Fillable Printable Power of Attorney and Declaration of Representative - Maine

Fillable Printable Power of Attorney and Declaration of Representative - Maine

Power of Attorney and Declaration of Representative - Maine

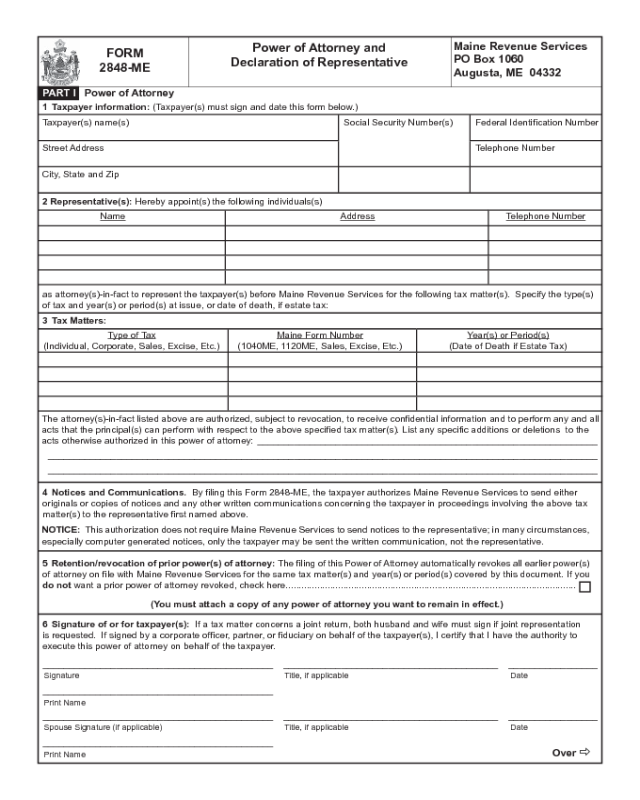

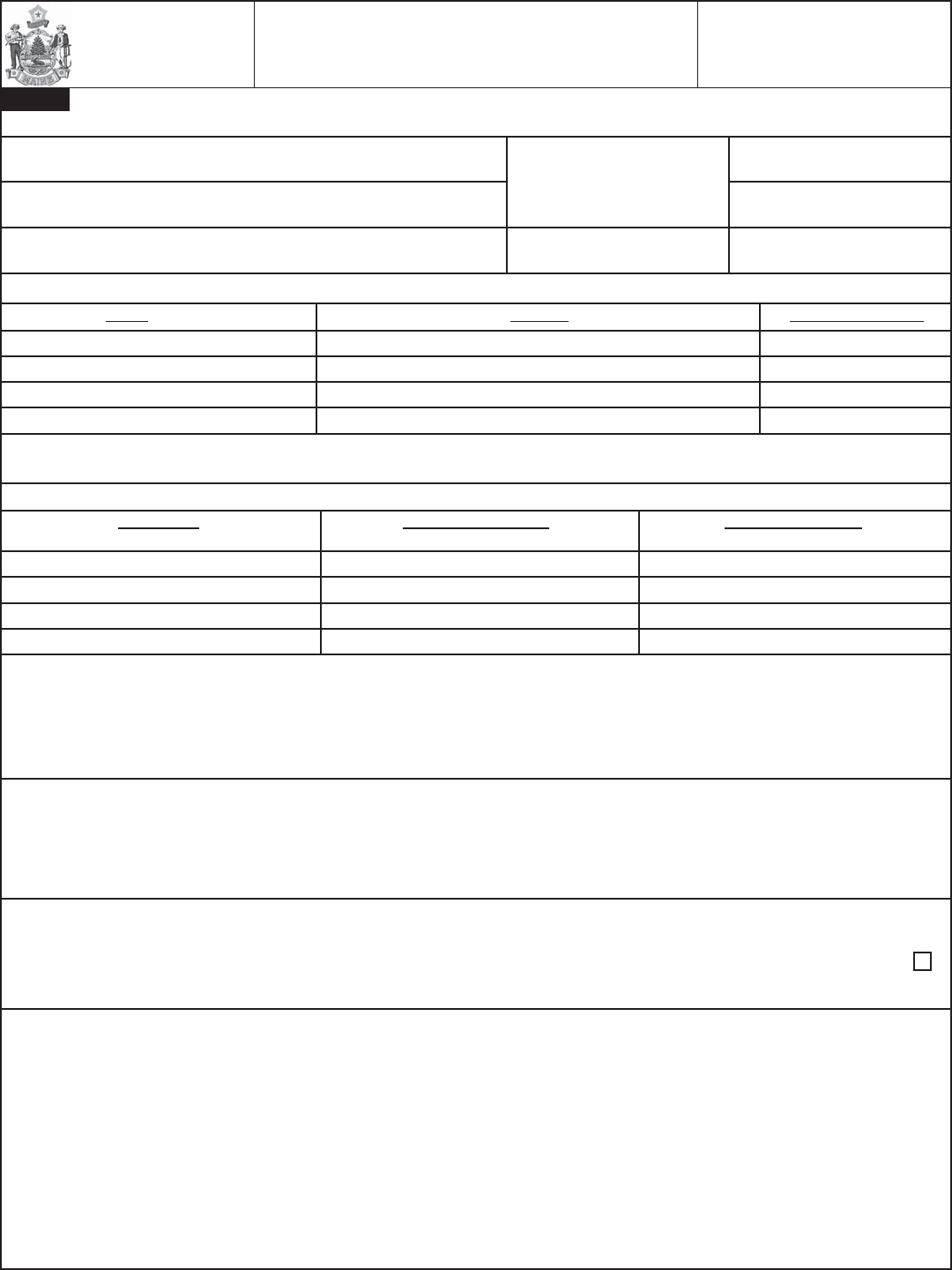

FORM

2848-ME

Power of Attorney and

Declaration of Representative

Maine Revenue Services

PO Box 1060

Augusta, ME 04332

Over

PART I Power of Attorney

1 Taxpayer information: (Taxpayer(s) must sign and date this form below.)

Taxpayer(s) name(s) Social Security Number(s) Federal Identifi cation Number

Street Address Telephone Number

City, State and Zip

2 Representative(s): Hereby appoint(s) the following individuals(s)

Name Address Telephone Number

as attorney(s)-in-fact to represent the taxpayer(s) before Maine Revenue Services for the following tax matter(s). Specify the type(s)

of tax and year(s) or period(s) at issue, or date of death, if estate tax:

3 Tax Matters:

Type of Tax Maine Form Number Year(s) or Period(s)

(Individual, Corporate, Sales, Excise, Etc.) (1040ME, 1120ME, Sales, Excise, Etc.) (Date of Death if Estate Tax)

The attorney(s)-in-fact listed above are authorized, subject to revocation, to receive confi dential information and to perform any and all

acts that the principal(s) can perform with respect to the above specifi ed tax matter(s). List any specifi c additions or deletions to the

acts otherwise authorized in this power of attorney: _________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

4 Notices and Communications. By fi ling this Form 2848-ME, the taxpayer authorizes Maine Revenue Services to send either

originals or copies of notices and any other written communications concerning the taxpayer in proceedings involving the above tax

matter(s) to the representative fi rst named above.

NOTICE: This authorization does not require Maine Revenue Services to send notices to the representative; in many circumstances,

especially computer generated notices, only the taxpayer may be sent the written communication, not the representative.

5 Retention/revocation of prior power(s) of attorney: The fi ling of this Power of Attorney automatically revokes all earlier power(s)

of attorney on fi le with Maine Revenue Services for the same tax matter(s) and year(s) or period(s) covered by this document. If you

do not want a prior power of attorney revoked, check here ...............................................................................................................

(You must attach a copy of any power of attorney you want to remain in effect.)

