- Premier Certified Lenders Program Security Agreement - U. S. Small Business Administration

- Security Agreement Sample Form

- Security Agreement (For Direct Loans Including Motor Vehicles) - Denver

- Sample Security Agreement Form

- Motor Vehicle Security Agreement Form

- Connecticut Security Agreement Form Public Deposit

Fillable Printable Sample Security Agreement Form

Fillable Printable Sample Security Agreement Form

Sample Security Agreement Form

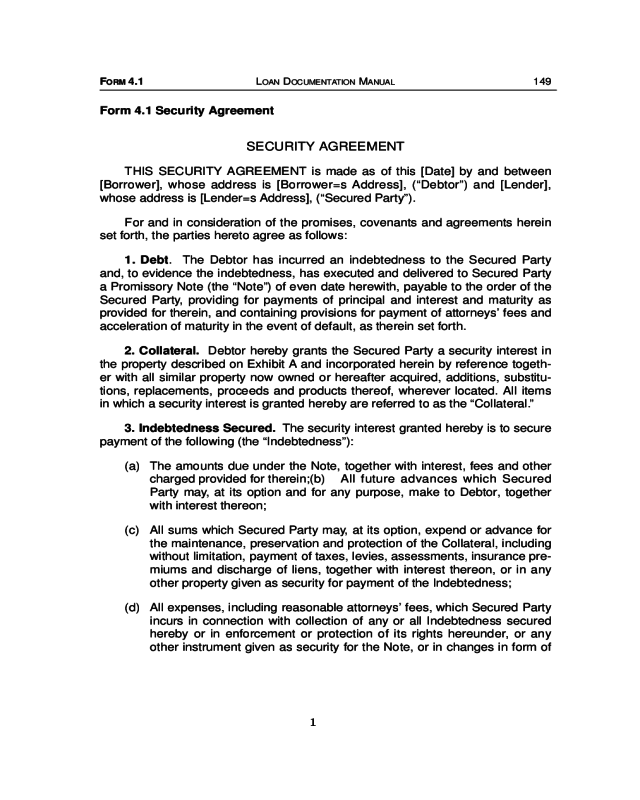

Form 4.1 Security Agreement

SECURITY AGREEMENT

THIS SECURITY AGREEMENT is made as of this [Date] by and between

[Borrower], whose address is [Borrower=s Address], (“Debtor”) and [Lender],

whose address is [Lender=s Address], (“Secured Party”).

For and in consideration of the promises, covenants and agreements herein

set forth, the parties hereto agree as follows:

1. Debt. The Debtor has incurred an indebtedness to the Secured Party

and, to evidence the indebtedness, has executed and delivered to Secured Party

a Promissory Note (the “Note”) of even date herewith, payable to the order of the

Secured Party, providing for payments of principal and interest and maturity as

provided for therein, and containing provisions for payment of attorneys’ fees and

acceleration of maturity in the event of default, as therein set forth.

2. Collateral.Debtor hereby grants the Secured Party a security interest in

the property described on Exhibit A and incorporated herein by reference togeth-

er with all similar property now owned or hereafter acquired, additions, substitu-

tions, replacements, proceeds and products thereof, wherever located. All items

in which a security interest is granted hereby are referred to as the “Collateral.”

3. Indebtedness Secured.The security interest granted hereby is to secure

payment of the following (the “Indebtedness”):

(a)The amounts due under the Note, together with interest, fees and other

charged provided for therein;(b) All future advances which Secured

Party may, at its option and for any purpose, make to Debtor, together

with interest thereon;

(c) All sums which Secured Party may, at its option, expend or advance for

the maintenance, preservation and protection of the Collateral, including

without limitation, payment of taxes, levies, assessments, insurance pre-

miums and discharge of liens, together with interest thereon, or in any

other property given as security for payment of the Indebtedness;

(d)All expenses, including reasonable attorneys’ fees, which Secured Party

incurs in connection with collection of any or all Indebtedness secured

hereby or in enforcement or protection of its rights hereunder, or any

other instrument given as security for the Note, or in changes in form of

(Rev. 1, 9/99)

FORM4.1 LOANDOCUMENTATIONMANUAL 149

1

such Indebtedness which may be made from time to time by agreement

between Debtor and Secured Party, together with interest thereon;

(e)All other present or future, direct or indirect, absolute or contingent, lia-

bilities, obligations and indebtedness of Debtor to Secured Party, howev-

er created, and specifically including all or part of any renewal or exten-

sion of the Note whether or not the Debtor executes any extension

agreement or renewal instruments.

4. Warranties and Covenants of Debtor. Debtor expressly warrants and

covenants and agrees that:

(a)Debtor is and will continue to be the owner of the Collateral free from

any lien, security interest or encumbrance, other than that created by

this Security Agreement; Debtor will defend the Collateral against all

claims and demands of all other persons at anytime claiming the same

or any interest therein; and Debtor will not sell the Collateral (except in

the ordinary course of business) without the prior written consent of the

Secured Party;(b)No effective financing statement covering any of the

Collateral or any proceeds thereof is on file in any public office, nor will

Debtor (except as provided herein) execute any financing statement

affecting the Collateral during the term of this Security Agreement with-

out the prior consent of the Secured Party;

(c) Debtor will pay the Indebtedness to Secured Party as the same

becomes due and payable;

(d)Debtor will from time to time as required by Secured Party join with

Secured Party in executing one or more financing statements pursuant to

the Uniform Commercial Code of [State] (and any assignments, exten-

sions or modifications thereof) in form satisfactory to Secured Party;

(e)Debtor will pay all costs of filing any financing, continuation, assignment

or termination statements with respect to the security interest created by

this Security Agreement and hereby appoints Secured Party its

attorney-in-fact to do, at Secured Party’s option and at Debtor’s

expense, all acts and things which Secured Party may deem necessary

to perfect and continue perfected the security interest created by this

Security Agreement;

(f) Without the prior written consent of Secured Party, Debtor will not volun-

tarily or involuntarily encumber, or agree to encumber any portion of the

Collateral (including the replacement of such Collateral in the ordinary

150 FORMS FORM4.1

2

course of business), and in the event Secured Party grants written con-

sent for the establishment of another security interest in the Collateral,

and with respect to the Security Agreements of record, Debtor will per-

form its obligations under those security agreements;(g) Debtor will

pay as they become due all taxes or other liens or claims which may

become a charge against the Collateral;

(h)Debtor will insure the Collateral with companies and in amounts accept-

able to Secured Party, such amount being the full replacement value of

the Collateral or the maximum amount the insurer will permit, against

risks of theft, vandalism, fire and such other risks as are normally

insured against, including standard extended coverage. All insurance

policies shall be written for the benefit of Debtor and Secured Party as

their interests may appear, and the Secured Party shall be named as a

loss payee on an indorsement to all insurance policies. All policies,

indorsements and certificates evidencing the same shall be furnished to

Secured Party. All insurance policies shall provide for at least 10 days’

prior written notice of cancellation to Secured Party;

(i) Debtor will maintain the Collateral in good condition and repair, and

Secured Party may examine and inspect the Collateral at any reason-

able time and wherever located;

(j) The location of the Collateral will be at the address specified for the

Debtor in this Agreement. Debtor will not permit any part or all of the

Collateral to be removed from said location, except for temporary peri-

ods in its normal and customary use, without the prior written consent of

Secured Party, and Debtor will give immediate notice to Secured Party

of any change in location of any part or all of the Collateral (and in no

event will Debtor remove, or allow to be removed, any part of all of the

Collateral from the State of [State]);

(k) Debtor will indemnify and hold the Secured Party harmless from any

and all loss, damage, injury or other casualty to persons or property

caused or occasioned by the maintenance, operation and use of the

Collateral by Debtor, its agents, invitees or employees;(l) Debtor will

from time to time supply Secured Party with a current list specifying the

Collateral at the request of Secured Party;

(m)With respect to any Collateral to be purchased with monies advanced by

Secured Party to Debtor, this Security Agreement creates a purchase

money security interest;

(Rev. 1, 9/99)

FORM4.1 LOANDOCUMENTATIONMANUAL 151

3

(n)Debtor will execute and deliver such other and further instruments and

will do such other and further act as in the opinion of the Secured Party

may be necessary or desirable to carry out more effectually the purpos-

es of this instrument, including, without limiting the generality of the fore-

going:

i) prompt correction of any defect which may hereafter be discov-

ered in the title to the Collateral or in the execution and acknowl-

edgment of this instrument, the Note, or any other document used

in connection herewith; and

ii) prompt execution and delivery of all other documents or instru-

ments which in the opinion of the Secured Party are needed to

transfer effectually the Collateral or the proceeds or the Collateral to

the Secured Party.

