asset.

a

Name of foreign entity

b Reserved

cType of foreign entity(1)

Partnership(2)Corporation(3)

Trust

(4)

Estate

d

Mailing address of foreign entity. Number, street, and room or suite no.

e

City or town, state or province, and country (including postal code)

8

If asset reported on line 1 is not stock of a foreign entity or an interest in a foreign entity, enter the following information for the

asset.

Note.If this asset has more than one issuer or counterparty, attach a continuation statement with the same information for each

additional issuer or counterparty (see instructions).

a

Name of issuer or counterparty

Check if information is for

IssuerCounterparty

bType of issuer or counterparty

(1)Individual(2)Partnership(3)Corporation(4)Trust(5)Estate

cCheck if issuer or counterparty is a

U.S. personForeign person

d

Mailing address of issuer or counterparty. Number, street, and room or suite no.

eCity or town, state or province, and country (including postal code)

Form 8938 (Rev. 12-2014)

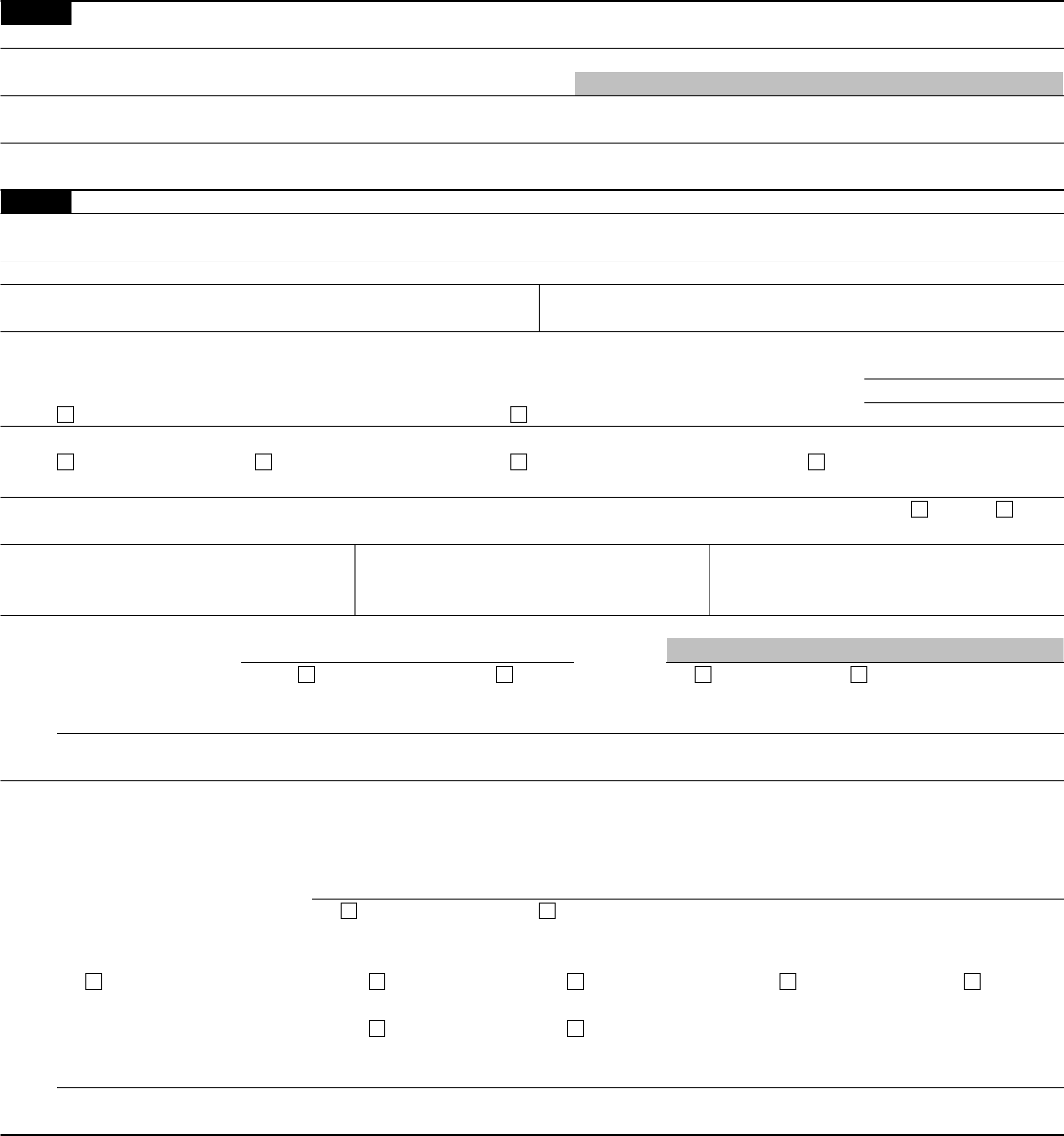

Form 8938 (Rev. 12-2014)

Page

(Continuation Statement)

Name(s) shown on returnIdentifying number

Part V

Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part I Summary

(see instructions)

1

Type of account

DepositCustodial

2 Account number or other designation

3Check all that applya

Account opened during tax yearbAccount closed during tax year

c

Account jointly owned with spouse

d

No tax item reported in Part III with respect to this asset

4Maximum value of account during tax year ..................... $

5Did you use a foreign currency exchange rate to convert the value of the account into U.S. dollars? ..

YesNo

6If you answered “Yes” to line 5, complete all that apply.

(a) Foreign currency in which

account is maintained

(b) Foreign currency exchange rate used to

convert to U.S. dollars

(c) Source of exchange rate used if not from

U.S. Treasury Financial Management Service

7a

Name of financial institution in which account is maintained

b Reserved

8

Mailing address of financial institution in which account is maintained. Number, street, and room or suite no.

