Fillable Printable Trader Joe's Application Form

Fillable Printable Trader Joe's Application Form

Trader Joe's Application Form

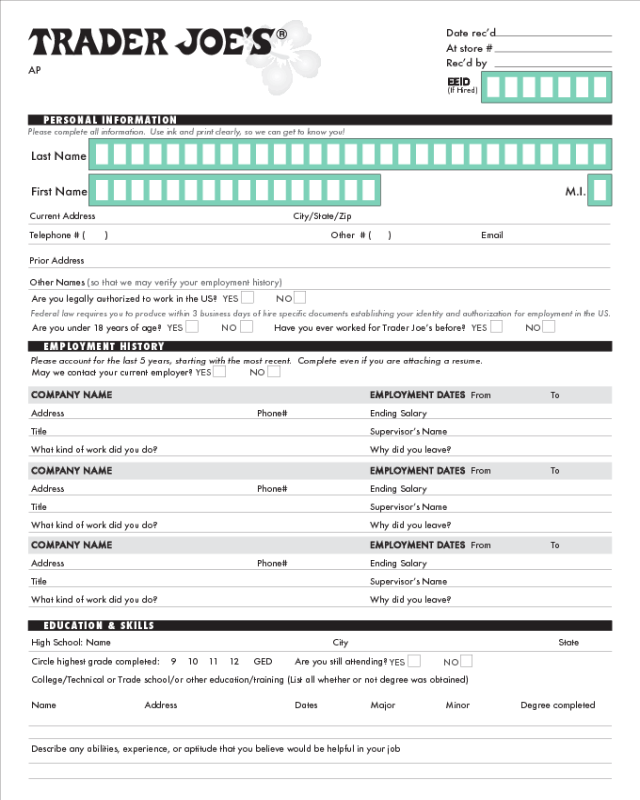

AP

Date recʼd

At store #

Recʼd by

PERSONAL INFORMATION

Please complete all information. Use ink and print clearly, so we can get to know you!

Current Address City/State/Zip

Telephone # ( ) Other # ( ) Email

Prior Address

Other Names (so that we may verify your employment history)

EMPLOYMENT HISTORY

EDUC ATION & SKILL S

Federal law requires you to produce within 3 business days of hire specific documents establishing your identity and authorization for employment in the US.

YES NO

YES NO

YES NO

Please account for the last 5 years, starting with the most recent. Complete even if you are attaching a resume.

May we contact your current employer?

YES NO

YES NO

High School: Name City State

Circle highest grade completed: 9 10 11 12 GED Are you still attending?

College/Technical or Trade school/or other education/training (List all whether or not degree was obtained)

Name Address Dates Major Minor Degree completed

Describe any abilities, experience, or aptitude that you believe would be helpful in your job

Are you under 18 years of age? Have you ever worked for Trader Joeʼs before?

Are you legally authorized to work in the US?

EEID

(If Hired)

M.I.

