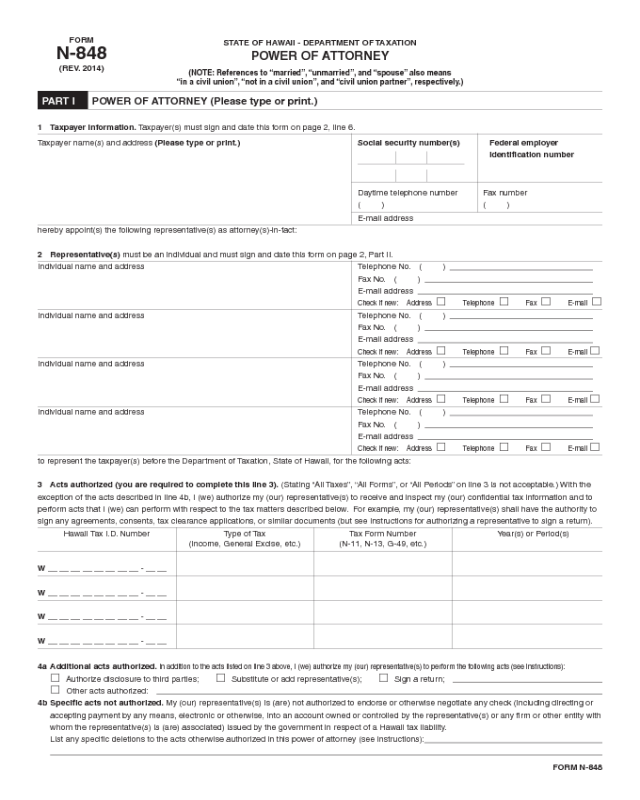

Fillable Printable Power of Attorney Example - Hawaii

Fillable Printable Power of Attorney Example - Hawaii

Power of Attorney Example - Hawaii

1 Taxpayer Information. Taxpayer(s) must sign and date this form on page 2, line 6.

Taxpayer name(s) and address (Please type or print.)

Social security number(s) Federal employer

identification number

Daytime telephone number

Fax number

( )

( )

E-mail address

hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

2 Representative(s) must be an individual and must sign and date this form on page 2, Part II.

Individual name and address Telephone No. ( )

Fax No. ( )

E-mail address

Check if new: Address Telephone Fax E-mail

Individual name and address Telephone No. ( )

Fax No. ( )

E-mail address

Check if new: Address Telephone Fax E-mail

Individual name and address Telephone No. ( )

Fax No. ( )

E-mail address

Check if new: Address Telephone Fax E-mail

Individual name and address Telephone No. ( )

Fax No. ( )

E-mail address

Check if new: Address Telephone Fax E-mail

to represent the taxpayer(s) before the Department of Taxation, State of Hawaii, for the following acts:

3 Acts authorized (you are required to complete this line 3). (Stating “All Taxes”, “All Forms”, or “All Periods” on line 3 is not acceptable.) With the

exception of the acts described in line 4b, I (we) authorize my (our) representative(s) to receive and inspect my (our) confidential tax information and to

perform acts that I (we) can perform with respect to the tax matters described below. For example, my (our) representative(s) shall have the authority to

sign any agreements, consents, tax clearance applications, or similar documents (but see instructions for authorizing a representative to sign a return).

Hawaii Tax I.D. Number Type of Tax Tax Form Number Year(s) or Period(s)

(Income, General Excise, etc.)

(N-11, N-13, G-49, etc.)

W __ __ __ __ __ __ __ __ - __ __

W __ __ __ __ __ __ __ __ - __ __

W __ __ __ __ __ __ __ __ - __ __

W __ __ __ __ __ __ __ __ - __ __

4a Additional acts authorized. In addition to the acts listed on line 3 above, I (we) authorize my (our) representative(s) to perform the following acts (see instructions):

Authorize disclosure to third parties; Substitute or add representative(s); Sign a return;

Other acts authorized:

4b Specific acts not authorized. My (our) representative(s) is (are) not authorized to endorse or otherwise negotiate any check (including directing or

accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative(s) or any firm or other entity with

whom the representative(s) is (are) associated) issued by the government in respect of a Hawaii tax liability.

List any specific deletions to the acts otherwise authorized in this power of attorney (see instructions):

FORM

N-848

(REV. 2014)

STATE OF HAWAII - DEPARTMENT OF TAXATION

POWER OF ATTORNEY

(NOTE: References to “married”, “unmarried”, and “spouse” also means

“in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

PART I POWER OF ATTORNEY (Please type or print.)

