Fillable Printable Partnership Agreement Sample Form

Fillable Printable Partnership Agreement Sample Form

Partnership Agreement Sample Form

1

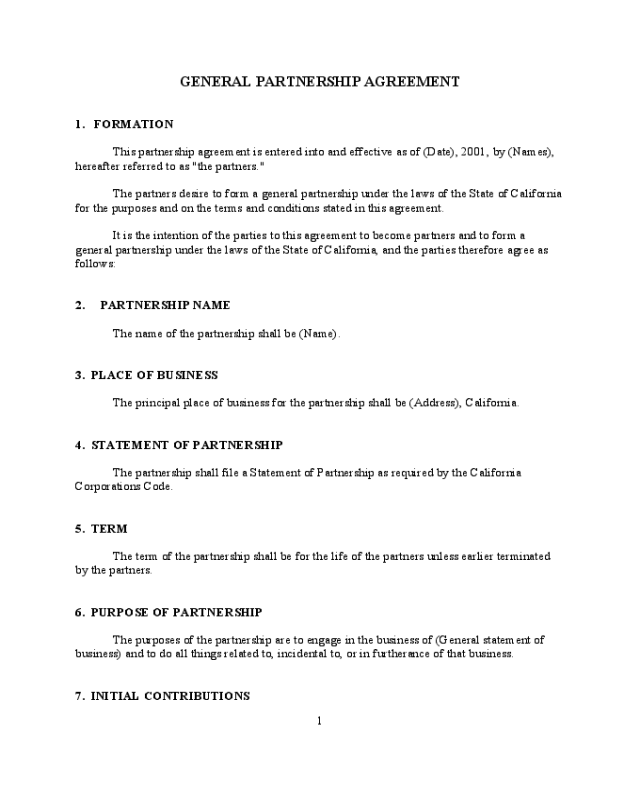

GENERAL PARTNERSHIP AGREEMENT

1. FORMATION

This partnership agreement is entered into and effective as of (Date), 2001, by (Names),

hereafter referred to as "the partners."

The partners desire to form a general partnership under the laws of the State of California

for the purposes and on the terms and conditions stated in this agreement.

It is the intention of the parties to this agreement to become partners and to form a

general partnership under the laws of the State of California, and the parties therefore agree as

follows:

2. PARTNERSHIP NAME

The name of the partnership shall be (Name).

3. PLACE OF BUSINESS

The principal place of business for the partnership shall be (Address), California.

4. STATEMENT OF PARTNERSHIP

The partnership shall file a Statement of Partnership as required by the California

Corporations Code.

5. TERM

The term of the partnership shall be for the life of the partners unless earlier terminated

by the partners.

6. PURPOSE OF PARTNERSHIP

The purposes of the partnership are to engage in the business of (General statement of

business) and to do all things related to, incidental to, or in furtherance of that business.

7. INITIAL CONTRIBUTIONS

2

A. The initial cash and property to be contributed to the partnership shall be as follows:

(Names and Contributions)

B. The partners shall make the above initial contributions within (Number) days after the

signing of this agreement.

C. If any partner fails to pay or convey his initial contribution to the partnership's capital

at the time and in the form and amount required by this agreement, the partnership shall

immediately dissolve and each partner who has paid or conveyed all or any portion of his initial

contribution to the partnership's capital shall be entitled to a return of the funds and properties he

contributed, unless the partners shall have entered into a written agreement requiring an

alternative procedure for continuing the partnership, in which case that alternative procedure

shall be followed.

8. SUBSEQUENT CONTRIBUTIONS

Each partner shall contribute, in amounts unanimously agreed upon from time to time,

sums sufficient to develop partnership projects, and such additional sums as are needed with

respect to any particular project of the partnership, such additional sums being in the same ratios

for the particular project as the partners' initial investment ratios for the same project.

9. WITHDRAWAL OF CAPITAL

No partner may withdraw capital from the partnership without the consent of all the

partners.

10. REPAYMENT OF LOANS

A. The initial loan by (Name of loan source) shall be repaid out of the partnership profits

on the following terms. Prior to any division or distribution of profits, salaries, or draws, the

partnership shall pay out of its earnings, to (Name of loan source), the sum of $(Amount) per

month, together with interest computed at the rate of (Interest rate) annually, starting on the first

day of the month following the making of the loan, and continuing until the balance is paid in

full, exept that the balance shall be paid in full, in any event, within (Time period) after making

of the loan.

B. Subsequent loans by either partner shall be repaid on the same or similar schedule as

the initial.

3

C. Any changes to the above terms of repayment shall be by written agreement, executed

by the partners.

11. TOOLS, EQUIPMENT AND PROPERTY CONTRIBUTED BY PARTNERS UPON

INITIAL FORMATION OF THE PARTNERSHIP

All property originally paid or brought into, or transferred to, the partnership as

contributions to capital by the partners, on account of the partnership, shall be partnership

property.

12. LOANED TOOLS, EQUIPMENT AND PROPERTY FOLLOWING FORMATION

OF THE PARTNERSHIP

A. Any partner lending an asset to this partnership shall be precluded from selling,

assigning, or hypothecating the loaned asset during the life of the partnership without the consent

of a majority of his partners.

B. Tools, equipment, vehicles, furniture, furnishings, merchandise, premises, leases,

supplies or other properties owned by a partner and left on the partnership premises or made

available for the exclusive use of the partnership shall be deemed a loan by the owner and the

owner shall be entitled to reposses said property so long as notice shall be given adequate to

prevent disruption of the partnership business, except that in the event said property is left on the

partnership premises or made available for the exclusive use of the partnership for a period

longer than (Time period), said property shall be deemed a contribution to the partnership, unless

otherwise agreed in writing.

C. In the event property loaned to the partnership is deemed a contribution under the

terms of this section, such contribution shall give the contributing partner an increase in his

partnership interest, profits, and losses, in proportion to the value of the contribution, as may be

reasonably ascertained.

13. TITLE TO PROPERTY TO REMAIN IN PARTNER

It is agreed that the following described property is being made available to the

partnership by (Name of Partner) exclusively for the use of the partnership as a loan only, and is

to remain the property of (Name of Partner), and is to be returned to him on demand with sixty

days notice.

PARTNER DESCRIPTION OF PROPERTY

(List) (List)

4

14. MONTHLY SALARY

Each partner shall be entitled to a monthly salary as follows:

Name Amount

or such other amounts that may from time to time be determined by the unanimous written

consent or agreement of all the partners. These salaries shall be treated as partnership expenses

in determining its profits or losses.

15. SHARED PROFITS AND LOSSES

The partnership's profits and losses shall be shared equally among the partners.

(alternative)

XV. SHARED PROFITS AND LOSSES

A. PROFITS.

The partnership's profits shall be shared among the partners as follows:

Name Percentage

%

B. LOSSES.

All losses that occur in the operation of the partnership shall be paid, first, out of

the capital of the partnership and the profits of the business. In the event such sources are

inadequate to cover such losses, then the remaining, unpaid losses shall be paid by the partners

out of their separate assets as follows:

Name Percentage

%

16. ANNUAL STATEMENT

The partnership shall cause to be prepared within forty_five days after the close of each

accounting year and upon the termination or dissolution of the partnership, at the expense of the

partnership, a report of the partnership's operation, containing a balance sheet and a statement of

income and surplus for each partnership investment. Within sixty days after the close of the

period covered by the report a copy of it shall be furnished to each member of the partnership.

17. DISTRIBUTION OF PROFITS

5

A. The amount of the profits to be distributed annually shall be distributed to each

partner as set forth herein, within (Number) days after the end of each fiscal year.

B. The amount of the partnership profits which shall be distributed and the amount

withheld in the partnership accounts as a loan in the partnership shall be as mutually agreed by

all of the partners. In the event that the partners fail to agree on said amounts, then

(Percentage)% of the profits shall be disbursed and (Percentage)% shall be withheld in the

partnership accounts as a loan.

18. MONTHLY DRAW; LIVING EXPENSES

A. Each month each partner shall be entitled to draw against profits amounts agreed on

by a majority of the partners. These amounts shall be charged to the partners' drawing accounts

as they are drawn.

B. The partnership shall keep an account for each partner of the sums drawn by each

partner, respectively.

C. The aggregate amounts distributed to the partners from the partnership's profits shall

not, however, exceed the amount of cash available for distribution, taking into account the

partnership's reasonable working capital needs as determined by a majority in capital interest of

the partners.