9

City or town, state or province, and country (including postal code)

Part VIDetailed Information for Each "Other Foreign Asset" Included in the Part II Summary (see instructions)

1

Description of asset

2 Identifying number or other designation

3Complete all that apply. See instructions for reporting of multiple acquisition or disposition dates.

a

Date asset acquired during tax year, if applicable ..................

b

Date asset disposed of during tax year, if applicable .................

c

Check if asset jointly owned with spousedCheck if no tax item reported in Part III with respect to this asset

4Maximum value of asset during tax year (check box that applies)

a

$0 - $50,000b$50,001 - $100,000c$100,001 - $150,000d$150,001 - $200,000

e

If more than $200,000, list value ........................$

5Did you use a foreign currency exchange rate to convert the value of the asset into U.S. dollars? ...

YesNo

6If you answered “Yes” to line 5, complete all that apply.

(a) Foreign currency in which asset

is denominated

(b) Foreign currency exchange rate used to

convert to U.S. dollars

(c) Source of exchange rate used if not from

U.S. Treasury Financial Management Service

7

If asset reported on line 1 is stock of a foreign entity or an interest in a foreign entity, enter the following information for the asset.

a

Name of foreign entity

b Reserved

cType of foreign entity(1)Partnership(2)Corporation(3)

Trust(4)Estate

dMailing address of foreign entity. Number, street, and room or suite no.

e

City or town, state or province, and country (including postal code)

8

If asset reported on line 1 is not stock of a foreign entity or an interest in a foreign entity, enter the following information for the

asset.

a

Name of issuer or counterparty

Check if information is for

IssuerCounterparty

bType of issuer or counterparty

(1)Individual(2)Partnership(3)Corporation(4)Trust(5)Estate

cCheck if issuer or counterparty is a

U.S. personForeign person

dMailing address of issuer or counterparty. Number, street, and room or suite no.

eCity or town, state or province, and country (including postal code)

Form 8938 (Rev. 12-2014)