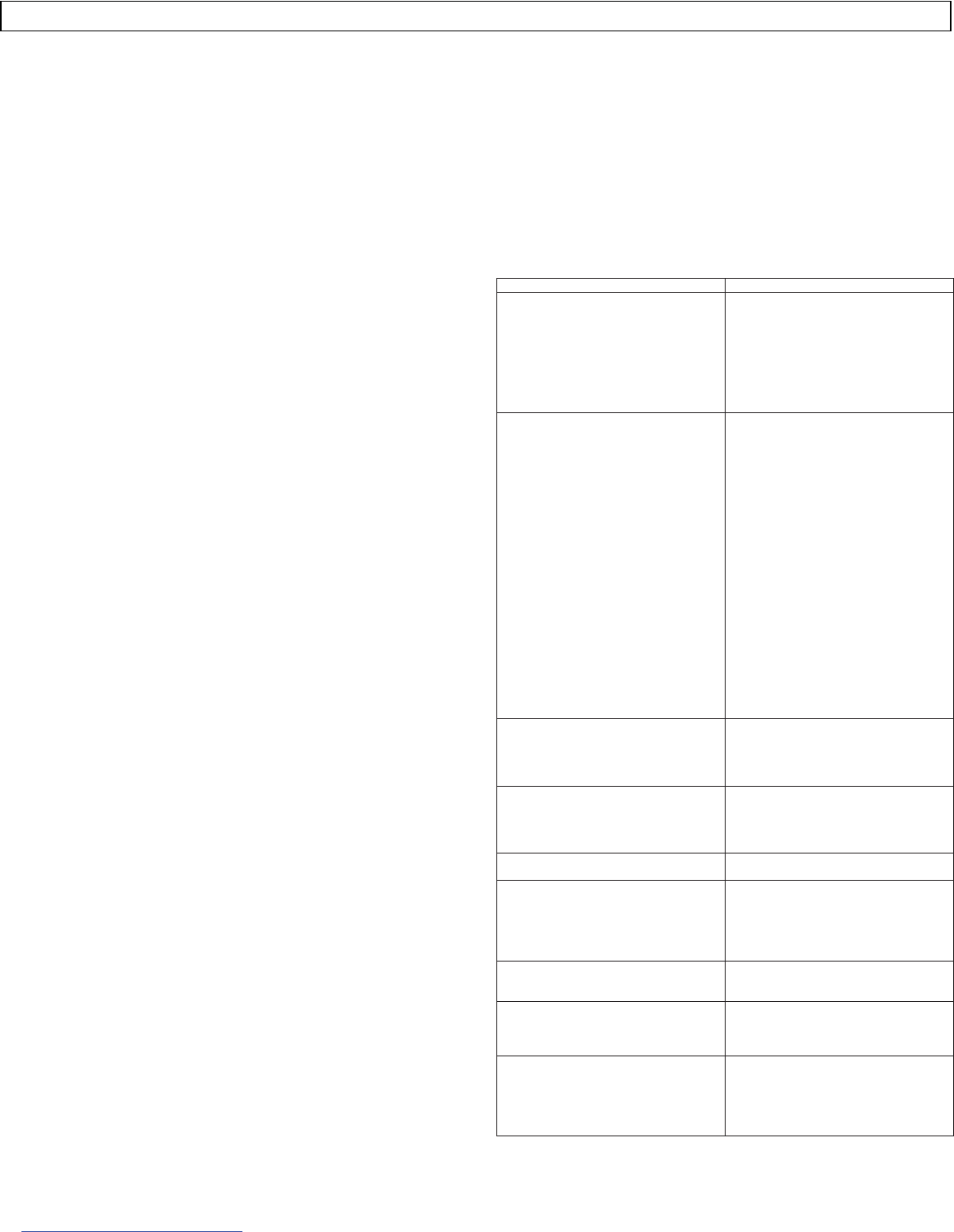

COMPANY NAME EMPLOYMENT DATES From To

Address Phone# Ending Salary

Title

Supervisorʼs Name

What kind of work did you do? Why did you leave?

COMPANY NAME EMPLOYMENT DATES From To

Address Phone# Ending Salary

Title

Supervisorʼs Name

What kind of work did you do? Why did you leave?

COMPANY NAME EMPLOYMENT DATES From To

Address Phone# Ending Salary

Title

Supervisorʼs Name

What kind of work did you do? Why did you leave?

