Fillable Printable Loan Estimate Template

Fillable Printable Loan Estimate Template

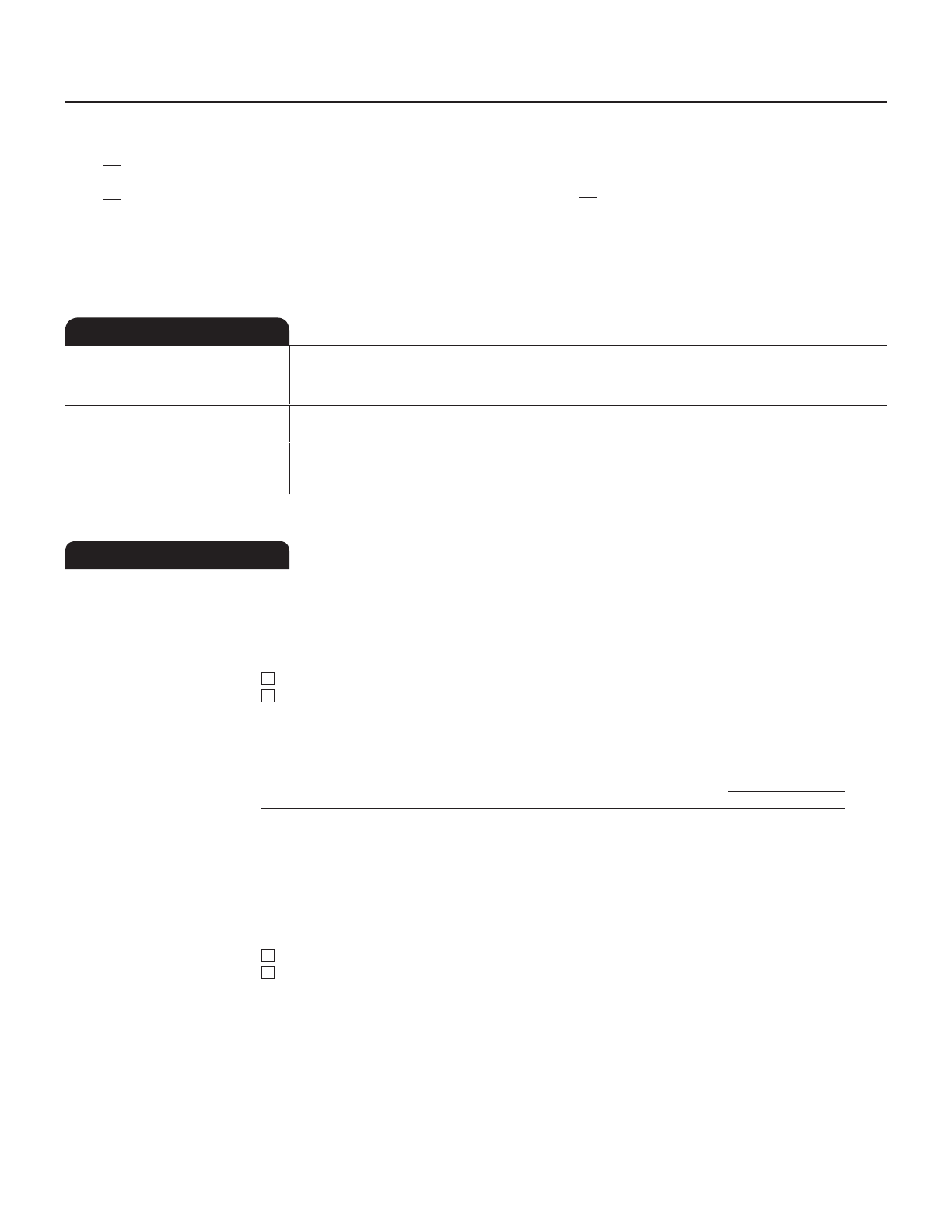

Loan Estimate Template

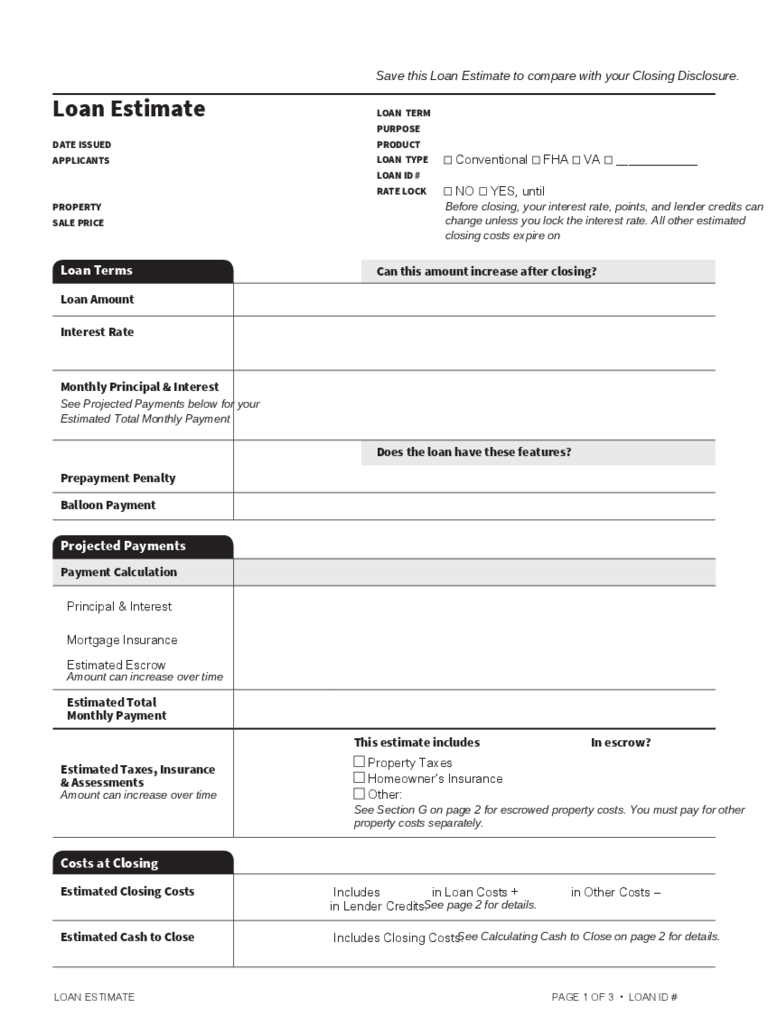

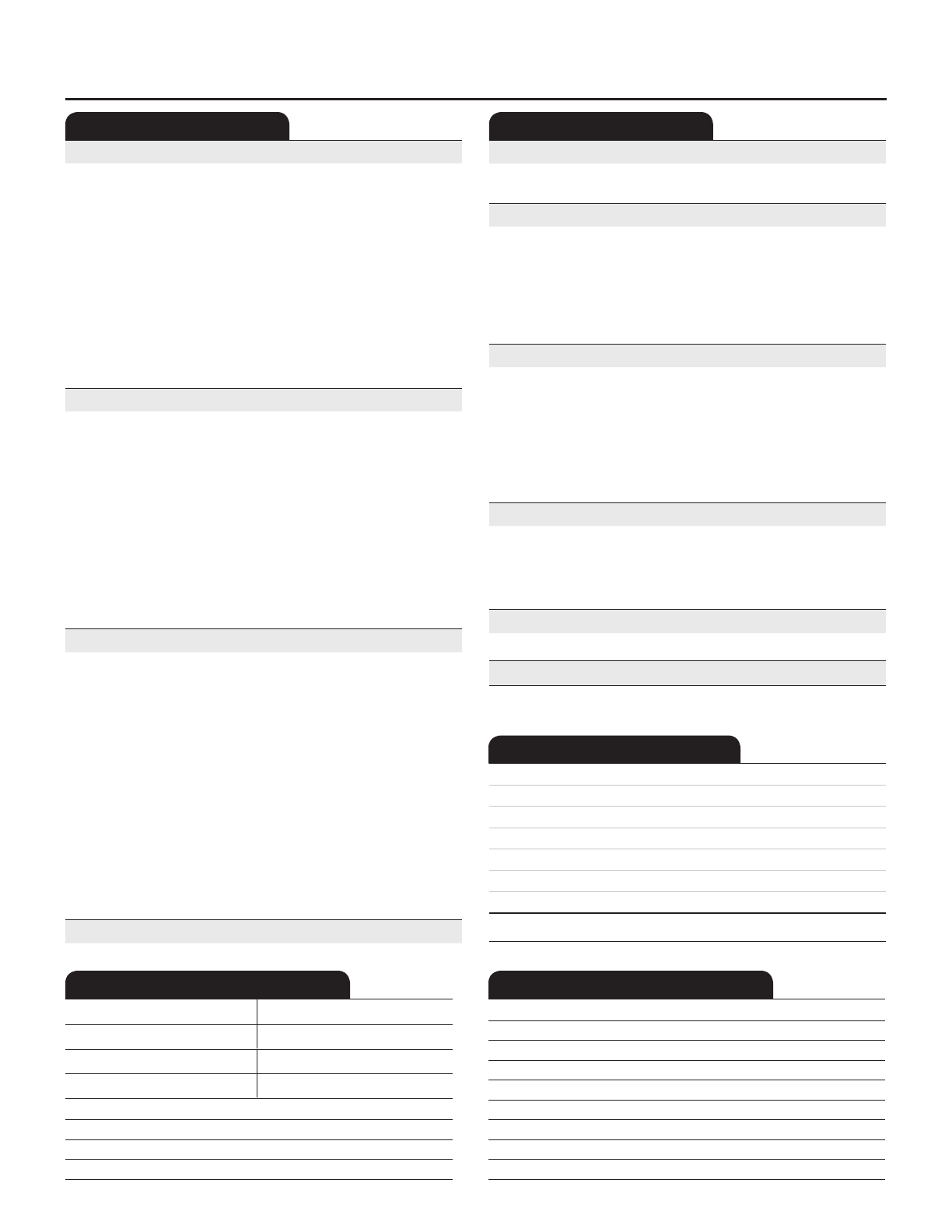

Loan Terms

Can this amount increase after closing?

Loan Amount

Interest Rate

Monthly Principal & Interest

See Projected Payments below for your

Estimated Total Monthly Payment

Does the loan have these features?

Prepayment Penalty

Balloon Payment

DATE ISSUED

APPLICANTS

PROPERTY

SALE PRICE

LOAN TERM

30 years

PURPOSE

Purchase

PRODUCT

5 Year Interest Only, 5/3 Adjustable Rate

LOAN TYPE

Conventional FHA VA _____________

LOAN ID #

1330172608

RATE LOCK

NO YES, until

Loan Estimate

Projected Payments

Payment Calculation

Principal & Interest

Mortgage Insurance

Estimated Escrow

Amount can increase over time

Estimated Total

Monthly Payment

Estimated Taxes, Insurance

& Assessments

Amount can increase over time

Before closing, your interest rate, points, and lender credits can

change unless you lock the interest rate. All other estimated

closing costs expire on

Save this Loan Estimate to compare with your Closing Disclosure.

PAGE 1 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

See Section G on page 2 for escrowed property costs. You must pay for other

property costs separately.

This estimate includes In escrow?

Property Taxes

Homeowner’s Insurance

Other:

Costs at Closing

Estimated Closing Costs

Includes in Loan Costs + in Other Costs –

in Lender Credits.

See page 2 for details.

Estimated Cash to Close

Includes Closing Costs.

See Calculating Cash to Close on page 2 for details.

