Fillable Printable Form of Stock Transfer

Fillable Printable Form of Stock Transfer

Form of Stock Transfer

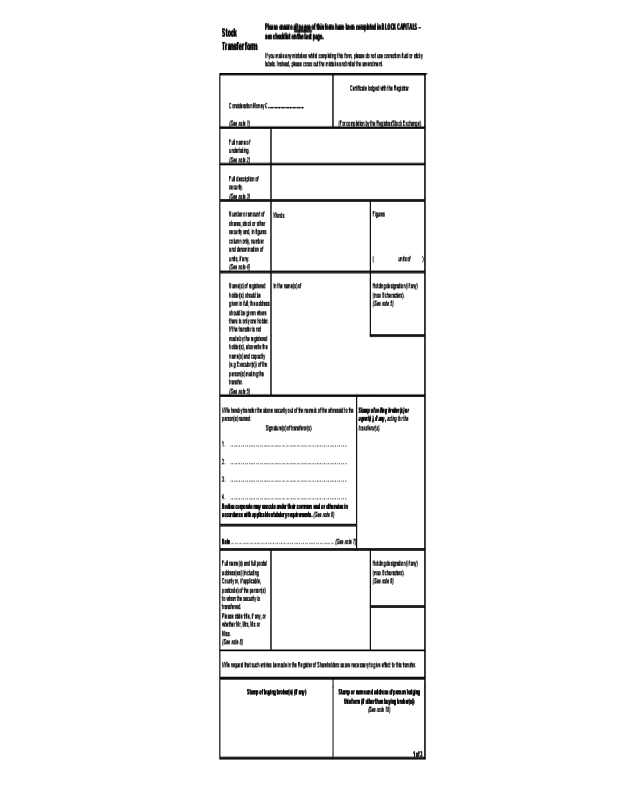

Stock

Transfer form

Please ensure all pages of this form have been completed in BLOCK CAPITALS –

see checklist on the last page.

If you make any mistakes whilst completing this form, please do not use correction fluid or sticky

labels. Instead, please cross out the mistake and initial the amendment.

Consideration Money £ ………………………..

(See note 1)

Certificate lodged with the Registrar

(For completion by the Registrar/Stock Exchange)

Full name of

undertaking.

(See note 2)

Full description of

security.

(See note 3)

Number or amount of

shares, stock or other

security and, in figures

column only, number

and denomination of

units, if any.

(See note 4)

Words

Figures

( units of )

Name(s) of registered

holder(s) should be

given in full; the address

should be given where

there is only one holder.

If the transfer is not

made by the registered

holder(s), also write the

name(s) and capacity

(e.g Executor(s)) of the

person(s) making the

transfer.

(See note 5)

In the name(s) of

Holding designation (if any)

(max 8 characters).

(See note 5)

I/We hereby transfer the above security out of the name/s of the aforesaid to the

person(s) named:

Signature(s) of transferor(s)

1. …………………………………………………………………………………..

2. …………………………………………………………………………………..

3. …………………………………………………………………………………..

4. …………………………………………………………………………………..

Bodies corporate may execute under their common seal or otherwise in

accordance with applicable statutory requirements. (See note 6)

Stamp of selling broker(s) or

agent(s), if any, acting for the

transferor(s).

Date ………………………………………………………………………… (See note 7)

Full name(s) and full postal

address(es) (including

County or, if applicable,

postcode) of the person(s)

to whom the security is

transferred.

Please state title, if any, or

whether Mr, Mrs, Ms or

Miss.

(See note 8)

Holding designation (if any)

(max 8 characters).

(See note 9)

I/We request that such entries be made in the Register of Shareholders as are necessary to give effect to this transfer.

