- Security Agreement Sample Form

- Connecticut Security Agreement Form Public Deposit

- Motor Vehicle Security Agreement Form

- Premier Certified Lenders Program Security Agreement - U. S. Small Business Administration

- Security Agreement (For Direct Loans Including Motor Vehicles) - Denver

- Sample Security Agreement Form

Fillable Printable Premier Certified Lenders Program Security Agreement - U. S. Small Business Administration

Fillable Printable Premier Certified Lenders Program Security Agreement - U. S. Small Business Administration

Premier Certified Lenders Program Security Agreement - U. S. Small Business Administration

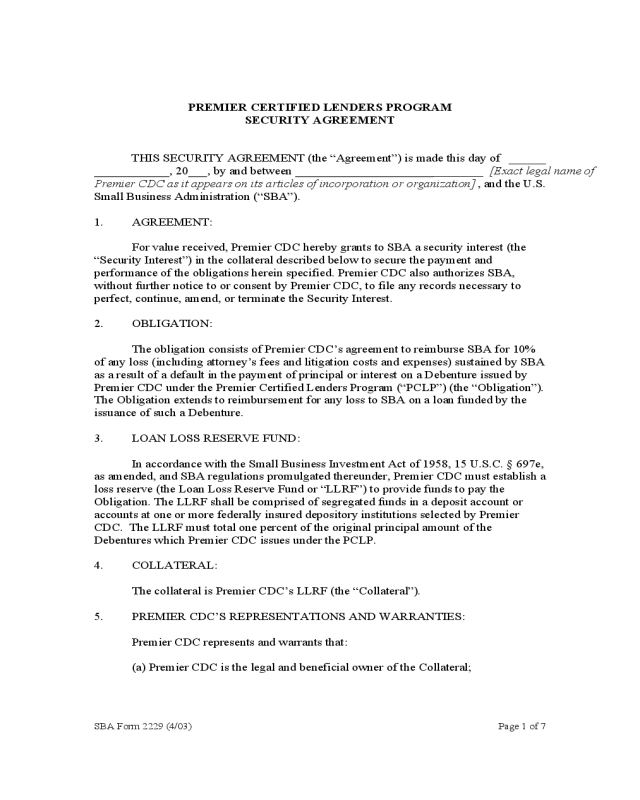

PREMIER CERTIFIED LENDERS PROGRAM

SECURITY AGREEMENT

THIS SECURITY AGREEMENT (the “Agreement”) is made this

day of

, 20

, by and between

________ [Exact legal name of

Premier CDC as it appears on its articles of incorporation or organization]

, and the U.S.

Small Business Administration (“SBA”).

1.

AGREEMENT:

For value received, Premier CDC hereby grants to SBA a security interest (the

“Security Interest”) in the collateral described below to secure the payment and

performance of the obligations herein specified. Premier CDC also authorizes SBA,

without further notice to or consent by Premier CDC, to file any records necessary to

perfect, continue, amend, or terminate the Security Interest.

2.

OBLIGATION:

The obligation consists of Premier CDC’s agreement to reimburse SBA for 10%

of any loss (including attorney’s fees and litigation costs and expenses) sustained by SBA

as a result of a default in the payment of principal or interest on a Debenture issued by

Premier CDC under the Premier Certified Lenders Program (“PCLP”) (the “Obligation”).

The Obligation extends to reimbursement for any loss to SBA on a loan funded by the

issuance of such a Debenture.

3.

LOAN LOSS RESERVE FUND:

In accordance with the Small Business Investment Act of 1958, 15 U.S.C. § 697e,

as amended, and SBA regulations promulgated thereunder, Premier CDC must establish a

loss reserve (the Loan Loss Reserve Fund or “LLRF”) to provide funds to pay the

Obligation. The LLRF shall be comprised of segregated funds in a deposit account or

accounts at one or more federally insured depository institutions selected by Premier

CDC. The LLRF must total one percent of the original principal amount of the

Debentures which Premier CDC issues under the PCLP.

4.

COLLATERAL:

The collateral is Premier CDC’s LLRF (the “Collateral”).

5.

PREMIER CDC’S REPRESENTATIONS AND WARRANTIES:

Premier CDC represents and warrants that:

(a) Premier CDC is the legal and beneficial owner of the Collateral;

SBA Form 2229 (4/03)

Page 1 of 7

(b) The Collateral is not subject to any liens, security interests, claims or

encumbrances other than the Security Interest granted to SBA and the rights

of a bank permitted under any control agreement entered into by Premier

CDC, SBA, and such bank;

(c) Premier CDC has the power and authority to execute, deliver and perform this

Agreement;

(d) Premier CDC has taken all necessary action to authorize the execution,

delivery and performance of this Agreement and has duly executed and

delivered this Agreement;

(e) This Agreement is Premier CDC’s valid and legally binding obligation,

enforceable against Premier CDC in accordance with its terms;

(f) The execution, delivery and performance of this Agreement does not and will

not violate the terms of any of Premier CDC’s governing documents, result in

the breach of any of Premier CDC’s material agreements or result in the

violation of any law, rule, regulation, order, judgment or decree to which

Premier CDC or its property is subject;

(g) This Agreement is effective to create a valid security interest in the Collateral,

prior to all security interests, liens or claims of any other persons or entities

other than claims of a bank permitted pursuant to a control agreement entered

into by Premier CDC, SBA and such bank;

(h) Premier CDC’s exact legal name is set forth at the beginning of this

Agreement; [and, if applicable, it is a corporation or limited liability company

duly organized and validly existing under the laws of

___________________].

6.

PREMIER CDC’S AGREEMENT AND RIGHTS:

Premier CDC agrees that:

(a) Premier CDC will cooperate with SBA in obtaining control with respect to the

Collateral by executing a control agreement between a bank, the Premier CDC

and SBA for each deposit account comprising the Premier CDC’s LLRF;

(b) The only property that will be credited to the Collateral will be funds which

are not instruments, and which are (i) eligible for federal deposit insurance,

and (ii) segregated from all other funds or property of Premier CDC which do

not constitute the LLRF;

(c) Premier CDC will not instruct the Bank to issue any instruments in connection

with the LLRF;

SBA Form 2229 (4/03)

Page 2 of 7

(d) Premier CDC will immediately notify SBA if the aggregate amount of all

Premier CDC’s funds on deposit with any bank at which all or part of the

LLRF is maintained which are eligible for federal deposit insurance (including

certificates of deposit and funds in deposit accounts other than the Collateral)

is more than the maximum amount eligible for federal deposit insurance;

(e) Without SBA’s prior written consent, Premier CDC will not attempt to

withdraw any funds from the Collateral or give any bank at which all or part

of the LLRF is maintained any instructions with respect to the Collateral;

(f) Without SBA’s prior written consent, Premier CDC will not enter into any

agreements relating to the Collateral (i) with a bank at which all or part of the

LLRF is maintained other than such bank’s customer agreement governing

deposit accounts, if any, and a Loan Loss Reserve Fund Deposit Account

Control Agreement, or (ii) any other person or entity;

(g) Premier CDC will not create or suffer to exist any security interests, liens,

claims or other encumbrances on the Collateral other than those in favor of

SBA and the rights of a bank permitted under a control agreement entered into

by Premier CDC, SBA and such bank;

(h) Premier CDC will maintain all Collateral in good condition, and pay promptly

all taxes, judgments, or charges of any kind levied or assessed thereon;

(i) Premier CDC will execute and will pay the filing and recording costs of any

records necessary to perfect, continue, amend, or terminate the Security

Interest, as demanded by SBA, and Premier CDC ratifies all previous such

filings, including financing statements;

(j) Premier CDC will not change it’s legal name, change or reorganize the type of

organization or form under which it does business or, if a corporation or

limited liability company, change its state of organization except upon prior

written approval of SBA; if such approval is given, Premier CDC agrees that

all records demanded by SBA in connection therewith shall be prepared and

filed at Premier CDC’s expense before any such change occurs;

(k) Premier CDC maintains records concerning the Collateral at the following

address:_______________________;

(l) Premier CDC waives any right it may have to require SBA to defend against

or pursue any third party for any obligation or claim arising from this

Agreement; and

(m) Premier CDC will enter into any additional agreements or modifications to

this Agreement which SBA deems necessary or desirable to ensure that SBA

SBA Form 2229 (4/03)

Page 3 of 7

has and maintains a valid and perfected first priority security interest in the

Collateral.

7.

DEFAULT AND SBA’S RIGHT TO PROTECT THE COLLATERAL:

(a) It shall be considered a default if Premier CDC fails to reimburse SBA for

10% of any loss (including attorney’s fees and litigation costs and expenses)

sustained by SBA as a result of a default in the payment of principal or

interest on any Debenture issued by Premier CDC or any loss to SBA on a

loan funded by the issuance of such a Debenture under the PCLP after (i) a

determination (including the expiration of any time period for appeal to the

SBA Assistant Administrator for Financial Assistance) of the loss sustained

by SBA, (ii) demand by SBA to Premier CDC for reimbursement for 10% of

such loss, and (iii) the expiration of any time period within which Premier

CDC must make such reimbursement.

(b) SBA also shall have the right to protect the Collateral and the priority of its

Security Interest in the Collateral in the event of:

(i) the making of any levy, seizure or attachment of or on the Collateral by a

party other than SBA; or

(ii) the appointment of a receiver for any part of the property of Premier

CDC, assignment for the benefit of creditors, or the commencement of any

proceedings under any bankruptcy or insolvency laws against Premier

CDC, which proceeding is not dismissed within ninety (90) days.

