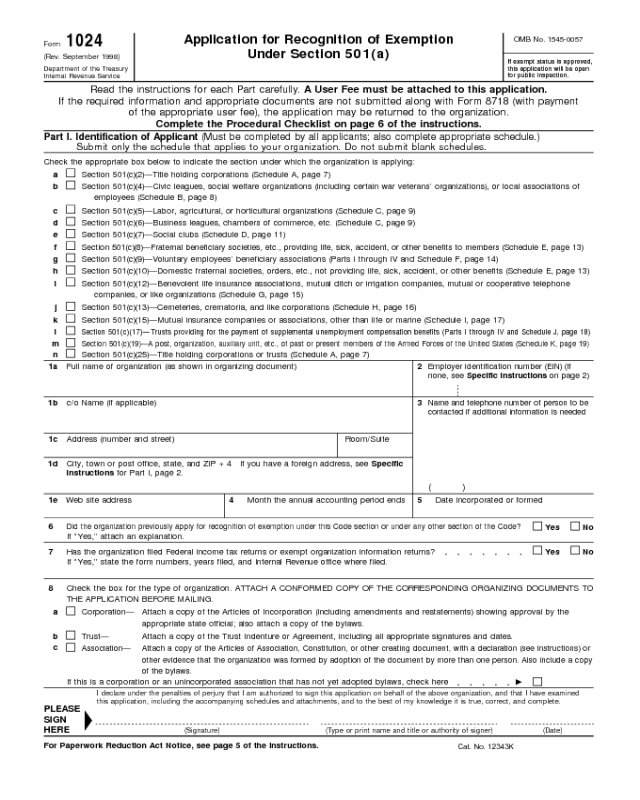

Form 1024

OMB No. 1545-0057

Application for Recognition of Exemption

Under Section 501(a)

Form 1024

If exempt status is approved,

this application will be open

for public inspection.

(Rev. September 1998)

Department of the Treasury

Internal Revenue Service

Read the instructions for each Part carefully. A User Fee must be attached to this application.

If the required information and appropriate documents are not submitted along with Form 8718 (with payment

of the appropriate user fee), the application may be returned to the organization.

Complete the Procedural Checklist on page 6 of the instructions.

Part I. Identification of Applicant (Must be completed by all applicants; also complete appropriate schedule.)

Check the appropriate box below to indicate the section under which the organization is applying:

Section 501(c)(2)—Title holding corporations (Schedule A, page 7)a

Section 501(c)(4)—Civic leagues, social welfare organizations (including certain war veterans’ organizations), or local associations of

employees (Schedule B, page 8)

b

Section 501(c)(5)—Labor, agricultural, or horticultural organizations (Schedule C, page 9)c

Section 501(c)(6)—Business leagues, chambers of commerce, etc. (Schedule C, page 9)d

Section 501(c)(7)—Social clubs (Schedule D, page 11)e

Section 501(c)(8)—Fraternal beneficiary societies, etc., providing life, sick, accident, or other benefits to members (Schedule E, page 13)

f

Section 501(c)(9)—Voluntary employees’ beneficiary associations (Parts I through IV and Schedule F, page 14)g

Section 501(c)(10)—Domestic fraternal societies, orders, etc., not providing life, sick, accident, or other benefits (Schedule E, page 13)h

Section 501(c)(12)—Benevolent life insurance associations, mutual ditch or irrigation companies, mutual or cooperative telephone

companies, or like organizations (Schedule G, page 15)

i

Section 501(c)(13)—Cemeteries, crematoria, and like corporations (Schedule H, page 16)j

Section 501(c)(15)—Mutual insurance companies or associations, other than life or marine (Schedule I, page 17)k

Section 501(c)(17)—Trusts providing for the payment of supplemental unemployment compensation benefits (Parts I through IV and Schedule J, page 18)

l

Section 501(c)(19)—A post, organization, auxiliary unit, etc., of past or present members of the Armed Forces of the United States (Schedule K, page 19)

m

n Section 501(c)(25)—Title holding corporations or trusts (Schedule A, page 7)

2

Employer identification number (EIN) (if

none, see Specific Instructions on page 2)

Full name of organization (as shown in organizing document)1a

1b c/o Name (if applicable)

Address (number and street)1c

City, town or post office, state, and ZIP + 4 If you have a foreign address, see Specific

Instructions for Part I, page 2.

