Fillable Printable Stock Transfer Form - London Stock Exchange Group

Fillable Printable Stock Transfer Form - London Stock Exchange Group

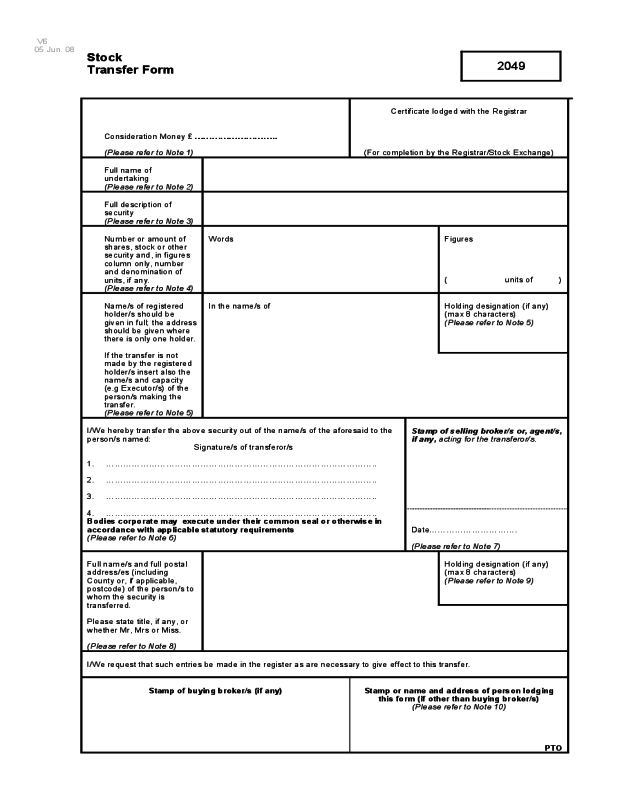

Stock Transfer Form - London Stock Exchange Group

2049

V6

05 Jun. 08

Stock

Transfer Form

Consideration Money £ ………………………..

(Please refer to Note 1)

Certificate lodged with the Registrar

(For completion by the Registrar/Stock Exchange)

Full name of

undertaking

(Please refer to Note 2)

Full description of

security

(Please refer to Note 3)

Number or amount of

shares, stock or other

security and, in figures

column only, number

and denomination of

units, if any.

(Please refer to Note 4)

Words

Figures

( units of )

Holding designation (if any)

(max 8 characters)

(Please refer to Note 5)

Name/s of registered

holder/s should be

given in full; the address

should be given where

there is only one holder.

If the transfer is not

made by the registered

holder/s insert also the

name/s and capacity

(e.g Executor/s) of the

person/s making the

transfer.

(Please refer to Note 5)

In the name/s of

Stamp of selling broker/s or, agent/s,

if any, acting for the transferor/s.

I/We hereby transfer the above security out of the name/s of the aforesaid to the

person/s named:

Signature/s of transferor/s

1. …………………………………………………………………………………..

2. …………………………………………………………………………………..

3. …………………………………………………………………………………..

4. …………………………………………………………………………………..

Bodies corporate may execute under their common seal or otherwise in

accordance with applicable statutory requirements

(Please refer to Note 6)

Date………………………….

(Please refer to Note 7)

Holding designation (if any)

(max 8 characters)

(Please refer to Note 9)

Full name/s and full postal

address/es (including

County or, if applicable,

postcode) of the person/s to

whom the security is

transferred.

Please state title, if any, or

whether Mr, Mrs or Miss.

(Please refer to Note 8)

I/We request that such entries be made in the register as are necessary to give effect to this transfer.

Stamp of buying broker/s (if any)

Stamp or name and address of person lodging

this form (if other than buying broker/s)

(Please refer to Note 10)

PTO

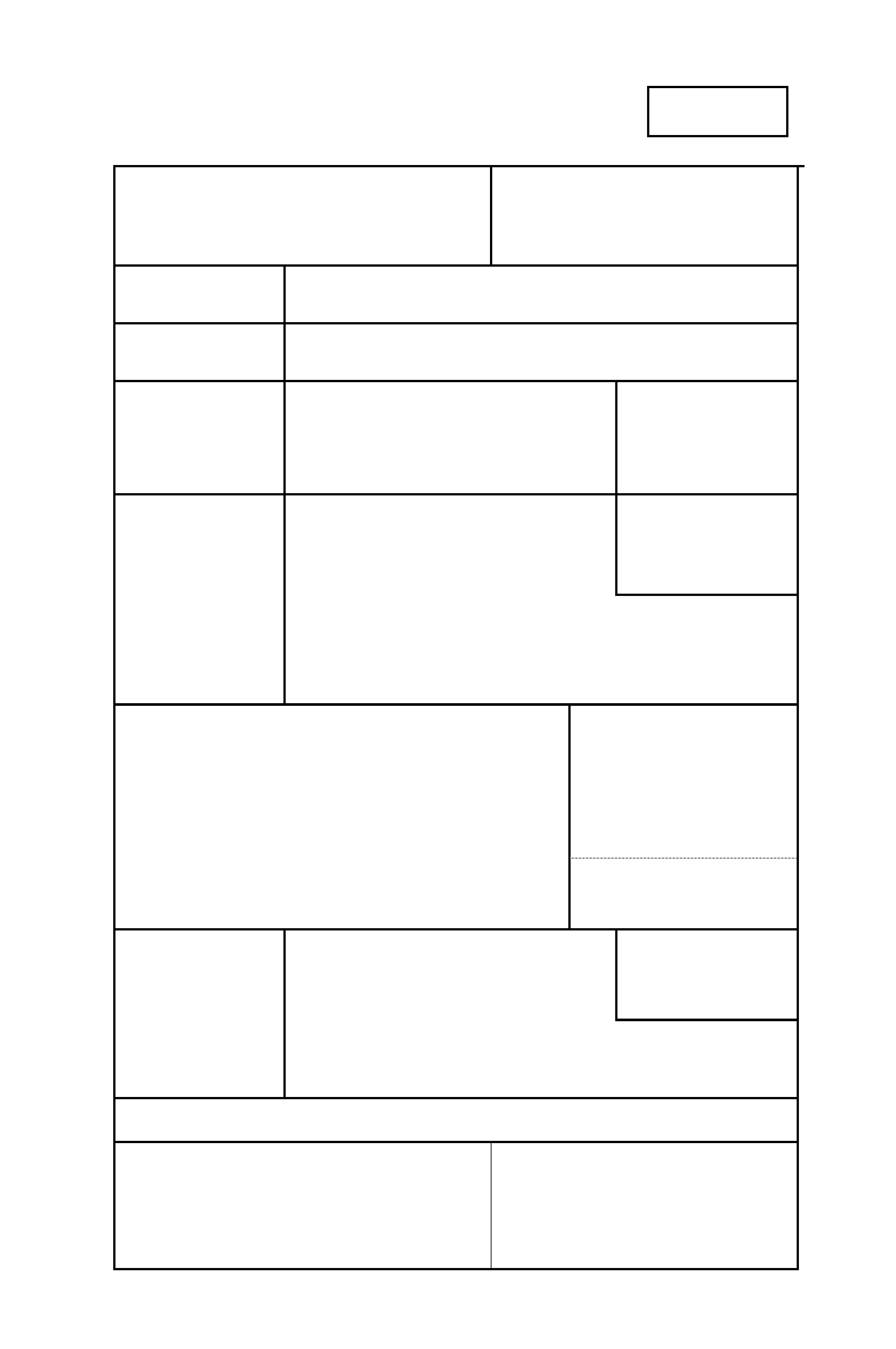

FORM OF CERTIFICATE REQUIRED WHERE TRANSFER IS EXEMPT FROM AD

VALOREM STAMP DUTY AS BELOW THRESHOLD.

(1) I/We certify that the transaction effected by this instrument does not form part of a larger transaction or

series of transaction in respect of which the amount or value, or aggregate amount or value, of the

consideration exceeds £1,000.

(Please refer to note 11)

(1) I/We confirm that (1) I/we have been duly authorised by the transferor to sign this certificate and that

the facts of the transactions are within (1) my/our knowledge (2).

(Please refer to note 12)

(1) Delete as appropriate.

(2) Delete second sentence if certificate is given by transferor or his solicitor.

Signature(s)

(Please see note 13)

Description (“Transferor”, “Solicitor”, etc)

---------------------------------------------------------------- -----------------------------------------------------------------------

---------------------------------------------------------------- -----------------------------------------------------------------------

---------------------------------------------------------------- -----------------------------------------------------------------------

---------------------------------------------------------------- -----------------------------------------------------------------------

Date (Please see note 14)

---------------------------------------------------------------

Notes

(1) If the above certificate has been completed, this transfer does not need to be submitted to the Stamp

Office but should be sent directly to the Company or its Registrars.

(2) If the above certificate is not completed, this transfer must be submitted to the Stamp Office and duly

stamped.

2008

Equiniti Limited

Aspect House

Spencer Road

Lancing

West Sussex

BN99 6DA

Did you know you can advise your bank details and view your shareholding online? Find out more by visiting

The Stock Transfer form must be completed in BLOCK CAPITALS and in black ink.

If you are not entering information in any of the fields please leave them blank and do not cross them through.

Please note that this instruction is specific to the holding shown on the Stock Transfer Form.

+

Guidance notes for the completion of a Stock Transfer Form by shareholders

+

These guidance notes should be read in conjunction with the attached Stock Transfer Form.

Note 1 If no payment is involved in transferring these shares you should complete the exemption certificate on the

reverse of the Stock Transfer Form.

If payment of £1,000 or less is involved in transferring these shares you should complete the exemption

certificate on the reverse of the Stock Transfer form.

If payment of more than £1,000 is involved in transferring these shares you should enter the amount

received in this box.

Stamp Duty will need to be paid on the shares transferred and you should telephone the Stamp Office

helpline on 0845 603 0135 who will advise you of the amount of duty payable.

A cheque or postal order made payable to “HMRC”, should be sent with the completed transfer form to

Birmingham Stamp Office, 9

th

Floor, City Centre House, 30 Union Street, Birmingham B2 4AR. The form

will be returned to you after stamping.

Note 2

Name of company in which these shares/stock are held.

Note 3

Type of shares/stock, for example, Ordinary/Preference and in the case of shares, its nominal value. Please

refer to the certificate/s which states the nominal value of each share. This form can only be used for

fully paid shares.

Note 4

Number of shares or amount of stock units and amount of each unit to be inserted in words (left hand box)

and figures (right hand box), which are being transferred. In cases where the number of shares or number

of stock units on the certificate exceeds the number or amount being transferred, a balance certificate will be

issued. Both boxes must be completed. In the second box please complete the denomination of each unit.

Note 5

Full name/s of person/s transferring these shares/stock (registered holder). Please include any designation

in the special box. The information should be written exactly as shown on the certificate. If there is only one

shareholder then the present address should also be written on the form. If the registered holder is

deceased please complete the full name and address of the deceased together with the full names of the

personal representatives. Please note that a transfer by personal representatives will not be

processed if the Grant of Representation has not been registered.

Note 6

Signature/s of person/s transferring these shares/stock. In the case of a body corporate, the words

“Executed as a deed” and either sealed by the Common Seal and attested; or signed by two directors or one

director and the secretary.

Note 7

The date on which the transfer form is completed must be shown.

Note 8

Full names including title of person/s to whom these shares/stock are being transferred. If there is more

than one transferee then only the address of the first named needs to be shown.

Please note that there are restrictions in dealing with shares where the holder of shares is under 18 living in

England and Wales or 16 in Scotland. If the holder is under 18 please send the original birth certificate (or a

certified copy).

Note 9

If applicable please enter the required account designation to a maximum of 8 characters. The designation

must not form a name or a word.

Note 10

If the new certificate is not to be sent to the address shown in the box referred to in Note 8, then please write

the name and address details here, plus any specific reference.

+

+

www.shareview.co.uk

+

+

Form of Certificate Required Where Transfer is Exempt from

AD VALOREM Stamp Duty as consideration is £1,000 or less.

To be completed before registration where transfers are exempt from AD VALOREM Stamp Duty.

Note 11

Delete “I” or “We” as appropriate. If consideration is between £0 and £1,000 then the transfer is exempt

from AD VALOREM Stamp Duty, provided that this certificate is signed and dated. If this transfer forms part

of a group of transfers and together the combined consideration is more than £1,000 then AD VALOREM

stamp duty is payable.

If you are unsure on this matter, please contact the Stamp Office on 0845 603 0135.

Note 12

Delete “I” or “We” as appropriate. This refers to the person/s signing the certificate.

Note 13 This should be signed by either the person/s that sign the transfer or their solicitor or their duly authorised

agent, and should state the capacity in which they are signing.

Note 14

Insert the date on which the certificate is signed. If no date is inserted on the front of the Stock Transfer

Form this date will be treated as the date of the transfer.

WHEN THE STOCK TRANSFER FORM HAS BEEN STAMPED, OR, WHEN THE STOCK TRANSFER FORM AND THE

EXEMPTION CERTIFICATE HAS BEEN COMPLETED, PLEASE SEND IT, TOGETHER WITH THE SHARE/STOCK

CERTIFICATE/S, TO THE COMPANY’S REGISTRAR FOR REGISTRATION.

+

Equiniti Limited and Equiniti Financial Services Limited are part of the Equiniti group of companies and whose registered offices are Aspect

House, Spencer Road, Lancing, West Sussex BN99 6DA. Company share registration, employee scheme and pension administration services

are provided through Equiniti Limited, which is registered in England & Wales with No. 6226088. Investment and general insurance services

are provided through Equiniti Financial Services Limited, which is registered in England & Wales with No. 6208699 and is authorised and

regulated by the UK Financial Services Authority.

+