Fillable Printable Letter Of Intent For Business Partnership Template

Fillable Printable Letter Of Intent For Business Partnership Template

Letter Of Intent For Business Partnership Template

LETTER OF INTENT

Between the parties of

Geo Genesis Group Ltd. and its subsidiaries and designees

(“GGG”)

And

Huashiji Science and Technology Development Group

and its subsidiaries and affiliates

(“the Company”)(“HSJ”)

For the attention of the board of Directors

16 February, 2009

Dear Sirs & Madams,

This letter sets forth our agreement and understanding as to the essential terms of the

intended investment to be provided by Geo Genesis Group Ltd and its 100%

subsidiary Geo Genesis Group – Qingdao China Partners Investment Advisory Ltd

(“GGG China”) in Huashiji Science and Technology Development Group and all its

subsidiaries and affiliates. (“the Company”) (“HSJ”)

Huashiji Science and Technology Development Group (“HSJ Group”) is incorporated

in Qingdao, Shandong, PRC. It consists three subsidiaries (“the Subsidiaries”):

Huashiji Precision Mold Co., Ltd, engages in designing and precision production of

mold for electronic products; Huashiji Electronics Co., Ltd, engages in plastic

injection, spray painting and assembly of electronic products; and Huashiji

Investment Management Co., Ltd, engages in investment and management of import

and export business. The parties intend this letter to be legally binding and

enforceable, and that it will ensure to the benefit of the parties and their respective

successors.

1. Services to be performed by GGG

The structured steps of GGG’s services are as follows:

1.1 Signing of the Letter of Intent between GGG and the Company.

1.2 GGG conducts commercial due diligence, beginning to identify shell for future

opportunity in US OTCBB market and initial preparations in relation to Private

Equity (PE) Investment.

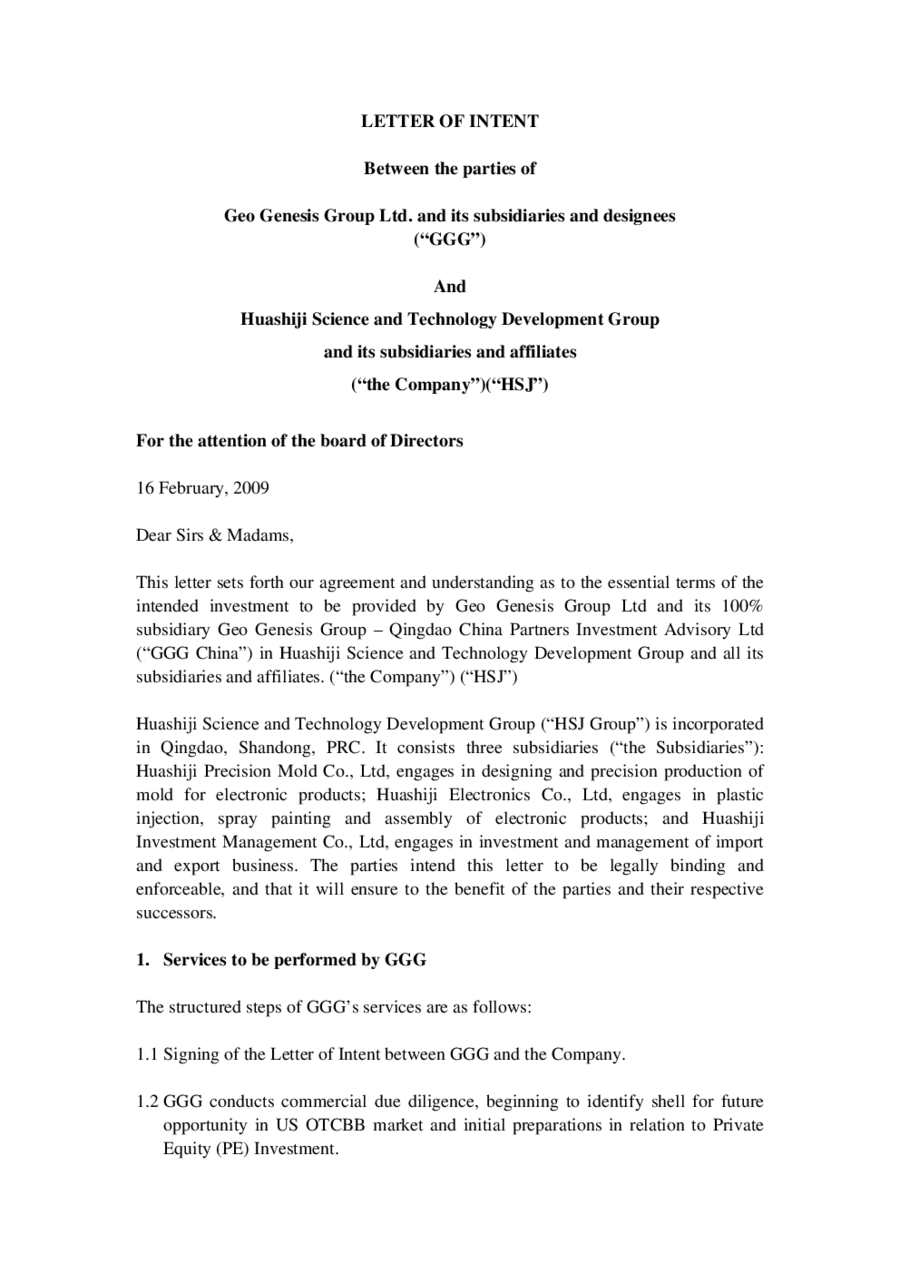

1.3 Reorganization and Restructure of the Company’s current shareholding structure

Upon the completion of domestic shareholding restructure ( refer to

“3.Obligations of the Company”), GGG will incorporate an offshore Special

Purpose Vehicle (“SPV”) with the proposed name being China Precision

Technology Ltd (“CPT”) and proceed with shareholding swap with HSJ Group to

enable the SPV to be the 100% holding company of HSJ Group as illustrated in

the “Organization Chart (1.3)”. Thereafter, HSJ Group will become a Wholly

Owned Foreign Enterprise (WOFE) held by the aforementioned SPV. In return,

GGG will derive 5% of SPV’s shareholding upon completion of the international

restructuring process with Ms Jia’s and/or her nominated shareholding

representative (collectively referred to as “Ms Jia” hereinafter) holding the rest

95%.

Organization Chart (1.3)

95% 5%

100%

100% 100% 100%

1.4 Legal and Financial Due Diligence by Law Firm and Accountancy Firm

GGG will assist the Company to appoint well accepted law firm and accountancy

firm to proceed with relevant and necessary 3

rd

party legal and financial due

diligence which include the audited financial report covering full years of 2007

and 2008 and legal due diligence on China based HSJ Group. The result of such

due diligence shall be satisfied by GGG in order for future process to proceed.

SPV

Qingdao Huashiji Science and

Technology Development Group

Qingdao Huashiji

Precision Mold Co., Ltd

Qingdao Huashiji

Electronic Co., Ltd

Qingdao Huashiji Investment

Management Co., Ltd.

GGG

Ms Jia

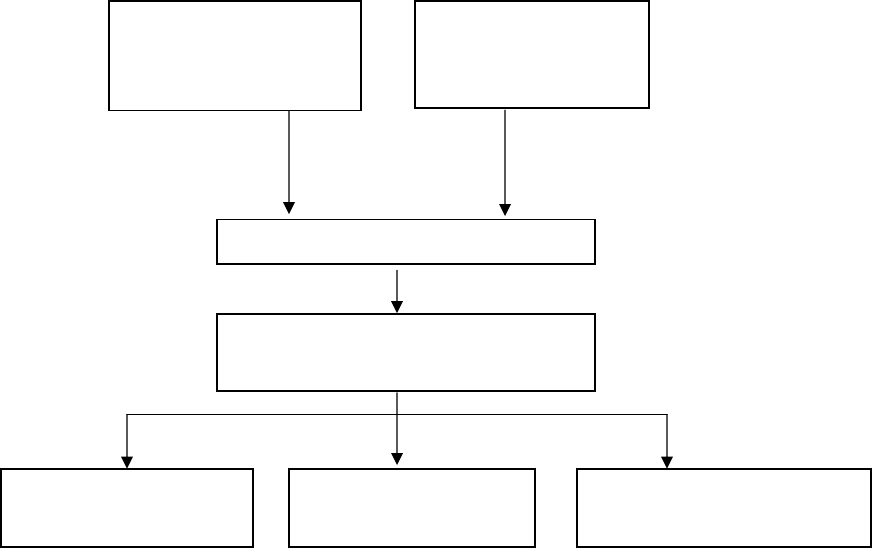

1.5 Acquisition of OTCBB Shell by GGG and reverse take over processes

GGG will identify and acquire a suitable OTCBB listing reverse takeover target

(“Shell”), making arrangements for the reverse take over between the Shell and

SPV. In return, 20% of additional shares are required to be issued to GGG prior to

the Shell acquisition, which will be held by GGG’s designee and shall become

GGG’s possession upon the reverse takeover completion. As a result, GGG will

possess a diluted 24% shareholding of the Shell, leaving Ms Jia and its nominated

shareholding representative with rest 76%.

Organization Chart (1.5)

76% 24%

100%

100%

100% 100% 100%

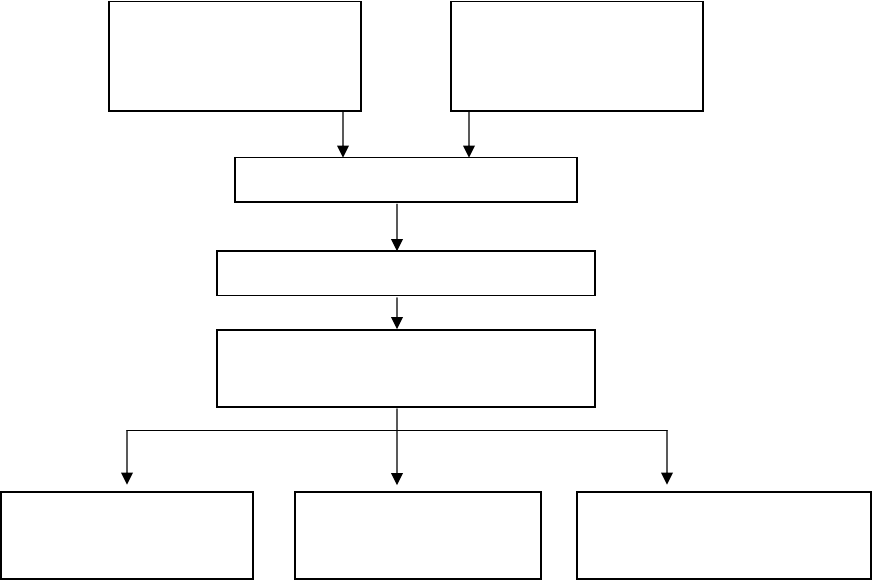

1.6 PE Investment

GGG will arrange on a best effort basis a further fundraising of RMB¥21 million

or equivalent (approximately USD $3.1 million) to inject into the Shell by further

issuing 30% of the Shell’s shares, the proceed will be used as follows:

z 1.6 million for the buyout of Mr. Ma

z 0.5 million to enhance working capital

z 0.5 – 1 million to expand production capacity

Upon the completion of PE Investment in the sum of USD 3.1 million is injected, Ms

Jia’s shares will be diluted to 53.2% of the total shareholding, with GGG holding the

right for the rest 46.8%.

SPV

OTCBB Shell

Qingdao Huashiji Science and

Technology Development Group

Qingdao Huashiji

Precision Mold Co., Ltd

Qingdao Huashiji

Electronic Co., Ltd

Qingdao Huashiji Investment

Management Co., Ltd.

GGG

Ms Jia

Organization Chart (1.6)

53.2% 46.8%

100%

100%

100% 100% 100%

Shareholding Position

Stages Ms Jia GGG

Upon Completion of International Restructure (Para 1.3) 95% 5%

Upon Controlling over OTCBB (Para 1.5) 76% 24%

Upon Completion of Investment (Para 1.6) 53.2% 46.8%

1.7 Further Fundraising

GGG will make arrangements on a best effort basis to raise further fund upon

demand of the Company through introduction of bank loan, PIPE (private

placement in public enterprise) and/or conduct IPO on NASDAQ SME or AMEX.

Terms and condition shall be illustrated in a new contract upon demand of the

Company.

2. GGG’ rights and compensations

GGG will have an option and right to resell those aforementioned agreed offer with a

specific spread to any qualified third party investor, upon the approval from the board

of the Company.

The Company will engage GGG as its advisor for public listing upon the signing of

this document for a period of 36 months. The Company will pay USD $3,000 per

month prior to the receipt of investment fund in the sum of USD 3.1 million and USD

$7,000 after it takes place.

SPV

OTCBB Shell

Qingdao Huashiji Science and

Technology Development Group

Qingdao Huashiji

Precision Mold Co., Ltd

Qingdao Huashiji

Electronic Co., Ltd

Qingdao Huashiji Investment

Management Co., Ltd.

GGG

Ms Jia

The two parties will cover their own expense during the commercial due diligence

conducted by GGG.

3. Obligations of the Company

The Company is required to cooperate with GGG’s services and relevant

requirements aforementioned in a prompt and professional manner.

The Company is required to restructure its domestic shareholding structure in a way

that Ms Jia will be a 100% shareholder of HSJ Group, HSJ Group will be a 100%

holding Company of all the subsidiaries.

The Company will grant three (3) year warrants at the first trading price to GGG and

its designees, equivalent to 5% of the shares issued and outstanding. Such grant shall

become effective upon the Shell listing date.

The Company will provide GGG with the audited financial statements for the full

year of 2007 and full year of 2008.

The Company will engage a law firm acceptable to GGG to undertake basic legal due

diligence which will include but not limited to:

1. Verifications of shareholding structure of the Company.

2. Verifications of land use rights/ leasing contracts and major fixed assets of the

Company.

3. Verifications on the contracts of major suppliers and customers.

4. Verification of any IPR owned by the Company such as patents and

trademarks.

The Company will sign separate contracts with accountancy firm and law firm, and

the costs incurred during the process will be at the Company’s own expense.

The Company shall be liable to pay any expenses and costs in relation to the

international shareholding restructure.

The Company shall be liable to pay any legal and filing fees incurred during the

reverse takeover process between SPV and the Shell.

The Company will provide GGG on an ongoing basis, the access to information and

documents required during all legal and financial due diligence process as well as

access to key personnel.

The Company will not sign any agreements with other similar investment firms upon

the signing of this document with GGG.

4. Due Diligence

The Company agrees to cooperate with GGG due diligence investigation of the

business and to provide the appointed Investment Bank (s) and its (their)

representatives with prompt and reasonable access to key employees and books,

records, contracts and other information pertaining to the business (“The Due

Diligence Information”).

5. Confidentiality

Non-competition. GGG will use the due diligence information solely for the purpose

of the due diligence investigation of the business, and unless and until the parties

consummate the reverse takeover, any consultants, their affiliates, directors, officers,

employees, advisors and agents will keep the Due Diligence information strictly

confidential with the exception of regulatory and listing requirements. GGG will

disclose the Due Diligence Information only to those representatives of the

Investment Banks, auditors, consultancy firms, investment funds and other legal

advisors who need to know such information for the purpose of consummating the

private equity funding of the Company.

6. Exclusive Dealing

Upon the signing of this document, the Company will not enter into any agreement,

discussion, or negotiation with, or provide information to, or solicit, encourage,

entertain or consider any inquiries or proposals from, any other corporation, or hire

another person with respect to (a) the possible hiring of professional registered

advisors authorized to access private and public financing on behalf of the Company.

If GGG failed to provide the aforementioned US$ 3.1 million to the company within

90 days upon completion of the aforementioned due diligence and works, the

Company has the right to look for other investing parties.

7. Public Announcement

All press releases and public announcements relating to the Letter of Intent will be

agreed to and prepared jointly by GGG and the Company.

Signed Date:

……………………………………………….

For and the behalf of Geo Genesis Group Ltd and its subsidiaries and designees

………………………………………………..

For and on the behalf of Huashiji Science and Technology Development Group and

its subsidiaries and affiliates