Fillable Printable Your Current Monthly Statement Income Form

Fillable Printable Your Current Monthly Statement Income Form

Your Current Monthly Statement Income Form

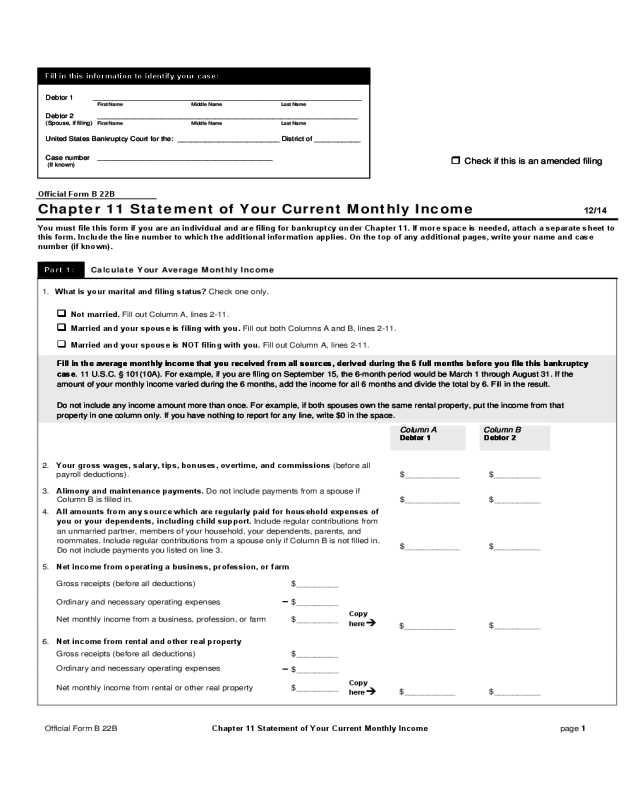

Official Form B 22B Chapter 11 Statement of Your Current Monthly Income page 1

Official Form B 22B

Chapter 11 Statement of Your Current Monthl y Income 12/14

You must file this form if you are an individual and are filing for bankruptcy under Chapter 11. If more space is needed, attach a separate sheet to

this form. Include the line number to which the additional information applies. On the top of any additional pages, write your name and case

number (if known).

Part 1: Calculate Your Average Monthly Income

1. What is your marital and filing status? Check one only.

Not married. Fill out Column A, lines 2-11.

Married and your spouse is filing with you. Fill out both Columns A and B, lines 2-11.

Married and your spouse is NOT filing with you. Fill out Column A, lines 2-11.

Fill in the average monthly income that you received from all sources, derived during the 6 full months before you file this bankruptcy

case. 11 U.S.C. § 101(10A). For example, if you are filing on September 15, the 6-month period would be March 1 through August 31. If the

amount of your monthly income varied during the 6 months, add the income for all 6 months and divide the total by 6. Fill in the result.

Do not include any income amount more than once. For example, if both spouses own the same rental property, put the income from that

property in one column only. If you have nothing to report for any line, write $0 in the space.

Column A

Debtor 1

Column B

Debtor 2

2. Your gross wages, salary, tips, bonuses, overtime, and commissions (before all

payroll deductions). $____________ $__________

3. Alimony and maintenance payments. Do not include payments from a spouse if

Column B is filled in. $____________ $__________

4. All amounts from any source which are regularly paid for household expenses of

you or your dependents, including child support. Include regular contributions from

an unmarried partner, members of your household, your dependents, parents, and

roommates. Include regular contributions from a spouse only if Column B is not filled in.

Do not include payments you listed on line 3.

$____________ $__________

5. Net income from operating a business, profession, or farm

Gross receipts (before all deductions) $_________

Ordinary and necessary operating expenses

– $_________

Net monthly income from a business, profession, or farm $_________

Copy

here

$___________

$__________

6. Net income from rental and other real property

Gross receipts (before all deductions) $_________

Ordinary and necessary operating expenses

– $_________

Net monthly income from rental or other real proper ty $_________

Copy

here

$___________ $__________

Debtor 1 ____________________________________________________________ ______

First Name Middle Name Last Name

Debtor 2 ____________________________________________________________ ____

(Spouse, if filing) First Name Middle Name Last Name

United States Bankruptcy Court for the: ______________________ Dis t rict of __________

Case number ___________________________________________

(If known)

Fill in this information to identify your case:

Check if this is an amended filing

Debtor 1 _______________________________________________________ Case number (if known)__________________________ ___________

First Name Middle Name Last Name

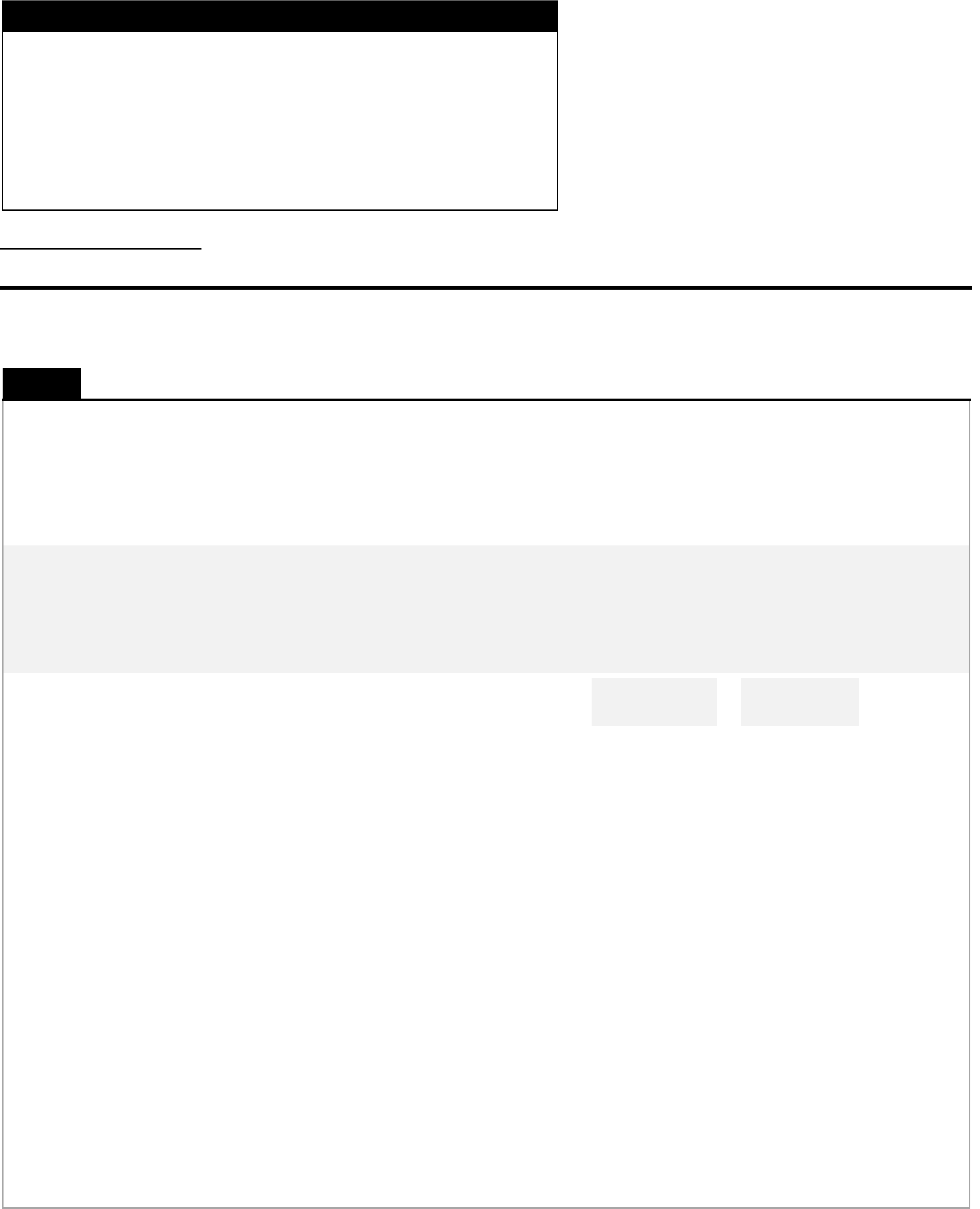

Official Form B 22B Chapter 11 Statement of Your Current Monthly Income page 2

Column A

Debtor 1

Column B

Debtor 2

7. In

te

r

est,

d

ivi

de

n

ds,

a

n

d

r

oya

l

t

i

es

$____________ $__________

8. Unemployment compensation $____________ $__________

Do not enter the amount if you contend that the amount received was a benefit

under the Social Security Act. Instead, list it here: ................................

For you .......................................................................... $_________

For your spouse ............................................................ $_________

9. Pension or retirement income. Do not include any amount received that was a

benefit under the Social Security Act.

$____________

$__________

10. Income from all other sources not listed above. Specify the source and amount.

Do not include any benefits received under the Social Security Act or payments

received as a victim of a war crime, a crime against humanity, or international or

domestic terrorism. If necessary, list other sources on a separate page and put the

total on line 10c.

10a. ________________________________________

$____________

$__________

10b. ________________________________________

$____________

$__________

10c. Total amounts from separate pages, if any.

+

$____________

+

$__________

11. Calculate your total average monthly income.

Add lines 2 through 10 for each column.

Then add the total for Column A to the total for Column B.

$____________

+

$_________

=

$_______

Total average

monthly income

Part 2: Deduct any applicable marital adjustment

12. Copy your total average monthly income from line 11.

$_____________

13. Calculate the marital adjustment. Check one:

You are not married. Fill in 0 in line 13d.

You are married and your spouse is filing with you. Fill in 0 in line 13d.

You are married and your spouse is not filing with you.

Fill in the amount of the income listed in line 11, Column B, that was NOT regularly paid for the household expenses of

you or your dep endents,

such as payment of the spouse’s tax liability or the spouse’s support of someone other than

you or your dep endents.

In lines 13a-c, specify the basis for excluding this income and the amount of income devoted to each purpose. If

necessary, list additional adjustments on a separate page

.

If this adjustment does not apply, enter 0 on line 13d.

13a. _______________________________________________________________________

$___________

13b. _______________________________________________________________________

$___________

13c. _______________________________________________________________________

+ $___________

13d. Total .................................................................................................................

$___________

Copy here. 13d.

─____________

14. Your current monthly income. Subtract line 13d from line 12.

14.

$ __________

Debtor 1 _______________________________________________________ Case number (if known)__________________________ ___________

First Name Middle Name Last Name

Official Form B 22B Chapter 11 Statement of Your Current Monthly Income page 3

Part 3: Sign Below

By signing here, under penalty of perjury I declare that the information on this statement and in any attachments is true and correct.

______________________________________________ ______________________________________

Signature of Debtor 1 Signature of Debtor 2

Date _________________ Date_________________

MM / DD / YYYY MM / DD / YYYY