1d

Date incorporated or formed5Month the annual accounting period ends4

Did the organization previously apply for recognition of exemption under this Code section or under any other section of the Code?

6

NoYes

If “Yes,” attach an explanation.

Has the organization filed Federal income tax returns or exempt organization information returns?7 NoYes

If “Yes,” state the form numbers, years filed, and Internal Revenue office where filed.

Check the box for the type of organization. ATTACH A CONFORMED COPY OF THE CORRESPONDING ORGANIZING DOCUMENTS TO

THE APPLICATION BEFORE MAILING.

8

Corporation—a

Trust—b

Association—

c

If this is a corporation or an unincorporated association that has not yet adopted bylaws, check here

©

I declare under the penalties of perjury that I am authorized to sign this application on behalf of the above organization, and that I have examined

this application, including the accompanying schedules and attachments, and to the best of my knowledge it is true, correct, and complete.

PLEASE

SIGN

HERE

©

(Date)(Type or print name and title or authority of signer)(Signature)

Submit only the schedule that applies to your organization. Do not submit blank schedules.

3

Name and telephone number of person to be

contacted if additional information is needed

Attach a copy of the Articles of Incorporation (including amendments and restatements) showing approval by the

appropriate state official; also attach a copy of the bylaws.

Attach a copy of the Trust Indenture or Agreement, including all appropriate signatures and dates.

Attach a copy of the Articles of Association, Constitution, or other creating document, with a declaration (see instructions) or

other evidence that the organization was formed by adoption of the document by more than one person. Also include a copy

of the bylaws.

()

Room/Suite

For Paperwork Reduction Act Notice, see page 5 of the instructions.

