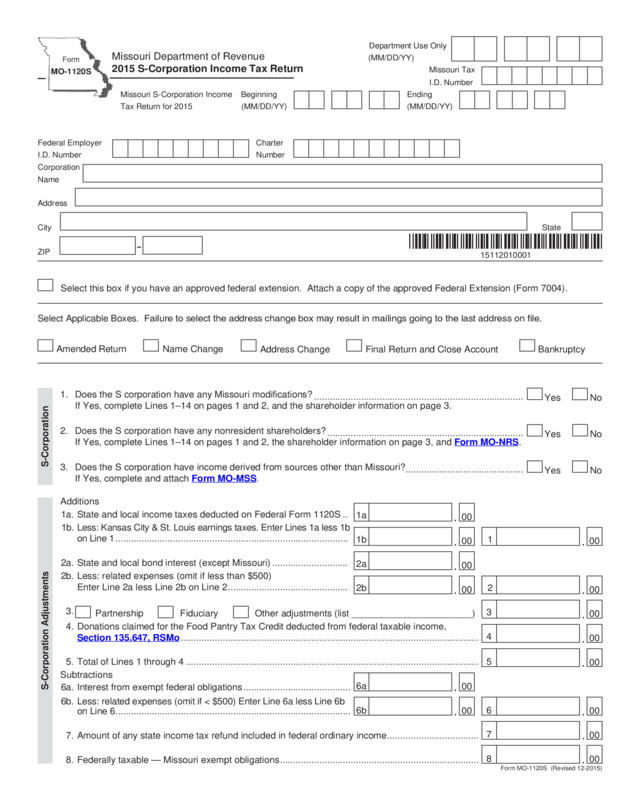

Fillable Printable Form Mo-1120S - 2015 S-Corporation Income Tax Return

Fillable Printable Form Mo-1120S - 2015 S-Corporation Income Tax Return

Form Mo-1120S - 2015 S-Corporation Income Tax Return

Additions

1a. State and local income taxes deducted on Federal Form 1120S ..

1a

1b. Less: Kansas City & St. Louis earnings taxes. Enter Lines 1a less 1b

on Line 1 .........................................................................................

1b

1

2a. State and local bond interest (except Missouri) .............................

2a

2b. Less: related expenses (omit if less than $500)

Enter Line 2a less Line 2b on Line 2 ..............................................

2b 2

3.

Partnership Fiduciary Other adjustments (list _______________________)

3

4. Donations claimed for the Food Pantry Tax Credit deducted from federal taxable income,

Section 135.647, RSMo ..................................................................................................................

4

5. Total of Lines 1 through 4 ................................................................................................................ 5

Subtractions

6a. Interest from exempt federal obligations .........................................

6a

6b. Less: related expenses (omit if < $500) Enter Line 6a less Line 6b

on Line 6 ..........................................................................................

6b

6

7. Amount of any state income tax refund included in federal ordinary income ...................................

7

8. Federally taxable — Missouri exempt obligations ............................................................................

8

I.D. Number

Form

MO-1120S

Missouri Department of Revenue

2015 S-Corporation Income Tax Return

State

Address

City

ZIP

-

Department Use Only

(MM/DD/YY)

Missouri S-Corporation Income

Tax Return for 2015

Beginning

(MM/DD/YY)

Ending

(MM/DD/YY)

Corporation

Name

Charter

Number

Missouri Tax

Federal Employer

I.D. Number

S-Corporation

00

.

1. Does the S corporation have any Missouri modifications?

................................................................................

Yes No

If Yes, complete Lines 1–14 on pages 1 and 2, and the shareholder information on page 3.

2. Does the S corporation have any nonresident shareholders?

...........................................................................

Yes No

If Yes, complete Lines 1–14 on pages 1 and 2, the shareholder information on page 3, and Form MO-NRS.

3. Does the S corporation have income derived from sources other than Missouri?

.............................................

Yes No

If Yes, complete and attach Form MO-MSS.

Select this box if you have an approved federal extension. Attach a copy of the approved Federal Extension (Form 7004).

Address Change

Amended Return Name Change

Final Return and Close Account Bankruptcy

Select Applicable Boxes. Failure to select the address change box may result in mailings going to the last address on le.

S-Corporation Adjustments

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

Form MO-1120S (Revised 12-2015)

00

.

00

.

00

.

00

.

00

.