Last Name

First Name

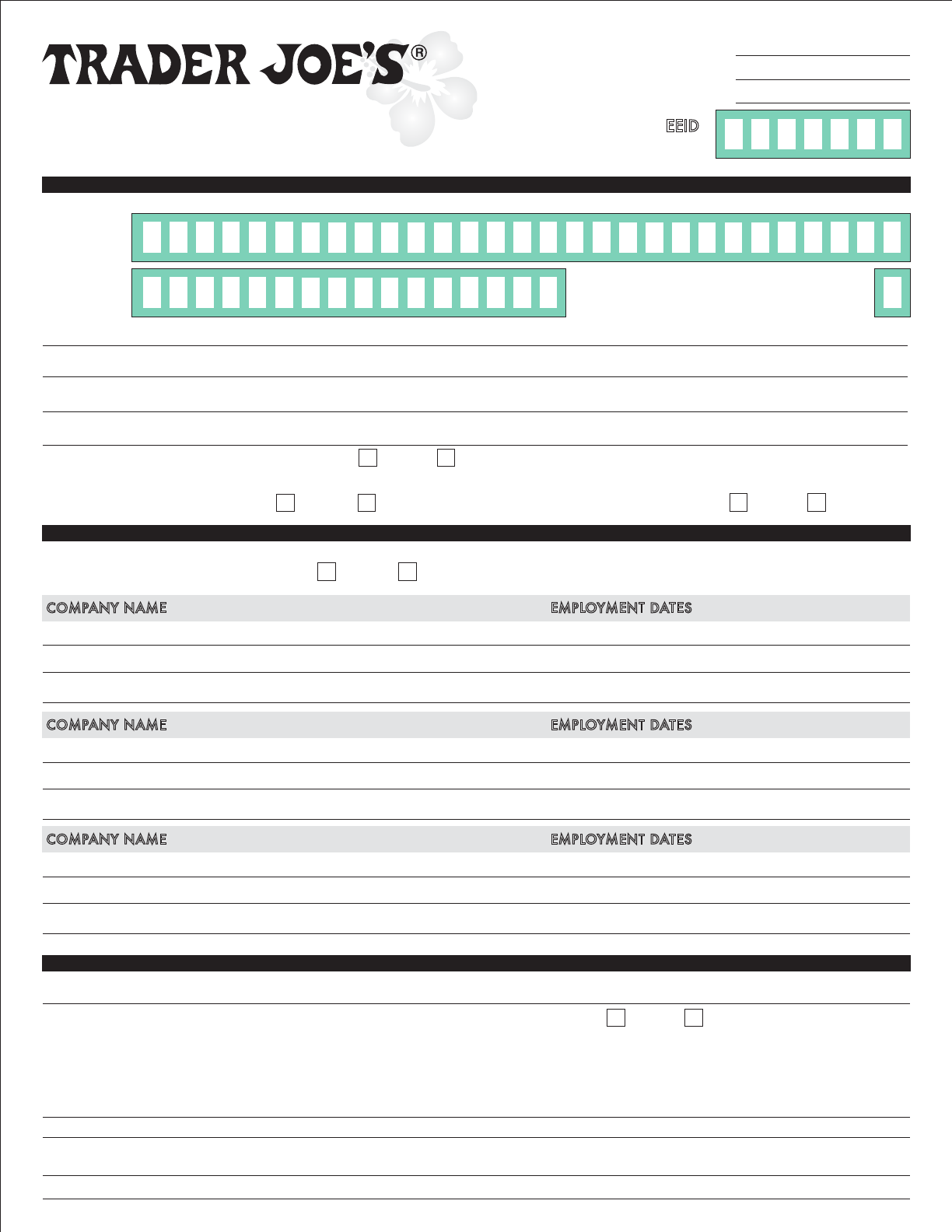

JOB INTERES T

How many hours per week would you like to work?

How did you hear about Trader Joeʼs?

AN EQUAL OPPORTUNITY EMPLOYER: We are an equal opportunity employer and do not discriminate based upon race, color,

religion, sex, sexual orientation, pregnancy, marital status, national origin, citizenship, veteran status, ancestry, age (over 40), physical

or mental disability, medical condition (cancer-related), gender identity or expression, genetic information including sickle cell or

hemoglobin C trait, or any other consideration made unlawful by applicable federal, state, or local law.

