- Security Agreement Sample Form

- Sample Security Agreement Form

- Security Agreement (For Direct Loans Including Motor Vehicles) - Denver

- Premier Certified Lenders Program Security Agreement - U. S. Small Business Administration

- Motor Vehicle Security Agreement Form

- Connecticut Security Agreement Form Public Deposit

Fillable Printable Motor Vehicle Security Agreement Form

Fillable Printable Motor Vehicle Security Agreement Form

Motor Vehicle Security Agreement Form

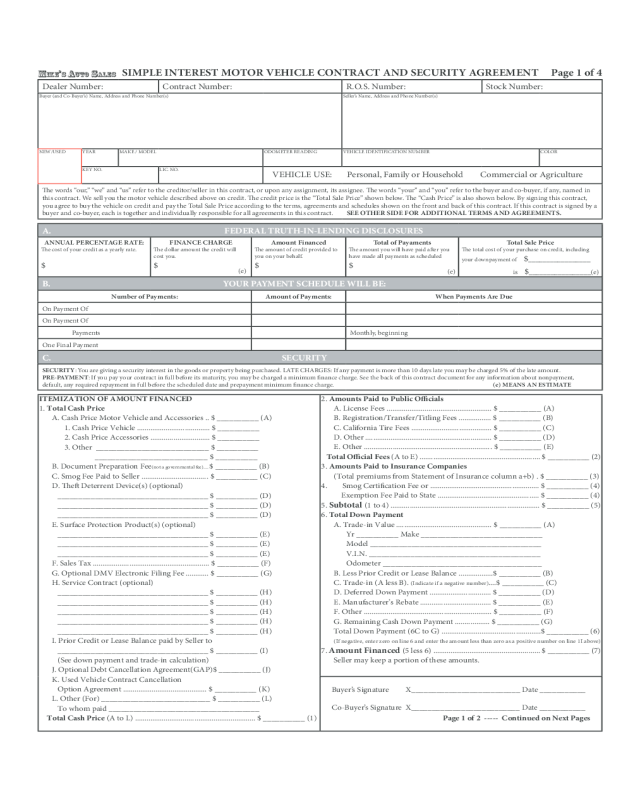

SIMPLE INTEREST MOTOR VEHICLE CONTRACT AND SECURITY AGREEMENT Page 1 of 4

Dealer Number: Contract Number: R.O.S. Number: Stock Number:

Buyer (and Co-Buyer’s) Name, Address and Phone Number(s) Seller’s Name, Address and Phone Number(s)

NEW/USED YEAR MAKE / MODEL ODOMETER READING VEHICLE IDENTIFICATION NUMBER COLOR

KEY NO. LIC. NO.

VEHICLE USE: Personal, Family or Household Commercial or Agriculture

e words “our,” “we” and “us” refer to the creditor/seller in this contract, or upon any assignment, its assignee. e words “your” and “you” refer to the buyer and co-buyer, if any, named in

this contract. We sell you the motor vehicle described above on credit. e credit price is the “Total Sale Price” shown below. e “Cash Price” is also shown below. By signing this contract,

you agree to buy the vehicle on credit and pay the Total Sale Price according to the terms, agreements and schedules shown on the front and back of this contract. If this contract is signed by a

buyer and co-buyer, each is together and individually responsible for all agreements in this contract. SEE OTHER SIDE FOR ADDITIONAL TERMS AND AGREEMENTS.

A. FEDERAL TRUTH-IN-LENDING DISCLOSURES

ANNUAL PERCENTAGE RATE:

e cost of your credit as a yearly rate.

$

FINANCE CHARGE

e dollar amount the credit will

cost you.

$

Amount Financed

e amount of credit provided to

you on your behalf.

$

Total of Payaments

e amount you will have paid aer you

have made all payments as scheduled

$

Total Sale Price

e total cost of your purchase on credit, including

your downpayment of $_________________

is $_________________(e)

B. YOUR PAYMENT SCHEDULE WILL BE:

Number of Payments: Amount of Payments: When Payments Are Due

On Payment Of

On Payment Of

Payments Monthly, beginning

One Final Payment

C. SECURITY

SECURITY: You are giving a security interest in the goods or property being purchased. LATE CHARGES: If any payment is more than 10 days late you may be charged 5% of the late amount.

PRE-PAYMENT: If you pay your contract in full before its maturity, you may be charged a minimum nance charge. See the back of this contract document for any information about nonpayment,

default, any required repayment in full before the scheduled date and prepayment minimum nance charge. (e) MEANS AN ESTIMATE

ITEMIZATION OF AMOUNT FINANCED

1. Total Cash Price

A. Cash Price Motor Vehicle and Accessories .. $ __________ (A)

1. Cash Price Vehicle ...................................... $ __________

2. Cash Price Accessories ............................... $ __________

3. Other ___________________________ $ __________

___________________________ $ __________

B. Document Preparation Fee

(not a governmental fee).... $ __________ (B)

C. Smog Fee Paid to Seller ................................... $ __________ (C)

D. e Deterrent Device(s) (optional)

____________________________________ $ __________ (D)

____________________________________ $ __________ (D)

____________________________________ $ __________ (D)

E. Surface Protection Product(s) (optional)

____________________________________ $ __________ (E)

____________________________________ $ __________ (E)

____________________________________ $ __________ (E)

F. Sales Tax ............................................................. $ __________ (F)

G. Optional DMV Electronic Filing Fee ............ $ __________ (G)

H. Service Contract (optional)

____________________________________ $ __________ (H)

____________________________________ $ __________ (H)

____________________________________ $ __________ (H)

____________________________________ $ __________ (H)

____________________________________ $ __________ (H)

I. Prior Credit or Lease Balance paid by Seller to

____________________________________ $ __________ (I)

(See down payment and trade-in calculation)

J. Optional Debt Cancellation Agreement(GAP)$ __________ (J)

K. Used Vehicle Contract Cancellation

Option Agreement ............................................ $ __________ (K)

L. Other (For) __________________________ $ __________ (L)

To whom paid ____________________________________

Total Cash Price (A to L) ............................................................... $ __________ (1)

2. Amounts Paid to Public Ocials

A. License Fees ....................................................... $ __________ (A)

B. Registration/Transfer/Titling Fees ................. $ __________ (B)

C. California Tire Fees .......................................... $ __________ (C)

D. Other .................................................................. $ __________ (D)

E. Other ................................................................... $ __________ (E)

Total Ocial Fees (A to E) ............................................................... $ __________ (2)

3. Amounts Paid to Insurance Companies

(Total premiums from Statement of Insurance column a+b) . $ __________ (3)

4. Smog Certication Fee or ......................................................... $ __________ (4)

Exemption Fee Paid to State ..................................................... $ __________ (4)

5.

Subtotal (1 to 4) .............................................................................. $ __________ (5)

6. Total Down Payment

A. Trade-in Value .................................................. $ __________ (A)

Yr __________ Make _____________________________

Model _________________________________________

V.I.N. _________________________________________

Odometer ______________________________________

B. Less Prior Credit or Lease Balance ..................$ __________ (B)

C. Trade-in (A less B).

(Indicate if a negative number)....$ __________ (C)

D. Deferred Down Payment ................................ $ __________ (D)

E. Manufacturer’s Rebate ..................................... $ __________ (E)

F. Other ................................................................... $ __________ (F)

G. Remaining Cash Down Payment .................. $ __________ (G)

Total Down Payment (6C to G) ....................................................$ __________ (6)

(If negative, enter zero on line 6 and enter the amount less than zero as a positive number on line 1I above)

7. Amount Financed (5 less 6) ........................................................ $ __________ (7)

Seller may keep a portion of these amounts.

Buyer’s Signature X__________________________ Date ___________

Co-Buyer’s Signature X__________________________ Date ___________

Page 1 of 2 ----- Continued on Next Pages

Mike’s Auto sAles

(e)

(e)

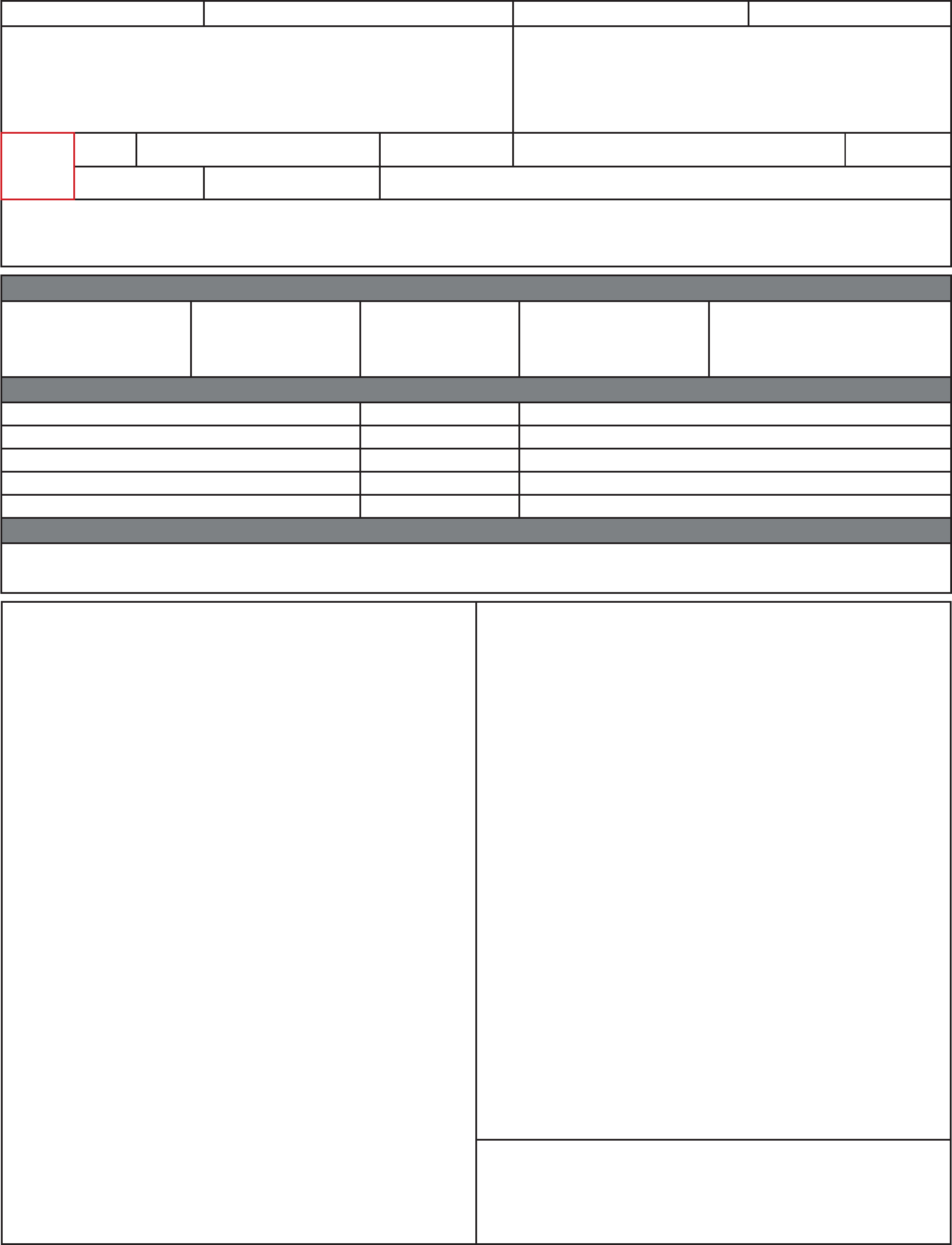

NOTICES:e names and addresses of all persons to whom the notices required or permitted by law

to be sent are set forth at the top of this form.

..

SERVICE CONTRACT (Optional) You request a service contract written with the following com-

pany for the term below. e cost is shown on line 1 H in Itemization of Amount Financed.

Company ____________________Term ___________ Mos. Or _________ Miles

Company ____________________Term ___________ Mos. Or _________ Miles

Company ____________________Term ___________ Mos. Or _________ Miles

Buyer X____________________________________ Co-Buyer X____________________________

STATEMENT OF INSURANCE

NOTICE: No person is required, as a condition of nancing the purchase of a motor vehicle, to

purchase or negotiate any insurance through a particular insurance company, agent or broker.

ONLY PHYSICAL DAMAGE INSURANCE IS REQUIRED TO OBTAIN CREDIT.

UNLESS A CHARGE IS INCLUDED IN THIS AGREEMENT FOR PUBLIC LIABILITY OR

PROPERTY DAMAGE INSURANCE, PAYMENT FOR SUCH COVERAGE IS NOT PROVIDED

BY THIS AGREEMENT.

You have requested Seller to include in the balance due under this agreement the following insur-

ance; Buyer requests Seller to procure insurance upon the described property against re, the, and

collision for the term of this agreement. Any insurance will not be in force until accepted by the

insurance carrier. Premium

$_______________ DED., COMP., FIRE & THEFT ______ Mos. $_______________

$_______________ DEDUCTIBLE COLLISION ________ Mos. $_______________

BODILY INJURY $______________LIMITS ___________ Mos. $_______________

PROPERTY DAMAGE $__________LIMITS __________ Mos. $______________

MEDICAL ______________________________________ Mos. $______________

TOTAL VEHICLE INSURANCE PREMIUMS $______________ (a)

e foregoing declarations are hereby acknowledged.

X___________________________________ X______________________________________

SELLER BUYER

OPTIONAL CREDIT & DISABILITY INSURANCE AUTHORIZATION AND APPLICATION

You voluntarily request the credit insurance checked below, if any, and understand that such insur-

ance is not required. You acknowledge disclosure of the cost of such insurance and authorize it to

be included in the balance payable under the security agreement. Any returned or refunded credit

insurance premiums shall be applied to the sums due under this contract. Only the persons whose

names are signed below are insured.

CREDIT LIFE _____________ Mos. Premium $ _________

JOINT LIFE _______________Mos. Premium $ _________

CREDIT DISABILITY_______ Mos. Premium $ _________

TOTAL CREDIT INSURANCE PREMIUMS $ _______ (b)

Company ________________________________________

You Want Credit Life Insurance You want Joint Credit Life Insurance

You want Credit Disability Insurance (Primary Buyer Only)

You are applying for the credit insurance marked above. Your signature below means

that you agree that: (1) You are not eligible for insurance if you have reached 65th birthday. (2) You

are eligible for disability insurance only if you are working or wages or prot 30 hours a week or

more on the Eective Date. (3) Only the primary buyer is eligible for disability insurance.

DISABILITY INSURANCE MAY NOT COVER CONDITIONS FOR WHICH YOU HAVE SEEN

A DOCTOR OR CHIROPRACTOR IN THE LAST 6 MONTHS

(refer to”Total Disabilities Not Cov-

ered” in your policy or certilicate for details). By signing below, you agree to buy credit insurance

______________X___________________________________________________________

DATE PRIMARY BUYER AGE

______________X___________________________________________________________

DATE CO-BUYER AGE

DISCLOSURE OF AUTO BROKER FEE

A BROKERAGE FEE was was not PAID

To (name) ___________________________________________________

NOTICE OF RESCISSION RIGHTS

If Buyer signs here, the provisions on the reverse side shall be applicable to this contract.

Buyer’s Signature X____________________________________

Co-Buyer’s Signature X_________________________________

If you are buying a used vehicle with this contract, as indicated in the description of the vehicle

above, federal regulation may require a special Buyers Guide to be displayed on the window.

BUYERS GUIDE. THE INFORMATION YOU SEE ON THE WINDOW FORM FOR THIS

VEHICLE IS PART OF THIS CONTRACT. INFORMATION ON THE WINDOW FORM

OVERRIDES ANY CONTRARY PROVISIONS IN THE CONTRACT OF SALE. GUIA DEL

COMPRADOR DE AUTOS USADOS. LA INFORMACION QUE USTED VE EN LA FORMA

QUE SE ENCUENTRA EN LA VENTANA DE ESTE VEHICULO FORMA PARTE DE ESTE

CONTRATO. LA INFORMACION DE LA FORMA EN LA VENTANA INVALIDA CUALQUIER

DISPOSICION QUE FUERA CONTRARIA AL CONTRATO DE VENTA .

GUARANTY

Each person who signs as Guarantor individually guarantees the payment of this contract, even if

we do one or more of the following: (1) give the Buyer more time to pay one or more payments; (2)

give a full or partial release to any other Guarantor; (3) release any security; (4) accept less from the

Buyer than the total amount owing; or (5) otherwise reach a settlement relating to this contract or

extend the contract. Each Guarantor acknowledges receipt of a completed copy of this contract and

guaranty at the time of signing and Guarantor waives notice of acceptance as of this Guaranty, notice

of the Buyer’s non-payment, non-performance, and default; and notices of the amount owing at any

time, and of any demands upon the Buyer.

