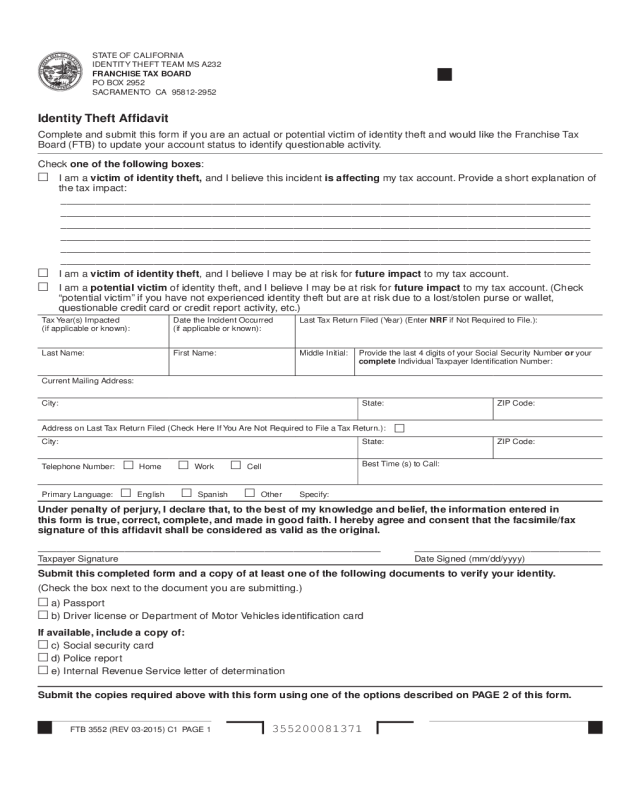

Fillable Printable Identity Theft Affidavit Form - California

Fillable Printable Identity Theft Affidavit Form - California

Identity Theft Affidavit Form - California

FTB 3552 (REV 03-2015) C1 PAGE 1

355200081371

STATE OF CALIFORNIA

IDENTITY THEFT TEAM MS A232

FRANCHISE T AX BOARD

PO BOX 2952

SACRAMENTO CA 95812-2952

Identity Theft Affidavit

Complete and submit this form if you are an actual or potential victim of identity theft and would like the Franchise Tax

Board (FTB) to update your account status to identify questionable activity.

Check one of the following boxes:

I am a victim of identity theft, and I believe this incident is affecting my tax account. Provide a short explanation of

the tax impact:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

I am a victim of identity theft, and I believe I may be at risk for future impact to my tax account.

I am a potential victim of identity theft, and I believe I may be at risk for future impact to my tax account. (Check

“potential victim” if you have not experienced identity theft but are at risk due to a lost/stolen purse or wallet,

questionable credit card or credit report activity, etc.)

Tax Year(s) Impacted

(if applicable or known):

Date the Incident Occurred

(if applicable or known):

Last Tax Return Filed (Year) (Enter NRF if Not Required to File.):

Last Name: First Name: Middle Initial: Provide the last 4 digits of your Social Security Number or your

complete Individual Taxpayer Identification Number:

Current Mailing Address:

City: State: ZIP Code:

Address on Last Tax Return Filed (Check Here If You Are Not Required to File a Tax Return.):

City: State: ZIP Code:

Telephone Number: Home Work Cell

Best Time (s) to Call:

Primary Language: English Spanish Other

Specify:

Under penalty of perjury, I declare that, to the best of my knowledge and belief, the information entered in

this form is true, correct, complete, and made in good faith. I hereby agree and consent that the facsimile/fax

signature of this affidavit shall be considered as valid as the original.

___________________________________________________________ ________________________________

Taxpayer Signature Date Signed (mm/dd/yyyy)

Submit this completed form and a copy of at least one of the following documents to verify your identity.

(Check the box next to the document you are submitting.)

a) Passport

b) Driver license or Department of Motor Vehicles identification card

If available, include a copy of:

c) Social security card

d) Police report

e) Internal Revenue Service letter of determination

Submit the copies required above with this form using one of the options described on PAGE 2 of this form.

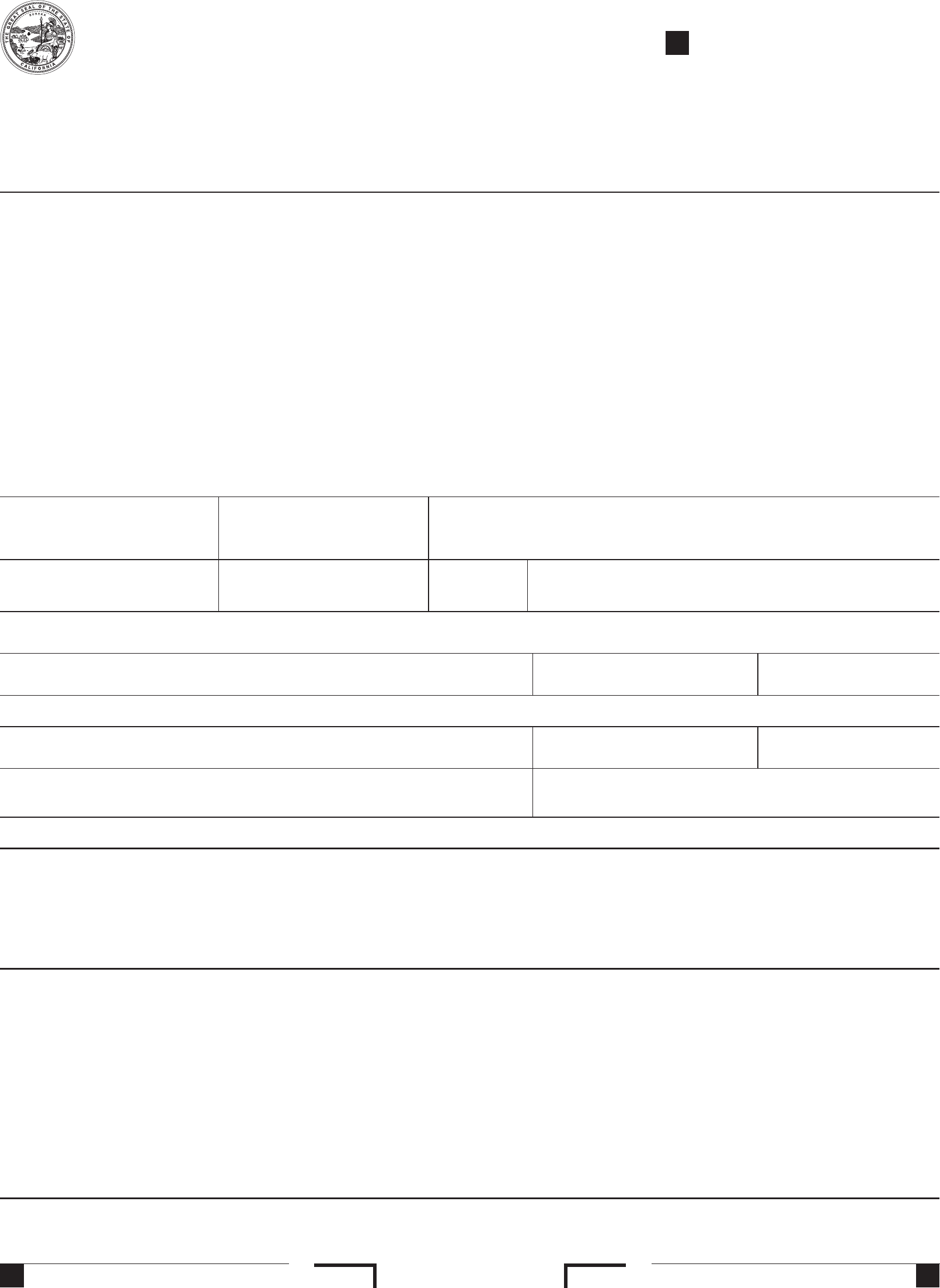

FTB 3552 (REV 03-2015) C1 PAGE 2

Submit the copies required above with this form using one of the options described on PAGE 2 of this form.

By Mail: By Fax:

If you received a notice from FTB, return this

form with a copy of the notice to the address

contained in the notice.

If you have not received an FTB notice and are

self-reporting potential risk for future impact to

your tax account, mail this form to:

IDENTITY THEFT TEAM MS A232

FRANCHISE T AX BOARD

PO BOX 2952

SACRAMENTO CA 95812-2952

If you received a notice in the mail from FTB and a fax

number is shown, fax this completed form with a copy of

the notice to that number. Include a cover sheet marked

“Confidential.” If no fax number is shown, follow the mailing

instructions.

FTB does not initiate contact with taxpayers by email or fax.

If you have not received an FTB notice and are self-reporting

potential risk for future impact to your tax account, fax this form

to:

916.843.0561

Go to oag.ca.gov and search for identity theft for additional resources and information regarding identity theft.

Get FTB 1131, Franchise Tax Board Privacy Notice, at ftb.ca.gov or call 800.338.0505. If outside the United States, call

916.845.6500.

Internet and Telephone Assistance

Website: ftb.ca.gov

Telephone: 800.852.5711 from within the United States

916.845.6500 from outside the United States

TTY/TDD: 800.822.6268 for persons with hearing or speech impairments