FORM N-848

Clear Form

FORM N-848

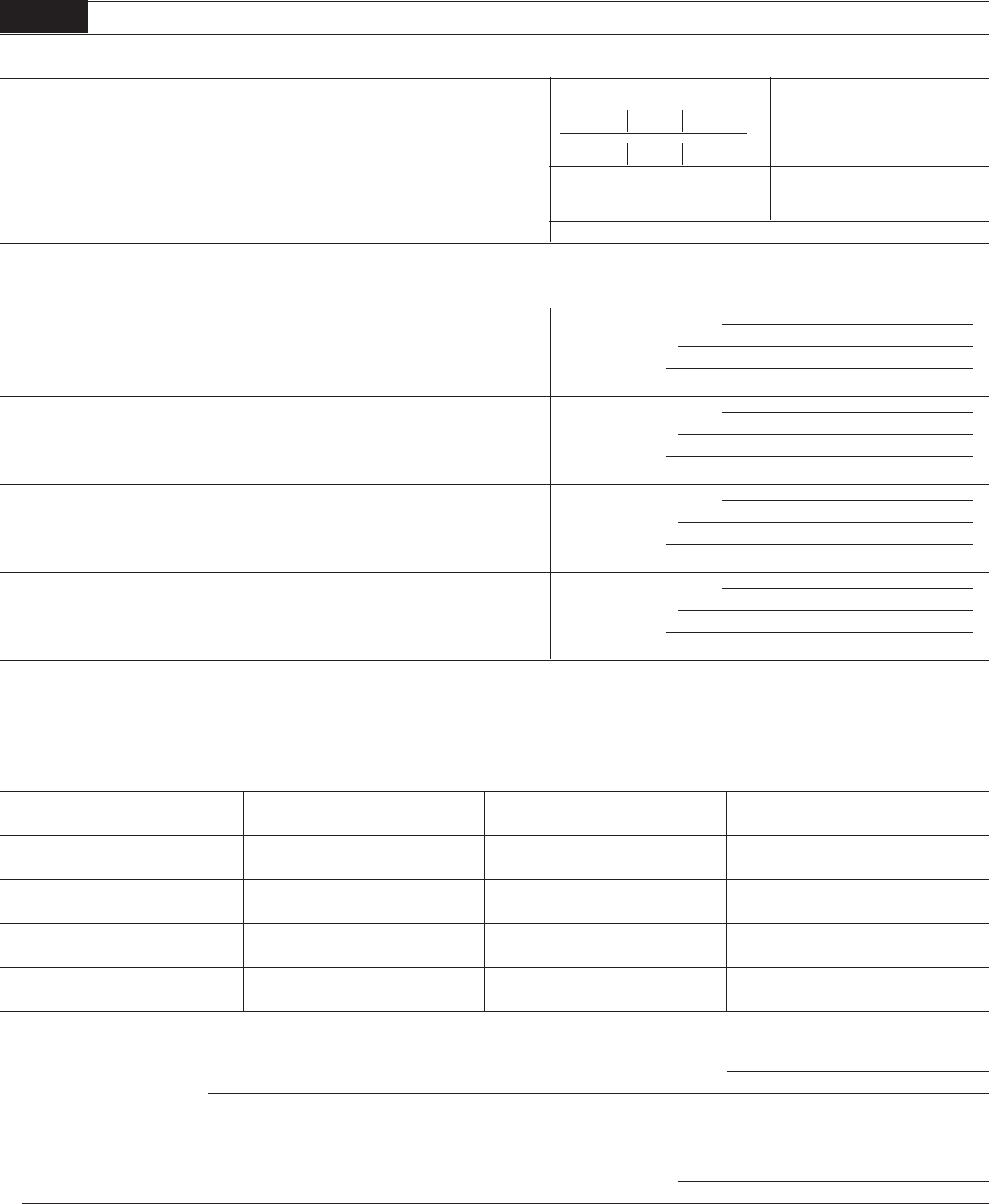

(REV. 2014) Page 2

5 Retention/Revocation of Prior Power(s) of Attorney. The filing of this power of attorney automatically revokes all earlier power(s) of attorney on

file with the State of Hawaii for the same tax matters and years or periods covered by this document. If you do not want to revoke a prior power of

attorney, check here ............................................................................................................................................................................................

