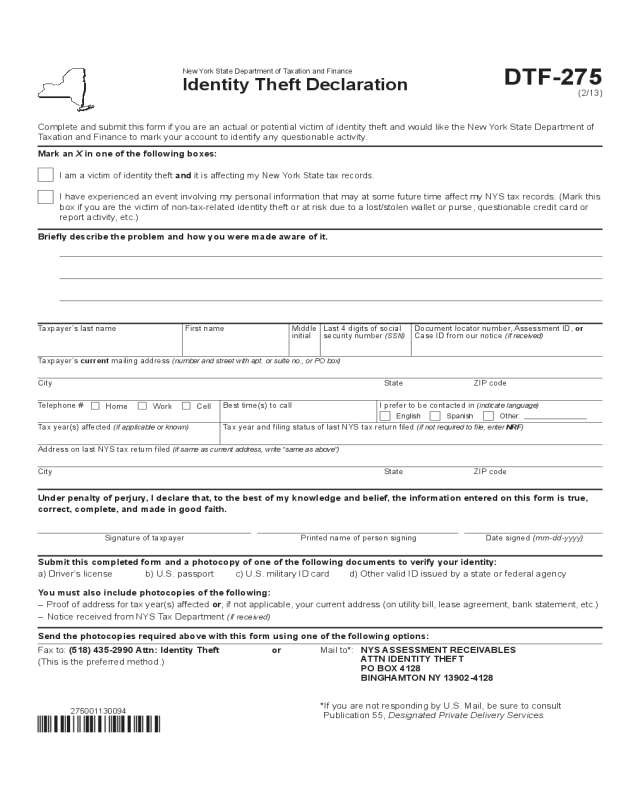

Fillable Printable Identity Theft Affidavit Form - New York

Fillable Printable Identity Theft Affidavit Form - New York

Identity Theft Affidavit Form - New York

275001130094

DTF-275

(2/13)

New York State Department of Taxation and Finance

Identity Theft Declaration

Taxpayer’s last name First name Middle Last 4 digits of social Document locator number, Assessment ID, or

initial security number (SSN) Case ID from our notice (if received)

Taxpayer’s current mailing address (number and street with apt. or suite no., or PO box)

City State ZIP code

Telephone #

Home Work Cell

Best time(s) to call I prefer to be contacted in (indicate language)

English Spanish Other:

Tax year(s) affected (if applicable or known) Tax year and ling status of last NYS tax return led (if not required to le, enter NRF)

Address on last NYS tax return led (if same as current address, write “same as above”)

City State ZIP code

Under penalty of perjury, I declare that, to the best of my knowledge and belief, the information entered on this form is true,

correct, complete, and made in good faith.

Complete and submit this form if you are an actual or potential victim of identity theft and would like the New York State Department of

Taxation and Finance to mark your account to identify any questionable activity.

Mark an X in one of the following boxes:

Mail to*: NYS aSSeSSMeNT receIvableS

aTTN IDeNTITY THeFT

PO bOx 4128

bINgHaMTON NY 13902-4128

I am a victim of identity theft and it is affecting my New York State tax records.

I have experienced an event involving my personal information that may at some future time affect my NYS tax records. (Mark this

box if you are the victim of non-tax-related identity theft or at risk due to a lost/stolen wallet or purse, questionable credit card or

report activity, etc.)

Briey describe the problem and how you were made aware of it.

Submit this completed form and a photocopy of one of the following documents to verify your identity:

a) Driver’s license b) U.S. passport c) U.S. military ID card d) Other valid ID issued by a state or federal agency

You must also include photocopies of the following:

– Proof of address for tax year(s) affected or, if not applicable, your current address (on utility bill, lease agreement, bank statement, etc.)

– Notice received from NYS Tax Department (if received)

Send the photocopies required above with this form using one of the following options:

Signature of taxpayer Printed name of person signing Date signed (mm-dd-yyyy)

Fax to: (518) 435-2990 attn: Identity Theft

(This is the preferred method.)

*If you are not responding by U.S. Mail, be sure to consult

Publication 55, Designated Private Delivery Services.

or