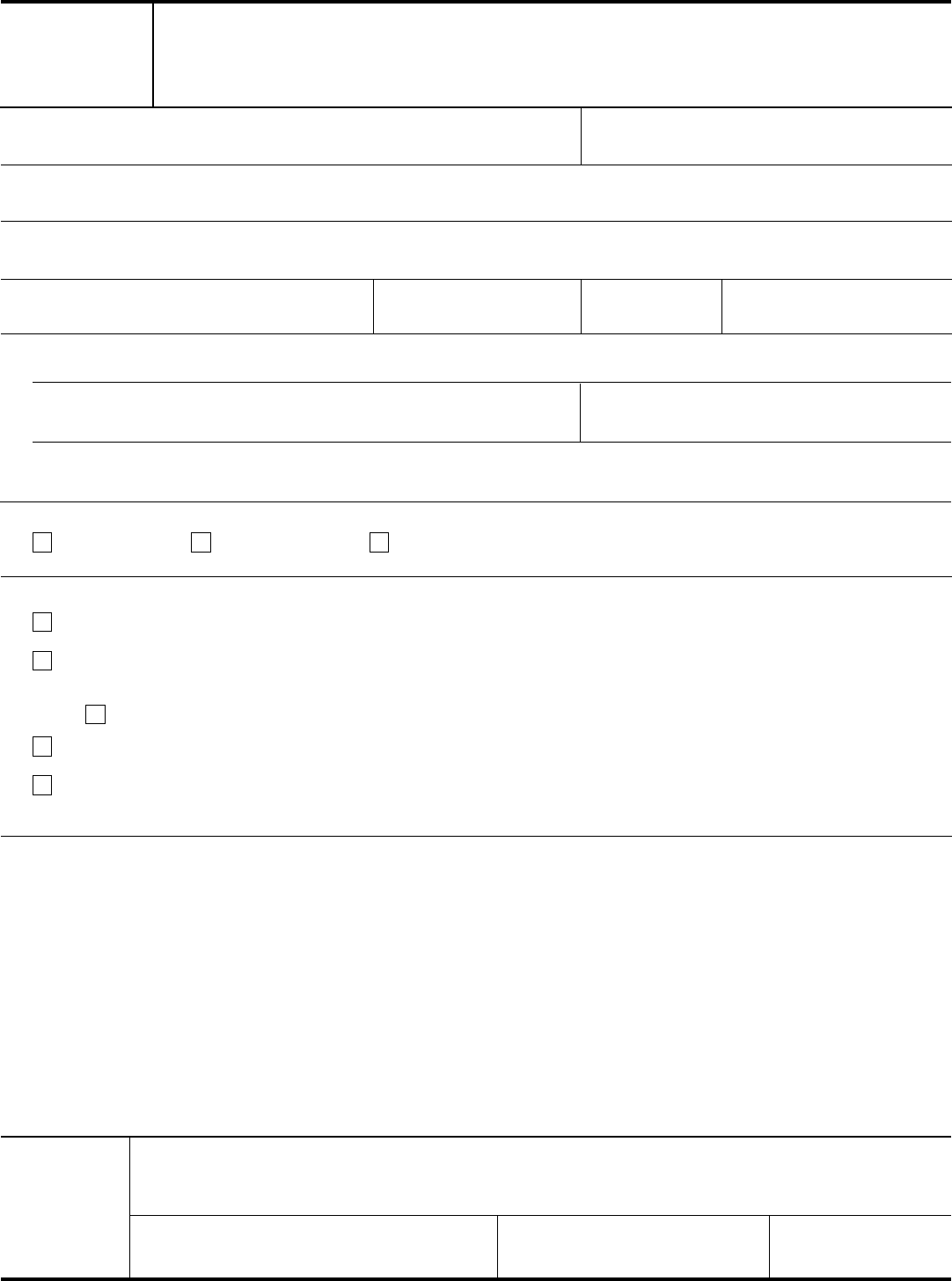

Form 12277

Form 12277

(October 2011)

Department of the Treasury — Internal Revenue Service

Application for Withdrawal of Filed

Form 668(Y), Notice of Federal Tax Lien

(Internal Revenue Code Section 6323(j))

1. Taxpayer Name

(as shown on the Notice of Federal Tax Lien) 2. Social Security/Employer Identification No.

3. Taxpayer's Representative, if applicable, or Name and Title of contact person, if taxpayer is a business

4. Address

(Number, Street, P.O. Box)

5. City 6. State 7. ZIP code 8. Phone Number

9. Attach copy of the Form 668(Y), Notice of Federal Tax Lien, if available, OR, if you don't have a copy, provide the

following information, if available:

Serial number of Form 668(Y)

(found near the top of the document) Date Form 668(Y) filed

Recording office where Form 668(Y) was filed

10. Current status of the federal tax lien

("x" appropriate box)

Open Released Unknown

11. Reason for requesting withdrawal of the filed Notice of Federal Tax Lien

("x" appropriate box(es))

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The taxpayer entered into an installment agreement to satisfy the liability for which the lien was imposed

and the agreement did not provide for a Notice of Federal Tax Lien to be filed.

The taxpayer is under a Direct Debit Installment Agreement.

Withdrawal will facilitate collection of the tax.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the

best interest of the taxpayer and the government.

12. Explain the basis for the withdrawal request

(attach additional sheets and other documentation that substantiates your

request, as needed)

Affirmation

Under penalties of perjury, I declare that I have examined this application (including any accompanying

schedules, exhibits, affidavits, and statements) and, to the best of my knowledge and belief, it is true,

correct, and complete

Signature (Taxpayer or Representative)

Title (if business) Date

Catalog Number 27939C

www.irs.gov

Form

12277 (Rev. 10-2011)

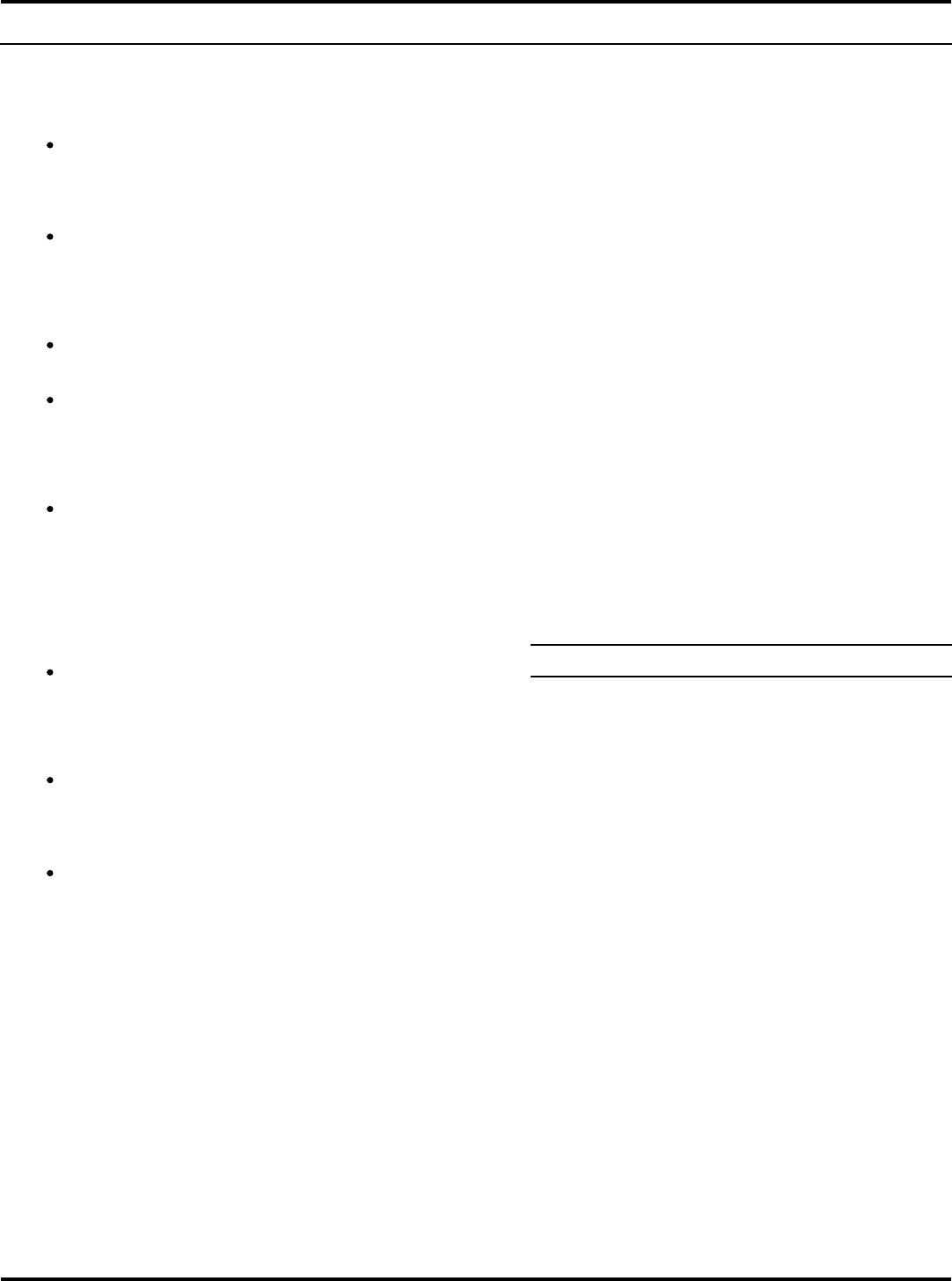

Page 2 of 2

General Instructions

1.