(o)If the Debtor is a corporation, it is duly organized and validly existing

under the laws of the State of [State] and the execution of this

Agreement has been duly authorized and approved by the Board of

Directors of Debtor and, if required, by the shareholders of Debtor. If the

Debtor is a partnership, it is duly organized and validly existing under

the laws of the State of [State] and the execution of this Agreement has

been authorized and approved by all partners necessary to authorize

the same. Debtor has full power and authority to carry on its business as

now being conducted with full power and authority to enter into this

Agreement and effect the transactions contemplated to be effected by

and under the terms of this Agreement;(p) There is no pending or

threatened litigation, claim for infringement, proceeding or investigation

by any governmental authority or any other person known to Debtor

against or otherwise affecting Debtor or any of its assets or its officers,

partners, directors or agents in their capacities as such, nor does the

Debtor know of any ground for any such litigation, infringement claims,

proceedings or investigations;

(q)No contract or organizational document prohibits any term or condition

of the security agreement;

(r) The execution and delivery of the security agreement will not violate any

law or agreement governing the Debtor or to which the Debtor is a party;

(s) All information and statements furnished in connection with the Note,

this Security Agreement and any other documents related to this

152 FORMS FORM4.1

4

secured obligation are true and correct, and contain no false or mislead-

ing statements.

5. Secured Party’s Right to Discharge.At its option, Secured Party may

discharge taxes, liens, assessments, security interest or other encumbrances at

any time levied or placed on the Collateral, may pay for premiums for insurance

on the Collateral, costs of maintenance or preservation of the Collateral, and any

other charges or expenses or perform any obligation imposed upon Debtor here-

under. Debtor agrees to reimburse Secured Party on demand for any payment

made, or any expense incurred by Secured Party, pursuant to the foregoing

authorization. Until reimbursed, the amounts so advanced or expenses incurred

shall be part of the Indebtedness to the Note, with interest thereon at the default

rate specified in the Note.

6. Possession of Collateral.Until default, Debtor may have possession of the

Collateral and use it in any lawful manner not inconsistent with this Agreement and

not inconsistent with any policy of insurance thereon, but upon default Secured Party

shall have the immediate right to possession and use of the Collateral.

7. Events of Default.Any one of the following shall constitute a default for

purposes of this Security Agreement:

(a)If the Debtor uses the Collateral in violation of any statute or ordinance;

or

(b)If Debtor fails to promptly pay when due all taxes and assessments

upon the Collateral or fails to keep the Collateral in good condition and

repair and fully insured; or

(c) If Debtor fails to pay promptly in full any Indebtedness secured hereby

when any part of such Indebtedness becomes due and payable; or

(d)If Debtor breaches any term, condition, representation or covenant to be

performed or observed by Debtor provided in this Security Agreement,

the Note or in any other instrument given in connection with or securing

part or all of the Indebtedness of Debtor to Secured Party; or

(e)If any warranty, representation or statement made or furnished to

Secured Party by or on behalf of Debtor in connection with the Security

Agreement proves to have been false in any respect; or

(f) If the Collateral, or any part thereof, is levied upon or seized under any

levy or attachment or any other legal process; or

(Rev. 1, 9/99)

FORM4.1 LOANDOCUMENTATIONMANUAL 153

5

(g)The insolvency (however evidenced) or the commission of any act of

insolvency, by Debtor, or the making of an assignment to or for the ben-

efit of creditors of Debtor, or the appointment of a receiver, liquidator,

conservator or trustee of Debtor, or its property, or the filing of a volun-

tary petition or the commencement of any proceeding by Debtor for

relief under any bankruptcy, insolvency, reorganization, arrangement or

receivership laws, or any other law relating to the relief of debtors of any

state or of the United States, or the filing of any involuntary petition

(unless and until discharged or dismissed within 30 days after such fil-

ing) for the bankruptcy, insolvency, reorganization, arrangement or

receivership or the involuntary commencement of any similar proceed-

ing under the laws of any state or of the United States relating to the

relief of debtors, against Debtor; or

(h)If the Collateral suffers substantial damage or destruction, or if any of

the items of Collateral existing from time to time is lost or stolen, and is

not immediately repaired or replaced; or

(i) If any material adverse change occurs in the financial condition, assets,

or management of the Debtor or any material adverse change occurs in

the Debtor’s ability to carry on its business as presently conducted or to

meet its obligations for the Indebtedness, on a timely basis, or

(j) A good faith belief by the Secured Party that the obligations are inade-

quately secured or that the prospect of payment of performance of the

Indebtedness, this Security Agreement or any of the obligations thereby

is impaired.