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

6 Signature of Taxpayer(s). If a tax matter concerns a year in which a joint return was filed, both spouses must sign if joint representation is

requested. If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, administrator, or trustee on behalf of the

taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED TO THE TAXPAYER.

Signature Date Title (if applicable)

Print Name Print name of taxpayer from line 1 if other than individual

Signature Date Title (if applicable)

Print Name

Social Security Number

(Last 4 numbers)

Type or Print Name Signature Date

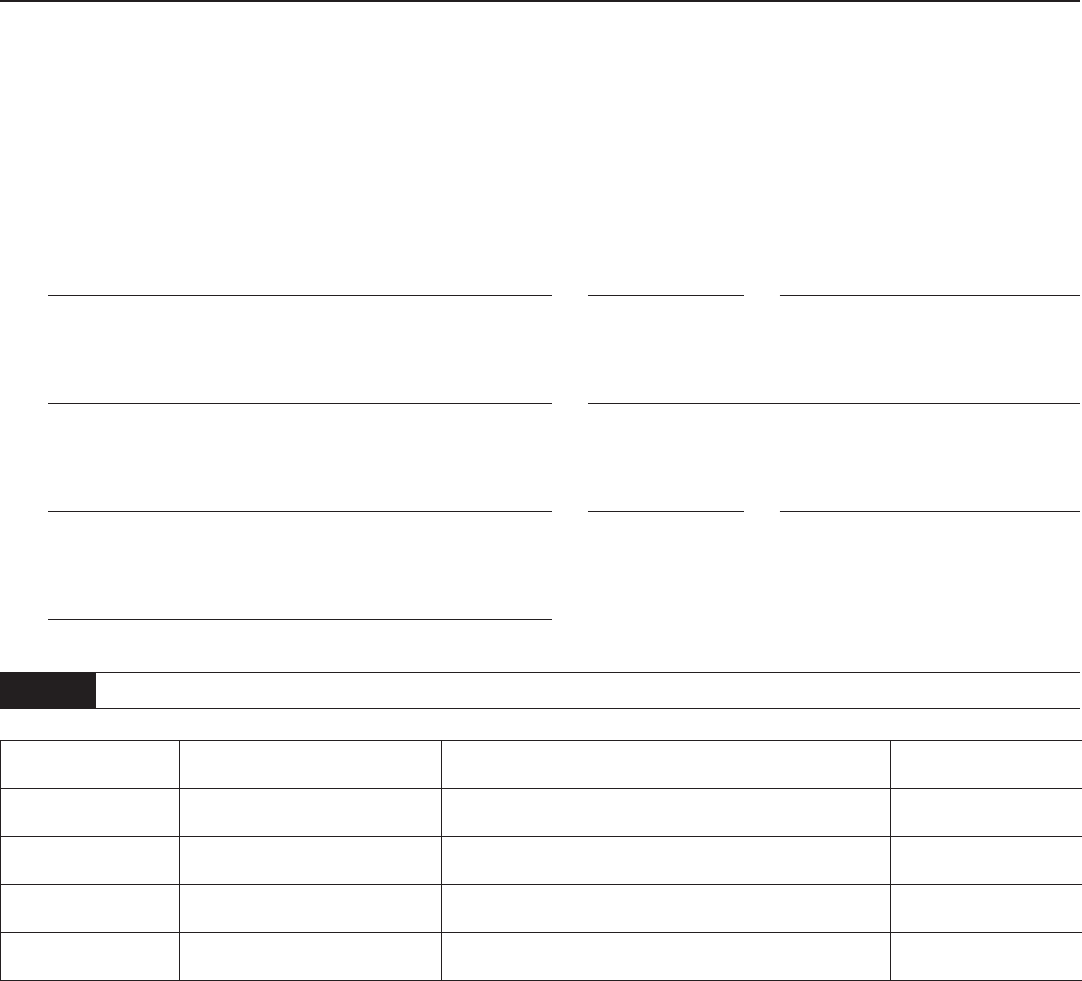

PART II SIGNATURE OF REPRESENTATIVE(S)

Filing the Power of Attorney

File the original, photocopy, or facsimile transmission (fax) with each letter, request, form, or other document for which the power of attorney

is required. For example, if you wish to designate an individual to represent you in obtaining tax clearance certificates, a copy of Form

N-848 must be filed each time you submit Tax Clearance Applications. The Department does not maintain a permanent, centralized file of

powers of attorney.