Guarantor X__________________________________________________ Date ______________

Address ________________________________________________________________________

Guarantor X_______________________________________________ Date _________________

Address ________________________________________________________________________

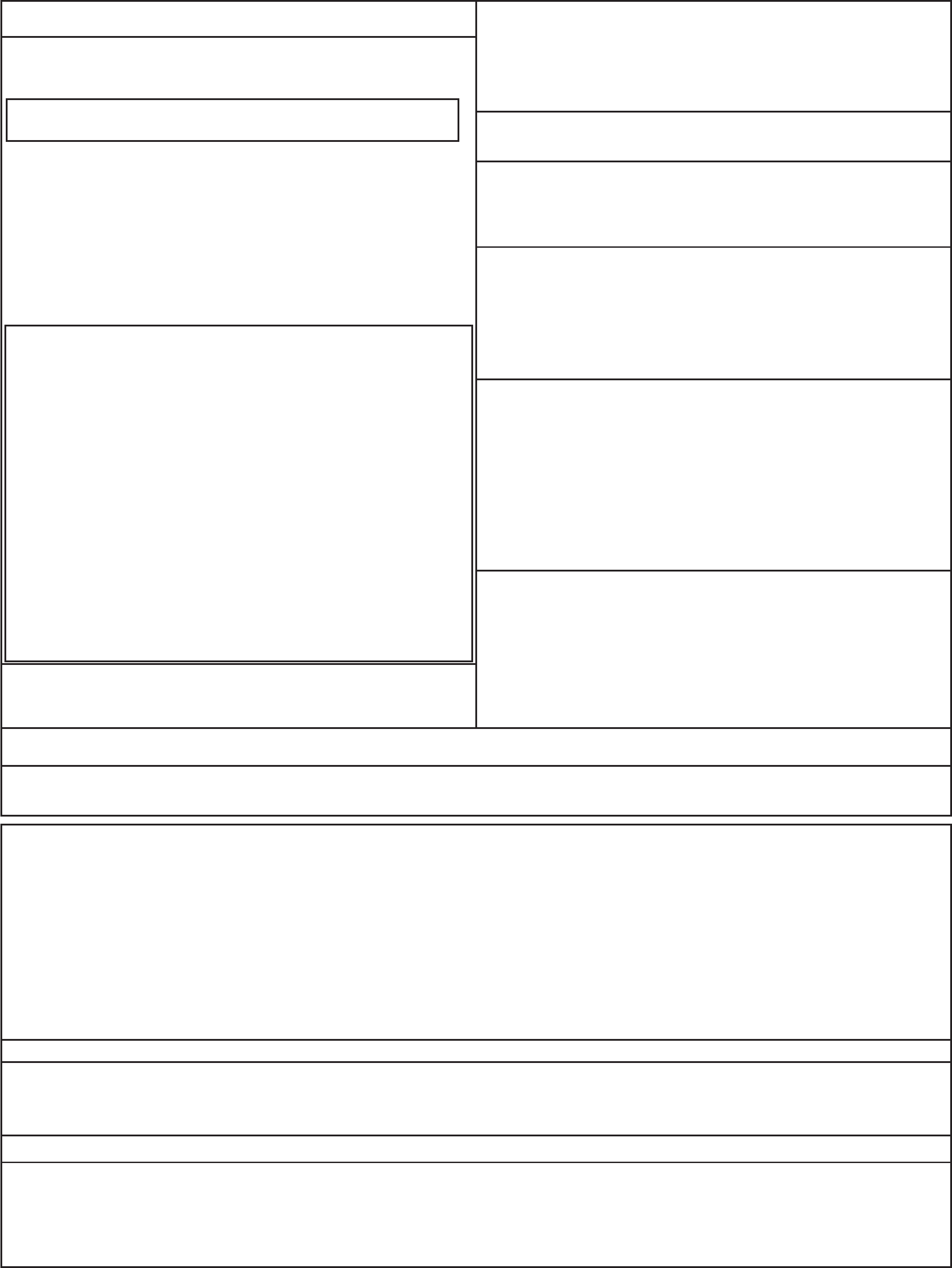

Trade in Payo - Seller used and relied upon information from you or lessor of your trade-in vehicle

for the payo amount in 6B of the Itemization of Amount Financed as the “Prior Credit or Lease

Balance.” Seller agrees to pay the amount in 6B to the lienholder or lessor of the trade-in vehicle, or

its designee. If the payo amount is more than the

amount shown in 68, you must pay the Seller the excess on demand. If the payo amount is less than

the amount shown in 6B, Seller will refund the dierence to you. Except

as stated in the “Notice” on the back of this contract, any assignee of this contract will not be obli-

gated to pay the Prior Credit or Lease Balance or any refund due from the Seller.

X________________________ X_____________________________

TITLE TRANSFER FEES (Not Financed): e Buyer will pay the estimated fee(s) of $ _________

to the appropriate public authority in order to transfer registration aer payment in full.

OPTION: You pay no Finance Charge if the Amount Financed, item 7, is paid in full on or

before _____________ Year _________ SELLERS INITIALS

OPTIONAL DEBT CANCELLATION CONTRACT (GAP). Debt cancellation coverage is not required to obtain credit. I want to purchase a debt cancellation contract which is part of this contract shown

in line (1J) above. Company ______________ Term ______ Months Buyer X_____________________________ Co-Buyer X____________________________

SELLER ASSISTED LOAN: FOR THIS LOAN, BUYER MAY BE REQUIRED TO PLEDGE SECURITY AND WILL BE OBLIGATED FOR THE INSTALLMENT PAYMENTS ON BOTH THE SECU-

RITY AGREEMENT AND THE LOAN. Proceeds of loan - From ________________________ Amount $ ______ Finance Charge $ _____ Total $ ______

Payable in Installments of $ ______________ $ _______________ from this loan is described in (6D) above.