Complete the application. If the information you supply is

not complete, it may be necessary for the IRS to obtain

additional information before making a determination on the

application.

Sections 1 and 2: Enter the taxpayer's name and

Social Security Number (SSN) or Employer

Identification Number (EIN) as shown on the Notice of

Federal Tax Lien (NFTL).

Section 3: Enter the name of the person completing

the application if it differs from the taxpayer's name in

section 1 (for example, taxpayer representative). For

business taxpayers, enter the name and title of person

making the application. Otherwise, leave blank.

Sections 4 through 8: Enter current contact information

of taxpayer or representative.

Section 9: Attach a copy of the NFTL to be withdrawn,

if available. If you don't have a copy of the NFTL but

have other information about the NFTL, enter that

information to assist the IRS in processing your

request.

Section 10: Check the box that indicates the current

status of the lien.

"Open" means there is still a balance owed with

respect to the tax liabilities listed on the NFTL.

"Released" means the lien has been satisfied or is no

longer enforceable.

"Unknown" means you do not know the current status

of the lien.

Section 11: Check the box(es) that best describe the

reason(s) for the withdrawal request. NOTE: If you are

requesting a withdrawal of a released NFTL, you

generally should check the last box regarding the best

interest provision.

Section 12: Provide a detailed explanation of the

events or the situation to support your reason(s) for the

withdrawal request. Attach additional sheets and

supporting documentation, as needed.

Affirmation: Sign and date the application. If you are

completing the application for a business taxpayer,

enter your title in the business.

2.

Mail your application to the IRS office assigned your

account. If the account is not assigned or you are

uncertain where it is assigned, mail your application to IRS,

ATTN: Advisory Group Manager, in the area where you live

or is the taxpayer's principal place of business. Use

Publication 4235, Advisory Group Addresses, to determine

the appropriate office.

3.

Your application will be reviewed and, if needed, you may

be asked to provide additional information. You will be

contacted regarding a determination on your application.

a. If a determination is made to withdraw the NFTL, we

will file a Form 10916(c), Withdrawal of Filed Notice of

Federal Tax Lien, in the recording office where the

original NFTL was filed and provide you a copy of the

document for your records.

b. If the determination is made to not withdraw the

NFTL, we will notify you and provide information

regarding your rights to appeal the decision.

4.

At your request, we will notify other interested parties

of the withdrawal notice. Your request must be in

writing and provide the names and addresses of the

credit reporting agencies, financial institutions, and/or

creditors that you want notified.

NOTE: Your request serves as our authority to release the

notice of withdrawal information to the agencies, financial

institutions, or creditors you have identified.

5.

If, at a later date, additional copies of the withdrawal notice

are needed, you must provide a written request to the

Advisory Group Manager. The request must provide:

a. The taxpayer's name, current address, and taxpayer

identification number with a brief statement

authorizing the additional notifications;.

b. A copy of the notice of withdrawal, if available; and

c. A supplemental list of the names and addresses of

any credit reporting agencies, financial institutions, or

creditors to notify of the withdrawal of the filed Form

668(Y).

.

Privacy Act Notice

We ask for the information on this form to carry out the

Internal Revenue laws of the United States. The primary

purpose of this form is to apply for withdrawal of a notice of

federal tax lien. The information requested on this form is

needed to process your application and to determine

whether the notice of federal tax lien can be withdrawn.

You are not required to apply for a withdrawal; however, if

you want the notice of federal tax lien to be withdrawn, you

are required to provide the information requested on this

form. Sections 6001, 6011, and 6323 of the Internal

Revenue Code authorize us to collect this information.

Section 6109 requires you to provide the requested

identification numbers. Failure to provide this information

may delay or prevent processing your application; providing

false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the

Department of Justice for civil and criminal litigation, and to

cities, states, the District of Columbia, and U.S.

commonwealths and possessions for use in administering

their tax laws. We may also disclose this information to

other countries under a tax treaty, to federal and state

agencies to enforce federal nontax criminal laws, or to

federal law enforcement and intelligence agencies to

combat terrorism.

Catalog Number 27939C

www.irs.gov

Form

12277 (Rev. 10-2011)