Stamp of buying broker(s) (if any)

Stamp or name and address of person lodging

this form (if other than buying broker(s))

(See note 10)

1 of 3

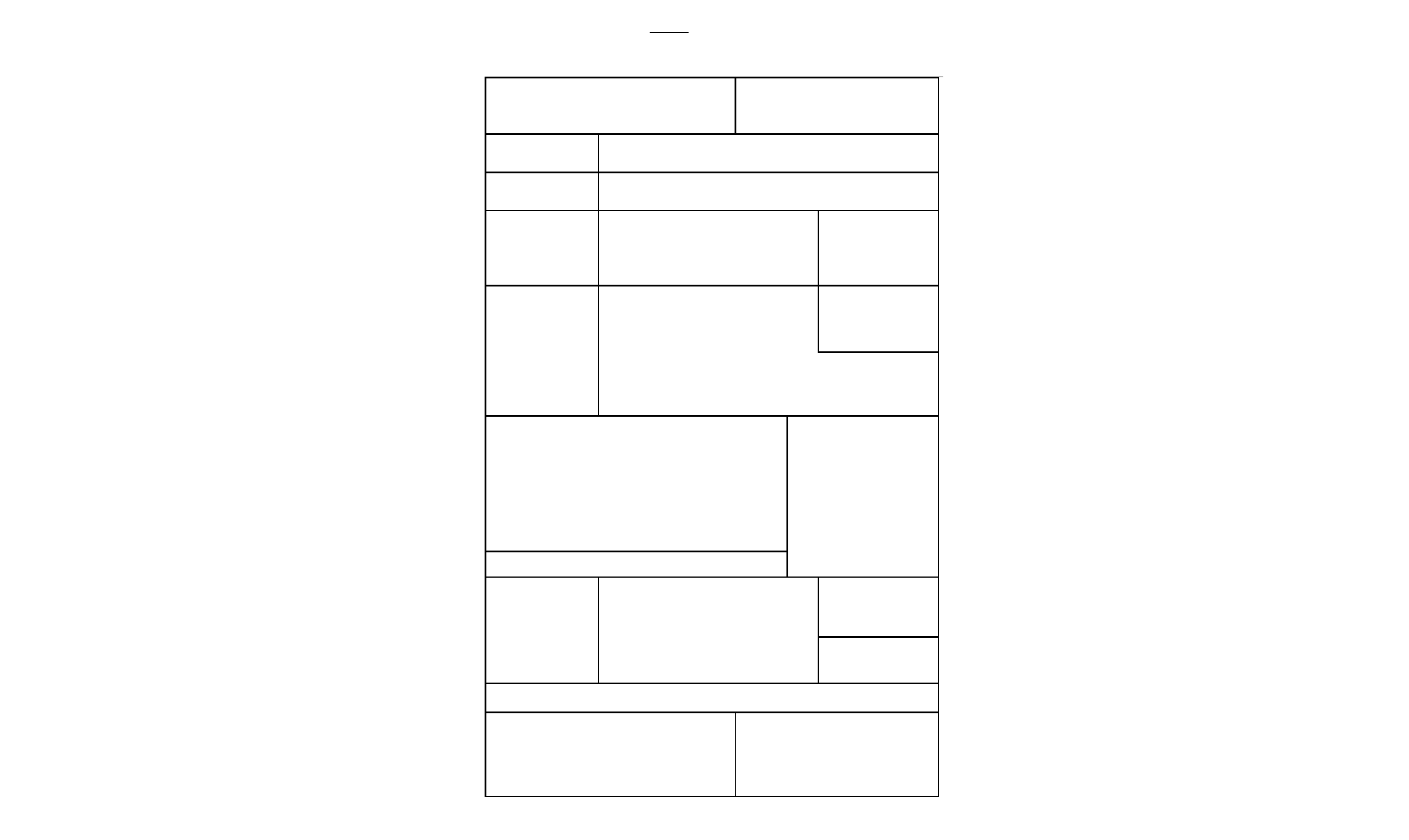

Form of certificate required – transfers not chargeable with ad valorem Stamp Duty

Complete Certificate 1 if:

- the consideration you give for the shares is £1,000 or less and the transfer is not part of a larger

transaction or series of transactions (as referred to in Certificate 1). (Neither Certificate if the

Consideration is Nil).

Complete Certificate 2 if:

- the transfer is otherwise Exempt (see note 15) from Stamp Duty and you are not claiming a relief (see

note 16), or

- the consideration given is not chargeable consideration (see note 15).

Certificate 1

* Please delete

as appropriate

I/We* certify that the transaction effected by this instrument does not form

part of a larger transaction or series of transactions in respect of which the

amount or value, or aggregate amount or value, of the consideration

exceeds £1,000. (see note 11)

** Delete second

sentence if certificate

is given by transferor

I/We* confirm that I/we* have been authorised by the transferor to sign

this certificate and that I/we* am/are* aware of all the facts of the

transaction.** (see note 12)

Signature(s) (see note 13) Description (“Transferor”, “Solicitor”, etc).

---------------------------------------------------------------- -------------------------------------------------------------------

---------------------------------------------------------------- -------------------------------------------------------------------

---------------------------------------------------------------- -------------------------------------------------------------------

Date (see note 14)

---------------------------------------------------------------

Certificate 2 (see note 15)

* Please delete

as appropriate

I/We* certify that the transfer effected by this instrument is otherwise

exempt from ad valorem Stamp Duty without a claim for relief being made

or that no chargeable consideration is given for the transfer for the

purposes of Stamp Duty.

** Delete second

sentence if certificate

is given by transferor

I/We* confirm that I/we* have been authorised by the transferor to sign

this certificate and that I/we* am/are* aware of all the facts of the

transaction.**

Signature(s) (see note 13) Description (“Transferor”, “Solicitor”, etc).

---------------------------------------------------------------- -------------------------------------------------------------------

---------------------------------------------------------------- -------------------------------------------------------------------

---------------------------------------------------------------- -------------------------------------------------------------------

Date

---------------------------------------------------------------

NOTES

(1) You don’t need to send this form to HM Revenue & Customs (HMRC) if you have completed either

Certificate 1 or 2, or the consideration for the transfer is nil (in which case you must write ‘nil’ in the

‘Consideration Money’ box on the front of the form). In these situations send the form straight to us.

(2) In all other cases – including where relief from Stamp Duty is claimed – send the transfer form to

HMRC to be stamped before sending it to us.

(3) Information on Stamp Duty reliefs and exemptions and how to claim them can be found on the

2 of 3

HMRC website at www.hmrc.gov.uk/sd.

CHECKLIST

Please make sure that the Stock Transfer form is fully completed and returned with the valid share

certificate(s), by checking each item on the list below.

The name of the Company (referred to as Full Name of Undertaking) in which the shares are held.

The type of share (referred to as Full Description of Security) for example Ordinary Shares.

Amount of shares to be transferred in both words and figures.

Entered the full name and address details for both transferor (the old owner) and transferee (the new owner).

The signature of the transferor, personal representatives or Power of Attorney.

The transfer has been dated underneath the signature(s) of the transferor(s).

Ensure that you fully complete, sign and date the front of the form. If you are not required to pay Stamp Duty you will

also need to complete and sign the back of the form.

Please return valid share certificates with the transfer form for sufficient number of shares to cover the transfer.

Please be aware that:

FORMS NEED TO BE RETURNED TO: EQUINITI, ASPECT HOUSE, SPENCER ROAD, LANCING, WEST SUSSEX,

BN99 6DA, UK.

TRANSFERS WITHIN A CORPORATE SPONSORED NOMINEE (UN-CERTIFICATED HOLDINGS) REQUIRE A

DIFFERENT FORM – PLEASE CALL 0871 384 2030* AND WE WILL SEND YOU THE APPROPRIATE FORM.

*Calls cost 8p per minute plus network extras. Lines are open from 8.30am to 5.30pm, Monday to Friday.

3 of 3

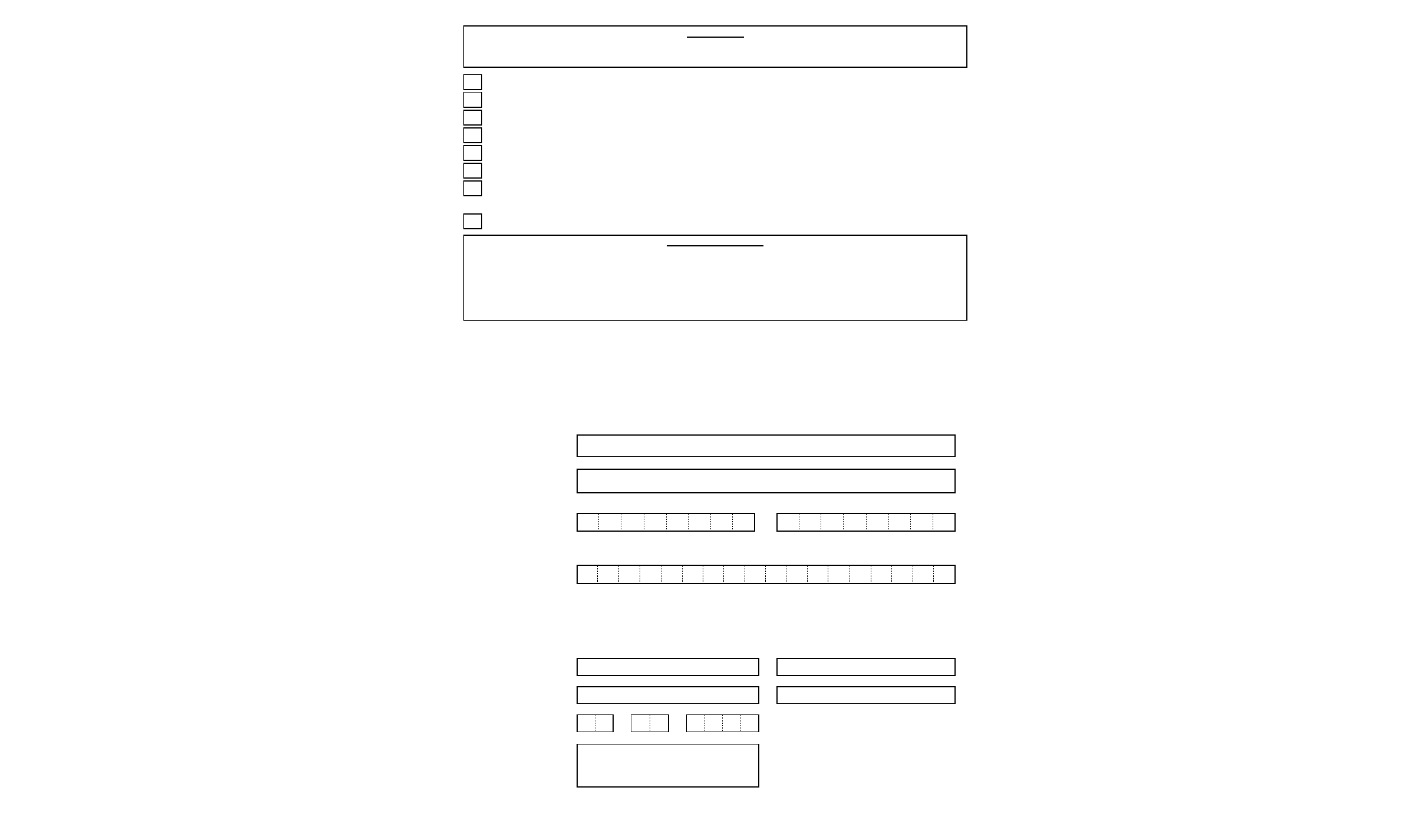

Payments Direct to your Bank/Building Society Account

For payments to be sent directly into a bank/building society account please complete the below section of the

form. Please note that this instruction is only applicable for the new transferee(s) holding requested on the Stock Transfer

form. (see note 17)

This form must be completed in BLOCK CAPITALS and in black ink.

Fields marked * must be completed. If you are not entering information in any of the fields please leave them blank and do

not cross them through.

Step 1

Transferee’s full name *

Step 2

Transferee’s full address *

Step 3

Sort Code *

(UK bank branches only)

Account Number *

(£ sterling accounts only)

Details of your bank or

building society account

- -

Building society reference or roll number

(if not applicable, please leave blank) (please check with your building society if unsure of this

reference)

Step 4

Please read then sign

and date below.

All transferees must sign

to confirm this instruction.

Please forward until further notice, all dividends or interest that may from time to time become payable

to me/us in respect of any shares or stock held, to the above nominated bank or building society, or to

such other branch of the organisation as the bank or building society may from time to time request.

Compliance with this request will discharge the Company's liability in respect of such dividends or other

monies.

Your signature(s) *

Signature 1 Signature 2 (if applicable)

Signature 3 (if applicable) Signature 4 (if applicable)

Today’s date *

D D / M M / Y Y Y Y

Step 5

If signing as a Power of

Attorney or other

authority please print

name(s).

(See note 6)

Equiniti Limited

Aspect House

Spencer Road

Lancing

West Sussex

BN99 6DA

Guidance Notes for the completion of a Stock Transfer form by shareholders.

To be read in conjunction with the attached Stock Transfer form.

The Stock Transfer form must be completed in BLOCK CAPITALS and in black ink. If you are

not providing information in any of the boxes, please leave them blank and do not cross them

through. Please note that this instruction is specific to the holding shown on the Stock Transfer

form.

Note 1

If payment of more than £1,000 is involved in transferring these shares you should enter the

amount received (the Consideration Money) in this box. Stamp Duty will need to be paid for the

shares transferred and you should telephone the Stamp Office helpline on: 0845 603 0135 or, if

calling from overseas, +44 1726 209 042. They will advise you of the amount of duty payable.

Alternatively, visit the website at: www.hmrc.gov.uk/sd.

A cheque or postal order, made payable to “HMRC”, should be sent with the completed Stock

Transfer form to: Birmingham Stamp Office, 9

th

Floor, City Centre House, 30 Union Street,

Birmingham, B2 4AR. The form will be returned to you after stamping.

If the payment involved in transferring the shares is £1,000 or less than £1,000, you will need to

complete Certificate 1 on the second side of the form. If Consideration is over £1,000 but

Stamp Duty exemptions apply (see note 15), Certificate 2 on the second side of the form will

need to be completed. If no payment (Consideration) is given for the shares, you must enter

‘Nil’ as the Consideration Money and you do not need to complete either certificate.

Note 2 Name of company in which these shares/stock are held.

Note 3 Type of shares/stock, for example, ‘Ordinary’ or ‘Preference’. In the case of shares, we also

require their nominal value. You can find the nominal value of shares on the corresponding

certificate(s).

Note 4 Both boxes must be completed. Amount of shares or stock units to be transferred needs to be

written in words (in the left hand box) and in figures (in the right hand box). If shares/stock are

packaged, please also specify the number of units in the box to the right. In cases where the

number of shares or stock units on the certificate exceeds the amount being transferred, a

balance certificate will be issued.

Note 5

Please write the full name(s) of person(s) (the registered shareholder(s)) transferring these

shares/stock. Please include any Designation (a specific reference) in the small box to the right.

The information should be written exactly as shown on the certificate. If there is only one

shareholder then the present address should also be written on the form. If someone other than

the shareholder is transferring the shares, please also write the capacity in which they sign.

Deceased Shareholders

If the registered holder is deceased, please write their full name, together with the full names of

the legal representative(s). Please note that a transfer by legal representative(s) will not be

processed if the Grant of Representation has not been registered.

If shares are held within a joint holding and one of the holders has died, we only require sight of

the death certificate to register the death. The shares are then automatically held in the name(s)

of the surviving shareholder(s).

Note 6 Signatories

Signature(s) of person(s) transferring the shares/stock is/are required.

Personal Representative

Where applicable, the designated personal representative needs to sign on behalf of the estate.

The personal representative(s) may be the executor(s) or administrator(s).

Power of Attorney

If a shareholder is unable to deal with their shares and a Power of Attorney is in place, and this

is already registered with us, the person with Power of Attorney can sign on their behalf.

Court of Protection Orders

If a Court of Protection Order is in place, then the deputy needs to sign on their behalf.

Corporate Bodies in England, Wales or Northern Ireland

To transfer shares out of the name of a corporate body incorporated in England, Wales or

Northern Ireland we need the transfer to be signed. It needs to be signed by one of the following

combinations of signatories with each signatory stating the capacity in which they sign:

- under seal by one authorised signatory

- under seal by one director

- under seal by one director and the company secretary.

Alternatively, any of the following combinations of signatories are acceptable:

- without seal by two directors

- without seal by the company secretary and one company director

- without seal by two authorised signatories

- without seal by one company director and one witness who must state that they are signing as

a

- witness and clearly print their name and address.

If the form is to be signed by any of the above four combinations, each signatory will need to

state the capacity in which they sign and also add that they are signing on behalf of the

company – e.g. ‘for and on behalf of ABC plc’.

Corporate Bodies in Scotland

To transfer shares/stock out of the name of a corporate body incorporated in Scotland the

transfer needs to be signed - in accordance with the Requirements of Writing (Scotland) Act

1995 – by any combination of the following, stating their capacity to sign:

- two directors

- one director and the secretary

- two authorised persons

- under seal by one director

- under seal by one authorised signatory

- one director, plus one witness who must state that they are signing as a witness. The witness

will

- need to clearly print their name and address.

Corporate Bodies Outside of the UK

To transfer shares out of the name of a corporate body not incorporated in the UK, The Foreign

Companies (Execution of Documents) Regulations 1994 needs to be adhered to. To adhere to

this Act we need you to confirm in writing, next to the signatures or on an accompanying letter,

that the enclosed document(s) has/have been executed in a manner permitted by the laws of

the territory (in which the company is incorporated) for the execution of documents by such a

company.

Note 7

The date on which the transfer form is completed must be shown; otherwise the transfer will be

rejected. Also, if there is a selling broker or agent acting on behalf of the transferor(s), please

provide the broker/agent’s stamp or write the name and address of the broker/agent in the

‘Stamp of selling broker(s) or agent(s)’ box.

Note 8 Full names including title of person(s) to whom these shares/stock are being transferred. If there

is more than one transferee then only the address of the first named transferee needs to be

shown.

Transferring Shares To A Minor

Please note that there are restrictions in dealing with shares when the shareholder is under 18

and lives in either England or Wales. This also applies in Scotland but when the shareholder is

under 16. If the shareholder is under 18 (or 16 in Scotland) please send the original birth

certificate (or a certified copy).

We can arrange to transfer shares to a minor. However, if the shares are to be sold or

transferred later on and the holder is still under age, there could be difficulties. Until the

shareholder reaches the age of majority, both parents or guardians need to sign the Sale or

Transfer form on their behalf.

Unless the child lives in Scotland, where it is not required, the parents or guardians will also

have to apply to the courts for a Court Order confirming that sale or transfer is for the minor’s

own benefit. If only one parent or guardian is able to sign a transfer, then there will also have to

be a letter explaining the circumstances.

An alternative to this process is to register the holding in the name of an adult (such as a parent

or guardian) using the minor’s initials as a Designation (a reference as defined by you) to label

the holding. The holding would then be controlled by the parents or guardians and could be

transferred to the minor as soon as he or she reaches the age of majority.

However, if you do decide to transfer the shares to a minor, you will need to send us the

following documents:

- the minor's birth certificate

- a completed and signed Stock Transfer form

- the relevant share certificates

Transferring Shares to a Corporate Body

We can only register shares into a corporate body if it possesses a ‘legal personality’. This

means it is incorporated via one of the following:

- Under the Companies Act (i.e. PLC or Limited);

- Under royal charter;

- By special act or parliament;

- Under foreign company law.

If the company is unincorporated, and none of the above is applicable, the shares should be

registered in the names of the underlying individuals (Company Representatives).