Your application will be considered active for 14 days. For consideration after that, you must submit a new application.

YOUR AVAIL ABILIT Y

How soon could you start working for Trader Joeʼs?

Shifts vary by store, starting as early as 4:00 a.m. and ending as late as 12:00 midnight. Please confirm the shift schedule needed at your store.

What is your availability?

EARLIEST TIME

LATEST TIME

SUNDAY MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY

SATURDAY

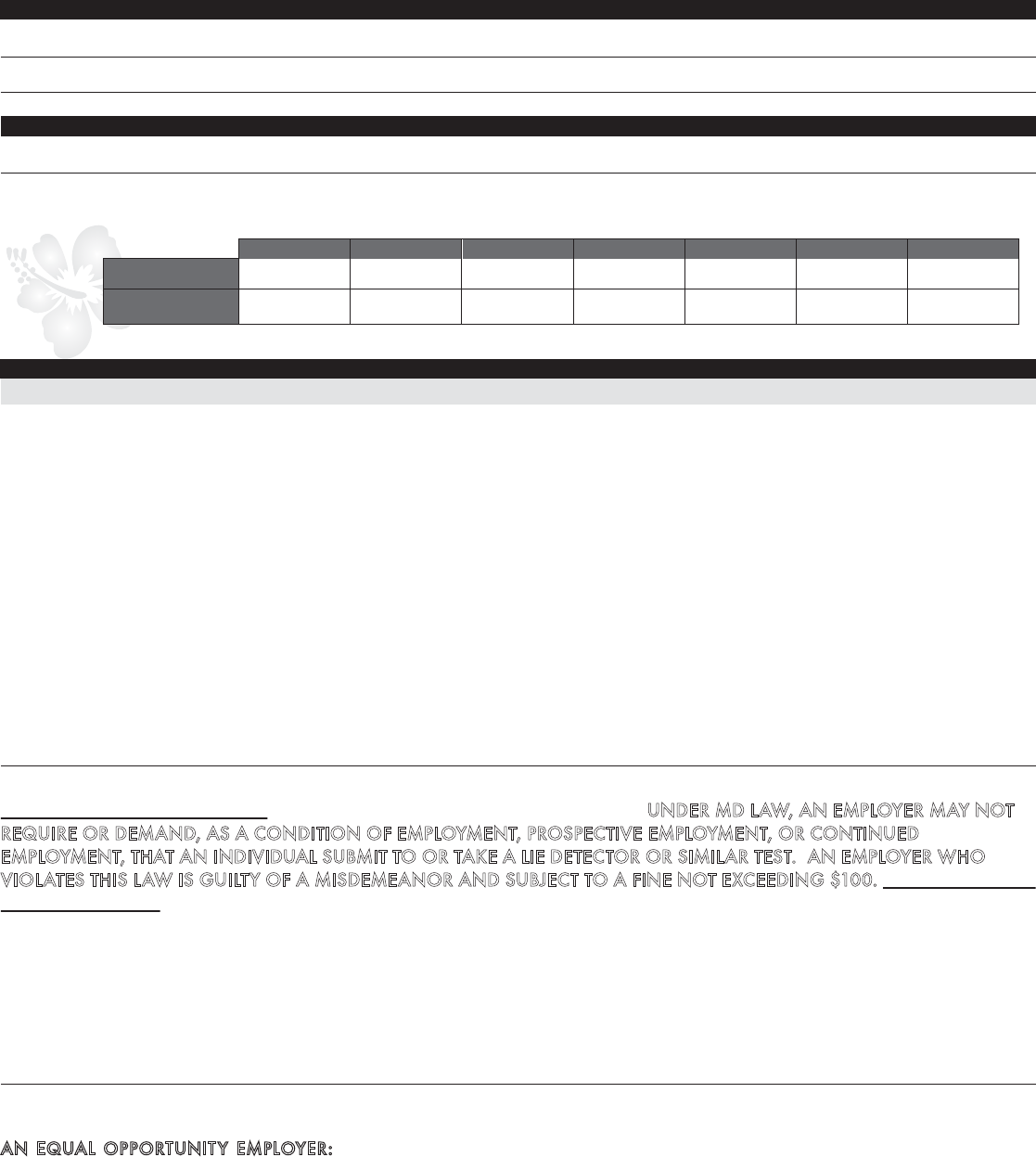

PLEASE READ CAREFULLY BEFORE SIGNING:

I read and understand the Position Description and can perform the essential functions with or without a reasonable accommodation. I

authorize Trader Joeʼs to make any necessary investigations into my personal history and authorize any former employer, educational

institution, financial institution, or person I provide as a reference to supply Trader Joeʼs or its agents with any information concerning

my background. I understand no criminal background check will be conducted until after a conditional offer of employment. In the

event a criminal background check is conducted after a conditional offer of employment, Trader Joeʼs will not request any information

regarding an applicantʼs arrest history that did not result in a conviction or in which there is not a pending criminal accusation. I release

from liability and hold harmless any individual or agency supplying this information to Trader Joeʼs or its agents. I answered every

question on this application completely, truthfully and correctly. I understand that if I am hired and any of the information I provided is

found to be untruthful, misstated, or purposely omitted, I could lose my job. I understand bonding is a condition of hire. I understand

that this application is not an offer, promise, or contract of employment, either expressed or implied. My employment would be “at will”

and could be terminated by either Trader Joeʼs or me at any time, with or without notice or cause.

APPLICANT'S SIGNATURE (Void unless signed and dated) DATE

TERMS OF HIRE

MARYLAND APPLICANTS ONLY: I acknowledge that I have been advised that UNDER MD LAW, AN EMPLOYER MAY NOT

REQUIRE OR DEMAND, AS A CONDITION OF EMPLOYMENT, PROSPECTIVE EMPLOYMENT, OR CONTINUED

EMPLOYMENT, THAT AN INDIVIDUAL SUBMIT TO OR TAKE A LIE DETECTOR OR SIMILAR TEST. AN EMPLOYER WHO

VIOLATES THIS LAW IS GUILTY OF A MISDEMEANOR AND SUBJECT TO A FINE NOT EXCEEDING $100. MASSACHUSETTS

APPLICANTS ONLY: I acknowledge that I have been advised that it is unlawful in Massachusetts to require or administer a lie

detector test as a condition of employment or continued employment. An employer who violates this law shall be subject to

criminal penalties and civil liability.

APPLICANT'S SIGNATURE (Void unless signed and dated) DATE

At Trader Joe’s…unyielding Integrity is required of us all.

The most important role for the Crew is to deliver a WOW Customer Experience. The Crew creates a fun,

warm and friendly shopping experience throughout the store. They share their product knowledge and enthusiasm

with customers by answering questions, offering suggestions, and walking customers to products. The Crew

makes sure our customers know they are welcome and cared for. The Crew are assigned to the following teams

based on the daily needs of the store: Customer Experience Team, Product Team, Store Opening Team, and

Store Closing Team. The Crew move between teams based on functional need.

The Crew demonstrate their commitment to our Values Guide by performing the following duties under direction

of Captains and Mates:

Engages customers by:

• Greeting them, making eye contact, smiling, and saying hello.

• Educating self about products in order to share this knowledge.

• Answering questions and enthusiastically helping customers find items.

• Offering suggestions for meals and entertaining.

• Operating the cash register in a fun yet efficient manner, being respectful of customers’ time.

• Bagging groceries with care.

• Helping customers out to their cars when needed.

• Promptly getting back to customers who have questions that need follow up.

Prepares the store for customers by:

• Receiving, unloading and verifying deliveries.

• Stocking shelves, regularly rotating product and recording unsaleables and returns.

• Building eye catching, informative merchandise displays.