COMPLAINT If you have a complaint concerning this sale, you should try to resolve it with the Seller. Complaints concerning unfair or deceptive practices or methods by the Seller may be referred

to the City Attorney, the District Attorney, or an investigator for the Department of Motor Vehicles, or any combination thereof.

HOW THIS CONTRACT MAY BE CHANGED Aer this contract is signed, the Seller may not change the nancing or payment terms unless you agree in writing to

the change. You do not have to agree to any change, and it is an unfair or deceptive practice for the Seller to make a unilateral change.

Buyer’s Signature X _______________________________ Co-Buyer’s Signature X _____________________________________

THE MINIMUM PUBLIC LIABILITY INSURANCE LIMITS PROVIDED IN THE LAW MUST BE MET BY EVERY PERSON WHO PURCHASES A VEHICLE. IF YOU ARE UNSURE WHETHER OR

NOT YOUR CURRENT INSURANCE POLICY WILL COVER YOUR NEWLY ACQUIRED VEHICLE IN THE EVENT OF AN ACCIDENT, YOU SHOULD CONTACT YOUR INSURANCE AGENT.

WARNING:YOUR PRESENT POLICY MAY NOT COVER COLLISION DAMAGE OR MAY NOT PROVIDE FOR FULL REPLACEMENT COSTS FOR THE VEHICLE BEING PURCHASED. IF YOU

DO NOT HAVE FULL COVERAGE, SUPPLEMENTAL COVERAGE FOR COLLISION DAMAGE MAY BE AVAILABLE TO YOU THROUGH YOUR INSURANCE AGENT OR THROUGH THE SELLING

DEALER. HOWEVER, UNLESS OTHERWISE SPECIFIED, THE COVERAGE YOU OBTAIN THROUGH THE DEALER PROTECTS ONLY THE DEALER, USUALLY UP TO THE AMOUNT OF

THE UNPAID BALANCE REMAINING AFTER THE VEHICLE HAS BEEN REPOSSESSED AND SOLD.

FOR ADVICE ON FULL COVERAGE THAT WILL PROTECT YOU IN THE EVENT OF LOSS OR DAMAGE TO YOUR VEHICLE, YOU SHOULD CONTACT YOUR INSURANCE AGENT.

THE BUYER SHALL SIGN TO ACKNOWLEDGE THAT HE/SHE UNDERSTANDS THESE PUBLIC LIABILITY TERMS AND CONDITIONS.

S/S

X_______________________________________ X____________________________________

e Annual Percentage Rate may be negoliable with the Seller. e Seller may assign this contract and retain its right to receive a part of the Finance Charge.

“THERE IS NO COOLING OFF PERIOD UNLESS YOU OBTAIN A CONTRACT CANCELLATION OPTION”

California law does not provide for a “cooling o” or other cancellation period for vehicle sales. erefore, you cannot later cancel this contract simply because you change your mind, decide the vehicle costs too

much, or wish you had acquired a dierent vehicle. Aer you sign below, you may only cancel this contract with the agreement of the Seller or for legal cause, such as fraud, However, California law does require a

seller to oer a 2 day contract cancellation option on used vehicles with a purchase price of less than $40,000, subject to certain statutory conditions, is contract cancellation option requirement does not apply to

the sale of a recreational vehicle, a motorcycle or an o highway motor vehicle subject to identication under California Law. See the vehicle contract cancellation option agreement for details.

BUYER ACKNOWLEDGES THAT (1 ) BEFORE SIGNING THIS AGREEMENT BUYER READ BOTH SIDES OF THIS AGREEMENT AND RECEIVED A LEGIBLE, COMPLETELY FILLED IN

COPY OF THIS AGREEMENT, AND (2) BUYER HAS RECEIVED A COPY OF EVERY OTHER DOCUMENT THAT BUYER SIGNED DURING THE CONTRACT NEGOTIATION.

Buyer’s Signature X__________________________ Date _________ Co-Buyer’s Signature X___________________________ Date _________

A co-buyer is responsible for the payments of the debt on this contract. An additional owner is listed on the title as an owner, but is not responsible for payment of the debt on this contract.

Additional Owner __________________________________________________ Address __________________________________________________________________________________________

Seller ______________________________ Address __________________________________________________________________________