Transferring Shares to a Charity

In the case of a charity that is not incorporated under the Charities Act 2011 or a body corporate

under any other statute or act of parliament, the holding must be registered in the names of the

trustees as individuals.

Transferring Shares to a Trust

Under Section 126 of the Companies Act 2006, we are not able to register shares into the name

of a trust. This is apart from those Scottish registered companies who recognise trusts in their

Articles of Association. The transfer can be registered if the trust is incorporated via one of the

following:

- Under the Companies Act (i.e. PLC or Limited);

- Under royal charter;

- By special act or parliament;

- Under foreign company law.

If the trust is unincorporated, and none of the above is applicable, then the shares must be

registered into the names of the trustees as individuals.

Transferring Shares to a Pension Fund, Association or Club

We can only register shares into a Pension Fund, Association or Club if it is incorporated via

one of the following:

- Under the Companies Act (i.e. PLC or Limited);

- Under royal charter;

- By special act or parliament;

- Under foreign company law.

If the organisation is unincorporated, and none of the above is applicable, then the shares

should be registered in the names of the underlying individuals (Official representatives).

Transferring Shares to a Partnership

We can register shares into a partnership if it is incorporated via one of the following:

- Under the Companies Act (i.e. PLC or Limited);

- Under royal charter;

- By special act or parliament;

- Under foreign company law.

We can also accept Limited Liability Partnerships (LLPs) as Scottish partnerships.

If the organisation is unincorporated, and none of the above is applicable, then the shares

should be registered in the names of the underlying individuals.

Note 9 If applicable, please enter the required holding Designation (a reference as defined by you).

This should be a maximum of 8 characters. The Designation must not form a name or a word.

Note 10 If the new certificate is not to be sent to the address shown in the box referred to in Note 8, then

please write the name and address details here, plus any specific reference you require.

Please be aware that anytime a share certificate is posted, it is sent at the shareholder’s

own risk.

Note 11 Where transfers are exempt from AD VALOREM Stamp Duty, due to the Consideration

Money being below the £1000 threshold, Certificate 1 on the second page of the Stock

Transfer form needs to be completed.

Delete “I” or “We” as appropriate. If Consideration Money (the payment amount for the shares)

is between £0 and £1,000, then the transfer is exempt from AD VALOREM Stamp Duty,

provided that this certificate is signed and dated. If this transfer forms part of a group of transfers

and together the combined Consideration Money is more than £1,000, then AD VALOREM

Stamp Duty is payable. If you are unsure on this matter, please contact the Stamp Office on:

0845 603 0135.

Note 12 Delete “I” or “We” as appropriate. This refers to the person(s) signing the certificate.

Note 13

This should be signed by either the person(s) that sign(s) the transfer, their solicitor or their duly

authorised agent. The person signing should state the capacity in which they sign.

Note 14 Give the date on which the certificate is signed. If no date is written on the front of the Stock

Transfer form, the date at which the Exemption Certificate is signed will be treated as the date of

the transfer.

Note 15 Where Stamp Duty is Not Chargeable or Exempt (and Certificate 1 does not apply)

If you acquire any of the following, in the following ways, they will not be chargeable with

Stamp Duty. Certificate 2, on the second side of the Stock Transfer form, should therefore be

completed for:

- Shares that you receive as a gift and that you don’t pay anything for (either money or some

other

- consideration);

- Shares that are received from your spouse or civil partner when you marry or enter into a civil

- partnership;

- Shares held in trust that are transferred from one trustee to another;

- Transfers that a liquidator makes as settlement to shareholders when a business is wound up;

- Shares that are transferred to you as a security for a loan;

- Shares that were held as security for a loan that are transferred back to you when you repay

the

- loan;

- Transfers to the beneficiary of a trust when the trust is wound up.

If any of the above applies, you should complete Certificate 2 on the second side of the Stock

Transfer form. The only exception is if any of the above applies and the Consideration is Nil. If

this is the case, neither certificate need to be completed, and the Stock Transfer form does not

need to be stamped by HMRC. No documents will need to be seen by HMRC as there will be no

Stamp Duty to pay. However, please ensure that ‘Nil’ is written as the ‘Consideration Money’

(see Note 1).

If you acquire any of the following, in the following ways, they will be exempt from Stamp Duty.

Certificate 2, on the second side of the Stock Transfer form, should therefore be completed if:

- Shares have been left to you in a Will;

- Shares are transferred if you get divorced or if your civil partnership is dissolved;

- Certain types of stock including Loan Notes, Permanent Interest Bearing Shares, Debenture

Stock

- etc. are being transferred.

If any of the above applies, you should complete Certificate 2 on the second side of the Stock

Transfer form. This form does not need to be stamped by HMRC and documents do not need to

be seen by HMRC as there will be no Stamp Duty to pay.

Note 16 Stamp Duty Relief – Transfers that qualify for Stamp Duty relief

There are some transfers that qualify for relief to reduce the amount of Stamp Duty due – to nil

in most cases. Neither Certificate 1 nor Certificate 2 will need to be completed but you’ll still

need to get the Stock Transfer form stamped by HMRC.

The following are some of the most common reliefs for which you can claim:

- intra-group relief - for transfers of shares between companies in the same group, so long as

- certain conditions are met;

-

acquisition relief - when one company acquires all the shares in another company but the

same

- people own both companies;

-

reconstruction relief - there's no Stamp Duty to pay when all or part of a company's trade is

- transferred, so long as certain conditions are met;

-

sales to intermediaries - there's no Stamp Duty to pay when stock is transferred to a

recognised

- intermediary;

-

repurchases and stock lending - there's no Stamp Duty to pay if transfers of stock meet

certain

- conditions;

- transfers to charities - there's no Stamp Duty to pay so long as certain conditions are met.

This isn't an exhaustive list of the Stamp Duty reliefs available. You can find out more about the

reliefs you can claim in Chapter 6 of the HMRC publication 'Stamp Taxes Manual'.

Enquiries about Stamp Duty exemptions and relief

If you're not sure whether your transaction is exempt from Stamp Duty, or if you think you may

be entitled to relief from Stamp Duty, you can contact the HMRC Stamp Taxes Helpline on 0845

for more information.

Note 17 Payments Direct to Bank/Building Society Account form

A payment instruction form has been provided for completion by new transferee(s), for the

option of future payments to be sent direct into a nominated bank or building society account

rather than received by cheque. To set up direct payments, please ensure the additional form is

completed and returned with the Stock Transfer form.

The attached payment form can’t be used for:

- a transferee who does not have a UK bank or building society account

- a transferee who is an entity or body

(refer to note 8 for definitions)

Where a transferee has an overseas account or is an entity/body, there are forms available to

register direct payments on the holding. Visit our website and download forms on the ‘Arrange

Please be aware that:

All FORMS NEED TO BE RETURNED TO: EQUINITI, ASPECT HOUSE, SPENCER ROAD, LANCING,

WEST SUSSEX, BN99 6DA UK.

TRANSFERS WITHIN A CORPORATE SPONSORED NOMINEE (UN-CERTIFICATED HOLDINGS)

REQUIRE A DIFFERENT FORM – PLEASE CALL: 0871 384 2030* AND WE WILL SEND YOU THE

APPROPRIATE FORM.

*Calls cost 8p per minute plus network extras. Lines are open 8.30am to 5.30pm, Monday to Friday.

Equiniti Limited and Equiniti Financial Services Limited are part of the Equiniti group of companies and whose registered

offices are Aspect House, Spencer Road, Lancing, West Sussex BN99 6DA. Company share registration, employee

scheme and pension administration services are provided through Equiniti Limited, which is registered in England &

Wales with No. 6226088. Investment and general insurance services are provided through Equiniti Financial Services

Limited, which is registered in England & Wales with No. 6208699 and is authorised and regulated by the UK Financial

Conduct Authority.

603 0135 or, if calling from overseas, +44 1726 209 042. Alternatively visit www.hmrc.gov.uk/sd

Direct Dividend Payments’ page at www.shareview.co.uk