Fillable Printable Letter of Intent Form Sample

Fillable Printable Letter of Intent Form Sample

Letter of Intent Form Sample

Use this form if you intend to purchase Class A shares of certain

Oppenheimer funds at a reduced sales charge. If you are

submitting this Letter of Intent in connection with a purchase

of shares in a new account, please obtain a prospectus

of the fund in which you wish to invest and complete an

OppenheimerFunds New Account Application. For information,

visit oppenheimerfunds.com or call your financial advisor or

OppenheimerFunds directly at 800 CALL OPP (225 5677).

Mail this form to:

OppenheimerFunds Distributor, Inc.

Regular Mail Overnight Mail

P.O. Box 5270 12100 E. Iliff Avenue

Denver, CO 80217-5270 Suite 300

Aurora, CO 80014-1250

PLEASE NOTE: You do not need to submit a Letter of Intent if your

current holdings under the Rights of Accumulation (ROA) privilege

already exceed the breakpoint being requested. (See the applicable

prospectus for more information about the ROA privilege.)

AO0000.011.0215 Page 1 of 3

Date

I am submitting this Letter of Intent to purchase shares of certain qualifying Oppenheimer funds. I have read and

understand the Letter of Intent provisions in the Prospectus and Statement of Additional Information of the applicable

fund and the Terms of Escrow on the back of this form.

I intend to invest in Class A and/or Class C shares of certain Oppenheimer funds (sold with a front-end sales charge

or subject to a contingent deferred sales charge) during the 13-month period from the date of my first purchase

pursuant to this Letter. The aggregate amount of such purchases (excluding any shares purchased by reinvestment of

dividends or capital gains distributions), together with my present holdings of Class A and/or Class C shares of such

funds (calculated at their public offering prices), will equal or exceed the minimum amount checked below ($25,000

mini mum for those funds with maximum front-end sales charge rate for Class A shares of 5.75%; $50,000

minimum for those funds with maximum front-end sales charge rate for Class A shares of 4.75%; $100,000

minimum for those funds with maximum front-end sales charge rate for Class A shares of 3.50% and 2.25%):

j

$25,000

j

$50,000

j

$100,000

j

$250,000

j

$500,000

j

$1,000,000

1

Subject to the conditions below, each purchase of Class A shares will be made at the public offering price that applies

to a single transaction in the aggregate dollar amount checked above, as described in the applicable Prospectus.

I am making no commitment to purchase shares, but if my purchases of shares within 13 months from the date

of my first purchase, when added to my present holdings, do not aggregate the minimum amount specified

above, I will pay the additional amount of sales charge prescribed in the Terms of Escrow set forth on this

form, as those terms may be amended from time to time in the Prospectus or in the Statement of Additional

Information for the respective fund. I understand that 2% of the minimum dollar amount checked above will be

held in escrow in the form of shares (rounded up to the nearest full share). These shares will be held subject to

the Terms of Escrow.

The concession paid by OppenheimerFunds Distributor, Inc. to the dealer for each purchase transaction shall be at

the rate applicable to the minimum amount of my intended purchases stated above. If my actual purchases do not

reach this minimum amount, the concessions previously paid to such dealer will be adjusted to the rate applicable to

my total actual purchases. If my total purchases exceed the dollar amount of my total intended purchases and pass

the next breakpoint, I shall receive the lower sales charge, provided that such dealer returns to OppenheimerFunds

Distributor, Inc. the excess of concessions previously paid to the dealer over that which would be applicable to the

amount of my total purchases.

In determining the total amount of purchases made hereunder, shares redeemed prior to termination of this Letter

will be deducted. It shall be mine and my dealer’s responsibility to refer to this Letter of Intent in placing any future

purchase orders for me while the Letter is in effect. In addition, all purchases under this Letter must be placed

through OppenheimerFunds Distributor, Inc.

1 | Letter of Intent

Please read the following and

indicate the amount you intend

to invest. Please print clearly.

