Fillable Printable Sample Partnership Agreement - Pennsylvania

Fillable Printable Sample Partnership Agreement - Pennsylvania

Sample Partnership Agreement - Pennsylvania

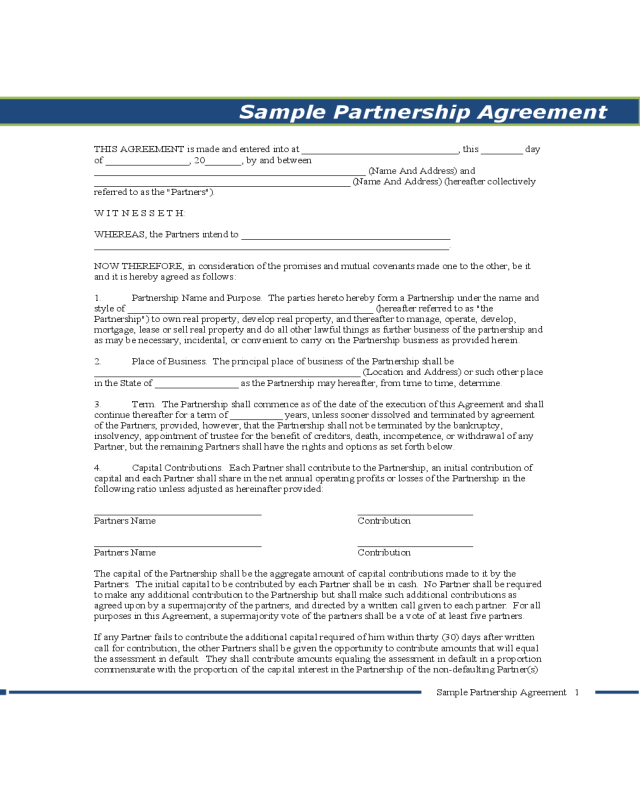

Sample Partnership Agreement

THIS AGREEMENT is made and entered into at ______________________________, this ________ day

of ________________, 20_______, by and between

____________________________________________________ (Name And Address) and

_________________________________________________ (Name And Address) (hereafter collectively

referred to as the "Partners").

W I T N E S S E T H:

WHEREAS, the Partners intend to ________________________________________

____________________________________________________________________.

NOW THEREFORE, in consideration of the promises and mutual covenants made one to the other, be it

and it is hereby agreed as follows:

1. Partnership Name and Purpose. The parties hereto hereby form a Partnership under the name and

style of _______________________________________________ (hereafter referred to as "the

Partnership") to own real property, develop real property, and thereafter to manage, operate, develop,

mortgage, lease or sell real property and do all other lawful things as further business of the partnership and

as may be necessary, incidental, or convenient to carry on the Partnership business as provided herein.

2. Place of Business. The principal place of business of the Partnership shall be

___________________________________________________ (Location and Address) or such other place

in the State of ________________ as the Partnership may hereafter, from time to time, determine.

3. Term. The Partnership shall commence as of the date of the execution of this Agreement and shall

continue thereafter for a term of __________ years, unless sooner dissolved and terminated by agreement

of the Partners; provided, however, that the Partnership shall not be terminated by the bankruptcy,

insolvency, appointment of trustee for the benefit of creditors, death, incompetence, or withdrawal of any

Partner, but the remaining Partners shall have the rights and options as set forth below.

4. Capital Contributions. Each Partner shall contribute to the Partnership, an initial contribution of

capital and each Partner shall share in the net annual operating profits or losses of the Partnership in the

following ratio unless adjusted as hereinafter provided:

________________________________ ______________________

Partners Name Contribution

________________________________ ______________________

Partners Name Contribution

The capital of the Partnership shall be the aggregate amount of capital contributions made to it by the

Partners. The initial capital to be contributed by each Partner shall be in cash. No Partner shall be required

to make any additional contribution to the Partnership but shall make such additional contributions as

agreed upon by a supermajority of the partners, and directed by a written call given to each partner. For all

purposes in this Agreement, a supermajority vote of the partners shall be a vote of at least five partners.

If any Partner fails to contribute the additional capital required of him within thirty (30) days after written

call for contribution, the other Partners shall be given the opportunity to contribute amounts that will equal

the assessment in default. They shall contribute amounts equaling the assessment in default in a proportion

commensurate with the proportion of the capital interest in the Partnership of the non-defaulting Partner(s)

Sample Partnership Agreement 1

prior to the call for additional contributions or in any other proportions that they may determine. The

allocation of profits or losses among all the Partners shall be adjusted according to the change in capital

contributions by the partners.

