- Vehicle Transfer/Tax Form - British Columbia

- Application to Transfer or Retain a Vehicle Registration Number - UK

- Vehicle Registration/Title Application - New York

- Vehicle Registration Transfer Application - Queensland State

- Power of Attorney to Transfer Motor Vehicle - Mississippi

- Notification of Change of Ownership - Western Australia

Fillable Printable Notification of Change of Ownership - Western Australia

Fillable Printable Notification of Change of Ownership - Western Australia

Notification of Change of Ownership - Western Australia

Government of Western Australia

Department of Transport

Driver and Vehicle Services

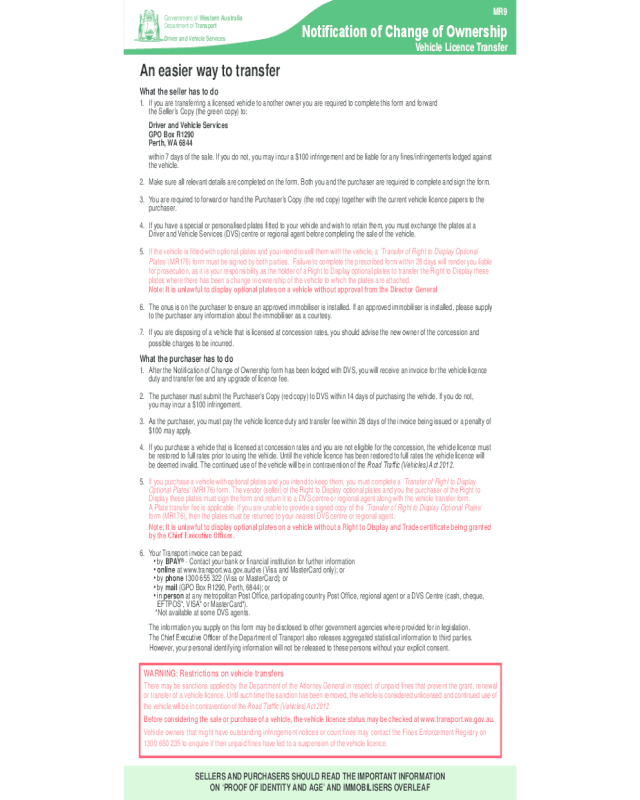

An easier way to transfer

What the seller has to do

1. If you are transferring a licensed vehicle to another owner you are required to complete this form and forward

the Seller’s Copy (the green copy) to:

Driver and Vehicle Services

GPO Box R1290

Perth, WA 6844

within 7 days of the sale. If you do not, you may incur a $100 infringement and be liable for any fines/infringements lodged against

the vehicle.

2. Make sure all relevant details are completed on the form. Both you and the purchaser are required to complete and sign the form.

3. You are required to forward or hand the Purchaser’s Copy (the red copy) together with the current vehicle licence papers to the

purchaser.

4. If you have a special or personalised plates fitted to your vehicle and wish to retain them, you must exchange the plates at a

Driver and Vehicle Services (DVS) centre or regional agent before completing the sale of the vehicle.

5. If the vehicle is fitted with optional plates and you intend to sell them with the vehicle, a ‘Transfer of Right to Display Optional

Plates’ (MR176) form must be signed by both parties. Failure to complete the prescribed form within 28 days will render you liable

for prosecution, as it is your responsibility as the holder of a Right to Display optional plates to transfer the Right to Display these

plates where there has been a change in ownership of the vehicle to which the plates are attached.

Note: It is unlawful to display optional plates on a vehicle without approval from the Director General

6. The onus is on the purchaser to ensure an approved immobiliser is installed. If an approved immobiliser is installed, please supply

to the purchaser any information about the immobiliser as a courtesy.

7. If you are disposing of a vehicle that is licensed at concession rates, you should advise the new owner of the concession and

possible charges to be incurred.

What the purchaser has to do

1. After the Notification of Change of Ownership form has been lodged with DVS, you will receive an invoice for the vehicle licence

duty and transfer fee and any upgrade of licence fee.

2. The purchaser must submit the Purchaser’s Copy (red copy) to DVS within 14 days of purchasing the vehicle. If you do not,

you may incur a $100 infringement.

3. As the purchaser, you must pay the vehicle licence duty and transfer fee within 28 days of the invoice being issued or a penalty of

$100 may apply.

4. If you purchase a vehicle that is licensed at concession rates and you are not eligible for the concession, the vehicle licence must

be restored to full rates prior to using the vehicle. Until the vehicle licence has been restored to full rates the vehicle licence will

be deemed invalid. The continued use of the vehicle will be in contravention of the Road Traffic (Vehicles) Act 2012.

5. If you purchase a vehicle with optional plates and you intend to keep them, you must complete a ‘Transfer of Right to Display

Optional Plates’ (MR176) form. The vendor (seller) of the Right to Display optional plates and you the purchaser of the Right to

Display these plates must sign the form and return it to a DVS centre or regional agent along with the vehicle transfer form.

A Plate transfer fee is applicable. If you are unable to provide a signed copy of the ‘Transfer of Right to Display Optional Plates’

form (MR176), then the plates must be returned to your nearest DVS centre or regional agent.

Note: It is unlawful to display optional plates on a vehicle without a Right to Display and Trade certificate being granted

by the Chief Executive Officer.

6. Your Transport invoice can be paid;

•byBPAY - Contact your bank or financial institution for further information

•online at www.transport.wa.gov.au/dvs (Visa and MasterCard only); or

•byphone 1300 655 322 (Visa or MasterCard); or

•bymail (GPO Box R1290, Perth, 6844); or

•inperson at any metropolitan Post Office, participating country Post Office, regional agent or a DVS Centre (cash, cheque,

EFTPOS*, VISA* or MasterCard*).

*Not available at some DVS agents.

The information you supply on this form may be disclosed to other government agencies where provided for in legislation.

The Chief Executive Officer of the Department of Transport also releases aggregated statistical information to third parties.

However, your p

ersonal identifying information will not be released to these persons without your explicit consent.

SELLERS AND PURCHASERS SHOULD READ THE IMPORTANT INFORMATION

ON ‘PROOF OF IDENTITY AND AGE’ AND IMMOBILISERS OVERLEAF

WARNING: Restrictions on vehicle transfers

The re may be s anc ti ons ap pli ed by th e Dep artment of t he At to r ney Ge ner al in re sp ec t of unpa id f i nes t hat pr event the gr ant, re newal

or transfer of a vehicle licence. Until such time the sanction has been removed, the vehicle is considered unlicensed and continued use of

the vehicle will be in contravention of the Road Traffic (Vehicles) Act 2012.

Before considering the sale or purchase of a vehicle, the vehicle licence status may be checked at www .transport.wa.gov.au.

Vehi cle ow ne rs that m i ght h ave outstandi n g infr in g em e nt not i ces o r cou rt f in e s m ay c o nt act the Fi ne s Enfo r cem ent Re gi st ry on

1300 650 235 to enquire if their unpaid fines have led to a suspension of the vehicle licence.

Notication of Change of Ownership

Vehicle Licence Transfer

MR9

Proof of Identity and Age (POI)

Purchasers must provide proof of identity and age before a vehicle licence can be transferred.

A vehicle licence can only be issued/transferred to:

•anindividual(naturalperson)aged18yearsorolderforaheavyvehicle(over4500kgmassratingforcharging)or

16 years or older for any other vehicle;

•acorporatecompanyorotherincorporatedbody;or

•anyotherbodythatisrecognisedasbeingalegalentity.

Proof of identity and age can be provided by:

An individual (natural person)

Providing details of your W.A. driver’s licence number in this space provided on the form or producing evidence

of your identity and date of birth to DVS (e.g. a Birth Certicate, Passport or anotherAustralian driver’slicenceetc).

Ifforwardedbymailpleaseincludecertiedcopies,notoriginals.

A corporate company or other incorporated body

Companies or corporate bodies registered under the Corporations Act (2001) must provide details of their

Australian Company Number (A.C.N.) in the space provided on the form or present a Certicate of Incorporation

(issued by ASIC) to DVS.

Organisations incorporated under any other Australian law (associations, unions, lubs, foundations etc), must present a

CerticateofIncorporationorotherlegaldocumentthatcreatesthebodyasalegalentityasevidenceofidentity.Ifthis

applicationistobelodgedbymail,pleaseencloseacertiedcopyoftheCerticate.

When a vehicle is jointly owned a Proof of Identity form must be completed and signed by all owners nominating an owner/

licence holder. Proof of Identity forms may be obtained online at www.transport.wa.gov.au/dvs.

Immobilisers are compulsory

Every vehicle, unless it is exempt, must have either a factory tted or Government approved immobiliser tted

before the licence can be transferred.

It is the purchaser’s responsibility to t or ensure that the vehicle is tted with an approved immobiliser.

Exempt vehicles are:

•vehiclesthatare25yearsorolder;

•vehiclesthathaveatareweightover3000kgoraGVMoraggregateweightover4500kg;

•motorcycles;

•somefarmvehicles.

Transferfeesandvehiclelicencedutycannotbepaidunlessthepurchasermakesadeclarationthatafactoryttedor

otherapprovedimmobiliseristtedtothevehicle.Afalseormisleadingdeclarationmayresultinaneandthevehicle

licence being cancelled.

For more information

Brochuresareavailablefromauthorisedinstallers,RACofcesandonlineatwww.transport.wa.gov.au/dvs.

Last Updated: 12/03/2015

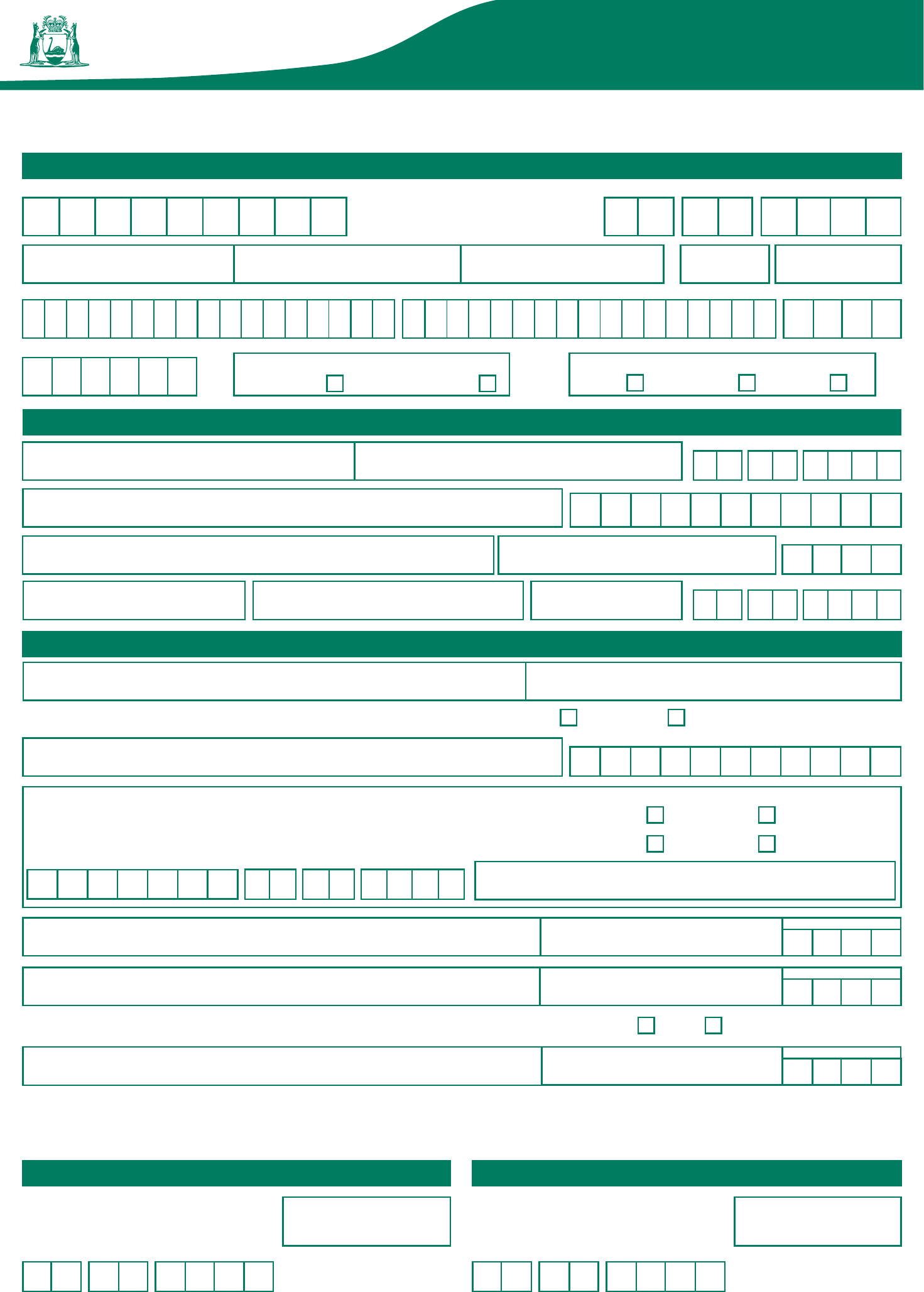

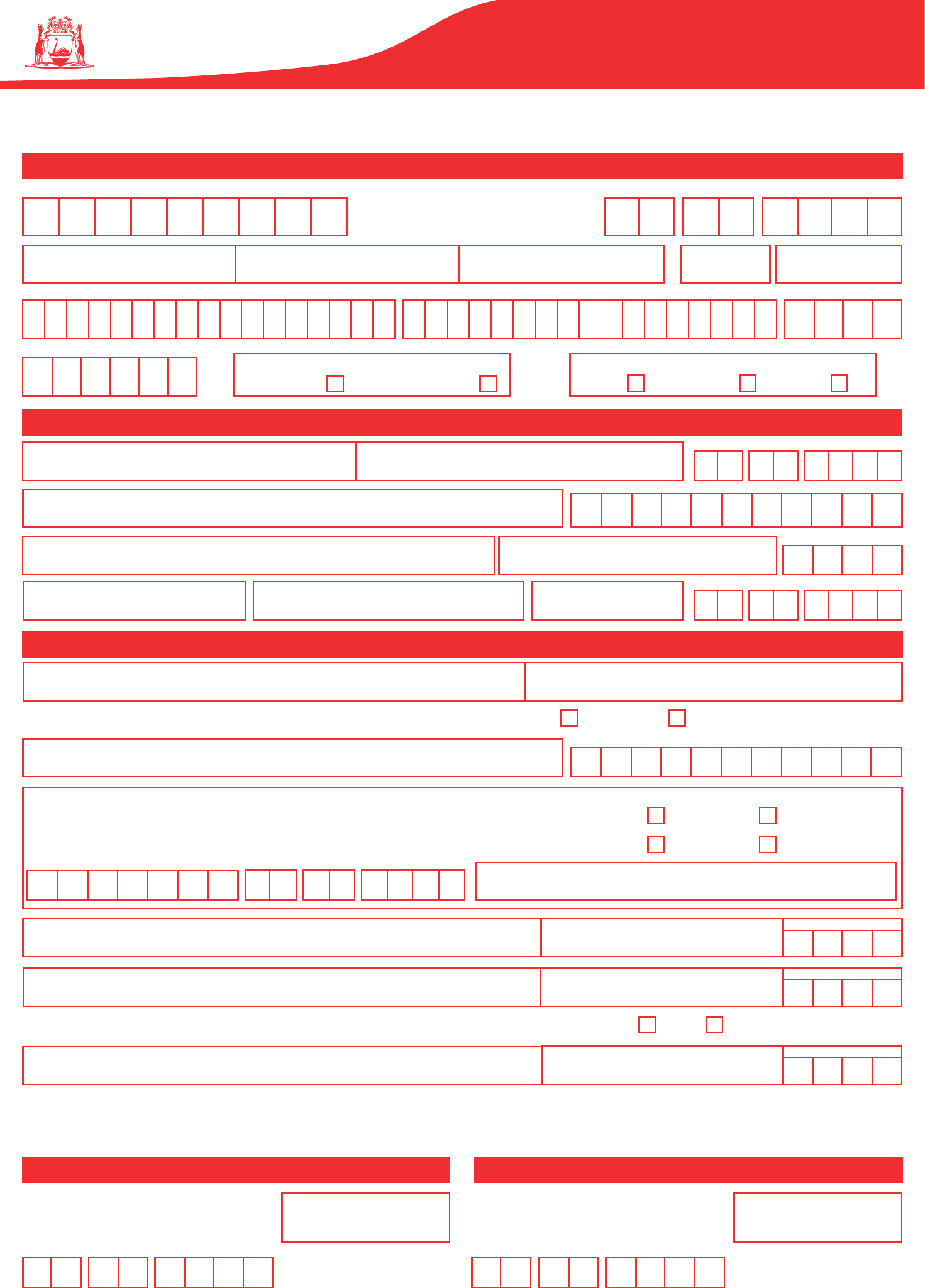

Seller’s Copy (green copy)

Notication of Change of Ownership

Vehicle Licence Transfer

MR9

Government of Western Australia

Department of Transport

Driver and Vehicle Services

This form must be completed and signed by both the seller and the purchaser. The seller must mail the seller’s copy to:

Driver and V ehicle Services, GPO Box R 1 290, Perth, W A 6844 within 7 days of the sale or a $ 1 00 infringement may be issued.

Vehicle Details (Details to be completed from vehicle licence papers)

Seller Details

Purchaser Details: IMPORTANT - all boxes must be completed. Refer to Proof of Identity requirements

It is important that you complete this information for the transfer process to proceed.

Will this vehicle be kept primarily in WA (see ‘Garaging Address’ on back of form for explanation)? YES NO

IsafactoryttedorGovernmentapprovedimmobiliserttedtothisvehicleandfullyoperational? YES NO

WA DRIVER’S LICENCE NUMBER DATE OF BIRTH

PLATE NUMBER LICENCE EXPIRY DATE

ENGINE NUMBER CHASSIS/VIN NUMBER

Transmission Type (please tick ü) Vehicle Condition (please tick ü)

Automatic Manual Poor Average Good

SELLER’S NAME IN FULL:

FAMILY NAME

COMPANY NAME

(IF VEHICLE IS LICENSED IN COMPANY NAME)

GIVEN NAMES

DUTIABLE VALUE

(SEE DEFINITIONS OVERLEAF)

SELLING

PRICE

GIVEN

NAMES

PURCHASER’S NAME IN FULL:

FAMILY NAME

Is this vehicle to be licensed in the name of a corporate company? (Please tick) YES NO

IF YES,

COMPANY NAME

CONTACT

PHONE NUMBER

WARNING

A seller or purchaser who understates the purchase price or dutiable value of a vehicle or who provides information which is false in a

material particular (important details) commits an offence under the Duties Act 2008 and is liable to a penalty of $20,000. The seller and the

purchaser are liable for the payment of the amount of shortfall of vehicle licence duty to the extent of the amount understated, together with

a penalty of 100% of that duty.

If the vehicle has optional number plates

tted, you must also transfer the ownership of

the right to display. See page 1.

YEAR OF MANUFACTURE

MAKE MODEL BODY TYPE BADGE SERIES

DATE OF BIRTH

AUSTRALIAN COMPANY NUMBER (ACN)

RESIDENTIAL SUBURB OR

ADDRESS TOWN

DATE OF DISPOSAL

AUSTRALIAN COMPANY NUMBER (ACN)

RESIDENTIAL

ADDRESS

SUBURB OR

TOWN

POSTAL ADDRESS

SUBURB OR

TOWN

POSTCODE

GARAGING ADDRESS

(SEE BACK OF FORM FOR EXPLANATION)

SUBURB OR

TOWN

CONTACT

NUMBER

Odometer Reading

Do you give consent to Driver and Vehicle Services (DVS) to use the address(es) above as your

residential/ postal address(es) for all DVS dealings?

YES NO

POSTCODE

POSTCODE

POSTCODE

Purchaser’s Declaration Seller’s Declaration

I decla re tha t a ll the above inf or mation I have

provided is true and correct and hereby apply

to transfer the vehicle licence into my name.

I dec l ar e th at al l th e ab ove inf or m at io n I have

provided is true and correct.

Date Date

Purchaser’s Signature Seller’s Signature

1. If you are selling a licensed vehicle to another owner you are required to complete this form and forward the Seller’s Copy (the green copy) to Driver

and Vehicle Services (DVS), GPO Box R1290, Perth WA 6844 within 7 days of the sale or a $100 infringement may be issued.

2. Make sure that all relevant details are completed on the form. Both you and the purchaser are required to complete and sign the form.

3. You are required to forward or hand the Purchaser’s Copy (the red copy) together with the current licence papers to the purchaser.

4. OncetheNoticationofChangeofOwnershipformhasbeenlodged,DVSwillinvoicethePurchaserforthevehicle licence duty and transfer fee.

5. Ifthevehicleisttedwithoptionalplates,andyouintendtosellthemwiththevehicle,a‘TransferofRighttoDisplaySpecialPlates’formmustbe

signed by both parties.

6. The onus is on the purchaser to ensure that an approved immobiliser is installed. If an approved immobiliser is installed, please supply to the

purchaser any information about the immobiliser as a courtesy.

7. If you are disposing of a vehicle that is licensed at concession rates, you should advise the new owner of the concession and possible charges.

8. Wheredetailshavenotbeencompletedyoumaybecontactedbytelephonetoconrmvehicledetails.

What the seller has to do

POSTAL ADDRESS

Driver and Vehicle Services

GPO Box R1290

Perth WA 6844

FOR ENQUIRIES

Website: www.transport.wa.gov.au/dvs

Telephone: 13 11 56

Facsimile: 1300 669 995

The information you supply on this form may be disclosed to other government agencies where provided for in legislation. The Chief Executive Officer

of the Department of Transport also releases aggregated statistical information to third parties. However, your personal identifying information will not be

released to these persons without your explicit consent.

Denitions - Dutiable Value

The term “dutiable value” is defined by Division 5 of the Duties Act 2008. The following interpretation is provided as a guide only.

New Vehicle:

For a new ve hic le (whi ch inc lud es a de mons trat ion m ode l that h as bee n used f or th at pur pos e for no t mor e than 2 m onth s) t hat is a m otor c ar, m otor wag on

or m ot o r c ycle, t h e l i s t p rice (see de fin i tio n bel ow), plu s t h e p ri ce fixe d by t h e m a n u f a ctur e r, i m porter or pr i ncip le dis t rib u t o r a s t h e a d d i tio n a l r etai l s e l l i n g p ri ce

in Western Australia for a particular type of transmission fitted to the vehicle. (For example, the set fee to upgrade a manual transmission to automatic).

Used Vehicle:

In relation to used vehicles - the amount for which the vehicle might reasonably be sold, free of encumbrance, in the open market. Where the dutiable value or

purchase price of a vehicle has been incorrectly stated the matter will be referred to the Office of State Revenue for investigation and possible prosecution .

List Price means the price that has been fixed by the manufacturer , importer or principle distributor as the retail selling price of that vehicle in Western Australia.

NOTE: Vehicles which are transferred for no monetary gain need to have an amount provided for which the vehicle might reasonably be sold, free of

encumbrances in the open market. i.e. its dutiable value.

Garaging Address (base of operation):

In accordance with section 5(3)(d) of the Road Traffic (Vehicles) Act 2012, vehicles cannot be licensed in Western Australia if they are garaged in another state.

You may be required to produce documentary proof of this.

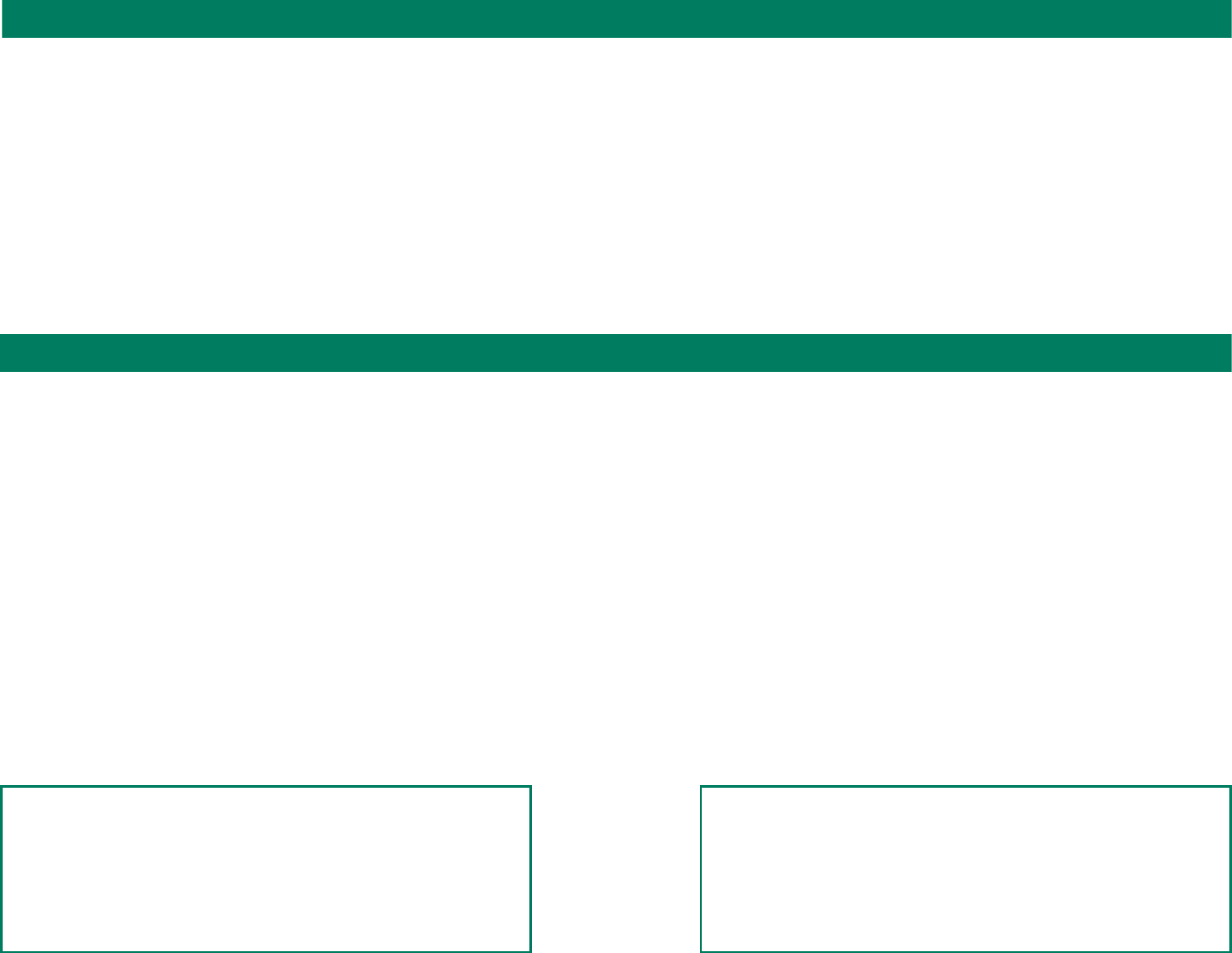

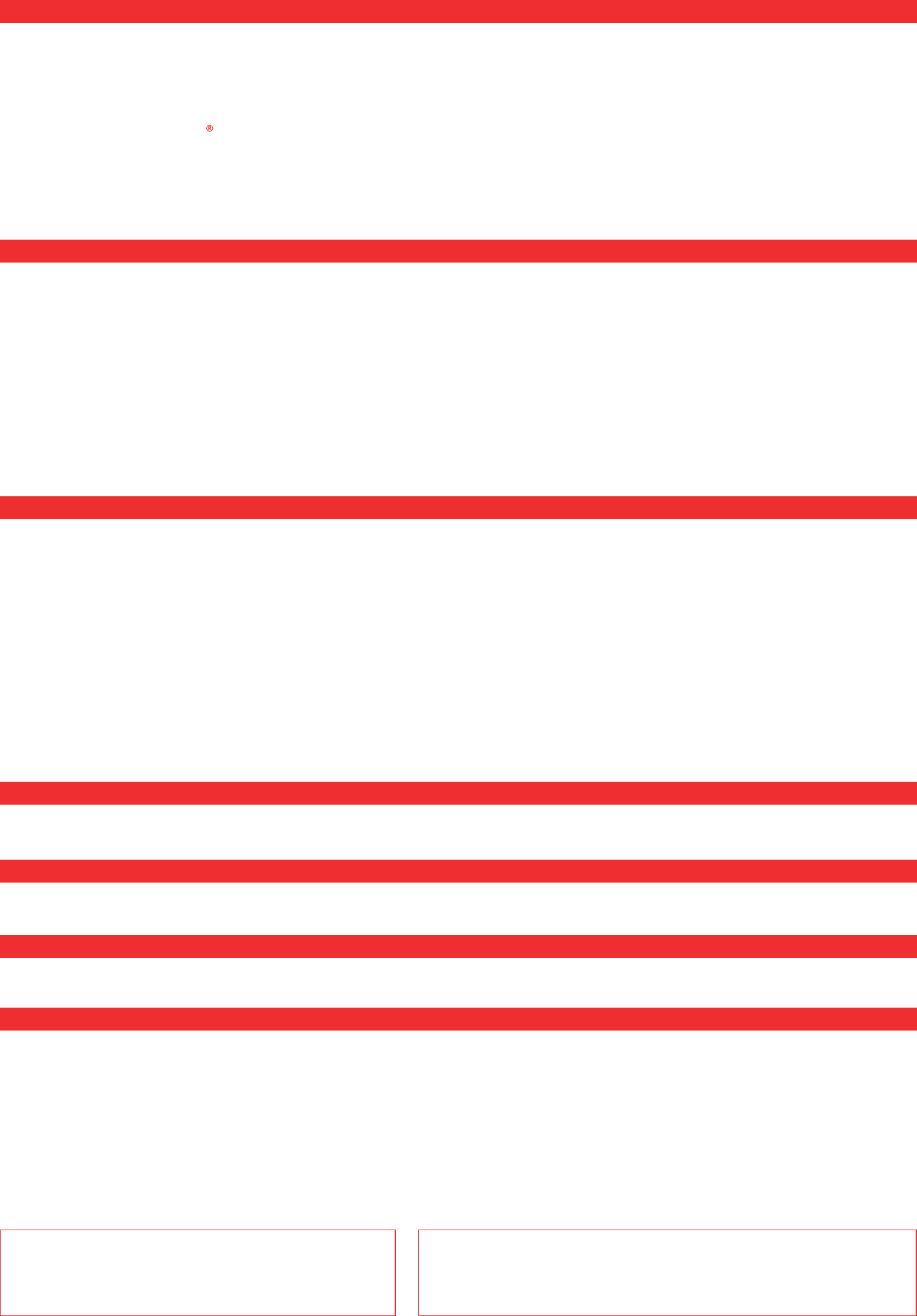

Government of Western Australia

Department of Transport

Driver and Vehicle Services

Notication of Change of Ownership

Vehicle Licence Transfer

MR9

Purchaser’s Copy (red copy)

Vehicle Details (Details to be completed from vehicle licence papers)

Seller Details

Purchaser Details: IMPORTANT - all boxes must be completed. Refer to Proof of Identity requirements

It is important that you complete this information for the transfer process to proceed.

Will this vehicle be kept primarily in WA (see ‘Garaging Address’ on back of form for explanation)? YES NO

IsafactoryttedorGovernmentapprovedimmobiliserttedtothisvehicleandfullyoperational? YES NO

WA DRIVER’S LICENCE NUMBER DATE OF BIRTH

PLATE NUMBER LICENCE EXPIRY DATE

ENGINE NUMBER CHASSIS/VIN NUMBER

Transmission Type (please tick ü) Vehicle Condition (please tick ü)

Automatic Manual Poor Average Good

SELLER’S NAME IN FULL:

FAMILY NAME

COMPANY NAME

(IF VEHICLE IS LICENSED IN COMPANY NAME)

GIVEN NAMES

DUTIABLE VALUE

(SEE DEFINITIONS OVERLEAF)

SELLING

PRICE

GIVEN

NAMES

PURCHASER’S NAME IN FULL:

FAMILY NAME

Is this vehicle to be licensed in the name of a corporate company? (Please tick) YES NO

IF YES,

COMPANY NAME

CONTACT

PHONE NUMBER

WARNING

A seller or Purchaser who understates the purchase price or dutiable value of a vehicle or who provides information which is false in a

material particular (important details) commits an offence under the Duties Act 2008 and is liable to a penalty of $20,000. The seller and the

purchaser are liable for the payment of the amount of shortfall of vehicle licence duty to the extent of the amount understated, together with

a penalty of 100% of that duty.

If the vehicle has optional number plates

tted, you must also transfer the ownership of

the right to display. See page 1.

YEAR OF MANUFACTURE

MAKE MODEL BODY TYPE BADGE SERIES

DATE OF BIRTH

AUSTRALIAN COMPANY NUMBER (ACN)

RESIDENTIAL SUBURB OR

ADDRESS TOWN

DATE OF DISPOSAL

AUSTRALIAN COMPANY NUMBER (ACN)

RESIDENTIAL

ADDRESS

SUBURB OR

TOWN

POSTAL ADDRESS

SUBURB OR

TOWN

POSTCODE

GARAGING ADDRESS

(SEE BACK OF FORM FOR EXPLANATION)

Do you give consent to Driver and Vehicle Services (DVS) to use the address(es) above as your

residential/ postal address(es) for all DVS dealings?

YES NO

SUBURB OR

TOWN

CONTACT

NUMBER

Odometer Reading

POSTCODE

POSTCODE

POSTCODE

Purchaser’s Declaration

Seller’s Declaration

I declare that all the above information I have

provided is true and correct and hereby apply

to transfer the vehicle licence into my name.

I dec l ar e th at al l th e ab ove inf or m at io n I have

provided is true and correct.

Date Date

Purchaser’s Signature Seller’s Signature

This form must be completed and signed by both the seller and the purchaser. The purchaser must mail the purchaser’s copy to:

Driver and V ehicle Services, GPO Box R 1 290, Perth, W A 6844 within 1 4 days of the sale or a $ 1 00 infringement may be issued.

What the purchaser has to do

Immobiliser Requirements

Denitions - Dutiable Value

Does The Vehicle Have Money Owing On It?

Pensioner Concession Card Enquiries

Vehicle Licence Duty Exemption on the Transfer of a Vehicle Licence Between Spouses/Defactos

Garaging Address (base of operation)

1. When purchasing a licensed vehicle you must complete this form together with the seller of the vehicle. The seller is required to forward the Seller’s

Copy (the green copy) to Driver and Vehicle Services (DVS), and give you (as the Purchaser) the Purchaser’s Copy (the red copy) and the current licence

papers. The purchaser must submit this copy either in person at a DVS Centre or agent, or by mail to the address at the foot of this page, within 14 days of

purchasing the vehicle. Failing to do so may result in a penalty. Failure to pay the vehicle licence duty and transfer fee within 28 days of the invoice being

issued may result in an infringement of $100.

2.The invoice may be paid by BPAY (contact your bank or financial institution for further information), credit card using DVS’s Phonepay 1300655322, by

mail (GPO Box R1290, PERTH, WA 6844), in person at any metropolitan Post Office, participating country Post Office, regional DVS agent or a DVS

centre (cash, cheque or EFTPOS).

A vehicle can only be licensed in the name of an individual (natural person), corporate company, incorporated body or any other body that

is recognised as a legal entity. If the vehicle is jointly owned, a Proof of Identity form must be completed and signed nominating an owner/

licence holder. Proof of Identity forms may be obtained online at www.transport.wa.gov.au/dvs.

POSTAL ADDRESS

Driver and Vehicle Services

GPO Box R1290

Perth WA 6844

FOR TRANSFER AND IMMOBILISER ENQUIRIES

Website: www.transport.wa.gov.au/dvs

Telephone: 13 11 56 Facsimile: 1300 669 995

The Personal Property Securities Register (the PPSR) is the register where details of security interests in personal property can be registered and searched.

The Insolvency and Trustee Service Australia (ITSA) is the Australian Government agency responsible for administering the PPSR.

The PPSR can advise you if money is owed on a licensed second-hand car, motorcycle or self-propelled farm vehicle. Research has shown that one in five

PPSR checks reveals the vehicle to be financially encumbered. In nearly half the cases, the purchaser wasn’t aware of it.

By doing a PPSR check, you can avoid the risk of your vehicle being repossessed. The PPSR can also improve your chances of knowing if a car on offer is

stolen. Buyers purchasing vehicles from licensed motor vehicle dealers do not need to use the PPSR.

To do a PPSR check, write down the vehicles plate number, engine number and chassis/VIN number and visit www.ppsr.gov.au for an online search or call

1300 007 777. Please phone between 6:00 am to 6:00 pm AEST Monday to Friday and 7:00 am to 1:00 pm Saturday and Sunday (including public holidays).

In accordance with section 5(3)(d) of the Road Traffic (Vehicles) Act 2012, vehicles cannot be licenced in Western Australia if they are garaged in another

state.

If you are the holder of a Pension Concession card issued by Centrelink or Department of Veterans’ Affairs or a WA Senior’s Card and a Commonwealth

Senior’s Health Card holder, you may be eligible for a concession on your vehicle or driver’s licence. For further information please call DVS on 13 11 56.

The Duties Act 2008 has been amended to introduce an exemption from vehicle licence duty upon the transfer of a vehicle licence between spouses or de

facto partners of at least two years. For further information please contact the Department of Finance on 9262 1400 or visit www.finance.wa.gov.au.

The term “dutiable value” is defined by Division 5 of the Duties Act 2008. The following interpretation is provided as a guide only.

New Vehicle:

For a new vehicle (which includes a demonstration model that has been used for that purpose for not more than 2 months) that is a motor car, motor wagon or

motorcycle, the list price (see definition below), plus the price fixed by the manufacturer, importer or principle distributor as the additional retail selling price in

Western Australia for a particular type of transmission fitted to the vehicle. (For example, the set fee to upgrade a manual transmission to automatic).

Used Vehicle:

In relation to used vehicles - the amount for which the vehicle might reasonably be sold, free of encumbrance, in the open market. Where the dutiable value

or purchase price of a vehicle has been incorrectly stated the matter will be referred to the Office of State Revenue for investigation and possible prosecution .

List Price means the price that has been fixed by the manufacturer, importer or principle distributor as the retail selling price of that vehicle in Western

Australia.

NOTE: Vehicles which are transferred for no monetary gain need to have an amount provided for which the vehicle might reasonably be sold, free of

encumbrances in the open market. i.e. its dutiable value.

The purchaser of the vehicle is responsible to ensure that an approved immobiliser is installed. Any application to transfer the vehicle licence will not be

accepted if the purchaser has not declared (by signing the declaration on the front of the Notification of Change of Ownership form) that an approved

immobiliser is fitted to the vehicle and is operational. A false or misleading declaration will result in a fine. Vehicles that are 25 years or older, vehicles

that have a tare weight over 3000 kg or a GVM or aggregate weight over 4500 kg, motorcycles and some farm vehicles are exempt from the fitment of an

immobiliser.

1. If an immobiliser is not fitted to the vehicle, you must have one fitted before you can transfer or licence the vehicle. If you are unsure, contact your local

authorised immobiliser installer, visit www.transport.wa.gov.au/dvs or call DVS on 13 11 56.

2. If the vehicle you are purchasing is already fitted with an immobiliser, you must confirm that it is an approved device. An approved immobiliser is:

•‘Factoryfitted’(i.e.fittedatthetimeofmanufacture).Thevehicleowner’shandbookshouldconfirmthis.

•Selfarming(i.e.deviceswhichautomaticallyarmthemselveswithoutanyassistancefromthedriver)andpreventsthevehiclefrombeingstarted.

If you are unsure about whether the vehicle immobiliser installed is approved, check with your nearest authorised installer, visit www.transport.wa.gov.au/dvs.

or call DVS on 13 11 56.