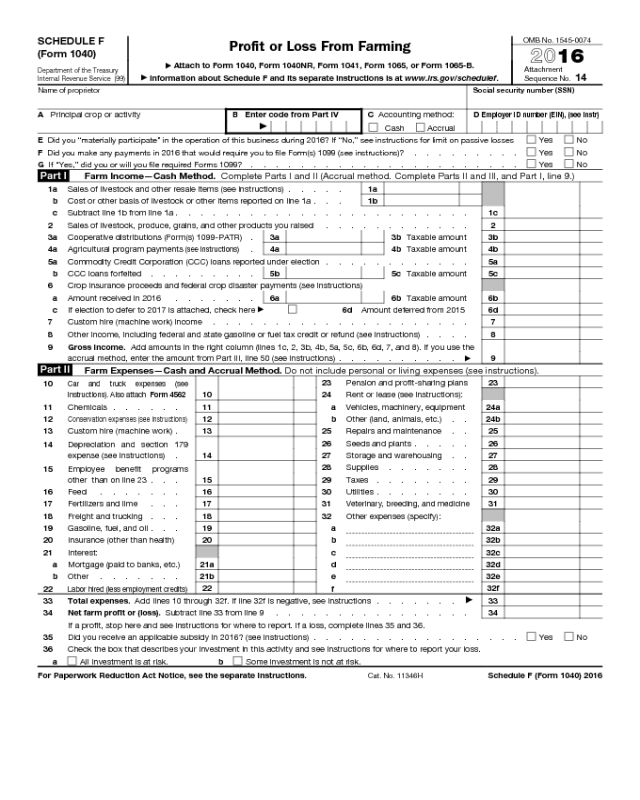

Form 1040 Schedule F

SCHEDULE F

(Form 1040)

Department of the Treasury

Internal Revenue Service (99)

Profit or Loss From Farming

▶

Attach to Form 1040, Form 1040NR, Form 1041, Form 1065, or Form 1065-B.

▶

Information about Schedule F and its separate instructions is at www.irs.gov/schedulef.

OMB No. 1545-0074

2016

Attachment

Sequence No. 14

Name of proprietor Social security number (SSN)

A Principal crop or activity B Enter code from Part IV

▶

C Accounting method:

Cash Accrual

D

Employer ID number (EIN), (see instr)

E Did you “materially participate” in the operation of this business during 2016? If “No,” see instructions for limit on passive losses Yes No

F

Did you make any payments in 2016 that would require you to file Form(s) 1099 (see instructions)? . . . . . . . . . Yes No

G

If “Yes,” did you or will you file required Forms 1099? . . . . . . . . . . . . . . . . . . . . . . Yes No

Part I

Farm Income—Cash Method. Complete Parts I and II (Accrual method. Complete Parts II and III, and Part I, line 9.)

1a Sales of livestock and other resale items (see instructions) . . . . . 1a

b Cost or other basis of livestock or other items reported on line 1a . . .

1b

c Subtract line 1b from line 1a . . . . . . . . . . . . . . . . . . . . . . . . 1c

2 Sales of livestock, produce, grains, and other products you raised . . . . . . . . . . . . 2

3a Cooperative distributions (Form(s) 1099-PATR) . 3a 3b Taxable amount 3b

4a Agricultural program payments

(see instructions)

. 4a 4b Taxable amount 4b

5a Commodity Credit Corporation (CCC) loans reported under election . . . . . . . . . . . . 5a

b CCC loans forfeited . . . . . . . . . 5b 5c Taxable amount 5c

6 Crop insurance proceeds and federal crop disaster payments (see instructions)

a Amount received in 2016 . . . . . . . 6a 6b Taxable amount 6b

c If election to defer to 2017 is attached, check here

▶

6d Amount deferred from 2015 6d

7 Custom hire (machine work) income . . . . . . . . . . . . . . . . . . . . . 7

8 Other income, including federal and state gasoline or fuel tax credit or refund

(see instructions) . . . . 8

9

Gross income. Add amounts in the right column (lines 1c, 2, 3b, 4b, 5a, 5c, 6b, 6d, 7, and 8). If you use the

accrual method, enter the amount from Part III, line 50 (see instructions) . . . . . . . . . .

▶

9

Part II

Farm Expenses—Cash and Accrual Method. Do not include personal or living expenses (see instructions).