Contributions to the capital of the Partnership shall not bear interest. However, any advance of money to

the Partnership by any Partner in excess of the amounts provided for in this Agreement or subsequently

agreed to as a Capital Contribution shall not be deemed a Capital Contribution to the Partnership, but a debt

due from the Partnership, and shall be repaid with interest at such rates and times as determined by a

supermajority of the Partners. Such debts may have preference or priority over any other payments to

Partners as may be determined by a supermajority of the Partners.

5. Capital Accounts. A separate capital account shall be maintained for each Partner, and capital

contributions to the Partnership by the Partners shall be charged to such accounts. Partnership profits or

losses shall also be charged or credited to the separate capital accounts in the manner hereinbefore

provided. No interest shall be paid on the capital account of any Partner.

6. Cash Distributions. Any amounts held by the Partnership and not required for purposes of its

business, including reasonable reserves for contingencies, may be distributed to the Partners pursuant to the

terms hereof. No Partner shall be entitled to make withdrawals from his individual account or have

returned to him his capital contributions except in accordance herewith. No Partner shall have the right to

require that a distribution be made to him other than in cash.

7. Banks and Books of Account. The funds of the Partnership shall be kept in a separate account or

accounts in a bank and/or savings institution in the name of the Partnership. All withdrawals from such

accounts shall be made upon checks or drafts signed by any Partner.

Full and complete books of account shall be kept and maintained at the principal place of business and all

transactions shall be entered in such books. Each Partner shall have access and the right to inspect and

copy such books and all other Partnership records. The books shall be closed at the end of each calendar

year and statements prepared showing the financial condition of the Partnership and its profit or loss.

8. Managing Partners. In the general conduct of the Partnership business, all the Partners shall be

consulted and the advice and opinions of the Partners shall be obtained so much as is practicable.

However, for the purpose of fixing and harmonizing the policies and practices of the Partnership and of

securing uniformity and continuity in the conduct of its business, the general management of the

Partnership business shall rest solely in the Managing Partners. The Managing Partners shall be:

_____________________________________________________ (Name and Address).

_____________________________________________________ (Name and Address).

Except in cases of gross negligence or willful misconduct, the doing of any act or the failure to do any act

by the Managing Partners, the effect of which may cause or result in loss or damage to the Partnership,

shall not subject the Managing Partners to any liability to the remaining Partners or to the Partnership. In

the event of the death, physical or mental incapacity, or withdrawal of either Managing Partner from the

Partnership, the surviving Partners shall have equal rights in the management of the Partnership and shall

appoint successor Managing Partners.

Except as otherwise provided herein, no Partner shall make any contract for and on behalf of the

Partnership without the prior approval of the other Partners. All contracts shall be made in the name of the

Partnership and in the case of any disagreement as to the making of any contract or assumption of any

obligation by the Partnership, such contract or obligation shall not be made or executed except as directed

by a supermajority of the Partners; further, no Partner shall release nor cancel any indebtedness or

obligation due the Partnership, except on full payment thereof, or upon the mutual agreement of all the

Partners, nor shall any Partner give, extend, or guarantee credit to or for any person, firm, corporation

Sample Partnership Agreement 2

without the consent of all the Partners, nor at any time shall any Partner sign the firm name nor pledge the

firm's credit nor in any other manner act as surety or guarantor in any paper, bill, bond, note, or draft or

other obligation whatsoever, nor assign pledge, mortgage, sell or otherwise dispose of, any Partnership

property or any interest therein or do anything or permit any act whereby the Partnership's money, interest,

or property or its interest therein, may be liable to seizure, attachment, or execution, except upon mutual

consent of all the Partners.

9. Relationship of the Partners. Each Partner may have other business interests and may engage in

any other business, trade, profession, or employment whatsoever on his own account or in partnership with,

as an employee of, or as an officer, director, or stockholder of any other person, firm, or corporation

(whether competitive with the Partnership or otherwise) and he shall not be required to devote his entire

time to the business of the Partnership. Each Partner shall devote such time and attention to the conduct of

the business of the Partnership as shall be deemed by all of the Partners to be required for the business of

the Partnership.

No Partner shall receive any salary or other special compensation or services rendered by him as Partner of

the Partnership, except as otherwise agreed by all the Partners. Notwithstanding the foregoing, each

Partner shall be permitted to do business with the Partnership and with any other Partner individually or

with any business entity in which such Partner may have an interest.

It is understood that each of the parties hereto are Partners for the purpose of this Partnership as set forth in

Paragraph 1 hereof, but nothing contained in this Agreement shall make the Partners partners with respect

to matters unrelated to the Partnership, or render them liable for any debts or obligations of any Partner, nor

shall any Partner be hereby constituted the agent for any Partner except to the limited extent herein

specifically permitted and as may be hereinafter agreed upon by consent of all the parties.