1e Web site address

Cat. No. 12343K

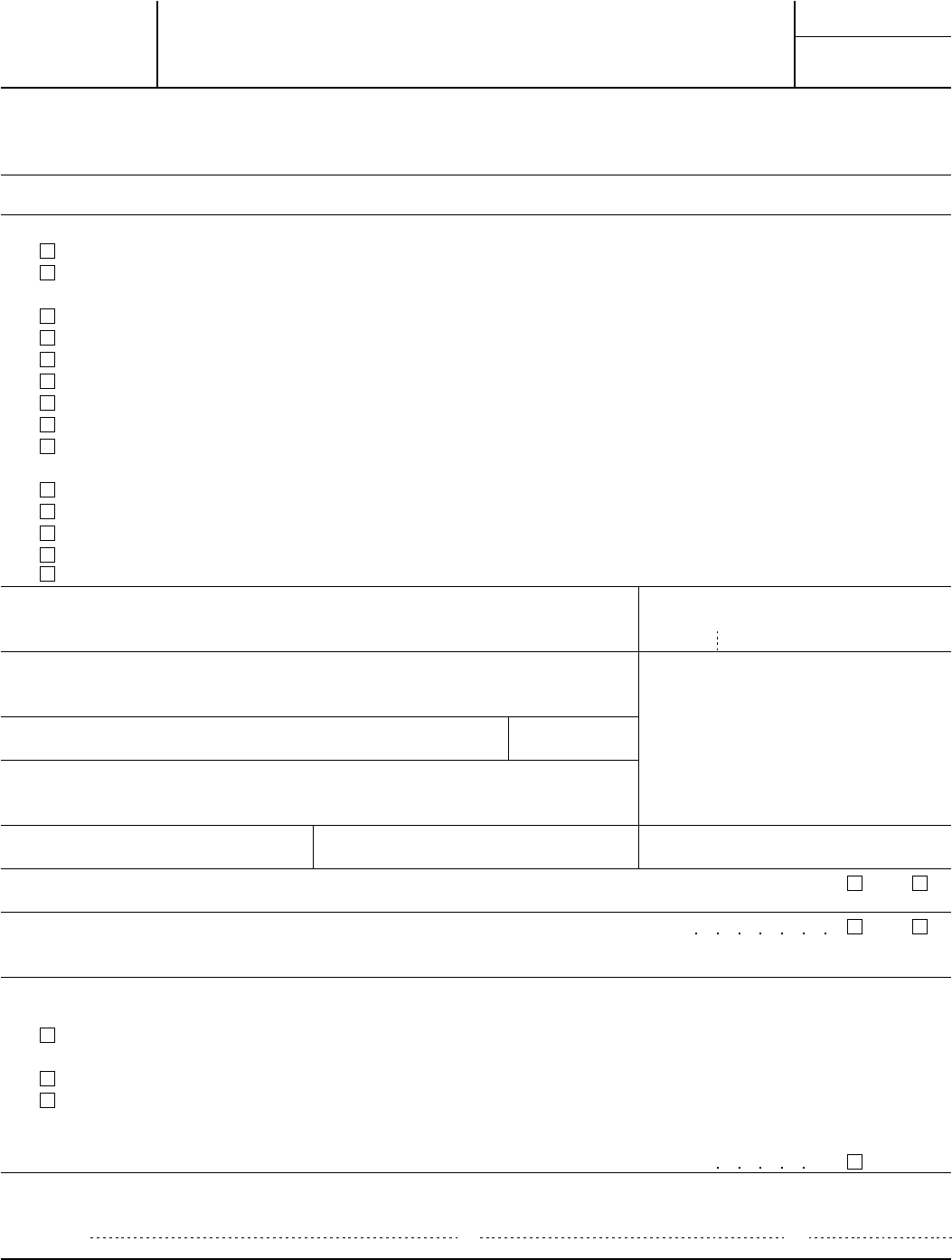

Form 1024 (Rev. 9-98) Page 2

Part II. Activities and Operational Information (Must be completed by all applicants)

Provide a detailed narrative description of all the activities of the organization—past, present, and planned. Do not merely refer to or

repeat the language in the organizational document. List each activity separately in the order of importance based on the relative time and

other resources devoted to the activity. Indicate the percentage of time for each activity. Each description should include, as a minimum,

the following: (a) a detailed description of the activity including its purpose and how each activity furthers your exempt purpose; (b) when

the activity was or will be initiated; and (c) where and by whom the activity will be conducted.

1

List the organization’s present and future sources of financial support, beginning with the largest source first.2

Form 1024 (Rev. 9-98) Page 3

Part II. Activities and Operational Information (continued)

Give the following information about the organization’s governing body:3

Annual compensationbNames, addresses, and titles of officers, directors, trustees, etc.a

If the organization is the outgrowth or continuation of any form of predecessor, state the name of each predecessor, the period during

which it was in existence, and the reasons for its termination. Submit copies of all papers by which any transfer of assets was effected.

4

If the applicant organization is now, or plans to be, connected in any way with any other organization, describe the other organization and

explain the relationship (e.g., financial support on a continuing basis; shared facilities or employees; same officers, directors, or trustees).

5

If the organization has capital stock issued and outstanding, state: (1) class or classes of the stock; (2) number and par value of the

shares; (3) consideration for which they were issued; and (4) if any dividends have been paid or whether your organization’s creating in-

strument authorizes dividend payments on any class of capital stock.

6

State the qualifications necessary for membership in the organization; the classes of membership (with the number of members in each

class); and the voting rights and privileges received. If any group or class of persons is required to join, describe the requirement and

explain the relationship between those members and members who join voluntarily. Submit copies of any membership solicitation material.

Attach sample copies of all types of membership certificates issued.

7

Explain how your organization’s assets will be distributed on dissolution.8

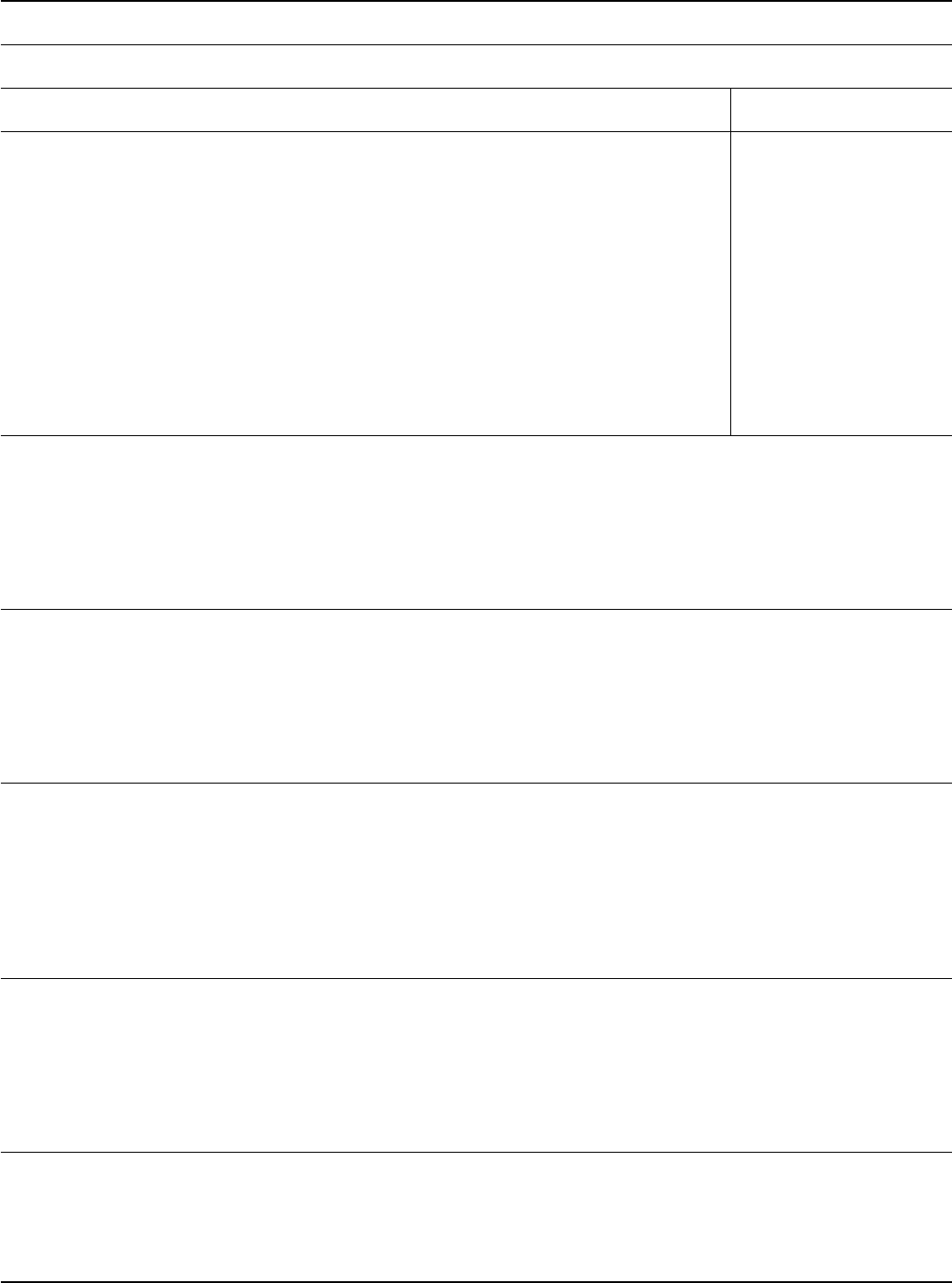

Page 4Form 1024 (Rev. 9-98)

Part II. Activities and Operational Information (continued)

9 Has the organization made or does it plan to make any distribution of its property or surplus funds to shareholders or

members?

NoYes

If “Yes,” state the full details, including: (1) amounts or value; (2) source of funds or property distributed or to be

distributed; and (3) basis of, and authority for, distribution or planned distribution.

Does, or will, any part of your organization’s receipts represent payments for services performed or to be performed?10

If “Yes,” state in detail the amount received and the character of the services performed or to be performed.

Has the organization made, or does it plan to make, any payments to members or shareholders for services performed

or to be performed?

11

If “Yes,” state in detail the amount paid, the character of the services, and to whom the payments have been, or will

be, made.