In the event of default, the Secured Party, at its option, may declare the

entire unpaid principal of and the interest accrued on the Indebtedness secured

hereby to be forthwith due and payable, without any notice or demand of any

kind, both of which are hereby expressly waived.

8. Remedies of the Secured Party in Event of Default.Debtor agrees that

upon the occurrence of any default set forth above, the full amount remaining

unpaid on the Indebtedness secured hereby shall, at the option of Secured Party

and without notice, be and become due and payable forthwith, and Secured Party

shall then have the rights, options, duties and remedies of a secured party under,

and the Debtor shall have the rights and duties of a debtor under, the Uniform

Commercial Code of [State], including without limitation the right in Secured

Party to take possession of the Collateral and of anything found therein, and the

right without legal process to enter any premises where the Collateral may be

found. Debtor further agrees in any such case to assemble the Collateral and

154 FORMS FORM4.1

6

make it available to Secured Party as directed by Secured Party. Secured Party

shall have the right and power to sell, at one or more sales, as an entirety or in

parcels, in public or private sales as it may elect, the Collateral, or any of it, at

such place or places and otherwise in such manner and upon such notice as the

Secured Party may deem appropriate, in its sole discretion, and to make con-

veyance to the purchaser or purchasers; and the Debtor shall warrant title to the

Collateral to such purchaser or purchasers. If the Collateral is to be sold in a pub-

lic sale, the Secured Party may postpone the sale of all or any portion of the

Collateral by public announcement at the time and place of such sale, and from

time to time thereafter may further postpone such sale by public announcement

made at time of sale fixed by the preceding postponement. The right of sale here-

under shall not be exhausted by one or any sale, and the Secured Party may

make other and successive sales until all of the Collateral is sold. It shall not be

necessary for the Secured Party to be physically present at any such sale, or to

have constructively in its possession, any or all of the personal property covered

by this Security Agreement, and the Debtor shall deliver all of such personal

property to the purchaser at such sale on the date of sale, and if it should be

impossible or impractical to take actual delivery of such property, then the title

and the right of possession to such property shall pass to the purchaser at such

sale as completely as if the same had been actually present and delivered.

(a)Judicial Proceedings. Upon occurrence of an event of default, the

Secured Party in lieu of or in addition to exercising the power of sale here-

inabove given, may proceed by a suit or suits in equity or at law, whether

for a foreclosure hereunder, or of the sale of the Collateral, or for the spe-

cific performance of any covenant or agreement herein contained or in aid

of the execution of any power herein granted, or for the appointment of a

receiver pending any foreclosure hereunder of the sale of the Collateral,

or for the enforcement of any other appropriate legal or equitable remedy.

(b)Certain Aspects of a Sale. The Secured Party shall have the right to

become the purchaser at any sale held by it or by any court, receiver or

public officer, and the Secured Party shall have the right to credit upon

the amount of the bid made therefor, the amount payable out of the net

proceeds of such sale to it. Recitals contained in any covenant made to

any purchaser at any sale made hereunder shall conclusively establish

the truth and accuracy of the matters therein stated, including, without

limiting the generality of the foregoing, non-payment of the unpaid prin-

cipal sum of, and the interest accrued on, the Indebtedness after the

same has become due and payable, and advertisement and conduct of

such sale in the manner provided herein.

(Rev. 1, 9/99)

FORM4.1 LOANDOCUMENTATIONMANUAL 155

7

(c) Receipt to Purchaser. Upon any sale, whether made under the power of

sale herein granted and conferred or by judicial proceedings, the receipt

of the Secured Party, or of the officer making sale under judicial pro-

ceedings, shall be sufficient to discharge the purchaser or purchasers at

any sale for his or their purchase money, and such purchaser or pur-

chasers, his or their assigns or personal representatives, shall not, after

paying such purchase money and receiving such receipt to the Secured

Party or of such officer therefor, be obligated to see the application of

such purchase money, or be in any way answerable for any loss, misap-

plication or non-application thereof.

(d)Effect of Sale. Any sale or sales of the Collateral, whether under the

power of sale herein granted and conferred or by virtue of judicial pro-

ceedings, shall operate to divest all right, title, interest, claim and demand

whatsoever either at law or in equity, of the Debtor of, in and to the

premises and the property sold, and shall be a perpetual bar, both at law

and in equity, against the Debtor, Debtor’s successors or assigns and

against any and all persons claiming or who shall thereafter claim all or

any of the property sold from, through or under the Debtor or Debtor’s

successors or assigns; nevertheless, the Debtor, if so requested by the

Secured Party, shall join in the execution and delivery of all property con-

veyances, assignments and transfers of the properties so sold.

(e)Application of Proceeds. The proceeds of any sale of the Collateral or

any part thereof, whether under and conferred or by virtue of judicial

proceedings, shall be applied as follows:

i) To the payment of all expenses incurred by the Secured Party in

any entry or taking of possession, of any sale, of advertisement

thereof, and of conveyances, and court costs, compensation of

agents and employees and attorneys’ fees;

ii) To the payment of the Indebtedness with interest to the date of such

payment;

iii) Any surplus thereafter remaining shall be paid to the Debtor or

Debtor’s successors or assigns, as their interests shall appear.

(f) Debtor’s Waiver of Appraisement, Marshaling, Etc., Rights. The Debtor

agrees, to the full extent that the Debtor may lawfully so agree, that the

Debtor will not at any time insist upon or plead or in any manner whatever

claim the benefit of any appraisement, valuation, stay, extension or

redemption law now or hereafter in force, in order to prevent or hinder the

156 FORMS FORM4.1

8

enforcement or foreclosure of this Security Agreement or the sale of the

Collateral or the possession thereof by any purchaser at any sale made

pursuant to any provision hereof; and the Debtor, for Debtor and all who

may claim through or under Debtor now or hereafter, hereby waives the

benefit of all such laws. The Debtor, for the Debtor and all who may claim

through or under Debtor, waives any and all right to have the Collateral

marshaled upon any foreclosure of the lien hereof, or sold in inverse order

of alienation, and agrees that the Secured Party or any court having juris-

diction to foreclose such lien may sell the Collateral as an entirety.

(g)Costs and Expenses. All costs and expenses for retaking, holding, stor-

ing, preparing for sale, selling and documenting such transactions

(including attorneys’ fees) incurred by the Secured Party in protecting

and enforcing its rights hereunder, shall constitute a demand obligation

owing by the Debtor to the Secured Party at the effective rate of interest

of the Note, all of which shall constitute a portion of the Indebtedness.

(h)Operation of Property by the Secured Party. Upon the occurrence of an

event of default and in addition to all other rights herein conferred on the

Secured Party, the Secured Party (or any person, firm or corporation

designated by the Secured Party) shall have the right and power, but

shall not be obligated, to enter upon and take possession of any of the

Collateral, and to exclude the Debtor, and the Debtor’s agents or ser-

vants, wholly therefrom and to hold, use, administer, manage and oper-

ate the same to the extent that the Debtor shall be at the time entitled

and in its place. The Secured Party, or any person, firm or corporation

designated by it, shall have the right to collect, receive and receipt for all

payments with respect to the Collateral or the goods, services produced

and sold from the Collateral, and to exercise every power, right and priv-

ilege of the Debtor with respect to the Collateral.

9. Notification. Any requirement of the Uniform Commercial Code of rea-

sonable notification of the time and place of any public sale, or the time after

which any private sale or other disposition is to be made, shall be met by mailing

to the Debtor at the address shown at the beginning of this Agreement, at least

five days’ prior notice of the time and place of any public sale or the time after

which any private sale or any other intended disposition is to be made. Debtor

shall be and remain liable for any deficiency remaining after applying the pro-

ceeds of disposition of the Collateral as provided in this Security Agreement.

10. No Waiver.The making of this Security Agreement shall not waive or

impair any other security Secured Party may have or hereafter acquire for the

(Rev. 1, 9/99)

FORM4.1 LOANDOCUMENTATIONMANUAL 157

9

payment of the Indebtedness, nor shall the taking of any such additional security

waive or impair this Security Agreement; but Secured Party may resort to any

security it may have in the order it may deem proper, and Secured Party shall

retain its rights to set-off against Debtor, notwithstanding any rights to the

Collateral hereunder.

11. Advances by the Secured Party. Each and every covenant herein con-

tained shall be performed and kept by the Debtor solely at the Debtor’s expense.

If the Debtor shall fail to perform or keep any of the covenants of whatsoever kind

or nature contained in this instrument, the Secured Party, or any receiver appoint-

ed hereunder, may, but shall not be obligated to, make advances to perform the

same on the Debtor’s behalf, and the Debtor hereby agrees to repay such sums

upon demand plus interest as a part of the Indebtedness. No such advance shall

be deemed to relieve the Debtor from any default hereunder.

12. Defense of Claims.The Debtor will notify the Secured Party in writing,

promptly of the commencement of any legal proceedings affecting the lien hereof

or the Collateral or any part thereof, and will take such action, employing attor-

neys acceptable to the Secured Party or, as may be necessary to preserve the

Debtor’s and the Secured Party’s rights affected thereby; and should the Debtor

fail or refuse to take any such action, the Secured Party may, upon giving prior

written notice thereof to the Debtor, take such action on behalf and in the name

of the Debtor and at the Debtor’s expense. The Secured Party may also take

such independent action in connection therewith as it may, in its discretion, deem

proper, the Debtor hereby agreeing that all sums advanced or all expenses

incurred in such actions plus interest, will, on demand, be reimbursed to the

Secured Party, or any receiver appointed hereunder, and shall become part of

the Indebtedness.

13. Payment of the Indebtedness.If the Indebtedness shall be fully paid

and the covenants herein contained shall be performed, the entire right, title and

interest of the Secured Party shall thereupon cease; and the Secured Party in

such case shall, upon the request of the Debtor and at the Debtor’s cost and

expense, deliver to the Debtor proper instruments acknowledging satisfaction of

this Security Agreement.

14. Renewals, Amendments and Other Security. Renewals and exten-

sions of the Indebtedness may be given at any time and amendments may be

made to agreements relating to any part of the Indebtedness without notice to or

consent of the Debtor. The Secured Party may resort first to such other security

or any part thereof or first to the security herein given or any part thereof, or from

time to time to either or both, even to the partial or complete abandonment of

158 FORMS FORM4.1

10

either security, and such action shall not be a waiver of any rights conveyed by

this Security Agreement, which shall continue as a lien upon the Collateral not

expressly released until the Indebtedness secured hereby is fully paid.

15. Release. No release from the lien of this Security Agreement or any part

of the Collateral by Secured Party shall in any way alter, vary, or diminish the

force, effect or lien of this Security Agreement on the balance of the Collateral.

16. Subrogation. This Security Agreement is made with full substitution and

subrogation of Secured Party in and to all covenants and warranties by another

heretofore given or made in respect of the Collateral or any part thereof.

17. Governing Law.This Security Agreement shall be governed by the laws

of the State of [State].

18. Instrument and Assignment, Etc.This Security Agreement shall be

deemed to be and may be enforced from time to time as an assignment, chattel

mortgage, contract, financing statement, real estate mortgage or security agree-

ment, and from time to time as any one or more thereof.

19. Limitation on Interest. No provision of this Security Agreement or of

the Indebtedness shall require the payment or permit the collection of interest in

excess of the maximum permitted by law or which is otherwise contrary to law. If

any excess of interest in such respect is herein or in the Indebtedness provided

for, or shall be adjudicated to be so provided for herein or in the Indebtedness,

the Debtor shall not be obligated to pay such excess.

20. Unenforceable or Inapplicable Provisions. If any provision hereof or

of the Indebtedness is invalid or unenforceable in any jurisdiction, or with respect

to any person or property, the other provisions hereof or of the Indebtedness in

such jurisdiction and the application thereof to any other person or property, shall

remain in full force and effect, and the remaining provisions hereof shall be liber-

ally construed in favor of the Secured Party in order to effectuate the provisions

thereof. The invalidity of any provision hereof in any jurisdiction shall not affect the

validity or enforceability of any such provision in any other jurisdiction.

21. Rights Cumulative.Each and every right, power and remedy herein

given to the Secured Party shall be cumulative and not exclusive; and each and

every right, power and remedy whether specifically herein given or otherwise

existing may be exercised from time to time and so often and in such order as

may be deemed expedient by the Secured Party, and the exercise, or the begin-

ning of the exercise, or any such right, power or remedy shall not be deemed a

waiver of the right to exercise, at the same time or thereafter, any other right,

(Rev. 1, 9/99)

FORM4.1 LOANDOCUMENTATIONMANUAL 159

11