*15112010001*

15112010001

Reset Form

Print Form

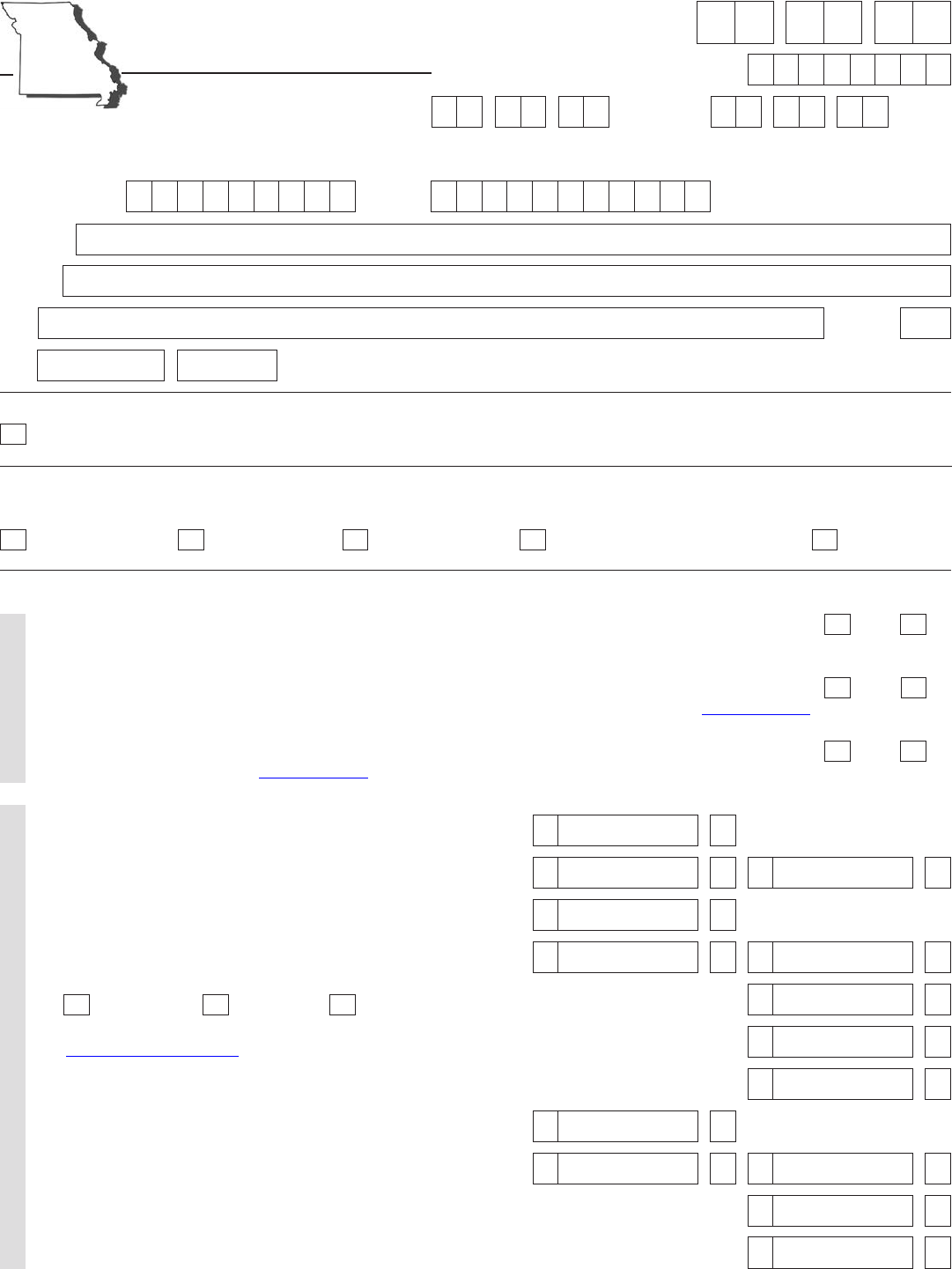

Signature

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any

member of his or her firm, or if internally prepared, any member of the internal staff. ..............................................................

Yes

No

Under penalties of perjury, I declare that the above information and any attached supplement is true,

complete,and correct.

S E

Signature

of Officer

Printed

Name

Telephone

Number

Date Signed

(MM/DD/YY)

Preparer’s Signature

(Including Internal Preparer)

Preparer’s FEIN,

SSN, or PTIN

Telephone

Number

Date Signed

(MM/DD/YY)

*15112020001*

15112020001

Form MO-1120S (Revised 12-2015)

Subtractions (continued)

9. Partnership Fiduciary Build America and Recovery Zone Bond Interest

Missouri Public-Private Transportation Act Other adjustments (list _____________)

9

10. Missouri depreciation basis adjustment (Section 143.121.3(7), RSMo) ..........................................

10

11. Depreciation recovery on qualified property that is sold (Section 143.121.3(9), RSMo) .................

11

12. Total Subtractions - Add Lines 6 through 11.....................................................................................