Does the organization have any arrangement to provide insurance for members, their dependents, or others (including

provisions for the payment of sick or death benefits, pensions, or annuities)?

12

If “Yes,” describe and explain the arrangement’s eligibility rules and attach a sample copy of each plan document and

each type of policy issued.

Is the organization under the supervisory jurisdiction of any public regulatory body, such as a social welfare agency,

etc.?

13

If “Yes,” submit copies of all administrative opinions or court decisions regarding this supervision, as well as copies of

applications or requests for the opinions or decisions.

Does the organization now lease or does it plan to lease any property?14

If “Yes,” explain in detail. Include the amount of rent, a description of the property, and any relationship between the

applicant organization and the other party. Also, attach a copy of any rental or lease agreement. (If the organization is

a party, as a lessor, to multiple leases of rental real property under similar lease agreements, please attach a single

representative copy of the leases.)

Has the organization spent or does it plan to spend any money attempting to influence the selection, nomination, election,

or appointment of any person to any Federal, state, or local public office or to an office in a political organization?

15

If “Yes,” explain in detail and list the amounts spent or to be spent in each case.

16 Does the organization publish pamphlets, brochures, newsletters, journals, or similar printed material?

If “Yes,” attach a recent copy of each.

NoYes

NoYes

NoYes

NoYes

NoYes

NoYes

NoYes

Page 5Form 1024 (Rev. 9-98)

Part III. Financial Data (Must be completed by all applicants)

Complete the financial statements for the current year and for each of the 3 years immediately before it. If in existence less than 4 years, complete the

statements for each year in existence. If in existence less than 1 year, also provide proposed budgets for the 2 years following the current year.

A. Statement of Revenue and Expenses

3 Prior Tax Years or Proposed Budget for Next 2 Years

(a) Current Tax Year

Revenue

From

(e) Total(b) (d) To

Gross dues and assessments of members1

Gross contributions, gifts, etc.2

Gross amounts derived from activities related to

the organization’s exempt purpose (attach

schedule) (Include related cost of sales on line 9.)

3

Gross amounts from unrelated business activities (attach schedule)

4

Gain from sale of assets, excluding inventory items

(attach schedule)

5

Investment income (see page 3 of the instructions)6

Other revenue (attach schedule)7

Total revenue (add lines 1 through 7)8

Expenses

Expenses attributable to activities related to the

organization’s exempt purposes

9

Expenses attributable to unrelated business activities

10

Contributions, gifts, grants, and similar amounts

paid (attach schedule)

11

Disbursements to or for the benefit of members (attach schedule)

12

Compensation of officers, directors, and trustees (attach schedule)

13

Other salaries and wages14

Interest15

Occupancy16

Depreciation and depletion17

Other expenses (attach schedule)18

Total expenses (add lines 9 through 18)19

Excess of revenue over expenses (line 8 minus

line 19)

20

B. Balance Sheet (at the end of the period shown)

Current Tax Year

as of

Assets

1

Cash

1

2

Accounts receivable, net

2

3

Inventories

3

4

Bonds and notes receivable (attach schedule)

4

5

Corporate stocks (attach schedule)

5

6

Mortgage loans (attach schedule)

6

7

Other investments (attach schedule)

7

8

Depreciable and depletable assets (attach schedule)

8

9

Land

9

10

Other assets (attach schedule)

10

11

Total assets

11

Liabilities

12

Accounts payable

12

13

Contributions, gifts, grants, etc., payable

13

14

Mortgages and notes payable (attach schedule)

14

15

Other liabilities (attach schedule)

15

16

Total liabilities

16

Fund Balances or Net Assets

17

Total fund balances or net assets

17

Total liabilities and fund balances or net assets (add line 16 and line 17)18

18

If there has been any substantial change in any aspect of the organization’s financial activities since the end of the period shown above,

check the box and attach a detailed explanation

©

(c)