8. RIGHTS

OF

SBA:

(a)

Upon default or at any time thereafter until such default is cured, and upon the

occurrence of any of the events in Paragraph 7(b), SBA shall:

(i)

have the rights of a secured party pursuant to the Uniform Commercial

Code (“UCC”);

(ii)

have the sole right to transfer or withdraw funds from the Collateral by

check, withdrawal slip, wire transfer instructions or any other means,

without further consent by Premier CDC, in order to apply such funds

to pay the Obligation and cure the default, or to protect the Collateral

and SBA’s Security Interest therein;

(iii)

hold as additional security any proceeds arising from the Collateral,

including but not limited to, any insurance rights;

(iv)

have the right to issue instructions to the bank under any control

agreement entered into by Premier CDC, SBA and such bank,

SBA Form 2229 (4/03)

Page 4 of 7

including instructions to the bank not to follow instructions from

Premier CDC with respect to any Collateral maintained at such bank;

and

(v)

take any other action necessary to enforce its rights under this

Agreement.

(b)

Before or after default, SBA may waive any of its rights (including rights

upon Premier CDC’s default) under this Agreement, but such waiver must be

in writing and signed by an authorized SBA official.

(c) All rights conferred on SBA hereby are in addition to those granted to it by

any state or local law or any other law. SBA’s failure or repeated failure to

enforce, or waiver of, any rights hereunder shall not impair SBA’s rights to

exercise such rights accruing prior or subsequent thereto.

9.

PAYMENT OF FEES; COSTS AND EXPENSES:

In no event will SBA be liable to a Bank or to Premier CDC for any costs or

expenses incurred under this Agreement or in connection with the Collateral.

10. AMENDMENTS

AND WAIVERS:

All amendments to this Agreement must be in writing and executed by an

authorized official of the Premier CDC and SBA. No waiver of any provision of this

Agreement shall be binding against any party unless it is in writing and executed by an

authorized official of the party to be charged therewith. Any waiver of any provision of

this Agreement shall not impair the exercise of that provision by either party on a future

date. This Agreement may not be terminated without the prior written consent of SBA.

11. SEVERABILITY:

Any provision of this Agreement that is prohibited or invalid in any jurisdiction

shall be ineffective in that jurisdiction, but such provisions shall have no effect on the

validity of the remaining provisions of this Agreement. Any such prohibition or

unenforceability in any jurisdiction shall not invalidate or render unenforceable such

provision in any other jurisdiction.

12. INCONSISTENCIES:

(a) If any provision of this Agreement is inconsistent with any provision in any

control agreement made pursuant to this Agreement between a bank, the

Premier CDC and SBA, the provision of such control agreement shall govern.

SBA Form 2229 (4/03)

Page 5 of 7

(b) If any provision of this Agreement is inconsistent with any provision of any

other agreement between the Premier CDC and SBA, the provision of this

Agreement shall govern.

13. NOTICES:

Any notice, request or other communication required or permitted to be given

under this Agreement must be in writing and either (i) delivered in person, or (ii) sent by

telecopy or other electronic means with electronic confirmation of error free receipt, or

(iii) sent by certified or registered United States mail, return receipt requested, postage

prepaid, or (iv) sent by overnight U.S. Express mail or overnight letter (commercial

courier), addressed as set forth below. Any such notice, request or other communication

shall be deemed effective upon receipt or failure to accept delivery. Any party may

change its address for notices in the manner set forth above.

If to Premier CDC, to:

INSERT NAME AND ADDRESS

If to SBA, to:

INSERT NAME AND ADDRESS OF LEAD SBA OFFICE

14. MISCELLANEOUS:

(a)

Unless otherwise specified, definitions in the UCC apply to terms and phrases

in this Agreement.

(b)

Binding Effect: This Agreement shall be binding upon and shall inure to the

benefit of each party and such party’s successors and assigns.

(c)

Governing Law: Except to the extent inconsistent with federal law, in which

case federal law will govern, Premier CDC and SBA agree that this

Agreement shall be governed by the laws of

[insert

jurisdiction where Premier CDC is located]

, including the UCC as adopted by

such jurisdiction as such laws may be amended from time to time, and without

reference to its conflicts of laws provisions.

15. COUNTERPARTS:

This Agreement may be executed in any number of counterparts, all of which

shall constitute one and the same instrument.

SBA Form 2229 (4/03)

Page 6 of 7

16.

RULES OF CONSTRUCTION:

(a)

Words in the singular include the plural and in the plural include the singular.

(b)

“Includes” and “including” are not limiting.

(c)

“Or” is disjunctive but not exclusive.

(d)

“All” includes “any” and “any” includes “all.”

[Instructions: (1) Add signature line(s) for Premier CDC as appropriate under local law.

(2) Attach to this Agreement a valid, certified resolution or other evidence of the

authority of the individual signing for Premier CDC.]

PREMIER CDC

U.S. SMALL BUSINESS

ADMINISTRATION

By:

B

y

:

N

a

m

e

:

N

a

m

e

:

Title: Title:

SBA Form 2229 (4/03)

Page 7 of 7