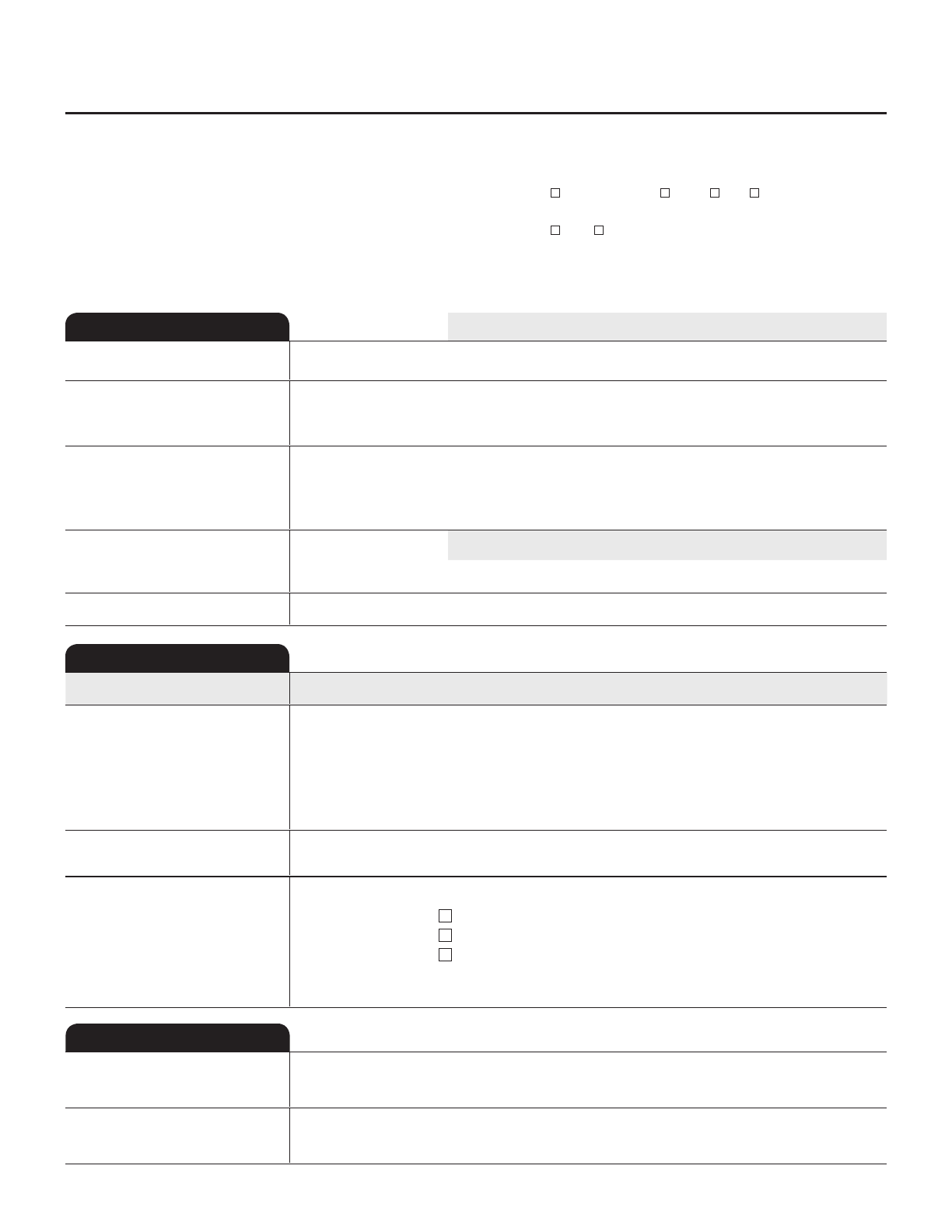

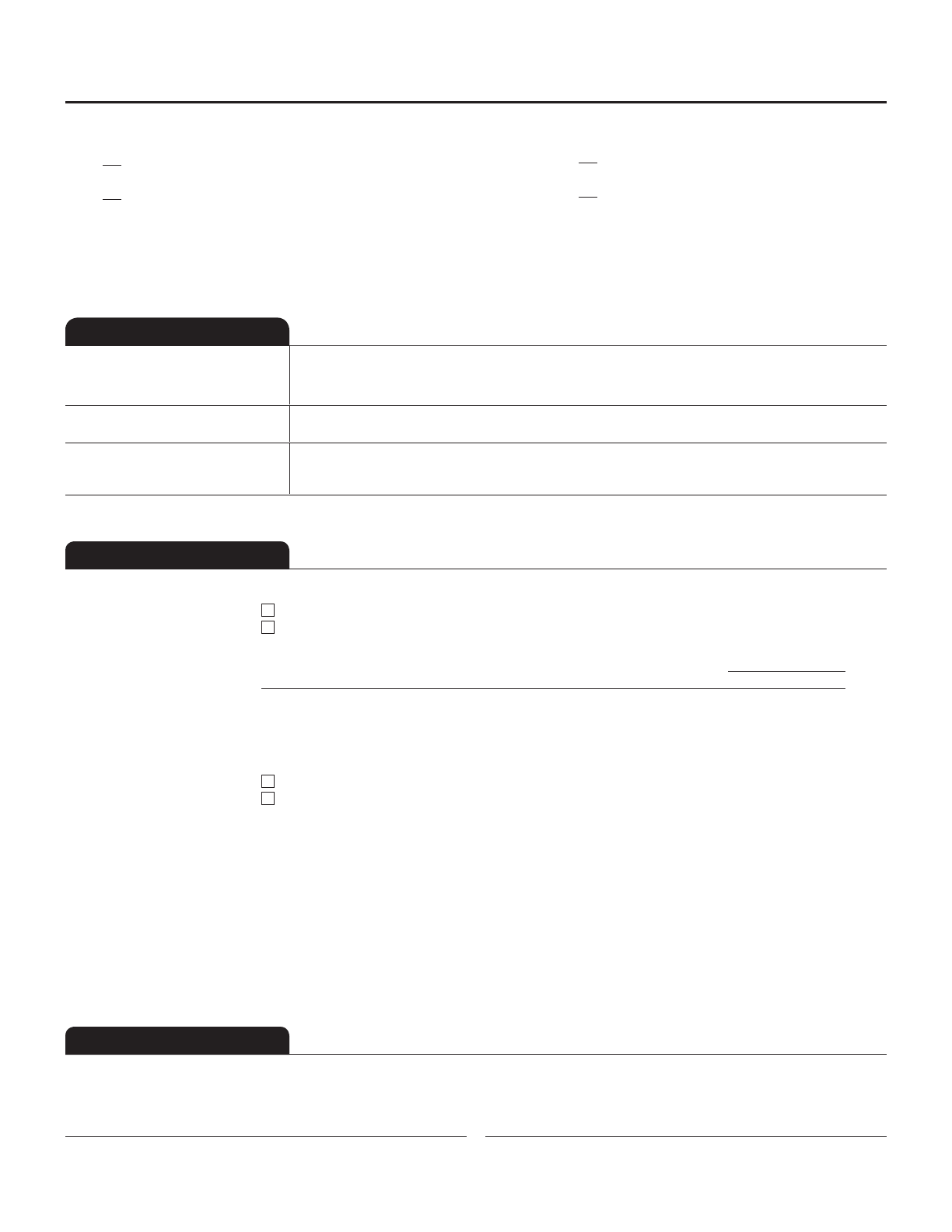

Loan Terms

Can this amount increase after closing?

Loan Amount

Interest Rate

Monthly Principal & Interest

See Projected Payments below for your

Estimated Total Monthly Payment

Does the loan have these features?

Prepayment Penalty

Balloon Payment

DATE ISSUED

APPLICANTS

PROPERTY

EST. PROP. VALUE

LOAN TERM

30 years

PURPOSE

Purchase

PRODUCT

5 Year Interest Only, 5/3 Adjustable Rate

LOAN TYPE

Conventional FHA VA _____________

LOAN ID #

1330172608

RATE LOCK

NO YES, until

Loan Estimate

Projected Payments

Payment Calculation

Principal & Interest

Mortgage Insurance

Estimated Escrow

Amount can increase over time

Estimated Total

Monthly Payment

Estimated Taxes, Insurance

& Assessments

Amount can increase over time

Before closing, your interest rate, points, and lender credits can

change unless you lock the interest rate. All other estimated

closing costs expire on

Save this Loan Estimate to compare with your Closing Disclosure.

PAGE 1 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

See Section G on page 2 for escrowed property costs. You must pay for other

property costs separately.

This estimate includes In escrow?

Property Taxes

Homeowner’s Insurance

Other:

Costs at Closing

Estimated Closing Costs

Includes in Loan Costs + in Other Costs –

in Lender Credits.

See page 2 for details.

Estimated Cash to Close

Includes Closing Costs.

See Calculating Cash to Close on page 2 for details.

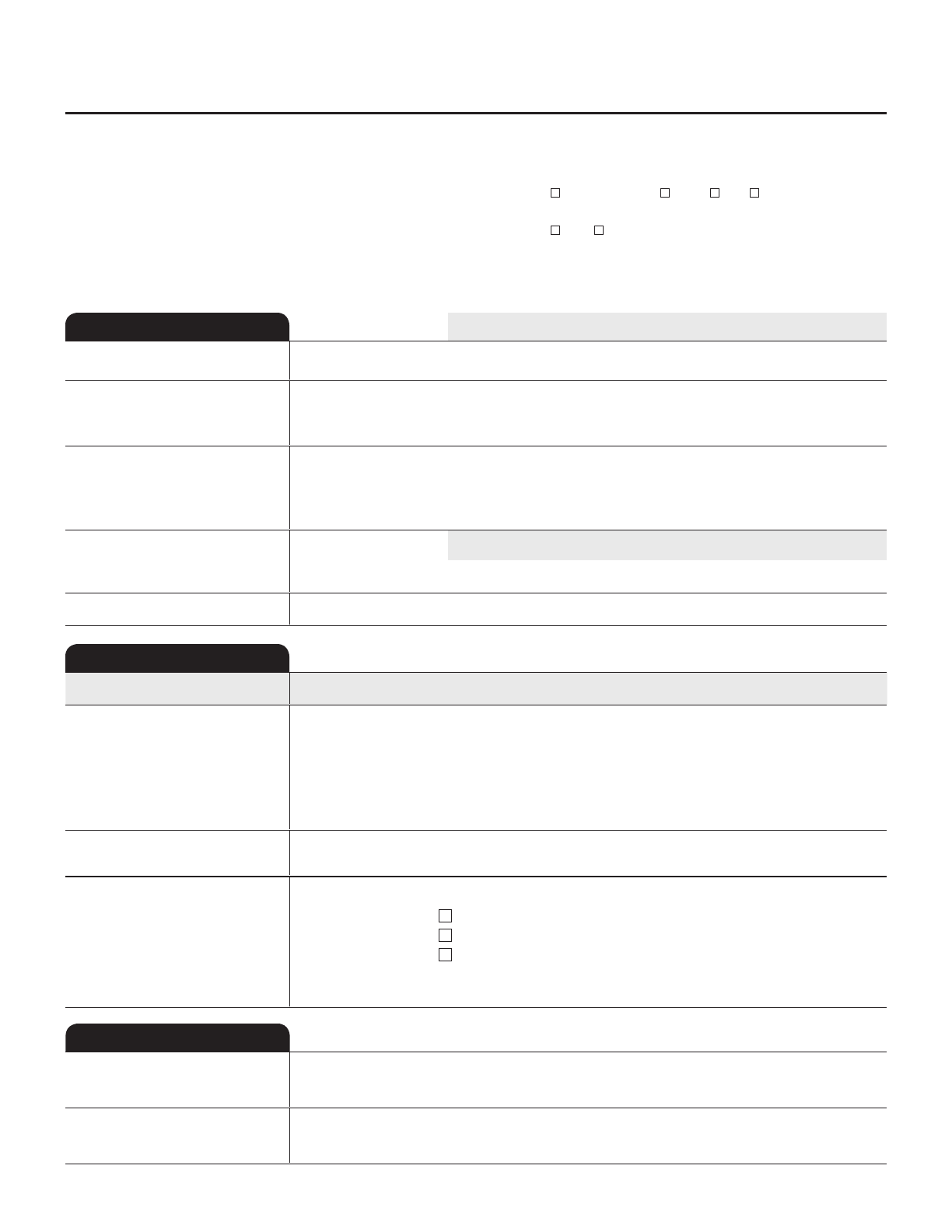

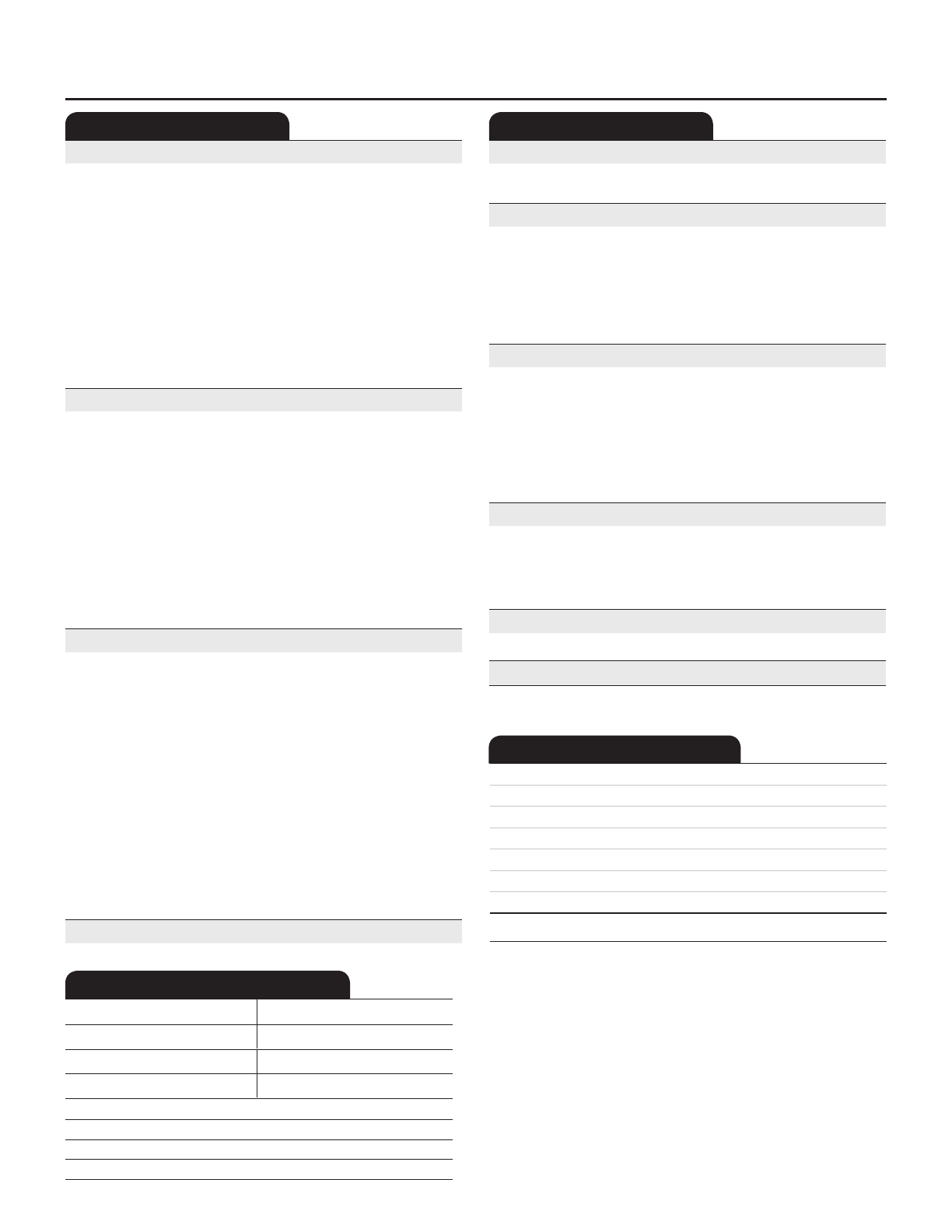

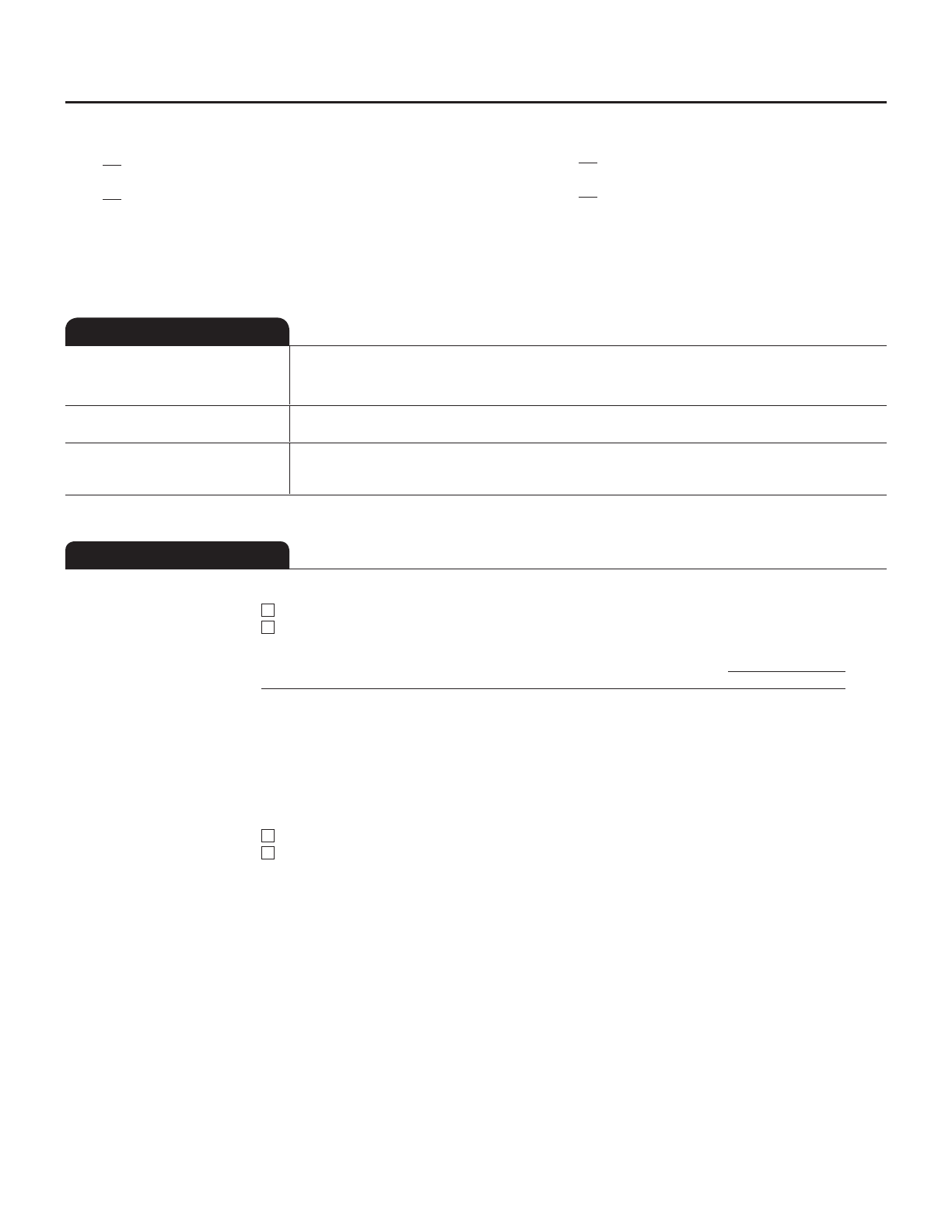

Loan Costs Other Costs

A. Origination Charges

% of Loan Amount (Points)

Desk Review Fee $150

Loan Origination Fee $1,000

Processing Fee $300

Rate Lock Fee $525

Underwriting Fee $675

Verification Fee $200

B. Services You Cannot Shop For

Appraisal Fee $305

Credit Report Fee $30

Flood Determination Fee $35

Lender’s Attorney $400

C. Services You Can Shop For

Pest Inspection Fee $125

Survey Fee $150

Title – Courier Fee $32

Title – Lender’s Title Policy $100

Title – Settlement Agent Fee $300

Title – Title Search $150

D. TOTAL LOAN COSTS (A + B + C)

E. Taxes and Other Government Fees

Recording Fees and Other Taxes

Transfer Taxes es

F. Prepaids

Homeowner’s Insurance Premium ( months)

Mortgage Insurance Premium ( months)

Prepaid Interest ( per day for days @ )

Property Taxes ( months)

G. Initial Escrow Payment at Closing

Homeowner’s Insurance per month for 3 mo.

Mortgage Insurance per month for 0 mo.

Property Taxes per month for 3 mo.

H. Other

Real Estate Broker Administration Fee $200

Title – Owner’s Title Policy (optional) $1,436

I. TOTAL OTHER COSTS (E + F + G + H)

J. TOTAL CLOSING COSTS

D + I

Lender Credits

Total Closing Costs (J)

Closing Costs Financed (Paid from your Loan Amount)

Down Payment/Funds from Borrower

Deposit

Funds for Borrower

Seller Credits

Adjustments and Other Credits

Estimated Cash to Close

Calculating Cash to Close

PAGE 2 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

Closing Cost Details

Loan Costs Other Costs

E. Taxes and Other Government Fees

Recording Fees and Other Taxes

Transfer Taxes

F. Prepaids

Homeowner’s Insurance Premium ( months)

Mortgage Insurance Premium ( months)

Prepaid Interest ( per day for days @ )

Property Taxes ( months)

G. Initial Escrow Payment at Closing

Homeowner’s Insurance per month for 3 mo.

Mortgage Insurance per month for 0 mo.

Property Taxes per month for 3 mo.

H. Other

Real Estate Broker Administration Fee $200

Title – Owner’s Title Policy (optional) $1,436

I. TOTAL OTHER COSTS (E + F + G + H)

J. TOTAL CLOSING COSTS

D + I

Lender Credits

Total Closing Costs (J)

Closing Costs Financed (Paid from your Loan Amount)

Down Payment/Funds from Borrower

Deposit

Funds for Borrower

Seller Credits

Adjustments and Other Credits

Estimated Cash to Close

Calculating Cash to Close

PAGE 2 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

Closing Cost Details

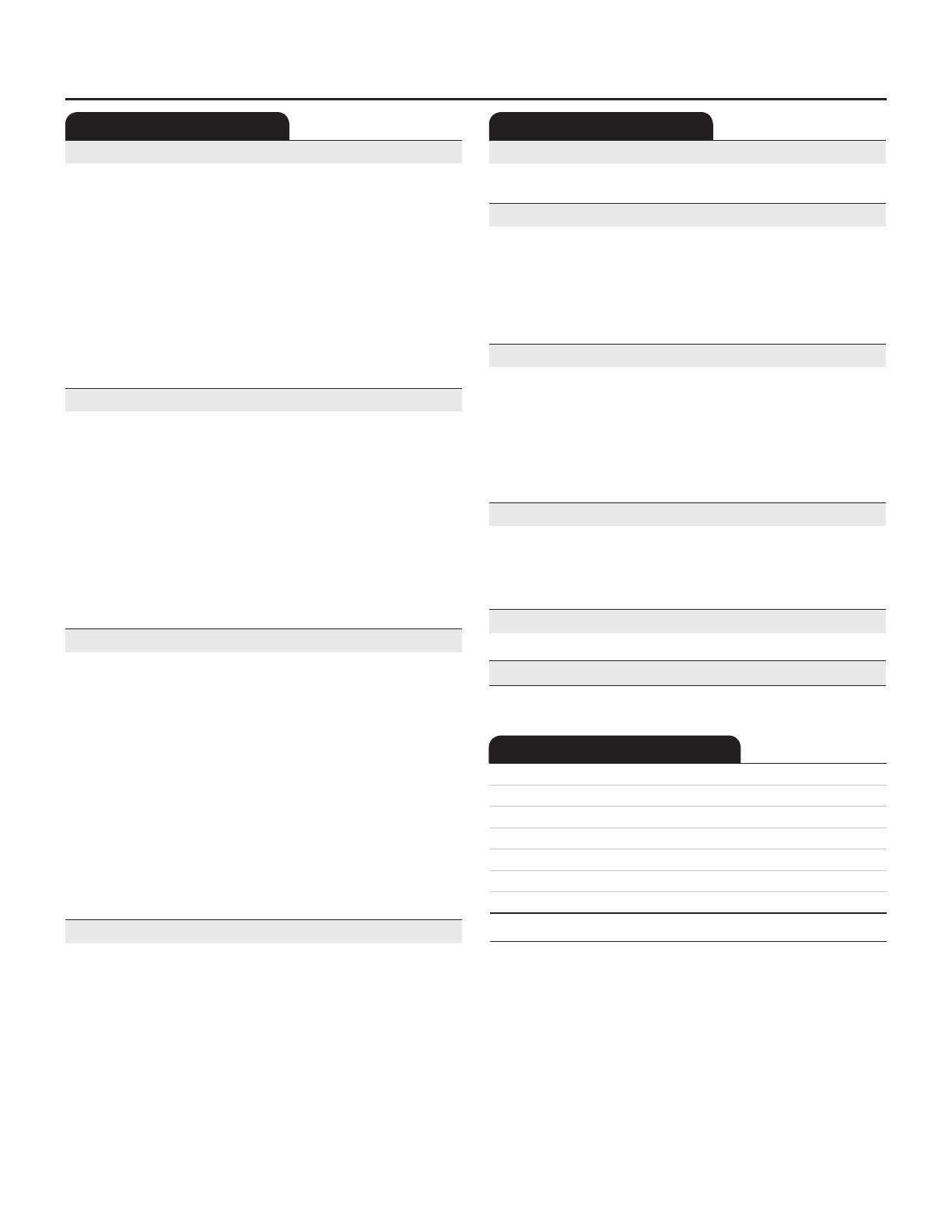

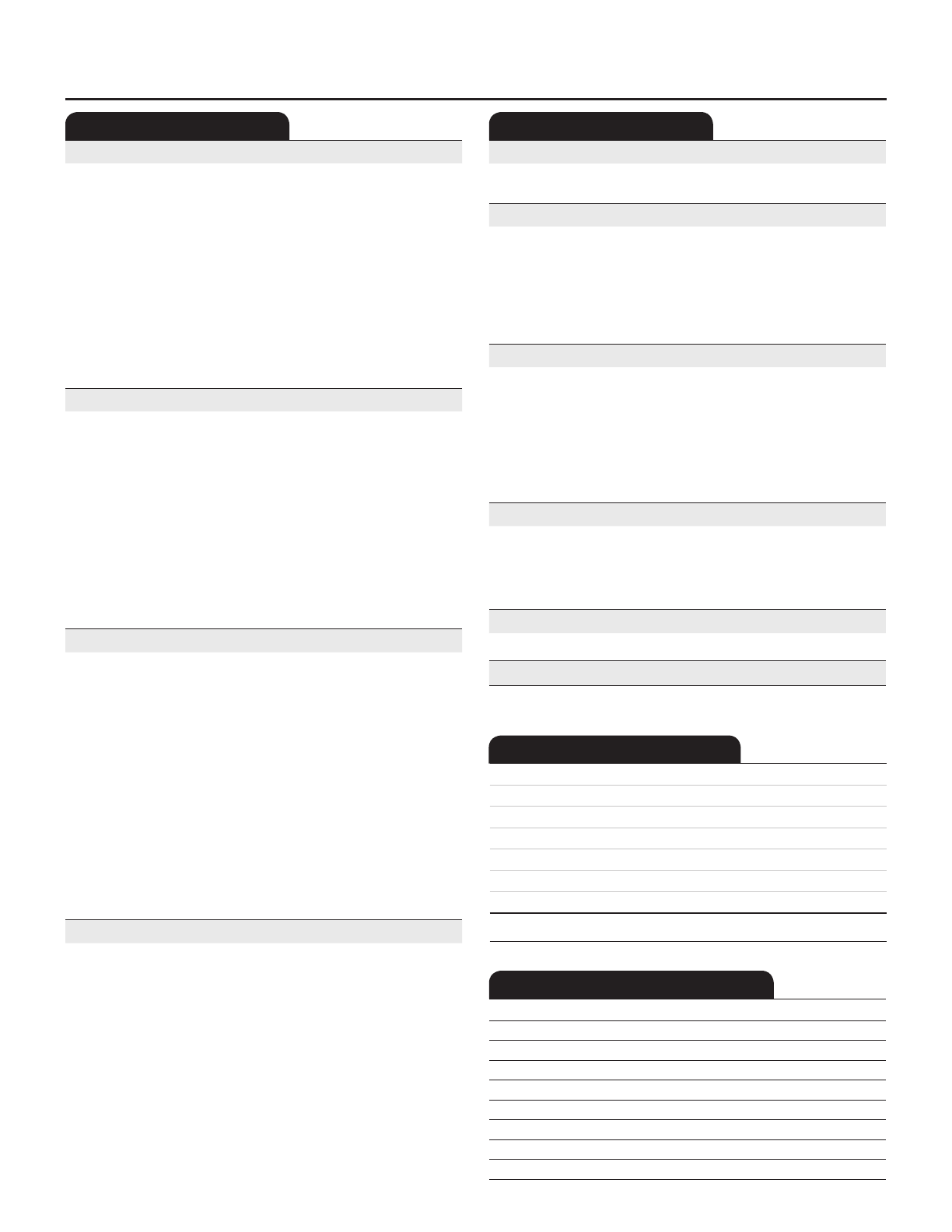

Adjustable Payment (AP) Table

Interest Only Payments?

Optional Payments?

Step Payments?

Seasonal Payments?

Monthly Principal and Interest Payments

First Change/Amount

Subsequent Changes

Maximum Payment

A. Origination Charges

% of Loan Amount (Points)

Desk Review Fee $150

Loan Origination Fee $1,000

Processing Fee $300

Rate Lock Fee $525

Underwriting Fee $675

Verification Fee $200

B. Services You Cannot Shop For

Appraisal Fee $305

Credit Report Fee $30

Flood Determination Fee $35

Lender’s Attorney $400

C. Services You Can Shop For

Pest Inspection Fee $125

Survey Fee $150

Title – Courier Fee $32

Title – Lender’s Title Policy $100

Title – Settlement Agent Fee $300

Title – Title Search $150

D. TOTAL LOAN COSTS (A + B + C)

Adjustable Interest Rate (AIR) Table

Index + Margin

Initial Interest Rate

Minimum/Maximum Interest Rate

Change Frequency

First Change

Subsequent Changes

Limits on Interest Rate Changes

First Change

Subsequent Changes

Loan Costs Other Costs

E. Taxes and Other Government Fees

Recording Fees and Other Taxes

Transfer Taxes

F. Prepaids

Homeowner’s Insurance Premium ( months)

Mortgage Insurance Premium ( months)

Prepaid Interest ( per day for days @ )

Property Taxes ( months)

G. Initial Escrow Payment at Closing

Homeowner’s Insurance per month for 3 mo.

Mortgage Insurance per month for 0 mo.

Property Taxes per month for 3 mo.

H. Other

Real Estate Broker Administration Fee $200

Title – Owner’s Title Policy (optional) $1,436

I. TOTAL OTHER COSTS (E + F + G + H)

J. TOTAL CLOSING COSTS

D + I

Lender Credits

Total Closing Costs (J)

Closing Costs Financed (Paid from your Loan Amount)

Down Payment/Funds from Borrower

Deposit

Funds for Borrower

Seller Credits

Adjustments and Other Credits

Estimated Cash to Close

Calculating Cash to Close

PAGE 2 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

Closing Cost Details

A. Origination Charges

% of Loan Amount (Points)

Desk Review Fee $150

Loan Origination Fee $1,000

Processing Fee $300

Rate Lock Fee $525

Underwriting Fee $675

Verification Fee $200

B. Services You Cannot Shop For

Appraisal Fee $305

Credit Report Fee $30

Flood Determination Fee $35

Lender’s Attorney $400

C. Services You Can Shop For

Pest Inspection Fee $125

Survey Fee $150

Title – Courier Fee $32

Title – Lender’s Title Policy $100

Title – Settlement Agent Fee $300

Title – Title Search $150

D. TOTAL LOAN COSTS (A + B + C)

Adjustable Payment (AP) Table

Interest Only Payments?

Optional Payments?

Step Payments?

Seasonal Payments?

Monthly Principal and Interest Payments

First Change/Amount

Subsequent Changes

Maximum Payment

Loan Costs Other Costs

E. Taxes and Other Government Fees

Recording Fees and Other Taxes

Transfer Taxes

F. Prepaids

Homeowner’s Insurance Premium ( months)

Mortgage Insurance Premium ( months)

Prepaid Interest ( per day for days @ )

Property Taxes ( months)

G. Initial Escrow Payment at Closing

Homeowner’s Insurance per month for 3 mo.

Mortgage Insurance per month for 0 mo.

Property Taxes per month for 3 mo.

H. Other

Real Estate Broker Administration Fee $200

Title – Owner’s Title Policy (optional) $1,436

I. TOTAL OTHER COSTS (E + F + G + H)

J. TOTAL CLOSING COSTS

D + I

Lender Credits

Total Closing Costs (J)

Closing Costs Financed (Paid from your Loan Amount)

Down Payment/Funds from Borrower

Deposit

Funds for Borrower

Seller Credits

Adjustments and Other Credits

Estimated Cash to Close

Calculating Cash to Close

PAGE 2 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

Closing Cost Details

A. Origination Charges

% of Loan Amount (Points)

Desk Review Fee $150

Loan Origination Fee $1,000

Processing Fee $300

Rate Lock Fee $525

Underwriting Fee $675

Verification Fee $200

B. Services You Cannot Shop For

Appraisal Fee $305

Credit Report Fee $30

Flood Determination Fee $35

Lender’s Attorney $400

C. Services You Can Shop For

Pest Inspection Fee $125

Survey Fee $150

Title – Courier Fee $32

Title – Lender’s Title Policy $100

Title – Settlement Agent Fee $300

Title – Title Search $150

D. TOTAL LOAN COSTS (A + B + C)

Adjustable Interest Rate (AIR) Table

Index + Margin

Initial Interest Rate

Minimum/Maximum Interest Rate

Change Frequency

First Change

Subsequent Changes

Limits on Interest Rate Changes

First Change

Subsequent Changes

LENDER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

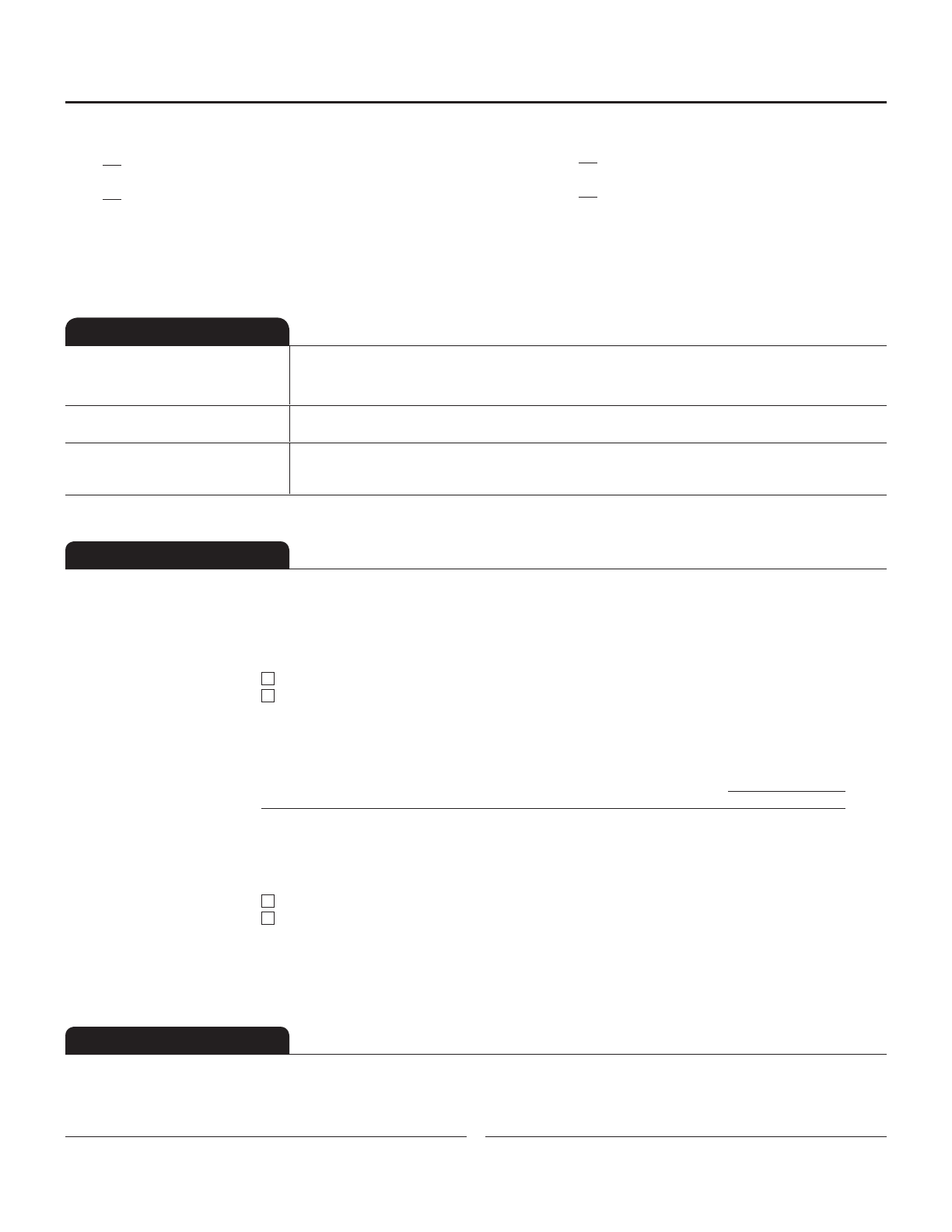

Comparisons

Use these measures to compare this loan with other loans.

In 5 Years

Total you will have paid in principal, interest, mortgage insurance, and loan costs.

Principal you will have paid off.

Annual Percentage Rate (APR)

Your costs over the loan term expressed as a rate. This is not your interest rate.

Total Interest Percentage (TIP)

The total amount of interest that you will pay over the loan term as a

percentage of your loan amount.

Other Considerations

Additional Information About This Loan

MORTGAGE BROKER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

PAGE 3 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

Confirm Receipt

By signing, you are only confirming that you have received this form. You do not have to accept this loan because you have signed or

received this form.

Applicant Signature Date Co-Applicant Signature Date

We may order an appraisal to determine the property’s value and charge you for this

appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close.

You can pay for an additional appraisal for your own use at your own cost.

If you sell or transfer this property to another person, we

will allow, under certain conditions, this person to assume this loan on the original terms.

will not allow assumption of this loan on the original terms.

This loan requires homeowner’s insurance on the property, which you may obtain from a

company of your choice that we find acceptable.

If your payment is more than ___ days late, we will charge a late fee of

.

Refinancing this loan will depend on your future financial situation, the property value, and

market conditions. You may not be able to refinance this loan.

We intend

to service your loan. If so, you will make your payments to us.

to transfer servicing of your loan.

Appraisal

Assumption

Homeowner’s

Insurance

Late Payment

Refinance

Servicing

LENDER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

Comparisons

Use these measures to compare this loan with other loans.

In 5 Years

Total you will have paid in principal, interest, mortgage insurance, and loan costs.

Principal you will have paid off.

Annual Percentage Rate (APR)

Your costs over the loan term expressed as a rate. This is not your interest rate.

Total Interest Percentage (TIP)

The total amount of interest that you will pay over the loan term as a

percentage of your loan amount.

Other Considerations

Additional Information About This Loan

MORTGAGE BROKER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

PAGE 3 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

We may order an appraisal to determine the property’s value and charge you for this

appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close.

You can pay for an additional appraisal for your own use at your own cost.

If you sell or transfer this property to another person, we

will allow, under certain conditions, this person to assume this loan on the original terms.

will not allow assumption of this loan on the original terms.

This loan requires homeowner’s insurance on the property, which you may obtain from a

company of your choice that we find acceptable.

If your payment is more than ___ days late, we will charge a late fee of

.

You do not have to accept this loan because you have received this form or signed a

loan application.

Refinancing this loan will depend on your future financial situation, the property value, and

market conditions. You may not be able to refinance this loan.

We intend

to service your loan. If so, you will make your payments to us.

to transfer servicing of your loan.

Appraisal

Assumption

Homeowner’s

Insurance

Late Payment

Loan Acceptance

Refinance

Servicing

LENDER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

Comparisons

Use these measures to compare this loan with other loans.

In 5 Years

Total you will have paid in principal, interest, mortgage insurance, and loan costs.

Principal you will have paid off.

Annual Percentage Rate (APR)

Your costs over the loan term expressed as a rate. This is not your interest rate.

Total Interest Percentage (TIP)

The total amount of interest that you will pay over the loan term as a

percentage of your loan amount.

Other Considerations

Additional Information About This Loan

MORTGAGE BROKER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

PAGE 3 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

Confirm Receipt

By signing, you are only confirming that you have received this form. You do not have to accept this loan because you have signed or

received this form.

Applicant Signature Date Co-Applicant Signature Date

If you sell or transfer this property to another person, we

will allow, under certain conditions, this person to assume this loan on the original terms.

will not allow assumption of this loan on the original terms.

If your payment is more than ___ days late, we will charge a late fee of

.

Refinancing this loan will depend on your future financial situation, the property value, and

market conditions. You may not be able to refinance this loan.

We intend

to service your loan. If so, you will make your payments to us.

to transfer servicing of your loan.

Assumption

Late Payment

Refinance

Servicing

LENDER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

Comparisons

Use these measures to compare this loan with other loans.

In 5 Years

Total you will have paid in principal, interest, mortgage insurance, and loan costs.

Principal you will have paid off.

Annual Percentage Rate (APR)

Your costs over the loan term expressed as a rate. This is not your interest rate.

Total Interest Percentage (TIP)

The total amount of interest that you will pay over the loan term as a

percentage of your loan amount.

Other Considerations

Additional Information About This Loan

MORTGAGE BROKER

NMLS/ LICENSE ID

LOAN OFFICER

NMLS/ LICENSE ID

EMAIL

PHONE

PAGE 3 OF 3 • LOAN ID # 1330172608LOAN ESTIMATE

If you sell or transfer this property to another person, we

will allow, under certain conditions, this person to assume this loan on the original terms.

will not allow assumption of this loan on the original terms.

If your payment is more than ___ days late, we will charge a late fee of

.

You do not have to accept this loan because you have received this form or signed a

loan application.

Refinancing this loan will depend on your future financial situation, the property value, and

market conditions. You may not be able to refinance this loan.

We intend

to service your loan. If so, you will make your payments to us.

to transfer servicing of your loan.

Assumption

Late Payment

Loan Acceptance

Refinance

Servicing