Fillable Printable Loan Estimate Form Template

Fillable Printable Loan Estimate Form Template

Loan Estimate Form Template

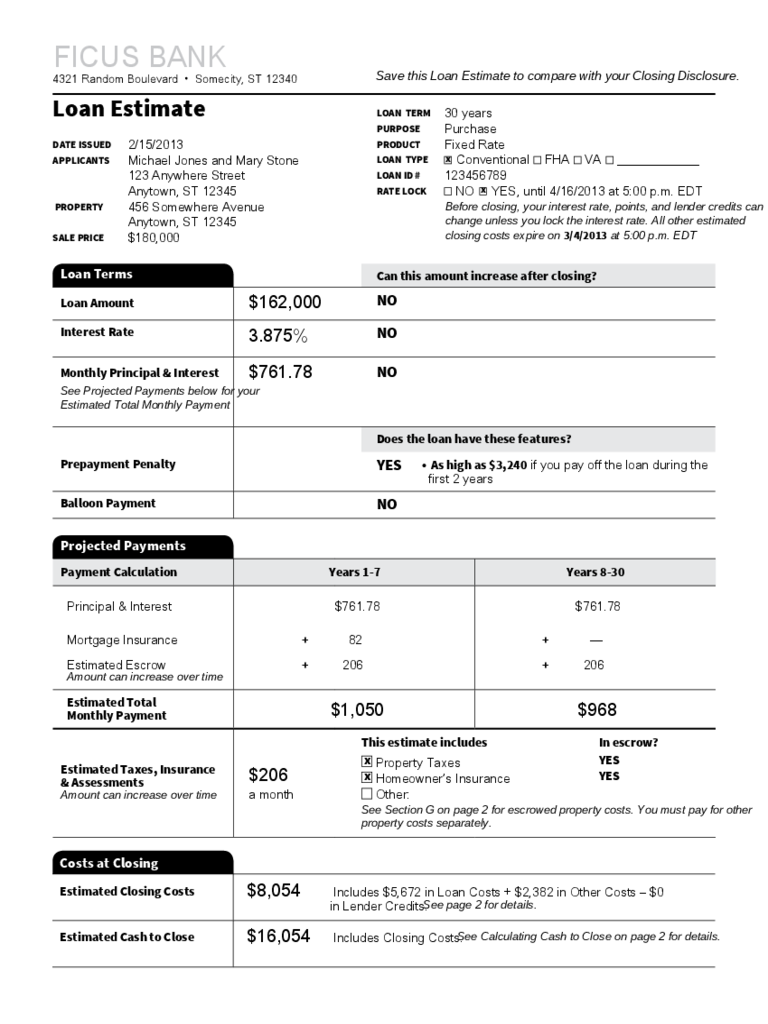

Loan Terms

Can this amount increase after closing?

Loan Amount

$162,000

NO

Interest Rate

3.875%

NO

Monthly Principal & Interest

See Projected Payments below for your

Estimated Total Monthly Payment

$761.78

NO

Does the loan have these features?

Prepayment Penalty

YES

• As high as $3,240 if you pay off the loan during the

first 2 years

Balloon Payment

NO

DATE ISSUED

2/15/2013

APPLICANTS

Michael Jones and Mary Stone

123 Anywhere Street

Anytown, ST 12345

PROPERTY

456 Somewhere Avenue

Anytown, ST 12345

SALE PRICE

$180,000

LOAN TERM

30 years

PURPOSE

Purchase ce

PRODUCT

Fixed Rate

LOAN TYPE

x

Conventional FHA VA _____________

LOAN ID #

1234567891330172608

RATE LOCK

NO

x

YES, until 4/16/2013 at 5:00 p.m. EDT

FICUS BANK

4321 Random Boulevard • Somecity, ST 12340

Loan Estimate

Projected Payments

Payment Calculation Years 1-7 Years 8-30

Principal & Interest

Mortgage Insurance

Estimated Escrow

Amount can increase over time

$761.78

+ 82

+ 206

$761.78

+ —

+ 206

Estimated Total

Monthly Payment

$1,050 $968

Estimated Taxes, Insurance

& Assessments

Amount can increase over time

$206

a month

Before closing, your interest rate, points, and lender credits can

change unless you lock the interest rate. All other estimated

closing costs expire on 3/4/2013 at 5:00 p.m. EDT

Save this Loan Estimate to compare with your Closing Disclosure.

See Section G on page 2 for escrowed property costs. You must pay for other

property costs separately.

This estimate includes In escrow?

x

Property Taxes

YES

x

Homeowner’s Insurance

YES

Other:

Costs at Closing

Estimated Closing Costs

$8,054 Includes $5,672 in Loan Costs + $2,382 in Other Costs – $0

in Lender Credits.

See page 2 for details.

Estimated Cash to Close

$16,054 Includes Closing Costs.

See Calculating Cash to Close on page 2 for details.

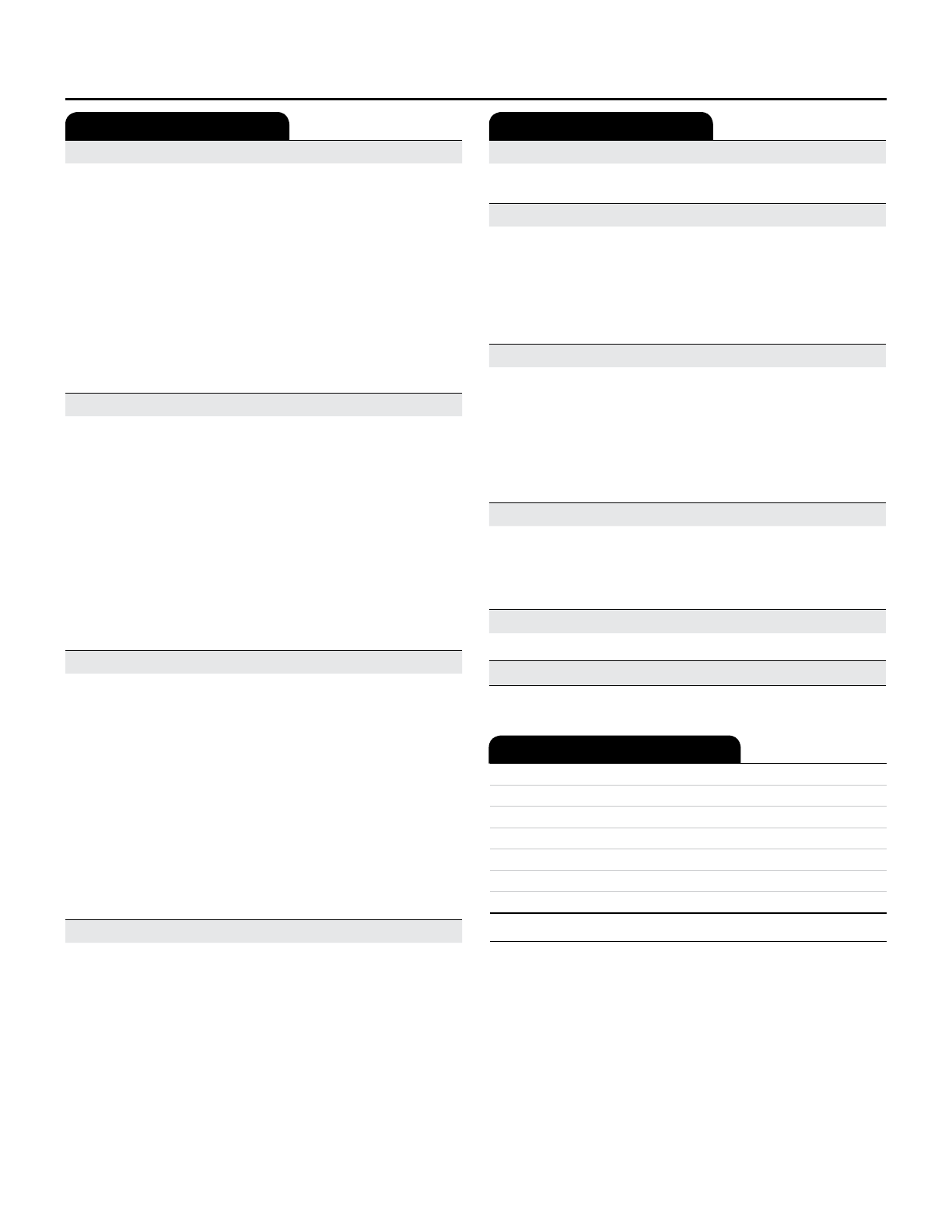

Loan Costs Other Costs

A. Origination Charges $1,802

.25 % of Loan Amount (Points) $405

Application Fee $300

Underwriting Fee $1,097

B. Services You Cannot Shop For $672

Appraisal Fee $405

Credit Report Fee $30

Flood Determination Fee $20

Flood Monitoring Fee $32

Tax Monitoring Fee $75

Tax Status Research Fee $110

C. Services You Can Shop For $3,198

Pest Inspection Fee $135

Survey Fee $65

Title – Insurance Binder $700

Title – Lender’s Title Policy $535

Title – Settlement Agent Fee $502

Title – Title Search $1,261

D. TOTAL LOAN COSTS (A + B + C) $5,672

E. Taxes and Other Government Fees $85

Recording Fees and Other Taxes $85

Transfer Taxes

F. Prepaids $867

Homeowner’s Insurance Premium ( 6 months) $605

Mortgage Insurance Premium ( months)

Prepaid Interest ( $17.44 per day for 15 days @ 3.875%) $262

Property Taxes ( months)

G. Initial Escrow Payment at Closing $413

Homeowner’s Insurance $100.83 per month for 23mo. $202

Mortgage Insurance per month for 0 mo.

Property Taxes $105.30 per month for 2 mo. $211

H. Other $1,017

Title – Owner’s Title Policy (optional) $1,017

I. TOTAL OTHER COSTS (E + F + G + H) $2,382

J. TOTAL CLOSING COSTS

$8,054

D + I $8,054

Lender Credits

Total Closing Costs (J) $8,054

Closing Costs Financed (Paid from your Loan Amount) $0

Down Payment/Funds from Borrower $18,000

Deposit – $10,000

Funds for Borrower $0

Seller Credits $0

Adjustments and Other Credits $0

Estimated Cash to Close $16,054

Calculating Cash to Close

Closing Cost Details

LENDER

Ficus Bank

NMLS/__ LICENSE ID

LOAN OFFICER

Joe Smith

NMLS/__ LICENSE ID

12345

EMAIL

joesmith@ficusbank.com

PHONE

123-456-7890

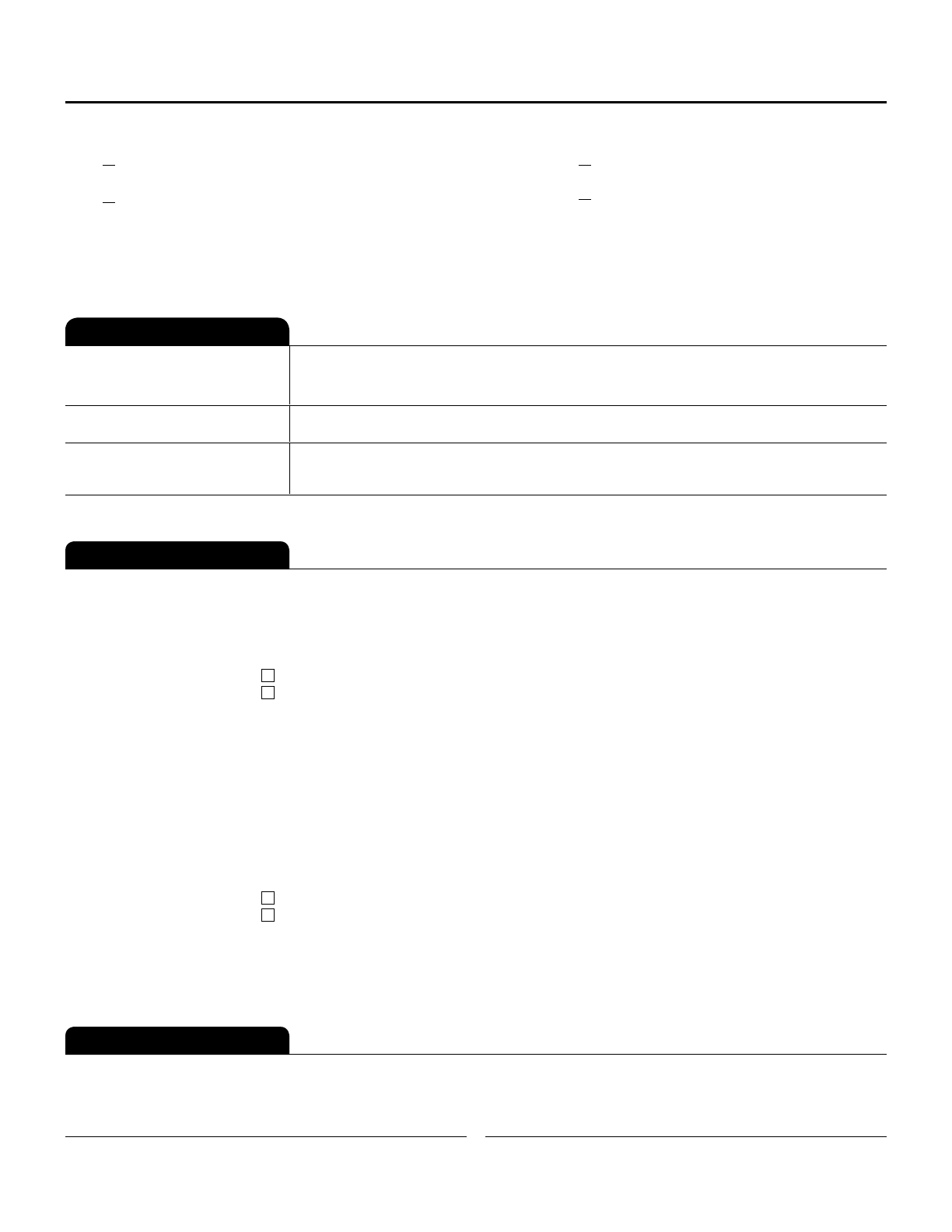

Comparisons

Use these measures to compare this loan with other loans.

In 5 Years

$56,582 Total you will have paid in principal, interest, mortgage insurance, and loan costs.

$15,773 Principal you will have paid off.

Annual Percentage Rate (APR)

4.274%

Your costs over the loan term expressed as a rate. This is not your interest rate.

Total Interest Percentage (TIP)

69.45%

The total amount of interest that you will pay over the loan term as a

percentage of your loan amount.

We may order an appraisal to determine the property’s value and charge you for this

appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close.

You can pay for an additional appraisal for your own use at your own cost.

If you sell or transfer this property to another person, we

will allow, under certain conditions, this person to assume this loan on the original terms.

x

will not allow assumption of this loan on the original terms.

This loan requires homeowner’s insurance on the property, which you may obtain from a

company of your choice that we find acceptable.

If your payment is more than 15 days late, we will charge a late fee of 5% of the monthly

principal and interest payment.

Refinancing this loan will depend on your future financial situation, the property value, and

market conditions. You may not be able to refinance this loan.

We intend

to service your loan. If so, you will make your payments to us.

x

to transfer servicing of your loan.

Appraisal

Assumption

Homeowner’s

Insurance

Late Payment

Refinance

Servicing

Other Considerations

Additional Information About This Loan

MORTGAGE BROKER

NMLS/__ LICENSE ID

LOAN OFFICER

NMLS/__ LICENSE ID

EMAIL

PHONE

Confirm Receipt

By signing, you are only confirming that you have received this form. You do not have to accept this loan because you have signed or

received this form.

Applicant Signature Date Co-Applicant Signature Date