D. Notwithstanding the provisions of this agreement governing drawing accounts of

partners, to the extent any partner's withdrawals under those provisions during any fiscal year of

the partnership exceed his distributable share in the partnership's profits, the excess shall be

regarded as a loan from the partnership to him that he is obligated to repay within (Number) days

after the end of that fiscal year, with interest on the unpaid balance at the rate of (Amount)% per

annum from the end of that fiscal year to the date of repayment.

19. BOOKS AND RECORDS

Proper and complete books of account of the partnership business shall be kept at the

partnership's principal place of business and shall be open to inspection by any of the partners or

their accredited representatives at any reasonable time during business hours. The accounting

records shall be maintained in accordance with generally accepted bookkeeping practices for this

type of business. The books shall be examined by an independent certified public accountant at

least annually.

20. MANAGEMENT AND CONTROL

6

Each partner shall participate in the control, management and direction of the business of

the partnership. All decisions shall be decided by a vote of the majority of the partners with each

partner having a vote equal to each other partner.

(alternative)

20. MANAGING PARTNER

The principal managing partners) shall be (Names).

Subject to the limitations specified in the following section, the managing partners shall

have control over the business of the partnership and assume direction of its business operations.

They shall, however, consult and confer as far as practicable with the non_managing partners on

all important matters, but the power of decision shall be vested in the managing partners.

Notwithstanding the above delegation of management authority, any decision of the

managing partners may be vetoed upon a unanimous vote of the non_managing partners. In the

event of the death, resignation, or expulsion of the managing partner's a successor managing

partner shall be selected by a majority in capital interest of the partners.

21. ACTS REQUIRING CONSENT OF PARTNERS

The following acts may be done only with the consent of a majority in capital interest of

the partners:

A. Borrowing money in the partnership's name, other than in the ordinary course of the

partnership's business or to finance any part of the purchase price of the partnership's properties.

B. Transferring, hypothecating, compromising, or releasing any partnership claim except

on payment in full.

C. Selling, leasing, or hypothecating any partnership property or entering into any

contract for any such purpose, other than in the ordinaiy course of the partnership's business to

secure a debt resulting from any transaction permitted under A, above.

D. Knowingly suffering or causing anything to be done whereby partnership property

may be seized or attached or taken in execution, or its ownership or possession otherwise

engaged.

22. SIGNATURES ON CHECKS

All partnership funds shall be deposited in the partnership's name and shall be subject to

withdrawal only on the signatures of any two of the following authorized signers:

7

(Names)

23. REIMBURSEMENT FOR OUT_OF_POCKET EXPENSES

Each partner shall be entitled to reimbursement, within 30 days, on the submission of an

itemized account and receipt, for any sums said partner shall have expended for the benefit of the

partnership business, except that any expenditure exceeding $(Amount) shall require advance

consent of the partners as provided in paragraph 20, unless such expenditure shall have been

reasonably necessaiy for the preservation of the partnership assets or business and reasonable

effort was made to obtain the consent of the remaining partners, in which event said partner shall

be entitled to reimbursement even though consent of the partners was not obtained.

24. OUTSIDE EMPLOYMENT

Any partner may be engaged in one or more businesses, other than the business of the

partnership, but only to the extent that this activity does not compete with or materially interfere

with the business of the partnership and does not conflict with the obligations of that partner

under this agreement. Neither the partnership nor any other partner shall have any right to any

income or profit derived by a partner from any business activity permitted under this section.

(alternative)

24. OUTSIDE EMPLOYMENT

While (Name) is required to participate in the control, management, and direction of the

partnership business, he shall devote his full time and attention to the conduct of that business,

and shall not be actively engaged in the conduct of any other business for compensation or a

share in profits as an employee, officer, agent, proprietor, partner, or stockholder. This

prohibition shall not prevent him from being a passive investor in any enterprise, however, if he

is not actively engaged in its business and does not exercise control over it. Neither the

partnership nor any partner shall have any right to any income or profit derived from any such

passive investment.