10

Car and truck expenses (see

instructions). Also attach Form 4562

10

11 Chemicals . . . . . . 11

12

Conservation expenses (see instructions)

12

13 Custom hire (machine work) . 13

14

Depreciation and section 179

expense (see instructions) . 14

15

Employee benefit programs

other than on line 23 . . . 15

16 Feed . . . . . . . 16

17 Fertilizers and lime . . . 17

18 Freight and trucking . . . 18

19 Gasoline, fuel, and oil . . . 19

20 Insurance (other than health) 20

21 Interest:

a Mortgage (paid to banks, etc.) 21a

b Other . . . . . . . 21b

22

Labor hired (less employment credits)

22

23 Pension and profit-sharing plans 23

24 Rent or lease (see instructions):

a Vehicles, machinery, equipment 24a

b Other (land, animals, etc.) . . 24b

25 Repairs and maintenance . . 25

26 Seeds and plants . . . . . 26

27 Storage and warehousing . . 27

28 Supplies . . . . . . . 28

29 Taxes . . . . . . . . 29

30 Utilities . . . . . . . . 30

31

Veterinary, breeding, and medicine

31

32 Other expenses (specify):

a 32a

b 32b

c 32c

d 32d

e 32e

f

32f

33 Total expenses. Add lines 10 through 32f. If line 32f is negative, see instructions . . . . . . .

▶

33

34

Net farm profit or (loss). Subtract line 33 from line 9 . . . . . . . . . . . . . . . .

If a profit, stop here and see instructions for where to report. If a loss, complete lines 35 and 36.

34

35 Did you receive an applicable subsidy in 2016? (see instructions) . . . . . . . . . . . . . . . . . Yes No

36 Check the box that describes your investment in this activity and see instructions for where to report your loss.

a

All investment is at risk. b Some investment is not at risk.

For Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 11346H

Schedule F (Form 1040) 2016

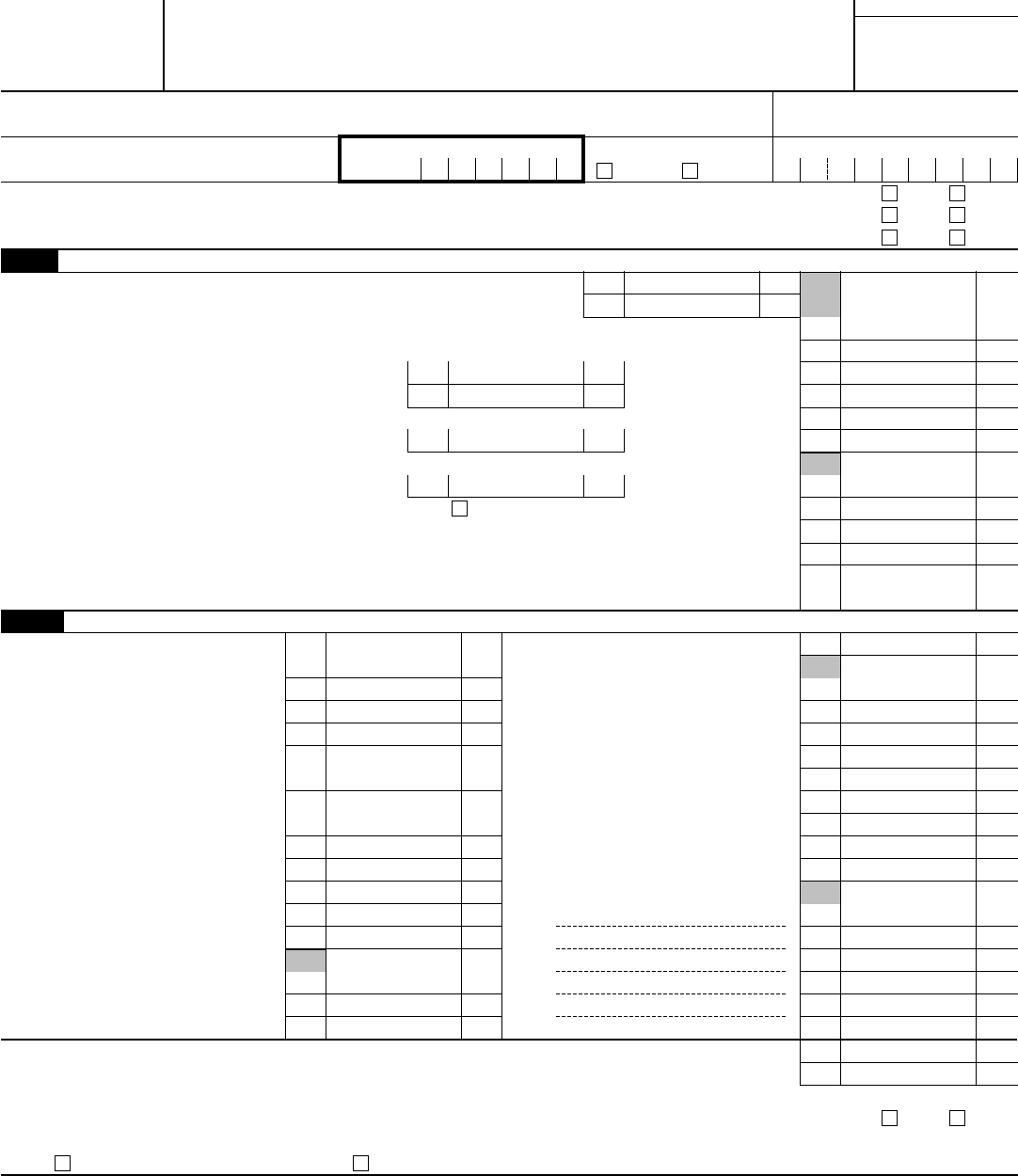

Schedule F (Form 1040) 2016

Page 2

Part III Farm Income—Accrual Method (see instructions).

37

Sales of livestock, produce, grains, and other products (see instructions) . . . . . . . . . . .

37

38a Cooperative distributions (Form(s) 1099-PATR) . 38a 38bTaxable amount 38b

39a Agricultural program payments . . . . . . 39a 39bTaxable amount

39b

40 Commodity Credit Corporation (CCC) loans:

a CCC loans reported under election . . . . . . . . . . . . . . . . . . . . . .

40a

b CCC loans forfeited . . . . . . . . . 40b 40cTaxable amount 40c

41 Crop insurance proceeds . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Custom hire (machine work) income . . . . . . . . . . . . . . . . . . . . .

42

43 Other income (see instructions) . . . . . . . . . . . . . . . . . . . . . . .

43

44 Add amounts in the right column for lines 37 through 43 (lines 37, 38b, 39b, 40a, 40c, 41, 42, and 43) . . 44

45

Inventory of livestock, produce, grains, and other products at beginning of

the year. Do not include sales reported on Form 4797 . . . . . . .

45

46

Cost of livestock, produce, grains, and other products purchased during the

year . . . . . . . . . . . . . . . . . . . . . .

46

47 Add lines 45 and 46 . . . . . . . . . . . . . . . . . 47

48 Inventory of livestock, produce, grains, and other products at end of year .

48

49 Cost of livestock, produce, grains, and other products sold. Subtract line 48 from line 47* . . . . .

49

50 Gross income. Subtract line 49 from line 44. Enter the result here and on Part I, line 9 . . . . .

▶

50

*If you use the unit-livestock-price method or the farm-price method of valuing inventory and the amount on line 48 is larger than the amount on line

47, subtract line 47 from line 48. Enter the result on line 49. Add lines 44 and 49. Enter the total on line 50 and on Part I, line 9.

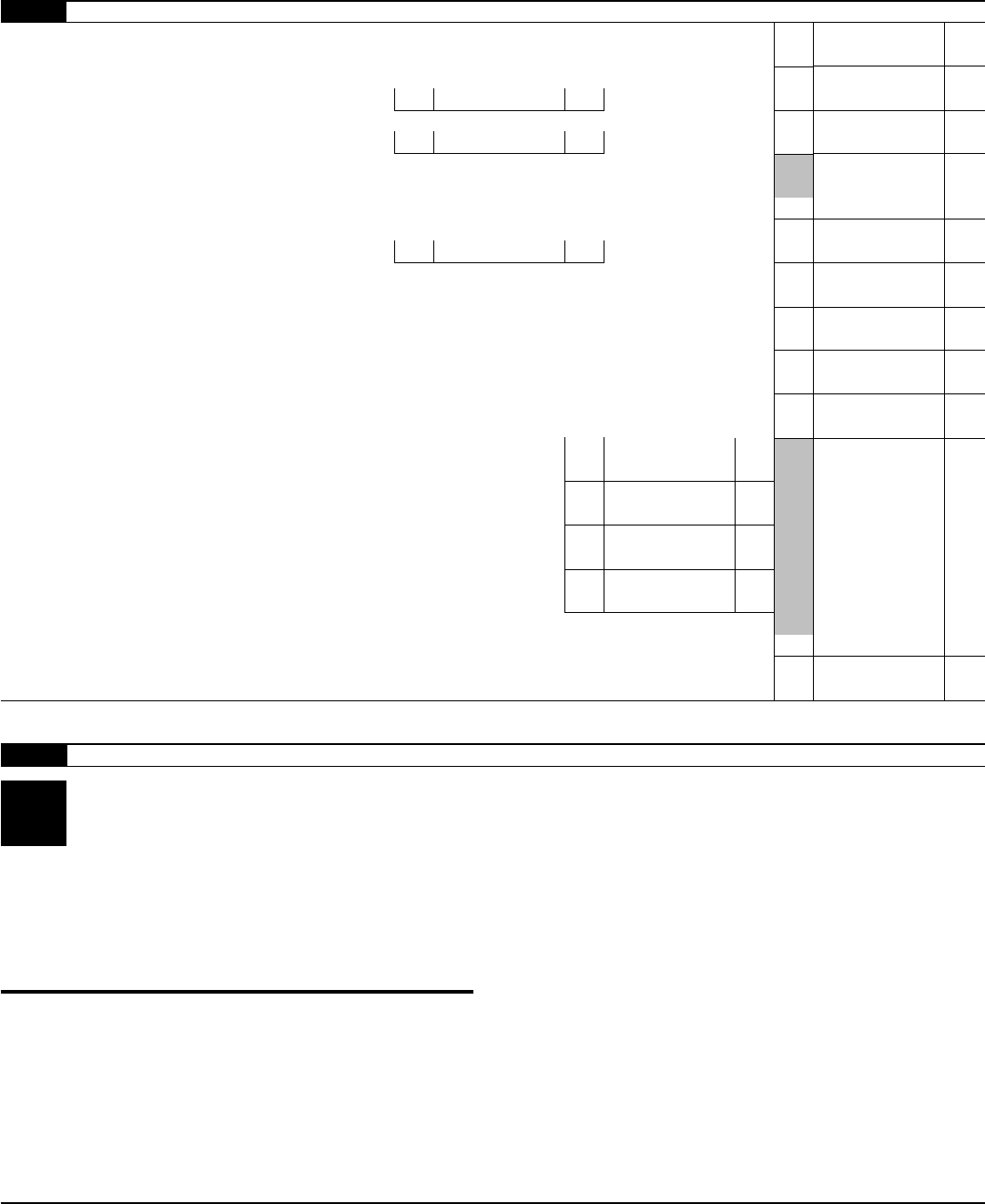

Part IV Principal Agricultural Activity Codes

▲

!

CAUTION

Do not file Schedule F (Form 1040) to report the

following.

• Income from providing agricultural services such as

soil preparation, veterinary, farm labor, horticultural, or

management for a fee or on a contract basis. Instead file

Schedule C (Form 1040) or Schedule C-EZ (Form 1040).

• Income from breeding, raising, or caring for dogs, cats, or

other pet animals. Instead file Schedule C (Form 1040) or

Schedule C-EZ (Form 1040).

• Sales of livestock held for draft, breeding, sport, or dairy

purposes. Instead file Form 4797.

These codes for the Principal Agricultural Activity classify

farms by their primary activity to facilitate the administration of

the Internal Revenue Code. These six-digit codes are based on

the North American Industry Classification System (NAICS).

Select the code that best identifies your primary farming

activity and enter the six-digit number on line B.

Crop Production

111100 Oilseed and grain farming

111210 Vegetable and melon farming

111300 Fruit and tree nut farming

111400 Greenhouse, nursery, and floriculture production

111900 Other crop farming

Animal Production

112111 Beef cattle ranching and farming

112112 Cattle feedlots

112120 Dairy cattle and milk production

112210 Hog and pig farming

112300 Poultry and egg production

112400 Sheep and goat farming

112510 Aquaculture

112900 Other animal production

Forestry and Logging

113000 Forestry and logging (including forest nurseries and

timber tracts)

Schedule F (Form 1040) 2016