1. Purchases of Class A shares in amounts aggregating $1 million or more are not subject to front-end sales charge but the redemption proceeds of such shares redeemed within 18 months of

the end of the calendar month of their purchases may be subject to a contingent deferred sales charge. (See the applicable Prospectus for details.)

Letter of Intent

Instructions

AO0000.011.0215 Page 2 of 3

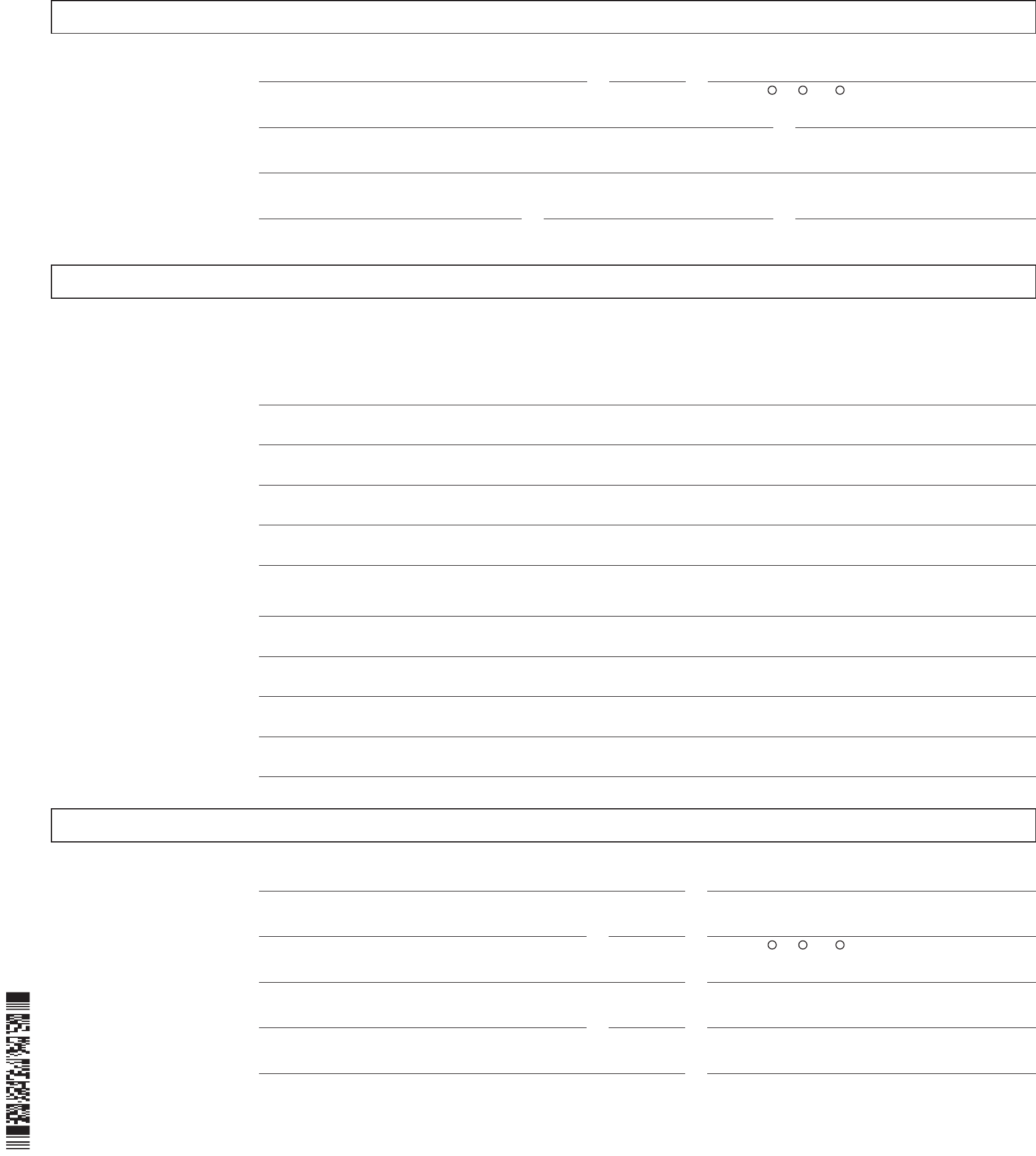

2 | Account ownership

3

|

Your fund accounts

Please list all new and/or existing accounts currently held in the Oppenheimer funds, including 529 accounts and

brokerage accounts (please provide Brokerage Identification Number). For a new account, please complete and mail

with your OppenheimerFunds New Account Application.

Name of Fund/Class of Shares

1.

2.

3.

4.

Account Number (for existing accounts)

1.

2.

3.

4.

4 | Financial advisor information

Owner’s first name Middle initial Last name

Mr. Mrs. Ms.

Street address Apartment or box number

City

State Zip Social Security number

Your advisor should

complete this section.

Rep ID number Clearing firm number

First name Middle initial Last name Mr. Mrs. Ms.

Clearing firm name FINRA branch mailing address

City State Zip

( )

Financial advisor’s phone number Financial advisor’s email address

5 | Your signature(s)

AO0000.011.0215 March 5, 2015

Page 3 of 3

X

Signature of individual or custodian Date

Signature of joint registrant, if any Date

X

Signature of corporate officer, general partner, trustee, etc. Date

Title of corporate officer, trustee, etc.

In submitting a Letter of Intent, the investor agrees to be bound by the terms and conditions applicable to Letters of

Intent appearing in the Prospectus and the Statement of Additional Information of the applicable fund and the Terms

of Escrow below, as they may be amended from time to time by the fund. Such amendments will apply automatically

to existing Letters of Intent.

Terms of Escrow for Letters of Intent

1. Out of the initial purchase (or subsequent purchases if necessary), 2% of the dollar amount specified in the Letter

of Intent (Letter) shall be held in escrow in shares of the fund by the fund’s transfer agent. For example, if the

minimum amount specified under the Letter is $50,000, the escrow shall be shares valued in the amount of $1,000

(computed at the public offering price adjusted for a $50,000 purchase). All dividends and any capital gains

distributions on the escrowed shares will be credited to the investor’s account.

2. If the total minimum investment specified under the Letter is completed within a 13-month period, the escrowed

shares will be promptly released. However, shares redeemed prior to completion of the purchase requirement

under the Letter will be deducted from the amount required to complete the investment commitment.

3. If the total eligible purchases made during the Letter period do not equal or exceed the intended purchase

amount, the concessions previously paid to the dealer of record for the account and the amount of sales charge

retained by the Distributor will be adjusted on the first business day following the expiration of the Letter period to

the rates applicable to actual total purchases. Full and fractional shares remaining after such redemption will be

released from escrow if a request is received to redeem escrowed shares prior to the payment of such additional

sales charge—the sales charge will be withheld from the redemption proceeds.

4. By signing the Letter, the investor irrevocably constitutes and appoints the transfer agent of the fund as attorney-

in-fact to surrender for redemption any or all escrowed shares prior to the payment of such additional sales

charge—the sales charge will be withheld from the redemption proceeds.

5. The shares eligible for purchase under the Letter (or the holding of which may be counted toward completion

of the Letter) include Class A shares sold with a front-end sales charge or Class A, Class B or Class C shares

subject to a contingent deferred sales charge (including any shares acquired in exchange for those shares) for

either (a) Class A shares of one of the other Oppenheimer funds that were acquired subject to a Class A initial or

contingent deferred sales charge or (b) Class B shares or Class C shares of one of the other Oppenheimer funds

that are subject to a contingent deferred sales charge.

6. Shares held in escrow hereunder will automatically be exchanged for shares of another fund for which an

exchange is requested as to the shareholder’s account, as described in the section of the Prospectus titled

“Exchange Privilege.”

Individual or

Custodial Accounts

Corporations,

Partnerships, Trusts, etc.

Please have all account owners

sign below.