Fillable Printable Florida's Identity Theft Victim Kit

Fillable Printable Florida's Identity Theft Victim Kit

Florida's Identity Theft Victim Kit

1

This kit is designed to help you work through the process of resolving your identity theft

case and clearing your name. While there are many general identity theft resource

guides available, this kit was specifically developed to provide assistance to Floridians

who are identity theft victims, as well as individuals in other states who had their

personal information fraudulently used in the state of Florida.

Navigating through the system as an identity theft victim can be a lengthy and confusing

process. As you contact law enforcement, creditors, and financial institutions, it is

important that you keep track of the actions you take and retain a record of your

progress.

When your identity is stolen your personal identifiers can be misused in a variety of

different ways. As soon as you become aware that your information has been misused,

there are several basic steps you should take that apply to nearly all kinds of identity

theft cases:

Step One

Report the incident to the fraud department of the three major credit bureaus.

• Ask the credit bureaus to place a "fraud alert" on your credit report.

• Order copies of your credit reports so you can review them to see if any

additional fraudulent accounts have been opened in your name or if any

unauthorized charges have been made to other accounts.

• Request a victim's statement that asks creditors to contact you prior to opening

new accounts or making changes to any existing accounts.

Contact information for the three major credit bureaus is as follows:

Florida's

Identity Theft

Victim Kit

A guide for victims of identity

theft, detailing what to do

and who to contact.

2

Equifax

P.O. Box 740241

Atlanta, GA 30374-0241

To order your report: 1-800-685-1111

To report fraud: 1-800-525-6285

TDD: 800-255-0056

www.equif ax.com

TransUnion

Fraud Victim Assistance

P.O. Box 6790

Fullerton, CA 92634-6790

Email: [email protected]

To order your report: 1-800-888-4213

To report fraud: 1-800-680-7289

TDD: 877-553-7803

www.transunion.com

Experian

P.O. Box 9532

Allen, TX 75013

To order your report: 1-888-EXPERIAN (397-3742)

To report fraud: 1-888-EXPERIAN (397-3742)

TDD: 800-972-0322

www.experian.com

Step Two

Contact the fraud department of each of your creditors.

• Gather the contact information for each of your credit accounts (credit cards,

utilities, cable bills, etc.) and call the fraud department for each creditor.

• Report the incident to each creditor, even if your account at that institution has

not been tampered with. Close the accounts that you believe have been

compromised. Ask the credit bureaus to place an "alert" on any accounts that

remain open.

• Follow-up in writing immediately. The Federal Trade Commission provides an

Identity Theft Affidavit (attached), a standardized form used to report new

accounts fraudulently opened in your name. Check with the company to see if

they accept this form. If not, request that they send you their fraud dispute form.

• Confirm all conversations in writing. Follow behind your phone call with a letter

and any necessary documentation to support your claim.

3

• Call the Federal Trade Commission at 1-877-IDTHEFT (438-4338) and request a

copy of their brochure "Identity Crime: When Bad Things Happen to Your Good

Name." This brochure contains sample dispute letters to help get you started as

well as more information on resolving credit problems. The brochure is also

available through the Federal Trade Commission website at www.ftc.gov

Step Three

Contact your bank or financial ins t itution.

• If your checks have been stolen, or if you believe they have been used, contact

your bank or credit union and stop payment right away.

• Put stop payments on any outstanding checks that you are unsure about.

• Contact the major check verification companies and request they notify retailers

who use their databases not to accept your checks:

TeleCheck 1-800-710-9898 or 927-0188

Cetergy, Inc 1-800-437-5120

International Check Services 1-800-631-9656

• Call SCAN at 1-800-262-7771 to learn if bad checks have been passed in your

name.

• If you suspect your accounts have been compromised, cancel your checking and

savings accounts and obtain new account numbers.

Step Four

Report the incident to law enforcement.

• Contact your local police department or sheriffs office to file a report. Under

Florida Statute 817.568, the report may be filed in the location in which the

offense occurred, or, the city or county in which you reside.

• When you file the report, provide as much documentation as possible, including

copies of debt collection letters, credit reports, and your notarized ID Theft

Affidavit.

• Request a copy of the police report. Some creditors will request to see the report

to remove the debts created by the identity thief.

4

What Else Can I Do?

File a complaint with the FTC's Identity Theft Clearinghouse

The Clearinghouse is the federal government's repository for ID theft complaints.

Complaint information is entered into a central database, the Consumer Sentinel,

which is accessed by many local and state law enforcement agencies in Florida,

as well as Florida's Attorney General, for identity theft investigation. Call the toll-

free hotline at 1-877-IDTHEFT.

Flag your Florida Driver's License.

At your request, the Fraud Section of the Department of Highway Safety and

Motor Vehicles (DHSMV) will place a flag on your driver's license if you are a

victim of identity theft (regardless of whether your Florida Driver's License has

been compromised). To reach the Fraud Section, call (850) 617-2405. You will

be asked to submit your request in writing to:

Department of Highway Safety and Motor Vehicles

DDL/BDI - Fraud Section, Room A327

Neil Kirkman Building

Tallahassee, FL 32399-0570

If you believe that the identity thief has actually used your personal information to

secure a Florida Driver's License or Identification Card, DSHMV will conduct a

fraud investigation. To initiate this investigation, request a DHSMV Identity Theft

Report Form and mail it to the address above. The form is also available through

the DHSMV website at www.hsmv.state.fl.us

Get assistance through Florida's Fraud Hotline.

Florida's Attorney General provides a toll-free fraud hotline for Floridians who are

the victims of Fraud. Contact the hotline at 1-866-9-NO -SCAM (1-866-966-7226).

Trained advocates can help provide additional resource information in your area.

Check your Florida criminal histor y information.

In some instances of identity theft, a victim may be faced with a criminal record

for a crime he or she did not commit. The Florida Department of Law

Enforcement (FDLE) can provide a Compromised Identity Review (based on a

fingerprint comparison of state criminal history files) to determine what, if any,

criminal history belongs to you, and if any arrest records have been falsely

associated with you as a result of someone using your identity. If a fingerprint

check determines you are an identity theft victim, FDLE will work with local law

enforcement agencies to attempt to clear fraudulent data from the criminal history

files and provide you with a Compromised Identity Certificate. For more

information, contact FDLE's Quality Control Section at (850) 410-8880 or visit

www.fdle.state.fl.us

5

Contact the Florida Department of Law Enforcement.

After you have filed a report with local law enforcement and with the FTC's

Identity Theft Clearinghouse, you may contact FDLE. FDLE Special Agents who

work identity theft cases may be able to provide additional guidance and

assistance. Check your phone book to find the nearest FDLE Regional

Operations Center or visit www.fdle.state.fl.us

Remove your personal identifiers from Florida court records.

Any person has the right to request the Clerk or County Recorder to

redact/remove his or her Social Security number, bank account number, credit,

debit or charge card number from an image or copy of an Official Record that has

been placed on such Clerk's/County Recorder's publicly available Internet

website, or in a court file. If you believe your personal information appears in a

publicly available record, contact your County Clerk's Office to initiate a request.

A listing of all County Clerks can be found at www.flcler ks.com

Report Mail Theft to the U.S. Postal Inspection Service.

The U.S. Postal Inspection Service will investigate if your mail has been stolen by

an identity thief and used to obtain new credit or commit fraud. Incidents should

be reported to your nearest U.S. Postal Inspection Service district office. Check

your telephone book for your local office or visit www.usps.com

Report Passport Fraud to the U.S. Department of State.

If your passport is lost or stolen, or you believe it is being used fraudulently,

contact your local Department of State field office. Check your telephone book

for your local office or visit www.state.gov

Protect your Social Securit y number.

The Social Security Administration can verify the accuracy of the earnings

reported on your social security number. To check for inaccuracies or fraud,

order a copy of your Personal Earnings and Benefit Estimate Statement (PEBES)

from the Social Security Administration by calling 1-800-772-1213 or visiting

www.ssa.gov

Instructions for

Completing the ID Theft Affidavit

To make certain that you do not become

responsible for the debts incurred by the identity

thief, you must provide proof that you didn’t

create the debt to each of the companies where

accounts were opened or used in your name.

A working group composed of credit grant-

ors, consumer advocates and the Federal Trade

Commission (FTC) developed this ID Theft

Affidavit to help you report information to many

companies using just one standard form. Use of

this affidavit is optional. While many companies

accept this affidavit, others require that you

submit more or different forms. Before you send

the affidavit, contact each company to find out if

they accept it.

You can use this affidavit where a new ac-

count was opened in your name. The information

will enable the companies to investigate the fraud

and decide the outcome of your claim. (If some-

one made unauthorized charges to an existing

account, call the company to find out what to

do.)

This affidavit has two parts:

• ID Theft Affidavit is where you report general

information about yourself and the theft.

• Fraudulent Account Statement is where

you describe the fraudulent account(s) opened

in your name. Use a separate Fraudulent Ac-

count Statement for each company you need to

write to.

When you send the affidavit to the compa-

nies, attach copies (NOT originals) of any support-

ing documents (e.g., drivers license, police report)

you have.

Before submitting your affidavit, review the

disputed account(s) with family members or

friends who may have information about the

account(s) or access to them.

Complete this affidavit as soon as pos-

sible. Many creditors ask that you send it within

two weeks of receiving it. Delaying could slow the

investigation.

Be as accurate and complete as possible.

You may choose not to provide some of the

information requested. However, incorrect or

incomplete information will slow the process of

investigating your claim and absolving the debt.

Please print clearly.

When you have finished completing the

affidavit, mail a copy to each creditor, bank or

company that provided the thief with the unautho-

rized credit, goods or services you describe.

Attach to each affidavit a copy of the Fraudulent

Account Statement with information only on

accounts opened at the institution receiving the

packet, as well as any other supporting documen-

tation you are able to provide.

Send the appropriate documents to each

company by certified mail, return receipt

requested, so you can prove that it was received.

The companies will review your claim and send

you a written response telling you the outcome of

their investigation. Keep a copy of everything

you submit for your records.

If you cannot complete the affidavit, a legal

guardian or someone with power of attorney may

complete it for you. Except as noted, the informa-

tion you provide will be used only by the company

to process your affidavit, investigate the events

you report and help stop further fraud. If this

affidavit is requested in a lawsuit, the company

might have to provide it to the requesting party.

Completing this affidavit does not guarantee

that the identity thief will be prosecuted or that

the debt will be cleared.

ID Theft Affidavit

Name __________________________________ Phone number _______________________ Page 1

Victim Information

(1) My full legal name is ___________________________________________________________

(First) (Middle) (Last) (Jr., Sr., III)

(2) (If different from above) When the events described in this affidavit took place, I was known as

____________________________________________________________________________

(First) (Middle) (Last) (Jr., Sr., III)

(3) My date of birth is ____________________

(day/month/year)

(4) My social security number is________________________________

(5) My driver’s license or identification card state and number are__________________________

(6) My current address is __________________________________________________________

City ___________________________ State _________________ Zip Code ______________

(7) I have lived at this address since _____________________________

(month/year)

(8) (If different from above) When the events described in this affidavit took place, my address

was_________________________________________________________________________

City ___________________________ State _________________ Zip Code ______________

(9) I lived at the address in #8 from __________ until __________

(month/year) (month/year)

(10) My daytime telephone number is (____)____________________

My evening telephone number is (____)____________________

How the Fraud Occurred

Check all that apply for items 11 - 17:

(11) ❑

I did not authorize anyone to use my name or personal information to seek the money,

credit, loans, goods or services described in this report.

(12) ❑

I did not receive any benefit, money, goods or services as a result of the events described

in this report.

(13) ❑My identification documents (for example, credit cards; birth certificate; driver’s license;

social security card; etc.) were ❑ stolen

❑ lost

on or about ____________________.

(day/month/year)

(14) ❑To the best of my knowledge and belief, the following person(s) used my information (for

example, my name, address, date of birth, existing account numbers, social security number, mother’s

maiden name, etc.) or identification documents to get money, credit, loans, goods or services without

my knowledge or authorization:

_________________________________ _____________________________________

Name (if known) Name (if known)

_________________________________ _____________________________________

Address (if known) Address (if known)

_________________________________ _____________________________________

Phone number(s) (if known) Phone number(s) (if known)

_________________________________ ____________________________________

additional information (if known) additional information (if known)

_________________________________ _____________________________________

_________________________________ _____________________________________

(15) ❑ I do NOT know who used my information or identification documents to get money,

credit, loans, goods or services without my knowledge or authorization.

(16) ❑

Additional comments: (For example, description of the fraud, which documents or

information were used or how the identity thief gained access to your information.)

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

_____________________________________________________________________________________

____________________________________________________________________________________

(Attach additional pages as necessary.)

Name __________________________________ Phone number _______________________ Page 2

Victim’s Law Enforcement Actions

(17)(check one) I ❑ am ❑ am not willing to assist in the prosecution of the person(s) who

committed this fraud.

(18)(check one) I ❑ am ❑ am not authorizing the release of this information to law enforce-

ment for the purpose of assisting them in the investigation and prosecution of the person(s) who com-

mitted this fraud.

(19)(check all that apply) I ❑ have ❑ have not reported the events described in this affidavit

to the police or other law enforcement agency. The police ❑ did ❑ did not write a report.

In the event you have contacted the police or other law enforcement agency, please complete the following:

_____________________________ _________________________________

(Agency #1) (Officer/Agency personnel taking report)

____________________________ _________________________________

(Date of report) (Report Number, if any)

_____________________________ _________________________________

(Phone number) (e-mail address, if any)

_____________________________ _________________________________

(Agency #2) (Officer/Agency personnel taking report)

_____________________________ _________________________________

(Date of report) (Report Number, if any)

_____________________________ _________________________________

(Phone number) (e-mail address, if any)

Documentation Checklist

Please indicate the supporting documentation you are able to provide to the companies you plan to

notify. Attach copies (NOT originals) to the affidavit before sending it to the companies.

(20)

❑

A copy of a valid government-issued photo-identification card (for example, your

driver’s license, state-issued ID card or your passport). If you are under 16 and don’t have a photo-ID,

you may submit a copy of your birth certificate or a copy of your official school records showing your

enrollment and place of residence.

(21)

❑ Proof of residency during the time the disputed bill occurred, the loan was made or the

other event took place (for example, a rental/lease agreement in your name, a copy of a utility bill or a

copy of an insurance bill).

Name __________________________________ Phone number _______________________ Page 3

(22)

❑

A copy of the report you filed with the police or sheriff’s department. If you are unable

to obtain a report or report number from the police, please indicate that in Item 19. Some companies

only need the report number, not a copy of the report. You may want to check with each company.

Signature

I declare under penalty of perjury that the information I have provided in this affidavit is true and

correct to the best of my knowledge.

_______________________________________ __________________________________

(signature) (date signed)

Knowingly submitting false information on this form could subject you to criminal

prosecution for perjury.

______________________________________

(Notary)

[Check with each company. Creditors sometimes require notarization. If they do not, please have one

witness (non-relative) sign below that you completed and signed this affidavit.]

Witness:

_______________________________________ __________________________________

(signature) (printed name)

_______________________________________ __________________________________

(date) (telephone number)

Name __________________________________ Phone number _______________________ Page 4

I declare (check all that apply):

❑ As a result of the event(s) described in the ID Theft Affidavit, the following account(s) was/were

opened at your company in my name without my knowledge, permission or authorization using my

personal information or identifying documents:

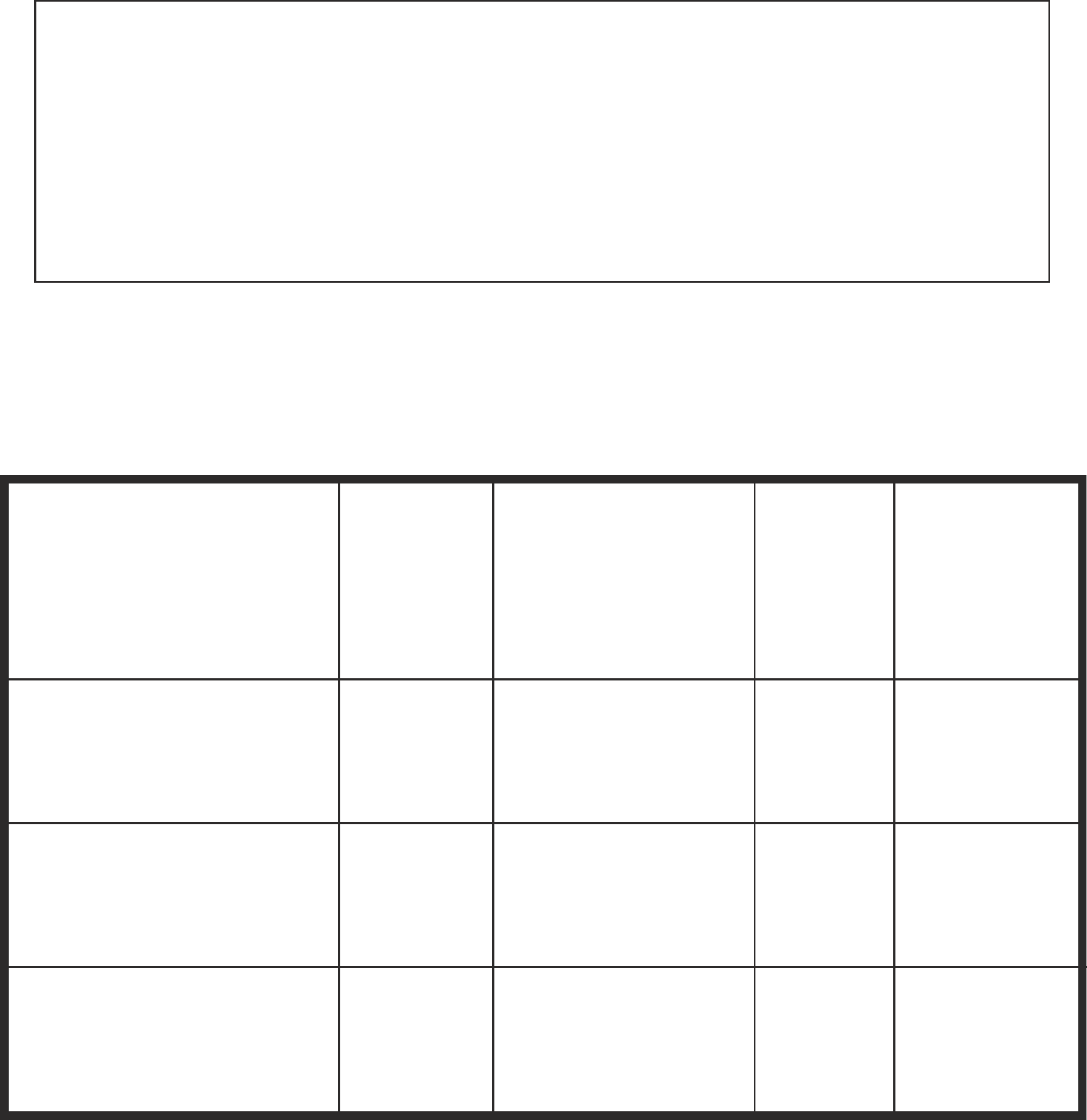

Completing this Statement

• Make as many copies of this page as you need. Complete a separate page for each

company you’re notifying and only send it to that company. Include a copy of your

signed affidavit.

• List only the account(s) you’re disputing with the company receiving this form. See the

example below.

• If a collection agency sent you a statement, letter or notice about the fraudulent account,

attach a copy of that document (NOT the original).

Fraudulent Account Statement

Creditor Name/Address

(the company that opened the

account or provided the goods or

services)

Account

Number

Type of unauthorized

credit/goods/services

provided by creditor

(if known)

Date

issued or

opened (if

known)

Amount/Value

provided

(the amount

charged or the

cost of the

goods/services)

❑ During the time of the accounts described above, I had the following account open with your company:

Billing name ________________________________________________________________________

Billing address ______________________________________________________________________

Account number ____________________________________________________________________

Example

Example National Bank

22 Main Street

Columbus, Ohio 22722

01234567-89 auto loan 01/05/2000 $25,500.00

Name __________________________________ Phone number _______________________ Page 5