___________________________________________________ By X ___________________________ Title _____________________________

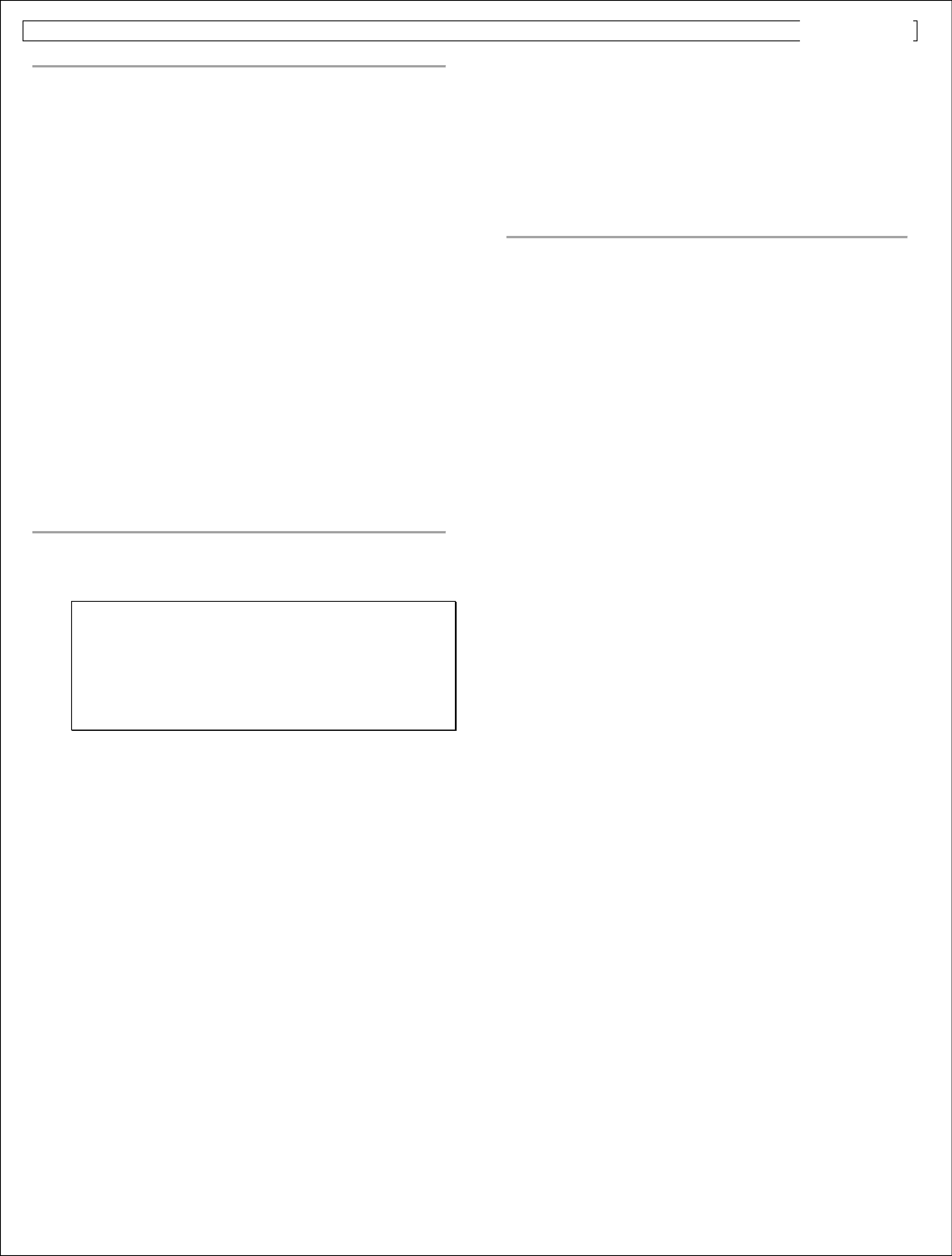

MIKE’S AUTO SALES – SI MPLE INTE REST MOTOR VEHICLE CONTRACT AND SECURI TY AGREEMENT CONTINUED -

Page 3 of 4

OTHER IMPORTANT AGREEMENTS

1. FINANCE CHARGE AND PAYMENTS

a. How we w ill figure Finance Charge. We wi ll f igure the Finan ce

C h arge o n a d aily basis at the An nual Per centage Rate on the

unpaid part of the Amount Financed. Creditor - Seller m ay receive

part of the Finance Charge.

b. Ho w we w ill app l y p a yments . We may apply each payment to

the earned and unpaid part of the Financ e Charge, to the unpa id

part of the Amount Financed and to other amounts you owe under

this contract in any order we choose.

c. How late payments or early payments change what you must

pay. We based the Finance Charge, Tot al of Payments, and Total

Sale Price shown on the front on the assumption that you will

mak e ev ery p aymen t on the da y i t is du e. Your Finan ce Charge,

Tota l of Paymen ts , and Total Sale Price will be more if you pay

late and less if you pay early. Changes may tak e the form of a

larger or smaller final payment or, at our option, more or fe wer

payments of the same amount as your scheduled payment with a

smaller final payment. We will send you a notice telling you about

these change before the final scheduled payment is due.

d. You may prepay. You may prepay all or part of the unpaid part

of the amount Financed at any time. If you do so, you must pay the

earned an d unpaid part of the Fin an ce Charge an d all other

am ounts due up to the dat e of your payment . As of the date of your

p ayment, if the mi nimum finance charge is grea ter than the earned

Fina n ce Charge, you may char ged the differenc e; the minimu m

finance charge is as follows: (1) $25 if the original Amount

Financed does not exceed $1000, (2) $50 if the original Amount

Financed is more t han $1,000 but not more than $2,000, or (3 ) $75

if the original Amount Financed is m ore than $2, 000.

2. YOUR OT H ER PROMISE S TO US

a. If the vehicle is damaged, destroyed, or missing. You agree to

pay us all you owe under this contract even if the vehicle is

damaged, destroyed, or missin g.

GAP LIABILITY NOTICE

In th e ev ent of theft or damage to you r v ehicl e that result s in a tota l

loss, there may be a gap between the amount you owe under this

contract and the proceeds of your insurance settlement and

deductible. THIS CO NTRACT PROVIDES THAT YOU ARE

LIABLE FOR THE GAP AMOUNT. An optional gap contract

(d ebt can cellation contract) for coverage of the gap am ount m ay be

offer ed for an additional char ge.

b. Using the vehicle. You a g ree no t to r emov e the vehicle fr o m

t he U.S. or Canada , or to sell, rent, lease, or tra ns fer any in terest

in the vehicle or this contract without our written permission.

You agree not to exp o se the vehicle to mis us e, seizure,

con fiscation, or involunta ry tra nsfer. If we pay an y repair bills,

st or age bills, taxes, fines, or charges on the vehi cle, you a gree to

repay the amount when we ask for it.

c. Security Interest.

You give us a security interest in:

• The vehicle and all parts or go ods installed on it;

• All money or goods received (proceeds) for the Vehicle.

• All in su rance, maintenance, servic e, or ot her contract s we

financed for you; and

• All proce eds f rom in surance, mai n tenan ce, ser v ice, or

other contracts we finance for you. This includes any

refun ds of premiu ms or charges from contracts.

This secures payment of all you owe on this contract. It also

secu res your o ther a g reements i n this co ntrac t as th e l aw allows.

You will make sure the t itle shows our security interest (lien) in

t he vehicle.

d. Insurance you must ha ve on the vehic le .

You agree to have ph ysi cal damage insurance coveri ng loss of or

d amag e to the vehi cle fo r the t er m of this contract . The

i nsu rance mu st co v er ou r in teres t in the vehi cle. If you do not

have this insurance, we may if we choose, buy physical damage

insurance. If we decide to buy physical damage in surance, we

ma y eit her buy insurance that covers your interest and our

i n terest in the vehi cle, or buy insurance that cov ers only our

i n terest. If we b uy either type of insuranc e, we will tell you

which type and the charge you must pay. The charge will be

t he premi um for the in surance an d a fi nance charge equa l to

the Annual Percen tage Ra te shown on the front of this c ontract

or, at our option, the highest rate the law permits. If the

vehicle is lost o r d amaged, you agree t h at we may u se any

i nsu rance settlement to redu ce what you owe or repair the

vehicle.

e. What happe ns to retur ned insurance , ma intena nce,

serv ic e, o r oth er con tract charges. If we get a refu nd of

i nsu rance, maint enance, servic e, or o ther cont ract cha rges, you

agree that we may subtract the refund from what you owe.

3. IF YO U P AY LATE O R BREAK YOUR OTHER PROM I SES

a. You may ow e lat e char ge s. You will pay a late charge on each

late payment as shown on the fron t. Acceptance of a late

p ayment o r l at e charge does not ex cuse you r late payment or

mean that you may keep making late payments. If you pay late,

we may also take the steps described below.

b. You may have to pay all you owe at once. If you break your

promises (default), we may demand that you pay all you owe on

this contract at once, subject to any right the law gives you to

reinstate this contract.

Defau l t means:

• You do not pay any payment on time;

• You start a proceeding in bankruptcy or one is started against

you or your p r operty;

• The vehicle i s lost, damaged or destroyed; or

• You b reak any agreements in this contract.

The amount you will owe will be the unpaid part of the Amount

Financed plus the earned and unpaid part of the Finance Charge,

any late charges, and any amounts due because you defaulted.

c. You may have to pay collection costs. You will pay our

reasonable costs to c ollec t what you owe, i ncluding att or ney

fees, court costs, collection agency fees, and fees pai d for oth er

reasonable collection effort s . You agree to pay a charge not to

exce ed $15 if any check you give to us is dishonored.

d. We may take the vehicle from you. If you defa ult, we may

t ake (r eposses s) the v ehicle from you if we do so peacef ully and

t he law allows i t. If your vehicle has an electr o nic tracking

d ev ice, you agree that we may use the device to f i nd the vehicle.

If w e ta ke the vehi cle, any a cc essories, equipment, and

replacement parts will stay with th e vehicle. If any personal

items are in the veh icle, we may st o r e th em for you at you r

expense. If you do not ask for these items back, we may dispose

of them as the law allows .

e. How you can g et t h e v ehicle back if w e take it. If we

repossess the vehicle, you may pay to g et it b ack (r edeem) . You

may redeem the vehicle by paying all you owe, or you may have

the right to reinstate this contract and redeem the vehicle by

paying past due payments and any late charges, providing proof

of insurance, and/or taking other action to cure the default. We

will provide you all notices required by law to tell you when and

how much to pay and/or what action you must take to redeem

t he vehicle.

f. We will sell the vehicle if you do not g et it ba ck. I f you do not

redeem, we will sell the veh icle. We will send you a written

n o tice of s ale before sellin g t he vehicle. We wil l appl y t he

money f r o m the s ale, less allowed expenses, t o the amoun t you

owe. Allo w ed expenses are expenses we pay as a direct result of

taking the vehi cle, h olding it, preparing it for sale, and selling it.

Attorney fees and court costs th e law permits are also allowed

expenses. If any money is left (surplus), we will pay it to you

unless the law requires us to pay it to someone else. If money

from the sale is not enough to pay the am ount you owe, you

must pay the rest to us. If you do not pay this amount when we

ask , we may cha r g e you interes t at the An nual Per centage Rate

shown on the face of this contract, not to exceed the highest rate

permitted by law, until you pay.

g. What we may do about optional i nsurance, maintenance,

serv ic e, o r oth er con tracts . This c ontract may contai n charges

for o pti o nal insurance, maint enance, servic e, or o ther c o ntracts.

MIKE’S AUTO SALES – SI MPLE INTE REST MOTOR VEHICLE CONTRACT AND SECURI TY AGREEMENT CONTINUED -

Page 4 of 4

If w e r eposses s the vehicle, we m ay claim b enefit s un der these

co ntracts and ca n cel th em to obtain refunds of unearned charges to

redu ce what you owe or r epai r t he vehic l e. If the vehi cle is a total

loss because it is confiscated, damaged, or stolen, we may claim

b enefits under thes e cont ra cts an d canc el them to obtai n refu n ds o f

unearned charges to reduce wh at you o w e.

4. WARRANTIE S SELLE R DI S CLAIMS

If you do not get a written warranty, and the Seller does not enter

into a service contract w i thin 90 days from the date of this

contract, the Seller makes no warranties, express or implied, on

the vehicle, and there will be no implie d warranties of

merchant abi lit y or o f fitness for a particular purp ose.