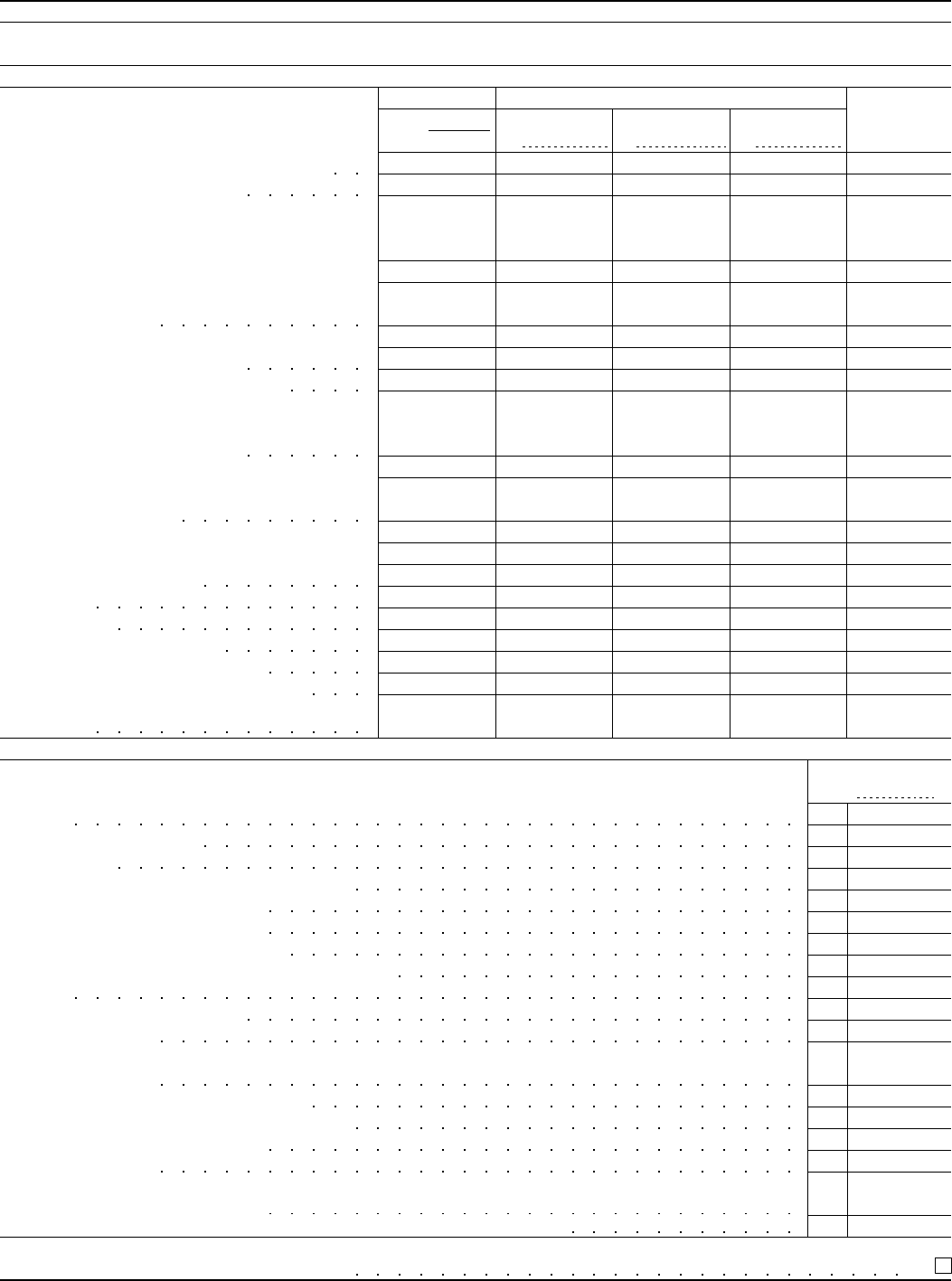

Page 6Form 1024 (Rev. 9-98)

Part IV. Notice Requirements (Sections 501(c)(9) and 501(c)(17) Organizations Only)

1

NoYes

Section 501(c)(9) and 501(c)(17) organizations:

2

If “Yes,” your organization qualifies under Regulation section 301.9100-2 for an automatic 12-month extension

of the 15-month filing requirement. Do not answer questions 3 and 4.

If “No,” answer question 3.

If you answer “No” to question 3, your organization’s qualification as a section 501(c)(9) or 501(c)(17) organization can

be recognized only from the date this application is filed. Therefore, does the organization want us to consider its

application as a request for recognition of exemption as a section 501(c)(9) or 501(c)(17) organization from the date the

application is received and not retroactively to the date the organization was created or formed?

4

NoYes

NoYes

Are you filing Form 1024 within 15 months from the end of the month in which the organization was created or formed

as required by section 505(c)?

If “Yes,” skip the rest of this Part.

If “No,” answer question 2.

If you answer “No” to question 1, are you filing Form 1024 within 27 months from the end of the month in which the

organization was created or formed?

If you answer“No”toquestion 2, does the organization wish to request an extension of time to apply under the“reasonable

action and good faith” and the “no prejudice to the interest of the government” requirements of Regulations section

301.9100-3?

If “Yes,” give the reasons for not filing this application within the 27-month period described in question 2. See Specific

Instructions, Part IV, Line 3, page 4, before completing this item. Do not answer question 4.

3

If “No,” answer question 4.

NoYes

Form 1024 (Rev. 9-98) Page 7

Organizations described in section 501(c)(2) or 501(c)(25) (Title holding corporations or trusts)

State the complete name, address, and EIN of each organization for which title to property is held and the number and type of the

applicant organization’s stock held by each organization.

1

If the annual excess of revenue over expenses has not been or will not be turned over to the organization for which title to property is

held, state the purpose for which the excess is or will be retained by the title holding organization.

2

3

4

Instructions

Line 4.—Indicate if the shareholder is one of the following:

Line 1.—Provide the requested information on each organization for

which the applicant organization holds title to property. Also indicate

the number and types of shares of the applicant organization’s stock

that are held by each.

1. A qualified pension, profit-sharing, or stock bonus plan that

meets the requirements of the Code;

2. A government plan;

Line 2.—For purposes of this question, “excess of revenue over

expenses” is all of the organization’s income for a particular tax year

less operating expenses.

3. An organization described in section 501(c)(3); or

4. An organization described in section 501(c)(25).

Line 3.—Give the exempt purpose of each organization that is the

basis for its exempt status and the Internal Revenue Code section

Schedule A

In the case of a corporation described in section 501(c)(2), state the purpose of the organization for which title to property is held (as

shown in its governing instrument) and the Code sections under which it is classified as exempt from tax. If the organization has received

a determination or ruling letter recognizing it as exempt from taxation, please attach a copy of the letter.

In the case of a corporation or trust described in section 501(c)(25), state the basis whereby each shareholder is described in section

501(c)(25)(C). For each organization described that has received a determination or ruling letter recognizing that organization as exempt

from taxation, please attach a copy of the letter.

With respect to the activities of the organization.

Is any rent received attributable to personal property leased with real property?

Will the organization receive income which is incidentally derived from the holding of real property, such as

income from operation of a parking lot or from vending machines?

Will the organization receive income other than rent from real property or personal property leased with real

property or income which is incidentally derived from the holding of real property?

that describes the organization (as shown in its IRS determination

letter).

5

a

b

c

If “Yes,” what percentage of the total rent, as reported on the financial statements in Part III, is attributable to

personal property?

If “Yes,” what percentage of the organization’s gross income, as reported on the financial statements in Part III, is

incidentally derived from the holding of real property?

If “Yes,” describe the source of the income.

Yes No

Yes No

Yes No

Form 1024 (Rev. 9-98) Page 8

Organizations Described in Section 501(c)(4) (Civic leagues, social welfare organizations

(including posts, councils, etc., of veterans’ organizations not qualifying or applying for

exemption under section 501(c)(19)) or local associations of employees.)

Has the Internal Revenue Service previously issued a ruling or determination letter recognizing the applicant organization

(or any predecessor organization listed in question 4, Part II of the application) to be exempt under section 501(c)(3) and

later revoked that recognition of exemption on the basis that the applicant organization (or its predecessor) was carrying

on propaganda or otherwise attempting to influence legislation or on the basis that it engaged in political activity?

1

Yes No

If “Yes,” indicate the earliest tax year for which recognition of exemption under section 501(c)(3) was revoked and the

IRS district office that issued the revocation.

Does the organization perform or plan to perform (for members, shareholders, or others) services, such as maintaining

the common areas of a condominium; buying food or other items on a cooperative basis; or providing recreational facilities

or transportation services, job placement, or other similar undertakings?

2

If “Yes,” explain the activities in detail, including income realized and expenses incurred. Also, explain in detail the nature

of the benefits to the general public from these activities. (If the answer to this question is explained in Part II of the

application (pages 2, 3, and 4), enter the page and item number here.)

If the organization is claiming exemption as a homeowners’ association, is access to any property or facilities it owns

or maintains restricted in any way?

3

If “Yes,” explain.

If the organization is claiming exemption as a local association of employees, state the name and address of each employer whose employees

are eligible for membership in the association. If employees of more than one plant or office of the same employer are eligible for membership,

give the address of each plant or office.

4

Yes No

Yes No

Schedule B

Form 1024 (Rev. 9-98) Page 9

Organizations described in section 501(c)(5) (Labor, agricultural, including fishermen’s

organizations, or horticultural organizations) or section 501(c)(6) (business leagues, chambers

of commerce, etc.)

Describe any services the organization performs for members or others. (If the description of the services is

contained in Part II of the application, enter the page and item number here.)

1

Fishermen’s organizations only.—What kinds of aquatic resources (not including mineral) are cultivated or harvested

by those eligible for membership in the organization?

2

NoYesLabor organizations only.—Is the organization organized under the terms of a collective bargaining agreement?3

If “Yes,” attach a copy of the latest agreement.

Schedule C

Page 11Form 1024 (Rev. 9-98)

Organizations described in section 501(c)(7) (Social clubs)

Has the organization entered or does it plan to enter into any contract or agreement for the management or operation

of its property and/or activities, such as restaurants, pro shops, lodges, etc.?

1

Yes No

If “Yes,” attach a copy of the contract or agreement. If one has not yet been drawn up, please explain the organization’s

plans.

Does the organization seek or plan to seek public patronage of its facilities or activities by advertisement or otherwise?2

If “Yes,” attach sample copies of the advertisements or other requests.

If the organization plans to seek public patronage, please explain the plans.

3a Are nonmembers, other than guests of members, permitted or will they be permitted to use the club facilities or participate

in or attend any functions or activities conducted by the organization?

If “Yes,” describe the functions or activities in which there has been or will be nonmember participation or admittance.

(Submit a copy of the house rules, if any.)

State the amount of nonmember income included in Part III of the application, lines 3 and 4, column (a)

b

%

Enter the percent of gross receipts from nonmembers for the use of club facilities

c

d Enter the percent of gross receipts received from investment income and nonmember use of the club’s facilities

%

Does the organization’s charter, bylaws, other governing instrument, or any written policy statement of the organization

contain any provision that provides for discrimination against any person on the basis of race, color, or religion?

4a

b If “Yes,” state whether or not its provision will be kept.

c If the organization has such a provision that will be repealed, deleted, or otherwise stricken from its requirements, state

when this will be done

If the organization formerly had such a requirement and it no longer applies, give the date it ceased to applyd

If the organization restricts its membership to members of a particular religion, check here and attach the explanation

specified in the instructions

e

See reverse side for instructions

Yes No

Yes No

Yes No

Schedule D

Form 1024 (Rev. 9-98) Page 12

Instructions

b. Limits its membership to members of a particular

religion; or

Line 1.—Answer “Yes,” if any of the organization’s

property or activities will be managed by another

organization or company.

2. A club that, in good faith, limits its membership to

the members of a particular religion in order to further

the teachings or principles of that religion and not to

exclude individuals of a particular race or color.

Lines 3b, c, and d.—Enter the figures for the current

year. On an attached schedule, fur nish the same

infor mation for each of the prior tax years for which

you completed Part III of the application.

Line 4e.—If the organization restricts its membership

to members of a particular religion, the organization

must be:

If you checked 4e, your explanation must show how

the organization meets one of these two requirements.

1. An auxiliary of a fraternal beneficiary society that:

a. Is described in section 501(c)(8) and exempt from

tax under section 501(a), and