6 Signature of or for taxpayer(s): If a tax matter concerns a joint return, both husband and wife must sign if joint representation

is requested. If signed by a corporate offi cer, partner, or fi duciary on behalf of the taxpayer(s), I certify that I have the authority to

execute this power of attorney on behalf of the taxpayer.

____________________________________________ _________________________________________ _________________

Signature Title, if applicable Date

____________________________________________

Print Name

____________________________________________ _________________________________________ _________________

Spouse Signature (if applicable) Title, if applicable Date

____________________________________________

Print Name

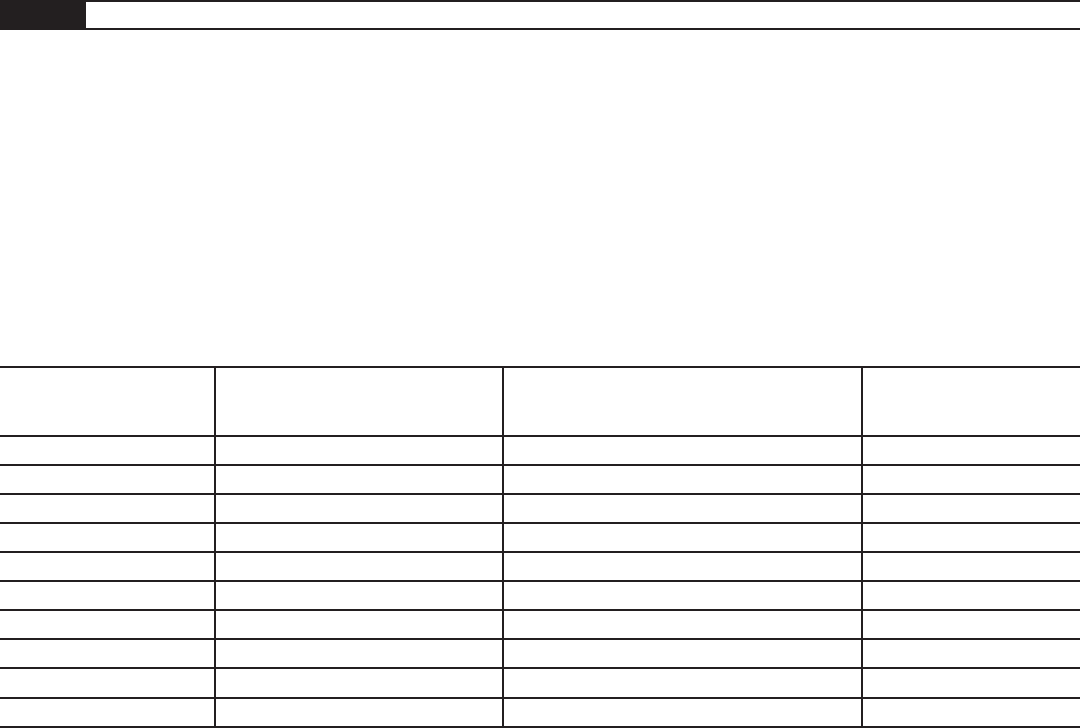

PART II Declaration of Representative

Under penalties of perjury, I declare that I am: (Circle one)

1. A member in good standing of the bar of the highest court of the jurisdiction shown below;

2. Duly qualifi ed to practice as a certifi ed public accountant in the jurisdiction shown below;

3. An enrolled agent enrolled under U. S. Department of Treasury Circular 230;

4. A bona fi de offi cer of the taxpayer’s organization;

5. A full-time employee of the taxpayer;

6. A member of the taxpayer’s immediate family (spouse, parent, child, brother or sister);

7. A fi duciary for the taxpayer;

8. Other (Explain) ______________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

Designation Jurisdiction Signature Date

(insert appropriate (state, etc.)

number from list above)

Revised: October, 2013

IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED,

THE POWER OF ATTORNEY WILL BE RETURNED.