This pr ovision does not aff ec t any warranties covering the vehi cle tha t

the vehicle manufacturer may provide. If the Seller has sold you a

certified used vehicle, the warranty of merchantability is not

disclaimed.

5. Used C ar Buyers G uide. The information you see on the window

form for this vehicl e is part of this contract. Information on the

window form overrides any contrary provisions in the contract of

sale.

Spanish Translation: Guia para compradores de vehiculos usados.

La informacion que ve en el formulari o de la ventanilla pa ra este

vehi culo forma parte del presente contrato. La informacion del

formulario de la ventanilla deja sin efecto toda disposicion en

co ntra ri o contenida en el contrato de venta.

6. Appli ca ble Law

Federal law and California law apply to this contract. If any part of

this contract is not valid, all other parts stay valid. We may delay or

refrain from enforcing an y of our right s under this contract without

los ing t hem. For example, w e may e x tend the time f or makin g some

payments without extending the time for making others.

7. W arranties of Buy er

You promise you have given true and correct information in your

application for credit, and you have no knowledge that will make that

information untrue in the future. We have relied on the truth and

accuracy of that information in entering into this contract. Upon

request, you will provide us with documents and other information

n ecessary to verify any item contained in your credit application.

You waive the provisi ons of Calif. Vehic le C ode Section 1808.21 and

authorize the California Department of Motor Vehic les to fu r nish your

res idence add r ess to us.

CREDI T DISAB ILI TY INSURANCE NOT ICE CLAIM

PROCEDURE

If you become disabled, you must tell us right away. (You are advised to

sen d this information to th e sam e a ddress to which you are normally

required to send your payments, unless a different address or telephone

number is given to you in writing by us as the location where we would like

to be notified.) We will tell you where to get claim forms. You must send

in the completed form to the insurance company as soon as possible and

tell u s as s oon as you d o.

If your disability insurance covers all of your m issed pa yment (s ), WE

CANNOT TRY TO COLLEC T WHAT YOU OWE OR FORE CLOSE

UPON REPOSSESS ANY COLLATERAL UNTIL THREE

CALENDAR MONTHS AFTER your first missed payment is due or

until the insurance company pays or rejects your claim, whichever comes

first. We can , however, try to collect, foreclose, or rep ossess if you have

any money due and owing us or are otherwise in default when you

disability claim is made or if senior mortgage or lien holder is

foreclosing.

If the insurance company pays the claim wit hi n the three cale nd ar

months, we must accept the money as though you paid on time. If the

insurance company rejects the claim within the three calendar months or

accepts the claim within the three calendar months on a partial disability

and pays less than for a total disability, you wi ll have 35 days from the

date that the rejection or the acceptance of the partial disability claim is

sent to pay past due payments, or the difference between the past due

payments and what the insurance company pays for the partial disability,

plus late charges. You ca n contac t us, and we will tell you how mu ch you

owe. After th at time, we ca n take a ction to collect o r foreclose o r

repos s es s any colla teral you m ay have gi ven.

If the insurance company accepts your cla im but req uires t hat you send in

additional form s to rema in eligi ble for continued payments, you s hould

sen d in these c om pleted additional forms n o later tha n required. If you do

not send in these forms on time, the insurance company may stop paying,

and we wil l then be able to tak e action to co ll ect or foreclos e or r eposses s

any collateral you may have given.

Seller's Right to Cancel

a. Seller agrees to deliver the vehicle to you on the date this contract is

signed by Seller and y ou. Y o u un ders t a n d that it may take a few

days for Sell er to verify you r credit and assign th e c ontract. You

ag ree that if Seller is unable to assign t he contrac t to any one o f the

financial institutions with whom Seller regularly does business

u n der an assi g nmen t accep table t o S el ler, Seller may cancel the

contract.

b. Seller shall give you written notice (or in any other manner in which

actual notice is given to you) within 10 days of the date th is co ntr act

i s signed if S eller elects to cancel. Upon rec eipt of such notice, you

must immed iately retu rn t he vehi cle to S eller in the sa me co ndition

as when sold, reasonable wear and tear excepted . Seller must gi v e

back to you all consideration received by Seller, including any

trade-in vehic le.

c. If you do not immediately return the vehicle, you sha ll be li able for

al l ex penses incurred by Seller in taking the veh icle from you,

including reasonable a ttorney's fees.

d. While the vehicle is in your possession, all terms of the contract,

including those relating to use of the vehicle and insurance for t he

vehic le, shall be in fu ll f o r ce and you s ha ll assu me all risk of los s or

damage to the vehicle. You must pay all reasonable costs for repair

of an y damage to the vehic l e unti l the vehicle i s returned to Sel ler.

NOTICE : ANY HOLDER OF THISCONSUMER CREDI T CONTR ACT I S SUBJECT TO ALL CLAIMS AN D DE FENS ES W HICH THE DEBTOR COULD

ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED PURSU ANT HERETO OR WITH THE PROCEEDS HEREOF. RECOVERY

HEREUNDER BY THE DEBTOR SHAL L NOT EXCEED AMO UNTS PAID BY THE DEBTOR HEREUNDER.

The precedi ng NOTICE appli es only if the "personal, f amil y or household" box i n the "Primary Use for Which Purchased" secti on of this contract is

check ed. I n all other cases, Buyer wil l not assert against any subsequent holder or ass i gnee of this contrac t any claims or defens es the Buyer (debtor)

may have agai nst the Seller, or against the manufacturer of the vehicle or equipm ent obtai ned under this contract .

Seller assigns its interest in this contract to (Assignee) at (ad dress)

u n der the terms of Sell er ’s agreement(s) with Assignee

Ass i gned with rec ourse Ass i gned without recours e Ass i gned with l imited rec ourse

Seller: By: Title: