Fillable Printable Income Tax Calculation Statement Form

Fillable Printable Income Tax Calculation Statement Form

Income Tax Calculation Statement Form

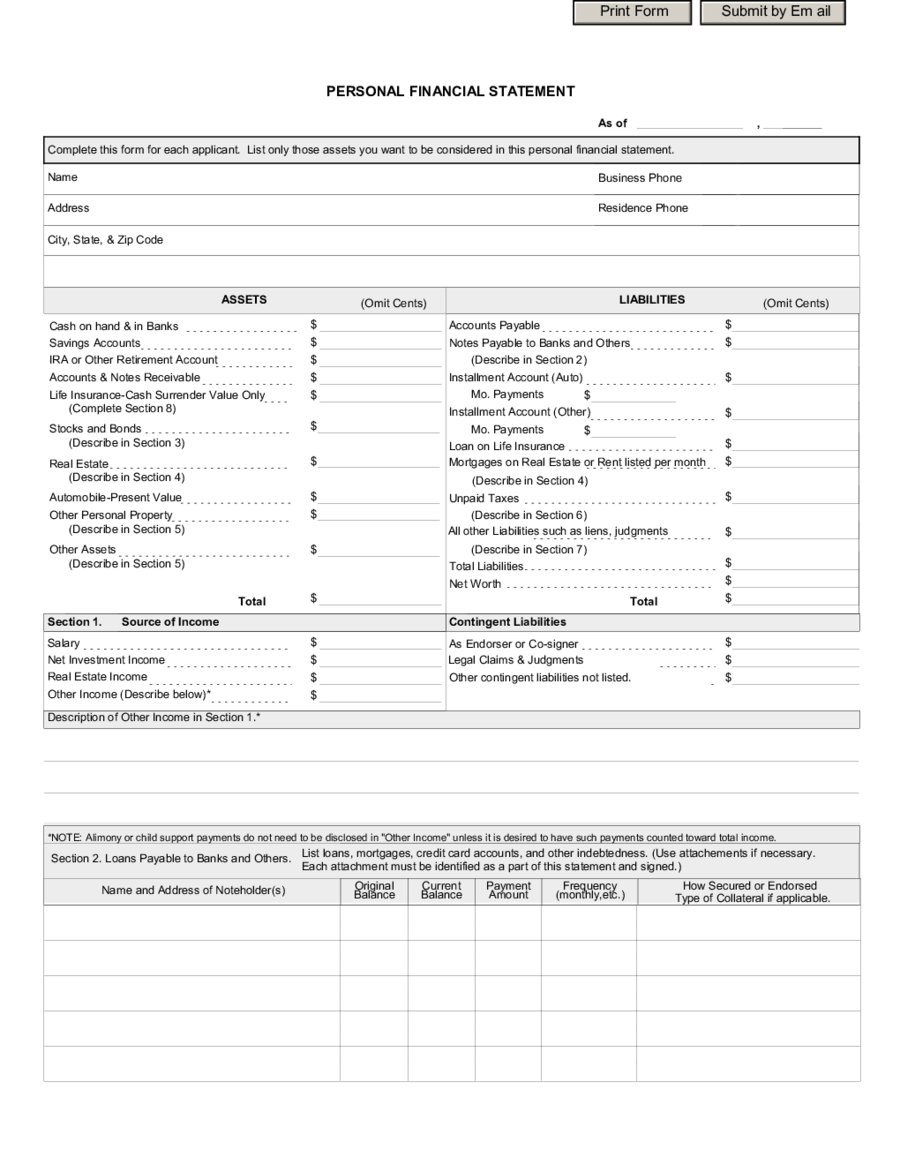

PERSONAL FINANCIAL STATEMENT

As of ,

Complete this form for each applicant. List only those assets you want to be considered in this personal financial statement.

Name

Business Phone

Address Residence Phone

City, State, & Zip Code

ASSETS

Cash on hand & in Banks

Savings Accounts

IRA or Other Retirement Account

Accounts & Notes Receivable

Life Insurance-Cash Surrender Value Only

(Complete Section 8)

Stocks and Bonds

(Describe in Section 3)

Real Estate

(Describe in Section 4)

Automobile-Present Value

Other Personal Property

(Describe in Section 5)

Other Assets

(Describe in Section 5)

Total

Section 1. Source of Income

Salary

Net Investment Income

Real Estate Income

Other Income (Describe below)*

Description of Other Income in Section 1.*

(Omit Cents)

LIABILITIES

(Omit Cents)

$

Accounts Payable

$

$

Notes Payable to Banks and Others

$

$

(Describe in Section 2)

$

Installment Account (Auto)

$

$

Mo. Payments

$

Installment Account (Other)

$

$

Mo. Payments

$

Loan on Life Insurance

$

$

Mortgages on Real Estate or Rent listed per month

$

(Describe in Section 4)

$

Unpaid Taxes

$

$

(Describe in Section 6)

All other Liabilities such as liens, judgments

$

$ (Describe in Section 7)

Total Liabilities

$

Net Worth

$

$

Total

$

Contingent Liabilities

$

As Endorser or Co-signer

$

$

Legal Claims & Judgments

$

$ $

$

Other contingent liabilities not listed.

*NOTE: Alimony or child support payments do not need to be disclosed in "Other Income" unless it is desired to have such payments counted toward total income.

List loans, mortgages, credit card accounts, and other indebtedness. (Use attachements if necessary.

Each attachment must be identified as a part of this statement and signed.)

Section 2. Loans Payable to Banks and Others.

Original Current Payment Frequency How Secured or Endorsed

Name and Address of Noteholder(s)

Balance Balance Amount (monthly,etc.)

Type of Collateral if applicable.

Submit by Em ailPrint Form

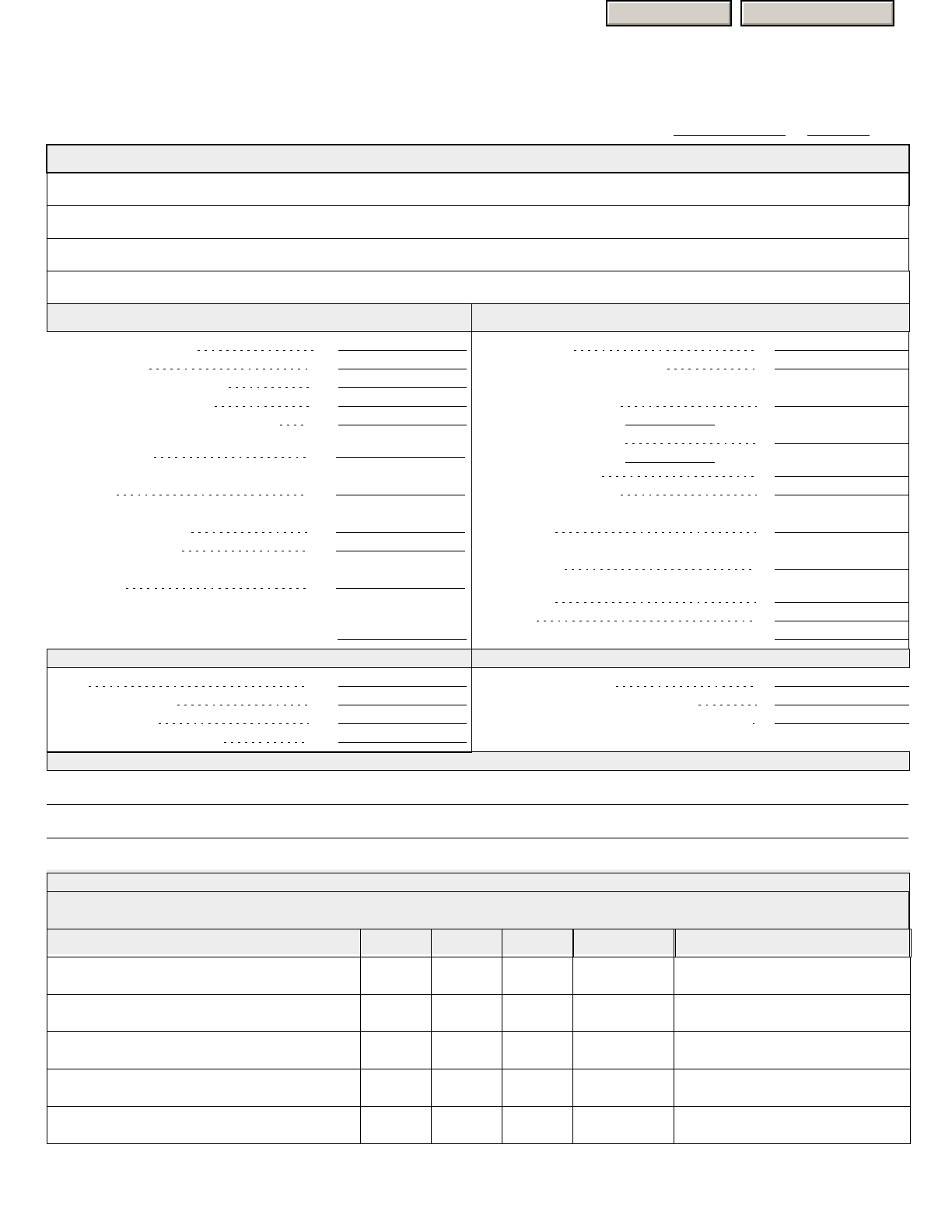

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed).

Number of Shares Name of Securities Cost

Market Value Date of

Total Value

Quotation/Exchange Quotation/Exchange

Section 4. Real Estate Owned.

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a part

of this statement and signed.)

Property A Property B Property C

Type of Property

Address

Date Purchased

Original Cost

Present Market Value

Name of Mortgage Holder

Mortgage Balance

Amount of Payment per Month/Year

Status of Mortgage

(Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms

Section 5. Other Personal Property and Other Assets.

of payment and if delinquent, describe delinquency)

Section 6. Unpaid Taxes.

(Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.)

Section 7. Other Liabilities.

(Describe in detail.)

Section 8. Life Insurance Held.

(Give face amount and cash surrender value of policies - and name of insurance company.

I hereby affirm that this personal financial statement contains no willful misrepresentation or falsifications and this information given by me/us is true and

complete to the best of my/our knowledge and belief.

Signature: Date:

Signature: Date: