Fillable Printable Principal Residence Exemption (PRE) Active Duty Military Affidavit - Michigan Department of Treasury

Fillable Printable Principal Residence Exemption (PRE) Active Duty Military Affidavit - Michigan Department of Treasury

Principal Residence Exemption (PRE) Active Duty Military Affidavit - Michigan Department of Treasury

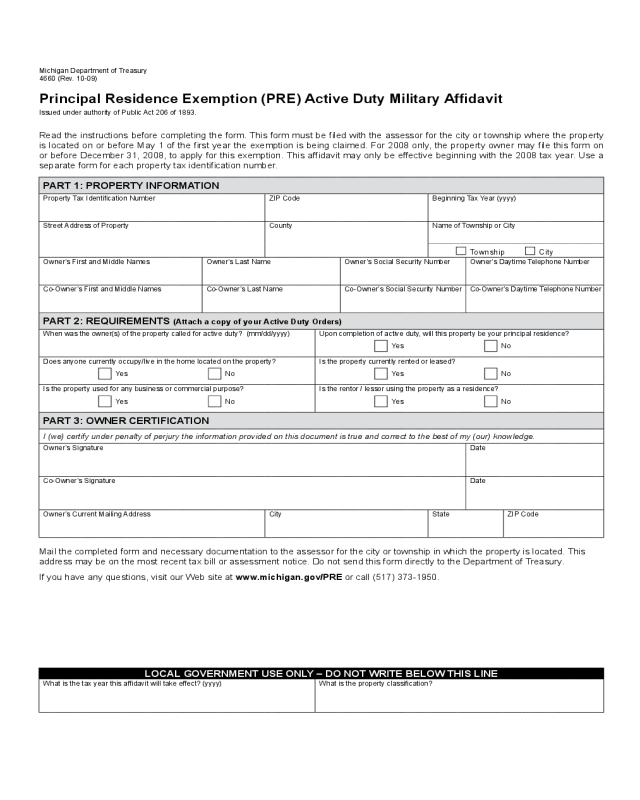

Michigan Department of Treasury

4660 (Rev. 10-09)

Principal Residence Exemption (PRE) Active Duty Military Afdavit

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the form. This form must be led with the assessor for the city or township where the property

is located on or before May 1 of the rst year the exemption is being claimed. For 2008 only, the property owner may le this form on

or before December 31, 2008, to apply for this exemption. This afdavit may only be effective beginning with the 2008 tax year. Use a

separate form for each property tax identication number.

PART 1: PROPERTY INFORMATION

Property Tax Identication Number ZIP Code Beginning Tax Year (yyyy)

Street Address of Property County Name of Township or City

Township City

Owner’s First and Middle Names Owner’s Last Name Owner’s Social Security Number Owner’s Daytime Telephone Number

Co-Owner’s First and Middle Names Co-Owner’s Last Name Co-Owner’s Social Security Number Co-Owner’s Daytime Telephone Number

PART 2: REquIREMENTs (Attach a copy of your Active Duty Orders)

When was the owner(s) of the property called for active duty? (mm/dd/yyyy) Upon completion of active duty, will this property be your principal residence?

Yes No

Does anyone currently occupy/live in the home located on the property? Is the property currently rented or leased?

Yes No Yes No

Is the property used for any business or commercial purpose? Is the rentor / lessor using the property as a residence?

Yes No Yes No

PART 3: OwNER cERTIFIcATION

I (we) certify under penalty of perjury the information provided on this document is true and correct to the best of my (our) knowledge.

Owner’s Signature Date

Co-Owner’s Signature Date

Owner’s Current Mailing Address City State ZIP Code

Mail the completed form and necessary documentation to the assessor for the city or township in which the property is located. This

address may be on the most recent tax bill or assessment notice. Do not send this form directly to the Department of Treasury.

If you have any questions, visit our Web site at www.michigan.gov/PRE or call (517) 373-1950.

lOcAl gOvERNMENT usE ONlY – DO NOT wRITE bElOw ThIs lINE

What is the tax year this afdavit will take effect? (yyyy) What is the property classication?

Instructions for Form 4660

Principal Residence Exemption (PRE) Active Duty Military Afdavit

This form enables a person with an established Principal Residence Exemption (PRE) to retain that PRE while on active

duty in the United States armed forces if the principal residence is rented or leased. Property that currently qualies

as a principal residence continues to qualify for three years after any portion of the dwelling or unit included in, or

constituting the principal residence, is rented or leased to another person and is used as a residence. All of the following

conditions must be satised:

The owner of the dwelling or unit is absent while on active duty in the armed forces of the United States.•

The dwelling or unit would otherwise qualify as the owner’s principal residence.•

The owner les Form 4660 with the assessor of the local tax collection unit on or before May 1 attesting that he/•

she intends to occupy the dwelling or unit as a principal residence upon completion of active duty in the United

States armed forces.

PART 1: PROPERTY INFORMATION

The following information must be provided to the assessor to process your afdavit:

Property is identied with a property tax identication number. This number can be found on your tax bill and •

on your property tax assessment notice. Enter this number in the space indicated. If you cannot nd this number,

call your township or city assessor. Your property number is essential. Without it, your township or city cannot

accurately adjust your property taxes.

Enter the rst tax year in which this Afdavit will become effective.•

Enter the complete property address of the exemption you are retaining.•

Enter the name of the township or city in which the property is located and check the appropriate box for city or •

township. If you live in a village, list the township in which the property located.

Enter the owner and co-owner’s complete name. Do not include information for a co-owner who did not occupy •

the property.

Enter the Social Security Number(s) of the legal owner(s). The request for the Social Security Number is •

authorized under section 42 USC 405(c)(2)(C)(i). It is used by the Department of Treasury to verify tax exemption

claims and to deter fraudulent lings. Any use of the number by closing agents or local units of government is

illegal and subject to penalty.

Enter the daytime phone number of the owner(s). This number is important because the assessor may need to •

contact the owner(s) to verify information in order to process this Afdavit.

PART 2: REquIREMENTs

The questions listed in Part 2 are very important in determining eligibility for the retention of the exemption. These

questions must be answered truthfully and to the best of the owners’ knowledge. Failure to answer these questions may

result in processing delays of this Afdavit and/or result in a subsequent denial of the exemption. A copy of the Active

Duty Orders must be submitted with this Afdavit.

PART 3: cERTIFIcATION

The form must be signed and dated by the owners listed in Part 1. Provide the owner’s current and complete mailing

address.

INTEREsT AND PENAlTY

If it is determined that the claimed property was not the owner’s principal residence, or that the requirements are not met,

the owner(s) may be subject to additional tax plus penalty and interest as determined under the General Property Tax Act.

4660, Page 2