• Exercising proper food handling procedures.

• Making the store shine - cleaning floors, bathrooms, break rooms.

• Collecting shopping carts and performing appropriate parking lot and store maintenance and upkeep.

Works as part of a team by:

• Being friendly, courteous and respectful of fellow crew members – having a positive attitude.

• Working with a sense of urgency within designated time frames.

• Seeking out new assignments and responsibilities.

• Discovering ways to improve processes.

• Arriving to work on time and ready to work at the start of their shift.

• Understands the importance of safety while performing all duties.

Additional duties may include performing the Helms role, working in the Demo station, creating signs or artwork,

or ordering product as a Section Leader. All tasks are important and build upon our commitment to welcome and

WOW! our customers. It is important that each crew member contributes to a great customer experience by

participating in all aspects of the job.

The Crew work standing and walking throughout their shift. They use repetitive hand movements, and frequently

lift weights up to 25 pounds. The Crew may occasionally lift weights from 10-50 pounds, to heights of 10 to 72

inches. They may also maneuver a 2-wheeled hand truck loaded with products weighing up to 200 pounds. Portions

of the shift may be performed in temperatures around or below freezing. There may be abrupt temperature changes

as the Crew moves from one environment to another. We deem regular and punctual attendance an essential part

of the job.

Education: High school graduate preferred.

Crew Job Description

Rev. 10/2015

Para informacion en espanol, visite

www.consumerfinance.gov/learnmore o escribe a la Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20006.

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies.

There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about

check writing histories, medical records, and rental history records). Here is a summary of your major rights under the FCRA. For more information,

including information about additional rights, go to www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau,

1700 G Street N.W., Washington, DC 20006.

States

may enforce the FCRA, and many states have their own

consumer reporting laws. In some cases, you may have more rights

under state law. For more information, contact your state or local

consumer protection agency or your state Attorney General. For

x You

must be told if information in your file has been used against

you. Anyone who uses a credit report or another type of consumer

report to deny your application for credit, insurance, or employment – or

to take another adverse action against you – must tell you, and must

give you the name, address, and phone number of the agency that

provided the information.

infor

mation about your federal rights, contact:

TYPE OF BUSINESS: CONTACT:

1.a. Banks, savings associations, and

credit unions with total assets of

over $10 billion and their affiliates.

b. Such affiliates that are not banks,

savings associations, or credit

unions also should list, in addition to the

Bureau:

a. Bureau of Consumer Financial

Protection

1700 G Street NW

Washington, DC 20006

b. Federal Trade Commission:

Consumer Response Center – FCRA

Washington, DC 20580

(877) 382-4357

2. To the extent not included in item 1

above:

a. National banks, federal savings

associations, and federal branches

and federal agencies of foreign banks

b. State member banks, branches and

agencies of foreign banks (other

than federal branches, federal agencies,

and insured state branches of

foreign banks), commercial lending

companies owned or controlled by

foreign banks, and organizations

operating under section 25 or 25A of the

Federal Reserve Act

c. Nonmember Insured Banks, Insured

State Branches of Foreign

Banks, and insured state savings

associations

d. Federal Credit Unions

a. Office of the Comptroller of the

Currency

Customer Assistance Group

1301 McKinney Street, Suite 3450

Houston, TX 77010-9050

b. Federal Reserve Consumer Help

Center

P.O. Box 1200

Minneapolis, MN 55480

c. FDIC Consumer Response Center

1100 Walnut Street, Box #11

Kansas City, MO 64106

d. National Credit Union Administration

Office of Consumer Protection (OCP)

Division of Consumer Compliance and

Outreach (DCCO)

1775 Duke Street

Alexandria, VA 22314

3. Air carriers Asst. General Counsel for Aviation

Enforcement & Proceedings

Department of Transportation

400 Seventh Street SW

Washington, DC 20590

4. Creditors Subject to Surface

Transportation Board

Office of Proceedings, Surface

Transportation Board

Department of Transportation

1925 K Street NW

Washington, DC 20423

5. Creditors Subject to Packers and

Stockyards Act

Nearest Packers and Stockyards

Administration area supervisor

6. Small Business Investment

Companies

Associate Deputy Administrator for

Capital Access

United States Small Business

Administration

406 Third Street, SW, 8th Floor

Washington, DC 20416

7. Brokers and Dealers Securities and Exchange Commission

100 F St NE

Washington, DC 20549

8. Federal Land Banks, Federal Land

Bank Associations, Federal

Intermediate Credit Banks, and

Production Credit Associations

Farm Credit Administration

1501 Farm Credit Drive

McLean, VA 22102-5090

9. Retailers, Finance Companies, and All

Other Creditors Not Listed

Above

FTC Regional Office for region in which

the creditor operates or

Federal Trade Commission: Consumer

Response Center – FCRA

Washington, DC 20580

(877) 382-4357

x You ha

ve the right to know what is in your file. You may request and

obtain all the information about you in the files of a consumer reporting

agency (your “file disclosure”). You will be required to provide proper

identification, which may include your Social Security number. In many

cases, the disclosure will be free. You are entitled to a free file

disclosure if:

x a person has taken adverse action against you because of

information in your credit report;

x you are the victim of identify theft and place a fraud alert in your file;

x your file contains inaccurate information as a result of fraud;

x you are on public assistance;

x you are unemployed but expect to apply for employment within 60

days.

In addition, all consumers are entitled to one free disclosure every 12

months upon request from each nationwide credit bureau and from

nationwide specialty consumer reporting agencies. See

www.consumerfinance.gov/learnmore for additional information.

x You have the right to ask for a credit score. Credit scores are

numerical summaries of your credit-worthiness based on information

from credit bureaus. You may request a credit score from consumer

reporting agencies that create scores or distribute scores used in

residential real property loans, but you will have to pay for it. In some

mortgage transactions, you will receive credit score information for free

from the mortgage lender.

x You have the right to dispute incomplete or inaccurate information.

If you identify information in your file that is incomplete or inaccurate,

and report it to the consumer reporting agency, the agency must

investigate unless your dispute is frivolous. See

www.consumerfinance.gov/learnmore for an explanation of dispute

procedures.

x Consumer reporting agencies must correct or delete inaccurate,

incomplete, or unverifiable information. Inaccurate, incomplete or

unverifiable information must be removed or corrected, usually within 30

days. However, a consumer reporting agency may continue to report

information it has verified as accurate.

x Consumer reporting agencies may not report outdated negative

information. In most cases, a consumer reporting agency may not

report negative information that is more than seven years old, or

bankruptcies that are more than 10 years old.

x Access to your file is limited. A consumer reporting agency may

provide information about you only to people with a valid need – usually

to consider an application with a creditor, insurer, employer, landlord, or

other business. The FCRA specifies those with a valid need for access.

x You must give your consent for reports to be provided to

employers. A consumer reporting agency may not give out information

about you to your employer, or a potential employer, without your written

consent given to the employer. Written consent generally is not required

in the trucking industry. For more information, go to

www.consumerfinance.gov/learnmore.

x You may limit “prescreened” offers of credit and insurance you get

based on information in your credit report. Unsolicited “prescreened”

offers for credit and insurance must include a toll-free phone number

you can call if you choose to remove your name and address from the

lists these offers are based on. You may opt-out with the nationwide

credit bureaus at 1-888-567-8688.

x You m

ay seek damages from violators.

If a consumer reporting

agenc

y, or, in some cases, a user of consumer reports or a furnisher of

information to a consumer reporting agency violates the FCRA, you may

be able to sue in state or federal court.

x Identity theft victims and active duty military personnel have

additional rights. For more information, visit

www.consumerfinance.gov/learnmore

.