Fillable Printable CONSULTING and RETAINER AGREEMENT

Fillable Printable CONSULTING and RETAINER AGREEMENT

CONSULTING and RETAINER AGREEMENT

1

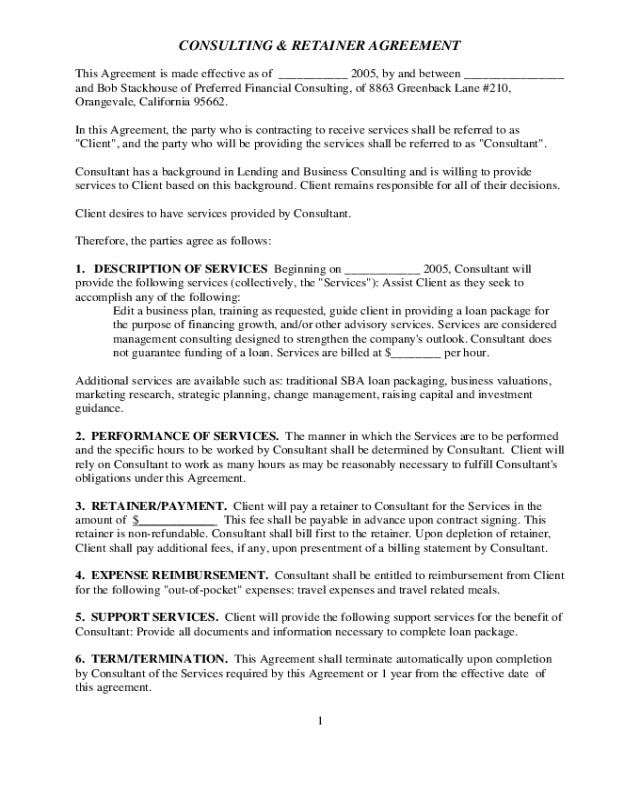

CONSULTING & RETAINER AGREEMENT

This Agreement is made effective as of ___________ 2005, by and between ________________

and Bob Stackhouse of Preferred Financial Consulting, of 8863 Greenback Lane #210,

Orangevale, California 95662.

In this Agreement, the party who is contracting to receive services shall be referred to as

"Client", and the party who will be providing the services shall be referred to as "Consultant".

Consultant has a background in Lending and Business Consulting and is willing to provide

services to Client based on this background. Client remains responsible for all of their decisions.

Client desires to have services provided by Consultant.

Therefore, the parties agree as follows:

1. DESCRIPTION OF SERVICES Beginning on ____________ 2005, Consultant will

provide the following services (collectively, the "Services"): Assist Client as they seek to

accomplish any of the following:

Edit a business plan, training as requested, guide client in providing a loan package for

the purpose of financing growth, and/or other advisory services. Services are considered

management consulting designed to strengthen the company's outlook. Consultant does

not guarantee funding of a loan. Services are billed at $________ per hour.

Additional services are available such as: traditional SBA loan packaging, business valuations,

marketing research, strategic planning, change management, raising capital and investment

guidance.

2. PERFORMANCE OF SERVICES. The manner in which the Services are to be performed

and the specific hours to be worked by Consultant shall be determined by Consultant. Client will

rely on Consultant to work as many hours as may be reasonably necessary to fulfill Consultant's

obligations under this Agreement.

3. RETAINER/PAYMENT. Client will pay a retainer to Consultant for the Services in the

amount of

$____________ This fee shall be payable in advance upon contract signing. This

retainer is non-refundable. Consultant shall bill first to the retainer. Upon depletion of retainer,

Client shall pay additional fees, if any, upon presentment of a billing statement by Consultant.

4. EXPENSE REIMBURSEMENT. Consultant shall be entitled to reimbursement from Client

for the following "out-of-pocket" expenses: travel expenses and travel related meals.

5. SUPPORT SERVICES. Client will provide the following support services for the benefit of

Consultant: Provide all documents and information necessary to complete loan package.

6. TERM/TERMINATION. This Agreement shall terminate automatically upon completion

by Consultant of the Services required by this Agreement or 1 year from the effective date of

this agreement.

2

7. RELATIONSHIP OF PARTIES. It is understood by the parties that Consultant is an

independent contractor with respect to Client, and not an employee of Client. Client will not

provide fringe benefits, including health insurance benefits, paid vacation, or any other employee

benefit, for the benefit of Consultant.

8. DISCLOSURE. Consultant is required to disclose any outside activities or interests that

conflict or may conflict with the best interests of Client. Prompt disclosure is required under this

paragraph if the activity or interest is related, directly or indirectly, to other consulting

relationships that may conflict with this Agreement.

Consultant receives referral fees from many financial institutions. The institutions generally do

not have to pay a business development officer a commission due to the high quality of

Consultant's loan packages (saving them time), therefore they can pay a referral fee without

affecting Client's pricing. The choice of banking relationship remains in the client's hands.

Consultant is not an Attorney, nor licensed to practice law. Discussions can skirt legal issues

and should be interpreted as opinions, or things to consider. If legal advice is desired, consult an

Attorney.

Consultant is not a CPA, nor a Tax Professional. Discussions can and do involve accounting

and presentation of financial results and projections. When Tax advice is requested, contact a

CPA or Tax professional.

Consultant is not an employee of any banking institution. Therefore consultant can not speak

for any particular institution. Financial institutions regularly change their policies and

procedures. Therefore advice should be considered as a general methodology.

Client maintains control of all decisions and should reject advice that they do not agree

with. Client may find that things have changed after they enter a relationship with a bank, or

other business concern.

Consultant can not control future events, therefore cannot be responsible for long term outcomes

of business or financing strategies.

9. EMPLOYEES. Consultant's employees, if any, who perform services for Client under this

Agreement shall also be bound by the provisions of this Agreement.

10. CONFIDENTIALITY. Client recognizes that Consultant has and will have the following

information:

- business affairs; financial information; personal information; future plans;

and other proprietary information (collectively, "Information") which are valuable, special and

unique assets of Client and need to be protected from improper disclosure. In consideration for

the disclosure of the Information, Consultant agrees that Consultant will not at any time or in any

manner, either directly or indirectly, use any Information for Consultant's own benefit, or

divulge, disclose, or communicate in any manner any Information to any third party without the

prior consent of Client. Consultant will protect the Information and treat it as strictly

confidential. A violation of this paragraph shall be a material violation of this Agreement.

11. CONFIDENTIALITY AFTER TERMINATION. The confidentiality provisions of this

Agreement shall remain in full force and effect after the termination of this Agreement.

12. RETURN OF RECORDS. Upon termination of this Agreement, Consultant shall deliver

all records, notes, and data of any nature that are in Consultant's possession or under Consultant's

control and that are Client's property or relate to Client's business.

3

13. NOTICES. All notices required or permitted under this Agreement shall be in writing and

shall be deemed delivered when delivered in person or deposited in the United States mail,

postage prepaid, addressed as follows:

IF for Client: IF for Consultant:

Preferred Financial Consulting

Bob Stackhouse

8863 Greenback #210

Orangevale, CA 95662

Such address may be changed from time to time by either party by providing written notice to

the other in the manner set forth above.

14. ENTIRE AGREEMENT. This Agreement contains the entire agreement of the parties and

there are no other promises or conditions in any other agreement whether oral or written. This

Agreement supersedes any prior written or oral agreements between the parties.

15. AMENDMENT. This Agreement may be modified or amended if the amendment is made

in writing and is signed by both parties.

16. SEVERABILITY. If any provision of this Agreement shall be held to be invalid or

unenforceable for any reason, the remaining provisions shall continue to be valid and

enforceable. If a court finds that any provision of this Agreement is invalid or unenforceable, but

that by limiting such provision it would become valid and enforceable, then such provision shall

be deemed to be written, construed, and enforced as so limited.

17. WAIVER OF CONTRACTUAL RIGHT. The failure of either party to enforce any

provision of this Agreement shall not be construed as a waiver or limitation of that party's right

to subsequently enforce and compel strict compliance with every provision of this Agreement.

18. APPLICABLE LAW. This Agreement shall be governed by the laws of the State of

California.

Party receiving services:

By: __________________________________________________________________________

Party providing services:

Preferred Financial Consulting

By:

Bob Stackhouse - Consultant

4

RECEIPT

Acknowledged receipt from Client the sum of $ ________________________. This payment

constitutes payment of the retainer required under Section 3 of this Agreement.

Date: