Fillable Printable Stock Transfer Sample Form

Fillable Printable Stock Transfer Sample Form

Stock Transfer Sample Form

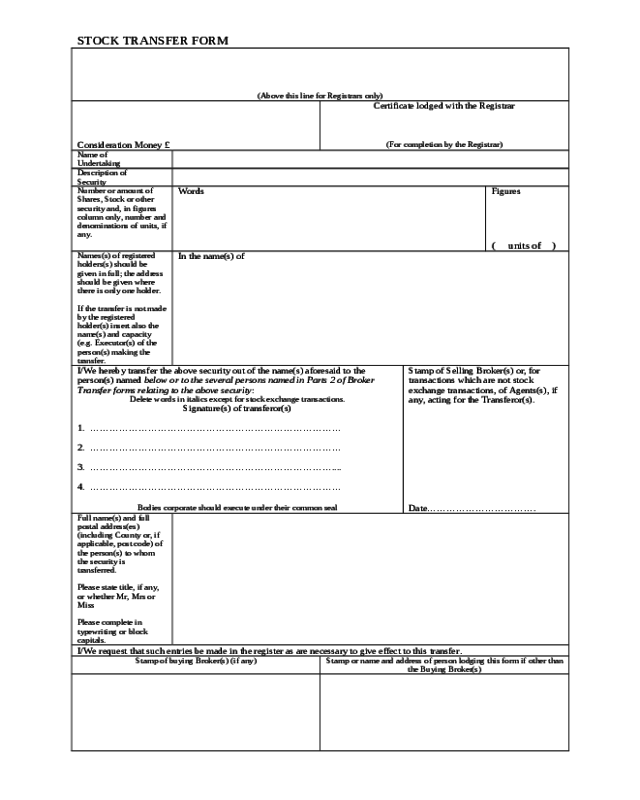

STOCK TRANSFER FORM

(Above this line for Registrars only)

Consideration Money £

Certificate lodged with the Registrar

(For completion by the Registrar)

Name of

Undertaking

Description of

Security

Number or amount of

Shares, Stock or other

security and, in figures

column only, number and

denominations of units, if

any.

Words Figures

( units of )

Names(s) of registered

holders(s) should be

given in full; the address

should be given where

there is only one holder.

If the transfer is not made

by the registered

holder(s) insert also the

name(s) and capacity

(e.g. Executor(s) of the

person(s) making the

transfer.

In the name(s) of

I/We hereby transfer the above security out of the name(s) aforesaid to the

person(s) named below or to the several persons named in Parts 2 of Broker

Transfer forms relating to the above security:

Delete words in italics except for stock exchange transactions.

Signature(s) of transferor(s)

1. ……………………………………………………………………

2. ……………………………………………………………………

3. …………………………………………………………………....

4. ……………………………………………………………………

Bodies corporate should execute under their common seal

Stamp of Selling Broker(s) or, for

transactions which are not stock

exchange transactions, of Agents(s), if

any, acting for the Transferor(s).

Date…………………………….

Full name(s) and full

postal address(es)

(including County or, if

applicable, post code) of

the person(s) to whom

the security is

transferred.

Please state title, if any,

or whether Mr, Mrs or

Miss

Please complete in

typewriting or block

capitals.

I/We request that such entries be made in the register as are necessary to give effect to this transfer.

Stamp of buying Broker(s) (if any) Stamp or name and address of person lodging this form if other than

the Buying Broker(s)

JE-06/03/12

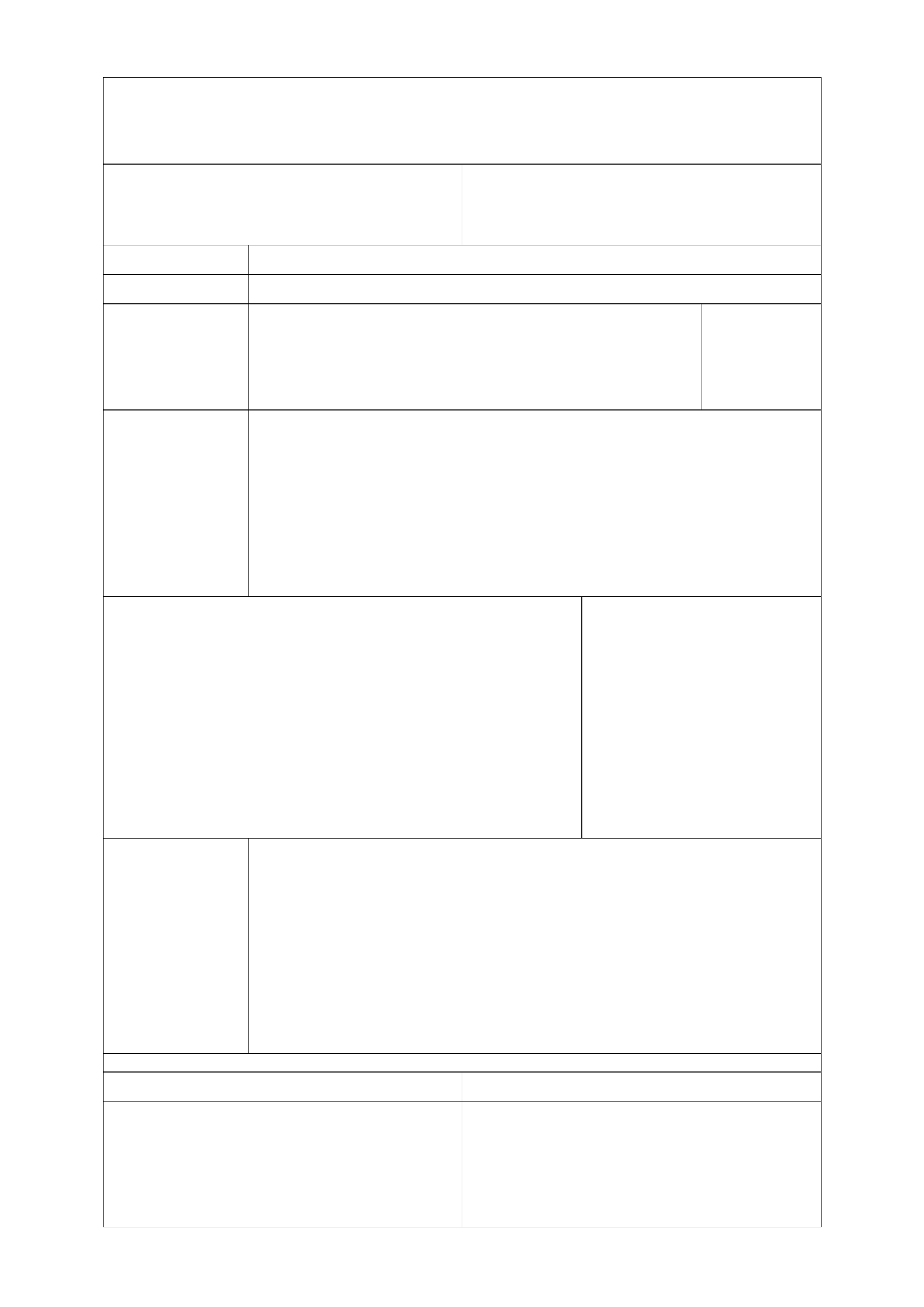

FORM OF CERTIFICATE REQUIRED – TRANSFERS NOT CHARGEABLE WITH

AD VALOREM STAMP DUTY

Complete Certificate 1 if:

•

the consideration you give for the shares is £1,000 or less and the transfer is not part of a larger

transaction or series of transactions (as referred to in Certificate 1).

Complete Certificate 2 if:

•

the transfer is otherwise exempt from Stamp Duty and you are not claiming a relief, or

•

the consideration given is not chargeable consideration.

Certificate 1

* Please delete as

appropriate

I/We* certify that the transaction effected by this instrument does not form part of a larger

transaction or series of transactions in respect of which the amount or value, or aggregate

amount or value, of the consideration exceeds £1,000.

** Delete second

sentence if

certificate is given

by transferor

I/We* confirm that I/we* have been authorised by the transferor to sign this certificate and that

I/we* am/are* aware of all the facts of the transaction. **

Signature(s) Description (“Transferor”, “Solicitor”, etc)

……………………………………. ………………………………………

……………………………………. ………………………………………

……………………………………. ………………………………………

Date _____________________

Certificate 2

* Please delete as

appropriate

I/We* certify that this instrument is otherwise exempt from ad valorem Stamp Duty without a

claim for relief being made or that no chargeable consideration is given for the transfer for the

purposes of Stamp Duty.

** Delete second

sentence if

certificate is given

by transferor

I/We* confirm that I/we* have been authorised by the transferor to sign this certificate and that

I/we* am/are* aware of all the facts of the transaction.**

Signature(s) Description (“Transferor”, “Solicitor”, etc)

……………………………………. ………………………………………

……………………………………. ………………………………………

……………………………………. ………………………………………

Date _____________________

NOTES

(1) You don’t need to send this form to HM Revenue & Customs (HMRC) if you have completed

either Certificate 1 or 2, or the consideration for the transfer is nil (in which case you must

write ‘nil’ in the consideration box on the front of the form) . In these situations send the form

to the company or its registrar.

(2) In all other cases - including where relief from Stamp Duty is claimed - send the transfer form

to HMRC to be stamped.

(3) Information on Stamp Duty reliefs and exemptions and how to claim them can be found on the

HMRC website at hmrc.gov.uk/sd.