12

13. Missouri S corporation adjustment — Net Addition — excess Line 5 over Line 12 ..........................

13

14. Missouri S corporation adjustment — Net Subtraction — excess Line 12 over Line 5 .....................

14

S-Corporation Adjustments

00

.

00

.

00

.

00

.

00

.

00

.

15. Approved overpayments applied from last file period to be refunded .............................................. 15

00

.

A R N

Department Use Only

Mail To: Refund or No Amount Due:

Missouri Department of Revenue Phone: (573) 751-4541

P.O. Box 700 Fax: (573) 522-1721

Visit http://dor.mo.gov/business/corporate/ for additional information.

Form MO-1120S (Revised 12-2015)

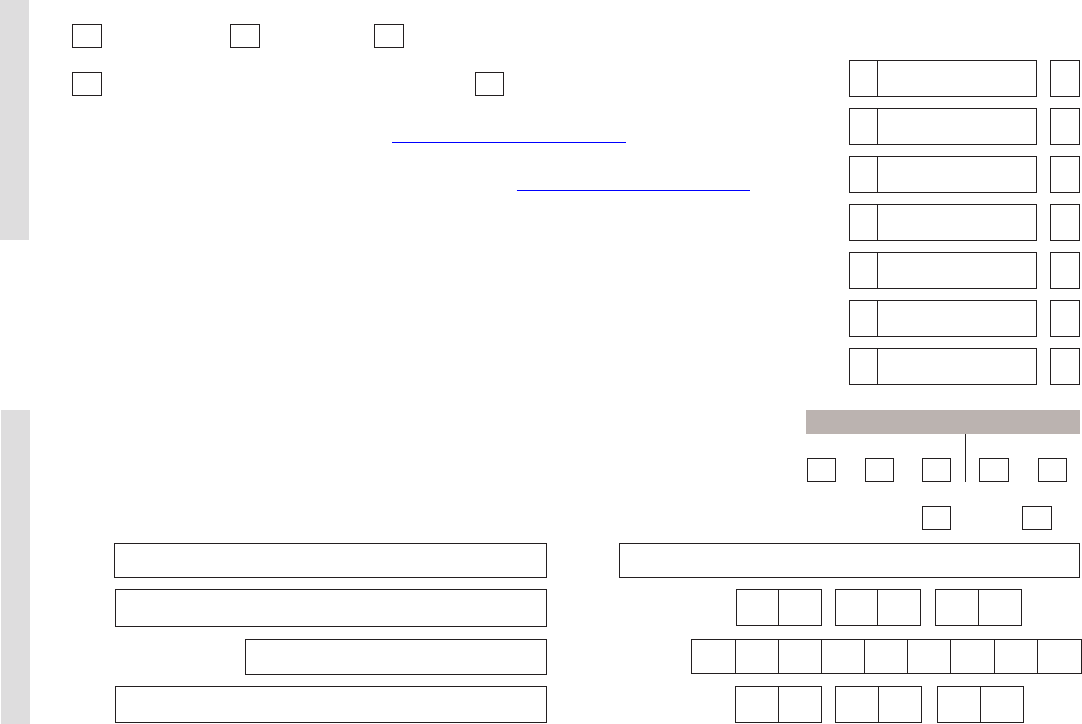

a) % 00

b) % 00

c) % 00

d) % 00

e) % 00

f) % 00

g) % 00

h) % 00

i) % 00

j) % 00

k) % 00

l) % 00

m) % 00

n) % 00

o) % 00

p) % 00

q) % 00

r) % 00

s) % 00

Total

% 00

Column 4 — Enter percentages from Federal Schedule K-1(s). Round percentages to whole numbers.

Column 5 — Enter Missouri S corporation adjustment from Form MO-1120S, Line 13 or 14, as total of Column 5. Multiply each percentage

in Column 4 by the total in Column 5. Indicate at the top of Column 5 whether the adjustments are additions or subtractions.

The amount after each shareholder’s name in Column 5 must be reported as a modification by the shareholder on his or her

Form MO-1040, Individual Income Tax Return, either as an addition to, or subtraction from, federal adjusted gross income.

1. Name of each shareholder. All shareholders

must be listed. Use attachment if necessary.

2. Select if

shareholder is

nonresident

4.

Shareholder’s

Share %

5. Shareholder’s Adjustment

Addition Subtraction

Allocation of Missouri S Corporation Adjustment to Shareholders

*15112030001*

15112030001

3. Social Security Number

Corporation

Name

Charter

Number

Federal Employer

I.D. Number

I.D. Number

Missouri Tax