25. TIME PARTNERS TO DEVOTE TO BUSINESS

Each partner shall devote to the business of the partnership the following amount of time:

Name Time to be Devoted to Business

____________________________ _______________hours per__________

8

____________________________ _______________hours per__________

____________________________ _______________hours per__________

26. NEW PARTNERS

A. A new partner may be admitted to the partnership, but only with the written approval

of all partners. Each new partner shall be admitted only if he shall have executed this agreement

and an appropriate supplement to it, in which he agrees to be bound by the terms and provisions

of this agreement as they may be modified by that supplement. Admission of a new partner shall

not cause dissolution of the partnership.

27. BANKRUPTCY OF A PARTNER

If any partner files a voluntary petition in bankruptcy, is adjudicated a bankrupt, becomes

insolvent, makes an assignment for the benefit of creditors, or applies for or consents to the

appointment of a receiver or trustee with respect to any substantial part of his assets, or if a

receiver or trustee is appointed or an attachment or execution levied with respect to any

substantial part of any partner's assets and the appointment is not vacated or the attachment or

execution is not released within (Number) days, of if a charging order is issued against any

partner's interest in the partnership and is not released or satisfied within (Number) days, that

partner shall then cease to be a partner and shall have no interest in common with the remaining

partners in the partnership or its properties. From the date of that event, he shall be considered in

equity as a seller to the partnership of his interest in the partnership at a price equal to (Amount,

Percentage, or Method of determination of interest), and that amount shall be considered a debt

owed by the partnership to that partner or his assignee or trustee, and all necessary deeds and

other documents shall be executed pursuant thereto.

28. CONTINUATION OF PARTNERSHIP

In the case of a partner's death, permanent physical or mental disability, retirement from

the partnership, or voluntary withdrawal from the partnership, the remaining partners may elect

to continue the partnership without interruption and without any break in continuity. On such

election, the partners shall not liquidate or wind up the affairs of the partnership, except as

otherwise provided in this agreement, but shall continue to conduct a partnership under the terms

of this agreement with any successor or transferee of the deceased or withdrawn partner.

In the event the remaining partners elect to discontinue the partnership, the affairs of the

partnership shall be wound up, the assets liquidated, the debts paid, and the net balance, if any,

distributed to the partners or their estates in proportion to their respective interests in the

partnership.

9

29. PURCHASE OF DECEASED PARTNER'S INTEREST

On the death of any partner (the "deceased partner"), if the remaining partners elect to

continue the partnership, the partnership shall liquidate the deceased partner's interest in the

partnership and shall pay for the interest the consideration determined by the terms of this

agreement. Consummation of the liquidation shall be deemed to occur as of the date of the

deceased partner's death. The amount distributed in liquidation of the interest shall be to the

deceased partner's designated beneficiary or, if no such designation has been made, to his estate,

within 120 days following his death. Each partner shall have the right to designate, in a written

instrument delivered to the partnership, a beneficiary to whom shall be paid the value of his

interest in the partnership as provided in this agreement.

30. DISABILITY OR VOLUNTARY WITHDRAWAL

A. Any partner may withdraw from the partnership upon 60 days written notice to the

remaining partners of intent to withdraw.

B. In the event of a partner's disability or withdrawal from the partnership, and the

remaining partners elect to continue the partnership, said partner shall be paid the value of his

interest in the partnership, plus other consideration, as follows:

a. The value of the partnership shall be determined according to paragraph 23. If said

valuation shows a positive net worth in the partnership, the disabled or withdrawing partner shall

be paid the following:

1) The value of his interest in the partnership, plus any undistributed regular

compensation due the withdrawing partner on date of withdrawal, less;

2) Any indebtedness which said partner owes to the partnership, including

advances on compensation or drawing accounts.

b. If said valuation shows a negative or zero net worth in the partnership, the disabled or

withdrawing partner shall be paid the amount of his initial capital contribution, plus undistributed

compensation, less his indebtedness to the partnership.

c. The above sums shall be paid as follows: Within 60 days of the effective date of

disability or withdrawal from the partnership, or if the partnership has insufficient funds, then the

remaining partners, or a combination of the partnership and the remaining partners, shall pay to

the disabled or withdrawing partner (Amount)% of the total sum due him upon buy_out, and

within (Number) days thereafter (Amount)% of the total sum due him, and the balance, if any, in

the form of a promissory note with interest at the rate of (Percent)% annually, payable at the rate

of$(Amount) per month until said balance is paid in full.

d. If the financial condition of the partnership at the time of the withdrawal is such that

the above terms would unreasonably endanger the continued operation of the partnership, the

remaining partners shall make a good faith effort to raise the required capital from their personal

assets.

e. Should the remaining partners be unable to finance the above terms, said remaining

partners and the disabled or withdrawing partner may make such other agreements for the

buy_out as shall be mutually agreeable. In the event they are unable to mutually agree on new

10

terms, then the partnership shall be dissolved and the affairs of the partnership wound up.

C. It is further agreed that in the event of voluntary withdrawal, the remaining partners

agree to make a good faith effort to refinance any loans, obligations, notes, and security for

which the disabled or withdrawing partner has co_signed so that he shall not be liable for said

notes, loan, obligation, or security. It is further agreed that whether or not the holder of any loan,

note, obligation, or security is willing to remove the disabled or withdrawing partner as a

co_signer thereto, the remaining partners shall hold harmless the withdrawing partner and

indemnify and reimburse him for any sums he is required to pay upon judgment or recall of any

such loan, note, obligation, or security.

D. Disability shall be determined as follows: If the remaining partners agree that a

partner is mentally or physically disabled such that he is unable to perform his tasks and carry on

his responsibilities in the partnership, said partner agrees to submit to be examined by a

psychiatrist or physician chosen by the remaining partners. If said examination reveals that the

partner is at least 50% disabled, then he shall withdraw from the partnership. If the disabled

partner believes that the examination is incorrect or in bad faith, then all of the partner's shall

elect a second psychiatrist or physician by lot, and the results of the second examination shall be

determinative.

31. RESTRICTION ON TRANSFER

No partner without the written consent of all the other partners shall make, execute or

deliver any transfer, assignment, contract to sell, bill of sale, deed, mortgage, or lease of his

interest in the partnership.

32. VALUATION OF INTEREST USING EQUITY AND EARNINGS (Note: Alternate

methods of valuation may be preferred, such as by agreement, a capital account method, or

appraisal)

Except as otherwise provided, the value of a partner's interest in the partnership for

purposes of this agreement shall be based on the value of the partnership, which shall be deemed

to be the sum of the following:

A. The amount by which the partnership's total assets exceeded its total liabilities at the

end of the partnership's last preceding fiscal quarter year, as stated on the partnership's balance

sheet, whether or not audited, prepared in the regular course of its business as of that date and, if

it is the last quarter of the fiscal year, contained in the partnership's income tax return for that

year; plus

B. The product of (Multiple) times the amount computed by subtracting (Amount)% of

the amount determined under (a) from the partnership's average annual net profit during the last

12 fiscal quarter years or the number of quarter years contained in the period from the

11

partnership's beginning to the end of its last complete fiscal quarter year, whichever period is

shorter. The partnership's "average annual net profit" shall be the product of four times the

quotient resulting from dividing the number of complete fiscal quarter years taken into account

into the aggregate net profit for all those fiscal quarter years, as shown on the partnership's profit

and loss statements, whether or not audited, prepared in the regular course of its business.

33. COVENANT NOT TO COMPETE

Following the voluntary withdrawal or retirement from the partnership of any partner, the

withdrawn or retired partner shall not carry on a business similar to partnership business within

the County of (Name) for a period of at least (Number) years.

34. DISSOLUTION

A. The partnership may be dissolved by mutual unanimous consent of the partners.

B. On any dissolution of the partnership under this section except as otherwise provided

in this agreement, the continuing operation of the partnership's business shall be confined to

those activities reasonably necessary to wind up on the partnership's affairs, discharge its

obligations, and preserve and distribute its assets. Promptly on dissolution, a notice of

dissolution shall be published as required by the California Corporations Code.

35. INDEMNIFICATION

A. Each partner shall indemnify and hold harmless the partnership and each of the other

partners from any and all expense and liability resulting from or arising out of any negligence or

misconduct on his part to the extent that the amount exceeds the applicable insurance carried by

the partnership.

B. The partnership shall reimburse and indemnify any partner held liable for a

partnership debt or adverse judgment not attributable to the negligence or misconduct of said

partner.

36. AMENDMENTS

This agreement may be amended at any time and from time to time, but any amendment

must be in writing and signed by each person who is then a partner.

37. DISPUTES BETWEEN THE PARTNERS