10. Waiver of Right to Partition. Each Partner hereto hereby waives his right to partition (or to

separately assert any right to partition under the statutes of the State of ________________ pertaining to

partition) any real property owned by the Partnership.

11. Voluntary Termination. The Partnership may be dissolved at any time by agreement of a

supermajority of the Partners, in which event the partners shall proceed with reasonable promptness to

liquidate the business of the partnership. The assets of the partnership and proceeds of liquidation shall be

applied in the following order:

(a) To the payment of or provision for all debts, liabilities and obligations of the Partnership to any

person (other than Partners) and the expenses of liquidation;

(b) To the payment of all debts and liabilities (including interest) to the Partners (except those on

account of their capital contributions);

(c) To the discharge of the balance of the income accounts of the Partners;

(d) To the payment of the capital accounts of the Partners, less any previous distributions and any

losses charged or chargeable to the capital accounts of the Partners and increased by any income or gains

credited to such capital accounts; and

(e) Between the Partners in the same proportion as their percentages of interest in the Partnership as

set forth in Paragraph 4.

Notwithstanding any other provisions of this Paragraph 11, if, upon ultimate liquidation of the Partnership,

the foregoing allocations would leave any Partner with a deficit in his capital account that is not to be

repaid to the Partnership, then, such allocation shall be modified so that, to the extent possible, the amount

of total gain (including the portion of any cancellation of indebtedness income not excluded by an election

Sample Partnership Agreement 3

under Internal Revenue Code Sections 108 and 1017) allocated to such Partner is sufficient to eliminate

such deficit. If there are several Partners with such deficits and the total gain is less than the aggregate

deficits, such gains shall be allocated in proportion to, but not in excess of, their respective deficits.

12. Retirement. No Partner may retire from the Partnership for a period of ____ years from the date

of this Agreement. After said period, any Partner shall have the right to retire from the Partnership at the

end of any calendar month. Written notice of intention to retire shall be served upon the remaining Partners

at least __________ days before the first day of the month in which the retiring Partner intends to retire.

The retirement of such Partner shall have no effect upon the continuance of the Partnership business. If the

remaining Partners elect to purchase the interest of the retiring Partner, the Partners shall serve written

notice of such election upon the retiring Partner within_______ days after receipt of the retiring Partner's

notice of intention to retire, and the purchase price and method of payment for the Partnership interest shall

be as provided in Paragraph 14 hereof. If the remaining Partners elect not to purchase the interest of the

retiring Partner, then the Partners shall proceed with reasonable promptness to liquidate the business of the

Partnership.

13. Involuntary Withdrawal. Any Partner may be required to withdraw from the Partnership upon the

happening of any of the following events:

(a) If any Partner makes an assignment for the benefit of creditors or applies for the appointment of a

trustee, a liquidator or receiver of any substantial part of his assets or commences any proceeding relating

to himself under any bankruptcy, reorganization, or arrangement of similar law; or if any such application

is filed or proceeding is commenced against any Partner and such Partner indicates his consent thereto, or

an order is entered appointing any such trustee, liquidator or receiver, or approving a petition in any such

proceeding and such order remains in effect for more than sixty (60) days; then that Partner shall be

deemed to have withdrawn from the Partnership as of the date of the happening of any such event.

(b) If any Partner shall be adjudged incompetent, then such Partner shall be deemed to have

withdrawn from the Partnership on the date set forth in a notice to such incompetent Partner from the

remaining Partners.

The value of the Partnership interest in the Partnership of any Partner who shall be required to withdraw

from the Partnership as provided in this paragraph, and the method of payment for the Partnership interest

shall be as provided in Paragraph 14 hereof.

14. Death of a Partner. Upon the death of a Partner, the Partnership shall not terminate, and the

business of the Partnership shall be continued to the end of the fiscal year in which such death occurs. The

estate of the deceased Partner shall share in the net profits or losses of the Partnership for the balance of the

fiscal year in the same manner the deceased Partner would have shared in them had he survived to the end

of the fiscal year, but the liability of the estate for losses shall not exceed the deceased Partner's interest in

the Partnership assets at the time of his death. The estate of the deceased Partner shall have no voice in the

affairs of the Partnership. At the end of the fiscal year, the surviving Partners shall have the option either to

liquidate the Partnership or to purchase the interest of the deceased Partner.

(a) If the surviving Partners elect to purchase the interest of the deceased Partner, they shall serve

notice in writing of such election within _______ months after the death of the Partner upon the Executor

or Administrator of such deceased Partner's estate, or if at the time of such election no such legal

representative has been appointed, upon any one of the known legal heirs of the decedent at the last known

address of such heir. The purchase price shall be equal to the deceased Partner's capital account as of the

end of the month next preceding the date of his death plus the deceased Partner's income account as of said

date, adjusted for the deceased Partner's share of profits not previously distributed or losses not previously

charged to either of said accounts through the end of the month next preceding death. No allowance shall

be made for goodwill, tradename, patents or other intangible assets, except as those assets have been

reflected on the Partnership books immediately prior to termination; but the surviving Partners shall

Sample Partnership Agreement 4

nevertheless be entitled to use the tradename of the Partnership. The capital account of the deceased

Partner shall be adjusted to reflect the fair market value of all Partnership land and improvements located

thereon and fixtures affixed thereto, the same to be determined by an independent appraiser selected by the

parties for this purpose, whose determination shall be final and binding upon all interested parties. The

purchase price shall be paid within ________ year(s) of the death of the deceased partner and shall bear

interest at the rate of ________ percent per annum thereafter. In the event no agreement can be made on

who shall be the appraiser, then the value shall be established by three appraisers, one selected by the

deceased partner's estate, one selected by the remaining partners and a third appraiser selected by those two

appraisers. The Partners intend that the payments for the deceased Partner's capital account shall be

distributions under Section 736(b) of the Internal Revenue Code, and that payments for undistributed

profits shall be a distributive share of the Partnership income or a guaranteed payment under Section 736(a)

of the Internal Revenue Code.

(b) If the surviving Partners do not elect to purchase the interest of the deceased Partner, they shall

proceed with reasonable promptness to liquidate the Partnership. During the period of liquidation, the

surviving Partners and the estate of the deceased Partner shall share in the profits and losses of the business

in the same manner that they would have shared in them had the deceased Partner survived to the end of the

fiscal year, except that the deceased Partner's estate shall not be liable for losses in excess of the deceased

Partner's interest in the Partnership assets as of the time of his death. Except as herein otherwise stated, the

procedure as to liquidation and distribution of the assets of the Partnership business shall be the same as

stated in Paragraph 11.

The parties agree that the provisions contained herein with respect to the discharge of a deceased Partner's

interest in the Partnership are in lieu of the provisions of ____________________________________

(State Statute)(Uniform Partnership Act))

and shall exclusively govern the disposition of and accounting for the interest of a deceased Partner in the

Partnership.

15. New Partners. No person shall be admitted as a Partner of the Partnership except with the consent

of all the Partners who shall determine the terms and conditions upon which such admission is to be

effective.

16. Prohibition on Transfer. A Partner shall not, and shall have no right, to sell, assign, pledge or

mortgage his interest in the Partnership, or the Partnership property or assets, except with the written

consent of all the Partners, and any such prohibition transfer, if attempted, shall be void and without force

or effect.

17. Entire Agreement. This Agreement contains the entire understanding of the parties hereto and

may not be modified or amended except by a writing signed by the parties to be charged therewith.

18. Controlling Law. This Agreement shall be controlled by and construed in accordance with the

laws of the State of ______________________.

19. Successors and Assigns. Subject to the restrictions set forth herein, this Agreement shall inure to

the benefit of and be binding upon the heirs, personal representatives, successors and assigns of the parties.

IN WITNESS WHEREOF, the parties hereto have set their hands and seals the date and place first above

mentioned.

_______________________________ _________________

Signature of Partner Date

_______________________________ _________________

Signature of Partner Date

Sample Partnership Agreement 5

108 Rockwell Hall

600 Forbes Ave

Pittsburgh, PA 15282-0103

Phone: (412) 396-6233

Fax: (412) 396-5884

The Duquesne University SBDC has made reasonable efforts to ensure the accuracy of this

information. It may, however, include inaccuracies or typographical errors and may be changed or

updated without notice. It is intended for discussion and educational purposes only and is not

intended to and does not constitute legal, financial, or other professional advice. Some materials may

provide links to other Internet sites only for the convenience of users. The SBDC is not responsible

for the availability or content of these sites. The Duquesne University SBDC does not endorse or

recommend any commercial products, processes, or services, or its producer or provider contained in

this material or information described or offered at other Internet sites. Funding support and

resources are provided by the Commonwealth of Pennsylvania through the Department of

Community & Economic Development; through a cooperative agreement with the U.S. Small

Business Administration; and in part through support from Duquesne University. All services are

extended to the public on a non-discriminatory basis. Special arrangements for persons with

disabilities can be made by calling 412-396-6233. All opinions, conclusions or recommendations

expressed are those of the author(s) and do not necessarily reflect the views of the SBA.”

Sample Partnership Agreement 6